Bitcoin Fundamentals Report #315

MicroStrategy dominates the news cycle, ETF options make a splash, price cools after first $100k run, and mining sector news.

November 25, 2024 | Block 871,966

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Consolidation after rip |

| Media sentiment | Very Positive |

| Network traffic | Stable |

| Mining industry | Lagging price |

| Price Section | |

| Weekly price* | $94,942 (+$4,366, +4.8%) |

| Market cap | $1.878 trillion |

| Satoshis/$1 USD | 1053 |

| 1 finney (1/10,000 btc) | $9.49 |

| Mining Sector | |

| Previous difficulty adjustment | +0.6322% |

| Next estimated adjustment | +3% in ~6 days |

| Mempool | 95MB |

| Fees for next block (sats/byte) | $0.67 (5 s/vb) |

| Low Priority fee | $0.53 |

| Lightning Network** | |

| Capacity | 5213.58 btc (+0.3%, +15) |

| Channels | 46,892 (-0.1%, -68) |

- All MicroStrategy

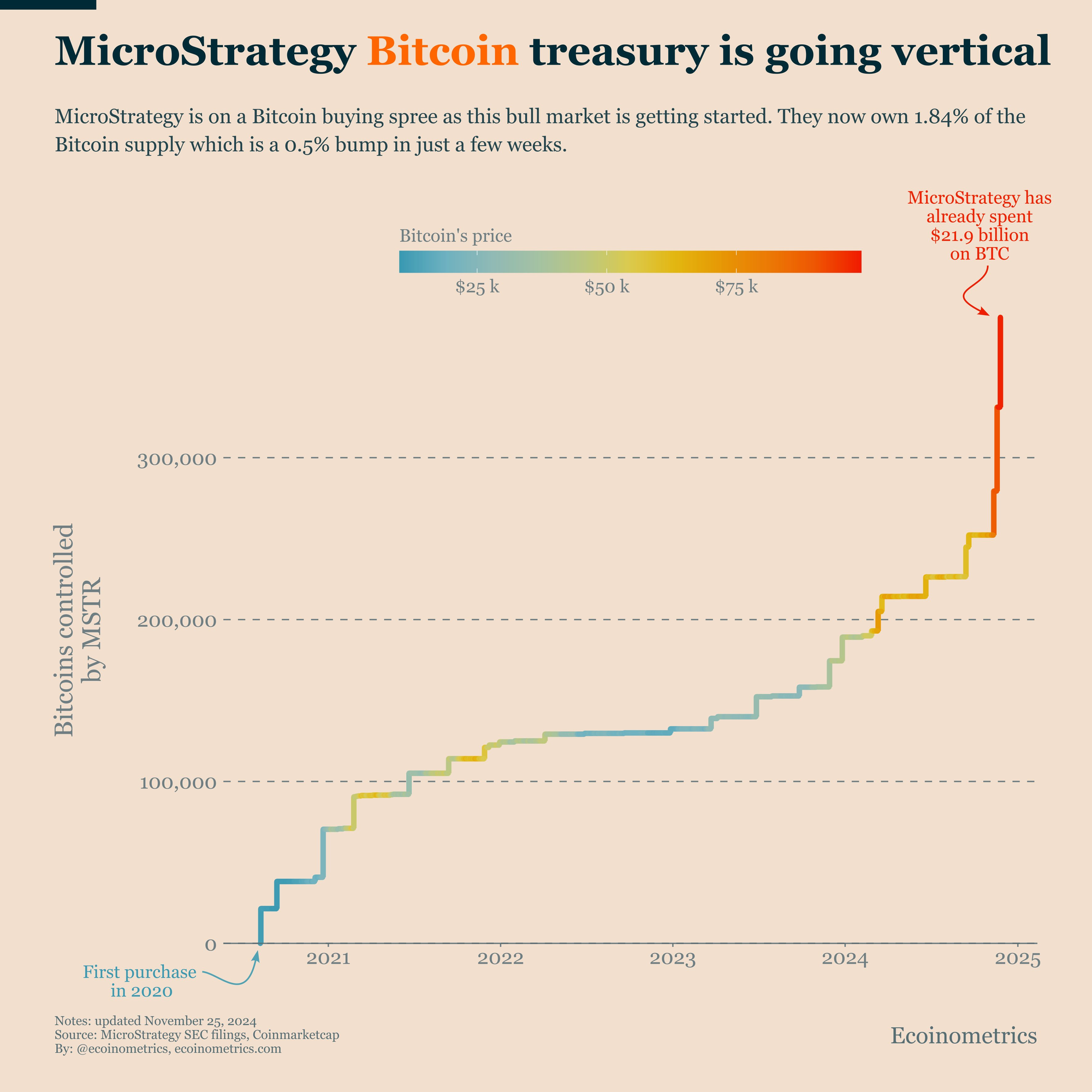

90% of this week's news cycle in Bitcoin has been about MicroStrategy. This week’s updates reveal they've purchased $12B in Bitcoin over the last three weeks, with progressively larger acquisitions ($2B, $4.6B, and $5.4B).

MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per #bitcoin and has achieved BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hodl 386,700 $BTC acquired for ~$21.9 billion at ~$56,761 per bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

Their treasury balance mirrors the price chart.t.

People are still confused about how this isn’t a giant Ponzi scheme. I've had pushback on Twitter from anonymous accounts claiming that this strategy will collapse if the price dips. However, this is very low-leverage strategy. Estimates for MicroStrategy before this latest purchase placed its net debt at $4B and total assets at $30B.

The amount of pushback tells me this rally has more room to rally before people's resistance is broken and only then will it mark a major top. I’ll monitor it closely, but I expect MicroStrategy’s stock (MSTR) to retest the highs this week or next.

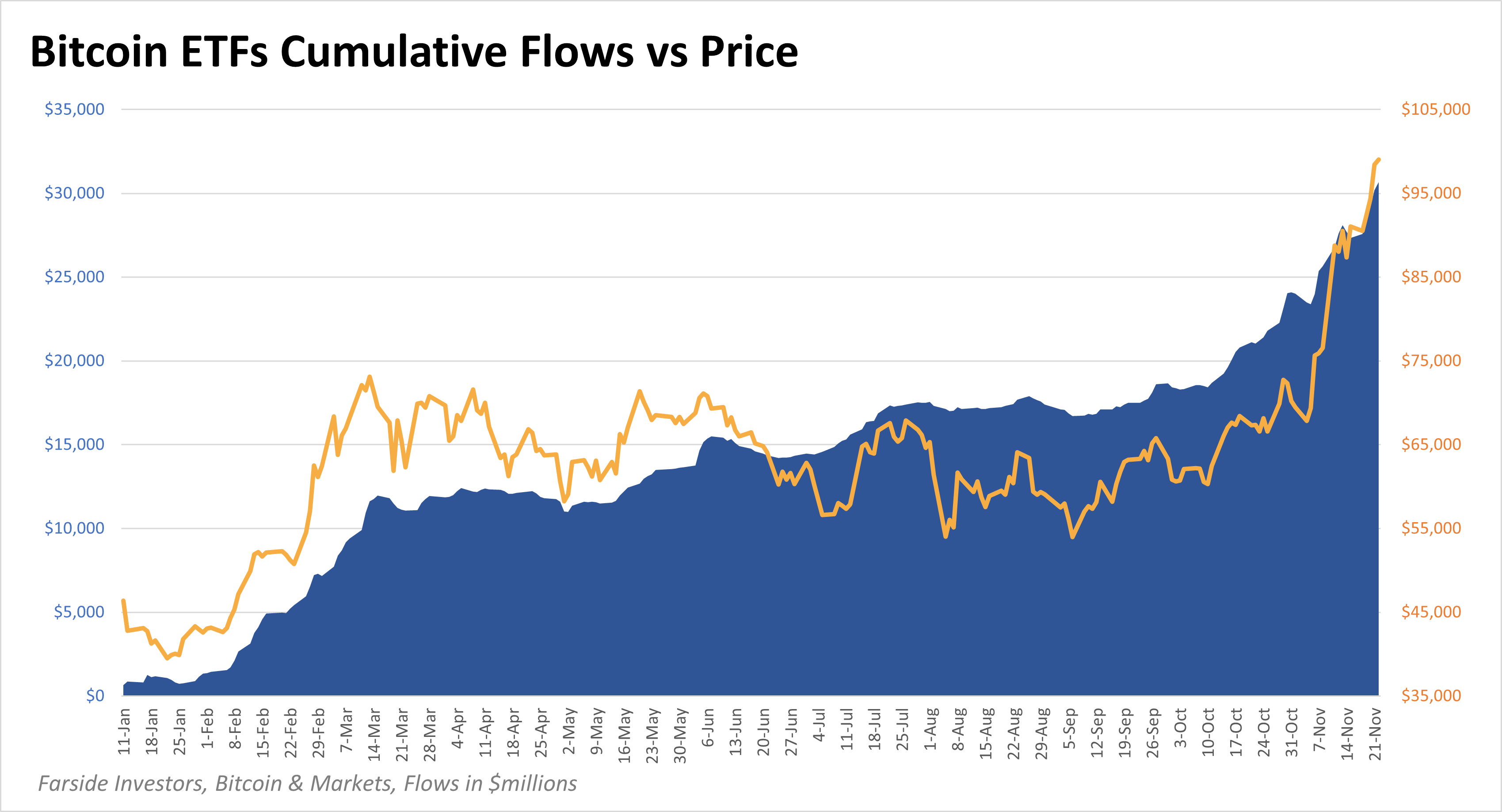

- ETFs Continue to Stack Bitcoin

With all the attention on MicroStrategy, many are overlooking the stacking happening via ETFs and other large players. Checkmatey on Twitter has estimated MicroStrategy's buying to account for only 10-15% of total buying activity.

The ETFs just passed $30B in net inflows since their launch. This has far surpassed the second-best ETF launch in history, rewriting the textbooks. Pre-launch estimates from industry professionals centered around $10B. We’re already at 3x that number with two months left in the first year of trading—and the rate of inflows is accelerating.

I wouldn’t be surprised if inflows hit $50B by Jan. 11, 2025, the one-year anniversary.

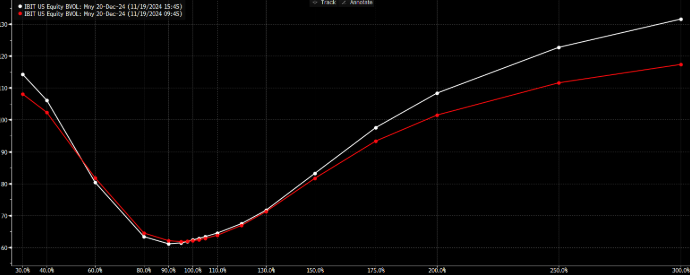

- Bitcoin Options Begin Trading

Part of the reason for the recent acceleration in ETF holdings is the approval of options trading. We’ve been waiting for this because of the impact of negative gamma and other unique characteristics that can create a “melt-up” in price.

Here is the first day of trading contracts, showing the predicted "volatility smile."

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

- Bessent In As Treasury Secretary

The decision has been made to nominate Scott Bessent as Treasury Secretary instead of Bitcoin uber-bull Howard Lutnick. Bessent is still considered Bitcoin-friendly, but not as bullish as Lutnick. His selection makes more sense when you consider his broader shitcoin interests, as he’s made positive comments about blockchain and crypto over the past year. This fits well with Trump's ties to shitcoins as well.

While this isn’t bad for Bitcoin, it’s less bullish than Lutnick’s potential nomination would have been.

I don’t have any other strong opinions on him at this time. Stan Druckenmiller has praised Bessent highly, saying: "He’s the only guy I know who's not only a market participant but very fluent and comfortable in academic circles," adding that Bessent has a rare combination of IQ and EQ (emotional intelligence).

Of course, the mainstream financial press has been all over this nomination, crediting it with notable market moves, which is absurd. They claim Bessent’s nomination has caused stocks to rally along with bond prices because of his stance on budget cuts and gradual tariffs.

Macro

- US 10Y Treasury Yield and Path Forward

I called out this topping pattern last Thursday with a sloppy drawing, then again on Friday with this chart. This is important because it shows that the rise in the 10Y yield was a temporary relief from the actual fundamentals pressures toward lower yields.

The structure of the global financial system, strained by oversaturation of debt, doesn’t allow for more debt to successfully backstop the economy here. While more debt may paper over a few issues, the overall pressure points toward deflation, not inflation. Yields will fall as we head into a recession.

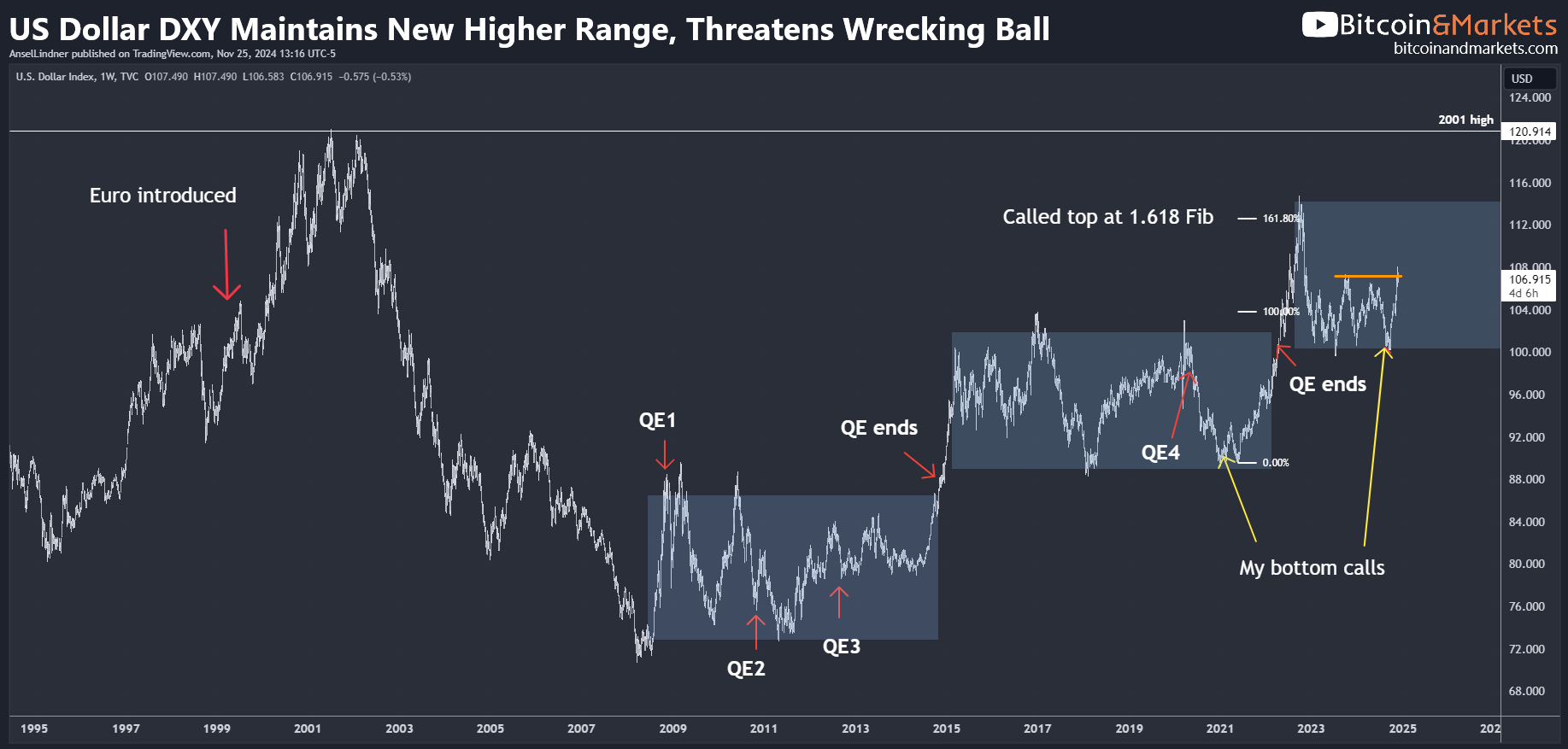

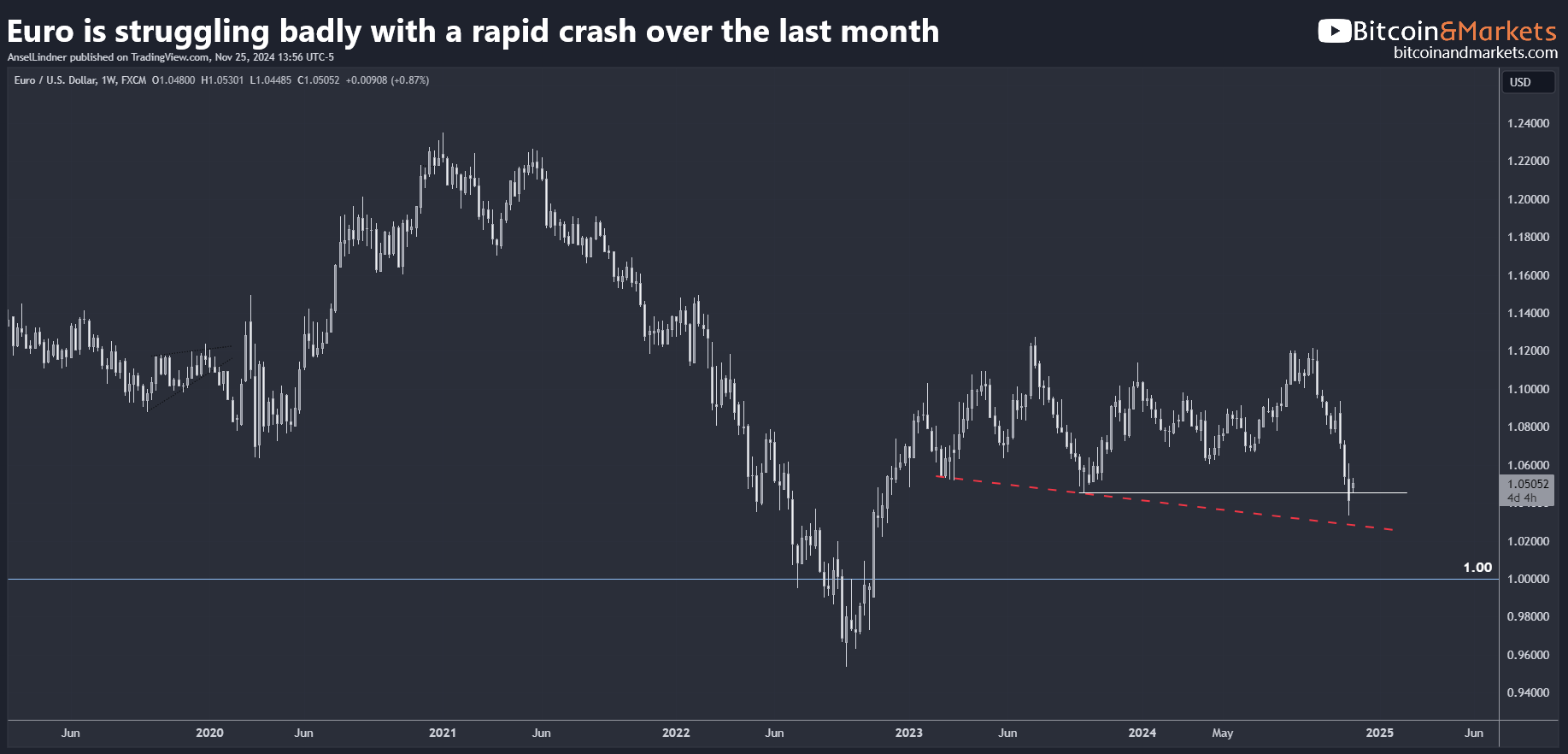

- US Dollar Rips, Euro On Life Support

Another key aspect of this pivot is the strengthening dollar. My macro thesis points toward lower yields and a stronger dollar, both of which came roaring back last week.

We are not heading back into inflation or entering a higher inflationary period with CPI above 3%. As we approach a recession, CPI will drop below 2% within a few months. This thesis is supported by falling yields and a rising dollar.

The Euro is performing so badly that comparisons to the Yen are being made. LOL.

The Euro is the worst-performing major currency in November. Things are desperate in Europe: they’ve gutted their energy production and economy, and now they’re trying to ban populist parties from taking power. France is trying to jail Le Pen, and Germany is seeking to ban the AfD.

- Musk, Ramaswamy Reveal DOGE Blueprint To Cut Government Waste

Their focus will be going after bloat after the Chevron Deference case. They will target the regulations themselves that overstep the bounds of the authority Congress has granted. This will allow for sweeping cuts, all completed by a stroke of the pen. By getting rid of extra-Congressional regulations, fewer employees will be need, and they want to trim there through paying for transition to the private sector.

- Russia Launches New Intermediate-Range Ballistic Missile

The globalists are doing everything they can to escalate the war in Ukraine before Trump takes office. They've approved the use of long-range missiles deep into Russia, which is very dangerous because they have to be targeted and launched by Americans, not Ukrainians. This is an open act of war. They are hoping Putin would retaliate to open full scale war.

Instead, Russia is opening up further fronts in the war. IMO the Chinese were cutting cables in the Baltic, North Korean troops are being embedded in target sites around Russia as human shields of sorts, and now Russia launches a new type of ballistic missile into Ukraine. I doubt Putin will allow escalation make him do something stupid when Trump is less than 2 months away.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

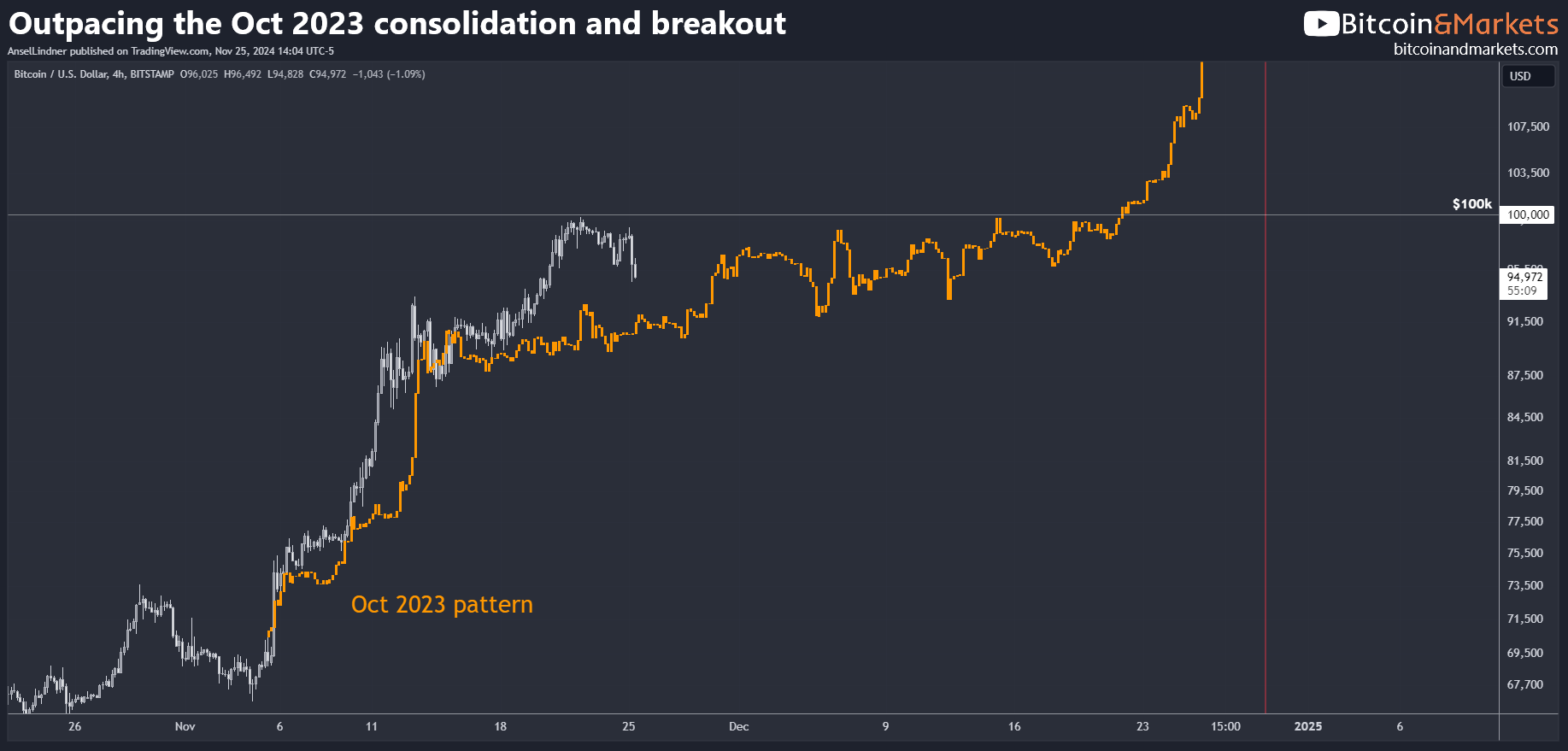

Despite all this bullish potential, the base case for this week remains consolidation along the October 2023 path. Some supply between the current price and $100K may become available, but the Saylor Put should prevent a significant dip. A breakout could happen this week, but it’s more likely to occur next week.

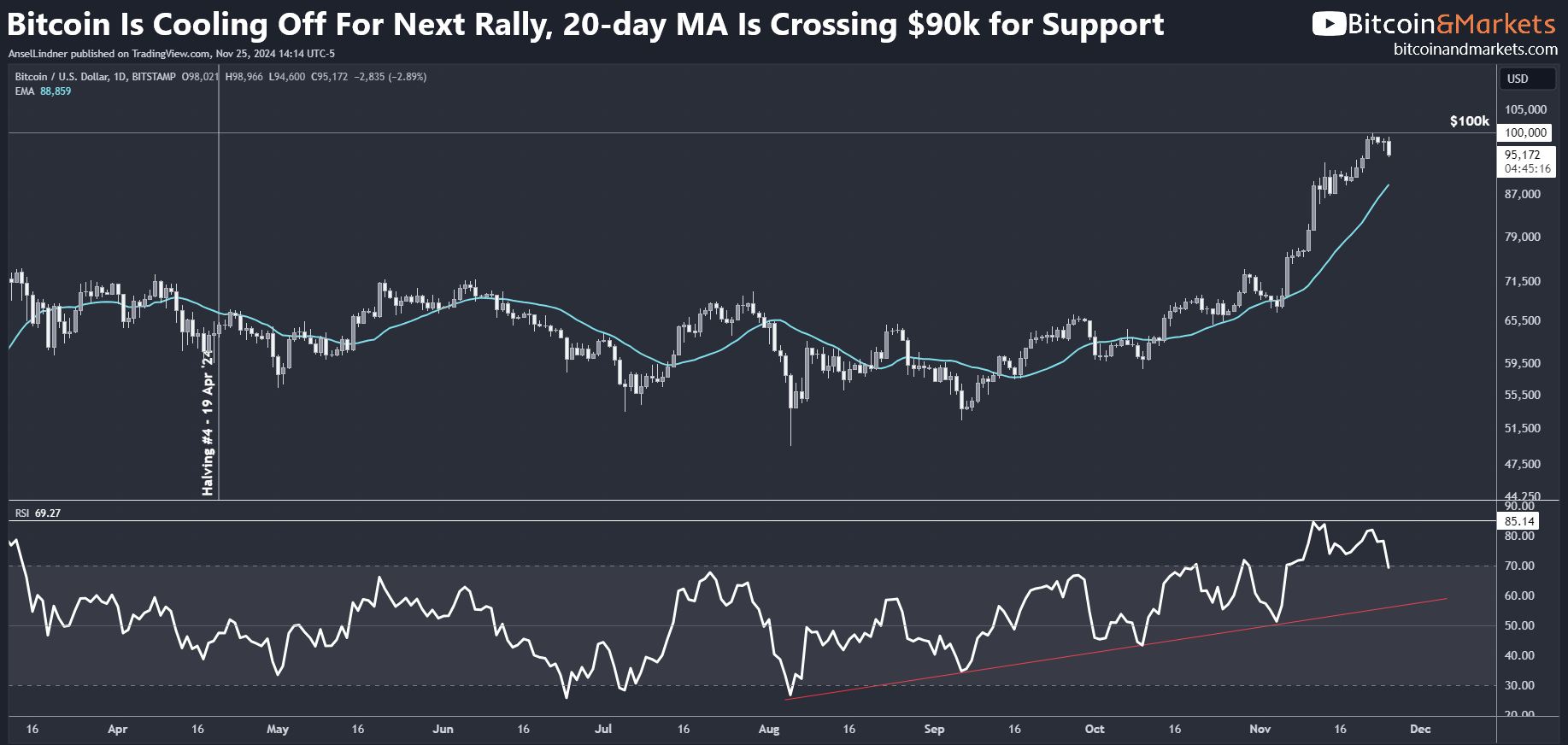

After pushing last week all the way to $99,800, price is coming back today, currently at $95,008. We have been outpacing the October 2023 path. I expected a faster consolidation period than 2023, but with the same general characteristic of a slow upward consolidation to a break out. I think the psychological pull of $100k was too strong, and price had to go test it. We should now settle into the bumpy sideways until the real break out happens.

MSTR and the ETFs continue to suck up bitcoin, minimizing any dips. Without these buyers, the rally to $99k would have had a larger correction than just $95k. Perhaps it would have even back tested down to $74k, historically bitcoin does 30-40% corrections in the bull market. Due to this constant buy pressure, I do not see the price going much lower.

Below is the 20-day moving average currently at $89k. At the rate that it is rising, it will be over $90k tomorrow, and as high as $94k by Thursday this week (Thanksgiving in the US). That would be nice support to bounce off of as bitcoiners get bombarded with questions by friends and family.

I think Thanksgiving could be a big day for a reversal, into Friday's end of month expirations.

My base case for this week remains consolidation sharing characteristics with the October 2023 pattern. Supply that has come onto the market due at the $100K level has been demolished by massive buyers already. The next test will have much less resistance. The end of month might allow some stiff resistance to rollover to a more favorable position making $100k less important to defend as well. A breakout could happen this week, but it’s more likely to occur next week.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

There are still some crazy environmentalists out there who refuse to learn anything.

A tentative proposal to tax cryptocurrency mining to raise funds for climate action took off during a United Nations climate conference that’s set to come to a close today.

The idea is that a climate tax could reduce emissions by incentivizing mining firms to clean up their operations. And it could provide desperately needed funding to help less affluent nations transition to renewable energy and adapt to the effects of climate change.

“There are swathes of the economy which are largely under-taxed yet polluting the planet. Yet they have huge potential to close the climate finance gap,” the report says.

Remember, bitcoin mining is ZERO EMISSION by the very standard that EV's are zero emission. These people are painfully dumb. Also, the bitcoin mining industry is by far already the most green industry for sources of power. Estimates are that over 50% of the energy for bitcoin mining comes from renewable/clean energy. This is because it provides the very profit for many of these industries. They are trying to kill their golden goose.

This won't go anywhere, just amazing to see the debunked 2017 talking points still believed and used by people.

Texas’ utility regulator has passed a rule requiring Bitcoin miners using the grid maintained by the Energy Reliability Council of Texas (ERCOT) to register and share key details about their facilities.

Under the Public Utilities Commission of Texas (PUCT) rule, passed on Nov. 21, miners must share the location, ownership information and demand for electricity of their facilities with the state agency.

Miners have only one working day after the date their facility connects to the ERCOT grid to register and must renew every calendar year on or before March 1.

Some might see this as a pretense for some sort of bitcoin mining crackdown, but I think it is in good faith. The authorities would like to have a detailed map of miners and their grid. They already enroll most large miners in their voluntary curtailment program that is works well for the grid and bitcoin miners.

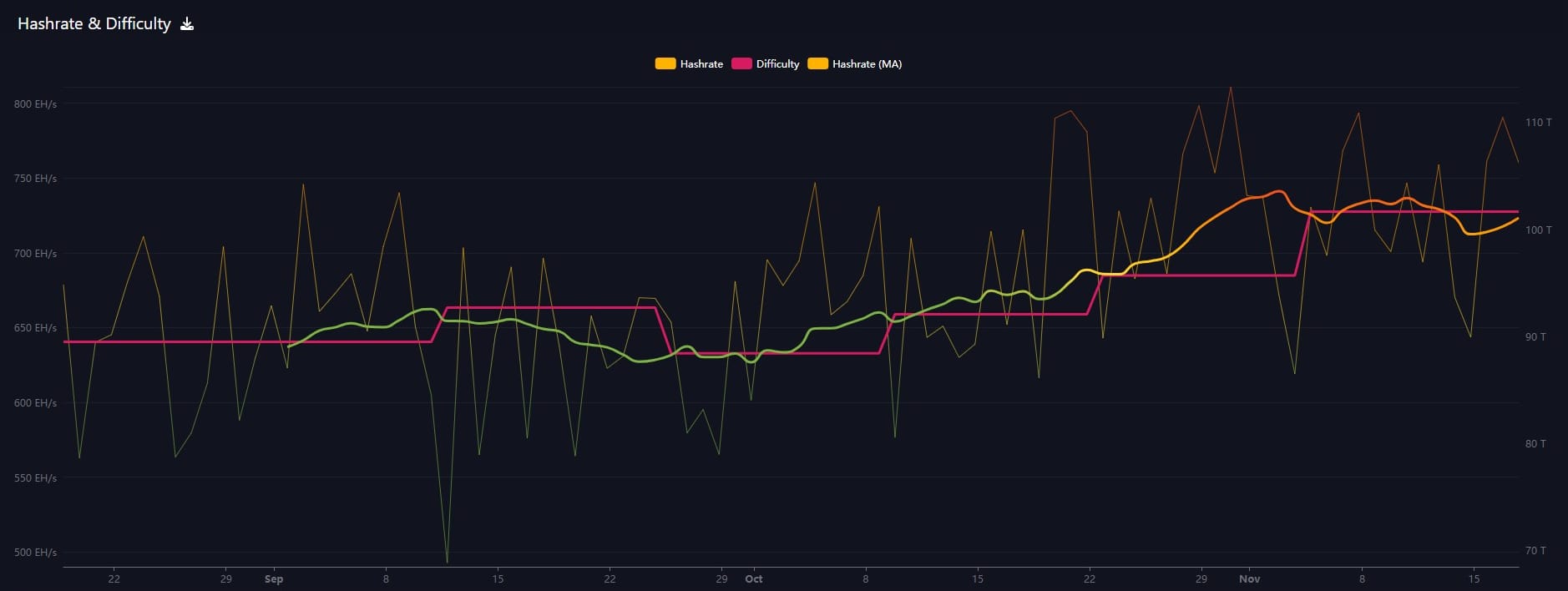

Hash rate and Difficulty

Bitcoin's hash rate has been surprisingly flat again this week, with no catch up yet to the price spike last week. This is generally healthy and we should expect it to rise in the near future.

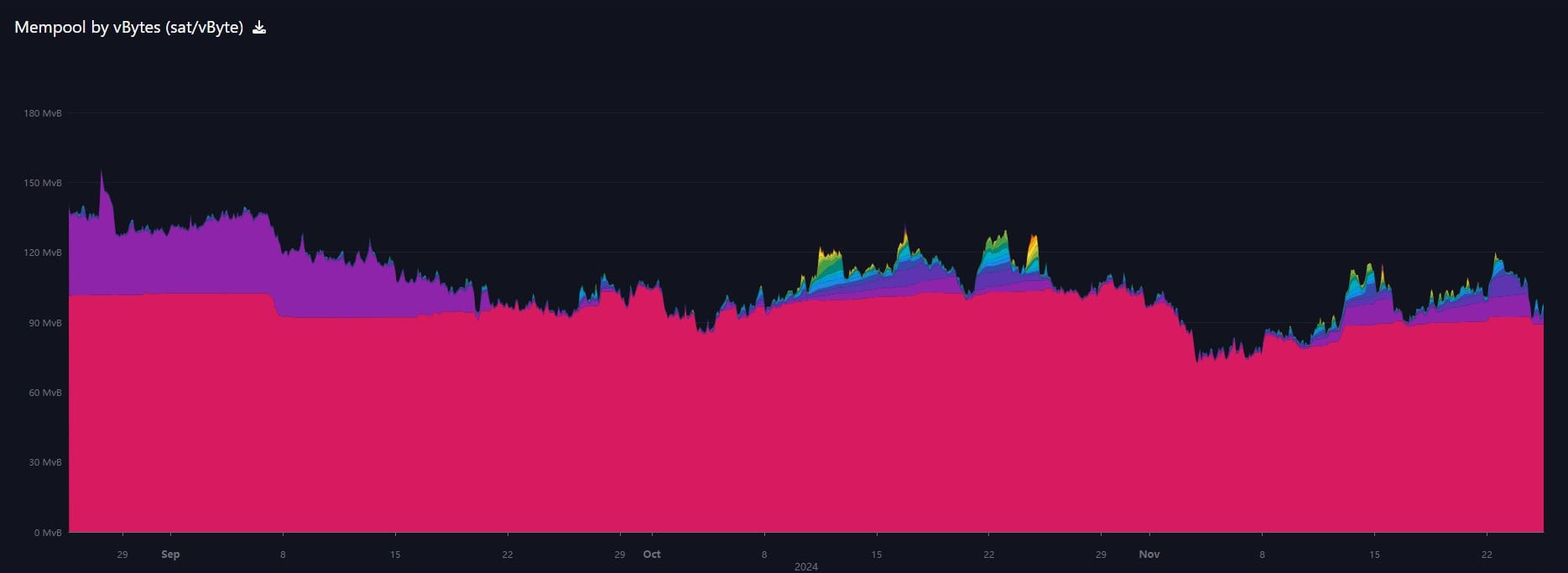

Mempool

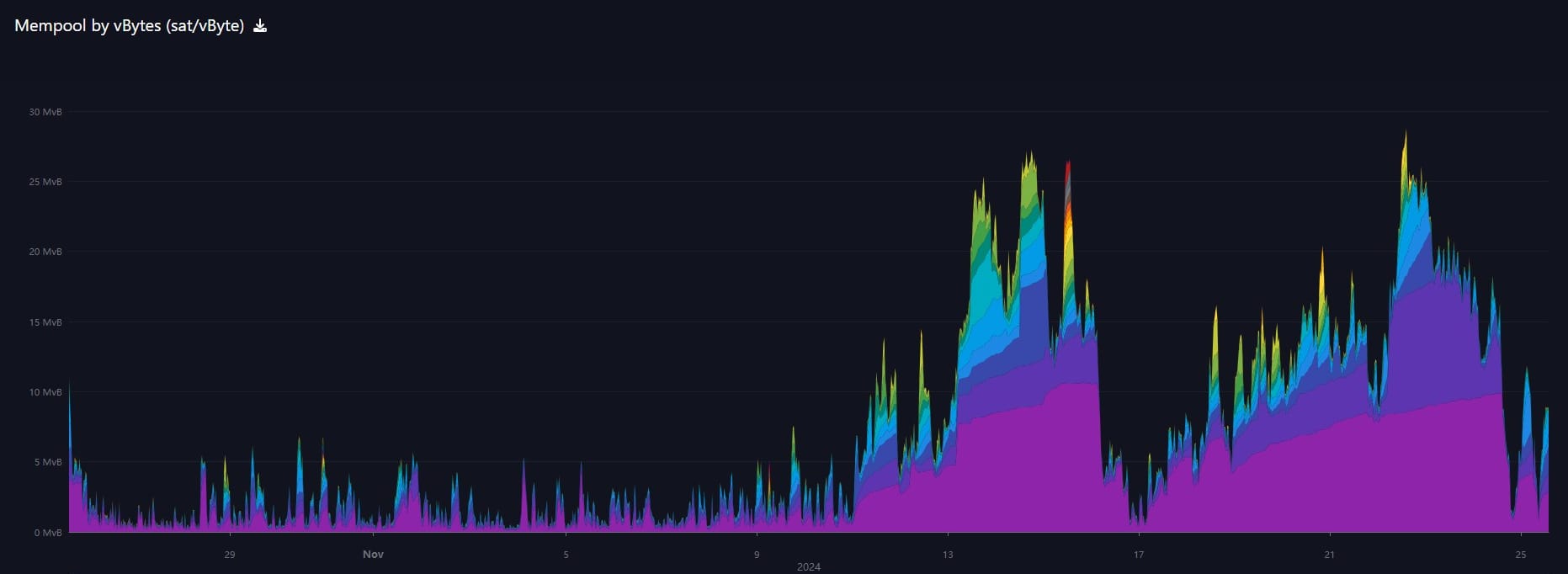

Despite the spike in price to nearly $100k, the mempool has been generally quiet this week. I typically use the mempool to weigh the drama in bitcoin. For instance, with the price almost breaking $100k and all the live streams, tweets and excitement around that event, the network doesn't seem to have gotten all that excited. This wasn't the euphoric move that we, deep in the rabbit, thought it was. The real network activity is likely after the $100k mark.

I stripped out the cheapest fee transactions to show the action this week more clearly. There was a very slightly spike of fees which has now disappeared. Nothing like one would expect almost breaking into 6 digits.

- NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Retail Traders Are Coming: New Google Trends Data For Bitcoin

- Key Indicators for Bitcoin's Path to $100K and Beyond - Premium

- MicroStrategy’s Bitcoin Blueprint Isn’t A Hunt Brothers Silver Scheme - FORBES

- What Trump’s Ross Ulbricht Pledge Could Mean For Other Campaign Promises - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com