Bitcoin Fundamentals Report #206

This week, bitcoin ETF news, futures spreads, price analysis with headwinds and tailwinds, mining sector news, and macro update on Europe, China, and US.

Jump to: Market Commentary / Price analysis / Mining sector / Europe and Russia / China / Jackson Hole and US Economy

In Case You Missed It...

Join my new Telegram Channel! Members can find the link to all past live stream recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) ECB Recognizing the Stakes and Jackson Hole Preview - FED 109

- (Fed Watch Clips) New clips coming soon!

- (Bitcoin & Markets) Reflexivity and the Merge - E248

- (Bitcoin & Markets) The Geopolitics of Power - E249

- (Member) Video for E248

- (Blog) Dollar Index DXY versus Broad Dollar: Death of the Euro

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to hold on |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Bottoming |

What a week. Another slow one for bitcoin news, but, man oh man, was the macro news on fire! In this section, I'll cover the couple stories from bitcoin this week, and dedicated a whole section at the end of this report to the macro news.

Make sure you are watching Fed Watch, now on Wednesdays at 3 pm ET, and following my Telegram channel. I post about 20 times a day in Telegram and do a near daily live stream.

Bitcoin

We have been waiting for 6 years for a US bitcoin ETF. I know the timing because I was in the hospital for the birth of my son, the day the Winklevoss ETF was finally denied, back in 2017. A spot bitcoin ETF will eventually come, I'm not too worried. It's just amazing to see the illogical knots the SEC puts themselves in by not approving one.

Here is the latest development for the ETF in the US.

Archived (so you don't have to give scam pumping websites clicks)

VanEck has a long history of ETF products. It was one of the first investment firms to offer a gold ETF back in 2006 (first ever US gold ETF was in 2004). VanEck has also been leading the charge for a spot bitcoin ETF, currently on their third attempt.

The company has long been trying to get the green light for what will be the first BTC ETF in America, with its first application lodged with the SEC dating back to 2017, which was eventually denied.

VanEck persevered with a third application for a BTC ETF offering in June 2022 filed with the SEC, highlighting a number of reasons why the SEC should reconsider its previous decisions.

VanEck’s primary argument was that American funds were gaining exposure to Bitcoin through BTC spot exchange-traded products offered in Canada. America’s northern neighbor approved a spot Bitcoin ETF in February 2021, becoming one of the first countries around the world to do so.

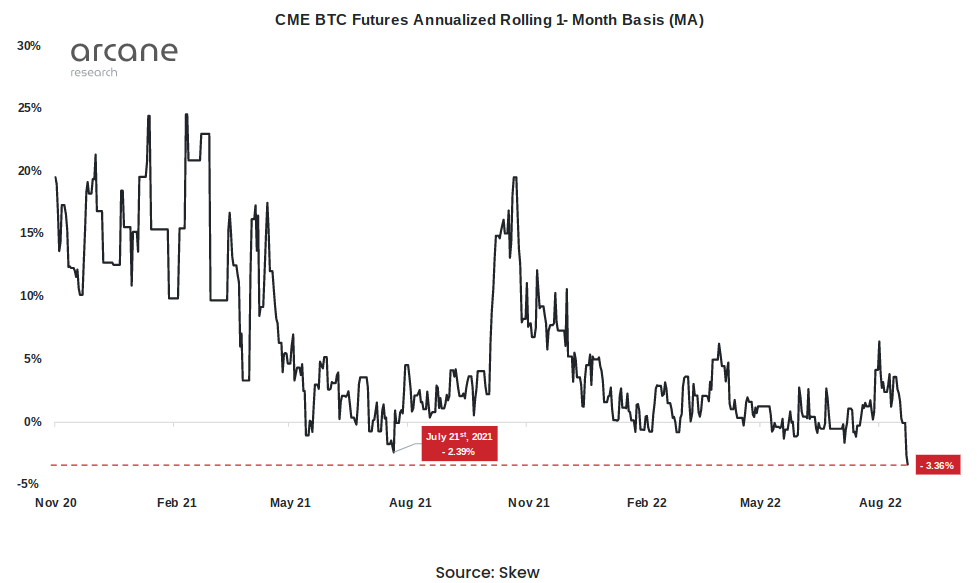

The slow week for bitcoin news forced most mainstream financial press sites to write headlines about the price, painting a negative picture. I think the lack of "action" and subsequent negative press around the price, has resulted in a negative spreads on futures.

Futures basis — the difference between futures contract prices and the Bitcoin spot price — is already back at lows seen only during June’s dip to $17,600. The move came thanks to last week’s sudden sell-off on BTC/USD, which resulted in multiple visits below the $21,000 mark.

“Overall, the current futures basis sits at levels only experienced briefly during the June crash,” Arcane confirmed, adding that the data is “indicative of a very bearish sentiment among futures traders.”

Normally, persistent and growing discounts means market sentiment is bearish, but I see this as just a result of low energy in bitcoin. There will be no lasting impact once "action" returns to the bitcoin market.

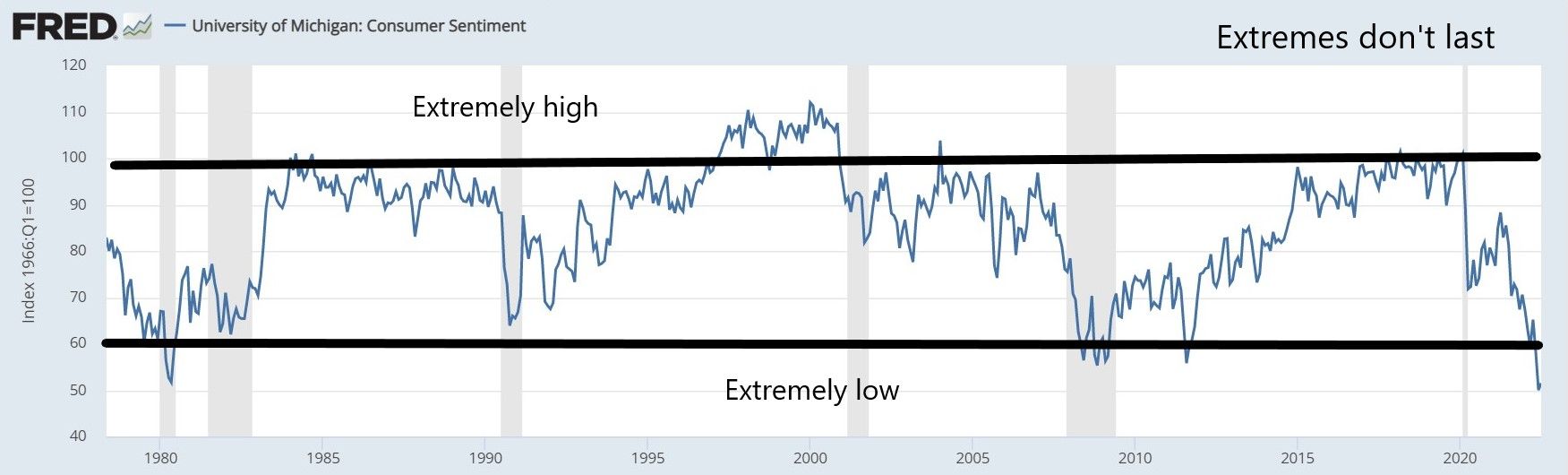

I'll take this opportunity to also point out how people often misinterpret the direction implied in current data. I see this all the time in consumer sentiment and other metrics of that nature.

Sentiment and other cyclical data will fluctuate within a range by definition. When statistics of this nature show "highest ever" or "lowest ever" on record, or "lowest in 40 years", it is highly likely conditions will reverse very soon. That data was formed by extraordinary conditions - i.e. "most ever" - that by definition are fleeting.

The more extreme these types of readings get, the more likely it is to reverse.

Applying that principle to this chart about Bitcoin Futures spreads, you can see we are at a big extreme. I wish they would have included the entire history, since bitcoin futures have only been trading on CME since December 2017. I'd like to compare 2018 to today.

The lack of action, a boring price, and MSM turning to stories about the price, naturally will affect the mainstream investors in markets like the CME, and they will slide into being more bearish.

Quick Price Analysis

| Weekly price* | $20,707 (-$585, -2.7%) |

| Market cap | $0.396 trillion |

| Satoshis/$1 USD | 4,824 |

| 1 finney (1/10,000 btc) | $2.07 |

Last week the bitcoin price decided it wasn't time to break out quite yet. The dip that started then has been very flat. No bounce whatsoever. Then, after Powell's Jackson Hole speech this morning, it started dipping a little more.

Daily chart

I do not see a massive waterfall cascading liquidation coming up in bitcoin. This low price has applied a lot of pressure to market participants, and if we were going to see liquidations, we would have already seen them. Like Terra and Celsius.

The order books are quite thin though (the number of bids and asks on exchanges at different prices), but there is plenty of money on the sidelines waiting to buy a big dip. Again, I don't think a big sell off is likely in this market. The bears have sold, the scams have been liquidated.

There's really not much more to say about price directly. We are waiting for market conditions to change. This is a good opportunity to ignore price for a while.

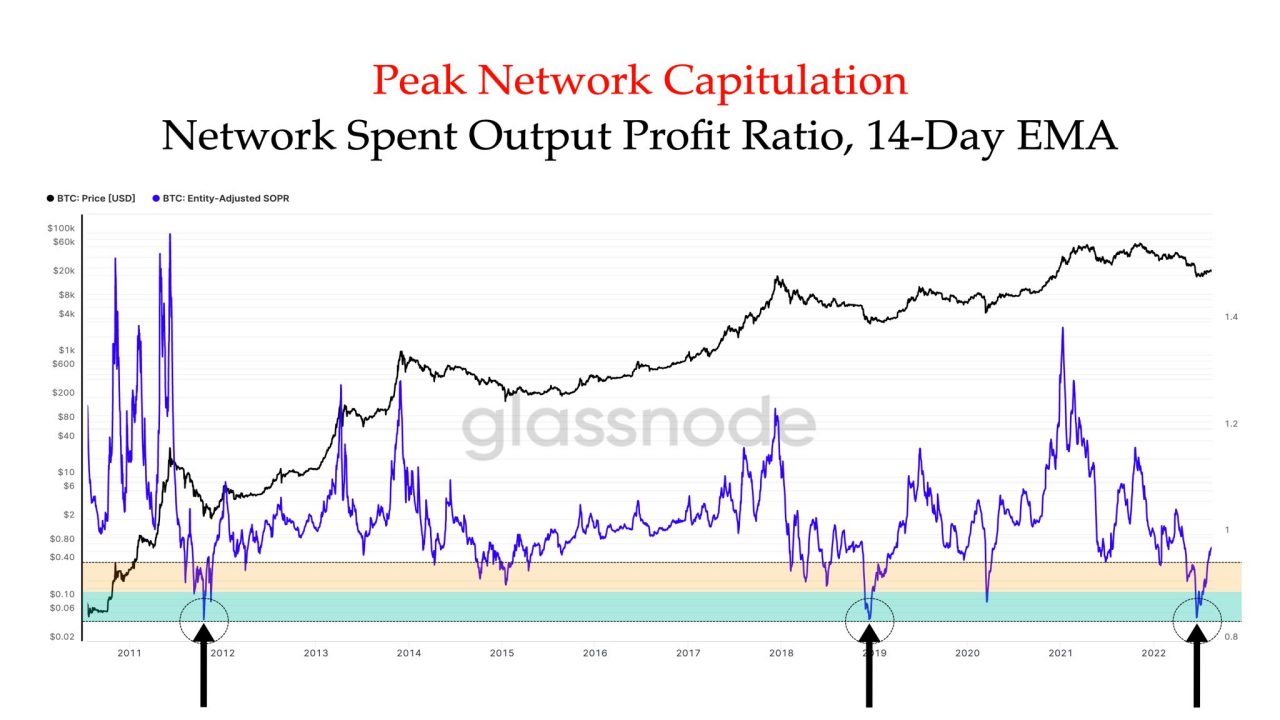

Hopium charts

Here are a couple hopium charts for you guys. There is light at the end of the tunnel.

The image below shows that the average bitcoin transaction was made at a loss from when the inputs were created. The last two times like three times it entered this territory marked major bottoms in price.

Headwinds and Tailwinds

Ethereum is a major headwind.

The Ethereum Crisis has not gotten any better. This week their team of developers found a new bug in the upgrade code that wiped the databases from a node on shutdown.

Ethereum merge in 12 days. pic.twitter.com/XPloPACyg9

— No Rest For The Wicked 🔥 ∞/21M ⚡ (@Arthur_van_Pelt) August 25, 2022

This was a MAJOR issue that was not caught in years of testing? The fix was quick, but not a good sign.

Remember, in one of my recent podcast episodes about the Ethereum Merge, it is not a binary outcome of success or failure. It could be failure on many different time scales. It won't be known for many years, if the Merge is bug free.

Even with the pre-fork hype, Ethereum is struggling with resistance. If this is a sell-the-news event in 12 days time, Ethereum is going to crash. Other than the recent low, there's nothing to offer support really to the price. That crash could negatively affect bitcoin, but that effect will be much less significant than most people think.

Stock Market

The perceived correlation between stocks and bitcoin has become a headwind this week.

In the chart above, you can see that bitcoin failed to rally as strongly as stocks three times now, the first two times bitcoin was right, and both markets went lower.

I don't think this will be the case this time. The stock market is on edge right now. The bears are saying we're in recession, stocks have to sell off, while bulls like me are seeing many reasons to expect a rally into the end of the year. Remember, stocks are forward looking. They don't care how bad the economy is right now, they care about how earnings will be in 6-12 months.

Anyway, bitcoin does not do well in an uncertain environment. The question is, whether stocks catch down, or bitcoin catches up? I'm leaning toward the latter eventually, but this coming week will see continued pressure on stocks.

Price Conclusion

The bitcoin market energy remains very low. Price is currently below all support levels I've identified in the last few weeks. It is facing the headwinds of the crazy Ethereum Crisis, global recession, and stocks consolidating their gains.

The risk of a large sell off is low, but there has been such a void in energy that price is finding it hard to get its feet under itself.

Overall, I expect the bitcoin price to continue a slow drop over the next week but for it to surprisingly hold its own relative to stocks.

Mining

| Previous difficulty adjustment | +0.6280% |

| Next estimated adjustment | +9.0% in ~4 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.09 (3 s/vb) |

| Median fee (finneys) | $0.09 (0.043) |

Mining News

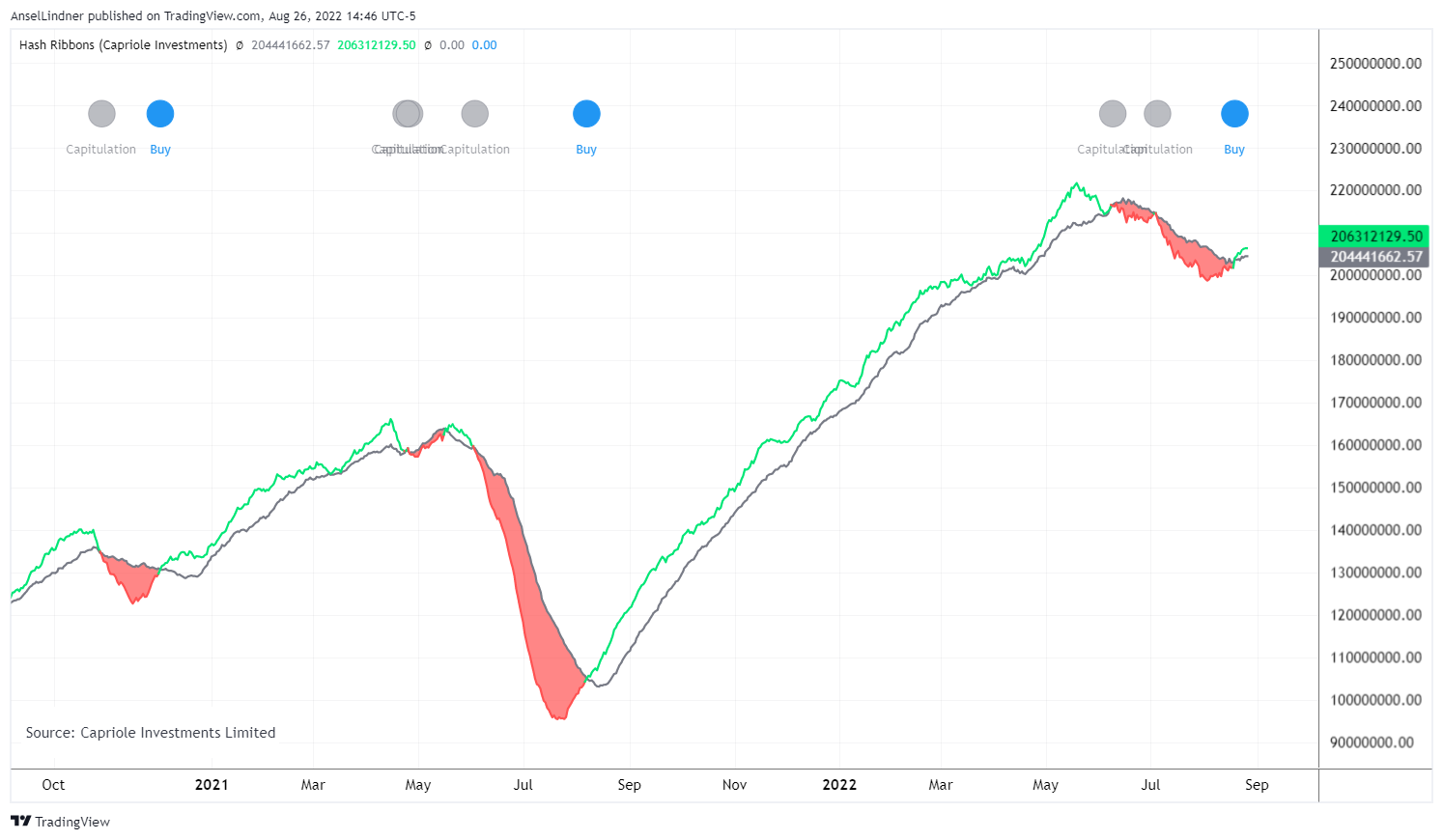

Bitcoin mining had a great week this week. Hash rate is surging, we got the BUY signal in the hash ribbon indicator, and

Bitcoin mining tends to go to where there is cheap excess energy, far away from population centers that could use that energy. Quebec, Canada and remote Russia are two examples. That's great, bitcoin can use the excess stranded hydro in a win/win for the power plant, but these remote locations don't always have fast internet connections.

Miners can purchase and run expensive satellite solutions, but that creates a centralizing pressure toward large miners that can more easily afford it. Small miners are left out.

Bitcoiners around the world are starting to look into SpaceX's Starlink internet. Currently, it is still too expensive for the individual miner, but it is already affordable for medium sized operations in remote locations, and work is being done to find ways to leverage this satellite internet link, to help decentralize and harden bitcoin's security.

Hash Ribbons

The hash ribbon is formed by the 30-day and 60-day moving averages. A bullish cross signals that the miner capitulation is over.

Last week, I showed that we were about to get a BUY signal, and this week we have it. This has been a very good indicator in the history of bitcoin because of miners' unique relationship to price.

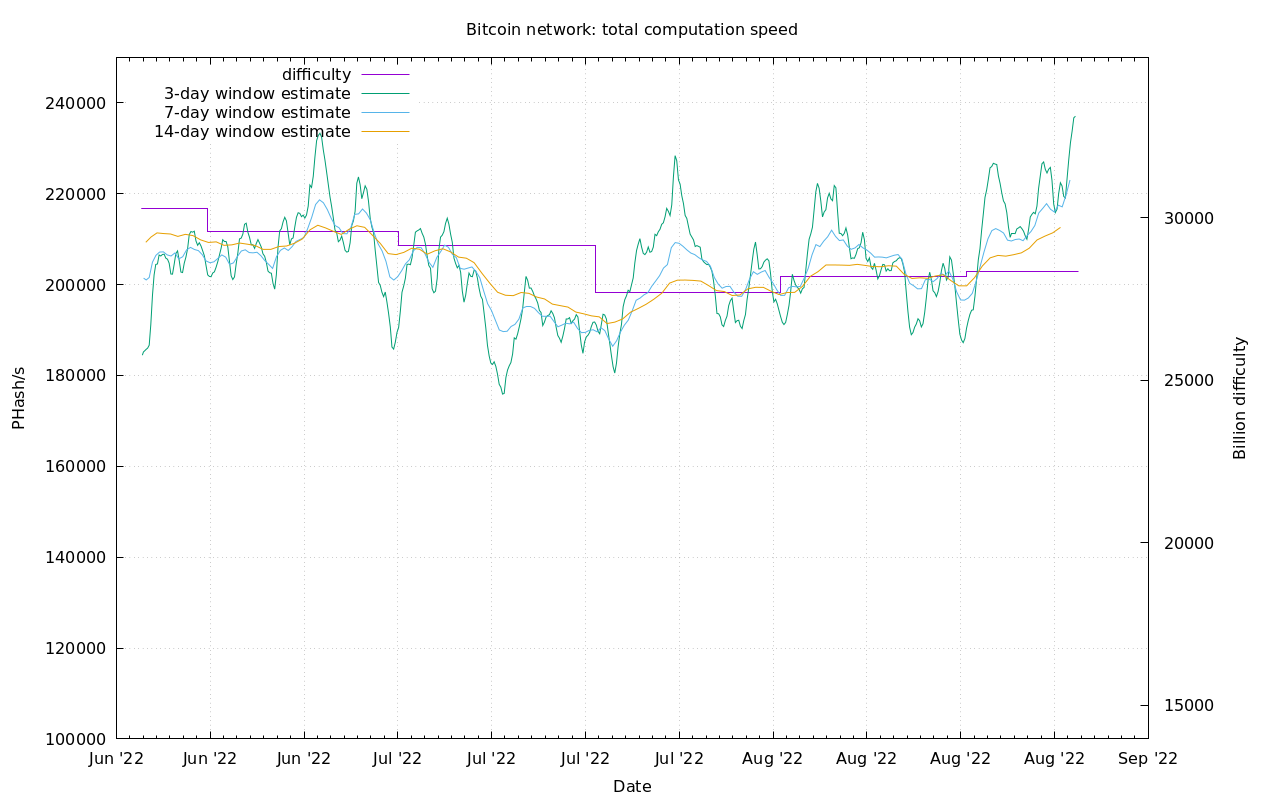

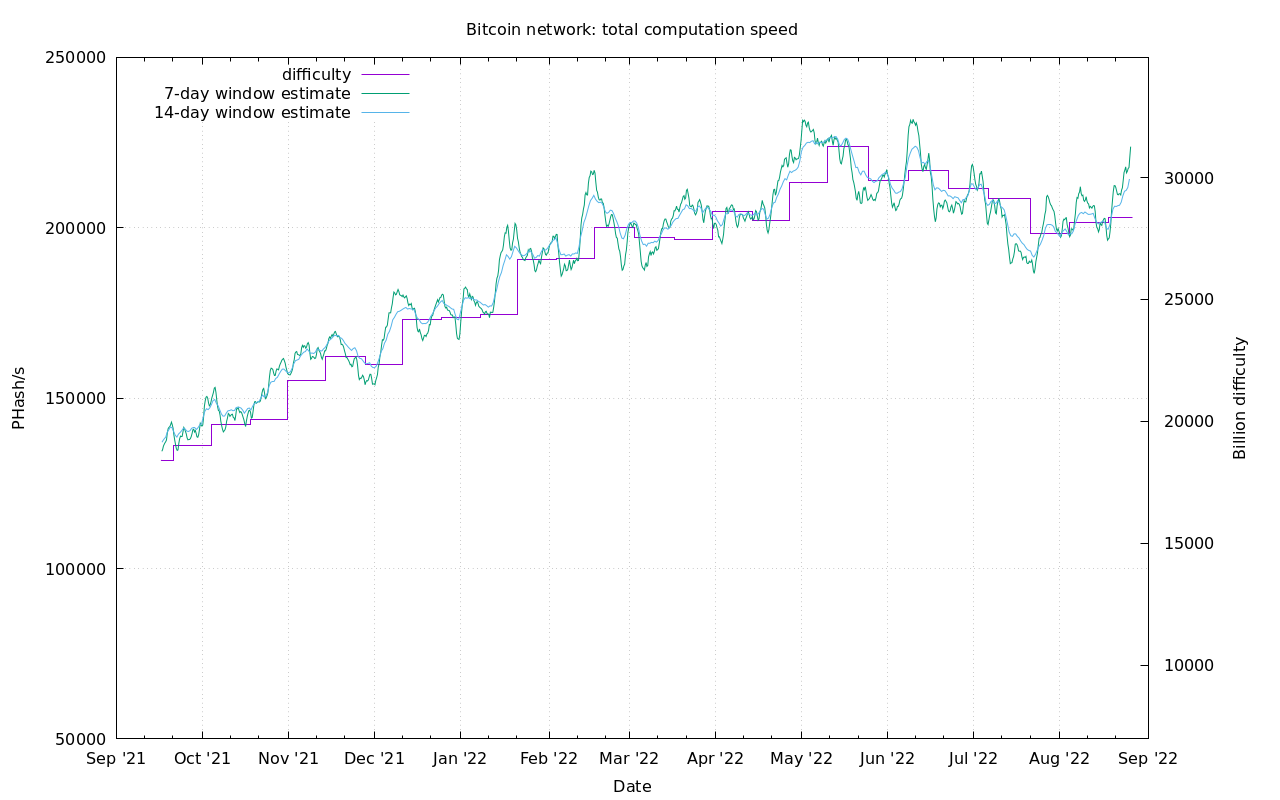

Difficulty and Hash Rate

Hash rate is surging this week in a sign that a large segment of the industry is in good health and bullish as ever.

We are approaching an ATH in hash rate, even though price is still 60% off the highs. Zooming out a little.

Europe and Russia

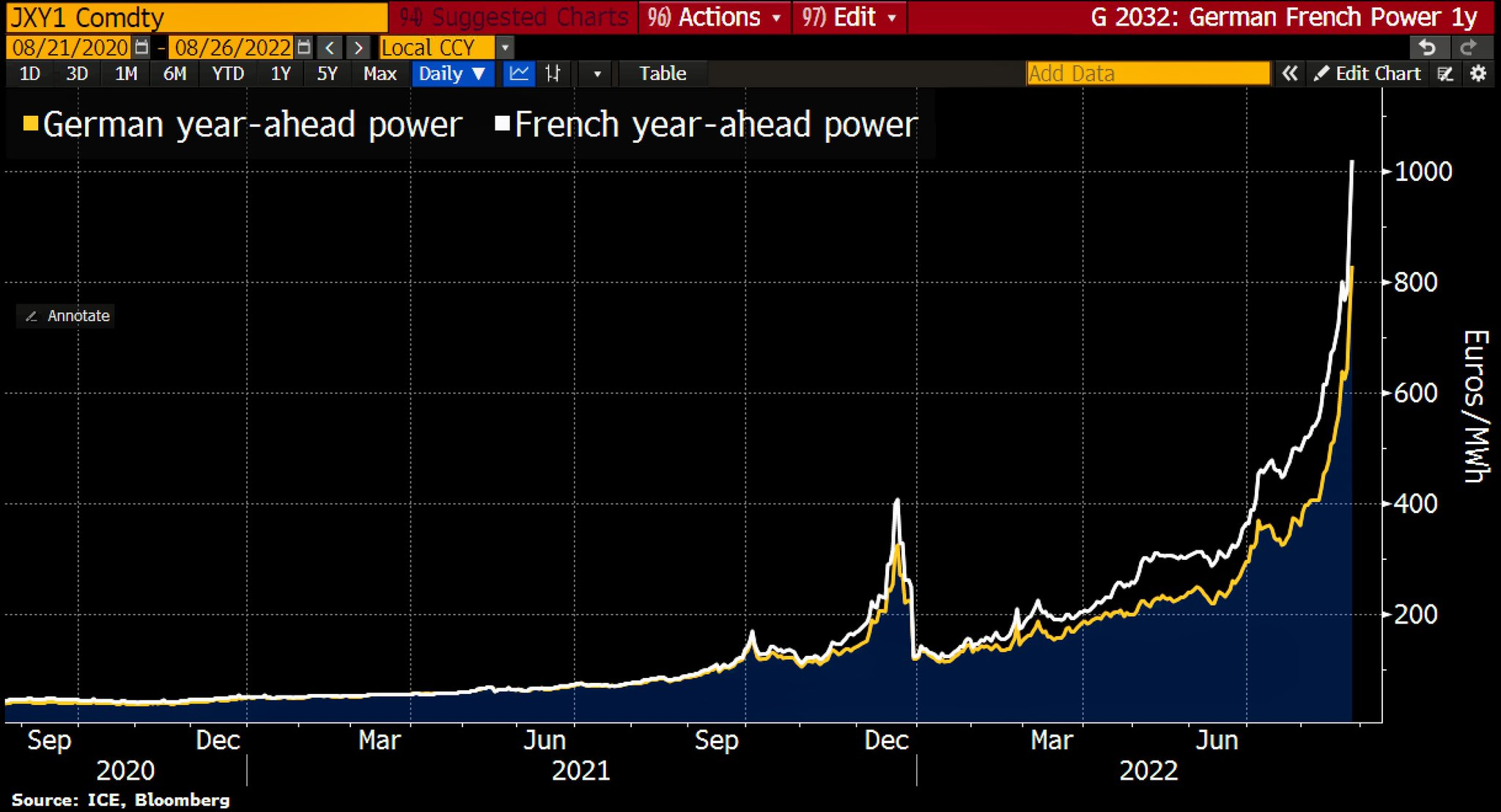

European energy prices are absolutely insane.

I've been trying to stress lately that "inflation" (price increases) is not monolithic across the world. We have been tricked by 50 years of increasing globalization, where goods flowed freely and prices tended to harmonize.

That is not the case anymore. We are seeing very high "inflation" numbers in Europe while the US hit 0% in July.

In Germany and France, electricity prices are 10x higher than normal. To put it bluntly, it is unsustainable and will cause years worth of damage to the European economies. People will freeze this winter.

I've seen graphs floating around twitter, trying to claim that German natural gas reserves are 75% full, and increasing. But their reserves can only fulfill 20% of their demand for the winter, and then next year, they will have to buy that much more natural gas to fill the reserves back up.

Basically, Germany is looking at a winter with only 15% of their normal demand covered, unless they can source it elsewhere, bidding up the prices even higher. It's a disaster.

I hope the European people know, their technocrat, Marxist, globalist leaders did this to them. These leaders chose an economic war with Russia when they knew very well the consequences. They chose to sacrifice the well-being of their people and the lives of many Ukrainians, all for their own delusions of power.

Germans are finally starting to get it.

Earlier this year, I saw an off ramp for Europe with a quick peace deal brokered by Turkey. That has failed. The EU (and US) war-mongers have spit on that deal. What I failed to see was that Russia would pursue a strategy of least risk to them, and that the European people were idiotically unaware of what was happening to them.

Right now, Russia is gearing up for a major offensive in Ukraine. They've grown tired of just attriting the Ukrainian military and want to make advances before the winter sets in.

The end of the conflict is still not in doubt. The only question is the path toward the eventual Russian success. Will they try to decisively end it, or simply allow the Europeans to deplete themselves, along with the Ukrainian military? I think Russia will try to gain territory prior to winter, but then might be happy to let Europe suffer for a while.

This means higher prices in Europe continue, businesses failing and closing their doors, and much of the heavy industry in Eastern Europe and Germany shutting down. Imagine being a chemical producer in Germany, and your input costs go up by 10x with no end in sight. You will be force to close down your operations.

China

Keeping with the theme that economic troubles are not equal across the world, it seems this week, that a whole lot of people are finally waking up to the fact that China is not doing so hot. Imagine that, I've been talking about this for a year.

The People's Bank of China (PBOC) has continued to cut rates, almost in a haphazard fashion. Each week, we get new reports of rate cuts to different official benchmarks. China's growth is likely negative for H1 2022, and will be worse in H2.

Their real estate sector, that was the largest asset class in the world (Chinese real estate was a $55 trillion market) is in free fall. The development model over the last couple of decades has been pre-sales of apartments. People would buy apartments a year or two before they were completed. Now, as it becomes more likely those projects will never even be started, citizen across the country are boycotting their mortgages.

70% of real estate developer bonds are below investment grade. Priced around $0.70 to the dollar. With a large segment nearly worthless. They are stuck in a self-reinforcing loop to disaster.

Lots of analysts thought record trade surpluses meant China was doing well. Instead, it was their own consumers who were in really bad shape. Domestic demand has fallen badly, while US demand has not, leading to a record trade surplus for China.

Note: this is likely a hidden source of declining oil demand, too. China's economy is probably much worse than the official stats portray. The Chinese people are struggling and their energy demand is really slumping.

Jackson Hole and US Economy

This morning, my Telegram channel listened to Powell's speech live together. It was short and sweet.

Anything less than increased hawkishness from the #Fed will be interpreted as dovishness. Anything less than 75 bps in Sept will be dovish. Anything near 0% MoM CPI for August will be dovish. https://t.co/Ooovuzk1Jm

— Ansel Lindner (@AnselLindner) August 25, 2022

Powell was not more hawkish, so by default that means he was dovish, but tried to walk the fine line between the two. He continually emphasized his policy was aimed at "reducing demand" and "below trend growth" in order to crush "inflation". Translation: they need to crash the economy in order to get inflation down.

Of course, I don't believe that. The Fed's actions really aren't that important. "Inflation" is already coming down, the first half of the year was bad economically, but the worst might be behind us. Q3 could be a positive quarter for GDP.

I expect a hidden part of the financial system to suffer acute stress, like September 2019, forcing the Fed to pivot their policy, but it will be transparent to most of the market. We won't notice it. The Fed will panic and pause rate hikes, but the US economy will stay hovering around zero growth.

The acute stress could come from China and Europe. The financial system and market for US government debt is global. If China and Europe have a massive credit squeeze, it would force the Fed to pivot. The rest of the world will be need the pivot more than the US.

What we are seeing right now, is that the US is an island of stability, sandwiched between the insanity and self-destruction in Europe and the credit crisis in China.

US CPI was 0% month-over-month in July, and the Fed's preferred CPI alternative Personal Consumption Expenditures (PCE) was announced this morning as well, which came in at -0.1% in July!

*US Personal Income +0.2% In Jul; Consensus +0.6%

— *Walter Bloomberg (@DeItaone) August 26, 2022

*US Personal Spending +0.1% In Jul; Consensus +0.5%

*Jul PCE Core Price Index +0.1% Rate On Mo; +4.6% On Yr

*Jul PCE Price Index -0.1% Rate On Mo; +6.3% On Yr

Gasoline futures also gapped down this morning. Gas prices have a very high correlation to CPI.

I expect August CPI to continue the slide started in July. We have a situation where high prices elsewhere in the world are crashing demand for oil so much, that the US is reaping the benefit. It's a weird world in macro right now.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 26, 2022 | Issue #206 | Block 751,283 | Disclaimer

* Price change since last week's report

Cover image: unknown