Bitcoin Fundamentals Report #199

What is Bitcoin Maximalism, deflation talk, price analysis including analysis of specific headwinds, bitcoin mining news, Marco developments

This Week

What is Bitcoin Maximalism, deflation talk, price analysis including analysis of specific headwinds, bitcoin mining news, Marco developments

Jump to: Market Commentary / Price analysis / Mining sector / Macro

In Case You Missed It...

I appreciate all the clicks and views. Please subscribe to and share the podcast and written posts. Thank you!

- (Fed Watch) Dollar, commodities and Q&A - FED 102 (Video)

- (Fed Watch) Fragmentation in the Euro and Dollar, The Bitcoin Solution - FED 101

- (Blog) Macro Update - 30 June 2022

- (Bitcoin & Markets) Response to Jeff Snider's Criticism of Bitcoin - E244

- (Member) E244 Video

- (Community) New Telegram Channel

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Possible breakout |

| Media sentiment | Very negative |

| Network traffic | Low normal |

| Mining industry | Recovering |

| Market cycle timing | Despair, infighting |

Bitcoin Maximalism

The fallout of the Nic Carter temper tantrum continues, and has morphed into a fight over the term "bitcoin maximalism". He went on a podcast bashing bitcoiners, saying they were holding him back all along and "my star will continue to rise". His 15 minutes are about up.

Surrounding this mini-scandal is a rhetorical game about the term "bitcoin maximalism", so, I thought I'd take a few lines to clear this up.

First and foremost, some people like Nic shorten the term to just "maxi" to make the slur more stinging, but ultimately it just makes you sound dumb and spiteful. The more these pluralists use it the better for bitcoin actually.

What is Bitcoin Maximalism exactly? From the Bitcoin Dictionary:

1) Originally, a pejorative intended to mean an unfounded belief in Bitcoin’s superiority, characterized by close-mindedness, aggressive debate style and public confrontation.

2) The general understanding of the technological, social and monetary properties of Bitcoin and how they explain the observable dominance of Bitcoin relative to altcoins.

Discussion: The term Bitcoin Maximalism was coined by the Founder of Ethereum, Vitalik Buterin, to poison the well against bitcoin arguments. The label was quickly re-appropriated by bitcoiners to emphasize the economic and technical theory behind this technology.

Bitcoin maximalists typically have an appreciation for sound money and markets. They are passionate about free speech but have little patience for willful ignorance and con men intentionally misleading investors.

Today, I most often use the term bitcoiner instead of bitcoin maximalist. A bitcoiner is a person who has reshaped their moral code and mental model of the world around the lessons bitcoin teaches. Those include sound money, privacy, free speech, free markets, low time-preference, private property, frugality, patience, ethics being more important than getting rich quick, demanding the highest personal standard, family, honesty, and a requirement for objective evidence. Bitcoin Maximalism is like economic Stoicism.

This debate will fizzle out, because the opposing side has no evidence to stand on. Their demand is that bitcoin maximalists lower their standards and stop calling out scams. That's not a sustainable position, therefore they resort to name calling.

George Gammon read my article on his YouTube channel

Starting around minute 9:00 in this video, George reads through my Interest Rate Fallacy article on Bitcoin Magazine. Pretty cool.

I want to expound on a couple things he said in the video. He was trying to make the argument that lower interest rates mean monetary conditions are tight (as I said), but the result is it will be harder to buy a house as rates fall. For context, he's a real estate investor by trade.

I don't come to the same conclusion. I think mortgages are a special type of loan, since they are collateralized, and are usually a payment people make, i.e. they will cut other expenses in order to pay their mortgages. Therefore, mortgages are relatively safe loans for the banks. They'd rather write a mortgage than a risky business loan in a bad economy. Indeed, this is my explanation for "asset price inflation" in general.

In a credit-based system, credit has to continue to grow or it collapses. Money can be tight, but its growth has to be at least minimally positive. Banks have an incentive in making this minimum amount of loans, but not any more. Therefore, they will choose to make less risky loans, i.e. mortgages not business loans.

Then how can money be tight if banks are making more mortgages? Well, because mortgages are not productive the same way that business loans are productive. Business is starved of credit, while loans flow to real estate. Money creation (loans) literally gets focused into real estate and other "asset prices" instead of growth ventures.

As interest rates go down, mortgage rates will, too, and house prices will continue to climb.

The US has a housing bubble. I won't deny that, but it is a long way from running out of room. Japan in 1990 or China in 2019 had housing bubbles that dwarf what we see in the US. Homes could double or triple in price, as crazy as that sounds, in the next 10 years. Especially, in States that are seeing massive immigration like Florida, Texas and Tennessee.

Only after the credit-based system gets replaced by a new money will this dynamic change, and the US property bubble deflate for good. It is one of my long time arguments that bitcoin will absorb much of the "store of value" out of real estate in the long run.

Bank of International Settlements green-lights 1% reserves

This story came out of the blue. It can be positive or negative depending on what you focus on. The Bank of International Settlements (BIS), creators of the Basel banking agreement that all major countries sign onto, has added bitcoin as an allowable reserve asset up to 1% of total assets.

At first blush, this is a very positive development for bitcoin. It says that bitcoin has a place on banks' balance sheets. I expect the market will take it as such for the time being. However, there is another way to look at it. They limited bitcoin to just 1% of reserves because it is too risky, which could be seen as a warning.

Of course, these regulations change all the time. So, by this time next year they could easily change it to 5%. The negative part is that the BIS has inserted themselves into the bitcoin allocation rule-making game.

Quick Price Analysis

| Weekly price* | $21,744 (+$2474, 12.8%) |

| Market cap | $0.416 trillion |

| Satoshis/$1 USD | 4,592 |

| 1 finney (1/10,000 btc) | $2.18 |

Lots can change in a week. There is some light at the end of the tunnel for bitcoin.

Weekly chart

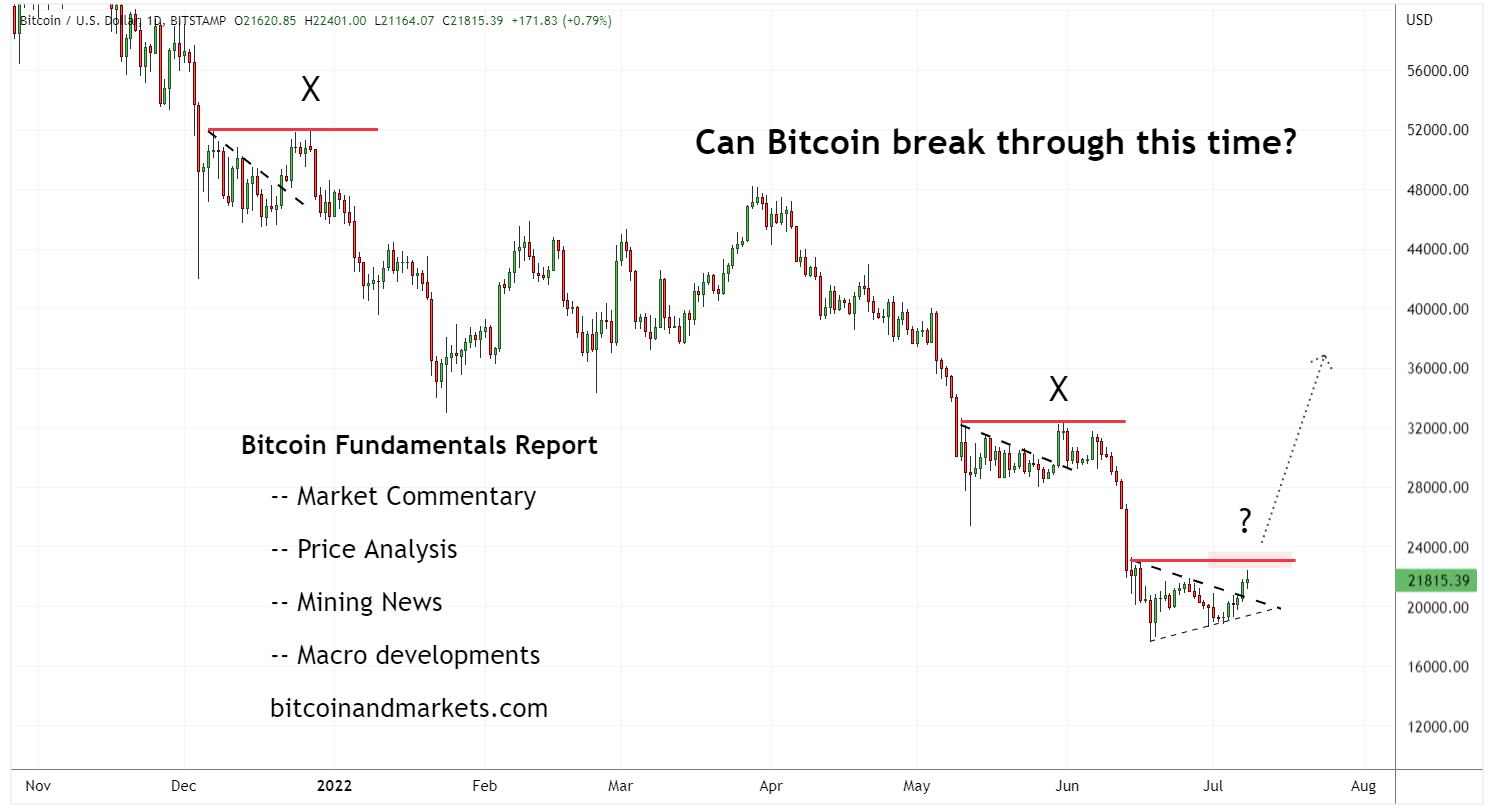

Bitcoin has now started to bounce off the previous cycle high and a zone of high volume support. The next level of resistance is $22,900 formed by the 200-week moving average and the next zone of elevated volume.

Daily

The daily chart is in a similar pattern to the beginning of June (highlighted). I am very cautious calling a breakout at this point. Adding to the resistance level mentioned above, price must clearly breakout above $24,000 to be an obvious break of this repeat pattern. That would be the first show of strength by bitcoin since at least early March, and arguably since the ATH back in November last year.

Monthly

The monthly chart shows price struggling with the 50-month moving average, and still being the most oversold on a monthly timeframe in its history.

Price Headwinds

Headwinds for bitcoin have eased again this week.

Altcoins

I call altcoins a headwind because the leveraged Ponzi scheme aspect of modern altcoins directly affects the price of bitcoin via forced liquidations. I am not equating the altcoin market to bitcoin directly, it is altcoins who need bitcoin.

That being said, this week saw a few developments on this front, from Chapter 11 bankruptcy by Voyager ("crypto" broker) and Chapter 15 by 3 Arrows Capital (leveraged "crypto" hedge fund). I also saw this morning that blockchain.com (has a history as an vehement enemy of bitcoin) is owed $250 million by 3AC, which they are unlikely to get back.

Even with all this mess, bitcoin made some gains over the last few days, up 18% since July 1st. That is a sign that these Ponzi's have moved on from the liquidation stage and have entered the bankruptcy stage. The worst dumpage is over.

Once again, Tether escaped due to savvy management.

Recession hysteria

The recession worry for Europe, China, Japan, and emerging markets is very real, but I think it is overblown for the US. I'm not saying that the US will not have a recession, I have known we are in one since at least March. What I'm saying is that the US will suffer a year of zero or slightly-negative growth, while the rest of the world will fall off a cliff.

What does that mean for bitcoin? Bitcoin has already finished its liquidation crisis, giving its valuation a much more sound basis. It is an escape for those people threatened by recession. As bitcoin begins to rally as the world burns, it could attract hot money from elites fleeing Europe and Asia.

Price Conclusion

The headwind from altcoins has eased this week, while the recession provides a new path to increase bitcoin interest.

The weekly candle is quite bullish, and the chart technicals are beginning to brighten. However, Bitcoin is not out of the woods, yet. That will come with a push above $24,000.

Mining and Development

| Previous difficulty adjustment | -1.4115% |

| Next estimated adjustment | +4% in ~11 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.70 (23 s/b) |

| Median fee (finneys) | $0.43 (0.197) |

Mining News

The stock price of bitcoin miners rose this week, adding another data point supporting the idea that the bottom of this drawdown might be in.

As miners generate their revenue in the form of Bitcoin, a rise in its price should help both their revenues and margins.

Adding to the leverage in this business, miners keep a large portion of the tokens they mine on their balance sheets rather than immediately converting them into cash. This can be a challenge when the price of Bitcoin falls, but when it rises, that has an amplified impact on their stock prices.

The White House is expected to release a report in coming weeks about their preferred framework for regulating bitcoin mining.

In a few weeks, the report is anticipated to be released by the Biden administration. Legislators hope that by publishing it, a wider audience will support the adoption of regulations governing mining operations.

Which government entity will be in charge of carrying out the regulations authorized by Congress is still unclear. As of now, it is clear that the EPA (Environmental Protection Agency) and other energy sector regulators will not.

According to Samaras, the Biden’s White House’s suggestions will undoubtedly exert pressure on investors to avoid involvement in or connection with cryptocurrency mining, particularly if the operations do not adhere to environmental rules.

According to Samaras, the study attempts to go deeper into arguments that have either praised or decried cryptocurrencies as local annoyances and environmental disasters.

The team intends to compare the energy efficiency of various mining methods, such as proof-of-stake, which is used by other cryptocurrencies and is more than 99 percent more energy efficient, to Bitcoin’s proof-of-work method.

If that is their true aim, this report cannot help but be very positive for bitcoin mining. Bitcoin mining uses a lot of energy, but is extremely clean, with upwards of 60% of energy coming from renewables, a very high percentage for any industry and a great example to hold up for their (idiotic) ESG goals.

Bitcoin's Proof-of-work mining is also the only way to maintain an independent network consensus outside the reach of regulators. Proof-of-stake is a fantasy that pre-dates bitcoin's PoW and has never remained independent for long. PoS might use 99% less energy, but it is 100% less viable in the long run.

I do not think it is the elite's intention to destroy bitcoin at this point, but they are getting more unpredictable lately as the globalists are backed into a corner.

The Bitcoin Policy Institute had a great public comment they submitted to this process.

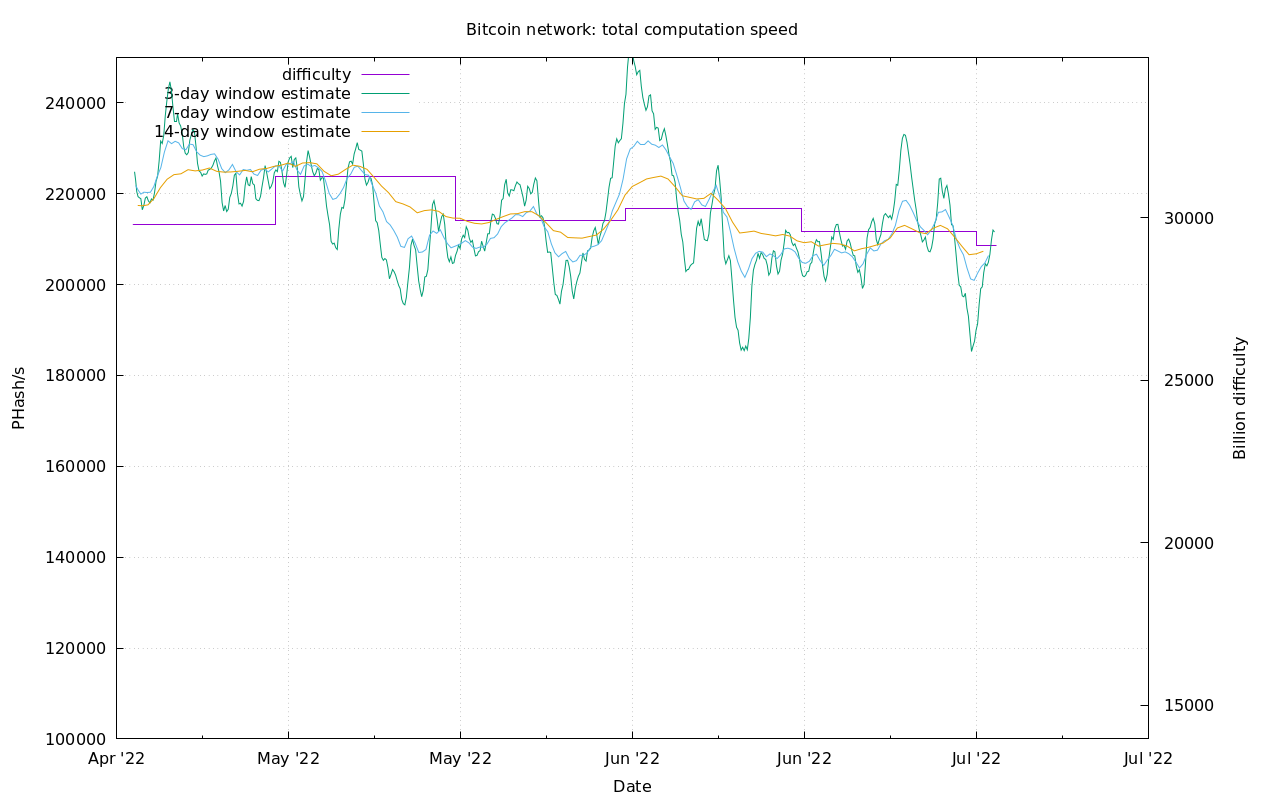

Difficulty and Hash Rate

Hash rate on the bitcoin network dipped this week, but has since recovered nicely.

On the chart below, notice the games being played prior to the difficulty adjustment. Difficulty is the purple line and it gets adjusted every 2100 blocks (~2 weeks) in order to keep the average block time at 10 minutes.

The days about halfway through the last difficulty period saw a big spike in hash rate. I was actually writing last week's newsletter during that jump in hash rate. The spike caused the estimated difficulty adjustment to rise to about 1-2%. Miners then cut their hash rate for the rest of that difficulty period, dropping most just before the adjustment. This caused the difficulty to adjust down instead of up.

With the bitcoin price low, miners do not want difficulty going up, despite being likely able to set a new all time high hash rate today. Lower difficulty means a slightly faster pace of finding blocks over the coming two weeks, and hence slightly higher revenues in human time.

Bitcoin time is simply blocks, but miners are humans that live in the real world with a daily, weekly, and monthly calendar. Margins matter. By keeping the difficulty low on purpose, miners can ramp back up their hash rate, increasing the number of blocks they find in calendar time.

For instance, rough math, if a miner can find 5% of all blocks, if there are only 2100 blocks in 14 days, they will get 105 blocks. But if they can manipulate the difficulty down slightly, they can can speed up the blocks so 2120 blocks can be found over 14 days, raising their revenue over that period by 1 block (6.25 btc, ~$131,000).

Anyway, I'll write more about this in the future, if readers are interested. It is very niche economics that not everyone will be interested in.

Macro

In a stunning development, Former Japanese PM Abe has been assassinated. He was the longest serving Prime Minister in Japanese history, and a conservative. Reading up on his legacy today, it seems he had a populist streak and might properly be viewed in line with populist leaders around the world today. He was also staunchly anti-communist and had multiple diplomatic spats over the years with the CCP.

In the post-US led order, Japan is bound to take a larger role, both politically and militarily. Over the last couple of years, Japan has increased the size of its Navy and has taken political steps toward a full professional military, things Abe advocated for.

This assassination could be a spark that lights the fire of rearmament in Japan. I'll be watching it closely.

Things are getting very bad in Europe. I don't know how much longer they can keep this farce going.

Germany’s biggest importer of gas, [owner] Fortum said Uniper has been hit hardest by reduced Russian gas flows. The company has received only 40% of Russian contracted volumes in recent weeks and has been forced to source the replacement volumes at significantly higher prices.

Fortum said it was engaged in “constructive talks” with the German government about how to stabilize Uniper’s business risks and financial position.

Due to planned maintenance, Russia is shutting down Nord Stream gas to Germany, causing panic. Many think Russia will not turn it back on.

The clown world part of this story is that this was scheduled maintenance, reportedly delayed by the Germans themselves. They shipped the needed parts to Canada for some reason, and now Canada will not send them back because they are obeying international sanctions on Russia.

There are also reports that the largest landlord in Germany (a country of renters, not owners like the US) is lowering heating in their units to save energy. The measure will supposedly save 8% of energy costs.

It's getting real in Europe folks. I've been saying for years that Europe will get much more rekt than the US in the coming years. I warned about China and Europe specifically as the centers of this crisis, and that is exactly what we are seeing. Next, I expect this to morph into a full-blown financial crisis. They are entering a very deep recession with an energy crisis and fragmentation risks to their European Union and the Euro. The globalists are losing.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 8, 2022 | Issue #199 | Block 744,187 | Disclaimer

* Price change since last week's report