Bitcoin Fundamentals Report #274

Free newsletter - ETF flows are hot topic. FTX sold $1 billion of GBTC. Net buying still positive, China crash update, bitcoin price, miners battle cold weather.

January 22, 2024 | Block 826,874

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | ETF flows |

| Media sentiment | Positive |

| Network traffic | Moderately high |

| Mining industry | Stable |

| Days until Halving | 86 |

| Price Section | |

| Weekly price* | $40,531 (-$2,355, -5.5%) |

| Market cap | $0.796 trillion |

| Satoshis/$1 USD | 2,468 |

| 1 finney (1/10,000 btc) | $4.05 |

| Mining Sector | |

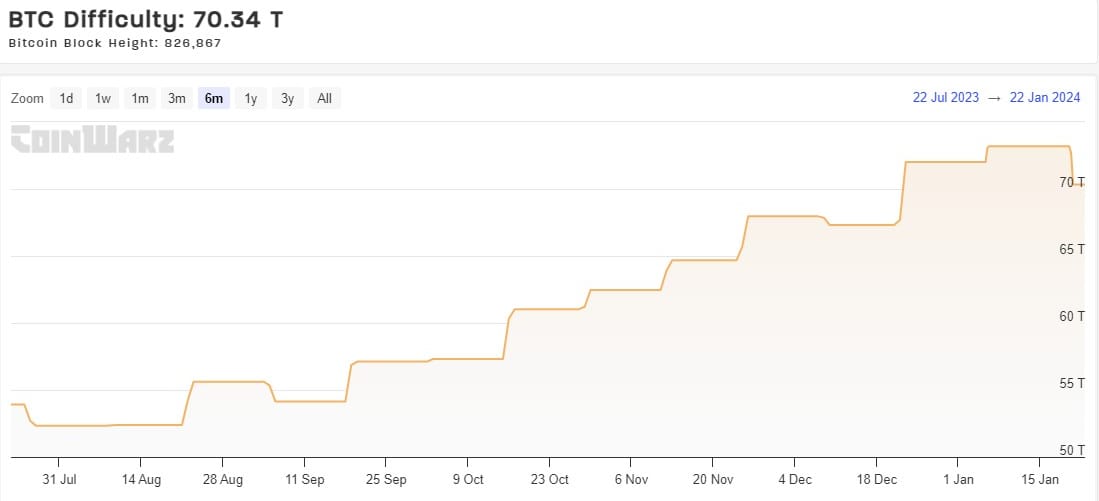

| Previous difficulty adjustment | -3.8992% |

| Next estimated adjustment | 0% in ~11 days |

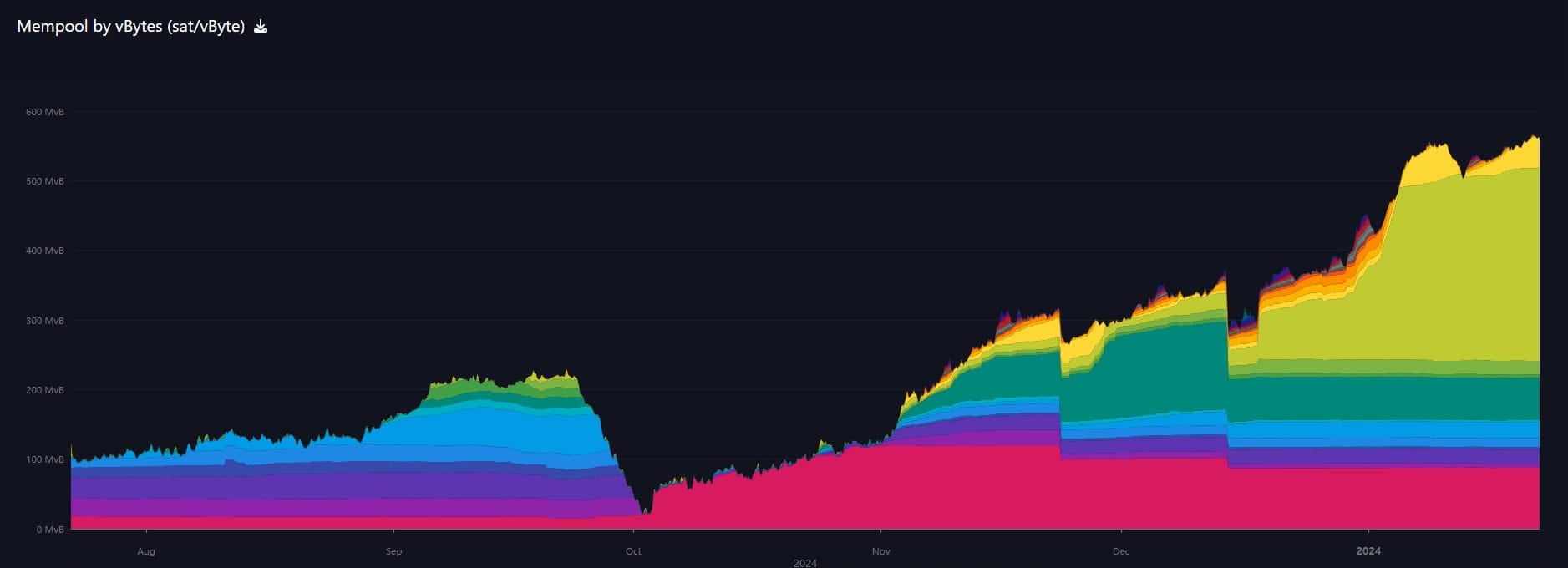

| Mempool | 561 MB |

| Fees for next block (sats/byte) | $2.04 (36 s/vb) |

| Low Priority fee | $1.93 |

| Lightning Network** | |

| Capacity | 4997.93 btc (+2.6%, +127) |

| Channels | 59,105 (+1.4%, +834) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- Why a Bitcoin 6102 Won't Happen

- Business Cycle: Is Limiting Credit the Best Route to Sanity? (public)

Bitcoin Magazine Pro

Headlines

Top 4 fastest ETFs for $1 billion in assets are

1. BITO (bitcoin futures)

2. GLD

3. IBIT (blackrock spot)

4. FBTC (fidelity spot)

This is amazing because there were so many bitcoin spot ETFs launched. If you combine all of them into one, it was by far the biggest and fastest launch in history. This is head turning for traditional investors. It is a huge boost to the reputation and legitimacy of bitcoin as an asset.

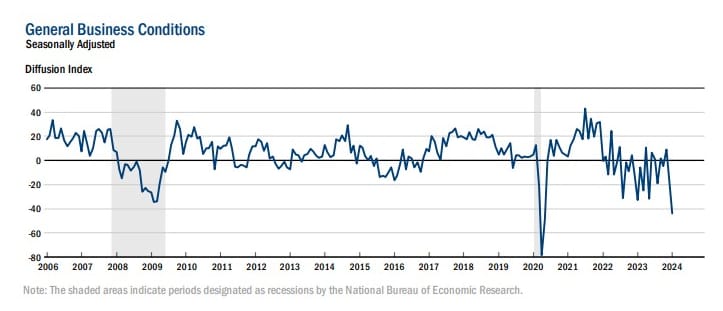

The timing in the broader macro cycle is also interesting. It is my forecast that Europe and China are already in deep recessions, and the US and Japan will likely follow in 2024. The Bitcoin ETF and halving are occurring right into the lead up to that safe haven bid, placing bitcoin as a safe haven in recession not just an inflation hedge.

People who understand the inflation fundamentals and call QE inflation, will buy bitcoin because it's an inflation hedge. Those who understand more clearly that recessions are deflationary and QE is just a sign of deflation happening and the need for psychological support of the market, will see bitcoin as a deflation hedge. Win-win.

Let me put into context how insane $10b in volume is in first 3 days. There were 500 ETFs launched in 2023. Today, they did a COMBINDED $450m in volume. The best one did $45m. And many have had months to get going. $IBIT alone is seeing more activity than the entire '23 Freshman… https://t.co/wV1zQFtPW1

— Eric Balchunas (@EricBalchunas) January 16, 2024

BREAKING: According to reports from CoinDesk, it appears that up to 1/2 of the $2B in GBTC outflows were from FTX liquidating their 22 million shares.

— Bitcoin News (@BitcoinNewsCom) January 22, 2024

In addition, FTX's sister hedge fund Alameda Research voluntarily drops its lawsuit against Grayscale Investments today. pic.twitter.com/zm9JgI5PEh

This morning it was breaking that FTX recievership dumped $1 billion worth of its GBTC shares when it returned to par at the launch of the spot ETF. That is roughly half the selling of GBTC which was still not enough to cover the buying from the other ETFs.

Alistair Milne on twitter has a list of large holders and the fate of their balances of GBTC. Remember, when GBTC was at a large premium, these players could harvest the spread by creating GBTC shares at NAV and shorting GBTC at the premium. They ended up holding a massive amount of GBTC and have since been liquidating.

DCG - $1bil of GBTC bought @~$60k at a discount to NAV, status unknown

Genesis / Gemini: fighting over 60mil GBTC shares (half may be sold at the bottom at steep discount)

3AC: liquidated at discount to NAV

Celsius: all sold all at 25% discount to NAV

FTX: all sold near par

BlockFi: all sold at discount to NAV

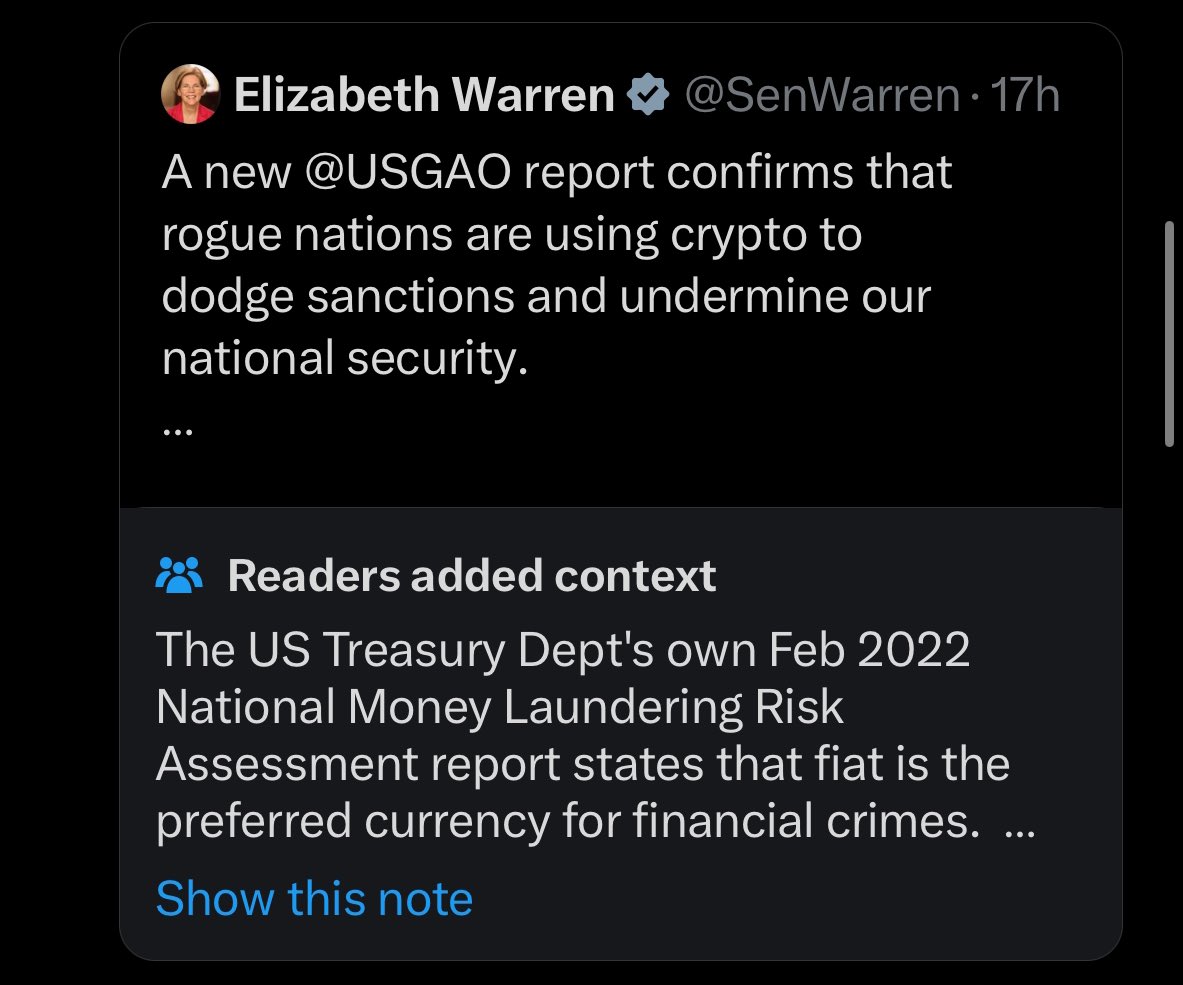

- Elizabeth Warren gets community noted again

This is just funny. They aren't sending their best to fight bitcoin. LOL

Macro

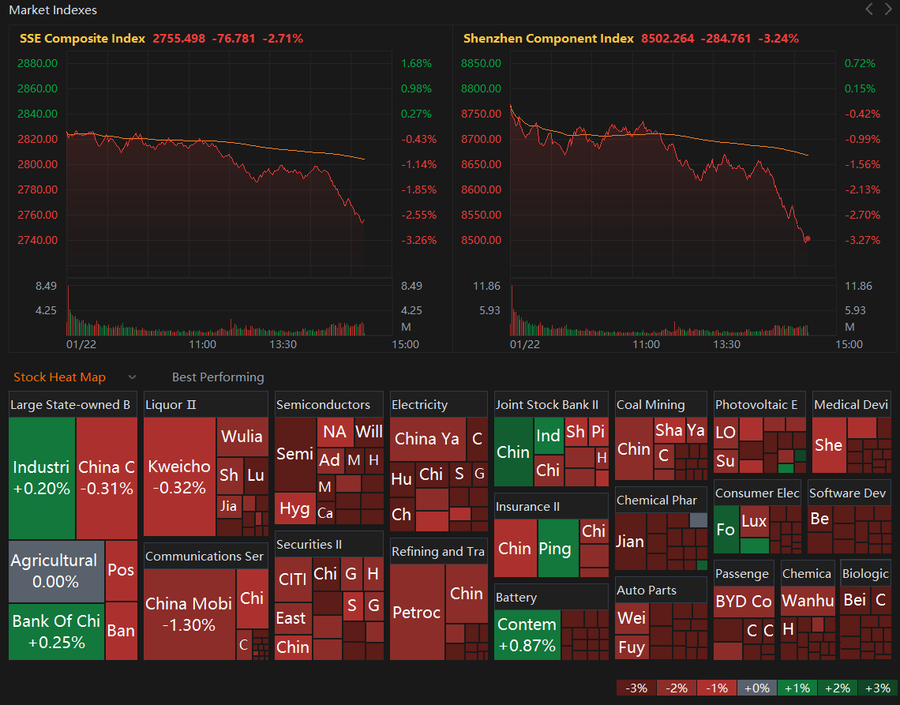

- China stock market collapsing

Chinese stock collapse accelerating.

SHENZHEN COMPONENT INDEX FELL MORE THAN 3%

CHINEXT INDEX FELL 2.4%

SHANGHAI COMPOSITE INDEX FELL 2.7%

-@sino_market

Also from @Sino_Market

Meanwhile, Chinese investors are rushing into Japan and US ETFs despite stock routs in #China.

China AMC Nomura Nikkei 225 ETF +1.7%.

E Fund Nikko Nikkei 225 ETF +3.1%.

E Fund MSCI US 50 ETF +2.07%.

Invesco Great Wall NASDAQ Tech ETF +2.88%.

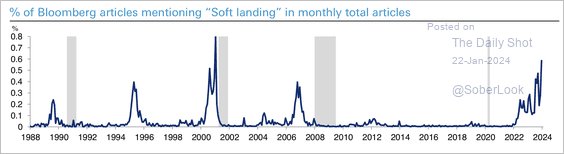

- People are being fooled as expected into soft landing hopes

The percent of Bloomberg articles that mention "soft landing" are rising. 2023 was an interesting year. It was a topic for most of last year. I have predicted that the "pre-recession" environment of rising stocks and gently falling yields will trick people into this soft landing expectation. Of course, it is just the pre-recession shift from economic expansion into relatively more safe investments.

The US markets will also be buoyed by disaster in Chinese and European markets as capital flees to relative safety in the US.

I covered this on last Friday's live stream. There is a huge disconnect between semi-independent Federal Reserve economic data and the data from the administration. The Fed's data is pointing to disaster.

The headline general business conditions index fell twenty-nine points to -43.7, its lowest reading since May 2020. New orders and shipments also posted sharp declines. Unfilled orders continued to shrink significantly, and delivery times continued to shorten. Inventories edged lower. Employment and the average workweek declined modestly. The pace of input price increases picked up somewhat, while the pace of selling price increases was little changed.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

A Proton will come out ASAP for current price action in bitcoin and Chinese stocks. The macro environment is uninteresting right now. It is not picking a direction for the time being. My base case is still for 2023 trends to continue into the first part of 2024, with eyes on March and Q3 for volatility.

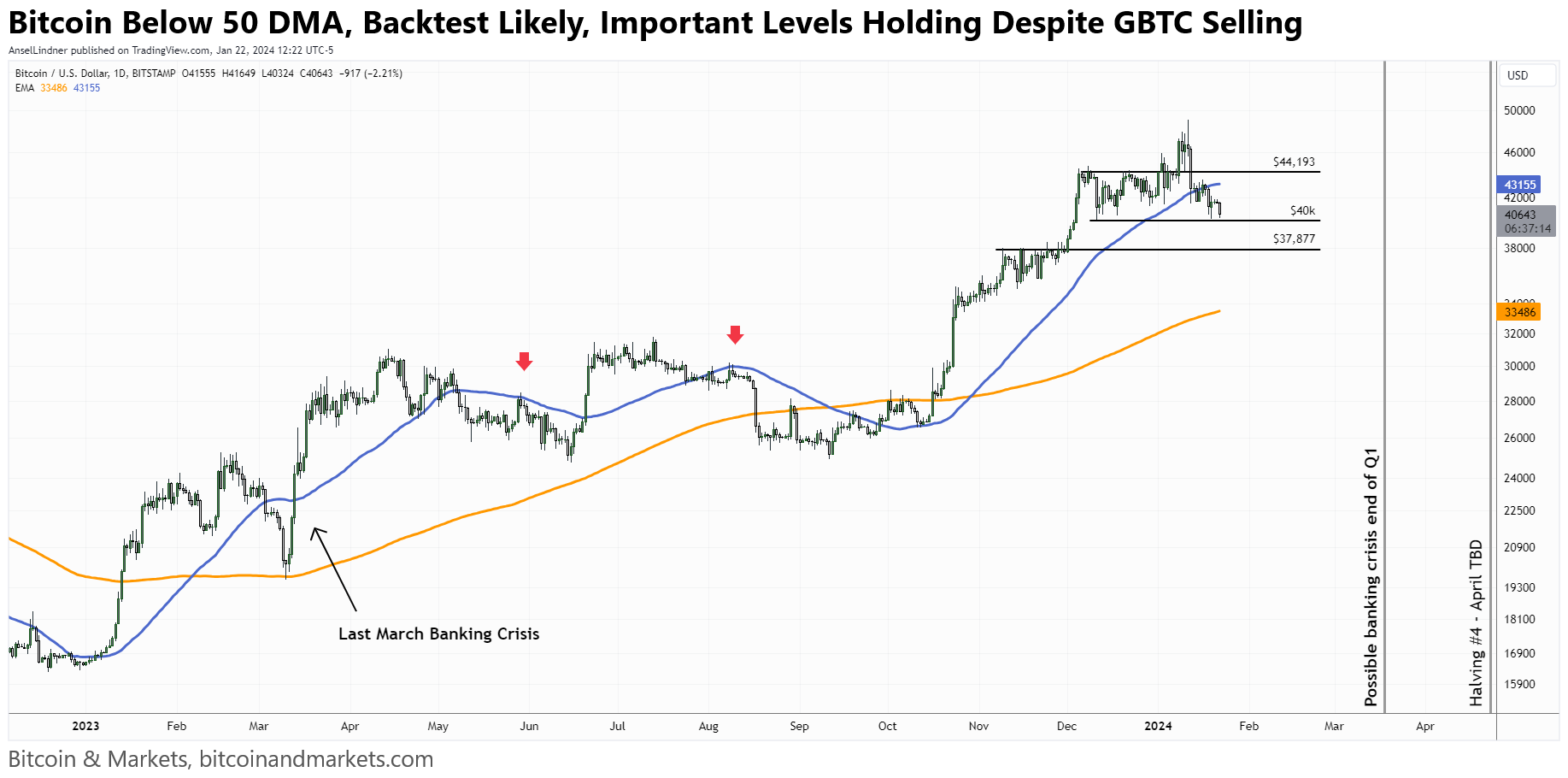

On the chart above, you can see when price dipped below the 50 DMA in June and August 2023 it back-tested the 50 DMA before consolidating further. We should expect at least a back-test of the 50 DMA, but with a higher chance to continue higher this time due to ETF inflows. That would bring us to $43,150 first, at which time the market has to decide between higher or more consolidation.

Tons of mixed metrics on bitcoin right now, so we have to stay focused on a few things to find the signal through the noise.

- Bitcoin is in its own cycle. The halving is coming.

- Bitcoin performed poorly during the COVID crash, but a similar event is not on the radar specifically at the moment. What we have today is a pre-recession slowing where stocks, bonds and safe haven assets will rise.

- Bitcoin ETF inflows are staying quite high, averaging over 10,000 BTC/day without GBTC forced selling for FTX and other whales. Including GBTC outflow, it is still nearly 4,000 BTC/day or $160 million/day.

With the report that FTX is done selling all their GBTC, we should expect those outflows to be cut in half, adding more NET buy pressure. We should NOT be surprised with brief periods of rapid appreciation followed by periods of calm.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

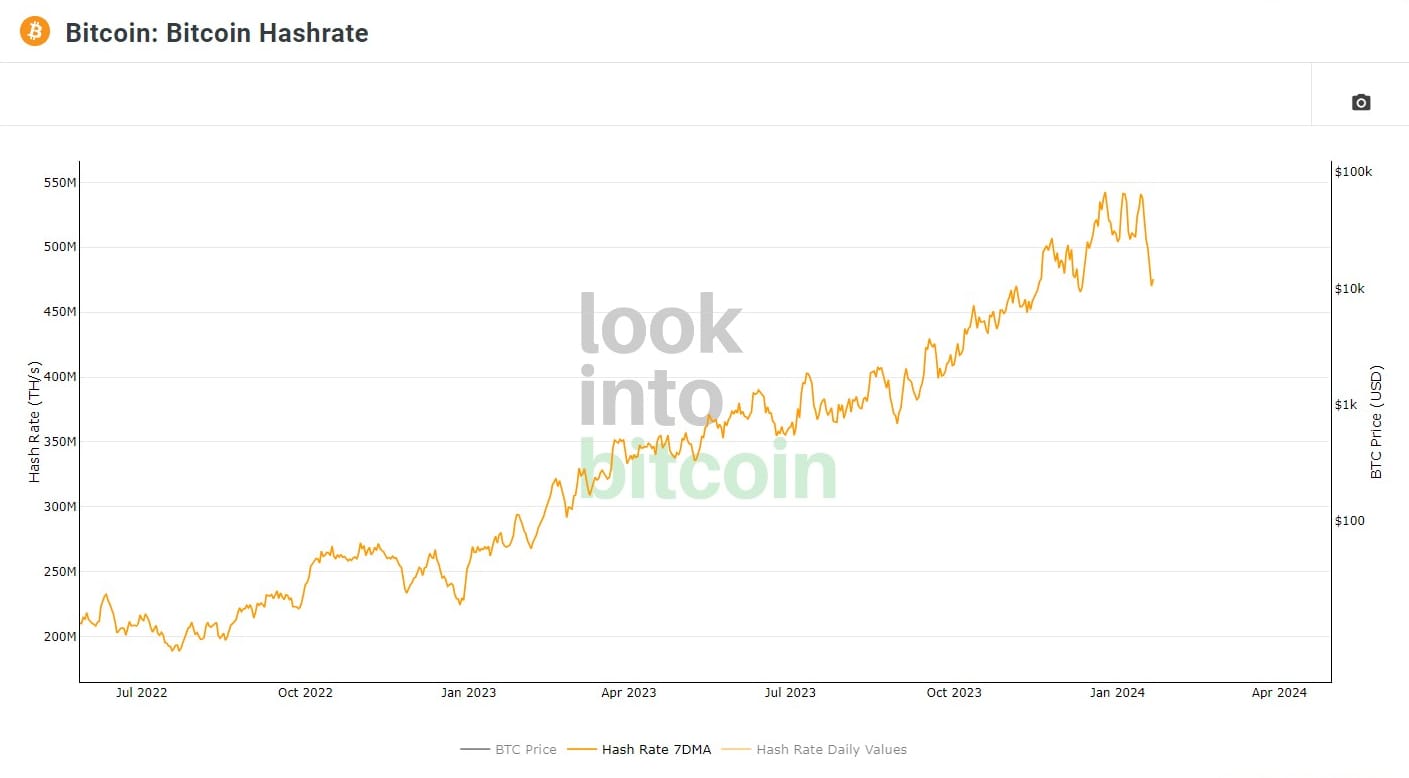

Bitcoin miners' demand response is getting better each year. Disruptions this year were significantly better resulting in fewer grid problems during this month's flash freeze.

The total Bitcoin network hash rate fell from more than 629 exahashes per second (EH/s) on Jan. 11 to roughly 415 EH/s on Jan. 15 — a 34% drop. The analytics site reported the hash rate increased to more than 454 EH/s on Jan. 16 as temperatures in Austin briefly rose above freezing during the day.

According to Foundry’s data pool, Texas accounted for roughly 29% of the Bitcoin hash rate in the United States. Many mining firms relocated to the state from China following the country’s crackdown on BTC miners and crypto. Several firms have operations in Texas, including Marathon Digital, Riot Platforms, Bitdeer and Core Scientific.

Unlike in 2021, when record low temperatures and a sudden winter storm caused hundreds of power outages to homes at a time when many roads were covered in ice and heavy snow, there were fewer reports of significant disruptions to Texas’ power grid. Many mining firms have joined a program organized by the Electric Reliability Council of Texas (ERCOT) that compensates them for adjusting their load on the state’s power grid during periods of high demand.

Specialist investment firm Deus X has teamed up with Fabiano Consulting to explore investment and strategic opportunities in the bitcoin mining sector.

The firms are looking to be investors and treasury management providers for mining companies that are looking for funding and strategic advice, including expansion and corporate structuring, according to a statement.

Deus X is a family office-backed investment firm with Tim Grant as CEO and $1 billion in assets. Grant previously held many executive roles, including Head of EMEA at Mike Novogratz’s Galaxy Digital (GLXY), CEO of SIX Digital Exchange, and also worked at TradFi giant UBS.

Fabiano Consulting was formed last year by former cryptocurrency financial services firm Galaxy Digital’s (GLXY) head of mining, Amanda Fabiano, who was previously the director of bitcoin mining at Fidelity Investments.

Difficulty

Difficulty adjusted down by 3.9% in the biggest decline since December 2022. These types of moves are not unheard of, especially with a cold blast in Texas. Miners have shown expert hash management, taking care of the grid and minimizing effect on the network. As of now, difficulty is estimated to rise 1%+ in the next adjustment.

Hash Rate

The Texas demand response clearly visible on the 7-day moving average of hash rate.

Mempool

Mempool has stopped its consistent rise. As you can see the last two weeks has been relatively stable. Fees continue to be relatively LOW.

Inscriptions

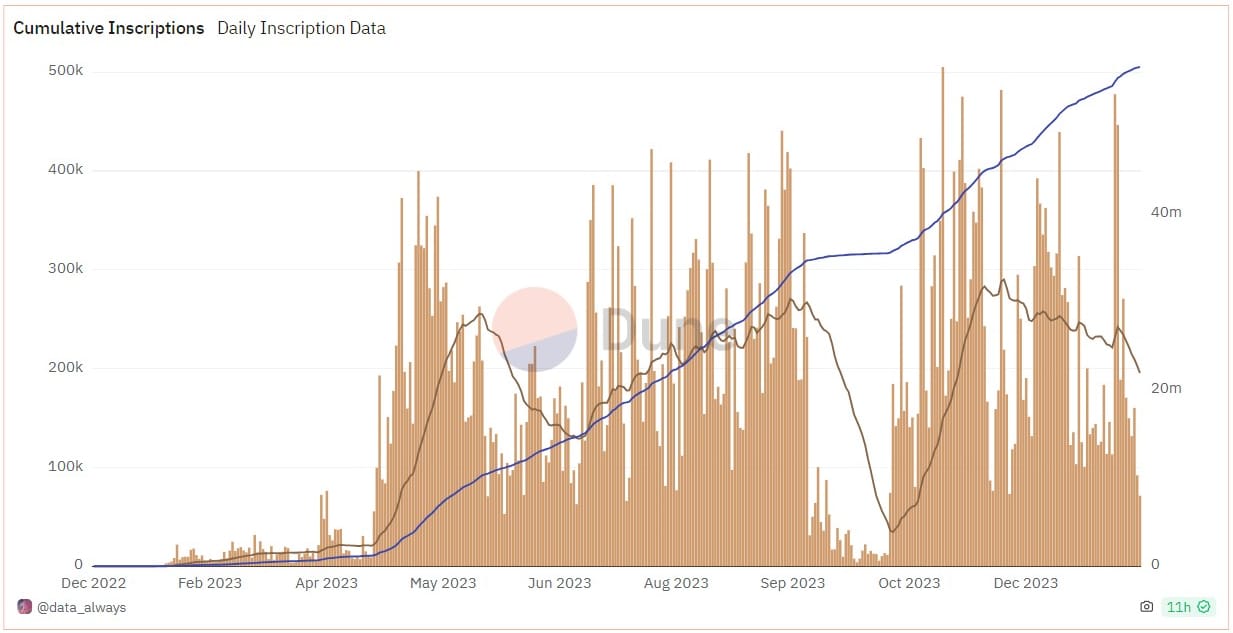

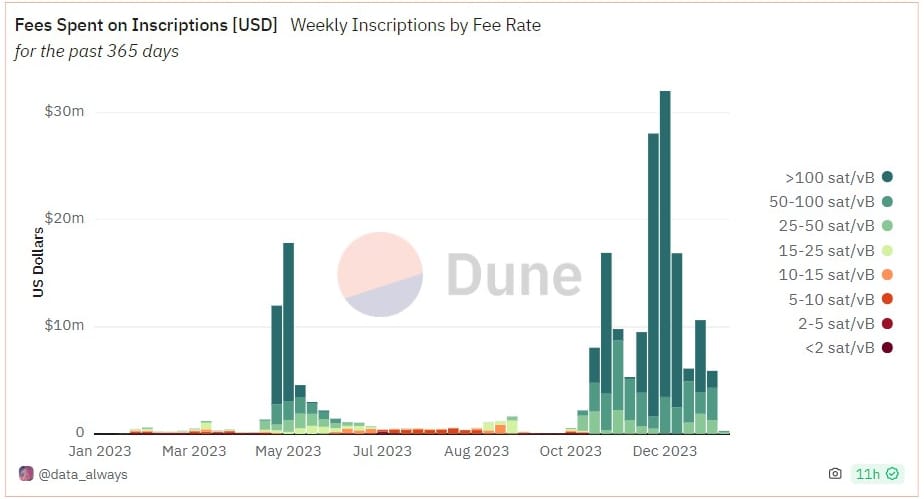

After two weeks of lower numbers of inscriptions, the last 2 days have both been over 400,000/day. A balance might be emerging, inscriptions go up causing fees to rise, in turn causing inscriptions to fall leading to fees falling.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space