Bitcoin Fundamentals Report #263

Everything you need to know about bitcoin in the latest week. WSJ FUD debrief, DTCC ETF listing, pre-FOMC look, US GDP hits 4.9%, mining and lightning news.

October 30, 2023 | Block 814,558

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidating at highs |

| Media sentiment | Negative |

| Network traffic | Medium |

| Mining industry | Stable |

| Days until Halving | 165 |

| Price Section | |

| Weekly price* | $34,340 (+$3,299, +10.6%) |

| Market cap | $0.670 trillion |

| Satoshis/$1 USD | 2,912 |

| 1 finney (1/10,000 btc) | $3.43 |

| Mining Sector | |

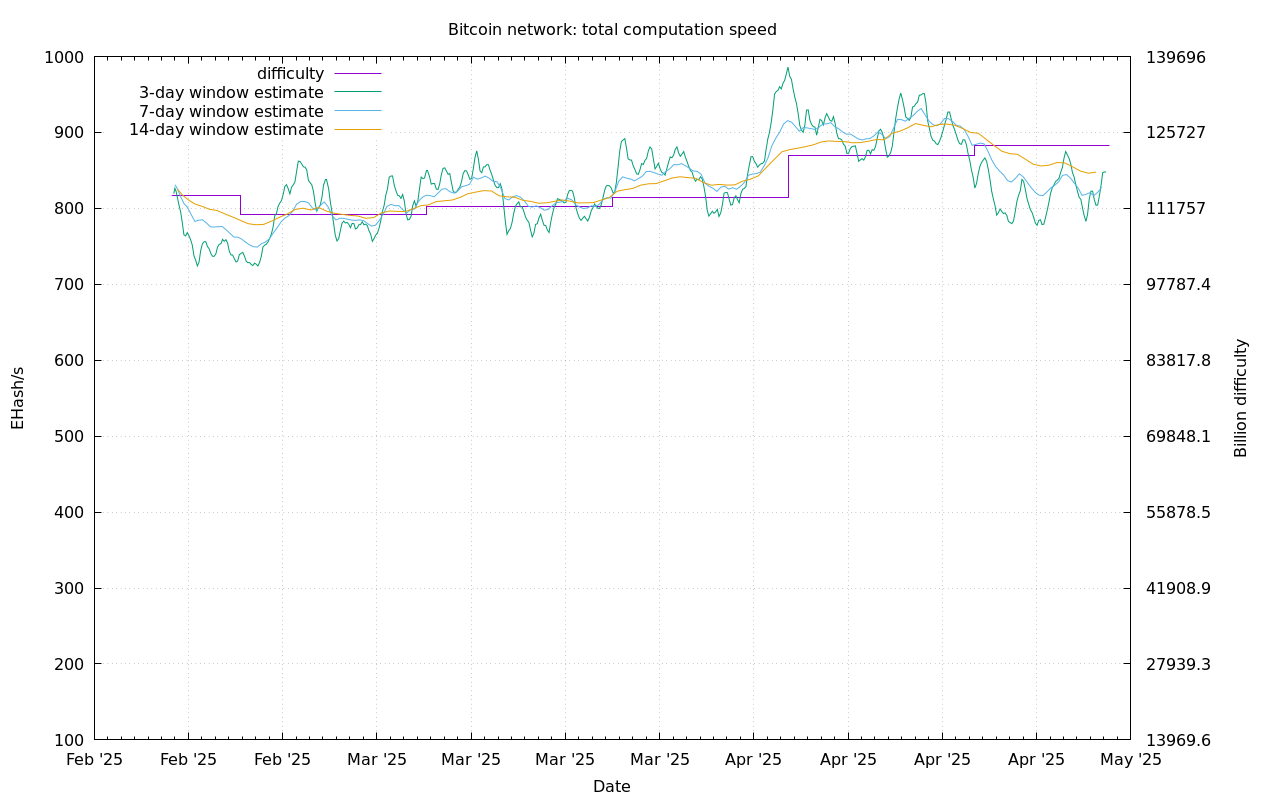

| Previous difficulty adjustment | +6.4708% |

| Next estimated adjustment | +4% in ~12 days |

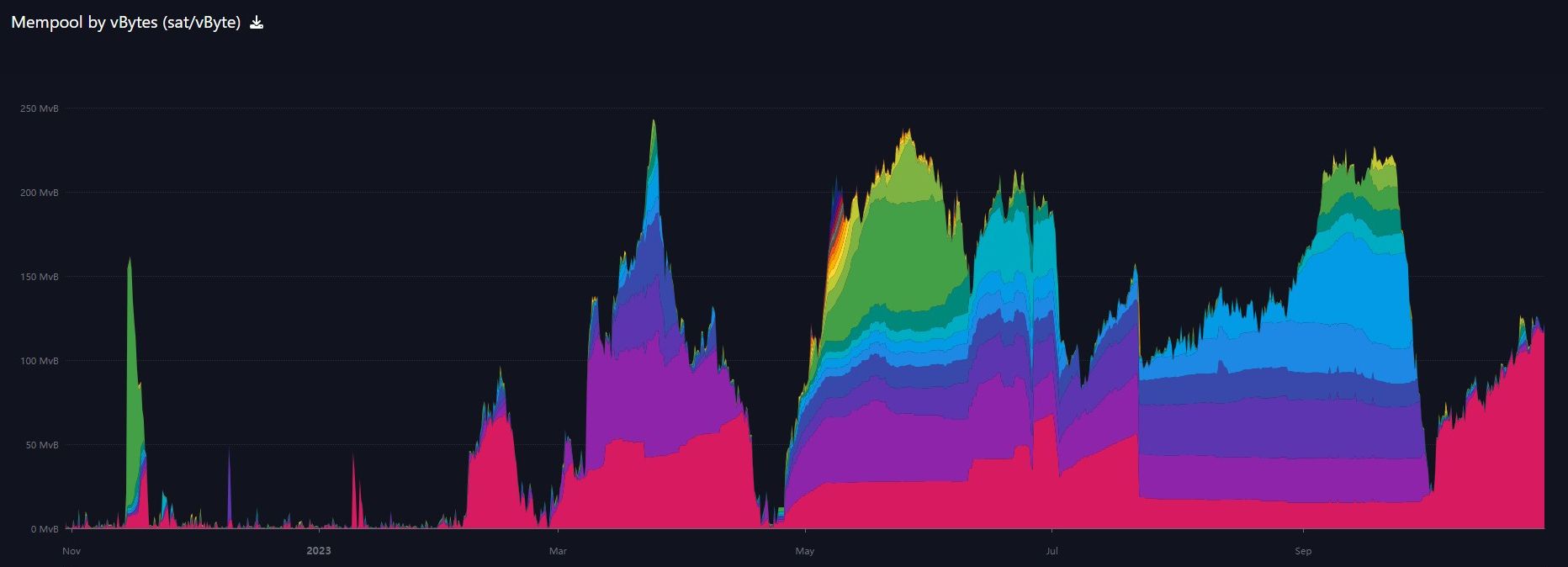

| Mempool | 128 MB |

| Fees for next block (sats/byte) | $0.62 (13 s/vb) |

| Low Priority fee | $0.58 |

| Lightning Network** | |

| Capacity | 5328.08 btc (+0.9%, +49) |

| Channels | 62,273 (-0.6%, -369) |

In Case You Missed It...

Member

- Stock Market Update, Yield Curve and Rollover, Bitcoin Price

- BREAKING: Bitcoin Rallies to Pivotal Point

Community streams and Podcast

Blog

- The Coming Multipolar World

- Demographic Collapse: Why Should We Care?

- Bitcoin is a Hedge Against Geopolitical Risk (continued...)

Bitcoin Magazine Pro

Headlines

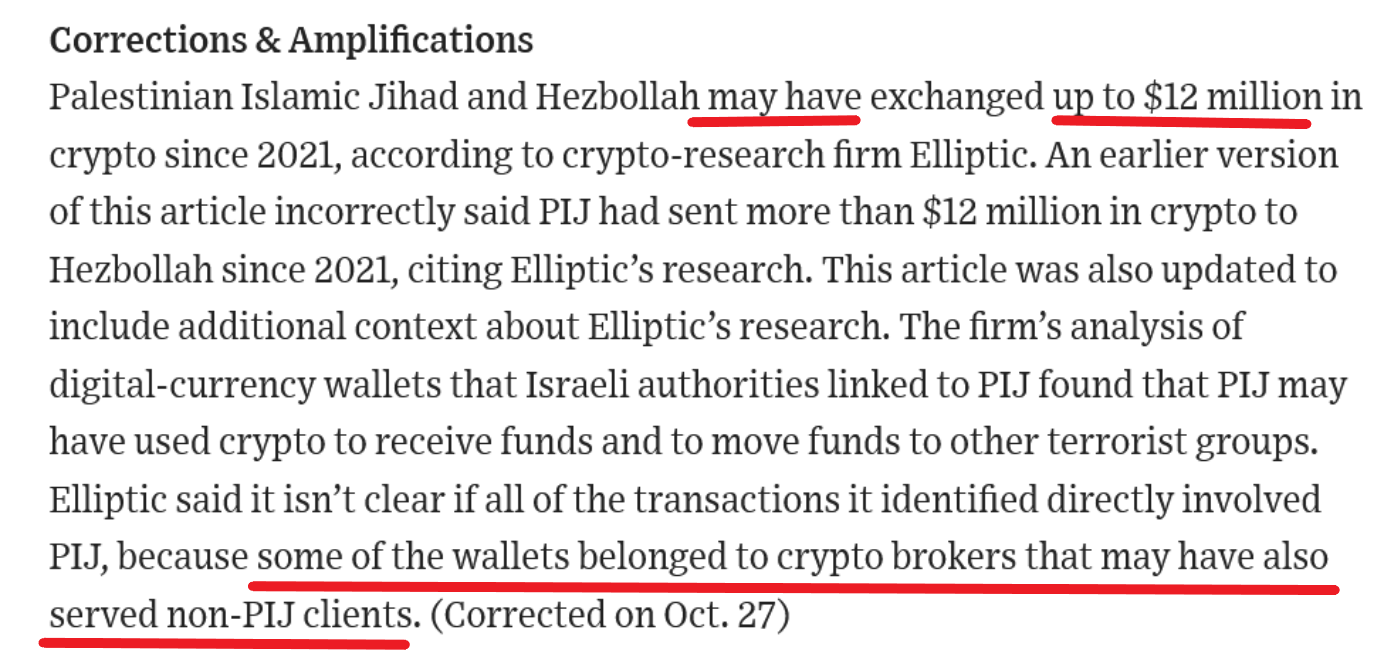

- Wall Street Journal has posted a correction to their Hamas funding story

The story that exploded this week on Twitter, highlighted by Nic "My Star is Rising" Carter, was that the WSJ published an article with bogus data around Hamas using "cryptocurrencies" to raise $93M. Senators immediately picked it up including semi-ally Cynthia Lummis, parroting the WSJ piece and going directly after bitcoin. Bitcoiners, of course, rose to the occasion and mobbed on Twitter proving WSJ's data was vastly over estimating the total. The WSJ initially refused to fix the article.

The actual story gets lost in this narrative. As LaurentMT explains in this Twitter exchange, the WSJ source was an Elliptic blog post from July. It wasn't until the WSJ controversy that Elliptic stealth edited the blog post. Once they did that and called out the WSJ like the edit never happened, only then did the WSJ offered a correction.

Elliptic is a proud WEF Technology Pioneer, displaying the association right on their website, and they have been caught publishing fake data to give ammunition to bitcoin attackers. The WSJ is not without blame in this whole episode, however, they are less to blame than WEF Elliptic.

- Dissonance about Bitcoin as Geopolitical Hedge

After my recent podcast and live stream about bitcoin as a geopolitical hedge, I tweeted at Bob Elliot and Michael Green to see if they wanted to recant their "bitcoin's thesis failed" comments. Of course, I didn't think they would, the only thing at least Michael hates worse than bitcoin is being wrong.

I was surprised with several anons piling on in favor of these men's theories. I think it should be beyond dispute at this point that bitcoin has performed very well since the Israel-Hamas conflict, even if this conflict is not being judged by the markets as that big of a geopolitical threat.

All the people saying it's not a geopolitical cite no evidence. They just state it as a fact. Kind of like how Bob and Michael did. When I called Bob on it, he slightly changed his point from an arbitrary timeframe to "how it trades through it." As if that matters. Bitcoin and gold, or any geopolitical hedge you pick, will have its own market dynamics and fundamentals that will slowly adjust and price in the geopolitical risk. They don't have to react overnight.

That is the point I was trying to make in this tweet.

Zoom out and look at the 20 or 50-day MA at a minimum.

Those people saying, "Bitcoin performed like X on this big news or this big event," are confirming their bias and can't see through to a complex market with many interacting fundamentals.

#Bitcoin bounced back to the S2F one standard deviation band (dark blue $31k - $103k). Showtime 😎 https://t.co/eTL0ITnn27 pic.twitter.com/NNtNnhyXGx

— PlanB (@100trillionUSD) October 25, 2023

I talked about this on one of last week's live streams. Stock to flow is definitely coming back in this next bull market. I like the model. It maintained 2 standard deviations and is now heading back into the 1 standard deviation range.

We like to think of ourselves as hyper-rational individuals, but we are fairly simple animals. The harder an asset is (the less supply can react to demand) the more it will be used as money. Will S2F be perfect? No, but it captures something fundamental to being a human, and the way we interact with the technology called money.

The DTCC is the private corporation that warehouses all your equity shares. You simply have a contract with DTCC to own those APPL shares. They switch ownership on the DTCC books is all. The listing of the Blackrock ETF seems a bit premature. Perhaps Blackrock and DTCC are trying to corner the SEC, twist a few arms, making any denial that much more strange.

Macro

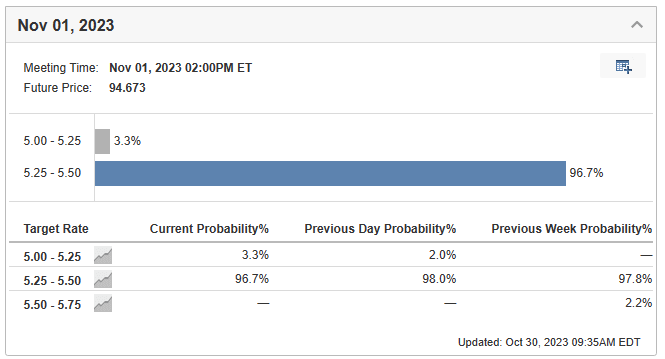

- IT'S FOMC WEEK!

The Federal Reserve will be meeting Tuesday and Wednesday, with the policy decision and press conference coming Wednesday. I will be live streaming it, so stay tuned for that.

I expect NO HIKE. In fact, the market is starting to price in the possibility of a rate cut. Chair Powell does have a few things he can do before a cut, like stopping QT, or lowering the Interest on Excess Reserves (IOER). I do expect a slowing of QT first, before a rate cut.

As you can see, the Fed Funds futures market is even pricing in a slight chance of a cut this week, and it has moved up the first likely cut to May from July. That means the market was pushing the cut later because the market seemed okay, and is not moving the first cut earlier, signifying the market is getting more bearish on recession.

This is also significant because the halving is estimated for April. If the first likely cut keeps moving earlier, the halving may coincide with the first/start of recession.

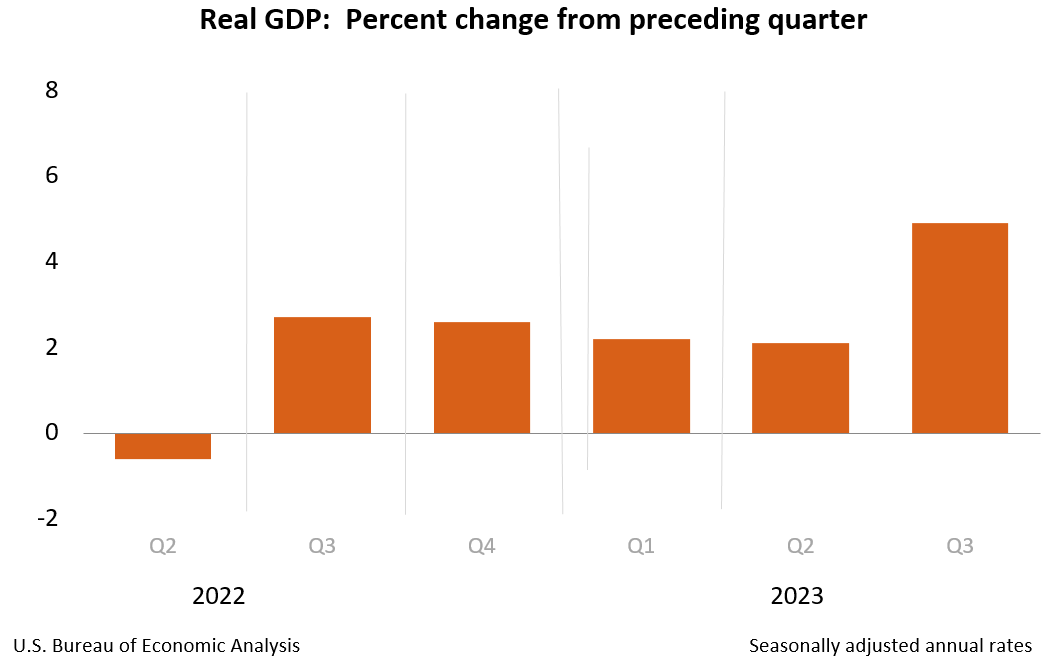

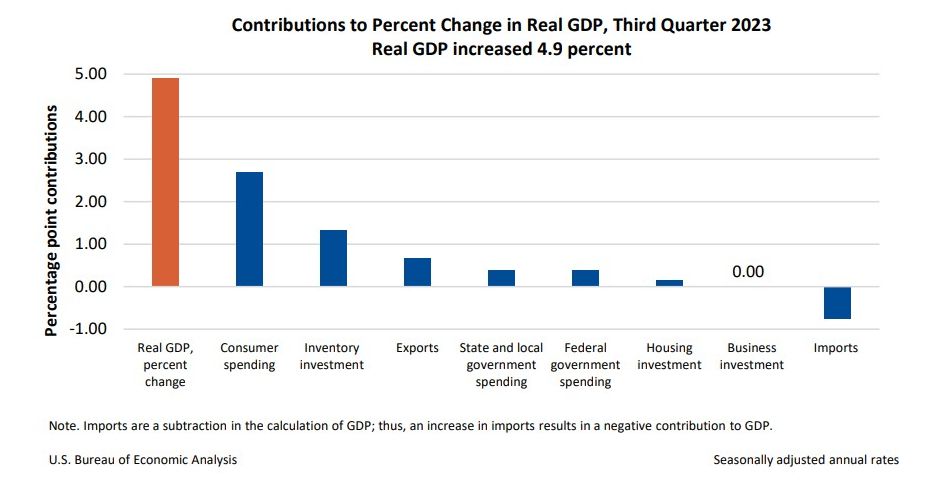

Overall, this was a solid print. Consumer spending rebounded and investment rose. There was nothing that stood out as a hidden gotcha in the calculations, like I had anticipated with Import/Export math. The one minor item that could portend the future was the drop by 1% in disposable income.

Take as a trend, however, this was not that good. IOW it didn't jump out and say, "wow, we have lift on in the economy." The general trend is still toward slowdown, with the decline in disposable income showing that future quarters will very likely slow. If we had these same numbers, but disposable income also rose by 3-5%, it would have been major news. As you could tell this week, most people didn't care about this abnormally high print.

As a quick note: remember, China does not calculate their GDP with output like the US does. Gross Domestic Product in China should be Gross Domestic Input. A lot can be counted by digging holes and filling them back in.

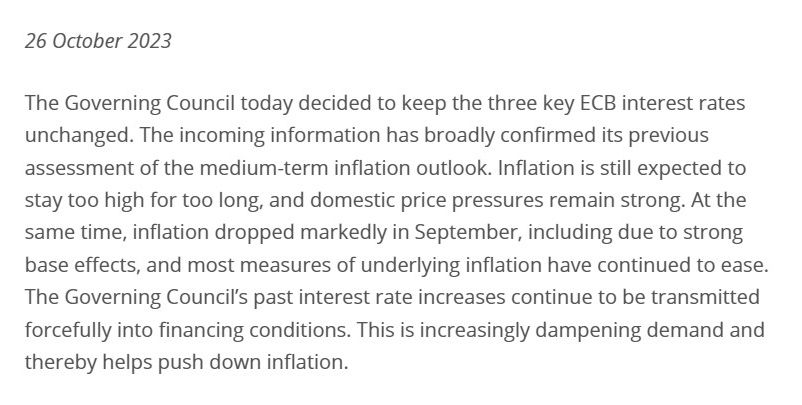

Please note: When the ECB references "inflation" they are talking about their price index. It differs from the US CPI by not counting shelter in the same way. This is interesting because that means their CPI will come down much faster than US CPI. Also, it highlights that this lagging sector does not have an important mind of its own on the way down, or else they would have likely worked it into their calculations. If you take shelter out of the US CPI, we hit 0.6% YOY and are still under 2%.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

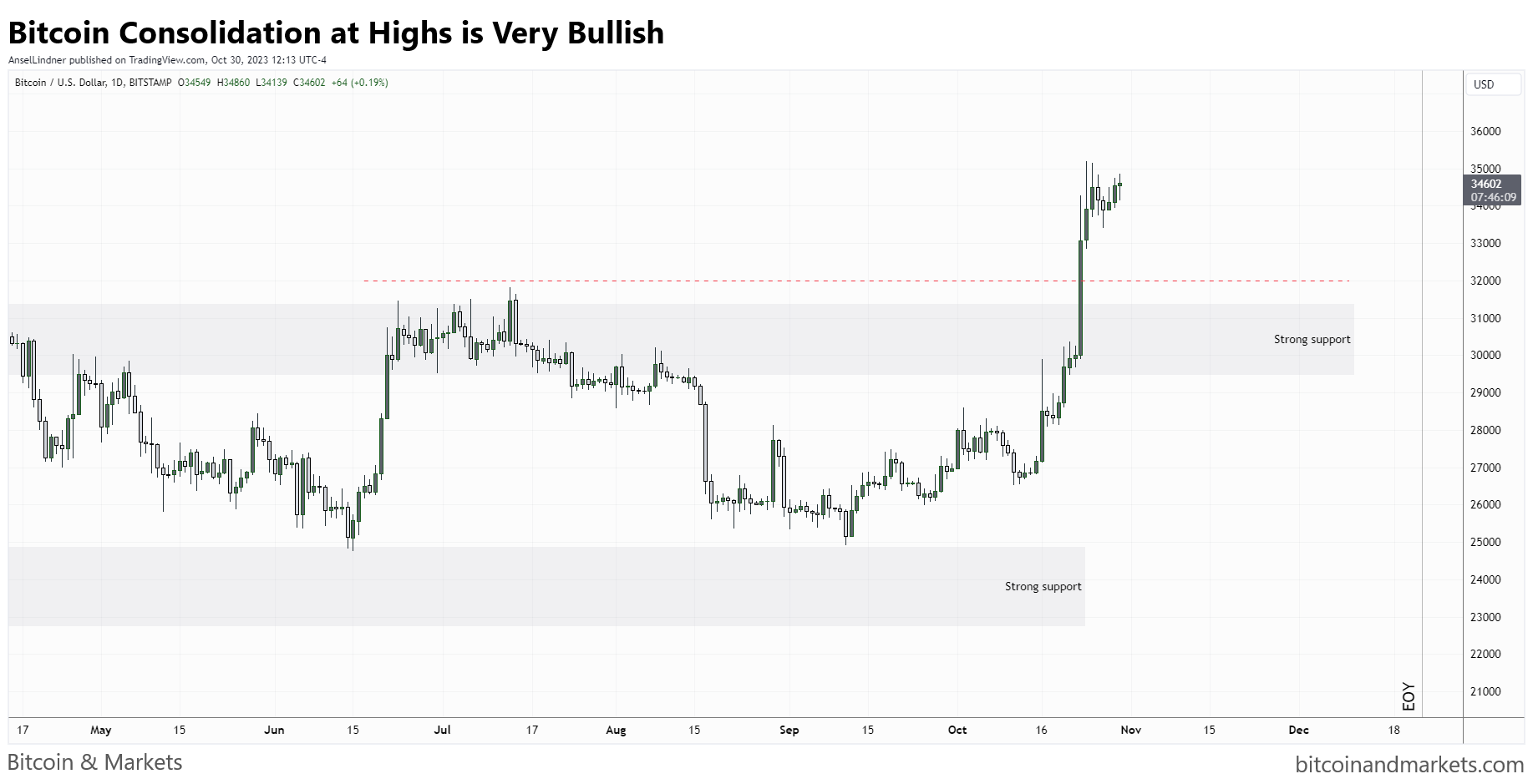

Bitcoin is still on the move. I have updated the previous resistance band to a new support band. It is highly unlikely that price could drop through both these levels of support. A target for a slight pull back would be the very top of support at $32k (red dash line).

The Golden Cross has occurred. Typically, this is an area of high interest on the chart and price tends to move toward it. So far, we haven't seen that, but I wouldn't be surprised with that kind of move over the next couple of days. Daily RSI is still quite elevated at 82, as well, so a small reset pull back is even more likely.

Speaking of RSI, the weekly RSI is over 70 for the first time since March 2021. When this happens for the first time in the cycle, it is typically right as the bull market is getting going.

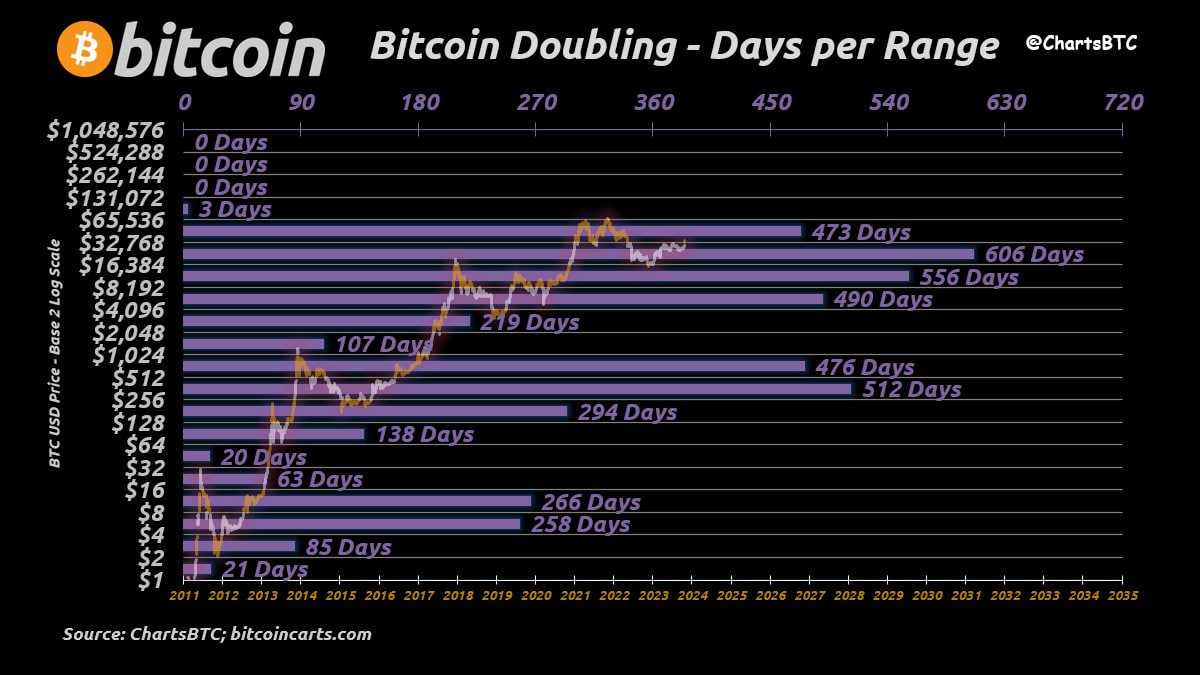

I posted this chart several weeks ago, it's a fantastic way to look at price levels by ChartsBTC. The ranges are defined by doublings, and it measures the number of days spent in the price range. Bitcoin is breaking into the next higher range right now.

The pattern that interests me the most about this is the levels with fewer number of days. We've spent a whole lot of time in the $16k-$32k range, are we bound to stay very short in the $65k -$131k range?

Much more detailed price analysis, including short, medium and long term forecasts on Market Protons!

Bitcoin Mining

Headlines

- The UN Released a report on Bitcoin mining

This week, the US released, Hidden Environmental Impacts of Bitcoin: Carbon is Not the Only Harmful By-product, a negative report on bitcoin mining.

This report stands out because it is the first negative piece on bitcoin mining in several months, probably since Greenpeace's skull stunt backfired.

Mining cryptocurrencies can have major environmental impacts on climate, water, and land, according to new research by United Nations scientists.

According to study results, published by the United Nations University and Earth’s Future journal, during the 2020–2021 period, the global Bitcoin mining network consumed 173.42 Terawatt hours of electricity. This means that if Bitcoin were a country, its energy consumption would have ranked 27th in the world, ahead of a country like Pakistan, with a population of over 230 million people. The resulting carbon footprint was equivalent to that of burning 84 billion pounds of coal or operating 190 natural gas-fired power plants. To offset this footprint, 3.9 billion trees should be planted, covering an area almost equal to the area of the Netherlands, Switzerland, or Denmark or 7% of the Amazon rainforest.

The UN scientists make a range of recommendations regarding possible interventions by the governments to monitor and mitigate the environmental impacts of cryptocurrencies. They also suggest investment in other types of digital currencies that are more efficient in terms of energy use and less harmful to the environment. - emphasis added

Of course, this utter nonsense. They cannot write anything honest about bitcoin mining. People on Twitter jumped to the task of debunking this report directly from their cited sources.

The US "scientists" cited the debunked and retracted 2018 Mora study drastically overestimated electricity consumption based on extrapolating from data on old mining equipment.

The concept of "excess energy" escapes these galaxy-brains as well. Power plants have to produce to peak energy consumption, so they aren't ramping up and down all day. It is MORE EFFICIENT to run at an optimal, producing excess energy that bitcoin miners can use. Yet the UN can't spin the truth to fit their radical Marxist climate alarmism.

Dozens of mining firms came to Washington to steer the policy narrative away from negative environmental claims and make a case for mining as an economic and security boon.

...representatives of that sector flooded offices on Capitol Hill this week to argue their businesses can help stabilize the power grid, tie into renewable resources and foster domestic technology.

Difficulty

Difficulty adjusted up by 2.3% last night (purple line), with hash rate remaining generally stable for the last 2 weeks near ATHs.

Mempool

The mempool continues to grow, yet fees are staying quite low at only an average of $1 for the next block.

Layer Two

In a new post on Bitcoin Magazine by Shinobi, he first goes through exactly what this attack is, and then tries to put it in context to judge the severity. I will quote some important passages by recommend you read his write up for yourself.

The Replacement Cycling Attack is a complicated way to try and accomplish exactly that undesired outcome, the target node losing money by having the outgoing hop claim the funds with a success transaction, and the incoming hop claiming funds through the refund transaction. This necessitates stalling out the victim node, and preventing them from seeing the preimage in the success transaction on one side until after the timelock expires on the other side, so they can claim the refund there.

The attack requires that a malicious party, or two conspiring parties, have a channel on both sides of the victims node routing a payment.

He then described the very detailed process of holding preimage and success transactions, and publishing to the network, in a certain way to almost eclipse the target.

The problem with this is two fold. Firstly, the victim's Bitcoin Core node must be specifically targeted to ensure that at no time does the preimage success transaction propagate into their mempool where their Lightning node can acquire the preimage. Secondly, if the second transaction Alice uses to evict the preimage transaction is confirmed, Alice incurs a cost. That means every time Bob re-broadcasts his timeout transaction, Alice has to pay a higher fee to re-evict it, and when that is confirmed she actually incurs a cost.

So Bob can force Alice to incur a big cost simply by regularly rebroadcasting his timeout transaction with a higher fee.

It would also be possible to prevent the attack completely by changing how HTLC success and timeout transactions are constructed. By using the SIGHASH_ALL flag, which means the signature commits to the entirety of the transaction and becomes invalid if the tiniest detail (like adding the new input in the preimage transaction required for this attack) is changed.

Peter Todd has also proposed a new consensus feature that would entirely solve the issue, essentially a reverse timelock, where the transaction would become invalid after a certain time or blockheight instead of becoming valid after. Going that far however is not necessary in my opinion.

Simply rebroadcasting your transaction regularly with a slight fee bump is a massive mitigation of the attack, but there are also numerous dynamics that just make it not a serious issue regardless.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space