Bitcoin Fundamentals Report #198

Bitcoin ride or die, Nic Carter redux, DARPA report debunked, price headwinds and analysis, and mining sector news.

This Week

Bitcoin ride or die, Nic Carter redux, DARPA report debunked, price headwinds and analysis, and mining sector news.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

- (Fed Watch) Fragmentation in the Euro and Dollar, The Bitcoin Solution - FED 101

- (Fed Watch) Japan YCC fails, Bullwhips, and Fragmentation - FED 100

- (Blog) Macro Update - 30 June 2022

- (Bitcoin & Markets) Response to Jeff Snider's Criticism of Bitcoin - E244

- (Member) E244 Video

- (Community) New Telegram Channel

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Holding but weak |

| Media sentiment | Very negative |

| Network traffic | Normal |

| Mining industry | Recovering |

| Market cycle timing | Despair |

Ride or die

Dear readers,

This is it, ride or die time. Do you have the fortitude to make it through this sell-off and come out the other side? All around us we are told by normies, the mainstream financial press, and establishment investment "experts" that bitcoin is dead. Do you have what it takes to hold?

Nic Carter's Rage Quit?

This situation escalated quickly. A few days ago, Nic's firm Castle Island Ventures, announced an investment in a wallet company with anti-privacy built in. Logically, Bitcoin Twitter erupted. Nic followed this up the next day with a very long blog post explaining himself. It had a derogatory tone, that people took as a rage quit.

Clearing up confusion about myself, Castle Island, Dynamic, and 'maximalism' https://t.co/nsROvOQqDr

— nic carter (@nic__carter) June 29, 2022

This is not a rage quit, Nic was always borderline.

First, I have to say, Nic seems like a good guy. He's measured in his opinions and has done well for himself without being an evil scammer type, which is sadly be very common in this space. He does make questionable investments in Ponzi schemes though.

That being said, I never understood the Bitcoin community's high opinion of Nic. I've read his articles and listened to a handful of his podcast episodes, and he never came across to me as someone with an elite-level grasp of bitcoin, long-term macroeconomics of bitcoin and altcoins, or the ethos of the space.

It seemed strange to me that a son of a Senior Director at the World Bank, came right out of university and started a "crypto" Venture Capital fund. I assumed Nic is well-intentioned but ultimately left-leaning with an overestimation of his own investment prowess.

That assumption turned out to be correct. His company could very well be ruined from recent market action and he has doubled down on being a pluralist (an ideology which values diversity at the cost of science and even logic).

Castle Island Ventures was invested in BlockFi. Now, worth less than a penny on the dollar. I don't know how much exposure they have to this disaster, but many VC firms in the industry were irresponsibly overexposed.

Castle Island Ventures' portfolio looks to be purposefully anti-bitcoin, not just bitcoin agnostic or pluralist, but consciously anti-bitcoin, it's really delusional. The argument can be made that bitcoin is only 50% of this industry, but only 1 of 39 investments on their website is a bitcoin specific company! Investing in NFT marketplaces, leveraged lending platforms, DeFi scams, and web3 garbage is the sign of people that have no understanding of the long term value in this space. Spray and pray.

Anyway, I'm sure Nic will stick around, but I think the high-water mark for his influence and his fund are in.

DARPA Thinks Bitcoin Attacks are Trivial (Report) 🤣

On June 21, 2022, a DARPA-funded report on blockchain centralization was released by Trail of Bits, a security research firm.

The above article from Swan Bitcoin's Yan Pritzker and Tomer Strolight, is a 6,000 word takedown of this government-funded hit piece on bitcoin's security model. They meticulously go through 13 individual claims made in the report and show how they are either false or misleading.

At face value, the paper elaborates on many already explored attack vectors in Bitcoin, some of which Bitcoin was literally invented to solve (sybil attacks), but fails to give context to the attacks and their achievability and consequences in the real world.

Pomp is a scammer

— gordolven (@gordolven) June 25, 2022

SEC's Gensler says Bitcoin the only commodity in this space

JUST IN - SEC Chair Gensler said #Bitcoin is the only cryptocurrency that is a commodity. pic.twitter.com/3KX18ODjuG

— Bitcoin Magazine (@BitcoinMagazine) June 27, 2022

Quick Price Analysis

| Weekly price* | $19,270 (-$1807, -8.6%) |

| Market cap | $0.369 trillion |

| Satoshis/$1 USD | 5,173 |

| 1 finney (1/10,000 btc) | $1.93 |

"Price is the only thing that matters." - Ansel Lindner :)

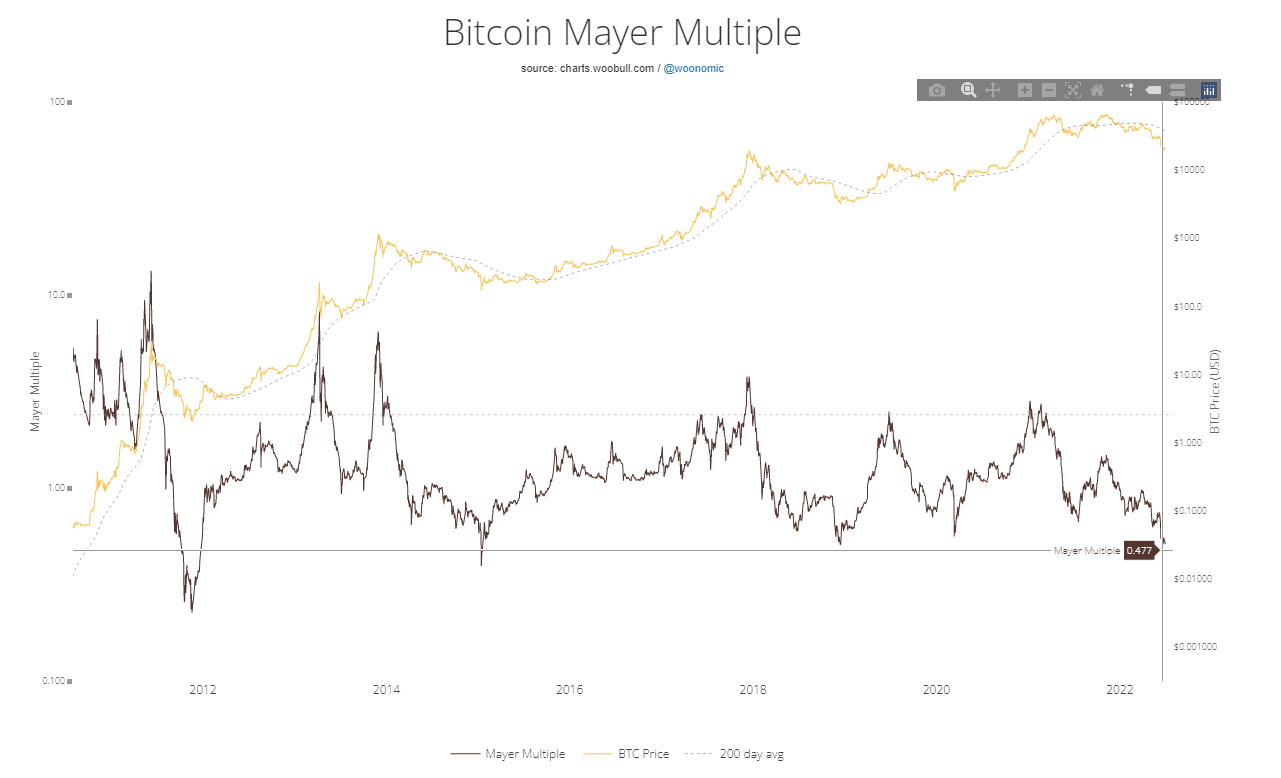

All models are broken at this point, we have to fly by strict technical analysis, informed by fundamentals. Not necessarily comparing it to any other time in bitcoin's history, but to straightforward charting network metrics.

Weekly chart

The chart is sitting roughly in the same place on the chart as last week. Bitcoin is desperately trying to hold onto $20k.

Monthly

Bitcoin is heavily oversold on the daily and the weekly timescales. There is not much more room to go in the immediate future to the down side. For instance, (as seen above) the weekly RSI is 25. While it could go lower, we have to say the probability of going lower is less than the probability that it goes up on the weekly timescale.

The difference in price from the 200-day moving average is at its most negative since 2015.

Monthly RSI still has room to go lower. When taken together with this same momentum indicator on the weekly and daily, we are due for a consolidation of several weeks. After that, it could proceed lower once again.

The TD sequential indicator (my preferred time-based indicator) is showing a Red 8 on the monthly, which means this trend has been unbroken for 8 months. It is not at the reversal sign of a 9, but if the August closes below the solid black horizontal line (~$38,000), we will get a Red 9 in August. Also, if you look at when the Red count started, it was not on the first red candle. I've noticed this several times with the generic TD Sequential indicator, that it is not sensitive enough at trend changes. So, if we add one to the count, July would be that Red 9.

Price Headwinds

Headwinds for bitcoin have eased this week.

Altcoins

Over the last week, several leveraged funds have blown up or were bought at rock bottom prices. Besides the ever-present Tether FUD, there are new rumors around Circle's stablecoin USDC.

I do not buy into any of these large centralized stablecoin worries. Too many people equate algorithmic stablecoins (hubristic scams that can never stay pegged to the dollar) with centralized stablecoins (companies that hold the issuance equivalent in assets and will redeem on demand).

Terra and other stablecoins that have recently blown up are all of the algorithmic type. They are also the most damaging to the bitcoin price, because they automatically sell whatever bitcoin is locked in their scheme to balance their shitcoin's price.

If centralized stablecoins were to implode, it would not necessarily be bad for bitcoin. At least some investors would sell their less liquid stablecoins or altcoins, for more liquid bitcoin.

Inflation hysteria

The inflation hysteria has totally died from my perspective. There are still some people out there that think the Fed pivoting, cutting rates and starting QE again, will turn inflation back into the main concern. However, there is zero evidence to support this claim.

If you do the work, and look at periods of QE, especially periods where QE started, they are characterized by falling or negative CPI prints.

I'll also add, that in bitcoin's history, there is no correlation with CPI movement. Yes, we can draw some medium term inverse relationship between bitcoin and the dollar, but over the last 12 years, the dollar and bitcoin have both moved up together.

Broad economic slowdown

Recession is here. Inflation fears have switched over the recession fears now. An unanswered question is how deep will it be. My base case, is the US has a long but mild recession, while the rest of the world has a deeper recession.

Price Conclusion

If we can stay above $20,700, I think some bullish momentum will come back to bitcoin this week. If price drops below that level, I think it could test the lows again, at least on a daily close basis ($18,900). - Last week

There is little on which to build a bullish case for bitcoin right now. We are approaching monthly lows like we've never seen, and time-based reversal zones. We also have historic negative spreads to the 200-day moving average, which portends a reversion to the mean. But that's about it.

Headwinds like the altcoin disaster have slowed, perhaps that gives time for bitcoin bulls to turn the ship around. Inflation worries are abating in favor of recession fears. This means we could see an acute crisis like a freeze in the plumbing of financial markets soon. That would be negative for all prices.

Medium term, global macro is returning to the Post-GFC normal, an environment that bitcoin thrives in. Hopefully, we can get there in the next couple of months. One thing I do not expect at this point is a miraculous bounce/spike in bitcoin's price. Any turn around is going to be a slow affair for its first stages. Then maybe after a month of no bleeding, we'll get a huge green candle.

Mining and Development

| Previous difficulty adjustment | -2.3548% |

| Next estimated adjustment | +1% in ~4 days |

| Mempool | 5 MB |

| Fees for next block (sats/byte) | $0.49 (18 s/b) |

| Median fee (finneys) | $0.30 (0.155) |

Mining News

Samsung will reportedly start trial production this week of three nanometer (3nm) chips for application-specific integrated circuits (ASICs) – the most efficient machines for mining bitcoin.

Samsung’s first customer, according to the report, is a Chinese ASIC company known as PanSemi, which designs ASICs used for mining bitcoin.

Bitcoin miners will be consistent customers for chip manufacturers in the future. Bitcoin miners, by necessity, want the newest fastest chips to keep their competitive advantage.

/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/6M4QKR5TAFF4DBLGJ7RHRZNZ6U.jpg)

New York state regulators today denied an air permit to a natural gas-fueled power plant near Seneca Lake that used most of the electricity it generated to mine the cryptocurrency Bitcoin.

Climate extremists are killing their own economies. They'd make us all go back to no electricity if they could. Bitcoin mining will just go elsewhere.

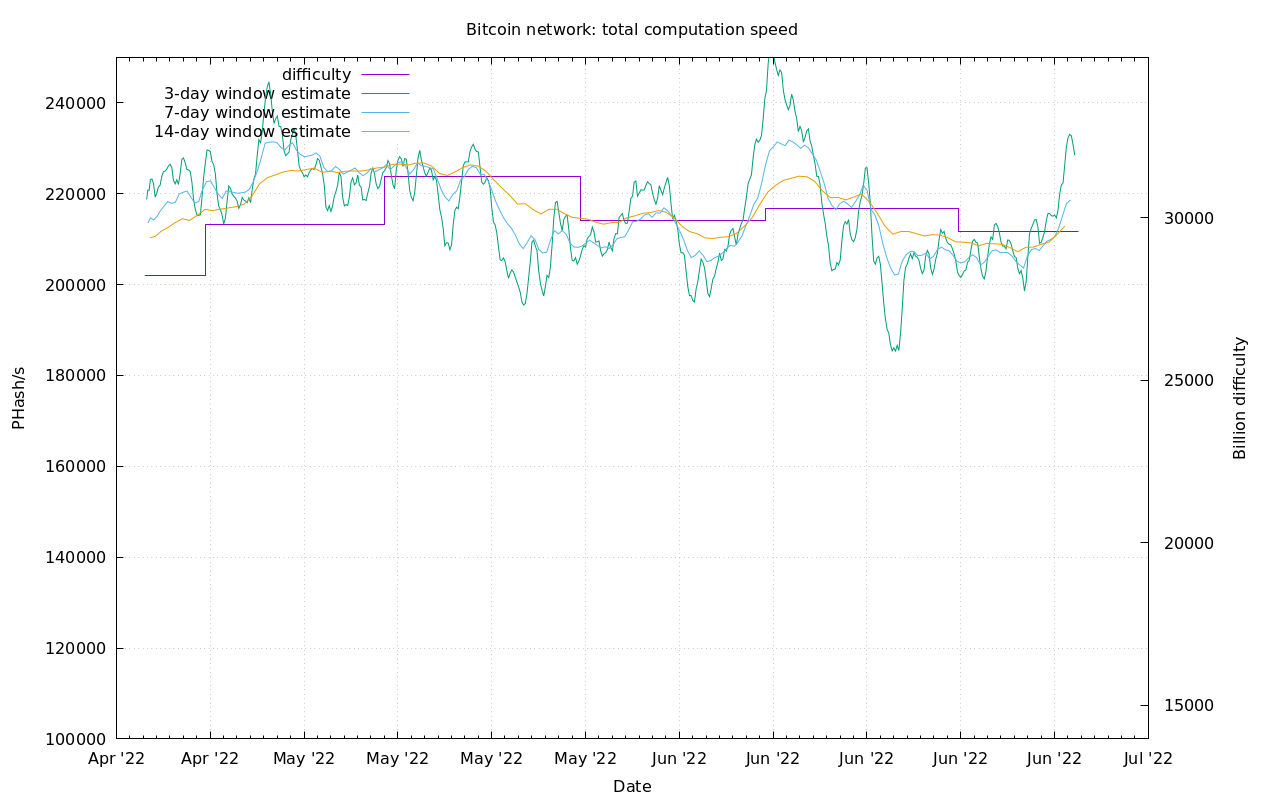

Difficulty and Hash Rate

Despite the price, bitcoin miners ramped up their hash rate this week.

It is an interesting dynamic, because when less efficient miners go out of business, they will sell their whole facilities to miners that have a better financial position. The mining equipment will go offline for a week or so, and then get turned back on by the new owners with better business practices.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 1, 2022 | Issue #198 | Block 743,204 | Disclaimer

Cover image: @Excellion and @BitcoinMemeHub

* Price change since last week's report