Bitcoin Fundamentals Report #226

Headlines on contraindicators, dead cat and bull trap callers, Genesis and Bitzlato, price analysis and forecast, and mining sector news.

Snapshot of Bitcoin

Click headings to jump to section

| General Bitcoin Headlines | |

| Weekly trend | Slowing bull breakout |

| Media sentiment | Negative |

| Network traffic | Very low |

| Mining industry | Strong at ATHs |

| Price Analysis | skip to Summary |

| Weekly price* | $22,970 (+$1650, +7.7%) |

| Market cap | $0.443 trillion |

| Satoshis/$1 USD | 4,359 |

| 1 finney (1/10,000 btc) | $2.29 |

| Mining Sector | |

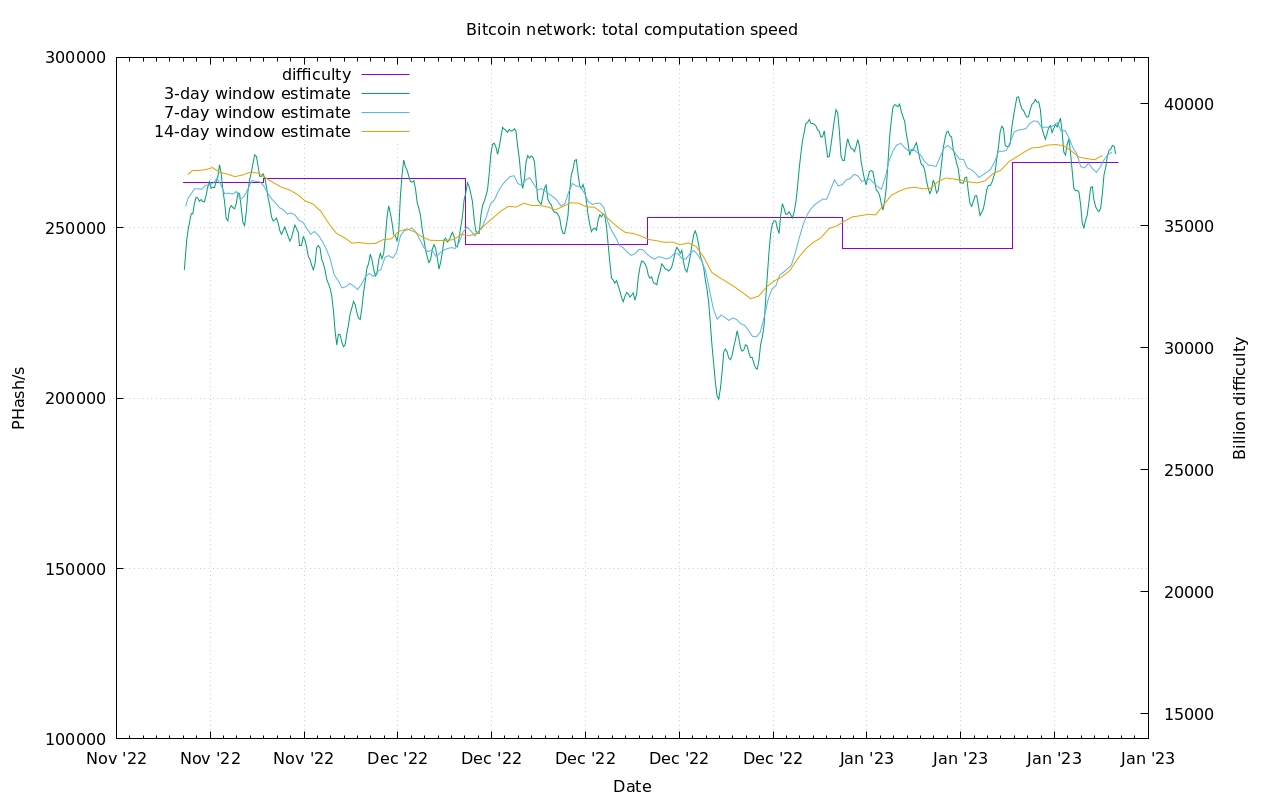

| Previous difficulty adjustment | +10.2567% |

| Next estimated adjustment | +1.5% in ~5 days |

| Mempool | 1 MB |

| Fees for next block (sats/byte) | $0.26 (8 s/vb) |

| Median fee (finneys) | $0.03 (0.013) |

| Lightning Network | |

| Capacity | 5,283.83 btc (+1.4%) |

| Channels | 74,146 (+0.6%) |

In Case You Missed It...

Daily Live streams

- Bitcoin Back Above $20K, plus SEC Timing - Daily Live 1.13.23 | E300

- Davos WEF History and Future Plans - Daily Live 1.16.23 | E301

- Ransomware and Bitcoin Demand - Daily Live 1.17.23 | E302

- International "Crypto" Enforcement, Should We Be Worried? - Daily Live 1.18.23 | E303

Fed Watch

⬇️ Check out the video below ⬇️

Listen to podcast here

Headlines

This week, I've changed up the format for the Report slightly due to feedback I received at the Bitcoin Day Naples event this last weekend. What I've done is move all the tables that were in the individual sections to the top, including links to those sections. This way, the reader can get a basic summary before jumping to the section they are interested in.

I will also cut back on my editorial commentary in the report. This is a constant struggle for me, editing down what I'd like to say about each item, but it is important for the whole Report to be digestible in 5 mins, since it is a weekly letter. I will also be using more bolded text to focus the eye of the reader. The other option I have is to switch to publishing monthly and keeping the editorial commentary long.

I'm always open to feedback that will help me grow my reach and community.

Bitcoin

- Bitcoin Shoots Up 30% Since Jim Cramer's Call To 'Get Out' Of Crypto (Jan 13th)

- Peter Schiff Advises Selling Bitcoin Today — Says It's 'the Smart Move' (Dec 25th)

Jim Cramer is the best contra-indicator in the world, but Peter Schiff is a close second for bitcoin. One day, if Peter Zeihan keeps on his ignore-bitcoin path, he'll be on this list, too.

This is the typical article you'll find out there right now. Calling bitcoin's rally a dead cat bounce or a bull trap. They are still in disbelief. I'll just mention that these outlets have never once seen a bitcoin rally coming, and have never once cheered on the rise of bitcoin.

Would we expect him to say anything else? His bank buys bitcoin for their clients.

They're just trying to control/manage the adoption rate, but they aren't actually fighting it anymore in my opinion.

Genesis Trading filed for bankruptcy protection after suffering crippling losses from the collapses of FTX and hedge fund Three Arrows Capital.

Genesis is a part of Barry Silbert’s Digital Currency Group, which has seen mounting problems in recent months.

Some of Genesis’ largest clients include Circle, which operates stablecoin USD Coin, and Gemini, which is backed by the Winklevoss twins.

Obviously, this is not a big deal for bitcoin as a whole. Price has rallied 30% even with this news. Bankruptcy can stop companies from dumping their reserves.

Funny thing is, no one in the bitcoin community proper has heard of Bitzlato! This is not a major event whatsoever. This was a shady haven for proceeds of illegal activity, high risk/high reward money. All this will do is force the people engaged in this activity to buy back the bitcoin they need.

Shutting down the exchange isn't shutting down the highly lucrative business models of these people. They will simply rebuy the bitcoin and start over. This effectively withdrew this bitcoin from circulation, boosting the price. If the authorities wanted to cripple these illicit activities, they'd legalize them, reducing the profit margins.

Macro headlines

Yes, you read that right. Prices paid to producers from retailers (one step removed from the Consumer Price Index (CPI) was -0.5% in December! Goods prices fell by -1.6%.

Coming up this week is December PCE. That is the measure the Federal Reserve uses, as well as the GDP calculation. I expect PCE to be negative as well. The Cleveland Fed is forecasting 0.05%, basically zero, and they were very far above CPI in December.

This is important for the path of the Federal Reserve policy, which is important to the psychology of the market. Lower price readings mean the Fed is likely to take their foot off the psychological neck of the market.

Granted, this is a Sputnik article, but I've come to a very similar conclusion over the last week. Davos 2023 was a flop and they have lost.

"Davos has become the dressing room of the West and is more divorced than ever from the rest. It no longer represents the real concerns of most of the world’s population. Its obsession with climate change, social justice, gender and other forms of wokeness has made it a laughing stock and target of disdain for most of the world."

"There is no return to the post-WWII system. In addition, we are seeing massive repudiation of some of the institutions and individuals who have been most associated with globalization: the media, Davos, entertainment industry etc. De-globalization can also be seen along cultural fault lines. Western ideas, ethics, and 'values' are rejected by billions who see them as dangerous and destabilizing,"

This is not to say the ROW will rise, only that the global Marxists represented by the World Economic Forum are failing and will lose. Populism is on the rise, State violence is on the rise, and international cooperation is in deep trouble.

Price Analysis

The pivot from bear to bull is almost complete. The price action has been amazing, rising 40% so far in January!

But rallies must have corrections. Are we there yet? Let's take a look.

Daily chart

Can a case be made for a minor correction at this point? I think so.

First and foremost, we must talk about the daily bearish divergence. Daily RSI peaked at 89.26! That is very high and very rare. The last time it hit that mark was January of 2021 and before that was December 2017. Therefore, it is highly unlikely that RSI will get back to 89 before it falls below 70 (into the band, out of overbought territory).

We are at a point of resistance according to the volume by price indicator as well. If it breaks this zone to the upside, technical analysis says that price will likely slide up to around $30k. However, with the RSI from above, we can say the chance of that is very unlikely. The alternative is then to slide down into the low volume notch, with $21k as a primary target, and $19.5k possible.

Those levels would also match with moving averages on the daily. The 200 DMA is currently at $19.6k and turning north. The 50 DMA is rapidly rising into a golden cross.

Weekly Charts

The bitcoin price is attempting to break the massive weekly trend line. Lots of eyes are on this!

A temporary pause and correction before reattacking this trend line would also make a lot of sense. It is unlikely for price to just slice through major trends like this without some pause.

Headwinds and Tailwinds

Recession

Most people are in disbelief of the market rally, both in bitcoin and stocks. The dominant economic narrative, promoted by so many over the last 6 months is that we are obviously heading for a very hard-landing recession. However, being that we are getting closer to a full pivot by the Federal Reserve, stocks and bitcoin are signaling the opposite. We might not even have a recession, let alone a hard-landing.

I've been on this call for a long time. The "inflation" (price rises) that occurred between roughly April 2021 and June 2022, are rapidly resetting to normal. This has the effect of "fooling" typical market indicators like yield curves and real GDP, because of how the metrics are built. They aren't built for rapidly moving prices.

Stocks

Stocks are smelling an end to the artificial imposed psychological pressure that's been hanging over the market the entire second half of 2022. Despite the Fed's hawkish narrative and blistering rate hikes, the stock markets ended the year higher than 6 months prior.

The stock market is also breaking major convergence of resistance.

Dollar

The dollar is not collapsing, but it is on the weaker side. That makes this a great time for risk assets to rally.

The dollar will likely bounce soon, but a new dollar wrecking ball type rise is not in the near or mid-term future. Again, this makes it a good time for low volatility, and subsequently a risk asset recovery/rally.

Price Conclusion

Summarizing...

Almost all timeframes and indicators have turned bullish, but are coming up to resistance and could be approaching correction territory.

A correction or pause looks likely on the daily chart. Not a collapse in price, but a technical move to reset indicators.

A correction will give the bull-trap-callers time to load up their shorts again, giving something to squeeze as price continues higher.

The certainty of a hard-landing recession has lessened this week. The CPI and PCE numbers will continue to dive making it very hard to print a negative real GDP in the first half of the year.

Stocks, just like bitcoin, are at some critical levels. They are on the verge of turning very bullish along with bitcoin.

Dollar risk is weak. Even if we do see a reversal in the dollar, it will not be a repeat of 2022's "dollar wrecking ball". This gives risk assets the monetary room to run.

Overall, risk of a downside surprise has declined to almost zero. I expect a correction in the price to roughly the $20-21k level before long. You could say, the price of bitcoin will hit $21k before $30k.

Mining

At the time the block was added, Bitcoin's total hash rate was just over 269 exahash per second, meaning the solo miner's 10 TH/s hash rate represented just 0.000000037% of the blockchain's entire computational power.

The 48-megawatt, 300,000-square-foot data center is directly connected to the Susquehanna nuclear power plant in northeast Pennsylvania, and its 1,200-acre campus is expected to host Bitcoin mining and cloud computing services – the first of its kind in the U.S.

- The bitcoin mining ETF is currently up 95% on the year!!

Difficulty and Hash Rate

Hash rate on the network is strong and holding near highs.

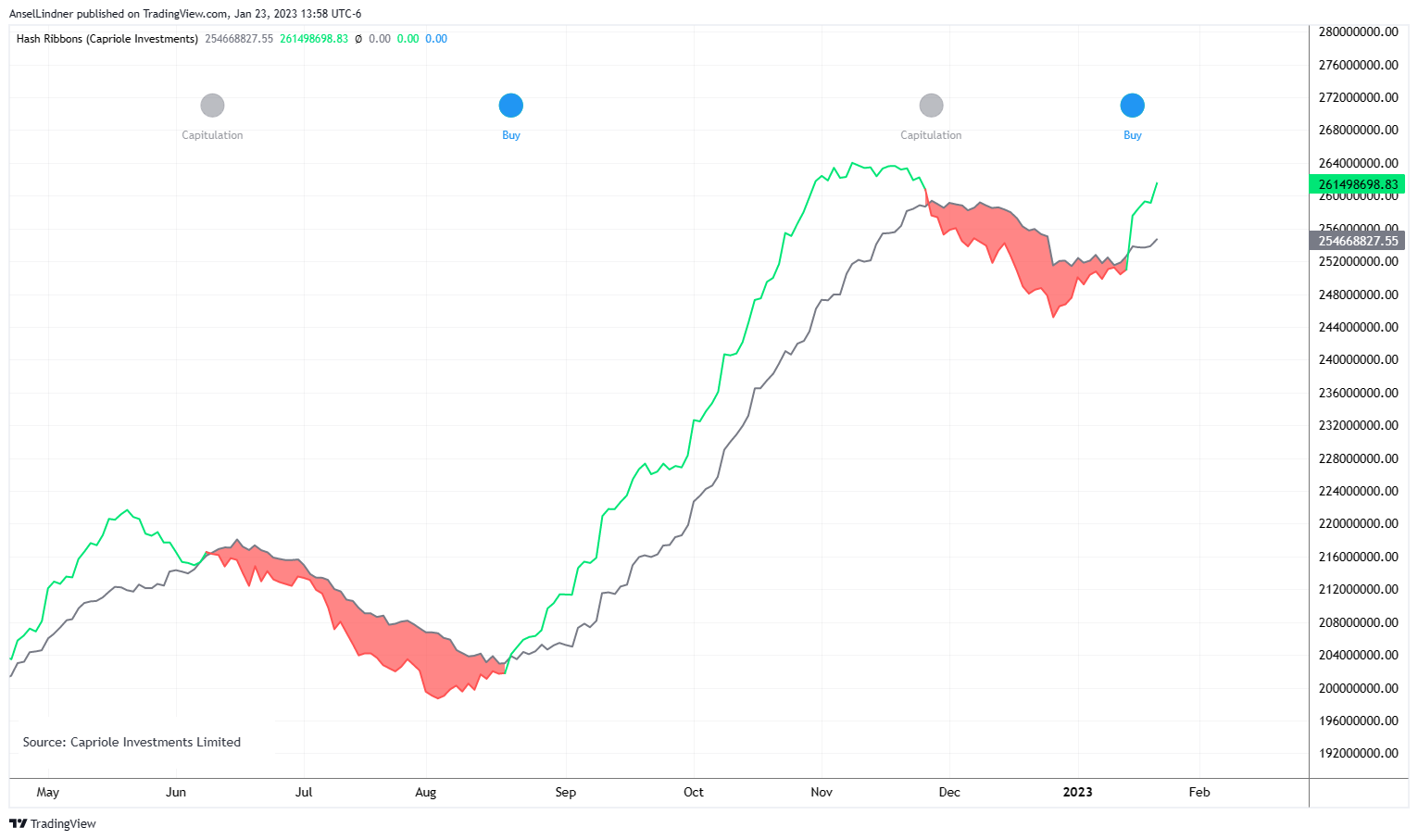

Hash ribbons have crossed and flashed the BUY signal.

Lightning Network

Lightning network has slow and steady improvement, but is now becoming a common target for FUDsters.

On Tuesday, the total circulating supply of bridged BTC, or BTC.b, on Avalanche rose to a record 5,700 BTC ($118.6 million), according to data sourced from Dune Analytics. Meanwhile, the number of bitcoin locked in the Lightening Network stood at 4,929 BTC ($100 million).

This is going to be a common narrative attack on the Lightning network going forward. But note, it is the amount of bitcoin that is the metric they are fighting over here.

It takes zero organic growth for a centralized scam to bridge over bitcoin to their network. We've also seen garbage projects like Terra/Luna attempt to bolster their network and tokens by putting bitcoin in their reserves. It didn't work for them, it won't work for Avalanche.

Bitcoin in the Lightning Network is transacted on a daily basis for real economic activity, not Ponzi-nomics in altcoins.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 23, 2023 | Issue #226 | Block 773,298 | Disclaimer

* Price change since last week's report