Bitcoin Fundamentals Report #287

Arresting devs, definition of money service business, keeping perspective, JPY spikes, GDP disappoints, Biden wants to eat the rich, and more

April 29, 2024 | Block 841,396

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | "Do Something" |

| Media sentiment | Negative |

| Network traffic | Back to normal |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $62,952 (-$3,647, -5.5%) |

| Market cap | $1.240 trillion |

| Satoshis/$1 USD | 1590 |

| 1 finney (1/10,000 btc) | $6.29 |

| Mining Sector | |

| Previous difficulty adjustment | +1.9859% |

| Next estimated adjustment | -1.5% in ~9 days |

| Mempool | 245 MB |

| Fees for next block (sats/byte) | $2.64 (30 s/vb) |

| Low Priority fee | $2.20 |

| Lightning Network** | |

| Capacity | 4736.45 btc (+1.8%, +85) |

| Channels | 52,081 (-0.7, -367) |

In Case You Missed It...

Bitcoin Magazine Pro

- Hong Kong Bitcoin ETFs: Greater Than the Sum of Its Parts

- Market Tracker breakdown: Bitcoin is Ready for Post-Halving Bullish Continuation

- Mining Tracker breakdown: New Realities in Bitcoin Post-Halving

Member

Community streams and Podcast

Blog

Headlines

Summary

- Keonne Rodriguez and William Lonergan Hill, founders of Samourai Wallet, face charges for operating an unlicensed money transmitting business and conspiring to launder money, linked to over $2 billion in illicit transactions through their bitcoin mixer.

- Samourai Wallet, known for its "Whirlpool" and "Ricochet" features, facilitated anonymous transactions, attracting criminal use for money laundering, leading to the seizure of its servers and app removal from the Google Play Store.

- The case highlights a significant international law enforcement collaboration, including the IRS, FBI, and Europol, aiming to combat the criminal use of bitcoin technologies.

Phoenix Wallet by Acinq and Wasabi Wallet by zkSNACKs are exiting the US market due to concerns about the legal status of self-custodial wallet providers following US regulatory actions against Samourai Wallet. These companies have responded to regulatory pressures by advising US users to cease using their services and prepare for changes, with Acinq giving Phoenix Wallet users until May 2 to adjust, while Wasabi Wallet's policy change took effect immediately. This move reflects wider regulatory scrutiny on whether such wallets could be considered Money Services Businesses, amidst global debates on the role of self-custody in potential illicit activities.

- Need for Perspective and Balance

My initial reaction to the Samourai news was as follows:

Governments can only stop privacy if we give up. Someone will create the next Samourai, will create 10 more Samourais.

They've come after #bitcoin before. It is antifragile. A significant portion of billionaires now hold it. Be outraged but be confident, bitcoin will win.

This "attack" on bitcoin needs to be kept in perspective. It's been 15 years, and they've arrested a few people. It's unjust, but it is to be expected, no? They haven't won a single battle, only a few engagements. This most likely means they are scared of the success we've had. Bitcoin on the other hand is stronger than ever!

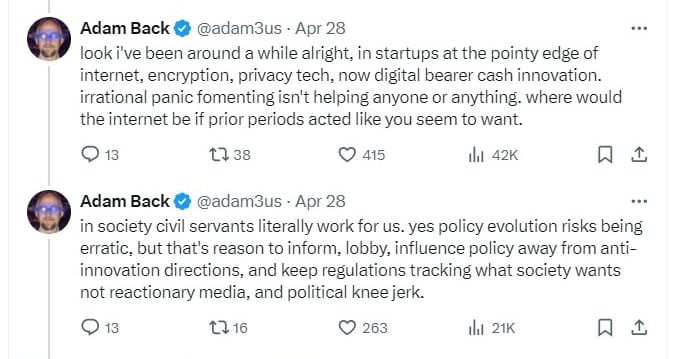

This is bad news but also an opportunity. We learn lessons from this and it pushed innovation in other directions. Adam Back said something similar. He urged calm.

Samson Mow also urged calm:

Keep calm and HODL #Bitcoin.

Everyone seems to be overreacting to the Samourai arrests, the FBI PSA, and Phoenix leaving the US. Here's my attempt to break it down.

Samourai

[...]

1 Samourai was a self-custodial wallet

2 Samourai was a mixer

3 Samourai was providing normal people with privacy

4 Samourai were knowingly marketing the service to criminals and flaunting that fact

Reading the charges, it seems like #4 is pretty cut and dry for this case. Their getting arrested for #4, doesn't automatically mean #1, #2, #3 are under siege as well. If Samourai was a taco stand laundering money and bragging about it, I'm sure they would be taken down too.

They may be accused of running a money transmitter now, but that may or may not stick. We'll find out in the trial.

All that said, we should always be vigilant to attempts to erode privacy and the ability to self-custody. It just does not seem that this fight is that fight.

FBI PSA

Seems pretty normal that the FBI would advise people to use compliant services, and the entire announcement seems to revolve around potential disruptions due to Samourai being taken down, and potentially others in the future. Given they took action, they have to post some bulletin about it.

Remember that when people lose funds or have funds stolen from them, they do go to the FBI for help. From their point of view, the best thing for people to do is use compliant services where they can potentially help.

The announcement concludes saying that services that purposely break the law will be investigated - so again we go back to #4 above. This is nothing new, and self-custody is not being criminalized.

Phoenix Leaving

As @jack said, it's feels completely unnecessary. Phoenix obviously is not a MSB and they are not doing anything illegal. In my view, their exit from the US app stores is a complete overreaction.

Keep Calm

Could "they" come after wallets, developers, mixers, nodes, LSPs, sidechains, eCash, VPNs, encryption, etc? It's totally possible. But if you're not breaking the law, you have nothing to worry about.

To my knowledge, there is still rule of law in the US, property rights are still protected, and privacy is enshrined in the Bill of Rights (@gladstein).

It would be very difficult to change the law or stretch it to incriminate these things because it's all just information and software, which is speech. Some will try. But as they are trying, #Bitcoin is becoming more and more mainstream and integral to the world's financial system.

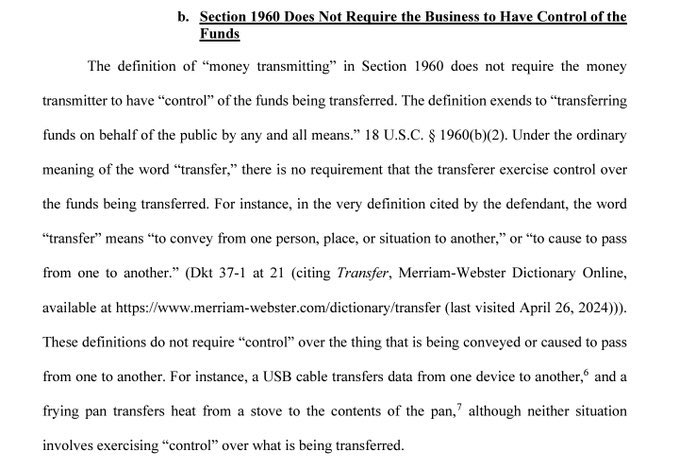

- Who is a Money Service Business?

This whole debate misses the point that bitcoin doesn't move and is not located in wallets. Only the "password" to reassign ownership is stored in wallets. THIS IS AN OPPORTUNITY TO EDUCATE AND ORANGE PILL!

- Morgan Stanley applies for 12 of their funds to get access to the bitcoin ETF

Macro

This is not new. It comes around every year almost. The Marxists always want to tax the rich. The US capital gains structure is currently 30% for short term <1 year and 15% for long term >1 year.

The new tax would tank the economy, not something Biden wants to do in a election year against Trump. Therefore, this is all political positioning to appease his base. It has almost zero chance of getting anywhere.

The proposal also includes a 25% tax on unrealized gains. "Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent." For this proposal to even apply to you, you have to make more than $1 million of income, or $400,000 of investment income each year.

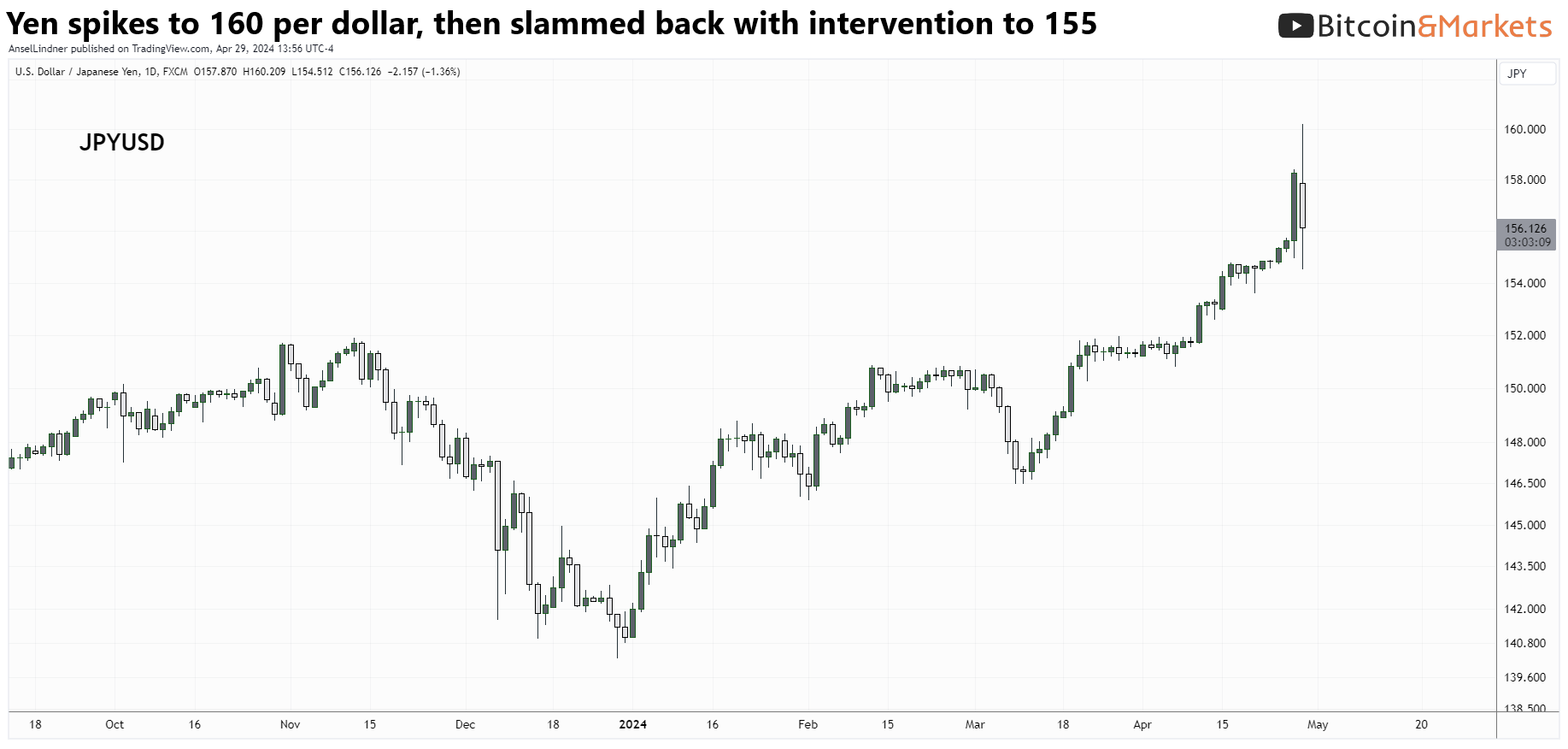

- Japanese Yen Collapses to 38-Year Low Against the Dollar

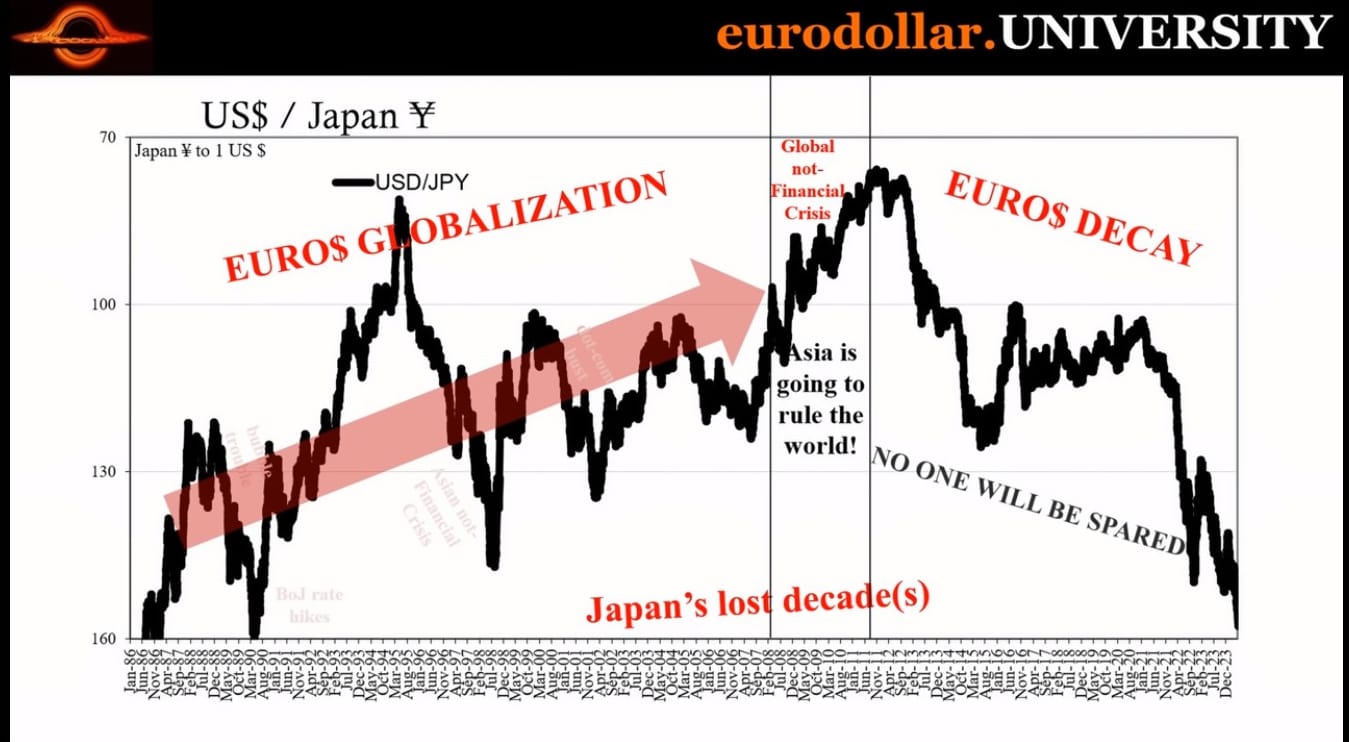

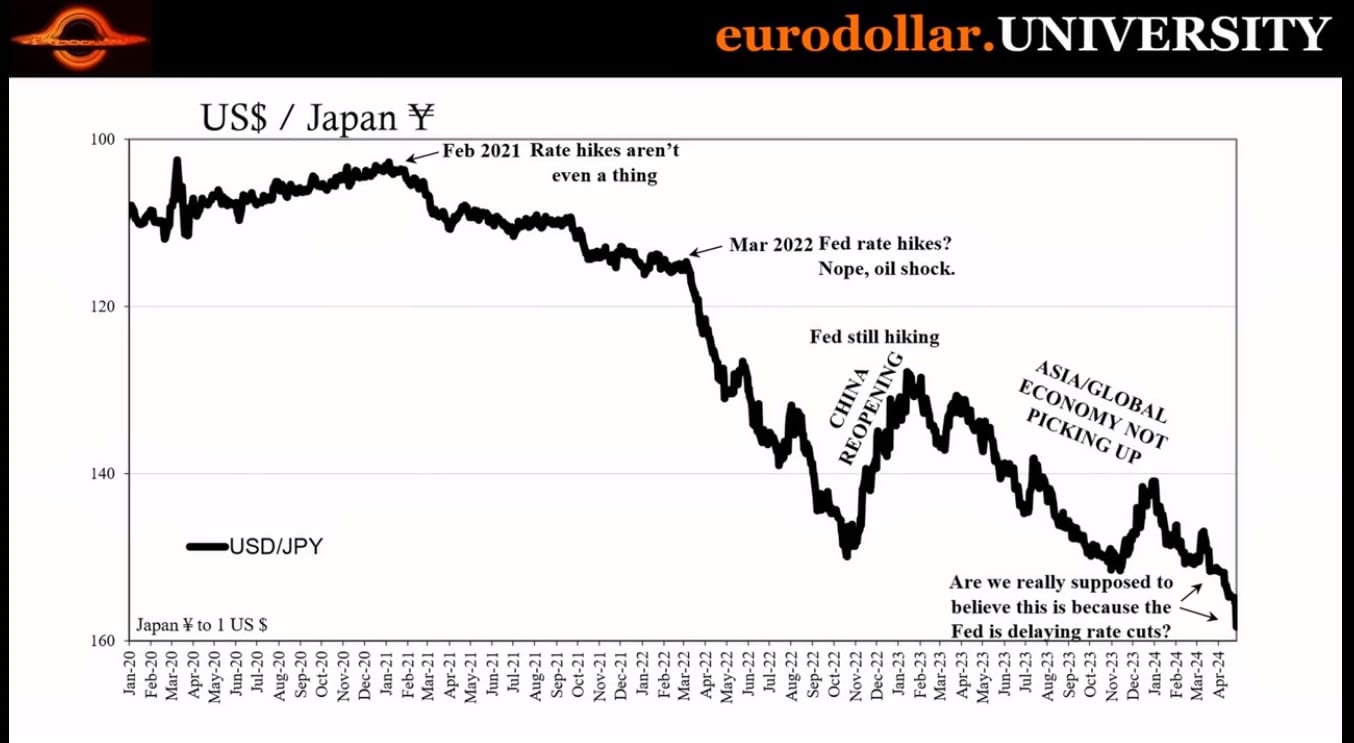

I wrote about this last week, something is breaking in Japan. I don't have direct evidence, but my feeling is that this is at the root and China economy problem. Japan is very closely intertwined with Chinese industry and banking, and the CNY is also having some troubles.

Jeff Snider has some good charts in one of his recent videos about this. His main point is that JPY depreciates as the Eurodollar system is eroding. If the global economy is having a brief reflationary episode, JPY rallies vs the USD. IOW, the crashing Yen means very bad dollar shortages and economic tectonic plate movements.

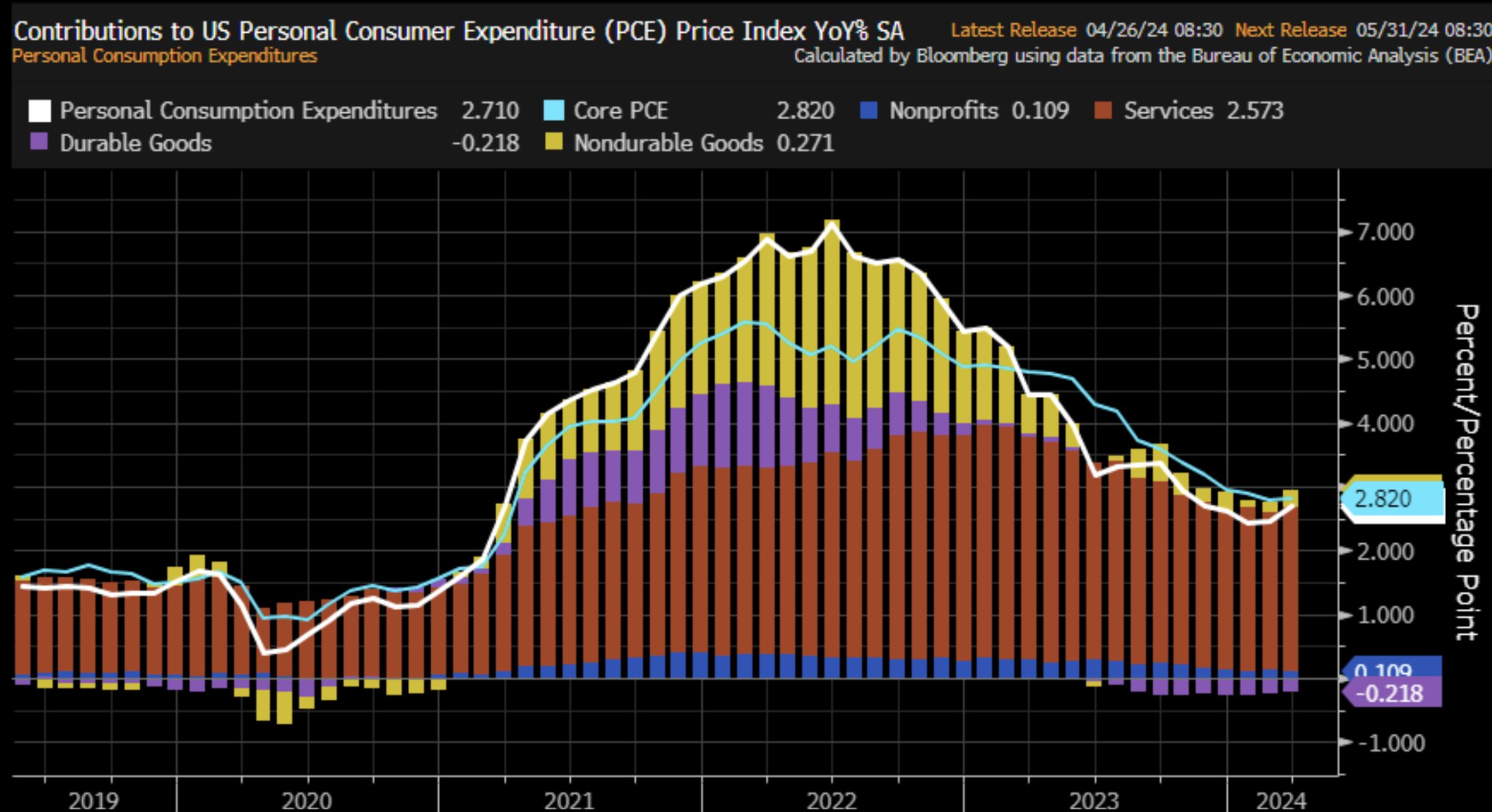

The balance is interesting here. Many people are immediately calling this stagflation, but that's not what's going on here. One quarter is not a trend. I've pointed out in the past that "inflation" tends to mildly spike right before recession, as specific non-productive components make the overall "inflation" metric look stronger, when in reality they are squeezing pocket books.

We are still on trend for a recession. If Q2 and then Q3 are negative real GDP, and jobs losses start, PCE will come down fast.

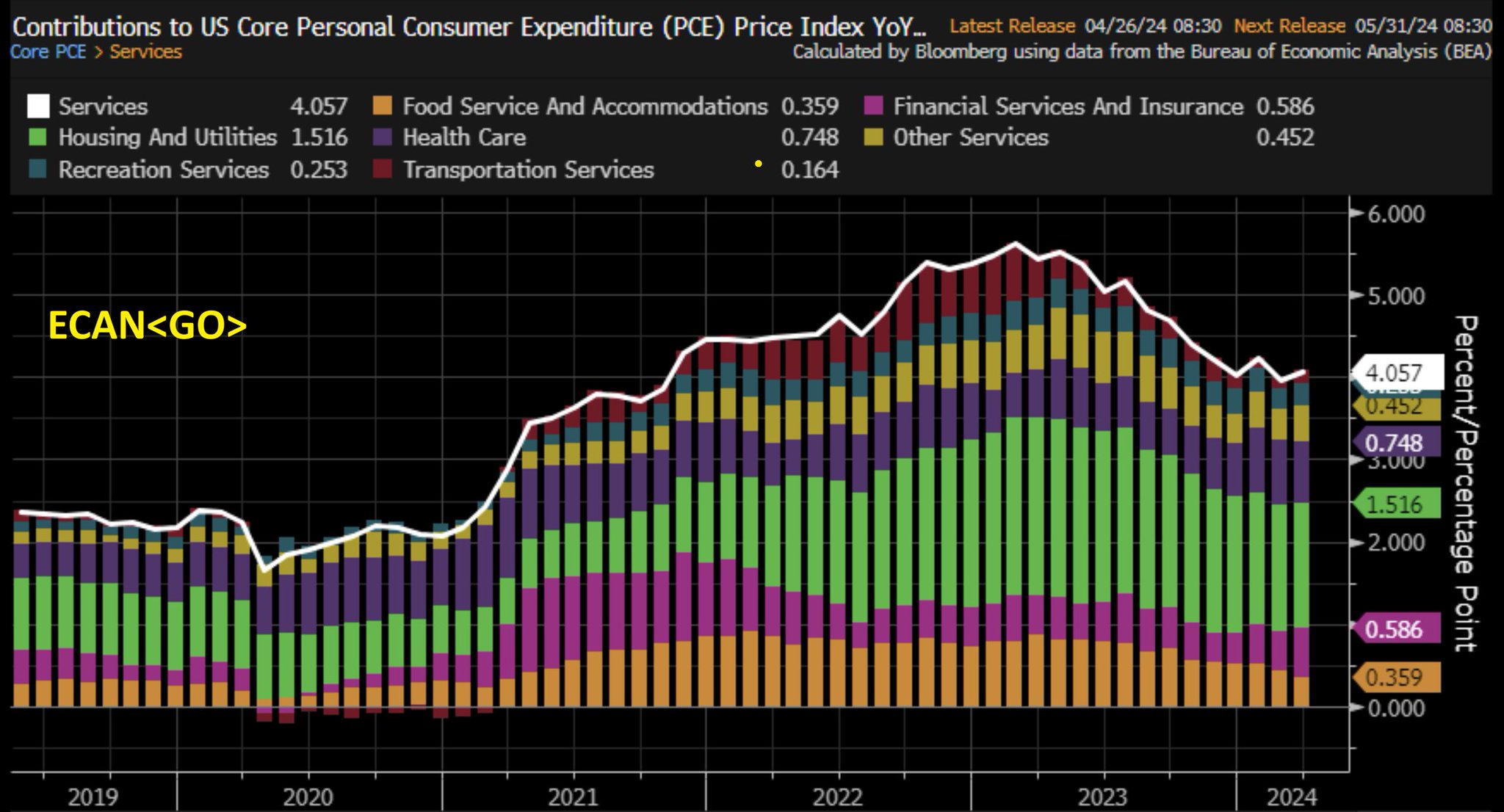

PCE itself is deceptive. It is being held up by services prices. Everything else comes out to roughly zero.

The small uptick in PCE came mainly from insurance. That is a non-productive use. It's not like there was higher demand for goods (you can see durable goods was actually negative above, meaning demand must be weak). A rise in insurance premiums is similar to a rise in oil prices due to geopolitical events, it strains the economy even more, making a recession more likely. And in recession, we have deflation, and prices tend to come down.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

Overall, the price is still relatively weak. We haven't seen a huge relief rally post-halving, but it is only Monday. $70k looks like a level to watch. If we can break above there, we might be off to the races again. Failure to break $70k this week, we likely have another couple weeks of consolidation ahead of us.

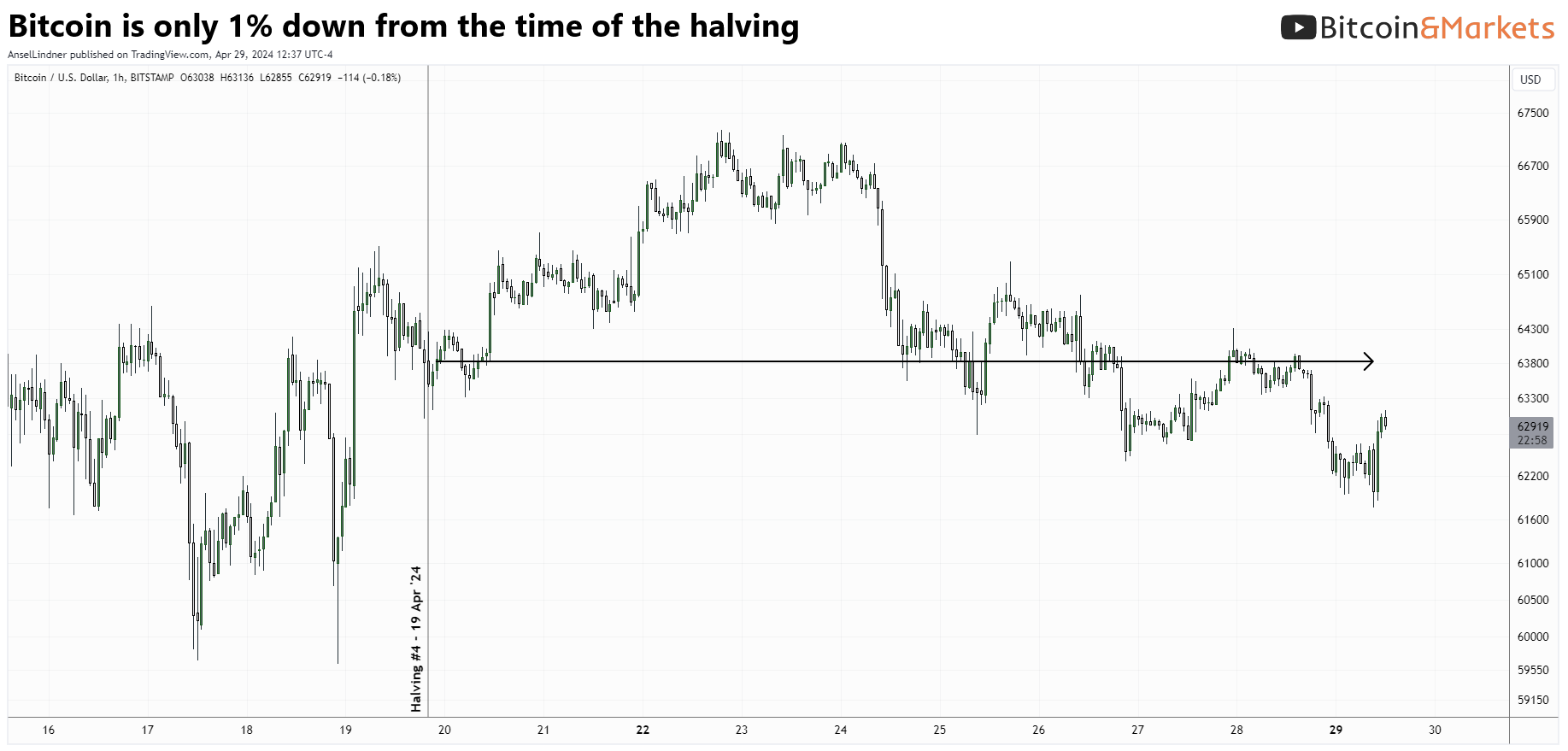

Well, we failed to even threaten $70k, meaning price has been more weak than even expected. It has held its ground relatively well through. Only down 1% since the halving 10 days ago.

One of the things I think about often is the role of uncertainty in price. Bitcoin is such a new thing to the people buying the new ETFs and new buyers in general that all these events have a heightened level of uncertainty attached. First, it was the halving, then it was the fee spike and controversy around tokens on top of bitcoin, now it is the money laundering charges and other wallets leaving the US.

With all that uncertainty, it is not a mystery why price has not been able to break out higher.

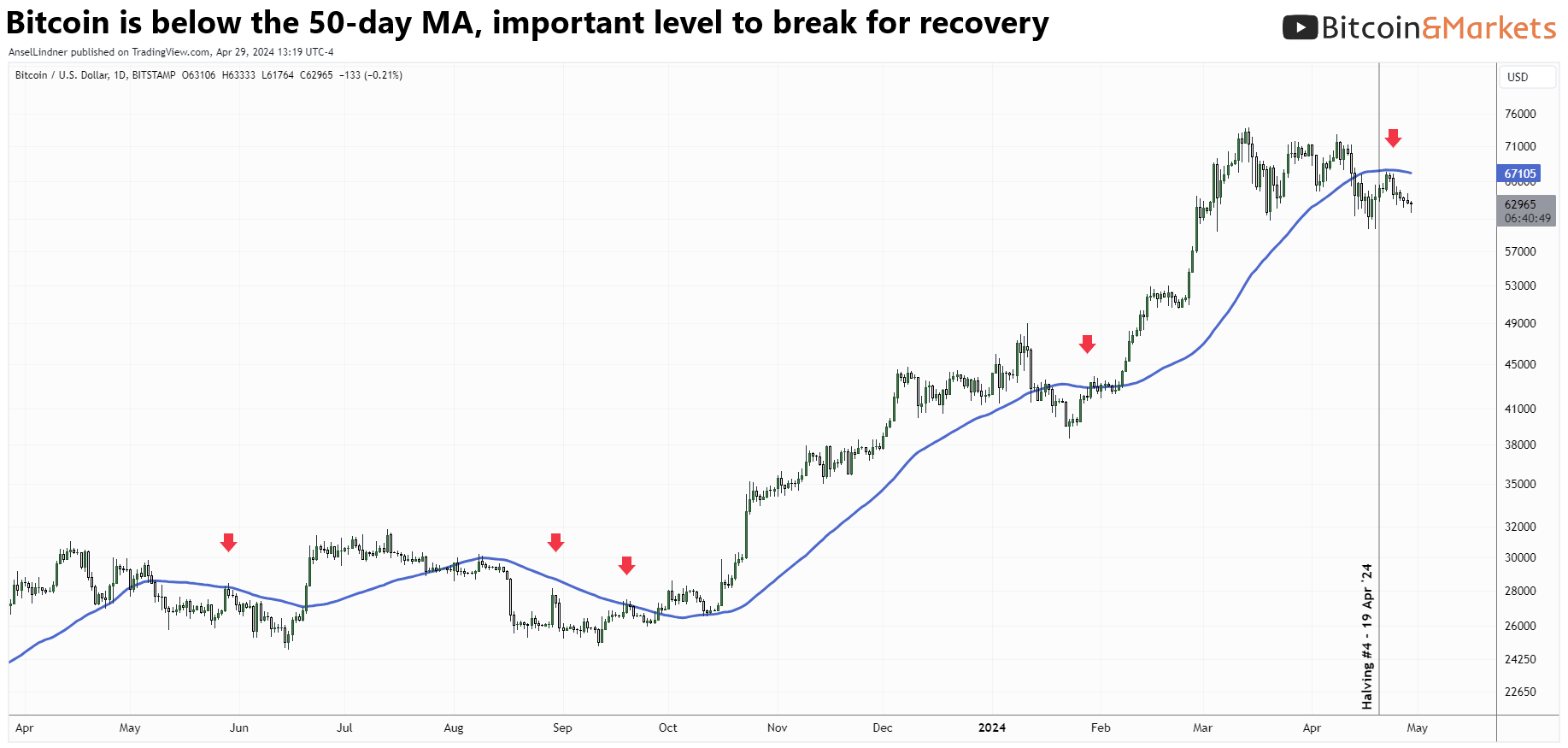

The bitcoin weekly chart looks just fine. There is a concern about the bearish divergence, but we've already had 4 red weeks since.

One metric I'm watching closely is the STH Realized Price. This is the average price that short-term holders (<155 days) bought bitcoin. Once price hits that market the short-term holders are more likely to sell. However, it doesn't necessarily happen every time. You can see two other instances on the chart, June and August last year. June was minimal but August led to a 10% sell-off. That could bring price down to roughly $55k. I think this is still unlikely, but we have to be watching for it.

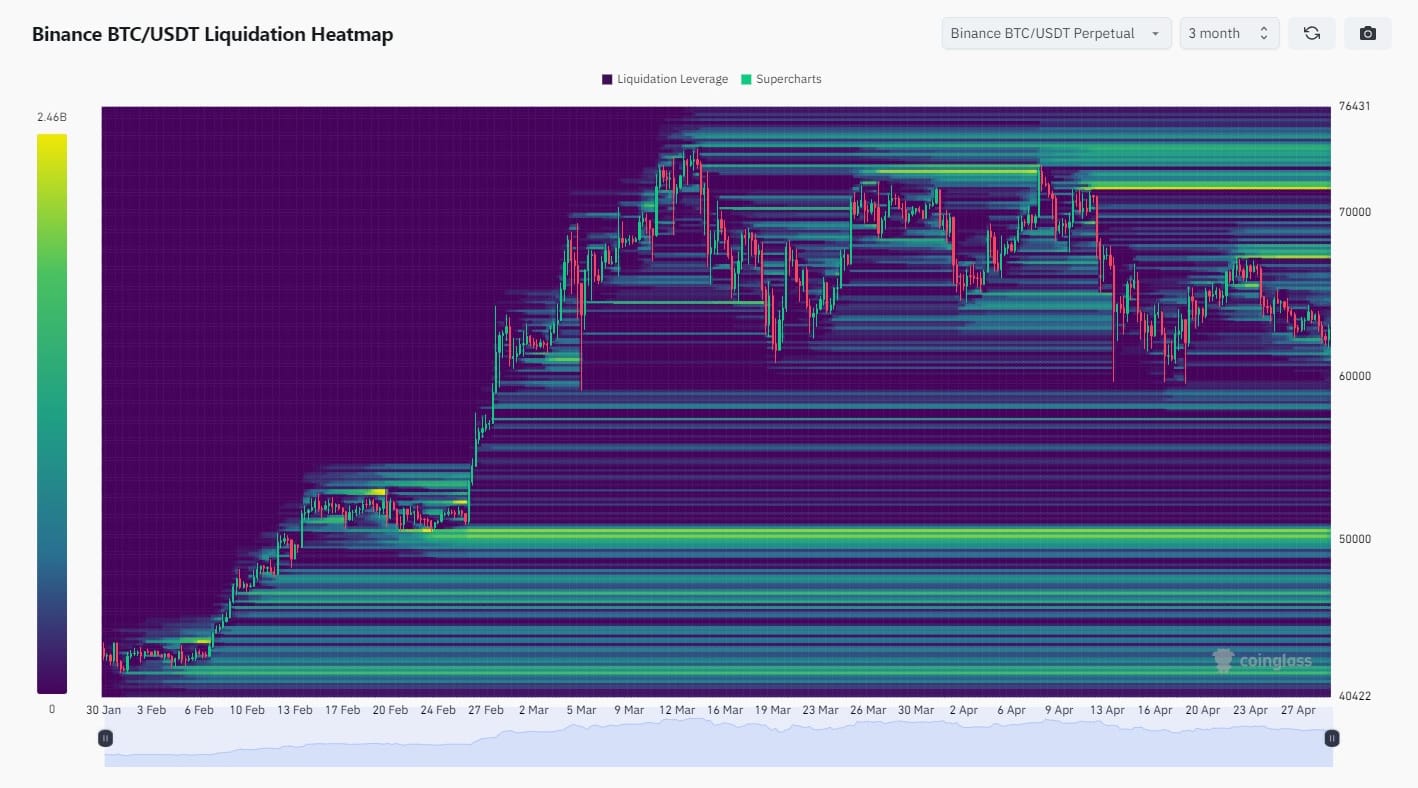

The bitcoin futures liquidation heat map is still favoring a move upward into liquidity. There is an area of liquidation down at $50k, but that is so far, down and not a lot of liquidity to get down there (liquidations in a cascade are not there).

Overall, I think price is likely to continue consolidation until we get some higher highs and higher lows. Risk of a brief sell-off is slightly elevated. The important high to breach for continued momentum higher is the 50-day SMA or $67k.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

A solo Bitcoin miner recently found a block receiving the entire reward of 3.125 BTC, which is a rare event. Despite an average hash rate of about 12 petahashes per second, this miner's success is notable as it marks only the 282nd occurrence of a solo miner solving a block out of over 841,300 blocks.

Here we have another example of the typical FUD surrounding Bitcoin halvings. Although recent reports highlight a reduction in mining revenue and concerns over the future viability of Bitcoin mining following the halving, the reality is that the industry is more resilient than ever. Despite the halving slashing miners' block rewards from 6.25 to 3.125 BTC, and a transient fluctuation in transaction fees, the Bitcoin hash rate not only sustained but reached a new all-time high.

This could be a headwind for bitcoin miners, but their recent dip in stock prices was likely the market pricing in this reduced revenue. What isn't priced in to miner stocks is a doubling of the bitcoin price.

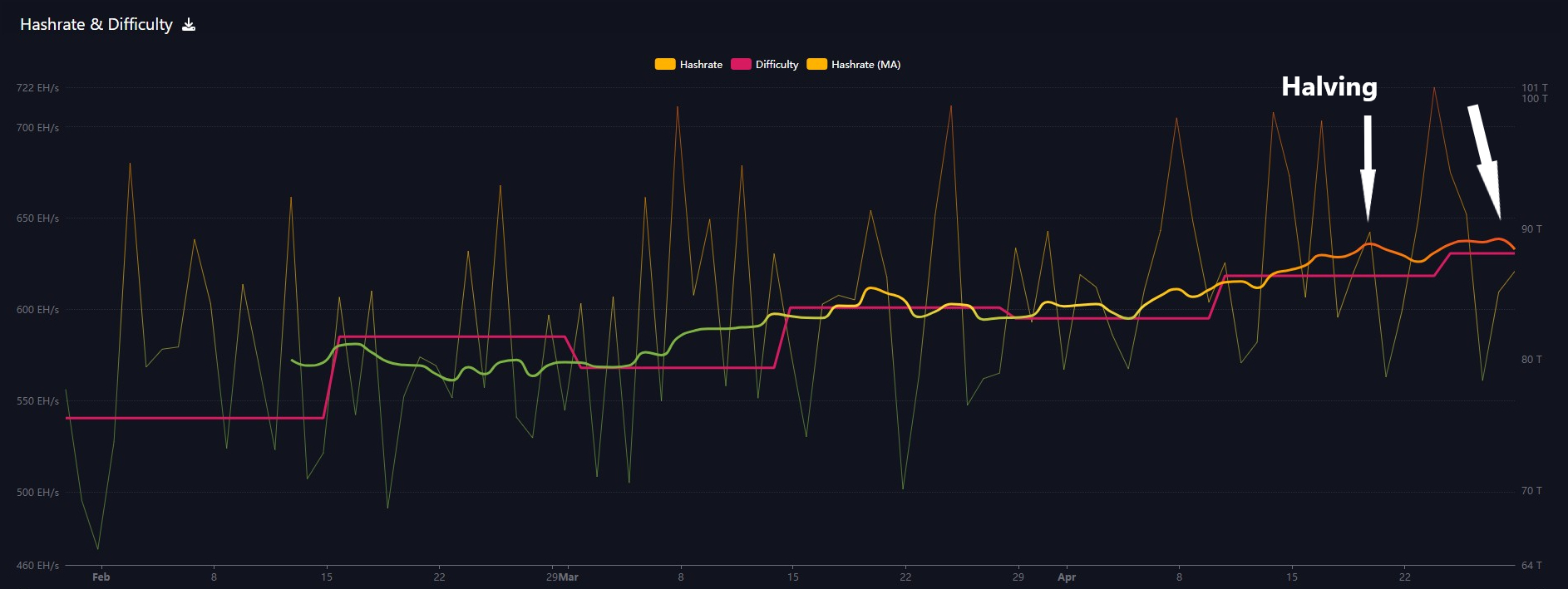

Hash rate and Difficulty

Hash rate hits a new ATH before falling off again. Everything is very steady. You wouldn't know by looking at this chart that the block reward was cut in half. I do not expect price to remain at these levels long, so miners' revenue will quickly recover.

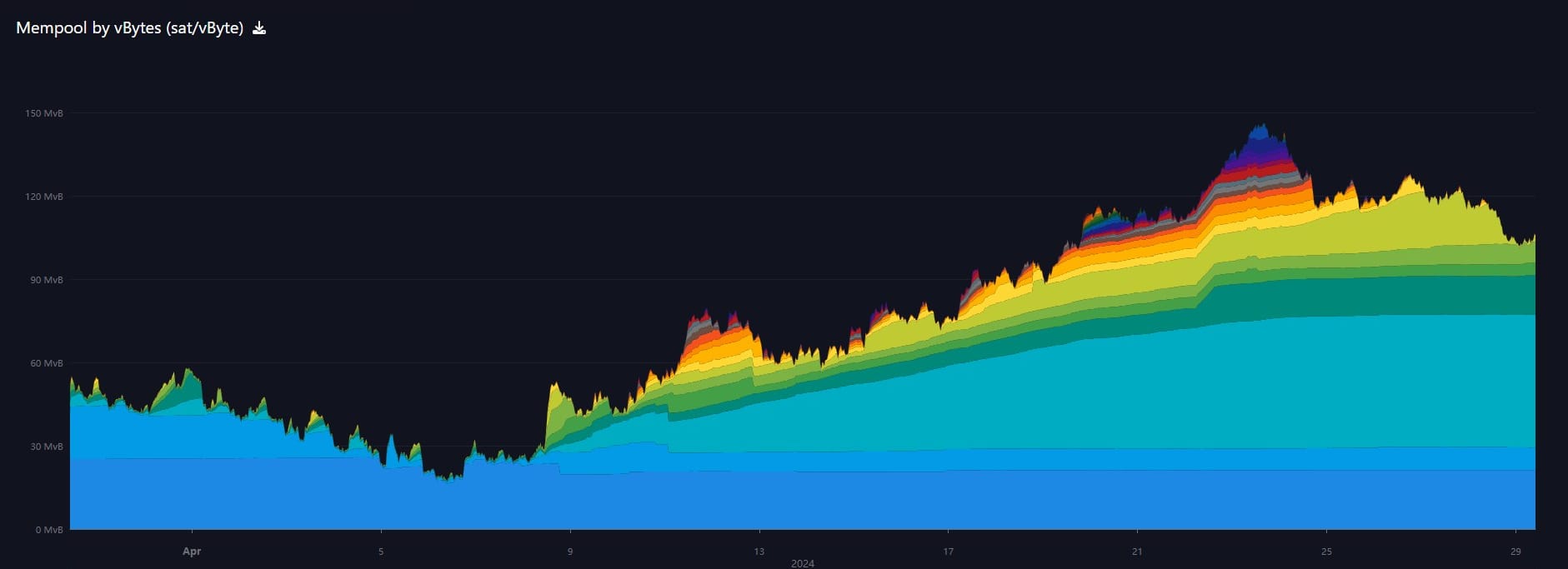

Mempool

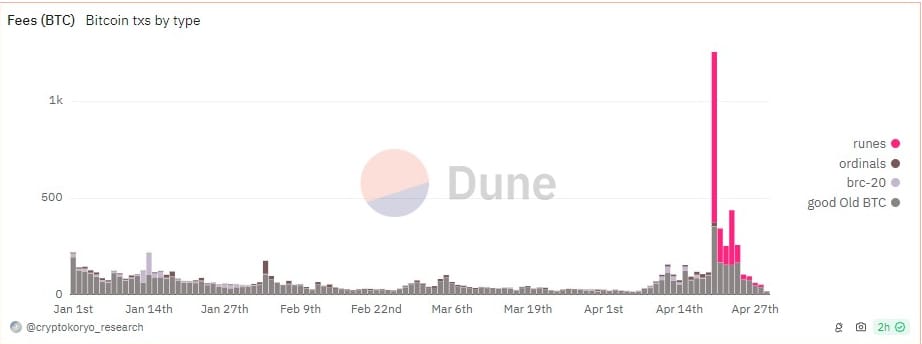

The network has chewed through a significant portion of the mempool this week. Runes turned out to be a flash in the pan and inscription numbers have not increased again. This is not the behavior we would expect going into a price dip. Yet another point against a significant sell-off occurring soon.

Layer 2 including Token Protocols

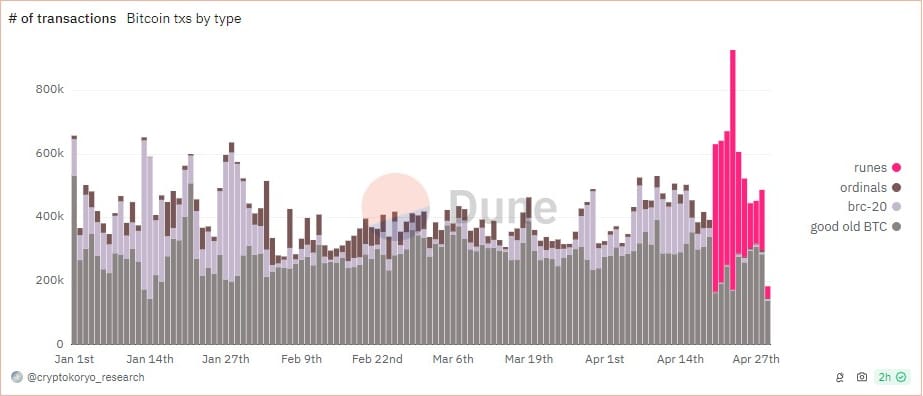

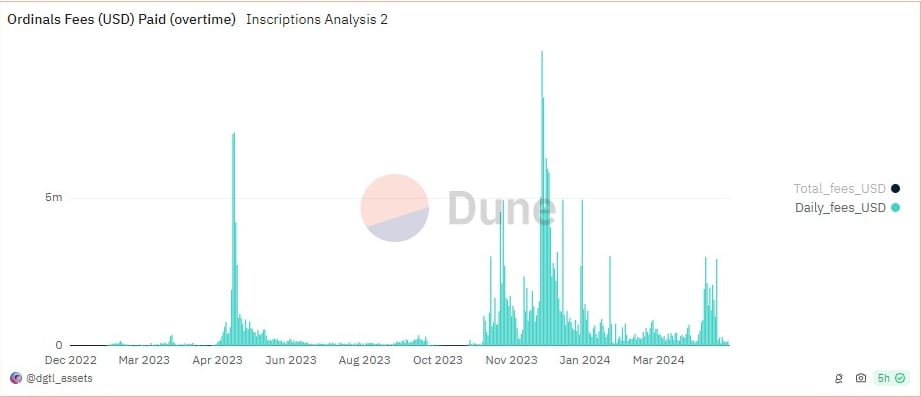

- Runes demand doesn't really exist

Runes transactions have almost entirely replaced BRC-20 and ordinals. However, there is still very little demand for them in general. Remember, fees are the referee and require there be some sustainable market demand in order to support these things. So far, that has not manifested.

One thing that is interesting about these L2 token protocols is that they are were the experimentation is happening. Personally, I do think that these tokens have staying power, but they are pushing development right now. In the end, they might be responsible for the creation of a solid L2 scaling solution, maybe as a place to trade these things or something.

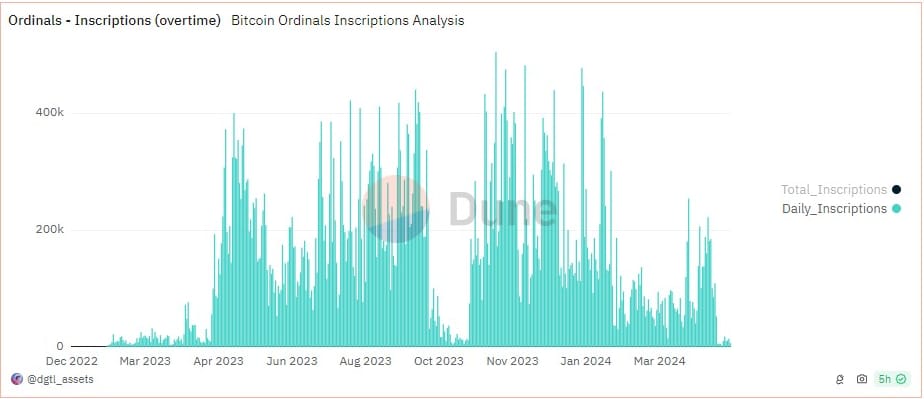

- Inscriptions falling off a cliff

The number of inscriptions has not recovered despite fees come way down, and volume for Runes is crashing. I suspect most of this activity will be ported over the Runes, which just adds more evidence that these tokens are not a long term investment that you can count on not changing.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com