Bitcoin Fundamentals Report #225

Covering all the weekly news, from Winklevoss vs the SEC, to Zeihan on Bitcoin, Russian war updates, epic price section, and the bitcoin mining boom!

Jump to: Bitcoin headlines / Price analysis + Price Conclusion / Mining sector

In Case You Missed It...

Daily Live streams

- Debunking Peter Zeihan About Bitcoin - Daily Live 1.9.23 | E296

- JPow SLAMS Central Bank ESG Lunacy! - Daily Live 1.10.23 | E297

- The Wealth Effect is Backwards - Daily Live 1.11.23 | E298

- My LIVE Reaction to Negative CPI in December - Daily Live 1.12.23 | E299

- Bitcoin Back Above $20K, plus SEC Timing - Daily Live 1.13.23 | E300

Article

Fed Watch

⬇️ Check out the video below ⬇️

Listen to podcast here

Headlines

| Weekly trend | Big bull move |

| Media sentiment | Very Negative |

| Network traffic | Medium |

| Mining industry | Surging to ATHs |

Bitcoin

On last week's report, I speculated that the slow news cycle of the past two weeks was the calm before the storm. Well, this week the main story is the epic price jump through the resistance areas, above the 200-day moving average, and it is now making a stand at $21K. I write about this in GREAT depth in the price section, but first some headlines.

I tend to speak about all these headlines on the live streams and podcasts, so make sure you are subscribed and listen to those shows!

I spoke about this story in depth on episode 300.

In Feb. 2021, crypto exchange Gemini, co-founded by twins Cameron and Tyler Winklevoss, offered its customers the opportunity to loan assets to crypto lender Genesis in a program that promised high interest rates, according to a press release from the SEC. Called the Gemini Earn program, Gemini facilitated the transactions and allegedly earned fees as high as 4.3 percent.

Interestingly, Tyler Winklevoss responded by saying they've been in constant contact with the SEC the whole time, and there was never any hint of anything wrong until the out-of-the-blue lawsuit. I'll just note, this is very interesting timing coinciding with the bitcoin price pump.

Again, I covered this in a podcast.

I appreciate Peter's geopolitical theories and agree with many of them. Where we differ is on the politics that will drive deglobalization and, as this topic indicates, on the understanding of money, what it is and its role in the coming changes.

To summarize his thoughts on bitcoin. First, he lumps everything together as "crypto" and even speaks about it as one monolithic thing, eg "some people think crypto is the future of currency." All crypto?? Dogecoin? He doesn't have a clear concept of what he's talking about.

Second, an most damning, he says a fixed supply cannot lead to a growing economy. Which again is not a clear concept. So, he thinks it can be used for a stagnant economy? He says the fixed supply with lead to price going up, which will lead to price going to zero. Hmm. And, actually bitcoin's price will be negative when you add in carbon tax (see the political bias?).

Macro headlines

- US CPI for December comes in NEGATIVE

Of course, I covered this in several podcasts this week, including Fed Watch.

US December CPI was -0.1% month-over-month, meaning there was an absolute decline in the aggregate price level in December. 6.5% year-over-year, which is a worthless measure at this point.

In the last half of 2022, the TOTAL CPI rise was 0.9%! Not 3.25% (6.5%/2). I expect 2023 to have several negative months in the first half of the year. Finally, everyone will have to admit (if they are honest) that CPI was transitory. We are returning to post-GFC normal of 1-2% inflation/CPI and stagnation. This is the mean that the economy will fluctuate around until we change the money to bitcoin.

- Russia takes Soledar

Compared to the coverage of the calculated withdrawals from Kherson and Izyum by the Russians last year, the defeat at Soledar has had almost zero coverage. It is a huge loss for NATO.

Soledar was a massive stronghold on the border, with miles of trenches, ammo depots, rail supply lines, constant stream of reinforcements, and the largest salt mine complex of underground tunnels in the world (from the reporting I've seen, massive in any case).

Soledar, along with Bakmut, are the center of the entire defense in Ukraine. NATO has spent months sending troops to the region to hold the line. Roughly half of the Ukrainian frontline troops are north or north west of Soledar, and half are south and south west. There is also a vital railway along the Ukrainian controlled side of the front line, which this Russian offensive has cut. Rumors are that Bakmut is days away from falling, as well. The dominos may fall all along the front line.

I've not written about the war on this report in a long time. I was wrong about how fast this war would conclude. I underestimated NATO resolve and misunderstood the Russian strategy.

However, we now have the first signs of the beginning of the end of this conflict. It remains unclear if the Russians will press their advantage quickly. If so, they could rout the enemy, but they seem content with a slow march under artillery support, wearing down NATO supplies and support of Ukraine's defenses.

Navy Secretary Carlos Del Toro acknowledged before a naval warfare conference in Arlington, Virginia on Wednesday that the US within the next six months could face a decision of whether to arm itself or Ukraine, due to rapidly depleting stockpiles due to supplying Ukraine.

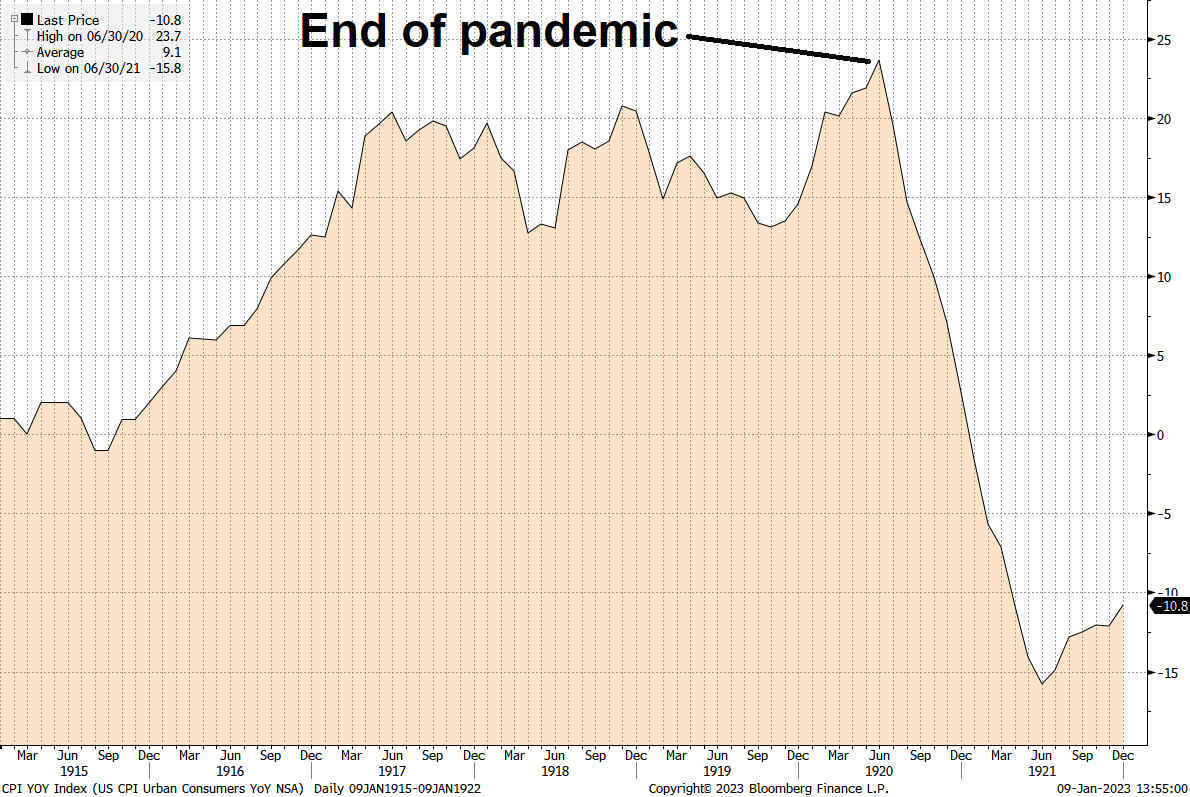

- CPI after the Spanish Flu, peaked and crashed just like today

Granted, the two episodes are quite different, the supply crisis was driven by WWI back then and government intervention today, but nonetheless it is very interesting.

Price Analysis

| Weekly price* | $21,320 (+$4093, +23.8%) |

| Market cap | $0.411 trillion |

| Satoshis/$1 USD | 4,689 |

| 1 finney (1/10,000 btc) | $2.13 |

This week feels so good! After holding through the FTX debacle and full court press of FUD, we are right back where we were pre-FTX. This move didn't come out of nowhere. I was calling it for weeks...

Three weeks ago

I'm expecting the bitcoin price to move slowly and cautiously higher, with some momentum beginning in the new year.

Two weeks ago

I'm expecting the bitcoin price to make its way back into the resistance zone, up to possibly as high as $18,500 in the next couple of weeks.

Last week

This week I expect more upside and for price to test that resistance zone.

Daily chart

Just so you guys get how much we've changed in a week, here is last week's chart.

And this is this week... !

A first glance, we blasted right through the resistance zone, but there was some slight pausing on the way up.

The 200-day moving average is the biggest surprise for me. I expected that to act as resistance, at least a little bit. Now, it might turn support!

TD Sequential

Last week I made a big deal about the Green 9 on the daily TD Sequential. This week, we can see it has only extended off the 9. This signals an overextended move, and to expect a correction.

Cloud

Last week's cloud analysis was right on the money. Let's update it again. All systems are GO on this indicator.

Below is the the cloud with extended settings, commonly used in bitcoin due to the 24/7 unique nature of the market.

Last week

This week

We now have a nearly perfect cloud set up for bitcoin on the extended settings. Lagging span is above price and cloud, price is above cloud, Tenkan is above Kijun, and cloud has twisted green. The only thing that might be more bullish is if the TK lines were above the cloud and the green cloud was more pronounced. BUT we do have that on the standard settings (above).

Note: Big moves like this tend to come back and test the Kijun, eventually. In standard that is $18,900, and extended that is $18,500.

Weekly Charts

Yearly Pivot

The new yearly pivot is $26,747.

Last week

This tends to be a highly relevant level and is most often hit early in the new period.

It doesn't look that far off now, does it?

The plain weekly chart with moving averages (below) shows the possibility of a rally into the "death cross", when the 50-day crosses below the 200-day. This is widely thought of as a bearish sign. However, it is more a powerful timing indicator showing when we are due for a trend change. The only other time we almost had a weekly death cross was back in 2015, and it marked the start of the new bull market!

Weekly cloud

I showed the weekly cloud a couple issues back and talked about the upcoming twist. So far, this idea is tracking well, also.

Lagging span (black line) crossed positive several weeks after the twist in 2015.

Today, the lagging span is crossing above the price well before the twist. This is similar to 2015, but obviously not the same. It wouldn't be surprised to see the price consolidate for a couple weeks, dropping the lagging span back below the price, until a final break out perhaps in 2 months.

Headwinds and Tailwinds

It's been a few weeks since I included this section. Well, it's back.

Headwinds are those forces that are working against bitcoin, and tailwinds are those working positively for bitcoin.

Recession

Recession is not necessarily a headwind. The build up to recession can take a long time and people will look for places to allocate capital in the coming bad market. Bitcoin should benefit greatly from that. We will have to wait and see what happens on this front, because a bad recession is definitely not a given.

Stocks

If we are going to have a deep nasty recession, stocks sure aren't buying it.

They might break back above 4000, the 200-day moving average, and the diagonal trend line. Bottom line, the stock market is at a decision point. If it can go up over the first few days this week, it will be in bullish territory like bitcoin.

Note: stocks are closed today. Futures are showing a slight rise to 4015.

Dollar

The dollar is the biggest surprise to me. I did not expect it to get this low. I will be doing some work on this part of my thesis in coming weeks. Make sure to join me on streams for that!

The dollar is continuing to fall, now down to 102. The weekly chart appears to have more room to fall.

But the daily chart looks like it's closer to a bottom. Particularly, I'm looking at the different pattern in the RSI. There are some major bullish divergences and the last time it looked somewhat like the consolidation we are see today, was back in May 2021, at the bottom.

Price Conclusion

Summarizing...

Almost all timeframes and indicators have turned bullish.

Price has come a long way in a week. We should not be surprised by a correction. Several indicators, shown above, give plenty of room for this correction to the $19 or even $18K level. But this would be a correction in a bull trend.

The weekly charts are more mixed. We had a great weekly candle, but can we hold it? Indicators are beginning to turn bullish but less consistently positive. This gives room for a correction of a week or two, followed by resumed upside.

Talking heads are more fearful of recession than the market. Of course, there are conflicting signals, but bitcoin can rally in the lead up to recession as it did in 2019!

Stocks might break out in a big bullish move here. If they do, the correlation with bitcoin should be a significant tailwind as well.

The dollar is still weakening, and when it does go back up (soon I think), the move will be weaker than the move in 2022. That relative weakness in the coming bounce is expected since it will be a reverberation into a new range, as I suspect. Overall, not strong enough to hurt the bitcoin price.

Overall, risk of devastating surprises has been greatly diminished. This week, I expect slower moves, perhaps a marginally higher high, and likely a correction to test the 200-day MA and top of previous resistance. The bull market is just getting started and will take time to develop further.

Mining

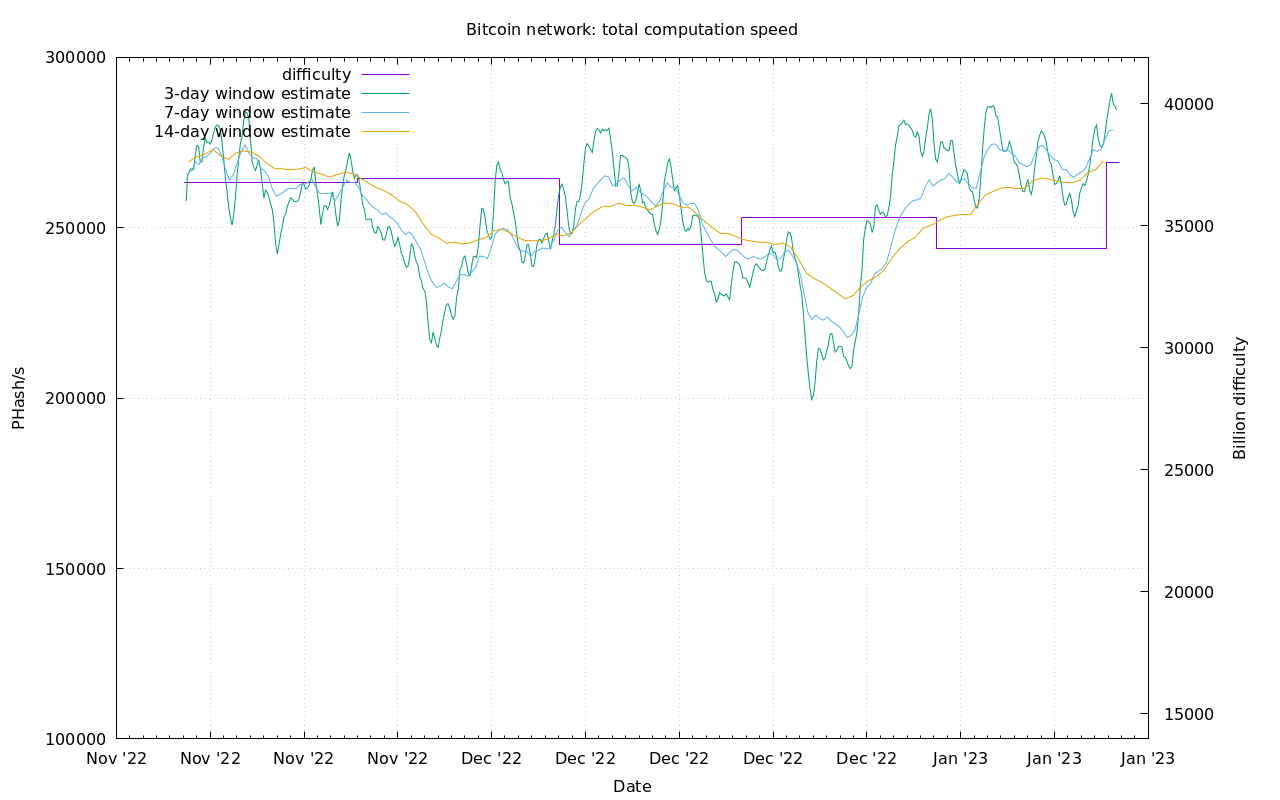

| Previous difficulty adjustment | +10.2567% |

| Next estimated adjustment | +5% in ~12 days |

| Mempool | 5 MB |

| Fees for next block (sats/byte) | $0.06 (2 s/vb) |

| Median fee (finneys) | $0.06 (0.028) |

Mining News

Regardless of the country’s attractiveness to crypto miners, the province of Manitoba, which enjoys the second-lowest energy prices in Canada, set an 18-month moratorium on new mining operations in November. The decision was justified on the grounds that new operations might compromise the local electricity grid.

Story from December about the government move, I missed it at the time.

Canadian bitcoin miners are still positive.

“These moratoriums are in place to give the utilities time to evaluate the existing crypto-mining operations. The new normal in Canada would involve crypto miners working with utilities to balance the grid or recycle energy in thoughtful ways, with a focus on sustainability.” - Aydin Kilic, CEO Hive Blockchain

Webber [CEO of Digital Power Optimization] stated that Bitcoin miners don’t use the power that is in high demand due to simple price factors. They might even make the grid more flexible and resilient by providing a profitable load that can easily be shut down when grid-based energy demand increases.

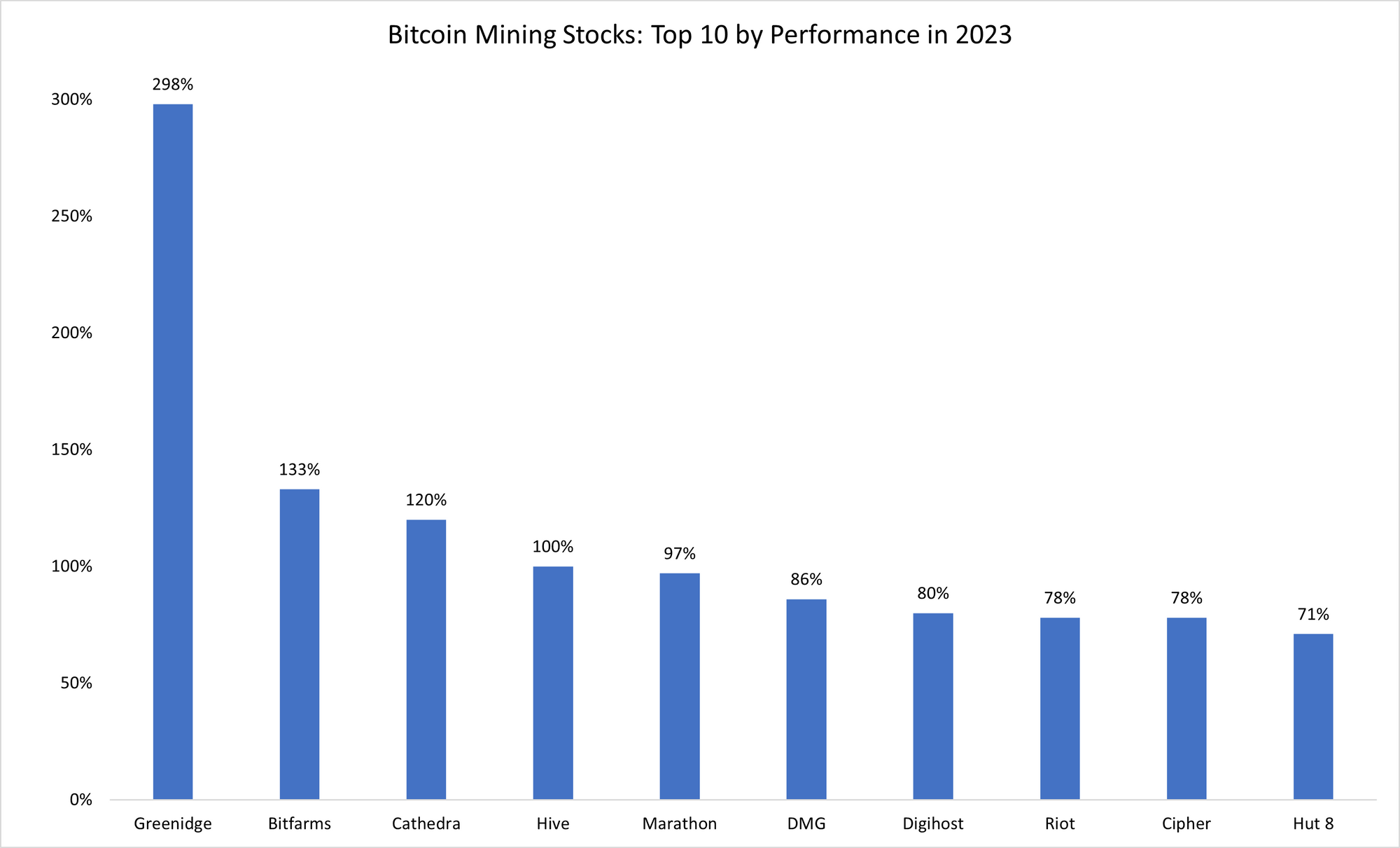

- Bitcoin Mining Stocks are Up BIG in 2023 So Far

The bitcoin miner ETF is up almost 80% since the start of the year.

Difficulty and Hash Rate

Bitcoin hash rate hits new All Time High! Difficulty adjusted a monster 10% yesterday! Wow. This is super strong.

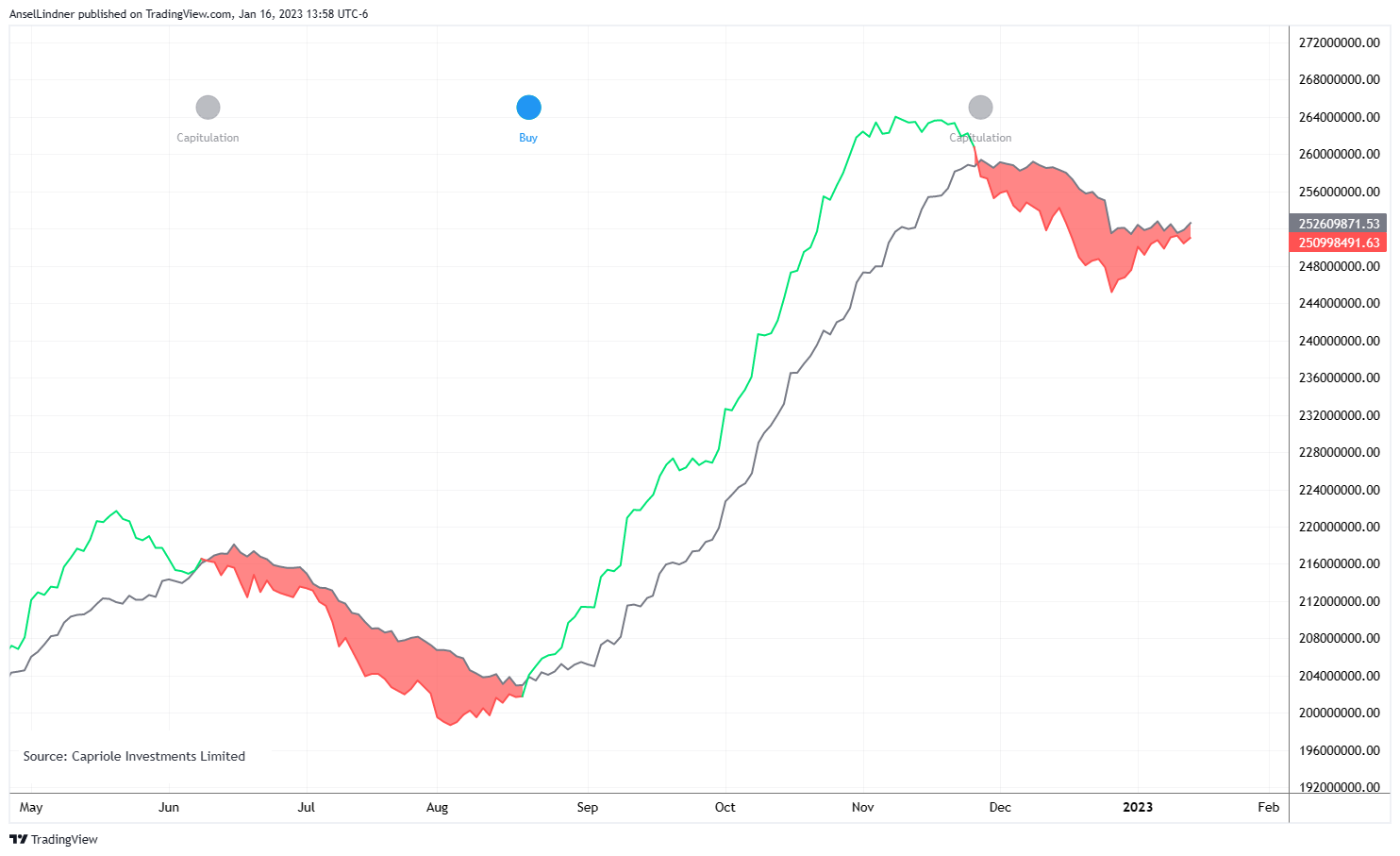

Hash ribbons have still not crossed or signaled a buy yet, but they are close. The moving averages will take a little while to feel the full effects of this recent surge in hash rate.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 19, 2023 | Issue #225 | Block 772,278 | Disclaimer

* Price change since last week's report