Bitcoin Fundamentals Report #281

Craig Wrong the only person who is not Satoshi, more bitcoin news headlines, macro events, Bitcoin price analysis, and mining industry update.

March 18, 2024 | Block 835,255

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Cool off |

| Media sentiment | Positive |

| Network traffic | Moderate |

| Mining industry | Stable |

| Days until Halving | 30 |

| Price Section | |

| Weekly price* | $67,184 (+$562, +0.8%) |

| Market cap | $1.321 trillion |

| Satoshis/$1 USD | 1491 |

| 1 finney (1/10,000 btc) | $6.70 |

| Mining Sector | |

| Previous difficulty adjustment | +5.7928% |

| Next estimated adjustment | -1.5% in ~9 days |

| Mempool | 201 MB |

| Fees for next block (sats/byte) | $4.22 (45 s/vb) |

| Low Priority fee | $3.94 |

| Lightning Network** | |

| Capacity | 4643.18 btc (+2.0%, +90) |

| Channels | 54,096 (-2.2%, -1197) |

In Case You Missed It...

Bitcoin Magazine Pro

- Exploring BRICS Pay: A New Blockchain-Based Payment System Versus Bitcoin's Global Influence

- Market and Mining Dashboards

Member

Community streams and Podcast

Blog

Headlines

Dear Readers,

Hope you are well. I missed last week's Report because I was on family vacation. In this issue, I'll catch up on the major news and price updates. Thanks for subscribing! Please share on social media and with friends and family for bitcoin and macro content you can count on to be honest and accurate!

Last week, a judge in London's High Court of Justice formally determined that CSW is not Satoshi Nakamoto. This news made very big headlines in the bitcoin space, confirming what most long-time bitcoiners already knew.

The Cryptocurrency Open Patent Alliance (COPA) to take a bold step in 2021 when it sued him in British courts to obtain a ruling over whether Wright has copyright ownership of Bitcoin’s white paper.

Justice James Mallor cited the “overwhelming evidence” as he made an immediate ruling against Wright’s claims. COPA released some of the evidence against Wright independently, including the particularly damning accusation that Wright has used ChatGPT to forge documents “on an industrial scale." Their legal team accused Wright of a “massive campaign of dishonesty and forgery” that “stray[ed] into farce," going so far as to claim that Wright was actively fabricating new documents during the course of the five-week trial. Mallor claimed he would give a more detailed account of his reasons at a later date, but the actual verdict is clear: Craig Wright is not Satoshi, is not the author of the white paper, and did not create Bitcoin or its software.

We all knew Craig was a liar and scammer, but it is nice that he will be unable to threaten the livelihoods of bitcoiners again. This trial as also produced interesting new early emails with Satoshi that had yet to be made public. This was the right decision and hopefully we can put CSW behind us as a particularly scammy footnote in bitcoin's history.

Looks like they just want to wind down GBTC as a product completely. Too much baggage?

Grayscale is seeking approval from the SEC to introduce the Grayscale Bitcoin Mini Trust, seeded by a percentage of GBTC shares.

Grayscale Bitcoin Mini Trust (BTC) will have lower fees, and the spin-off from GBTC to BTC will not trigger a capital gains tax event for GBTC shareholders.

The fees, which are not being disclosed at this time, will be competitive with some of the low-cost bitcoin ETFs in the market, a person close to Grayscale told CoinDesk.

- Elizabeth Warren gets trolled

No comment other than 🤣🤣

“A scenario: Bitcoin price rise leads to increased mining and greater energy use, driving up the cost of energy, causing inflation to rise and the dollar to decline, driving demand for Bitcoin and increased mining, driving demand for energy and the cycle continues. Bitcoin goes to infinity, energy prices skyrocket, and the economy collapses. Maybe I should buy some Bitcoin.”

There have been many good refutations of this comment so far, and Ackman has been relatively gracious in accepting feedback. A testament to his intellectual honesty.

I'd like to take Bitcoin & Markets angle to his comments, particularly the idea that rising energy costs cause inflation, a key link in his chain. I think Ackman is right about a rising price of bitcoin leading to rising demand for energy from bitcoin miners. Whether that comes from a bottom-feeder strategy or as incentive for renewables, I get the feeling that we are coloring around the edges instead of going for the heart of the debate.

Rising energy prices, unless matched with increased money supply, is a deflationary force. As prices go up (because of demand for the good, not number of currency units) that money to pay the higher prices must come from somewhere. First, the tend to come from savings to maintain levels of consumption elsewhere, but eventually, it affects demand broadly in the economy and leads to a deflationary recession.

Ackman says, "and the cycle continues," but he only gets there by misunderstanding inflation as prices and not money supply. His whole feedback loop is wrong.

- Strong Meme Game

Macro

I was unable to live stream this month's CPI release, but I'll be back for next month. Also, the FOMC is coming up this week, and I'll be here for that!

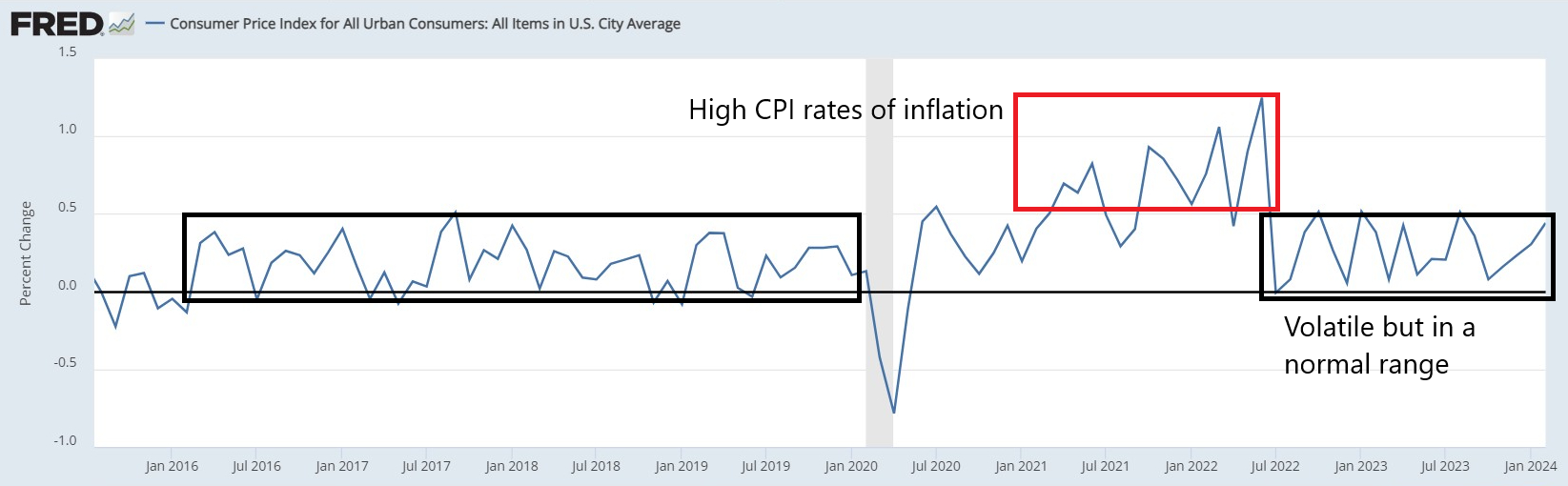

Headline (all items) CPI came in hot at 0.4% MoM. I'm expecting lower CPI and at first glance this seems to contradict my forecast. However, there is no timeframe other than we are headed lower in this business cycle before higher. 60% of this 0.4% came from shelter and gasoline alone.

I'll remind you that we need spikes of CPI to stress the economy, to make it go lower. There's no straight lines. If CPI stayed steady at 3% for a year, the total stress would still accumulate, but with small spikes in CPI, that stress accumulates faster, resulting a recession sooner.

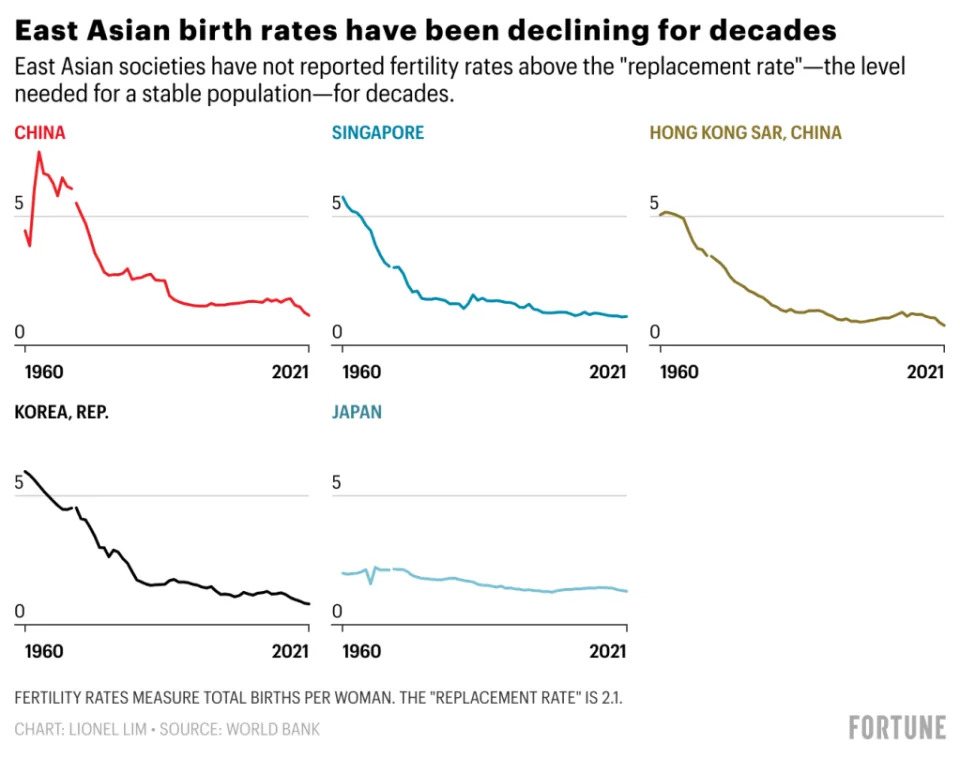

Demographics are getting more and more attention. People have to learn the basics of what's happening first, before we can face the issue. Many people still think our problem is overpopulation.

A low birth rate leads to a shrinking population, and a smaller workforce to produce the goods and services that lead to economic growth. Slower economic activity results in drops in fiscal revenue, giving fewer resources to a government that now needs to provide welfare for a growing elderly population.

This is true, but the focus on production leads to false solutions of robots. The bigger problem is a decline in demand or consumption. Older people consume less, and there will be fewer young people to do the consuming. Bad economic times also lead to less spending and tightening of the belt. So, it's ultimately a demand led decline, not a production led decline.

“The strange thing with fertility is nobody really knows what’s going on,” Anna Rotkirch, a research director at Family Federation of Finland’s Population Research Institute, told the Financial Times earlier this year. The demographer, who advised former prime minister Sanna Marin on population policy, now thinks fertility decline is “not primarily driven by economics or family policies. It’s something cultural, psychological, biological, cognitive.” - emphasis added

This is great to see an accepted expert say. It is primarily a shift in women's cultural position relative to the other three, psychological, biological and cognitive reality. The cultural shift women have undertaken in the last 50 years is not conducive to population stability. The demographic pain will continue until that changes.

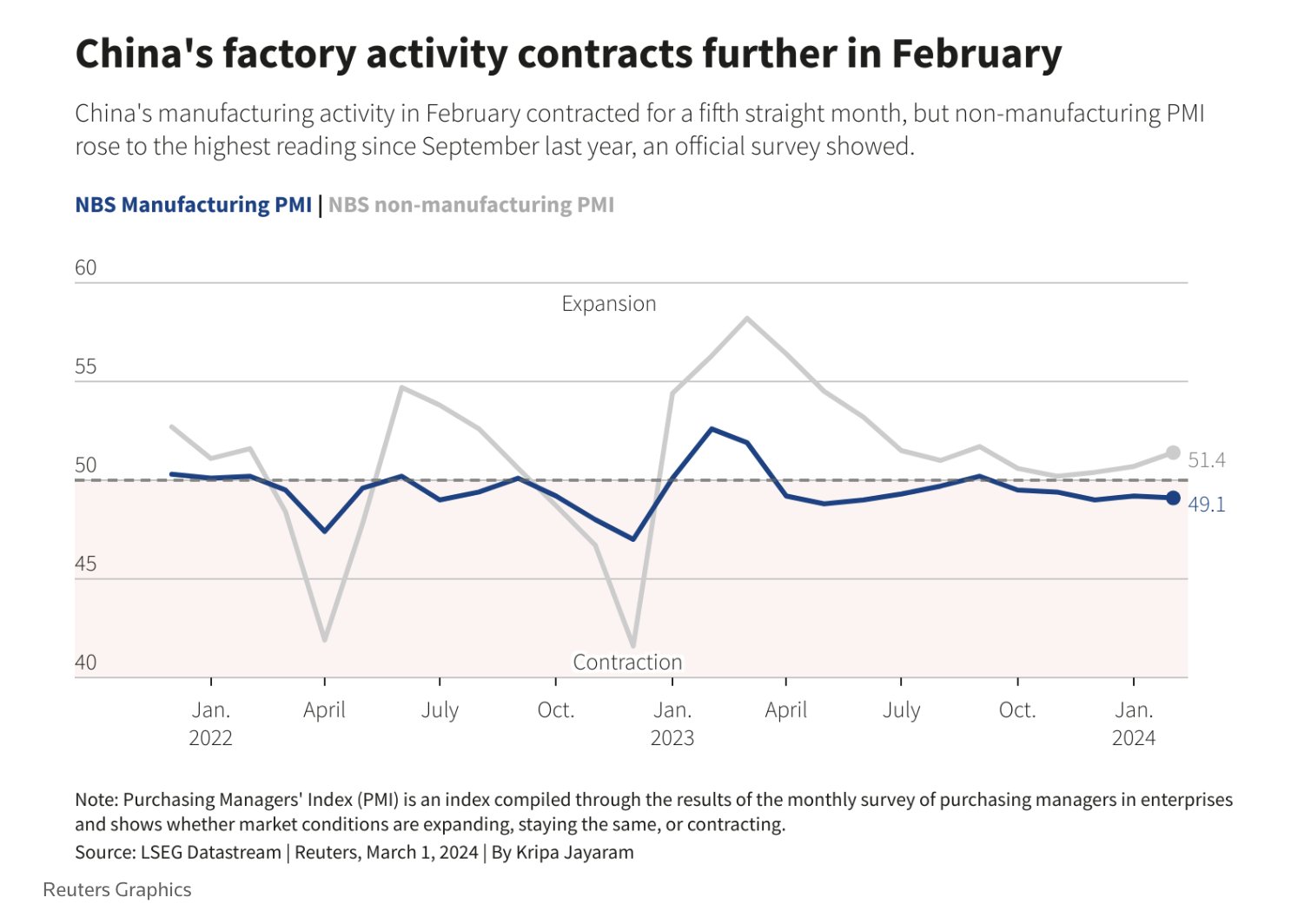

The CCP is trying to blow smoke up our rears. They are claiming their industrial output rose 7% YoY in February. But we have to take all their stats with a grain of salt, especially metrics that can be managed easily. GDP in China is measured differently than GDP in the US. The US measures output, where China measures dictates. For example, the CCP will set a target of 5% growth, and the local governments will go and make it happen. It doesn't matter if it is productive uses of capital, they'll build ghost cities or bridges to nowhere, or straight up cook the books, to hit targets.

Recently, the manufacturing PMI, of the manufacturing giant, has remained in contraction territory for most of the last year.

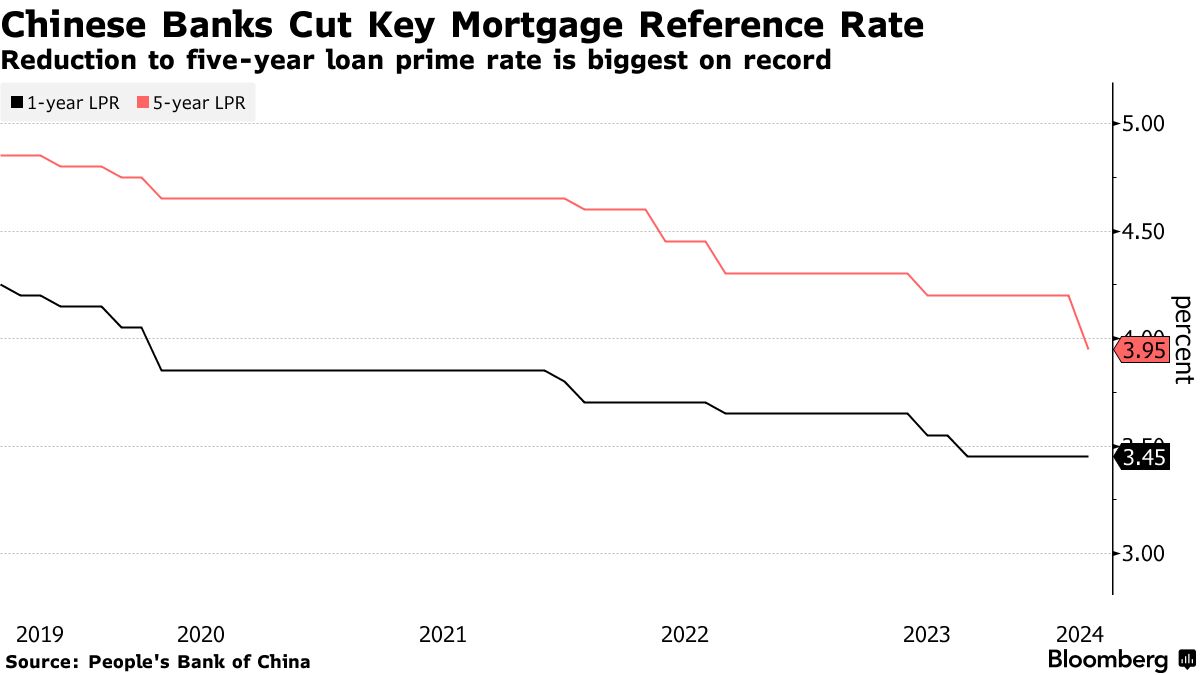

They also continue to cut policy rates.

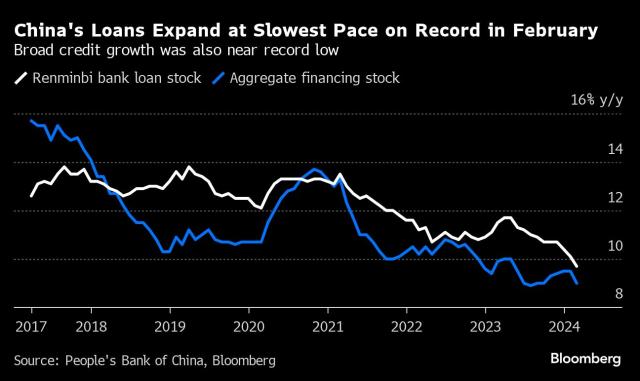

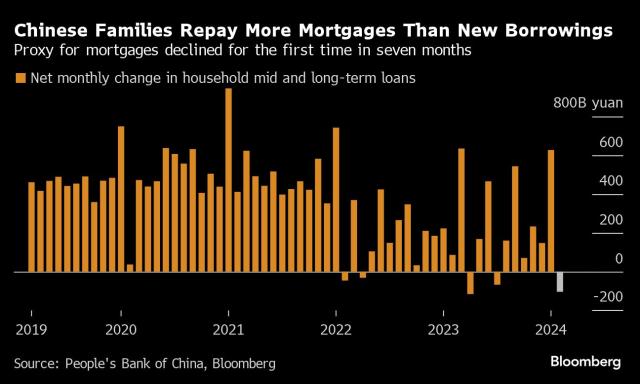

While overall credit, the core of a modern economy, continue contract. Remember, it is NET credit creation that is important, and it looks like China is in deflation.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last issue:

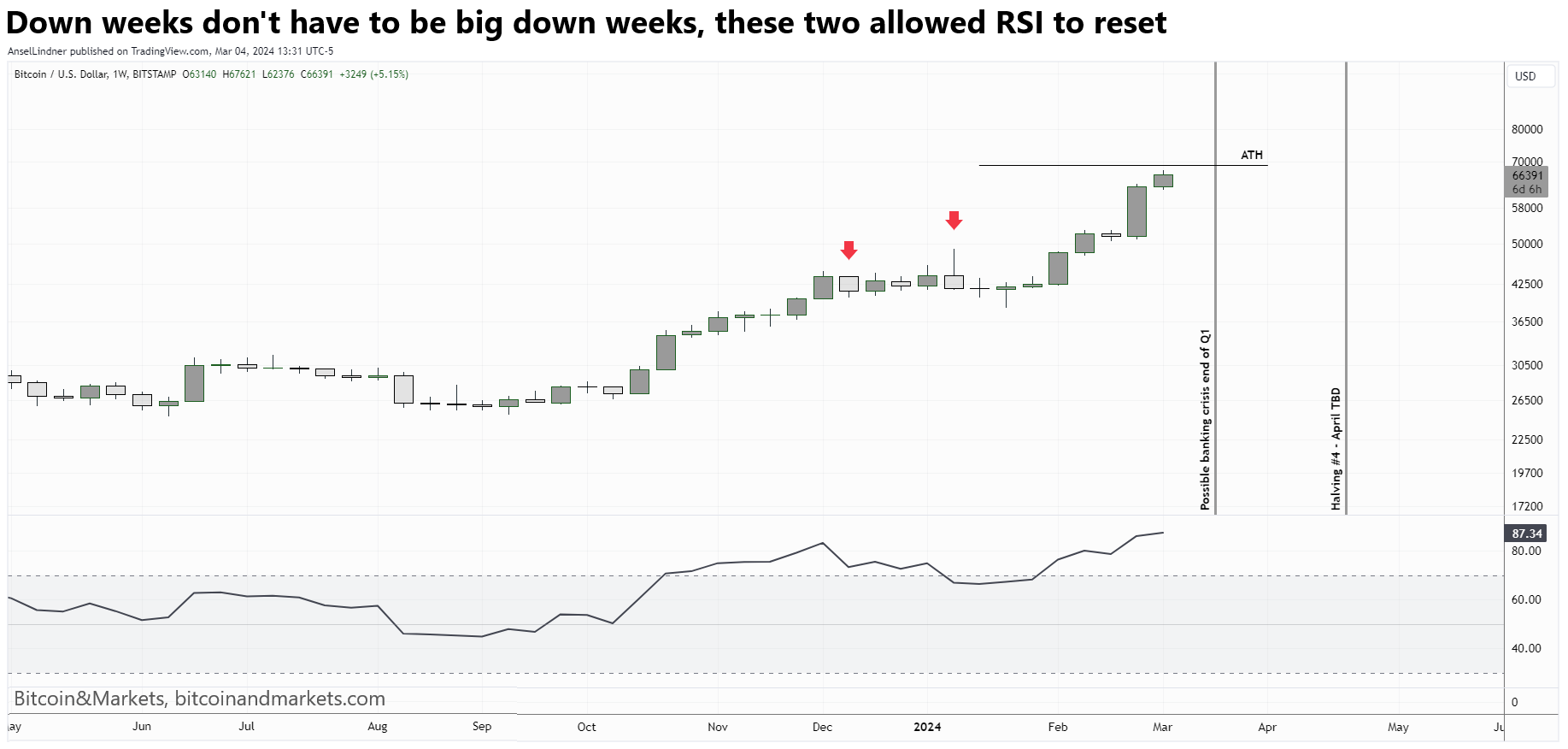

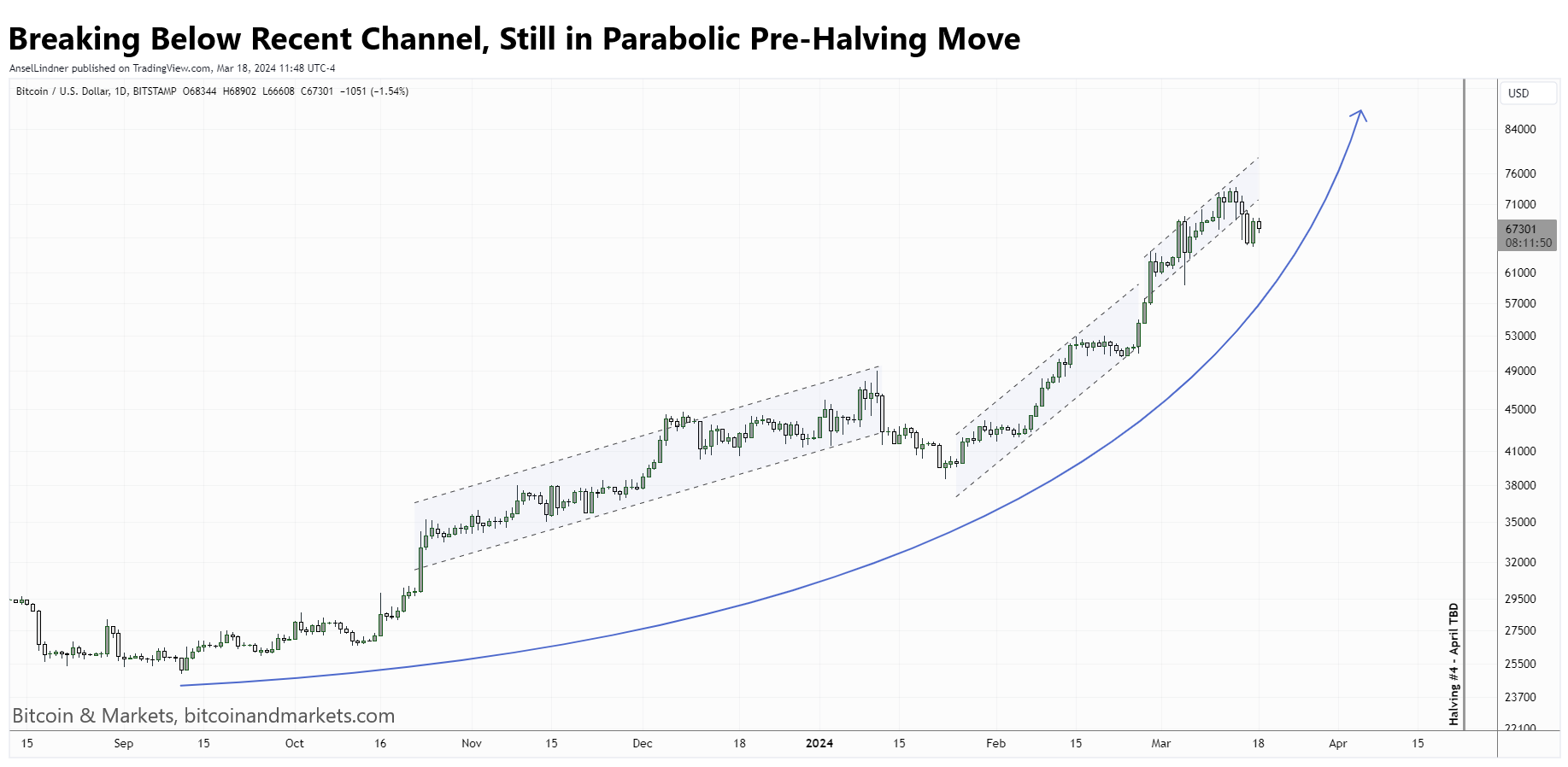

On the chart below, I highlighted two weeks that were not big sell-offs, but allowed the RSI to cool down in a sideways manner. I don't think we have that time, this time though. Therefore, I have to do it. I have to call for a sell-off. We could touch the ATH or even pass it by a little bit, but I think it is most likely that Daily and Weekly RSI will cool off very soon.

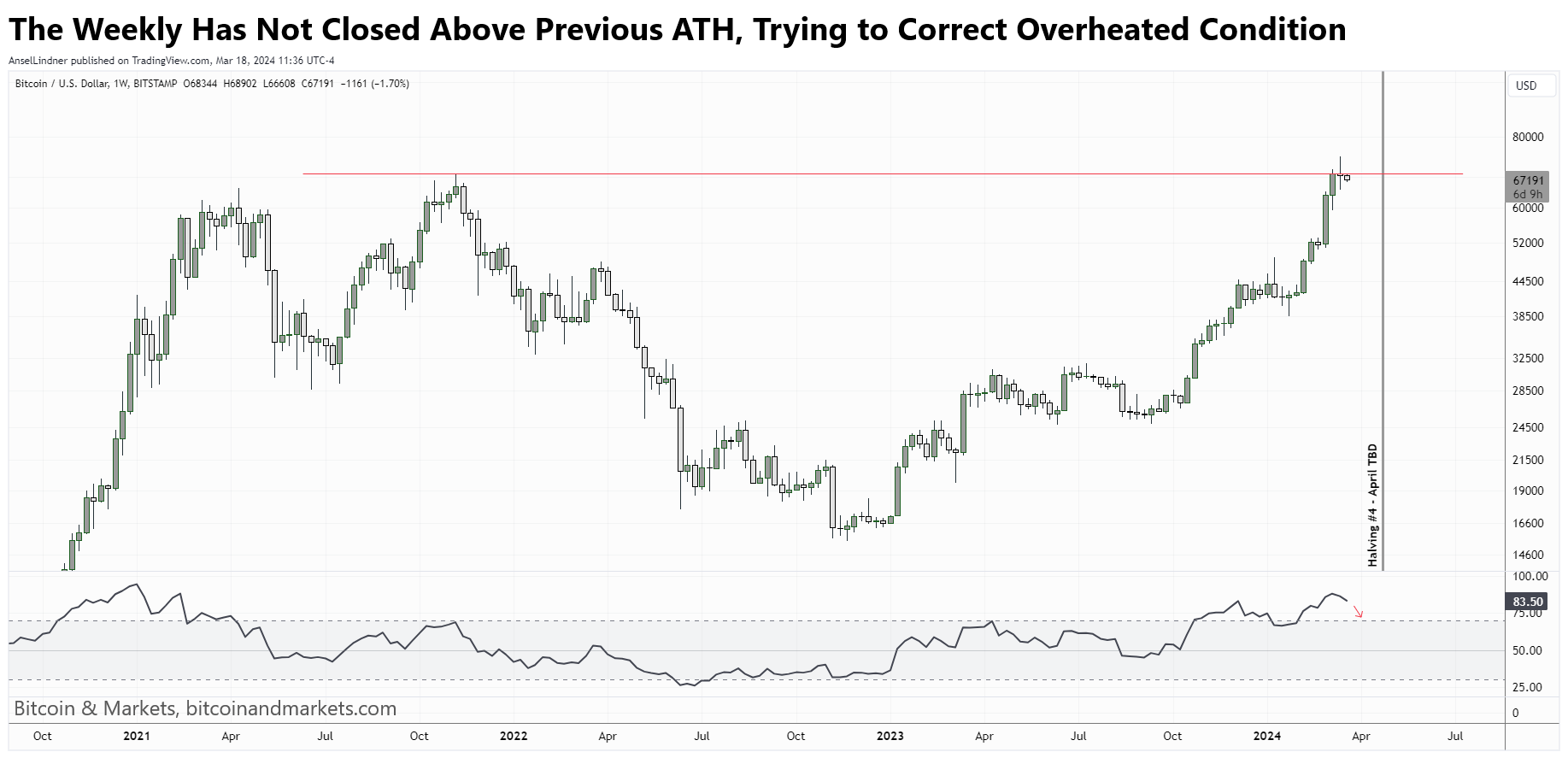

This week, price is still struggling to close above the previous ATH of $69k. As you can see on the weekly RSI, it has cooled from 88 to 83. It would be nice for it to cool all the way to 70, but that would take considerable downward price movement, to at least $60k, when the environment doesn't allow for that. It might be the case that price goes sideways until the halving, despite constant inflows.

This overall move is starting to look parabolic. It's not quite to the vertical stage through. Could we make one more push pre-halving? Yes, any furtherance of this parabola would be vertical. That would put $100k in play pre-halving. I don't think that is the likely thing to happen though. Several macro indicators like the US10Y are signaling that some outside pressure driving bitcoin's price up is lessening temporarily here. Most likely we continue a consolidation for at least the next week, and it could stretch into the halving.

Greatest Charts of the Week, LFG!

Another banger from @ChartsBTC! It's getting to the point that however you slice it, this time is different for Bitcoin. The below chart shows Realized price has barely turned upward. Bull markets tend to see significant rises in realized price. The bottom line is Realized price relative to its 200 DMA. We might call this the Realized Mayer Multiple. We should not be discussing an ultimate cycle top until roughly 1.8-2 on the Realized MM. Everything else is a correction on the way to new ATHs.

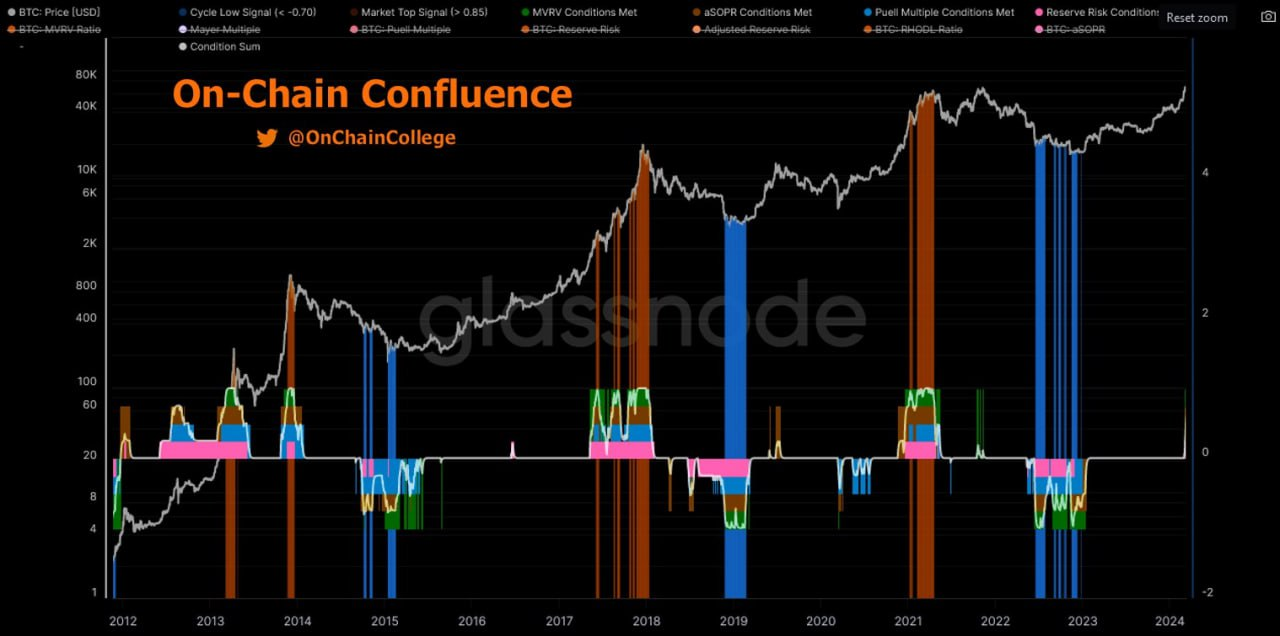

The next chart bent my brain a little to be honest. It is showing several on-chain metrics: MVRV (market value to realized value), Puell Multiple (value of daily issuance divided by 1-year average value of daily issuance), Reserve Risk (LTH confidence per price), and aSOPR (ratio of spent outputs in profit). There are many more on-chain metrics, but these 4 do a fantastic job of aligning bullish or bearish at tops and bottoms. We are just starting to see some alignment now.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

“Post halving, there will be some miners to lose profitability, maybe challenged, or maybe looking for an exit as their revenues will drop because of the Bitcoin rewarded will drop,” Thiel said. “The simple math is, if the industry average break-even point was around $23,000 per Bitcoin, it will now go up to around $43,000.”

They've reintroduced the 30% mining tax.

The Bitcoin mining industry is in an uproar after the White House reintroduced on Tuesday a controversial proposal for a tax on mining.

The Digital Asset Mining Energy tax, called DAME tax for short, would subject ̶d̶i̶g̶i̶t̶a̶l̶ ̶a̶s̶s̶e̶t̶ bitcoin miners to a 30% excise tax on their electricity costs.

“Implementing a blanket 30% federal tax on ̶d̶i̶g̶i̶t̶a̶l̶ bitcoin mining will certainly kill the sector and wipe out billions of dollars of investor value virtually immediately in the United States,” Taras Kulyk, CEO of SunnySide Digital, a mining hardware provider, told DL News.

“A proposed 30% punitive tax on d̶i̶g̶i̶t̶a̶l̶ ̶a̶s̶s̶e̶t̶ bitcoin mining would destroy any foothold the industry has in America,” Senator Cynthia Lummis, a Republican from Wyoming and one of the most pro-̶c̶r̶y̶p̶t̶o̶ bitcoin legislators in Congress, posted on X.

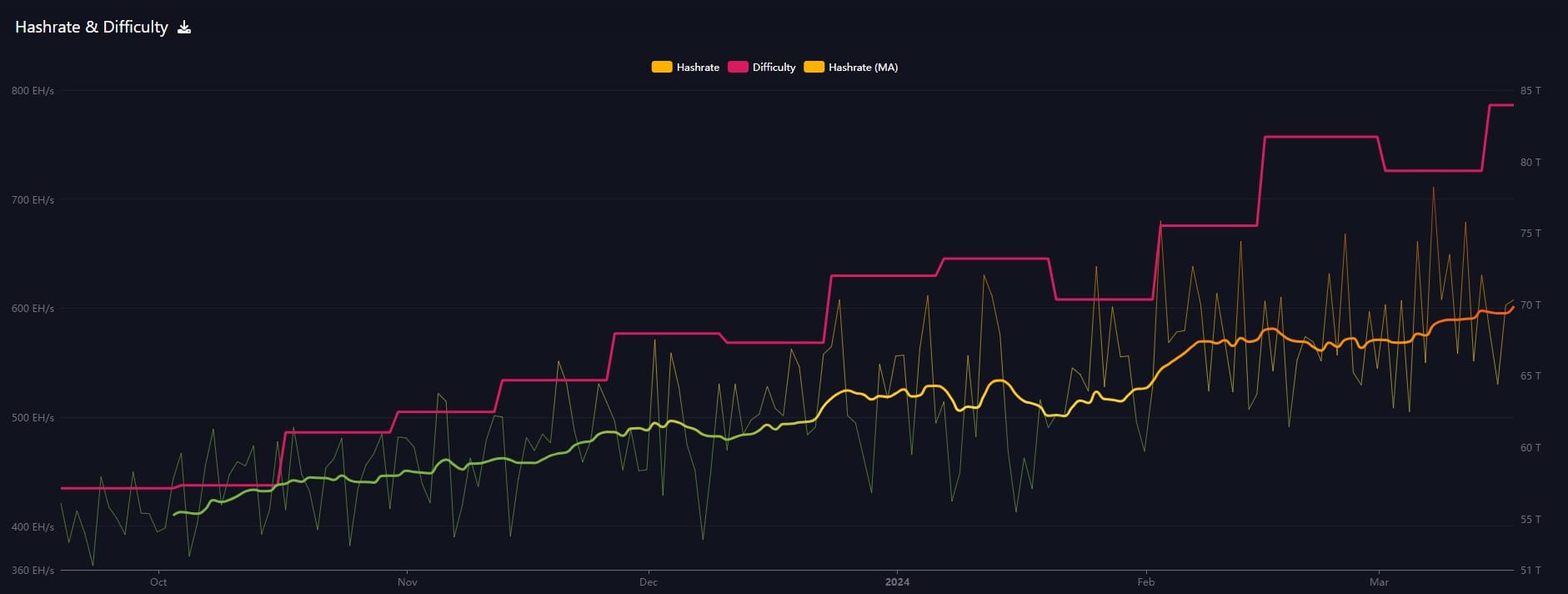

Hash rate and Difficulty

Difficulty adjusted up by 5.8% last Thursday. Average hash rate is slowly climbing as you can see with the solid orange line below. The last period began with slow blocks and an estimated adjustment after several days of -1% (see last report). The hash rate picked up significantly in the second half of the difficulty period resulting a nice 5% gain.

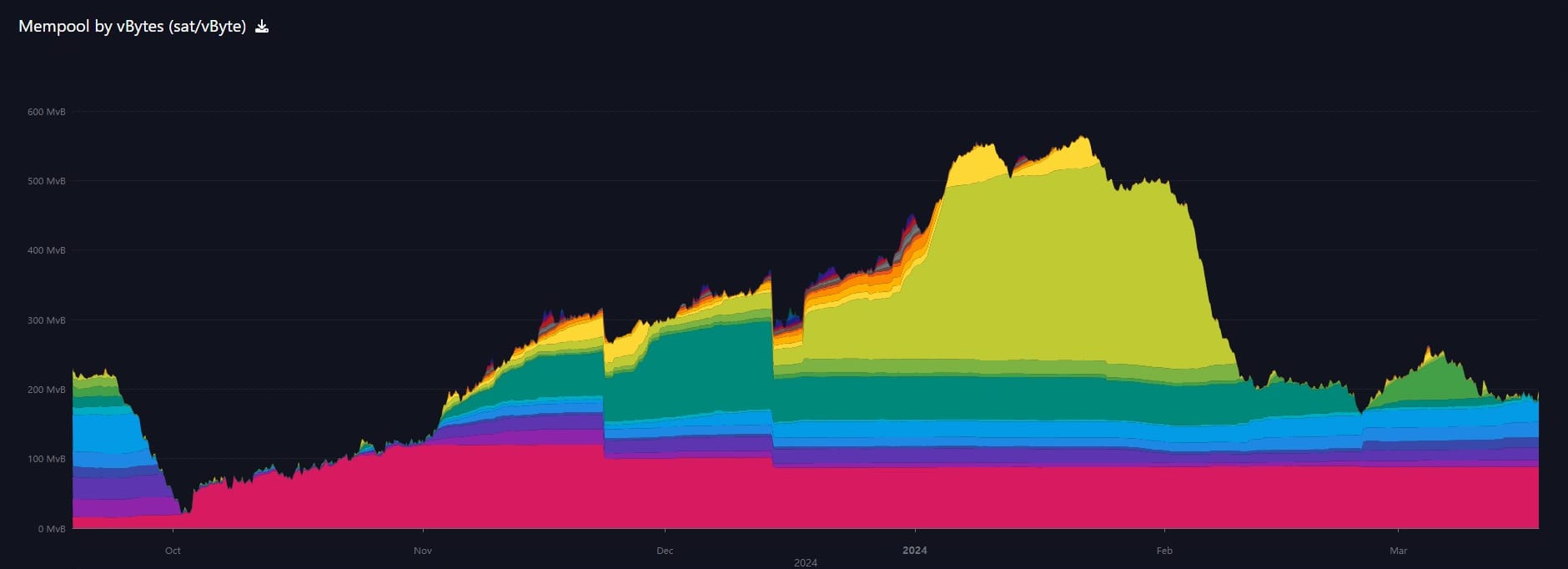

Mempool

The mempool has once again started to shrink. The slight increase we saw with the 4 March price spike has relaxed. This is pretty bullish if you ask me. The hype was noticeable but the signal of attracting sellers has disappeared from the mempool.

Inscriptions

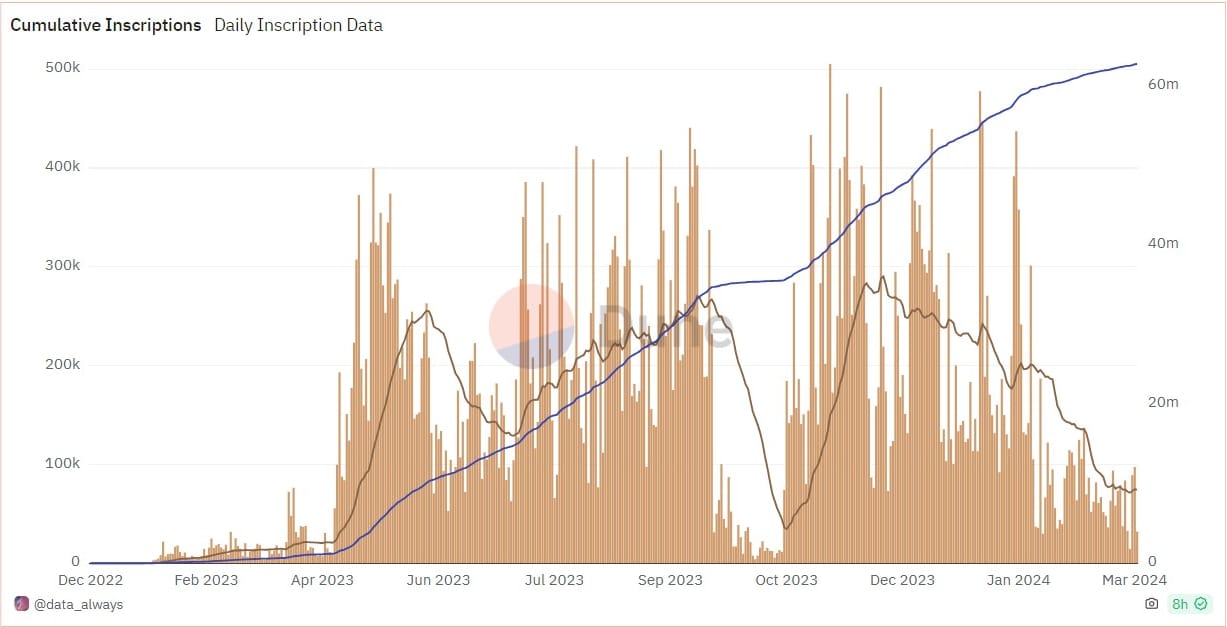

The number of daily inscriptions has really fallen. The decline in the monthly moving average has slowed, or plateaued at a relatively low level. There will likely be another period of higher volume for inscriptions, but as of now, there is no real market for these things. They are a waste of money.

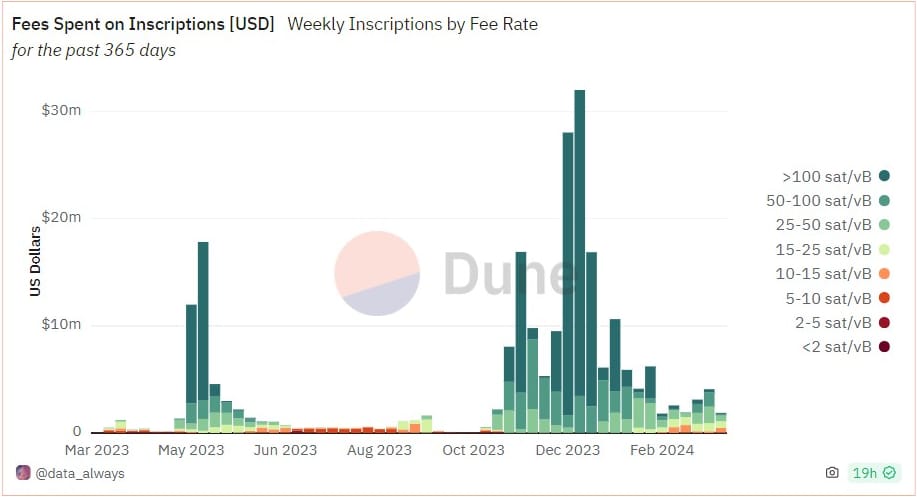

Fees paid by inscriptions over the last two weeks shows a slight increase followed by a dip to near lows. This signifies a total lack of speculative fervor in the bitcoin market right now, despite the recent price mania. We are nowhere near peak mania phase yet.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com