Bitcoin Fundamentals Report #205

The bitcoin news cycle was slow, but I comment on the Ethereum saga, price and mining.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! 30 live streams in 30 days! Members can find the link to the recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) China Rate Cuts and Jamie Dimon's Warning - FED 108

- (Fed Watch Clips) New clips From FED 107

- (Bitcoin & Markets) When Money is Credit, All Problems Look like Elasticity - E247

- (Bitcoin & Markets) Reflexivity and the Merge - E248

- (Member) Videos for E247 and E248

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to hold on |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining industry | Stable |

| Market cycle timing | Bull market starting |

It was a slow week for Bitcoin news, as well as macro for the most part. All the attention has shifted back to altcoins, this time because the #1 altcoin, the granddaddy scam of them all, Ethereum, is having major issues with its upcoming Merge.

Nothing has changed with bitcoin's fundamentals despite this recent drop. The drama is on the altcoin side of the house this week, so that's where I go next.

Ethereum is already dead

#Ethereum is already dead, believers just haven't realized it yet, and pumpers will hide it from you for as long as they can.

— Ansel Lindner (@AnselLindner) August 19, 2022

I don't want to sound like a broken record, but something has to be said about the largest Ponzi scheme the world has ever seen. Generations of analysts will be writing about what occurred in the early days of Bitcoin, and, so far, the most extreme in my opinion has been the Ethereum Bubble and Crisis.

When Ethereum launched, I immediately knew it wouldn't work as advertised. I was not alone either. Many people back then who understood bitcoin and the trade-offs made in its design, knew Ethereum couldn't possibly work the way they claimed it would work.

Ethereum is a copycat of Bitcoin with a few foundational differences. First, I must mention a non-technical argument before I go on to the technical and game theoretic ones. Ethereum has a well-known founder, one that played a pivotal role in the initial marketing, creation and subsequent development of the project. Vitalik Buterin. He was a "boy genius" type, only 21 when launching Ethereum. People immediately a cult of personality around him.

Less well-known at the time was his scammy past. Vitalik's past before Ethereum isn't that long, since he was so young when he started it. But that was enough time to sell shares in a "simulated quantum computing" scam, and try to convince bitcoin developers to revamp bitcoin from the ground up to serve his personal ambitions on the network with colored coins. Note: from the beginning, he was trying to print tokens. Of course, bitcoin devs said it was impossible, so Vitalik when off and started Ethereum.

Bitcoin in comparison was launched by Satoshi Nakamoto, a man that has never been identified, communicated anonymously and maturely, and then left, never touching his estimated 1 million bitcoins.

Technical Problems

Now, I won't pretend that I'm extremely technical, but I have a good understand of it, and a great grasp of the economics. Computer networking, in this case, is like economics, investment and return, resource allocation, and trade-offs.

The first problem in the core design of Ethereum is that it decentralizes computation, instead of validation. Each node in a decentralized network must be identical and perform the identical jobs, else it implies trusting others to perform those tasks. Bitcoin only decentralizes storage of the transactions (block chain) and validation (a quick hash function to QC that the inputs are valid).

Ethereum, on the other hand, decentralizes computation. "Smart contracts" are simply tiny programs, the node will run that program and check its inputs and outputs, and it charges "gas" for the time it takes to run the mini program. This is much more processing heavy. Each node needs to run each smart contract in that block. This doesn't scale.

We also knew from almost the beginning that Vitalik wanted to eventually transition to Proof-of-stake (PoS) instead of mining and Proof-of-work (PoW). A decentralized computer network needs some way for nodes and participants to agree on the current state of the network. In other words, they need a transparent ledger to look at and make sure everything on the network is exactly the same as every other node sees it.

Bitcoin accomplishes this through PoW, the miners expend unforgeable cost in the form of energy, in order to update the system. The miners only include valid transactions or else the nodes will reject the block, and will have wasted all that cost. All nodes need to do is make sure the transactions and blocks check out as valid cryptographically, and they can be sure the most work chain is the truth.

That is not possible with PoS. The Ethereum believers thought it was a technical problem, that with enough hard work, PoS's weaknesses could be overcome. However, for every weakness they solved, two more jumped up in its place.

Despite years of work, Ethereum still has not closed the loop. Instead, they made it so difficult to unravel, people didn't know better. They added complexity, instead of simplicity; added trade-offs as the scope of their project grew; and made the code more and more inaccessibility to all but the initiated developers.

Game Theory

When Ethereum was launched, they had a choice: A) start with a clean block chain on block #0 and build up on an equal footing, exposing Ethereum to cheap economic attacks; or B) pre-sell coins with a marketing campaign, spreading buy-in, getting the network over the initial vulnerable stage, and be able to raise money for developers and an Ethereum Foundation to shepherd the fledging network, but in doing so, rob deep balanced incentives, replacing them with moral hazard. They chose the latter.

This initial decision to launch through a pre-sale (premine - meaning block #0 has balances already on it) predetermined their path to today (just like a business and its stock btw). So, Vitalik and the team marched forward, adding complexity in place of simplicity, and erring on the side of centralized decision making when needed to push the project forward.

They had to maintain a controlling share of the tokens (70% at launch) in order to dictate that decision making. When met with the DAO exploit, where a smart citizen took "code is law" to heart and acquired millions of ethereum in an unintended way (from insiders), the ethereum team once again sided with centralized interests and stole those coins back via their control of software upgrade.

The end of the saga

Ethereum had a roadmap to fulfill their initial claims back at launch. One after another, promises fell by the wayside. Ethereum insiders called doubters Maxis or shamed up for asking questions, to keep their faulty system from being examined too closely. Now, they have run out of runway.

The Ethereum 2.0 upgrade is the Promise Land. It is a 7+ year process to upgrade from ETH1.0 to ETH2.0. What is promised with ETH2.0?

- Huge scaling. 1000x the throughput of the ETH1.0. To achieve this they have to use "sharding". Remember above, I said that decentralized computation didn't scale? Well, sharding is way to break up the computational burden into shards. It started at 1048 shards, but now only 64 shards, will be combined into a central chain.

- Proof-of-stake. I'm not sure if mining is incompatible with sharding or not, perhaps requiring some merge mining protocol? Regardless, PoS is an environmental decision for Ethereum. It was sold that way from Day 1. In PoS, people put up their Ethereum as stake, or an anti in poker, to play that round. Then a "random selection process" designates one person staking to form the next block. (there's lots of nuance in there I don't have the time to get into).

If you are a malicious miner in bitcoin, you lose all the cost to produce that block. Compared to PoS, you lose your stake.

PoS ideas have been around longer than bitcoin. This isn't new, and hasn't worked. But it is an ideological thing for Ethereum. They are climate activists against the climate positive Proof-of-work. Weird.

All that aside, the reality hitting Ethereum right now is that, despite their best laid plans, all the staking is being done by US regulated entities.

This didn't even cross these people's minds until last week, when Tornado Cash, a major Ethereum coin mixing service, was sanctioned by the US government. All hell broke loose. What this incident exposed is that the staking power (in Ethereum, the power to make the rules and confirm the transactions) is now in the controlling hands of the US government, not the insiders. WOW. BOMBSHELL.

What's to be done?

Nothing. This has to play out. Ethereum's incentives were corrupted from day-1. That's why my above tweet says, "Ethereum is dead already." Its fate was sealed at launch.

The only question is, "does that matter for the PUMP! ??" I think it will, for many reasons, but this is already getting longer than I intended, so I'll have that for another time and place.

Suffice it to say here, the small investors are about to get rug pulled once again. If You are reading this and identify with that, I'd rethink my exposure to Ethereum.

Quick Price Analysis

| Weekly price* | $21,292 (-$2,879, -11.9%) |

| Market cap | $0.409 trillion |

| Satoshis/$1 USD | 4,687 |

| 1 finney (1/10,000 btc) | $2.13 |

TIME TO PAY ATTENTION! - Last week

The bitcoin price has chosen a direction, but not the one we were hoping for.

Daily chart

Last week, I included two arrows on my chart. The green was the likely one IMO, but I also included the bearish case, and unfortunately that seems to be playing out.

The dashed line at $19,000 is the technical target for this move.

Bear Flag Update

This bear flag I have been pointing out for two weeks. I didn't think it would happen, but that's why I point these things out, so you can determine what your risk tolerance is.

I won't sugarcoat it, the price looks bad here. There is nothing technically on the charts keeping us from $19k, besides the little black line connecting the bottom wicks. From a purely Technical Analysis point of view, we have a target of $19-19.5k. However, it remains to be seen whether there is immediate demand from Blackrock, Fidelity, and other big players that will start easing in during this dip.

Headwinds and Tailwinds

Ethereum Uncertainty

Above, I wrote about the specifics of what's going on in Ethereum. Here, I'd like to mention a few things about how it will affect the price of bitcoin. Ethereum is a huge headwind.

In the short run, I see the Ethereum Crisis having a significant impact on Bitcoin. The low hanging fruit has been liquidated, eg TerraLuna, Celsius, etc, but if Ethereum crashes, it could affect a deep segment of the ecosystem, like exchanges. A lot of the froth has been taken out of bitcoin, but what's coming could be a test of foundations.

The market is going to shake higher up the tree now. The largest VC firms in "crypto" emerged mostly unscathed from the last few months, however, it is they who are the worst offenders of all the scams in the space. I'm not saying that they "should" get wrecked; I'm saying it's likely that at least one major VC firm will go down from this.

The future prospects of Ethereum look horrible. The Merge is almost definitely a "sell the news" event and it's only 27 days away. All we need is one of the large firms to defect and try to get out first, causing a cascade through the market, pulling bitcoin down temporarily along with it.

Stock Market

This week, stocks have turned from tailwind to neutral.

Bitcoin didn't follow stocks, remaining lower, and so far has been the important signal. As I always say, "nothing goes up in a straight line." Stocks will consolidate from their recent rally, but then continue higher. I maintain my bullish expectation for stocks throughout the rest of the year.

My reasons for higher stocks prices: 1) Cash on the sidelines is at a two decade high, in both stocks and bitcoin; 2) buyback season is upon us; and 3) the Fed will pivot to save face.

Those were from last week, but I'll add to the list. The populist wave (red wave) in the US is getting stronger. It is possible that people interpret the success of the red wave as helping to bring back the Trump economy (I'm not saying it was Trump's doing, but the economy was better before 2020).

The other big news for the stock market this week is that $2 trillion in options are expiring today. This means, if they were long, those positions will close, or sell and rebuy. This puts sell pressure on the market specifically for today.

Price Conclusion

Price apparently has chosen a direction. The bear flag pattern broke to the downside, slicing through the two best support levels we had on last week's chart. Stocks are consolidating, as $2 trillion in options contracts close or get rolled over. Sell pressure from altcoins is increasing. The lull in macro pressures of the last couple of weeks is starting to increase again.

Overall, while it's possible this move becomes a fake out, I expect the bitcoin price to drop over the next few days and test $19k. It will eventually break back into the mid-$20k's, but that might be a couple weeks from now.

Mining

| Previous difficulty adjustment | +0.6280% |

| Next estimated adjustment | +9.1% in ~12 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.09 (3 s/vb) |

| Median fee (finneys) | $0.09 (0.042) |

Mining News

“Stronghold has been consistently toggling between selling power to the grid and mining Bitcoin,” amid lower margins on the crypto and higher costs for power, the company said.

Stronghold’s power generation capacity remains unchanged. “[While] our Bitcoin mining fleet has been reduced in the short run, we have significantly more open exposure to strong power markets, which remain tight,” Greg Beard, cochairman and chief executive officer of Stronghold, said in the statement.

It has been a volatile year for bitcoin miners. The industry has been hit with a falling price, fragile electrical grids, and government regulation. Despite all that they keep hashing away, with a new bitcoin block every 10 minutes as designed and promised.

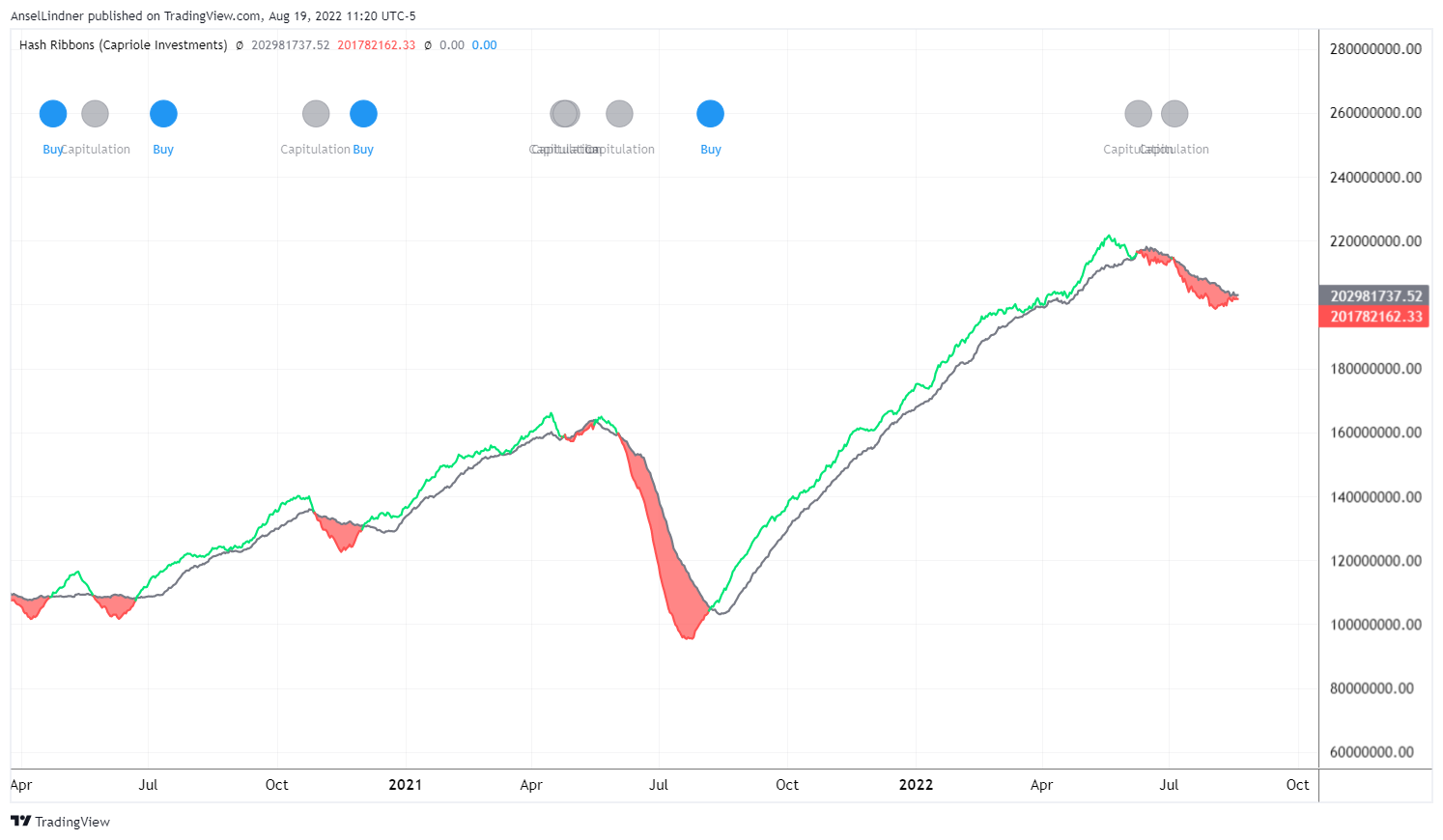

Hash Ribbons

The hash ribbons are beginning to close. The ribbon is formed by the 30-day and 60-day moving average of the hash rate in bitcoin. A bullish cross signals that the miner capitulation is over. We are approaching this mark, but it hasn't happened yet.

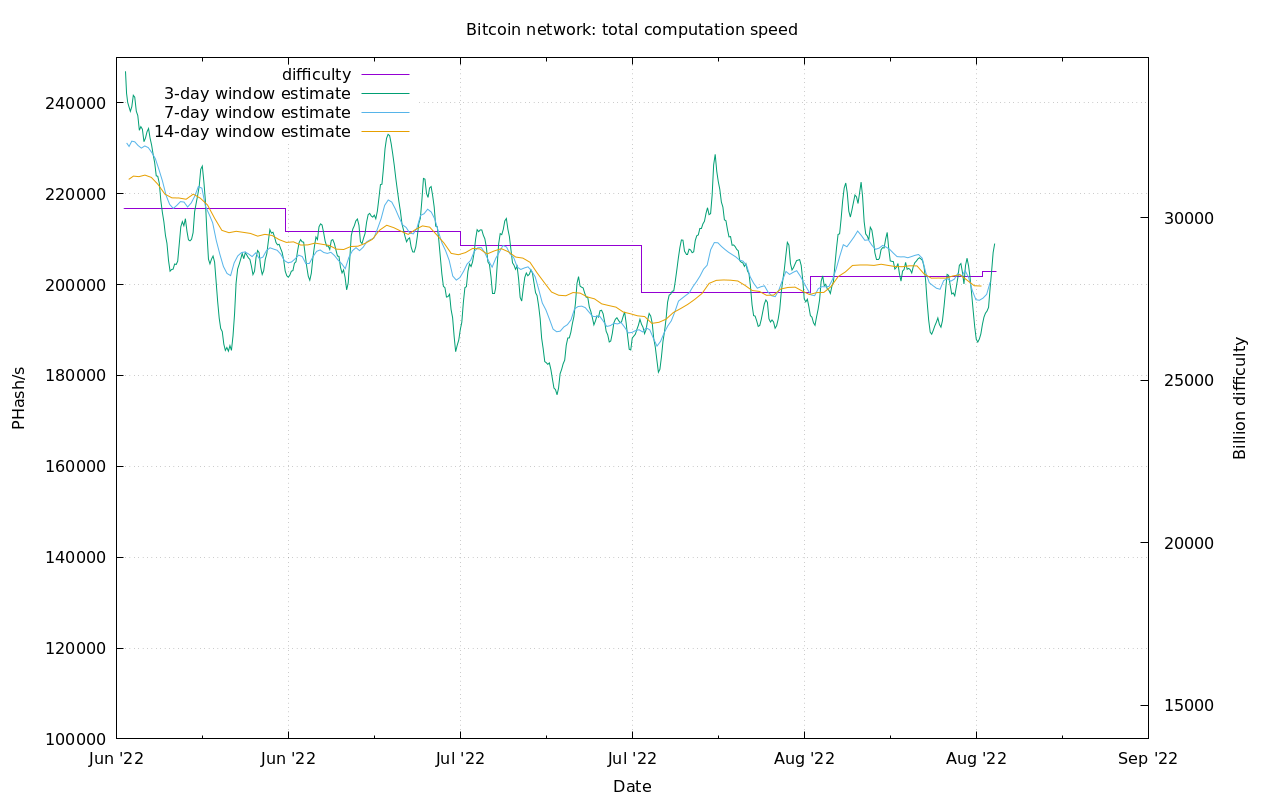

Difficulty and Hash Rate

Miners struggled a little this last week, as they dragged down the estimated difficulty adjustment from 2.5% to only 0.6% (seen in the purple difficulty line on the chart below).

Since that adjustment Thursday morning US time, hash rate has come back up, with an early pace for a big difficulty adjustment of 9% in 12 days.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 19, 2022 | Issue #205 | Block 750,185 | Disclaimer

* Price change since last week's report

Cover image: @idseval