Bitcoin Fundamentals Report #280

Vanguard CEO resignation appearances, Bitcoin ATHs in many currencies, March banking crisis update, price might temporarily top here, and mining sector update.

March 4, 2024 | Block 833,136

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidation at top |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Stable |

| Days until Halving | 44 |

| Price Section | |

| Weekly price* | $66,622 (+$11,954, +21.9%) |

| Market cap | $1.308 trillion |

| Satoshis/$1 USD | 1500 |

| 1 finney (1/10,000 btc) | $6.66 |

| Mining Sector | |

| Previous difficulty adjustment | -2.9049% |

| Next estimated adjustment | -1% in ~10 days |

| Mempool | 251 MB |

| Fees for next block (sats/byte) | $4.53 (49 s/vb) |

| Low Priority fee | $4.07 |

| Lightning Network** | |

| Capacity | 4553.03 btc (-0.8%, -36) |

| Channels | 55,293 (-0.4%, -200) |

In Case You Missed It...

Bitcoin Magazine Pro

- The Bitcoin Market Surge: Unraveling the Mystery of 'Mr. 100' and Sovereign Buyers

- Market and Mining Dashboards

Member

Community streams and Podcast

Blog

Headlines

Just weeks after Vanguard doubled down on keeping their clients from accessing the bitcoin ETFs or launching their own product, Tim Buckley is stepping down as CEO after 30 years with the company.

Now, I don't think this is directly attributable to their bitcoin stance, they've come out and said they are not going to change that stance. I think perhaps they simply wanted a change. They've been successful under Buckley, but emphasis on their international business has failed, according to linked story.

It doesn't have to be actually about bitcoin, however the appearance is there. Blackrock has made it okay and smart to invest in bitcoin, and the unintended inference from Vanguard is now, your career might depend on it.

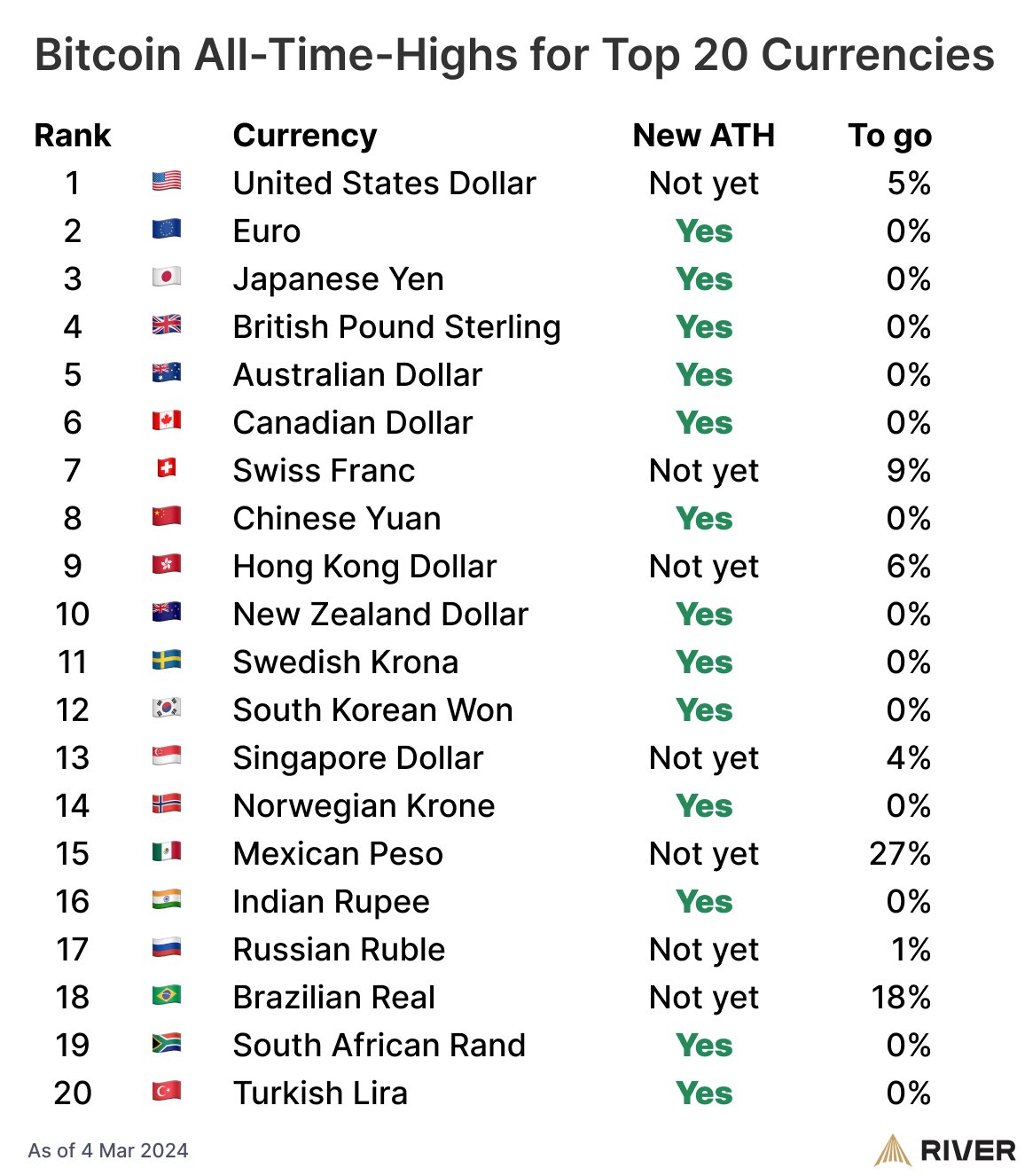

- ATH in Euros

Last week I reported on the new FUD from the ECB, ETF approval for bitcoin – the naked emperor’s new clothes.

The US dollar ATH is very important, but ATHs in other currencies is also important from a demand perspective and the propensity to hold globally.

China reiterates their ban. But Bitcoin is not banned in China. They can buy it P2P, it is their banking system that is banned from dealing with exchanges.

"The report cited Beijing-based lawyer Xiao Sa, stating that the sweeping ban on crypto extended to overseas Bitcoin ETFs and that investors in the mainland area were not allowed to purchase such products directly."

"[February's steep rise] sparked surging interest from investors in mainland China, who have remained active despite the government’s rigid stance against crypto."

"Bitcoin featured as a trending search last week on multiple Chinese online platforms, including microblogging site Weibo and multipurpose app WeChat, where the term’s popularity has surged more than fourfold."

Can't see video? Original tweet

For years bitcoiners said Ethereum's issuance was based on centralized arbitrary decisions. They now admit it.

I've said they shouldn't have targeted Minimum Viable Issuance, but Maximum Viable Issuance. Their Ponzi ecosystem depended on the inflationary stimulus. If they now take it negative, they are going to suck all the value out of the Ponzi faster.

If they want to pump ETH they should INCREASE the issuance.

Imagine NFT-flipping, scam-creating, 30-something central bankers making decisions for your money.

Macro

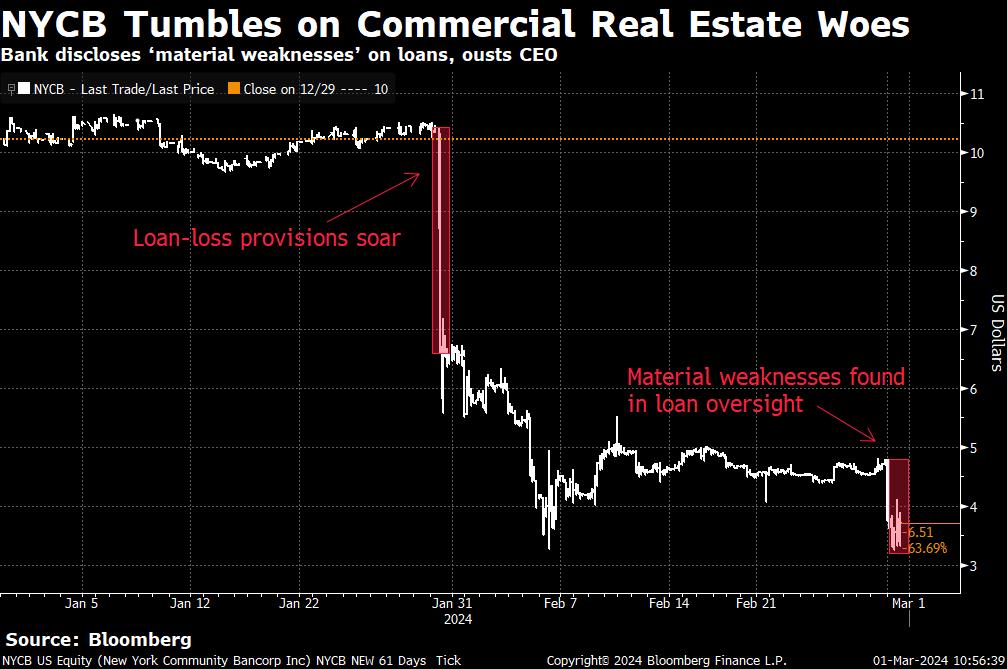

- March Banking Crisis Looming

The Bank Term Lending Program (BTFP) ends on March 11. There is still $163 billion out to struggling banks. Seasonally, end of Q1 is a crunch point in the year. COVID, March 2023, today.

The administration - not the Federal Reserve notice - is coming out warning that the banking system is not sound and resilient.

🔴 THE WHITE HOUSE: THE BANKING SYSTEM REMAINS SOUND, AND IS RESILIENT.

— FinancialJuice (@financialjuice) March 1, 2024

New York Community Bank (NYCB), who bought troubled Signature Bank last year, and is probably neck deep in BTFP, is crashing. This is the first, not the last for March.

I've had this line on my chart for at least 6 months. The possible March 2024 banking crisis. Last year, bitcoin rallied 40% as the BTFP was created. This is very bullish for bitcoin. Get your money out of a community bank and into bitcoin or a large bank that will be bailed out 100%.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

everything has room to rally significantly from here. I see little downside risk other than a crisis event or external market shock.

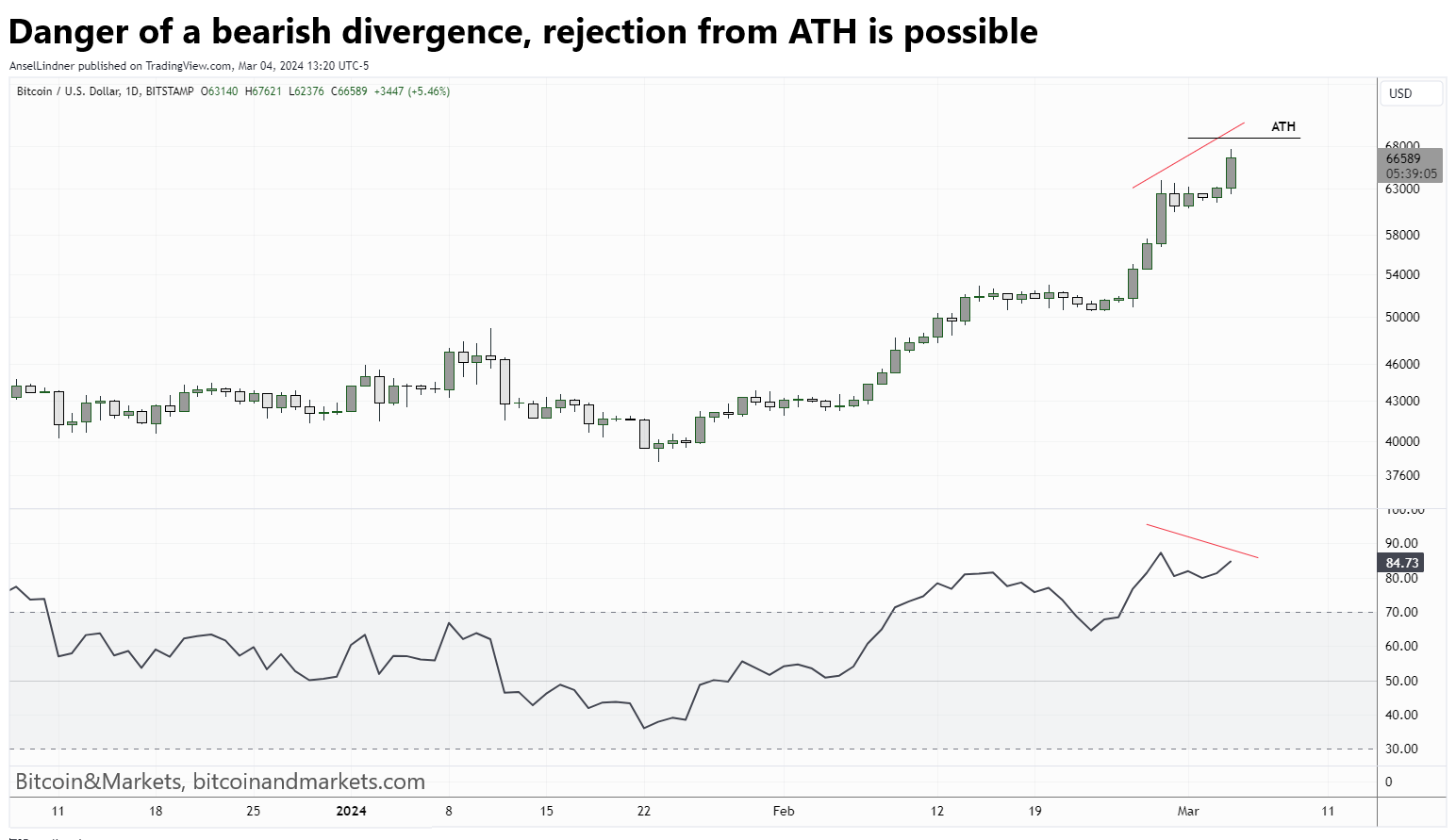

Nothing goes up in a straight line. It is easy to get very hyped for the ATH coming up. It has crossed the ATH in most other currencies already. None of them face any rejection at all really. I think USD will be different.

Last week's Premium Proton, that came out Wednesday after the three huge days and I was somewhat bearish. Everything is has gone right back to overheated.

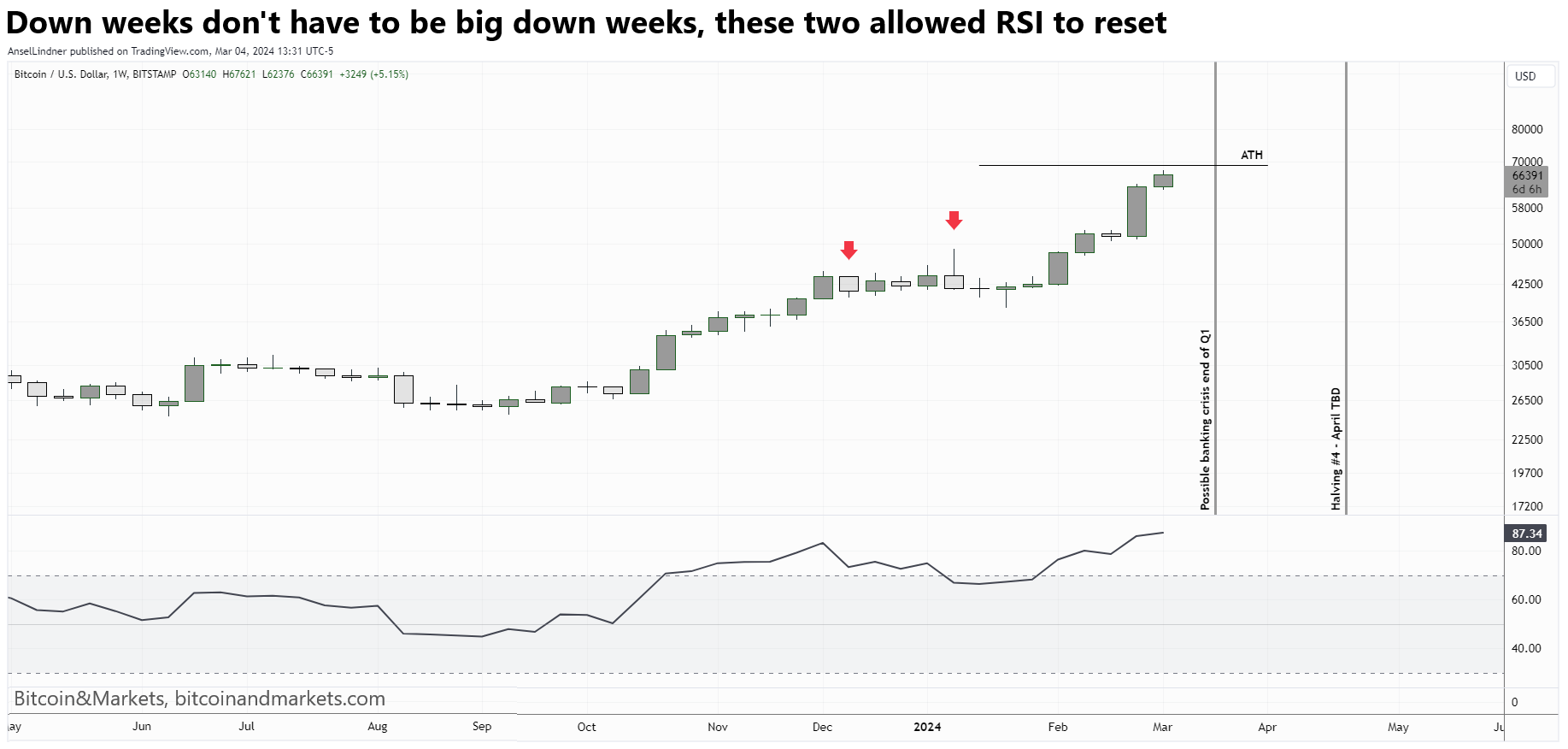

RSI must cool off. [...] A perfect story would be for one more push into the USD ATH, then come back to $62k and go sideways for a while. Everyone will be screaming double top! [I guess it's a triple top actually.] Bitcoin is too volatile! Then it turns around and blows right through it.

We are right back in that position again. The price continues to press higher, while the indicators cannot cool off. That is setting us up for a larger surprise did in the near future, IMO.

I want price to rip through the ATH and continue to $100k ASAP, but it looks more likely that some volatility is coming. ETF buyers must be tested. There's no free lunch in this game.

The weekly is also extremely overbought. It's possible we have 2 more weeks of big gains according to the weekly chart, but it has to come to an end soon. Again, I always say, we can correct through price or time. If we expect the looming banking crisis to be good for bitcoin, and the halving to also be good for bitcoin, we are getting short on available time for cooling off the weekly RSI prior to that.

On the chart below, I highlighted two weeks that were not big sell-offs, but allowed the RSI to cool down in a sideways manner. I don't think we have that time, this time though. Therefore, I have to do it. I have to call for a sell-off. We could touch the ATH or even pass it by a little bit, but I think it is most likely that Daily and Weekly RSI will cool off very soon.

ATH Rejections

Fun fact, we've never not rejected at least a little bit from the first ATH test on the major cycles pic.twitter.com/l4vqDTd5zI

— lowstrife (@lowstrife) March 4, 2024

LowStrife is an OG in the space. A little too shitcoining for my taste, but as discussed on Telegram over the weekend, my track record for calling prices in altcoins is not the best. I don't understand pure hype and fraud marketing I guess. Anyway, LowStrife here points out that we've never NOT rejected from the first attempt at a new ATH.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

This is HUGE news. Last week, I reported on the suspension of the survey due to court proceedings. Well, it didn't take long. The government withdrew their attempt and settled with the plaintiffs.

The Agreement sets forth that EIA has discontinued (that is, formally withdrawn and ceased) the emergency collection of Form EIA-862 that Plaintiffs challenge in this litigation, and that OMB has approved the discontinuance. As a result of the discontinuance, no person or entity is subject to any obligation to respond to Form EIA-862. The Agreement further sets forth that in the letter from EIA Administrator DeCarolis formally requesting approval of the discontinuance, EIA explained that it “has decided that it will not proceed through the emergency collection procedures set forth in 44 U.S.C. § 3507(j) and 5 C.F.R. § 1320.13 with respect to an information collection covering data of the type described in Form EIA-862.” EIA explained that it “will proceed through the PRA’s notice-and-comment procedures . . . to determine whether to request that OMB approve any collection of information covering such data.”

This powerful chip offers enhanced Bitcoin mining performance with minimized power consumption, leading to lower operating costs and a reduced environmental footprint for miners. The SEAL01 chip will seamlessly integrate into our upcoming mining rig, the SEALMINER A1.

Bitdeer has Tested Its 4nm Bitcoin Mining Chip SEAL01

— Bitdeer (@BitdeerOfficial) March 4, 2024

Bitdeer has successfully designed a Bitcoin mining chip, the SEAL01. As a world-leading technology company for blockchain and high-performance computing, Bitdeer (NASDAQ: BTDR) today introduced its first cryptocurrency mining…

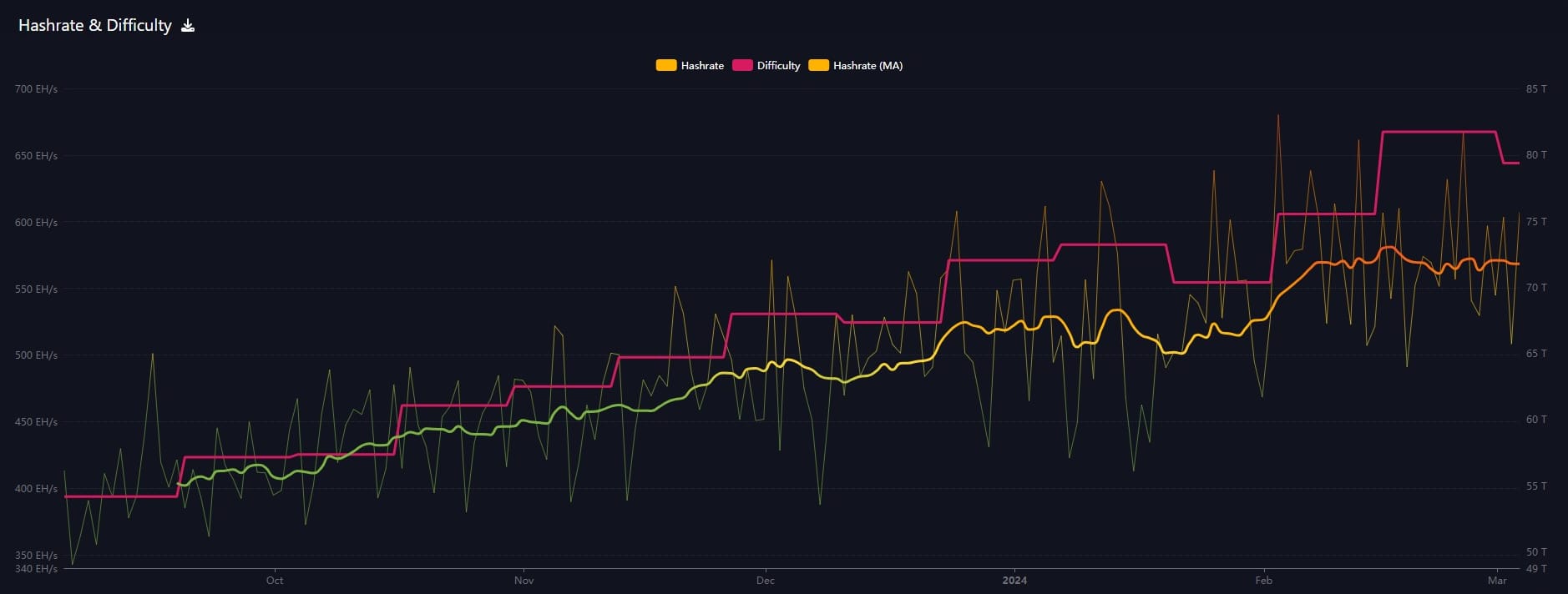

Hash rate and Difficulty

Hash rate growth has stalled over the past month. After two large difficulty adjustments higher of +7% and +8%, we had a negative -2.9% adjustment last Thursday. The current pace will lead to another -1% drop in 10 days.

Mempool

The mempool increased slightly this week along with fees. From <$2 for confirmation in the next block to $4 today.

Inscriptions

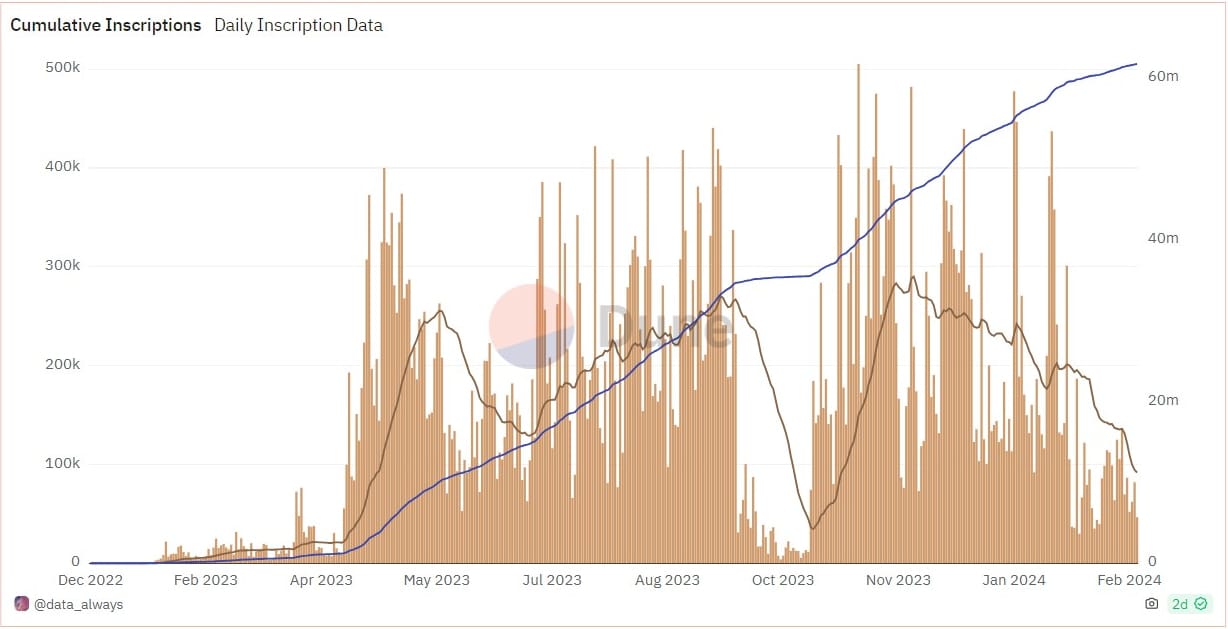

The number of daily inscriptions has really fallen. The last week caused the monthly moving average in this chart to drop significantly. There will likely be another period of higher volume for inscriptions, but as of now, there is no real market for these things. They are a waste of money.

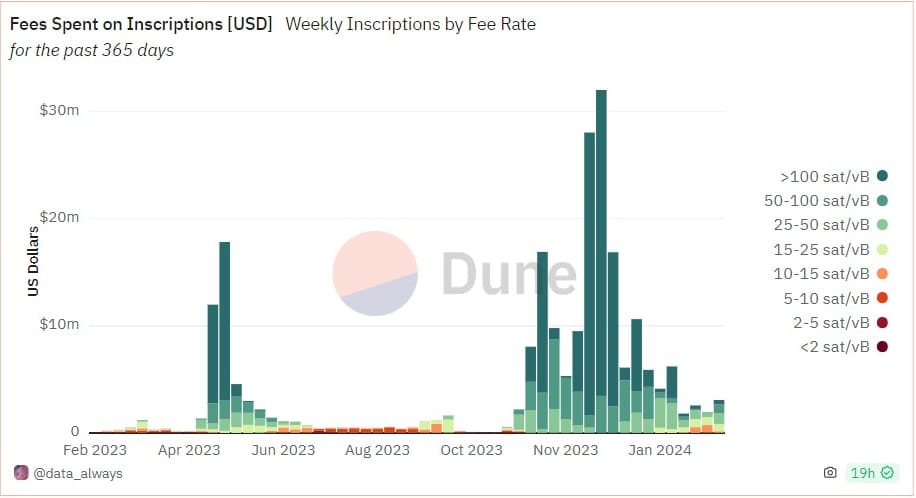

Fees paid by inscriptions increased last week slightly despite lower volumes, but are still under $5 million/week.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com