Bitcoin Fundamentals Report #214

This week, ultra-low volatility, "time to pay attention", DeFi crashes further, Jintao purge, price analysis, secret miner?, and lightning videos!

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Defining Convergence, Consensus, and Money - E253

- (Fed Watch) Clown World: UK Gilts, China’s No-Win Situation, and European Natural Gas - FED 116

- (Fed Watch Clips) Check out for edited Fed Watch episodes!

- (Members) Five live streams this week PLUS EXCLUSIVE E251 podcast on the EU, all uploaded to the Member Drive!

Join my Telegram Channel for all-day updates on bitcoin and macro!

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Very stable |

| Media sentiment | Negative |

| Network traffic | Slightly elevated |

| Mining industry | Very strong |

| Market cycle timing | Trying to start rally |

Bitcoin Headlines

The bitcoin news cycle is quite slow, but I included below the best from around the bitcoin industry and other important macro events.

"Alkesh Shah and Andrew Moss of Bank of America Securities (BofAS) said in a recent report that the world’s largest cryptocurrency now had a high correlation with gold prices, suggesting it is being used as a hedge against wider market uncertainty."

If you've been tuning into Fed Watch, you'll know I've been saying this very same thing as well. As bitcoin's volatility goes below the S&P 500, Nasdaq, the Dow Jones, the British Pound and even US Treasuries in some cases, the safe-haven bid will grow.

DeFi tokens are plunging. Tokens with names like Sushiswap and Uniswap are down more than 7%.

In a not-so-surprising development, Sushiswap has integrated a Consensys project called Transak.

"The Transak solution supports major payment systems, such as Visa, Mastercard, Google Pay, and SEPA, however, it also comes with a requirement for Know-Your-Customer (KYC) procedures."

Being that Ethereum is now more than 51% captured by OFAC compliant block producers in their Proof-of-stake scheme, making their network totally captured by regulators, the KYC in the swap protocols is not a surprise.

This will not help them compete against the legacy payments or the legacy monetary system. It forever neuters innovation, constraining them to a tiny approved sandbox.

In April of this year, in his time at the HM Treasury, Rishi Sunak put forward a sweeping plan for the UK to become a "crypto" haven. His ideas mostly center around stablecoins, but also deregulating markets for "defi" and other scams.

This doesn't show forward thinking, it demonstrates a lack of focus. These ideas were floated before the obvious Ponzi schemes blew up this year, so we'll have to see if he's learned any lessons. If they think so highly of "crypto" scams, they must understand that bitcoin is crown jewel, real deal.

This is another important development in that, once again bitcoin (and the swamp attached to bitcoin) is beginning to show up in plans of major countries.

Macro headlines

The 20th Party Congress is over and the purge is complete. Former premier Hu Jintao was escorted off stage in a public purge. The result of the "elections" were to unanimously vote in all Xi Jinping's cadre of hardcore Marxists. The pro-market Shanghai clique was purged.

We could remember this as a time equally as important as when China opened up in 1980. A massive generational change.

The next day, the long delayed economic data was released and it was obviously doctored. The industrial numbers were horrible, retail and real estate numbers were horrible, trade data was horrible, but somehow the quarter-on-quarter GDP numbers rebounded!

Chinese tech stocks crashed the most on record, with the Hang Seng Tech Index (the 30 largest companies on the Hong Kong stock exchange) falling over 8%. Big tech names had even worse days, Alibaba down 14%, Baidu down 15%.

Chinese yuan continues to fall versus the dollar.

Price Analysis

| Weekly price* | $19,362 (-$152, 0.8%) |

| Market cap | $0.372 trillion |

| Satoshis/$1 USD | 5,160 |

| 1 finney (1/10,000 btc) | $1.94 |

Last week:

Perhaps, we see a low volume fake breakdown, followed by a major bounce higher to $25,000. Risk of a cascading crash is low, so Buy The Dip.

Bitcoin OG's are starting to say, 'time to pay attention'.

BTC volatility within the range of historic lows, bbands tightening massively on higher time frames, and we got the 3-5ish breakup/breakdown fakeouts -- the violent move is very near

— BTCVIX (@BTCVIX) October 24, 2022

Daily chart

Epic low volatility continues. The line chart makes the sideways action look that much more impressive. Despite all the geopolitical and macroeconomic stress in the world, bitcoin has been rock solid! And it's getting noticed by big money, as shown by the safe-haven headline above.

Price is getting very close to the pinnacle of this pattern. A move is coming soon. Indicators are leaning bullish, but the pattern is bearish.

The price is attempting to break above the 50-day moving average (50-yard line). If it does so, the likelihood of a breakout instead of a breakdown, becomes much higher.

Weekly Charts

The weekly setup is beautiful for a breakout.

The TD Sequential Red 9 is still holding. If the Green 2 can close higher than the Green 1, it will effectively breakout of the pattern.

Checking out the weekly moving averages, we can see that the 7-week moving average is now below price. This could be yet one more factor aligning in the positive direction when the time comes for a decision.

Historically low volatility

Daily volatility has come up very slightly, but we are still in a historically low period. We have to go back to 2020 right before the massive rally to find a similar period.

Some people are comparing to today to the 2018 capitulation, and there is a similar period of low volatility back then. However, I've shown in the past how other indictors like the CMF are opposites. This was also closer in time to the previous top. Today, sellers are more exhausted.

Headwinds and Tailwinds

Dollar

The dollar is looking like it might want to cool off. I've been expecting it to maintain a new range between 100 and perhaps 115 for a couple years.

Several weeks ago when other macro commentators finally accepted that dollar strength was real and going to be a problem (better late than never), I had already moved on to the next phase a consolidation at these levels. Many factors go into this call, but suffice it to say here, that acute dollar stress wanes as damage is done. Weak marginal players causing the stress get liquidated. This doesn't fix anything, but does reduce the pressure on the dollar.

Stock Market

US stocks are showing some strength here. A short squeeze is possible.

Last week, I showed many technical indicators for US stocks, presenting a strong case for, at the least, a strong bear market rally. I remain a stock market bull.

If you knew nothing else, you'd look at the chart and say, "Well, it is higher than the June low 4 months ago. It has kept from falling dramatically. And where else is all the money from China and Europe going to go as their economies struggle? Definitely not Yuan or Euro denominated assets."

Price Conclusion

Summarizing... (not much changed from last week)

Bitcoin has been extremely stable despite all the economic and geopolitical drama, going on 4 weeks now!

The daily chart for bitcoin has hidden signs of strength in a bearish pattern. Strong reversal indications on the weekly chart remain. Historical volatility is very low levels, perhaps creating a growing safe haven bid.

Acute dollar stress seems to be weakening, which will ease liquidation pressure on other assets.

Stocks have bounced in this environment, but I don't trust it until bitcoin follows. I was hoping bitcoin would lead the bounce. However, the S&P 500 is only ~5% off the June lows, while bitcoin is ~10%.

Overall, the risk of a sell-off and many more months of recovery for bitcoin is getting less all the time. It's "time to pay attention" as this pattern draws to a close. Trusting an initial move could be hard, watch for volume to confirm, fake outs are likely. A close over the 50-day moving average is key (~$19600).

Mining

| Previous difficulty adjustment | +3.4397% |

| Next estimated adjustment | -3% in ~13 days |

| Mempool | 7 MB |

| Fees for next block (sats/byte) | $0.30 (11 s/vb) |

| Median fee (finneys) | $0.24 (0.124) |

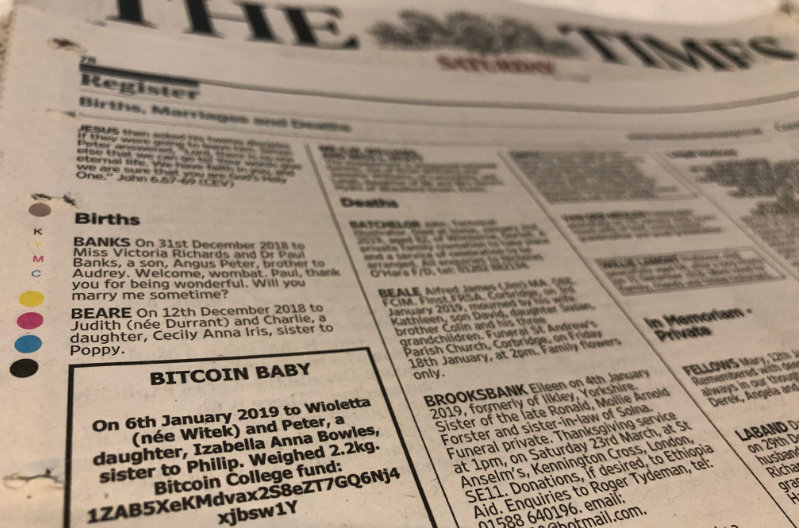

Speculation of Secret Mining Equipment

"Information is scarce and there’s an eerie air around the whole situation."

"Rumors about a new and extremely powerful Bitmain ASIC abound. Depends on who you ask, Bitmain themselves deployed it or they sent the machines to a powerful publicly traded mining company for them to test. In any case, the result is this against-all-logic extreme rise in bitcoin hashrate. These are just rumors, however. The company has not uttered a word about any new machine and there are no document leaks of any kind."

Speaking with a mining friend of the show, he filled me in that the new generation S19 XP from Bitmain began deliveries in the August/September timeframe. That would nicely explain the jump in hash rate without any need for a secret new miner.

These new efficient miners clocked at 141 Ths, I wrote about it last year on this newsletter. Well, they are starting to hit racks now. With the bitcoin price low and energy rates elevated, these 141 units should replace less efficient machines readily. If they were directly swapped for a S19j with 88 Ths, that is a 60% increase in hash rate.

Whatsminer has also recently started shipping their new top-of-the-line units in the last couple of months as well.

In the month of August the hash rate climbed 50%, which cannot all be from new miners. But we can explain a lot of the increase that way, and the remainder of the effect likely comes from a combination of basic sources, like Texas miners coming back online and typical growth of the mining industry.

When price and drama are low in bitcoin, people run with these type of rumors. Bottom line is the mining industry has not had a major capitulation event, it remains very strong and this bodes well for the bitcoin price.

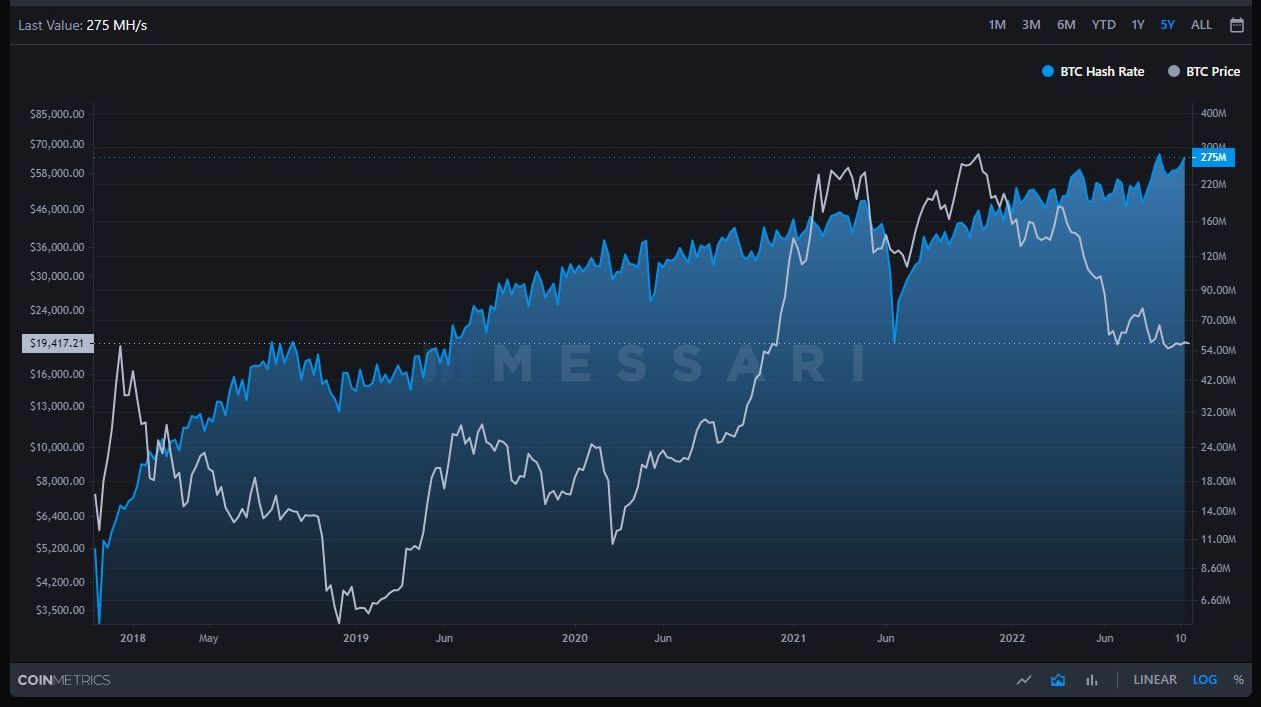

Difficulty and Hash Rate

Hash rate continues to be high. The advance has slowed down, but it's threatening to breakout again.

I wanted to highlight a few things on the hash rate chart, regarding the parallels people are drawing between today and the 2018 capitulation. This is yet another thing that is different this time.

1) Back in 2018, hash rate started coming down representing "miner capitulation" prior to the epic price capitulation. They bottomed at the same time.

2) In the recent epoch, we saw a slight capitulation from April to August 2022, during the crazy Terra/Luna and then Celsius crashes. It bottomed the first week of August, after which it has been surging, right as the S19 XP's were beginning delivery.

It is this latest surge, during depressed prices, that has the rumor mills working overtime. Instead, we should look at it as a big bullish confirmation.

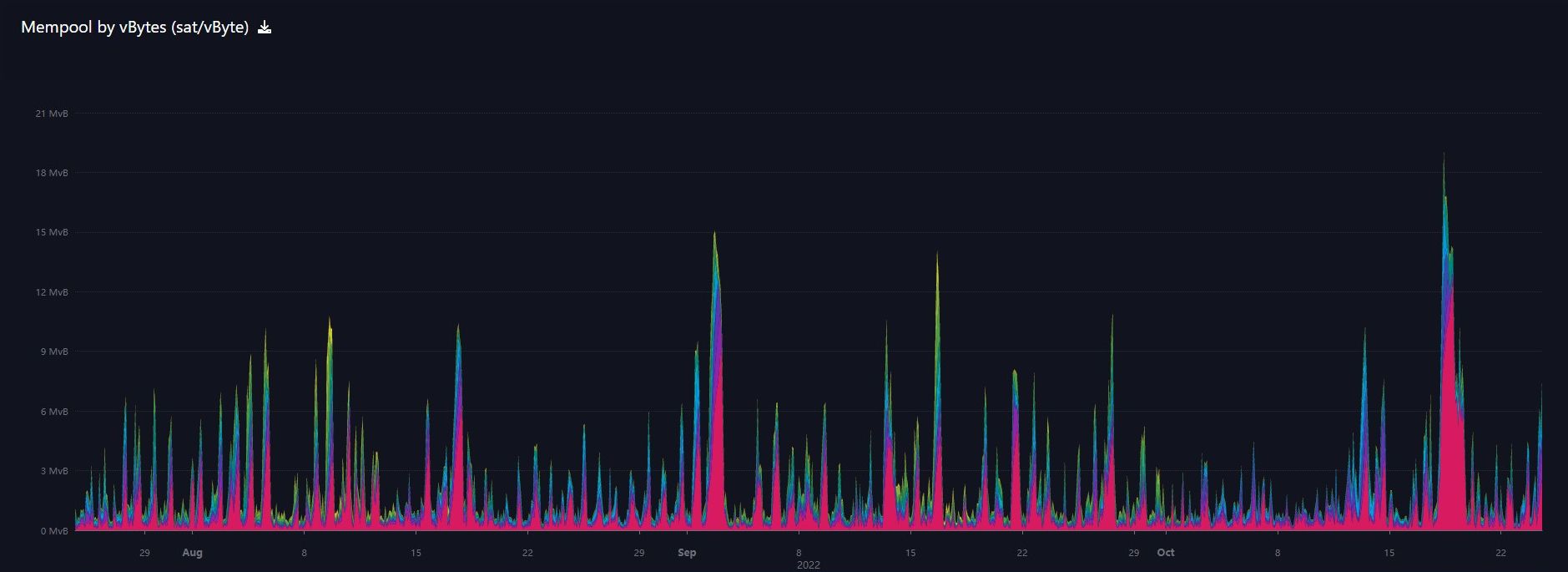

Mempool

Last Tuesday the 18th, saw the largest mempool in 3 months, since July 13th.

Lightning Network

Bitcoin Magazine's Amsterdam conference had several interesting Lightning Network presentations, here, here and here.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 24, 2022 | Issue #214 | Block 760,140 | Disclaimer

* Price change since last week's report