Bitcoin Fundamentals Report #275

Bitcoin ETF update, China bitcoin demand, transparency in spot ETFs, Texas border issue, Evergrande, peak cheap oil takedown, price analysis, and mining industry news

January 29, 2024 | Block 828,001

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Bullish |

| Media sentiment | Positive |

| Network traffic | Moderate |

| Mining industry | Surging |

| Days until Halving | 79 |

| Price Section | |

| Weekly price* | $43,040 (+$2,509, +6.2%) |

| Market cap | $0.845 trillion |

| Satoshis/$1 USD | 2,324 |

| 1 finney (1/10,000 btc) | $4.30 |

| Mining Sector | |

| Previous difficulty adjustment | -3.8992% |

| Next estimated adjustment | +7% in ~3 days |

| Mempool | 503 MB |

| Fees for next block (sats/byte) | $2.41 (40 s/vb) |

| Low Priority fee | $1.99 |

| Lightning Network** | |

| Capacity | 4997.93 btc (+2.6%, +127) |

| Channels | 59,105 (+1.4%, +834) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

- ETF update

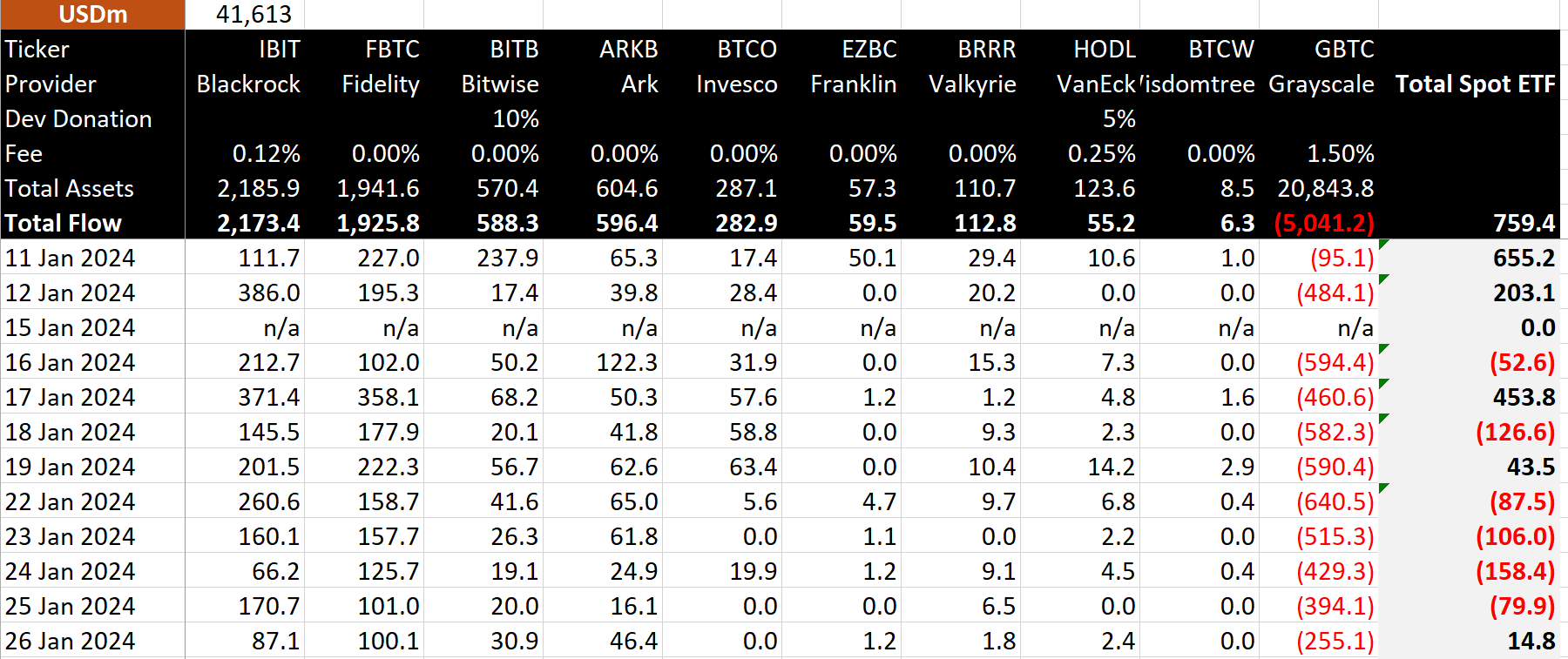

I'll offer a few ways to represent bitcoin flows in the spot ETFs. First up is this summary of flows in dollars from Bitmex Research. The far right column shows total flows, so far it is +$759.4 million after last Friday. You can also see in the GBTC column that outflows have been declining since 22 Jan.

Next up is flows in BTC from Capital15C. Here we can see the total flow is +17,571. Blackrock has broken the 50,000 BTC mark and Fidelity is close behind.

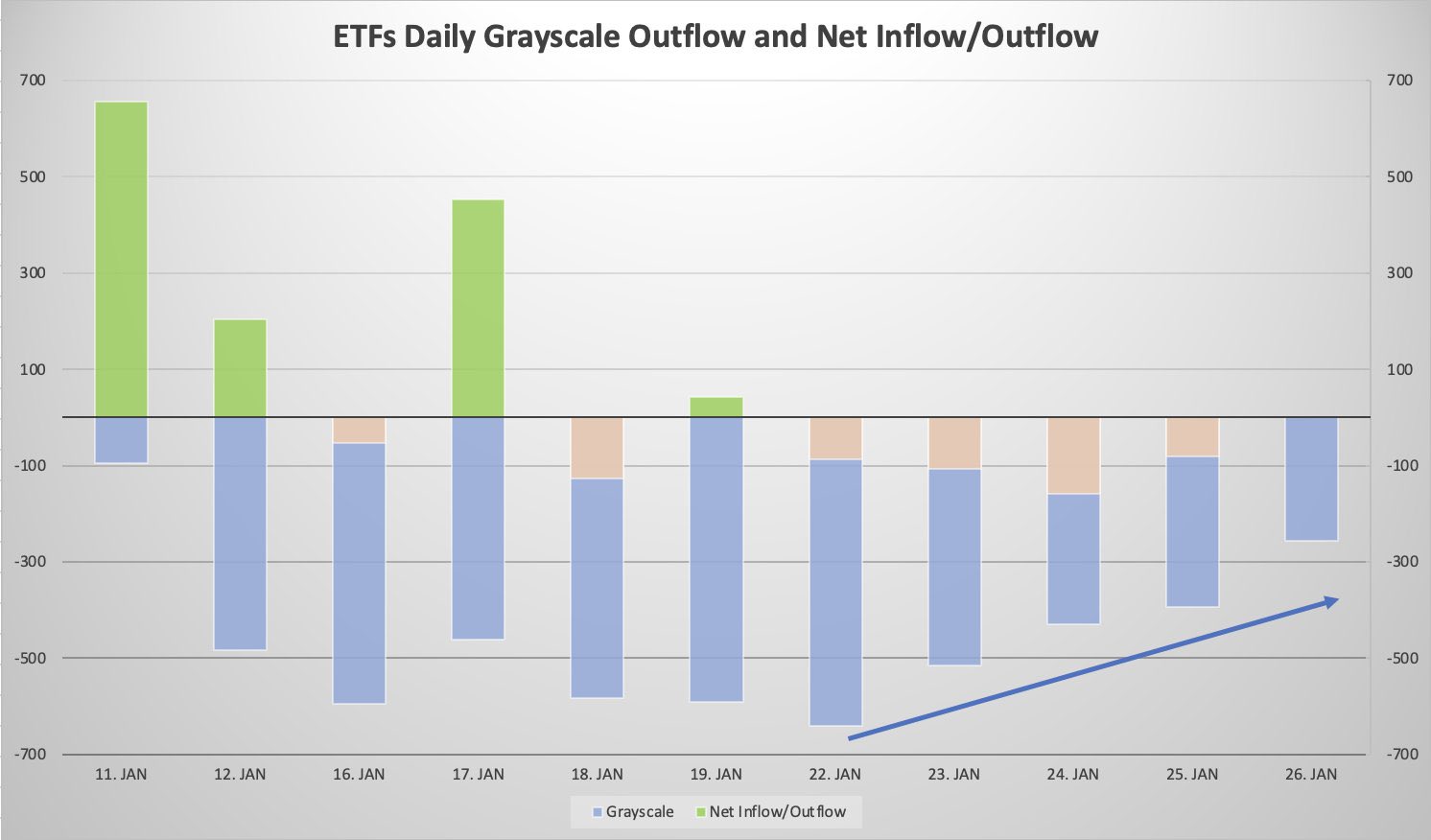

Lastly, here is an interesting graph by AlexOttaBTC on twitter. It is a simple representation of the flows by day, above and below zero. The blue is GBTC outflows. You can plainly see the decreasing sell pressure from them. I'd also add this is a good visual to understand the slow data reporting problem. While data has become more consistently reported after each trading day, we do not know if that data represents all current up-to-the-minute data. The T+1 or T+2 lags are frustrating.

We can watch the blockchain for GBTC to see outflows and inflows to many of the ETFs, but they have a fudge factor in regards to the settlement timing. They will probably streamline their procedure to settle after every trading day, but a possibility remains that they can take longer during volatile times.

Announcement: Today the Bitwise Bitcoin ETF (BITB) becomes the first U.S. bitcoin ETF to publish the bitcoin addresses of its holdings.

— Bitwise (@BitwiseInvest) January 24, 2024

Now anyone can verify BITB's holdings and flows directly on the blockchain.

Onchain transparency is core to Bitcoin's ethos. We're proud to… pic.twitter.com/1JTUh3zvDE

Hong Kim, CTO at Bitwise said the following:

in the past two days, our bitcoin etf received 998,085 sats (~$419) across 35 utxos

its negligible compared to the AUM (~$511 million as of yesterday) but those sats are added to NAV and accrue to the benefit of shareholders

if any sats are sent to us from ofac sanctioned addresses coinbase custody will flag it and those utxos will be left untouched and not be added to NAV

handling dust txes isn't that hard for an institutional custodian and the framing that you can "attack" a public bitcoin address by sending it free sats doesn't hold truth

in the past two days, our bitcoin etf received 998,085 sats (~$419) across 35 utxos

— Hong Kim (@hongkim__) January 26, 2024

its negligible compared to the AUM (~$511 million as of yesterday) but those sats are added to NAV and accrue to the benefit of shareholders

if any sats are sent to us from ofac sanctioned… https://t.co/Bw2SWuXnVg

I wrote about this extensively last week, both on Bitcoin Magazine Pro and my Bitcoin & Market Protons.

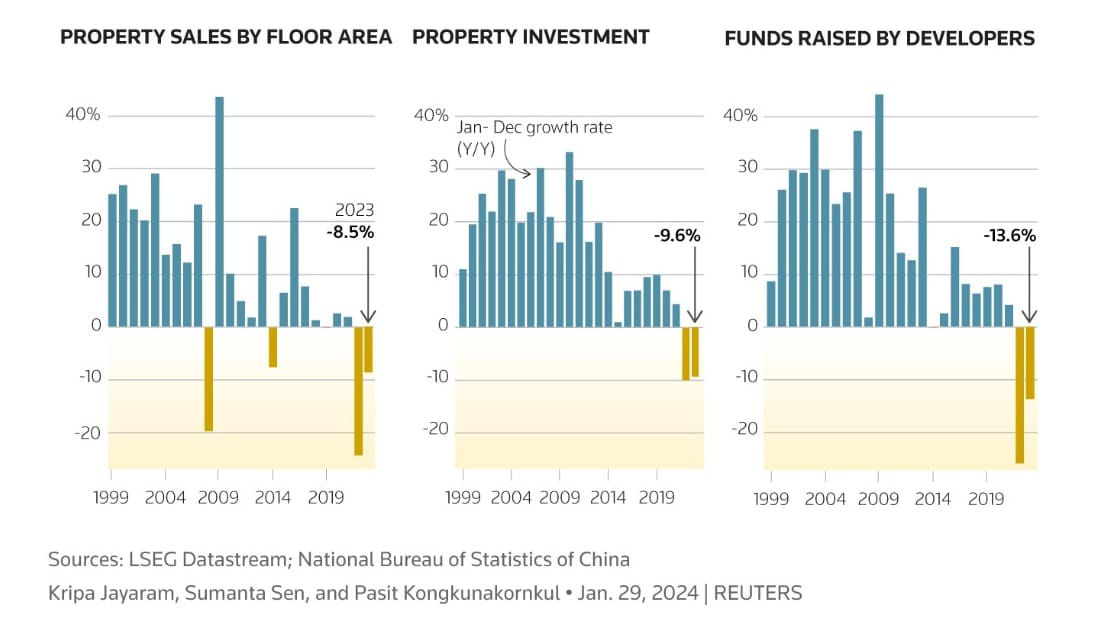

The bottom line is that the Chinese economy is multi-stage collapse. Right now, it is their stock market's turn to be hit hard. Young people, or investor of all ages, are looking at the stock market returns of the last decade and want an alternative. Bitcoin is increasingly becoming a way out for them. Hong Kong is opening up rapidly to bitcoin and money is flowing there from the mainland.

This is a pile of tinder waiting for a match. Yes, there are flows going into bitcoin from these types of Chinese investors, but once the bitcoin price starts to take off, FOMO in China will also kick in.

Macro

The standoff at the US southern border is a significant political event in the US. However, I am generally less concerned with escalation than other people. The proper context in which to view this situation is as a further incentive attention to turn inward for the US, instead of maintaining the liberal world order and globalization.

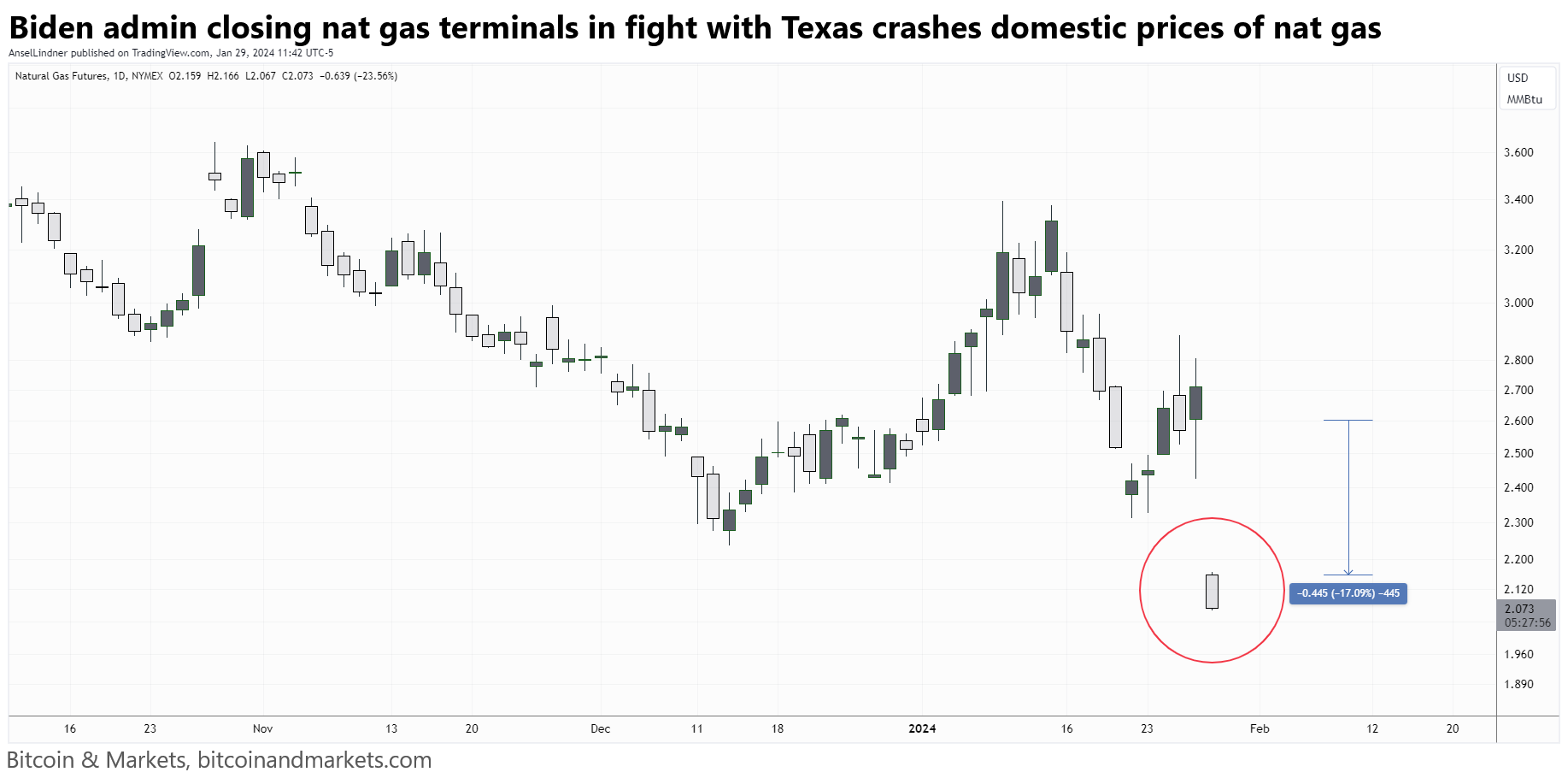

Immigration is a losing issue for Biden, he can't risk alienating the inner-city vote by publicly removing that razor wire. Instead, the response has been akin to foreign policy sanctions, with the administration refusing licenses to Houston natural gas exporters. Logically, the domestic price of natural gas crashed, gapping 17% lower on open.

This will also affect globalist allies in Europe, who have turned to US natural gas because of sanctions on Russia and blowing up Nord Stream. It is an interesting move by the administration, but will ultimately lead to increased globalist tensions and more pressure to disintegration than global integration.

A Hong Kong court on Monday ordered the liquidation of property giant China Evergrande Group, opens new tab, dealing a fresh blow to confidence in the country's fragile property market as policymakers step up efforts to contain a deepening crisis.

The decision sets the stage for what is expected to be a drawn-out and complicated process with potential political considerations as investors watch whether the Chinese courts will recognise Hong Kong's ruling, given the many authorities involved. Offshore investors will be focused on how Chinese authorities treat foreign creditors when a company fails.

I've debunked Peak Cheap Oil in the past and I will continue to talk about it because I think there are economic lessons in it. Recently, Doomberg did a take down of the idea as well. I'm not a subscriber to Doomberg, but I like his podcast appearances. My position differs from Doomberg in important ways, and I will be doing a podcast episode it in the near future.

Here he is debating an alarmist over peak cheap oil. The alarmists are dangerously linear thinkers. A broken clock is right twice a day, but the peak cheap oil guys will almost always be wrong unless they extrapolate from a known period based on an assumption, in a straight line until disaster. Of course, the real world doesn't work like that.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

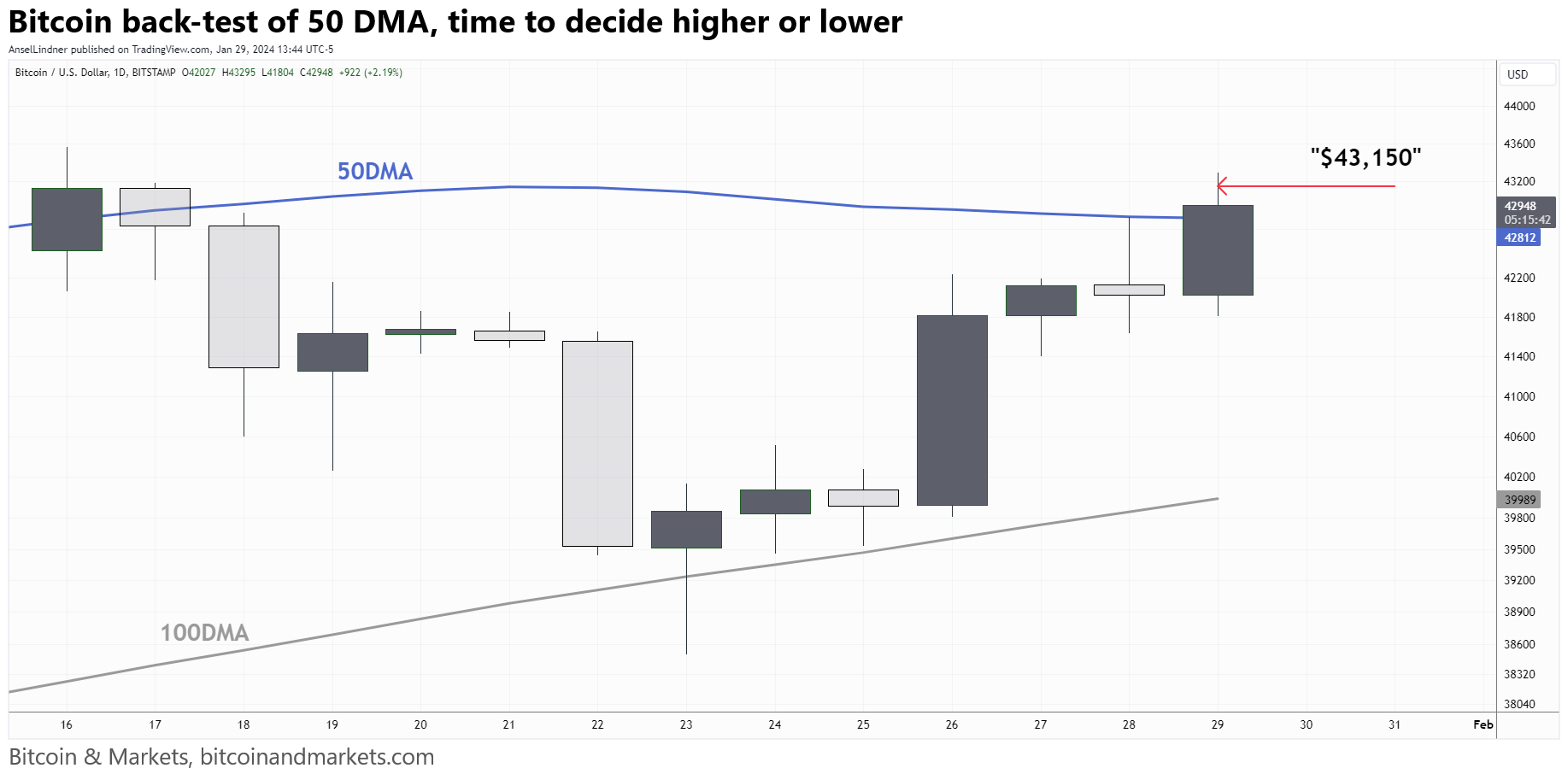

[When] price dipped below the 50 DMA in June and August 2023 it back-tested the 50 DMA before consolidating further. We should expect at least a back-test of the 50 DMA, but with a higher chance to continue higher this time due to ETF inflows. That would bring us to $43,150 first, at which time the market has to decide between higher or more consolidation.

Price is challenging the 50-day MA at the time of writing. This is the time to make a decision. If price fails to break and hold above the 50 DMA, we could rollover and test the lows. However, RSI and MACD are both turning bullish. Technically, if we close above the 50-day, there is a good risk:reward ratio for going long with a stop-loss just under the 50-day. If price is rejected, new lows down to $37,900 are in play. I do not expect a significant sell-off though, the odds of a big move greatly favor the upside.

Sources of demand continue to be strong and will only get stronger as price rises. Demand goes down or up with price in bitcoin. As bitcoin rises, we should expect inflows into the ETFs increase. When we break $49,000 it could be significantly more inflows. Demand out of China is the same thing.

Overall, since FTX price appreciation has come via brief steep appreciation followed by periods of calm. We should NOT be surprised if that continues.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Thinking back to the disagreement between Matt Odell and Cory Klippsten a couple months ago, perhaps it was due to investment in this stealth mining operation. Swan is setting itself up in a unique business model for going public. They sell bitcoin direct to retail, offer wealth management services, and mine bitcoin. We'll have to see if that all fits together, or if they are spreading themselves a little too thinly.

Swan Bitcoin has expanded into bitcoin mining, the company announced on Thursday.

[...] has been operating a mining arm since July 2023 that’s now coming out of stealth mode. Since July, Swan has mined more than 750 bitcoins, the company said.

Seven mining farms are powered by 160 megawatts of electricity and producing 4.5 exahash of mining power, Klippsten told The Block. Three more will come online in March, increasing the overall hashpower up to 8 exahash, he added.

"Our long-term goal is to be about 50% in the U.S. and 50% outside of the U.S.," Klippsten said.

Swan is working to achieve a public listing within the next 12 months.

Halving FUD again. Oh no! The bitcoin halving is going to bankrupt miners. Be afraid.

Bitcoin miners are expanding rapidly at current price levels, fully aware of the halving. It is not irrational to expect the bitcoin price to not just double to make up the difference in rewards, but likely quadruple this bull market. Also, fees will become more and more a source of revenue for miners going forward.

We have a new public bitcoin miner in the US, Griid (GRDI).

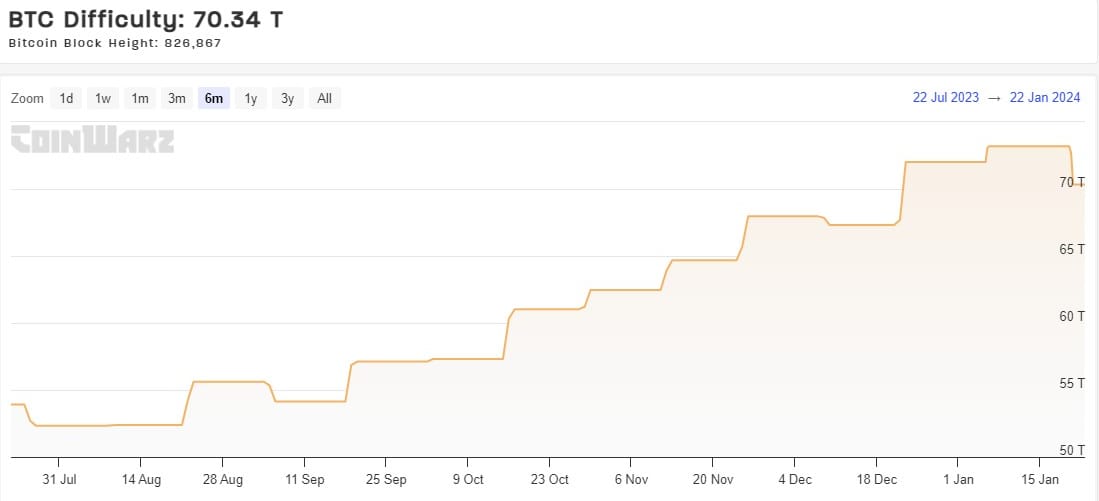

Difficulty

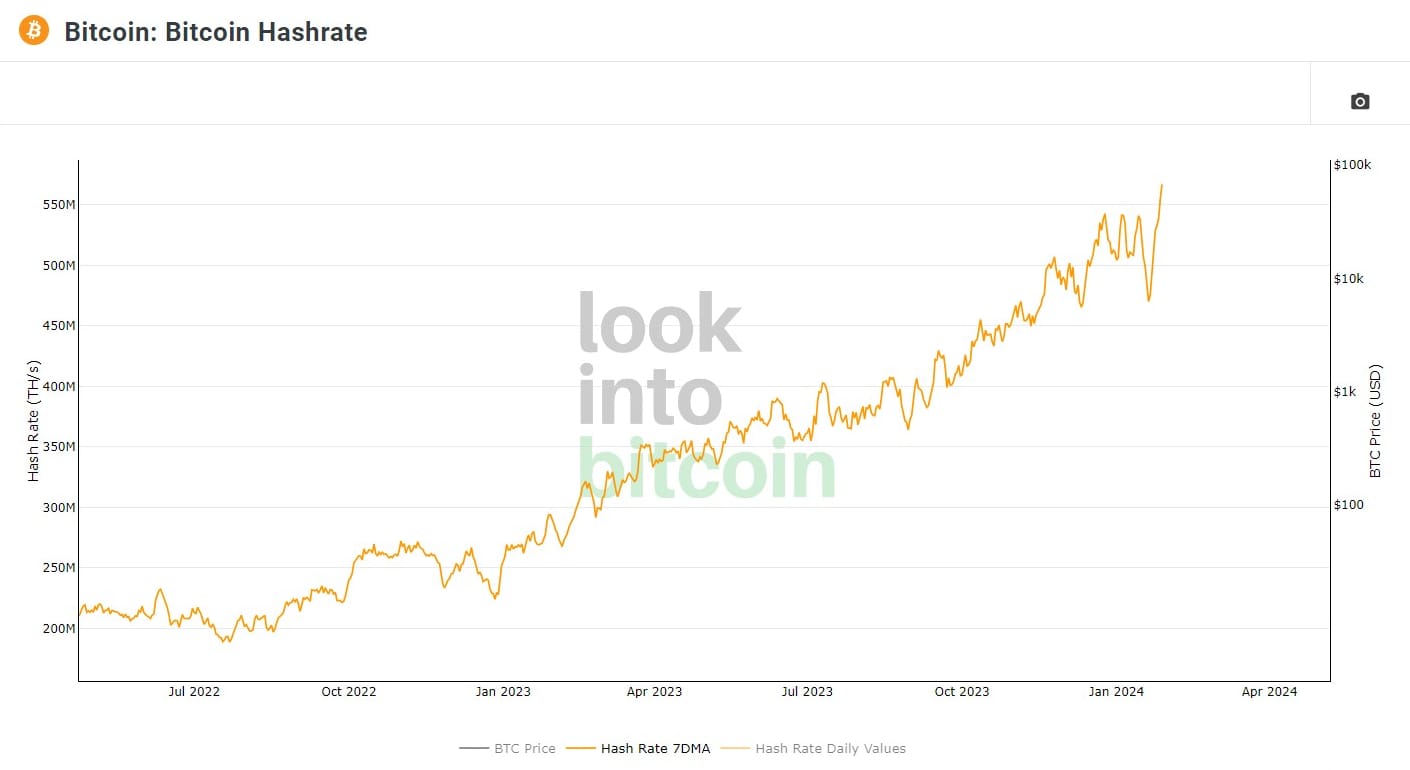

Bitcoin's difficulty did not adjust this week, after the largest decline since December 2022 last adjustment. This week, hash rate as skyrocketed, with the estimate next adjustment moving up from 1% last week to +7.5% right now.

Hash Rate

Massive rebound to new ATHs in hash rate this week, after the cold blast affect US miners earlier in the month.

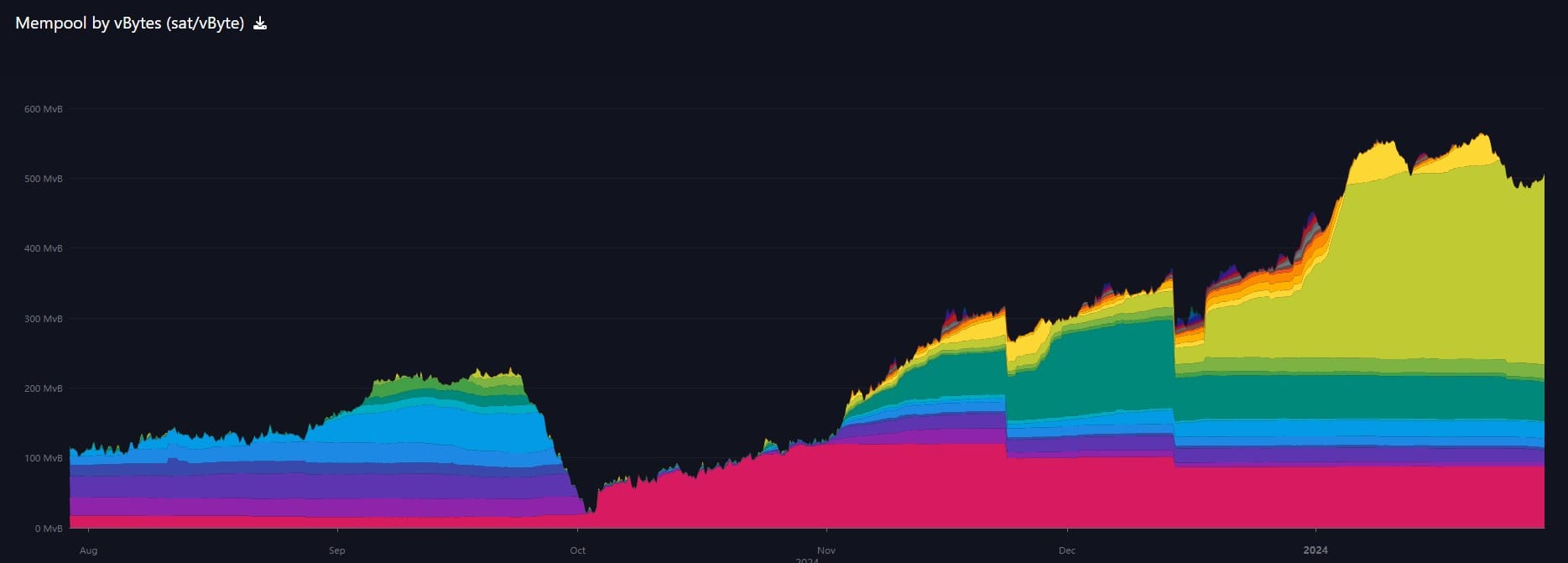

Mempool

Inscriptions

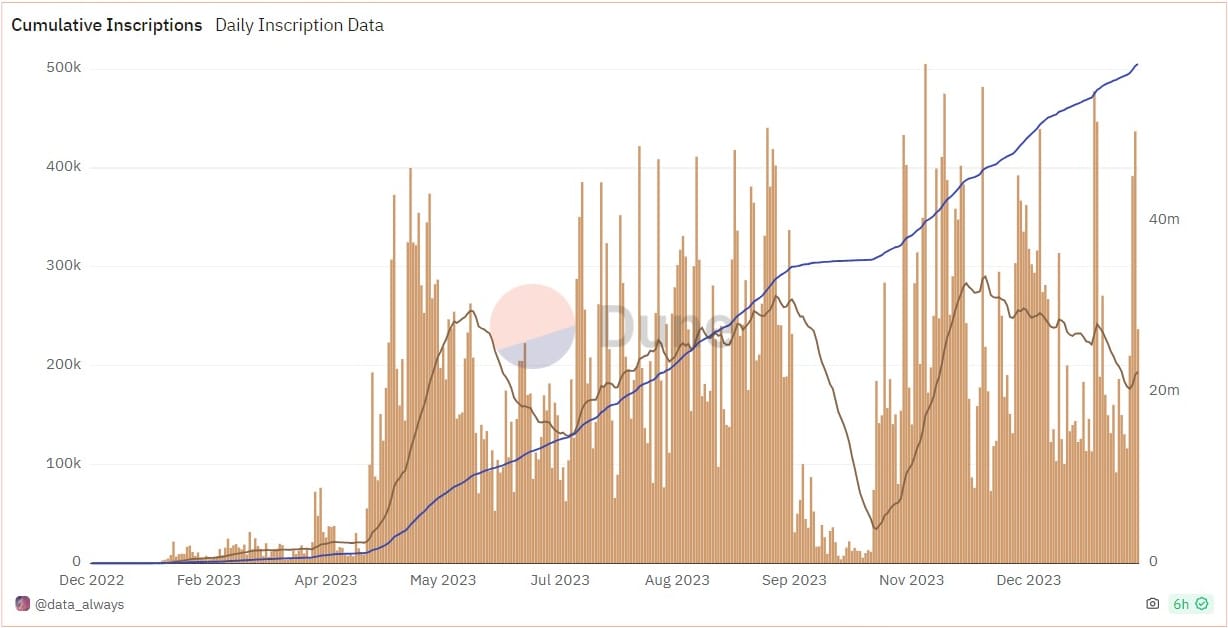

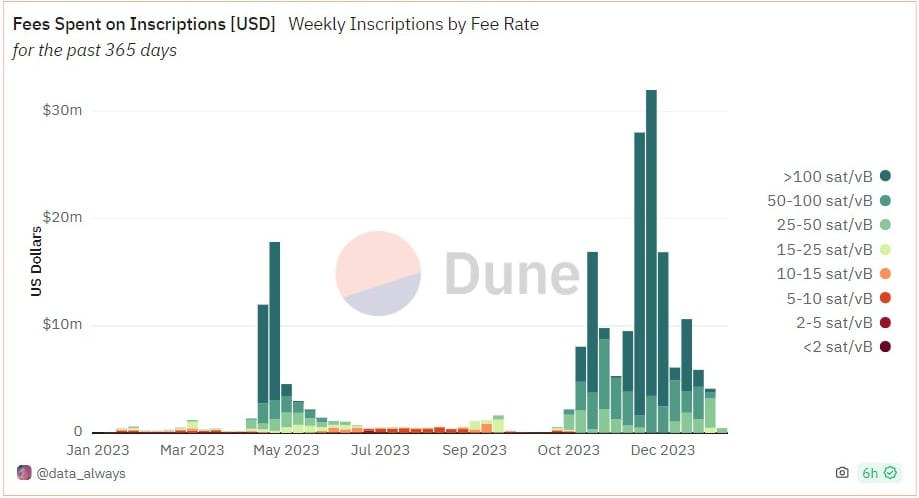

There was another spike of inscriptions over the weekend, with one day hitting 400,000. On average, inscriptions have been lower in January than previous months.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space