Bitcoin Fundamentals Report #288

Slow price news but lots happening behind the scenes in Congress and with 13F filings. 2024 is the Bitcoin election? SLOOS debrief and CPI coming up this week. Mining and L2 news.

May 13, 2024 | Block 843,316

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Something is about to happen |

| Media sentiment | Neutral |

| Network traffic | Back to normal |

| Mining industry | Squeezed |

| Price Section | |

| Weekly price* | $62,783 (-$169, -0.3%) |

| Market cap | $1.236 trillion |

| Satoshis/$1 USD | 1595 |

| 1 finney (1/10,000 btc) | $6.27 |

| Mining Sector | |

| Previous difficulty adjustment | -5.6250% |

| Next estimated adjustment | +1.5% in ~9 days |

| Mempool | 230 MB |

| Fees for next block (sats/byte) | $1.32 (15 s/vb) |

| Low Priority fee | $1.14 |

| Lightning Network** | |

| Capacity | 4859.67 btc (+2.6%, +123) |

| Channels | 51,883 (-0.4%, -198) |

In Case You Missed It...

Bitcoin Magazine Pro

- Fatal Flaws in Modern Monetary Theory

- Market Tracker breakdown: Will Bitcoin’s Market Malaise End Anytime Soon?

- Mining Tracker breakdown: Bitcoin Mining: Managing Change

Member

Community streams and Podcast

Blog

Headlines

- Extremely slow market, boring times

I skipped last week's newsletter due to travel, but we didn't miss much. The bitcoin space has been very quiet. There are some major rumblings under the surface, in the halls of Congress and behind the scenes with 13F filings showing large players taking positions in the ETFs. Something is going to happen soon. Time to pay attention.

In Staff Accounting Bulletin #121 (SAB 121), in very strange guidance, the SEC effectively cut banks ability to custody bitcoin. Congress has now taken up the matter and passed a measure in the House that would rescind this guidance. It is expected to pass the Senate relatively quickly, as well. This will open the flood gates to banks involvement in Bitcoin.

The US House voted to overturn a bill that prevents financial firms from acting as custodians for Bitcoin and other cryptocurrencies with a new bill. The proposed legislation, H.J. Res. 109, would overturn the SEC’s Staff Accounting Bulletin (SAB) No. 121. This bulletin imposes restrictions on financial institutions regarding the custody of digital assets, under the Congressional Review Act (CRA).

The measure will now go to the Senate for review. However, the endpoint, the executive office, has already made known its decision on the proposed pro-crypto bill. Early Wednesday, President Joe Biden said he would veto the potential bill to overturn the SEC’s SAB No. 121. “The Administration strongly opposes passage of H.J. Res. 109, which would disrupt the Securities and Exchange Commission’s (SEC) work to protect investors in crypto-asset markets and to safeguard the broader financial system,” The Executive Office of The President stated.

You can clearly see the fingers of the globalists here. They lost to the bitcoin ETFs, so they are going to try extra-legal regulatory loopholes to enforcement (read as illegal ways to stop wider buying). They will lose. The bankers are on our side in this fight, and you can clearly see that with the bi-partisan support of this bill.

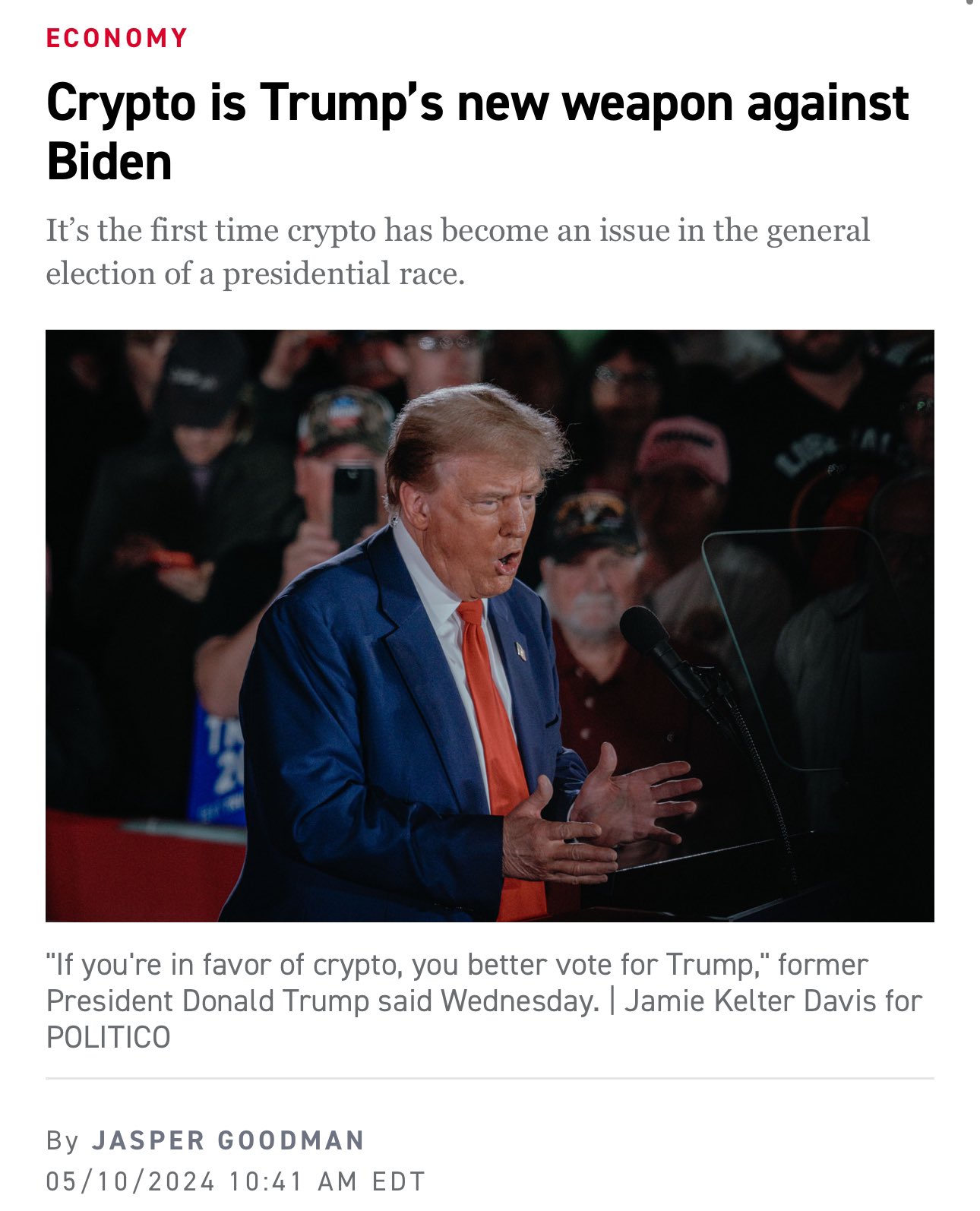

- The first Bitcoin election

I don't agree with everything Balaji says but this is pretty spot on. 2024 will be the first Bitcoin election. Trump has come out and said, if you like [Bitcoin] you have to vote for him. This is paralleled by Senator "Pocahontas" Warren and the globalist elitists, trying to take down Bitcoin. LOL

I personally don't vote. Living in Florida now, my vote wouldn't sway things either way anyway. But I try to have an objective view of the matter. What I see happening right now, is Trump running away with the election. Some polls have him up by 10% and every hypocritical trick they play against him, his poll numbers go up. That is VERY good for Bitcoin.

2016 was the first Twitter election.

— Balaji (@balajis) June 28, 2023

2024 is the first Bitcoin election. https://t.co/dDSOFN0Cm6

- David Bailey working with Trump

For the past month we have been working with the Trump campaign to develop their bitcoin and crypto policy agenda. We proposed a comprehensive executive order for President Trump to sign on day 1. I will be sharing those details soon. This week Trump took the first step, but there is much work to do. We intend to raise a $100m war chest for the campaign to insure the next President of the United States is pro Bitcoin. If you can help, please reach out.

For the past month we have been working with the Trump campaign to develop their bitcoin and crypto policy agenda. We proposed a comprehensive executive order for President Trump to sign on day 1. I will be sharing those details soon. This week Trump took the first step, but…

— David Bailey🇵🇷 $0.65m/btc is the floor (@DavidFBailey) May 11, 2024

Legend in the space for years, Junseth, recently released an audio recording of him talking with a teenage scammer who is tricking people into giving him their private key and send him their bitcoin. It's a very informative listen!

According to the latest 13F filings, Symmetry Investments, with a $61.5 million holding, Rubric Capital, with a $69.7 million investment, and Bracebridge Capital, now the largest IBIT holder with over $100 million invested in shares, have all disclosed their positions.

Interestingly, Bracebridge’s position is offset by a complex set of options valued at over $270 million per the SEC filing. A mix of calls and puts were placed, creating a complex Delta-Neutral Combo trade that combines elements of a Strangle and a Straddle with a bullish bias from extra-long calls. It will profit most if IBIT stages a large rally, but the long puts provide some downside protection. The share purchase helps to hedge the Delta and Theta of the options.

Macro

- SLOOS Data Release

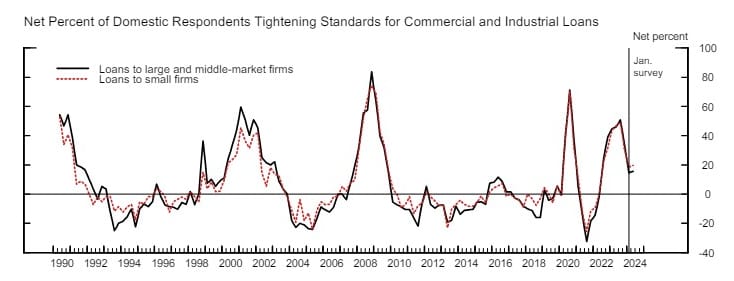

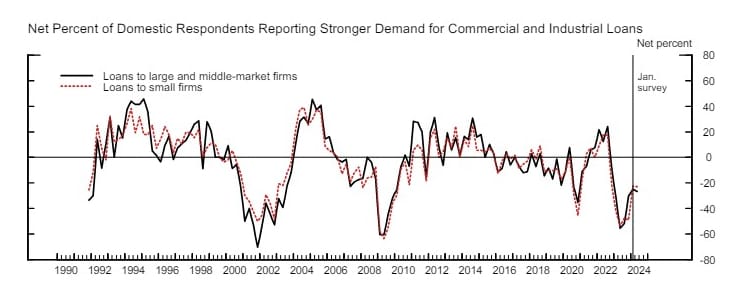

The Fed's Senior Loan Officer Opinion Survey on Bank Lending Practices is released quarterly and tells us about the lending standards of banks and demand for loans from customers. Since we live in a credit-based system this information is at the epicenter of growth or recession.

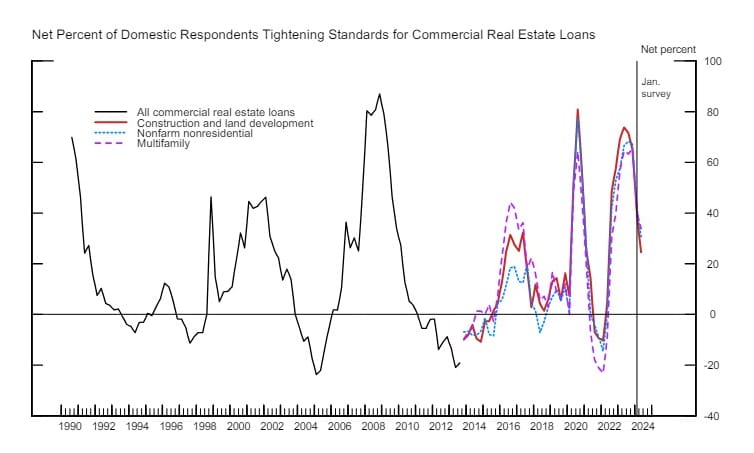

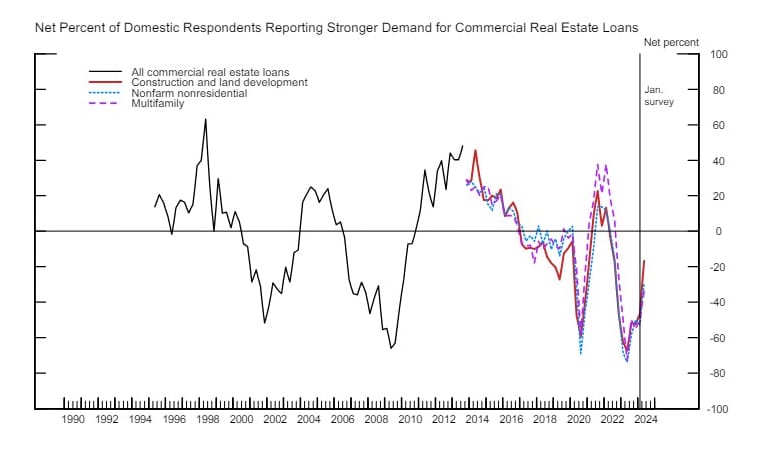

On the first two charts below, you can see standards and demand for commercial and industrial loans. Standards are tightening and demand is falling. This is a recipe for declining economic activity. Note: these numbers are cumulative, since the survey asks for the changes since the last survey. IOW in January, there was a net of 20% of banks tightening standards, and in April there was again an additional 20% net tightening.

The next two are CRE loans. The same story here. Both supply and demand are falling. There is literally no way this leads to reacceleration of inflation. Lending continues to tighten, the economy continues to be squeezed on the money side.

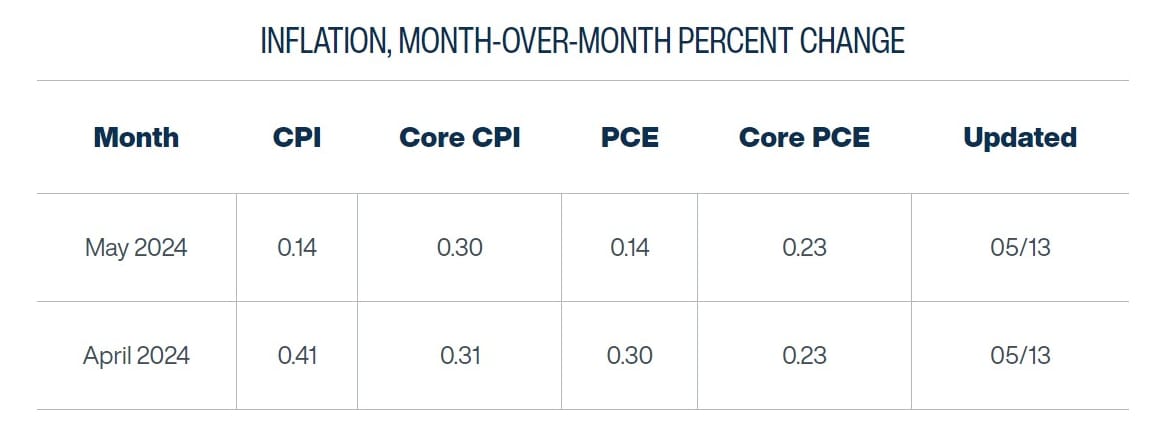

- April CPI released on Wednesday

CPI forecasts are dispersed around 0.4% MoM. I'm always expecting a downside miss and I think the market is primed for one. The slowness of bitcoin and macro in general will spike if we get a miss to the downside.

With a downside miss, people will think the Fed has room to cut rates. In the last meeting, they committed to reducing the rate of QT in June. Perhaps they will also cut rates at that meeting. The market would interpret this as very bullish easing from the Fed, when in reality, it is confirming downside risk to the economy. If the economy were robust, the Fed wouldn't be look for the opportunity to cut rates.

So far, Powell has done an exceptional job. I know that is taboo to say in the the bitcoin community, but by doing so little, he is doing so much. He's raised and held rates said, "we need to see more progress on inflation" for like 9 months now, and the market is just going higher (of course, while the real economy is getting crushed).

The UN typically publishes fertility rates each year, but they are behind publishing 2022 and 2023. Researchers are starting to put their own numbers together, and it's not pretty. With data from about half the world, countries are missing previous UN estimates by 10-20%. For instance, China had 16% fewer babies last year than the UN projection. Things are getting worse faster and faster.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

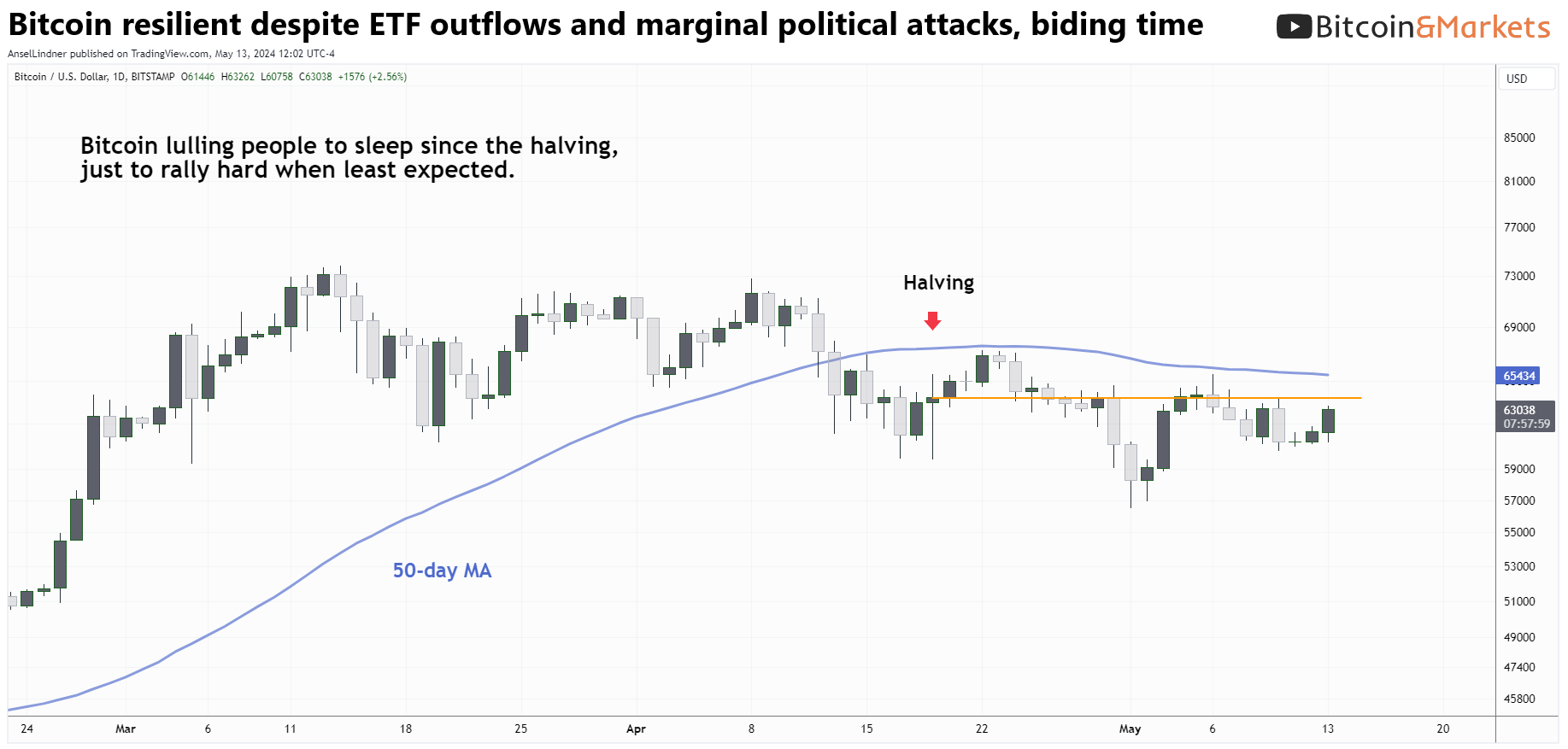

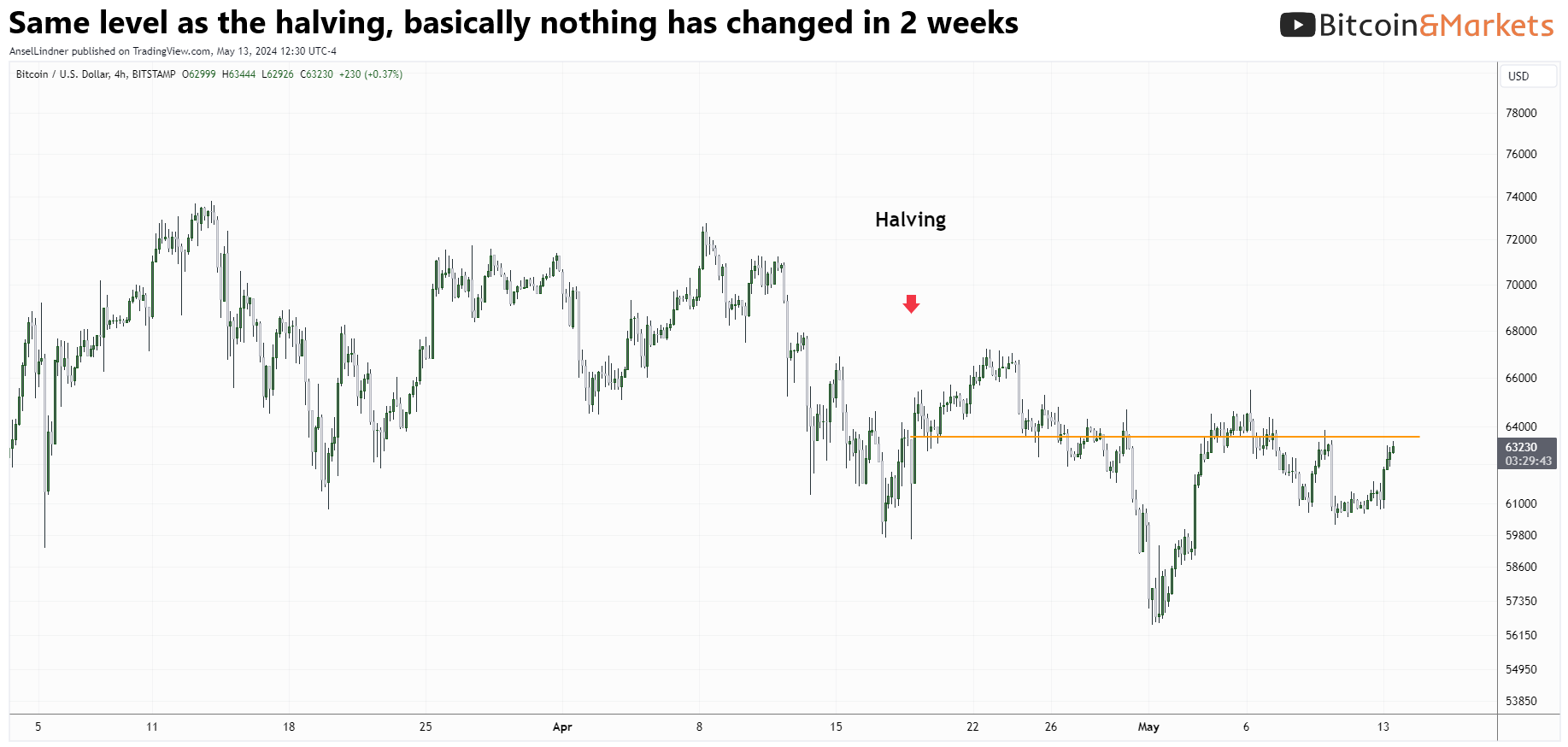

Very little has changed over the week off last week. Price has been sideways and most of the indicators are bullish.

Last issue:

Only down 1% since the halving 10 days ago.

Price is 0.5% below the price at the halving. So little has changed in those two weeks other than living through significant negative flows for the ETFs, FUD, and stacking sats.

It's hard to write anything about price at this point, because it has been so flat. Important levels held, little downward pressure on price, all signs are a move higher is coming soon.

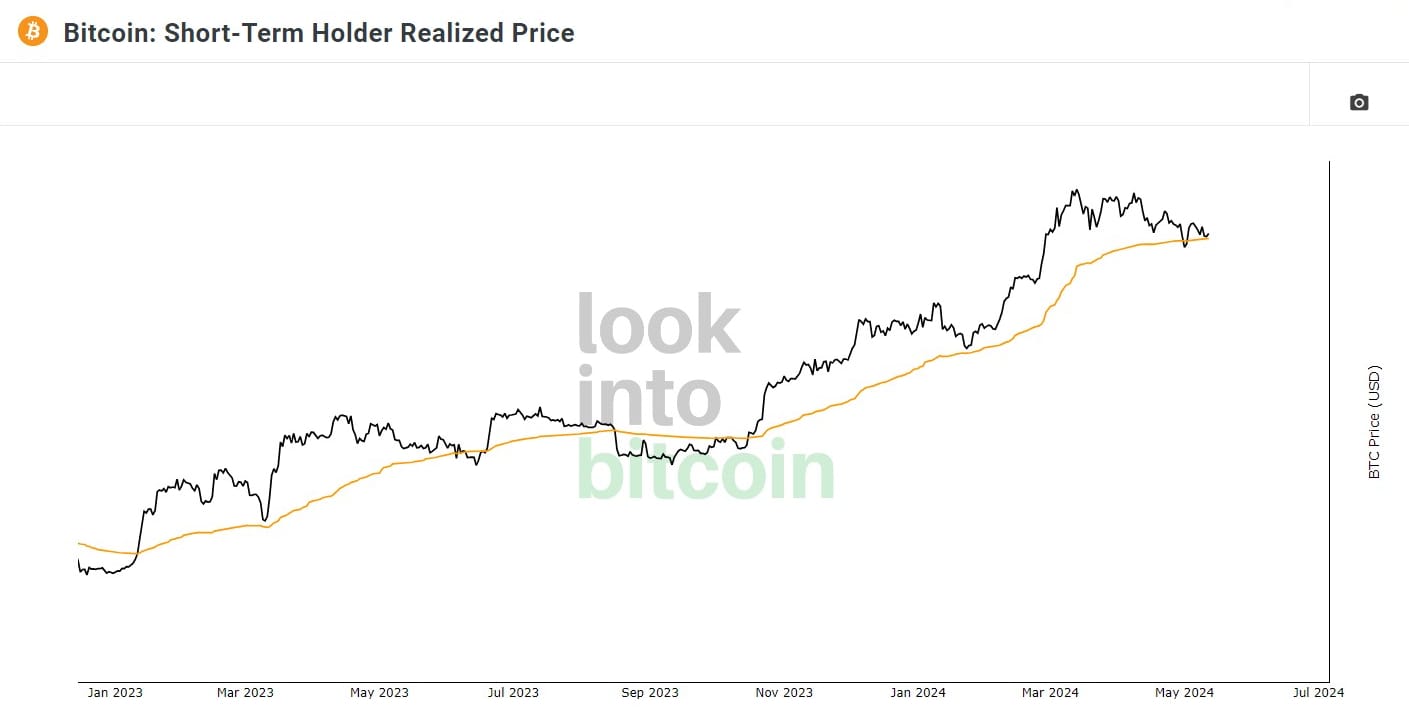

Update on STH Realized Price, we touched it, but have since decidedly bounced. It acted as support for sure.

Last issue:

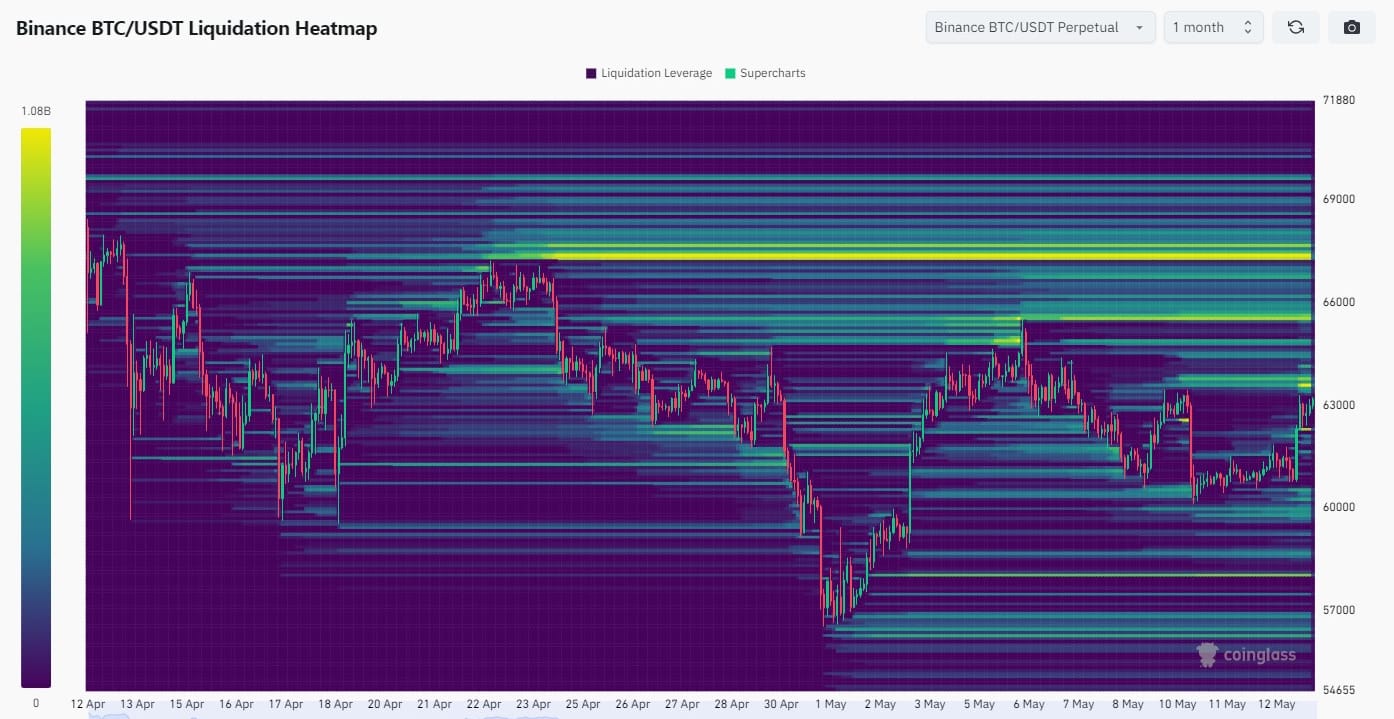

There is an area of liquidation down at $50k, but that is so far down and not a lot of liquidity to get down there (liquidations in a cascade are not there).

The heatmap is still favoring a cascade UP to $68k.

Last issue:

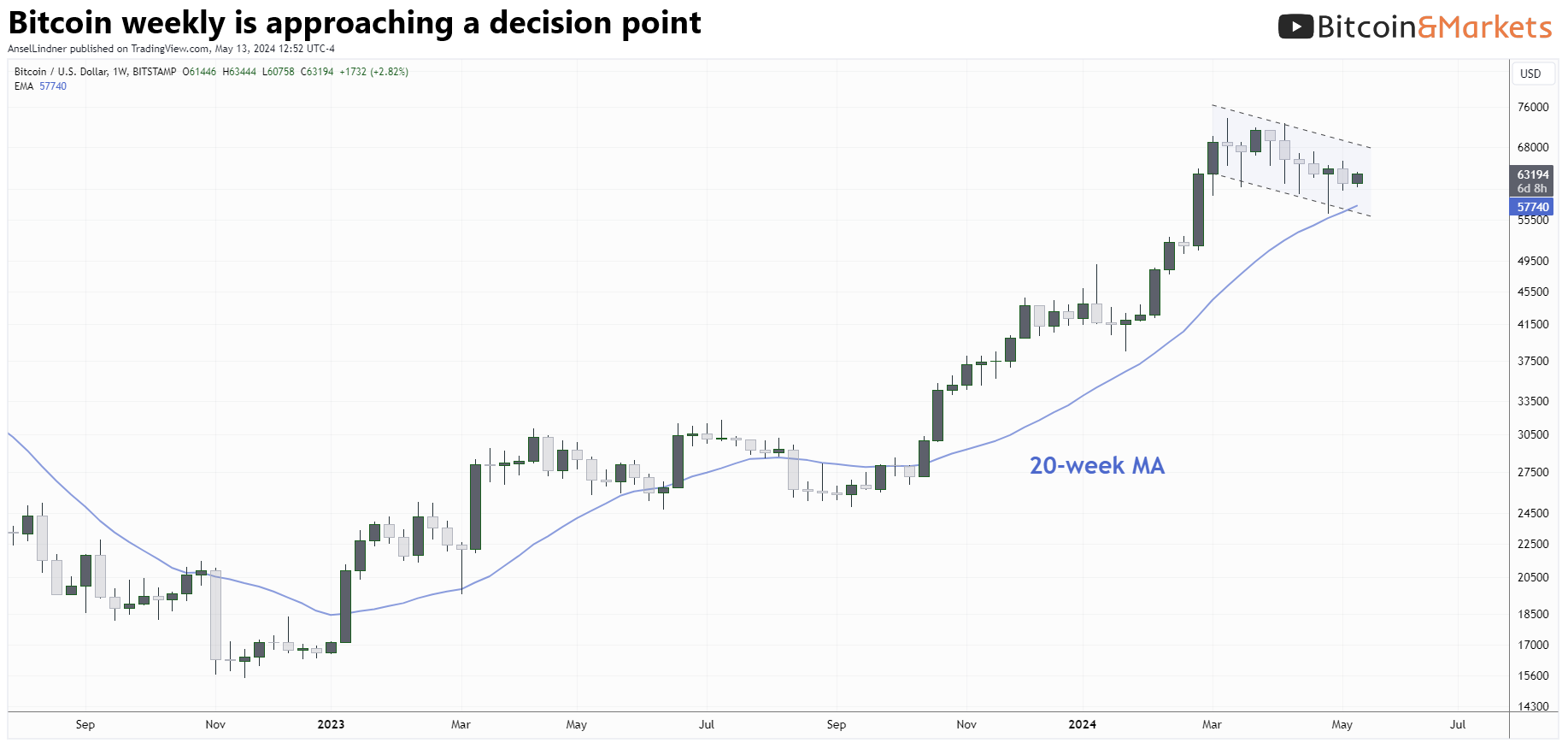

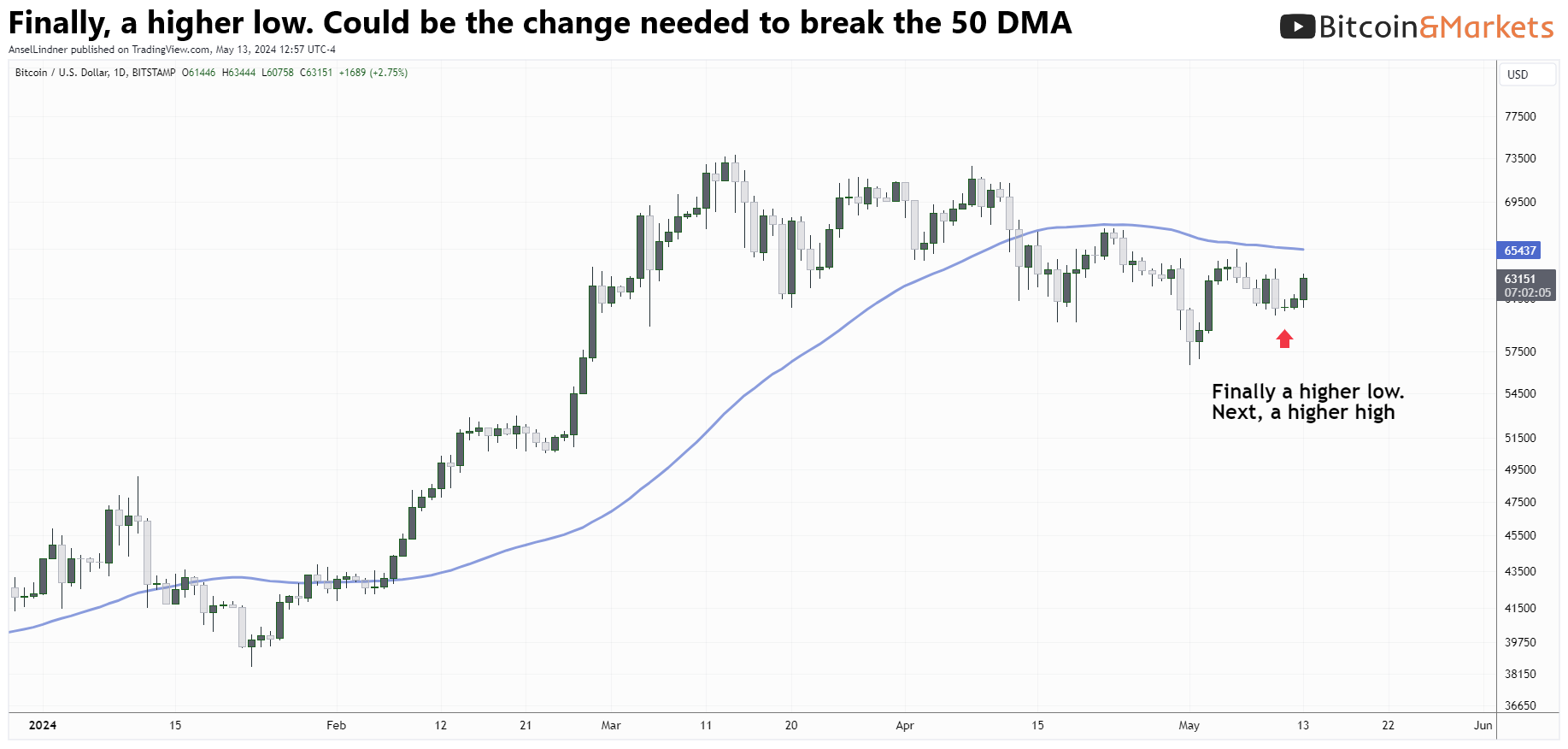

Overall, I think price is likely to continue consolidation until we get some higher highs and higher lows. Risk of a brief sell-off is slightly elevated. The important high to breach for continued momentum higher is the 50-day SMA or $67k.

Only thing that has changed in two weeks has been the 50 DMA has dropped to $65,500.

Once we break the 50 DMA price should rapidly hit $68k. That will be the true resistance IMO. If price can make it to $70k, price movements could be explosive. $78k by end of next week is not out of the question, if we can break $68k this week.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

CleanSpark Inc. (Nasdaq: CLSK), America's Bitcoin Miner™, today announced it has entered into definitive agreements to acquire two bitcoin mining locations in Wyoming, with 75 MW of available power, for a cash payment of $18.75 million. The agreement is anticipated to close in 45 days and the sites are expected to add over four exahashes per second (EH/s) once fully operational. The company plans to break ground on the new facilities shortly after closing.

The company plans to deploy a combination of S21 and S21 pros, the most powerful and efficient generation of bitcoin mining machines, from orders placed and fully funded earlier this year. The agreement includes the potential to expand the sites by an additional 55 MW. Combined, the two facilities would add over 7 EH/s to CleanSpark's hashrate as the Company continues its path of sustained progress toward 50 EH/s.

Cleanspark currently has 17 EH/s hash rate, so this is a big jump for them.

Bitfarms Ltd. said it had fired its outgoing interim president and chief executive officer, after the executive filed a lawsuit against the crypto miner claiming $27 million in damages for breach of contract among other issues.

Geoffrey Morphy, who was appointed to both positions in late 2022, was announced on March 25 to be leaving the Toronto-based company, pending a search for his replacement. Morphy has now been terminated effective immediately and no longer serves as a director of the company, Bitfarms said in a statement on Monday.

Morphy filed a claim against Bitfarms in the Superior Court of Ontario on Friday, the company said, requesting a payout for an alleged breach of contract, wrongful dismissal and aggravated and punitive damages. “The company believes the claims are without merit and intends to defend itself vigorously,” Bitfarms said. Morphy didn’t immediately respond to a request for comment.

Hash rate and Difficulty

Hash rate hits a new ATH briefly before falling, resulting in the largest difficulty decrease since 2022 (-5.625%). So far in the current difficulty epoch blocks are slightly ahead of schedule and estimated for a difficulty increase in 9 days of 1-2%.

Mempool

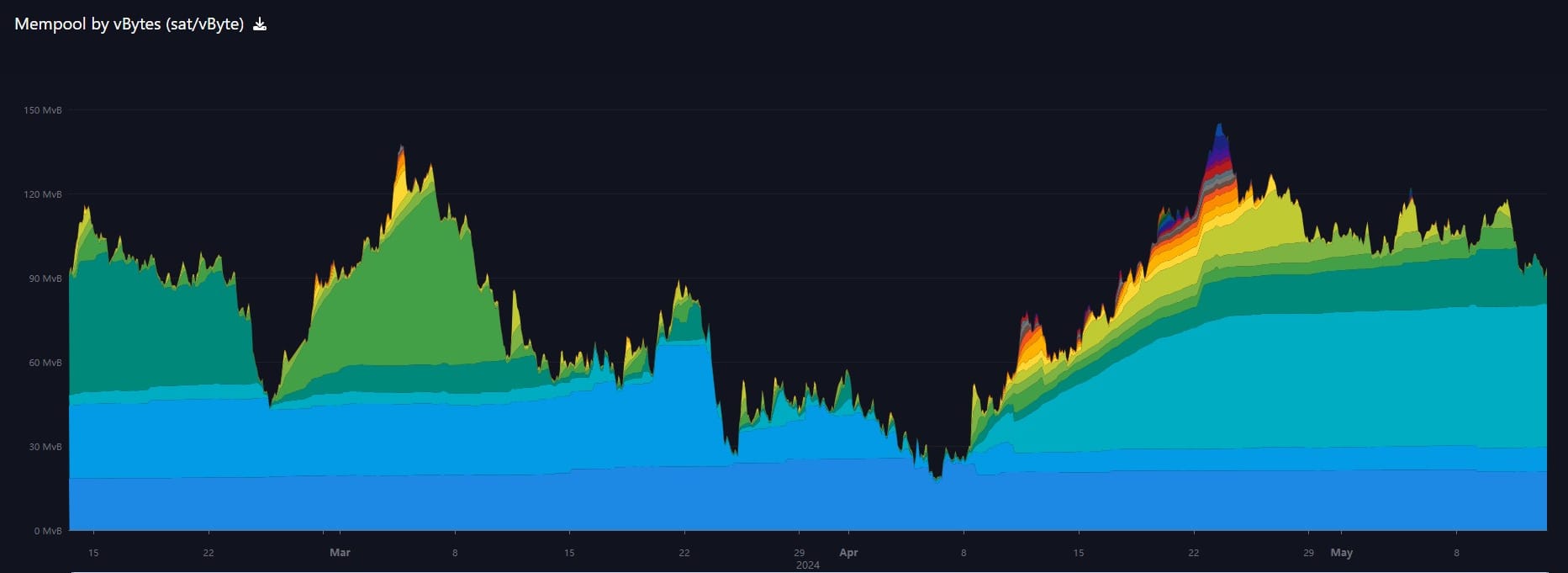

Fees have come way down, with the miners chewing through the mempool. The last of a growing fees signals that the chance of a sell off at this point is muted.

Layer 2 including Token Protocols

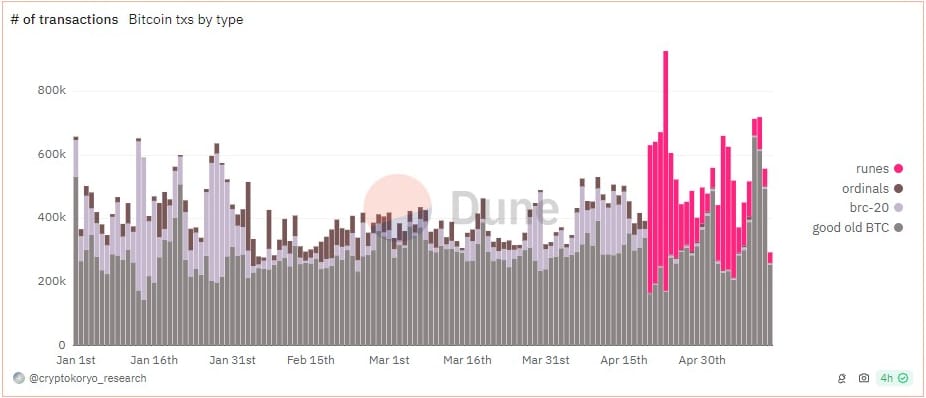

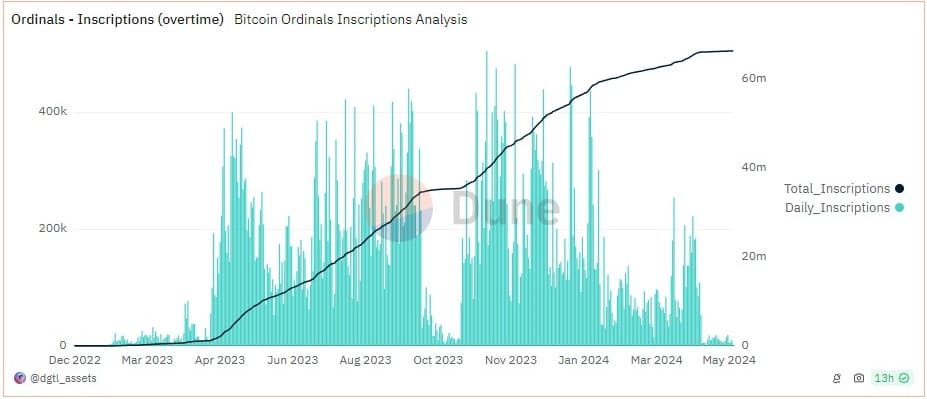

- Both Inscriptions and Runes transactions have fallen off a cliff

The slow bitcoin news cycle and lack of excitement in the space after the halving died down, has left the Runes and Inscriptions subculture at a total loss. They depend on hype demand and specifically, they leach off bitcoin's hype. We'll have to wait and see if any demand comes back once bitcoin pumps.

I'm not promoting this product, I just think it is interesting. This is a token on Liquid that is tradable 24/7/365.

With Lightning Network having struggles, this cycle might see much more interest in Liquid and elements sidechains. This is still the option for scaling bitcoin that I think is most ready for adoption. I can see each jurisdiction having their own elements side chain and being able to swap to other chains. This gives them control over their own sidechain, but makes it interoperable, because their sovereign tokens would be pegged to underlying bitcoin.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com