Bitcoin Fundamentals Report #252

This week's topics include Bitcoiner candidate wins Argentine Presidential primary, ETFs could be only 18 days away, China's collapse, price analysis, and mining gets more love.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Extremely low volatility |

| Media sentiment | Very positive |

| Network traffic | Medium |

| Mining industry | Stable |

| Days until Halving | 246 |

| Price Section | |

| Weekly price* | $29,509 (+$670, +2.3%) |

| Market cap | $0.574 trillion |

| Satoshis/$1 USD | 3,390 |

| 1 finney (1/10,000 btc) | $2.95 |

| Mining Sector | |

| Previous difficulty adjustment | +0.1201% |

| Next estimated adjustment | +3% in ~8 days |

| Mempool | 134 MB |

| Fees for next block (sats/byte) | $0.45 (11 s/vb) |

| Median fee | $0.41 |

| Lightning Network** | |

| Capacity | 4755.05 btc (-0.5%, -26) |

| Channels | 68,072 (-0.3%, -178) |

In Case You Missed It...

Member

Community streams

- Bitcoin ETF Imminent, Industry Update, Big Move Coming! - E362

- Plus live streams that haven't made it to podcast yet!

Fed Watch

Blog

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

- BREAKING: Bitcoiner Javier Milei wins Argentine Presidential Primary in Landslide

This is massive news. He is an outspoken hater of central banks and lover of Bitcoin. He has threatened to end the central bank of Argentina and adopt a Bitcoin standard.

He is being painted as a "far-right" radical. Really, he's a populist leader for Argentina's unique troubled history with money.

- Bitcoin Spot ETF news

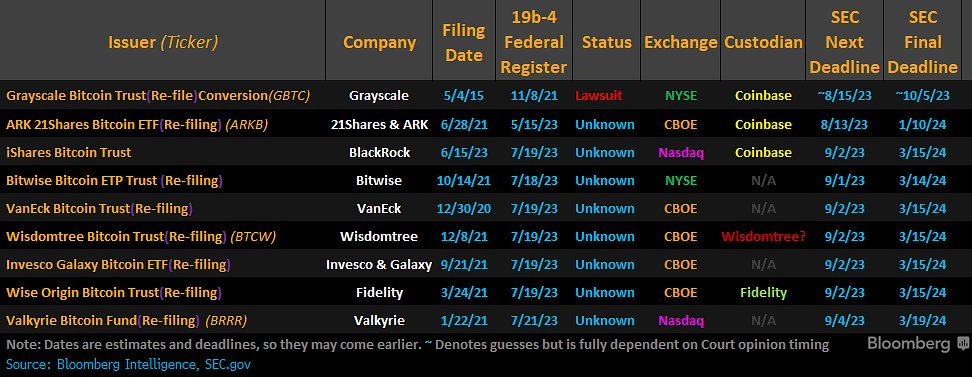

Last Friday, Cathie Woods' ARK ETF was delayed by the SEC. This was not a surprise to anyone. Even Woods herself came out a couple days prior and claimed the SEC was going to hold off and approve most, if not all, the ETFs at the same time.

The next important date is September 1st, 18 days away. The argument against delay is that once delayed, the chance of approval goes down. Therefore, if the chance is about 90% of approval right now, after a delay, IMO it will fall to under 50%. This is my feeling, and the argument made by James Seyffart of Bloomberg ETF department.

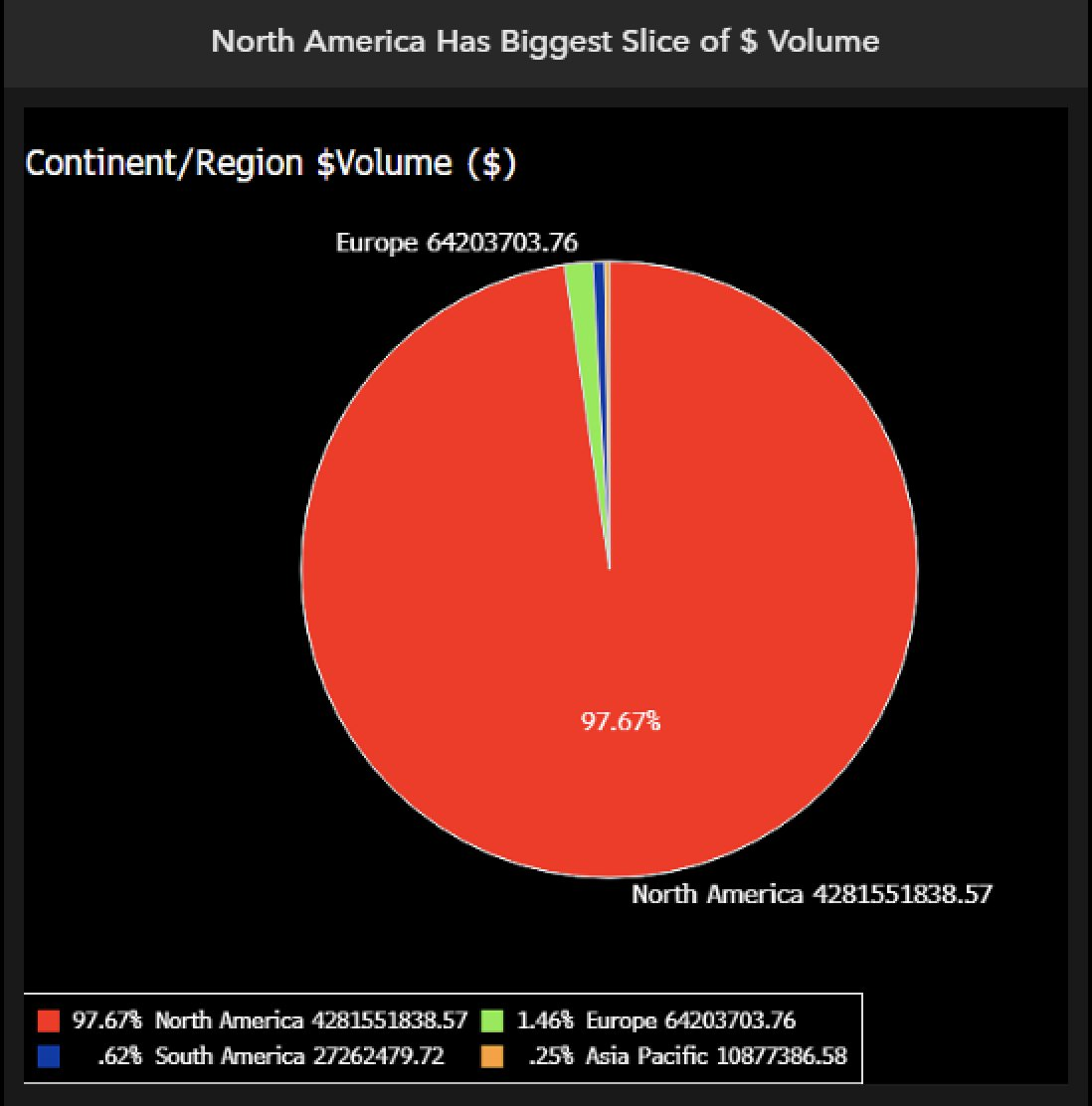

- Bitcoin related ETF volume globally is dominated by the US

Even without a spot ETF, which are already approved in several other countries, the US still responsible for 98% of global trade volume in bitcoin-related ETFs.

- Anti-cycle calls in Bitcoin

I've noticed a couple instances of people questioning the Bitcoin cycle in its entirety. Not just that this cycle might be smaller or something, but that we are going back to much lower lows and the cycles are an illusion.

I recommend watching this video in the tweet below to check your assumptions. He says we could retrace and then "kerplunk, all the way back down". He draws it to roughly $3000.

A belief is a market unto itself, and like a market, it can be squeezed.

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) August 10, 2023

One who believes in eternal crypto cycles would be wise to recognize that it's a crowded trade.

My friend @BCBacker is legit one of the best in the game. What he shows here is worth being mindful of. 👇 pic.twitter.com/tmXzo0brlH

The funny thing is he's using a commonly repeated pattern (fib retracements) to disprove a commonly repeated pattern (bitcoin cycles). Of course, anything is possible, but it is highly improbable that the price of bitcoin goes kerplunk.

The reason for bitcoin cycles is not necessarily the mechanical halving cycle, it is also the social proof cycles and psychological market cycles.

Last thing I'll say about this, and it's kind of long, is that most of these bad takes on the odds of bitcoin crashing are based on bad takes about monetary economics in the first place. They think QE is money printing and bitcoin can't go up if the dollar is going up and stocks are crashing.

The fact is in bitcoin's existence, the dollar has only gone up, yet bitcoin succeeded. We've been in a monetary shortage condition globally, where debts rise faster than our ability to pay them back. Think of an individual who lives paycheck to paycheck on a credit card. Sure, the initial spending on credit is money printing but when that bill comes due, you are in a money shortage. We are in a global money shortage where we continue to rake up the unpayable debt to just live and service the existing debt. This doesn't end in inflation, it ends in deflation. And what people do in those times is look for a monetary alternative.

The powers that be cannot allow the rollover to fail in a credit-based system. It's different if you have a backing to your currency, but in a credit-based system, you must roll it over. That means a return to bailouts, ZIRP, and asset price inflation (credit creation is narrowed to "safer" assets). None of that is bearish for Bitcoin.

Macro

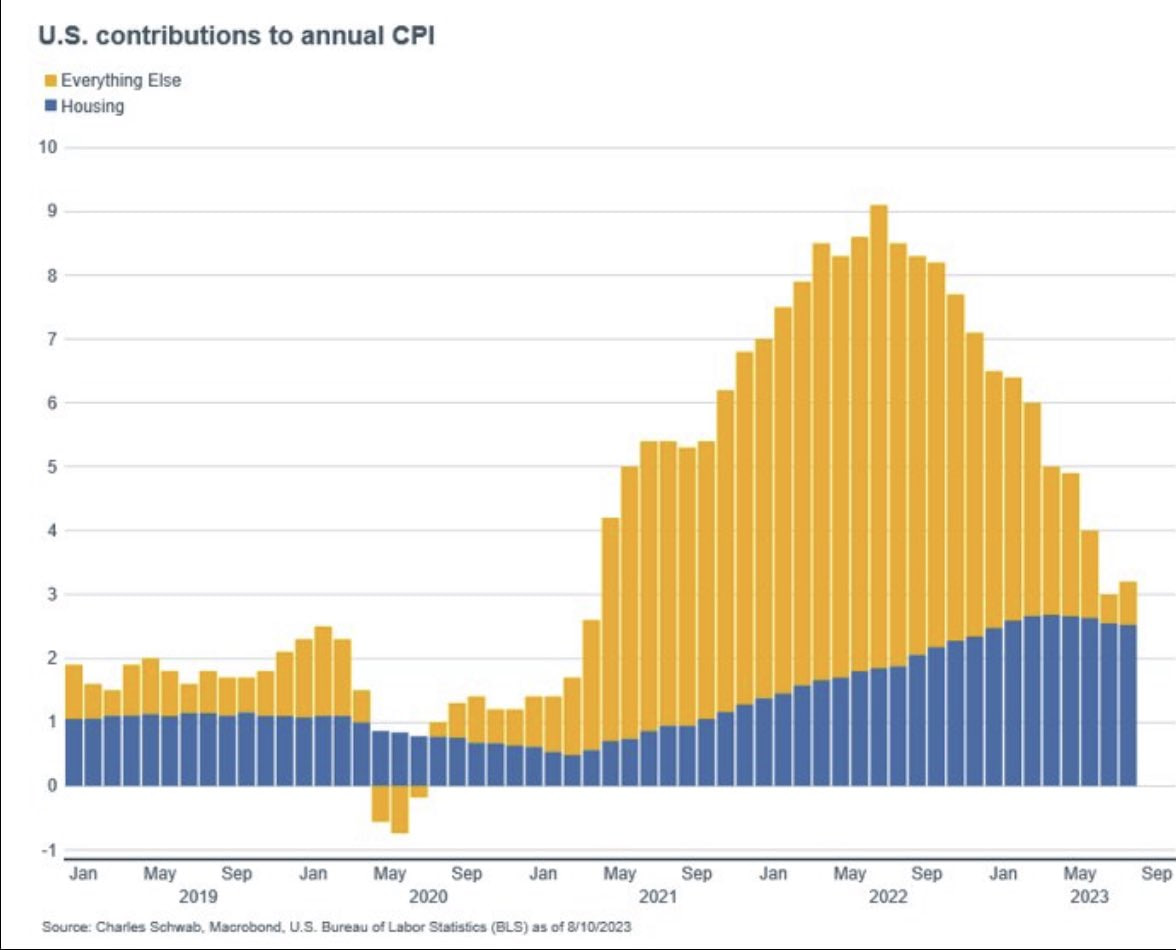

- Inflation is Dead

I spent a lot of time last week talking and thinking about the CPI. This chart below is a WOW. Without shelter prices rising CPI would be very close to zero. Shelter is a lagging component, without a mind of its own, it will also come down. We are starting to see it already.

One factor that will keep shelter more sticky is mortgage rates. They just passed 8% on a 30-year mortgage. That can keep Owner Equivalent Rent higher as owners price in interest expense as well. But rates will come down, too. They'll probably come down very fast when they do, and then OER will drop rapidly as well. Probably into negative territory on CPI.

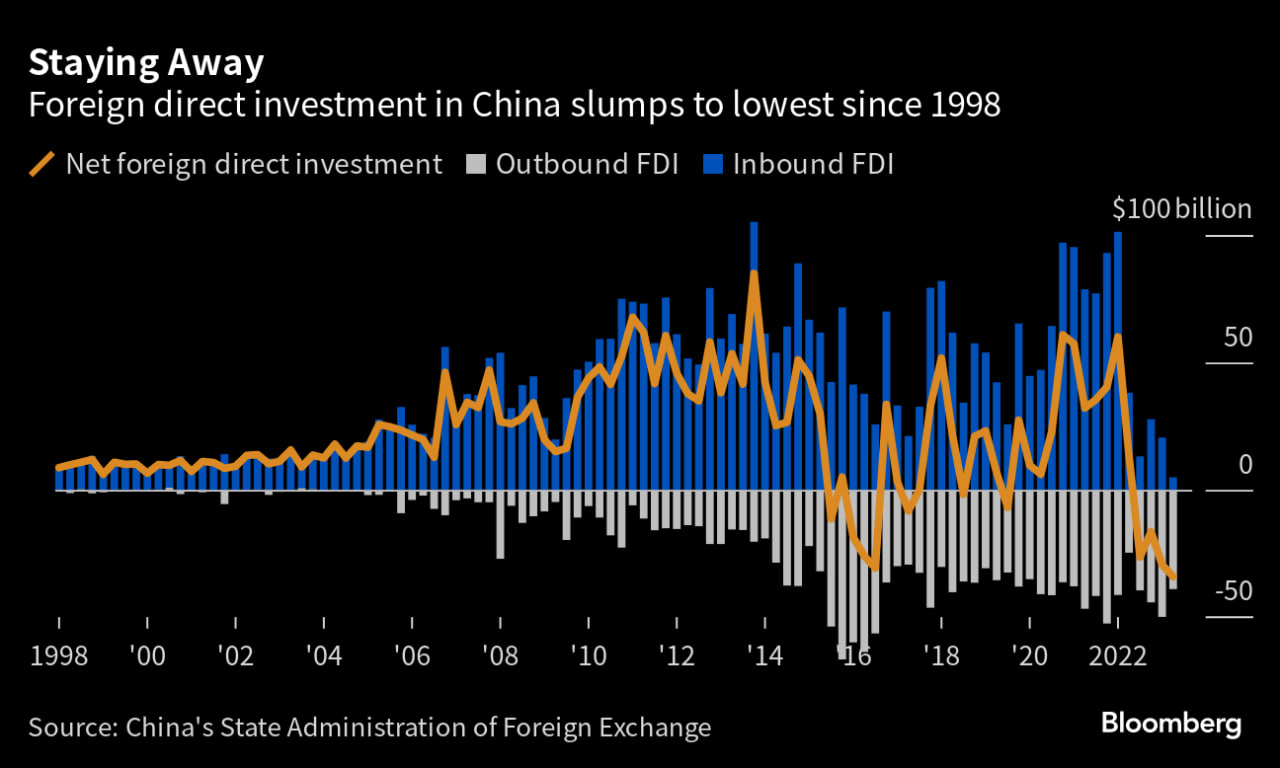

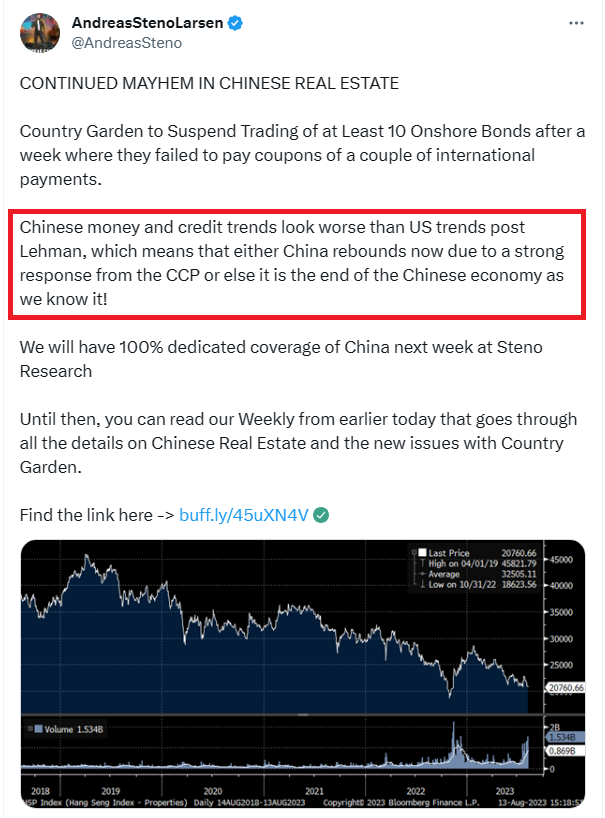

- China is collapsing as we speak

Comparisons are starting to be made in the mainstream financial press between China today and Japan 1990. I've been making that comparison for years.

Things are happening fast right now for China. It was just July 1st that they sacked their central bank chief, and put in place Pan Gongsheng, an expert of foreign currency exchange program (SAFE program), in order to stop the bleeding and try to save the currency. The reason it failed is because the Yuan weakness is structural. You can't simply do some fancy FX swaps to save the currency if your entire economic model is collapsing.

China is becoming toxic to investors. And remember, these foreign investors also act as a proxy for foreign demand of Chinese exports. Yikes.

Chinese real estate is in free fall. This is 70% of household wealth evaporating. Also think of this in context that the CCP is trying to transition to a consumer led economy, because they know they are completely dependent on globalization and other people buying their stuff. The CCP is pushing for this right as 70% of household wealth is disappearing.

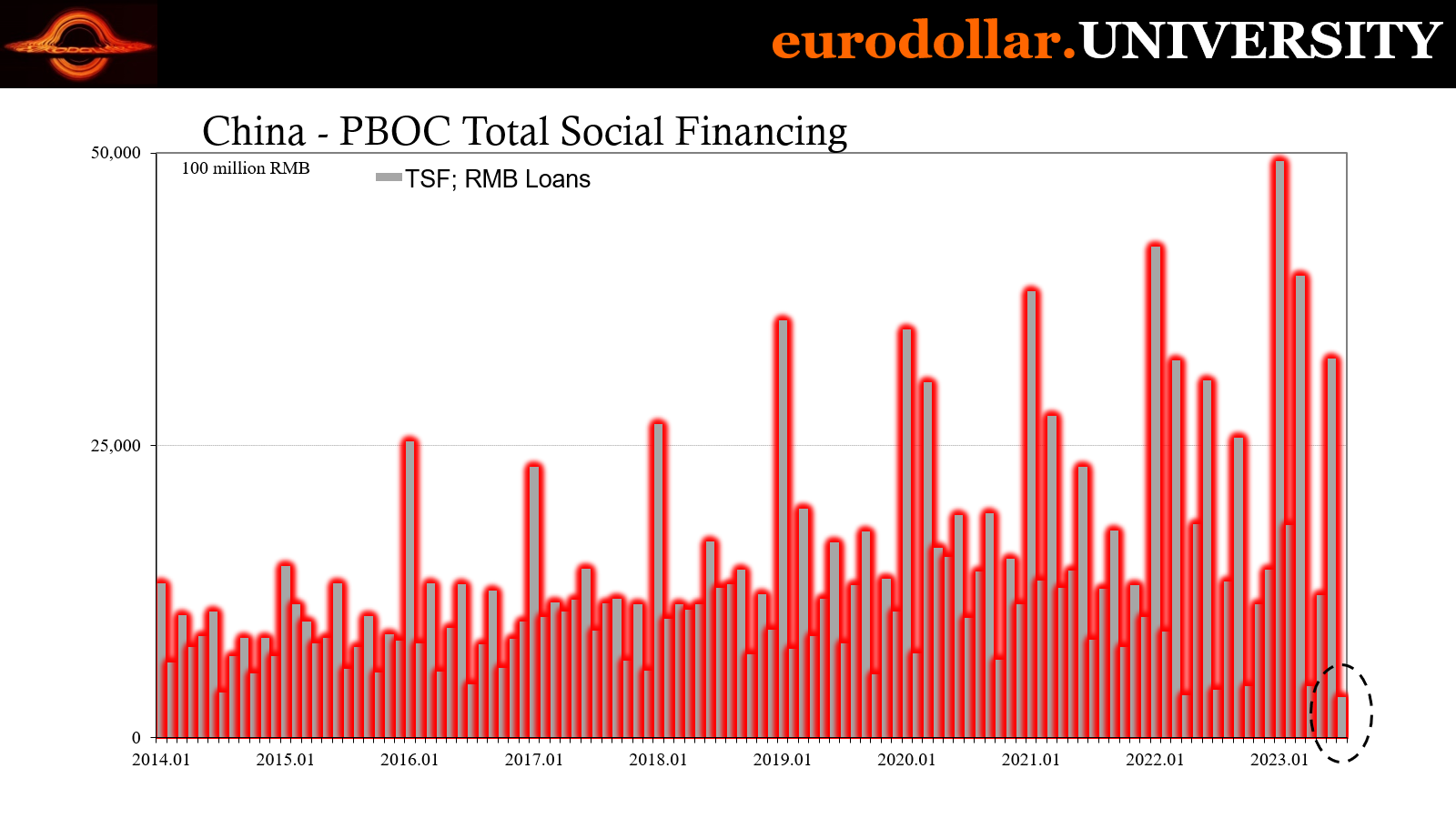

And lastly, their bank lending was the lowest in July since the 2009!! Money is printed through lending because a robust economy needs it. No economic activity, no loans. In other words, China's economy is grinding to a halt and people are fleeing the yuan.

Price Analysis

Join the Professional tier for in-depth price reports and actionable forecasts! Sign up today!

Bitcoin Charts

Last week, I said, it was "GO time." Well, we just got more boring sideways. Price has been so boring, media companies in Bitcoin are having to layoff people. Coindesk, the most widely read news outlet in Bitcoin, is being sold off. It's true, they are owned by struggling Digital Currency Group, but it's obviously losing money.

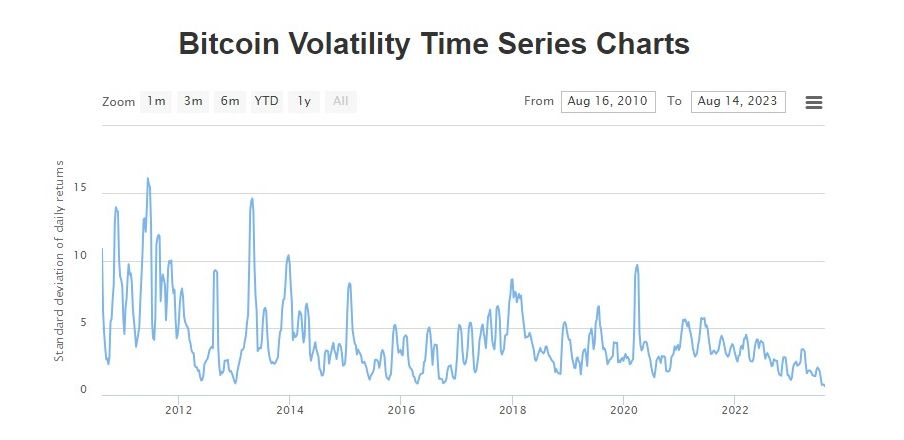

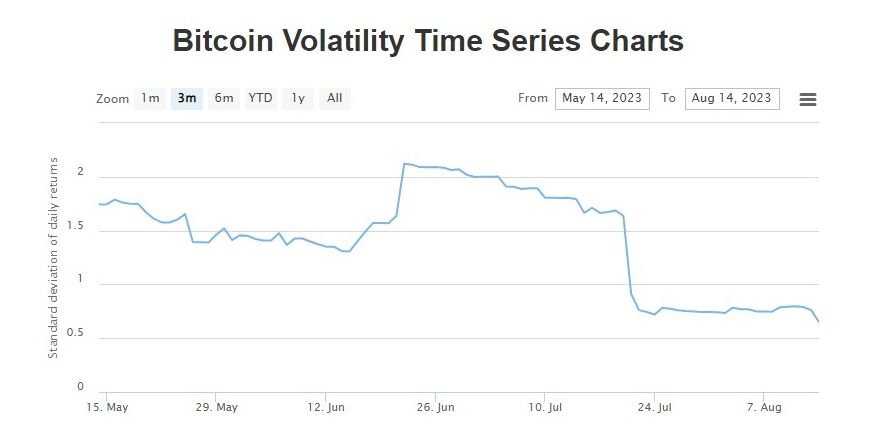

Volatility continues to fall to new All Time Lows!

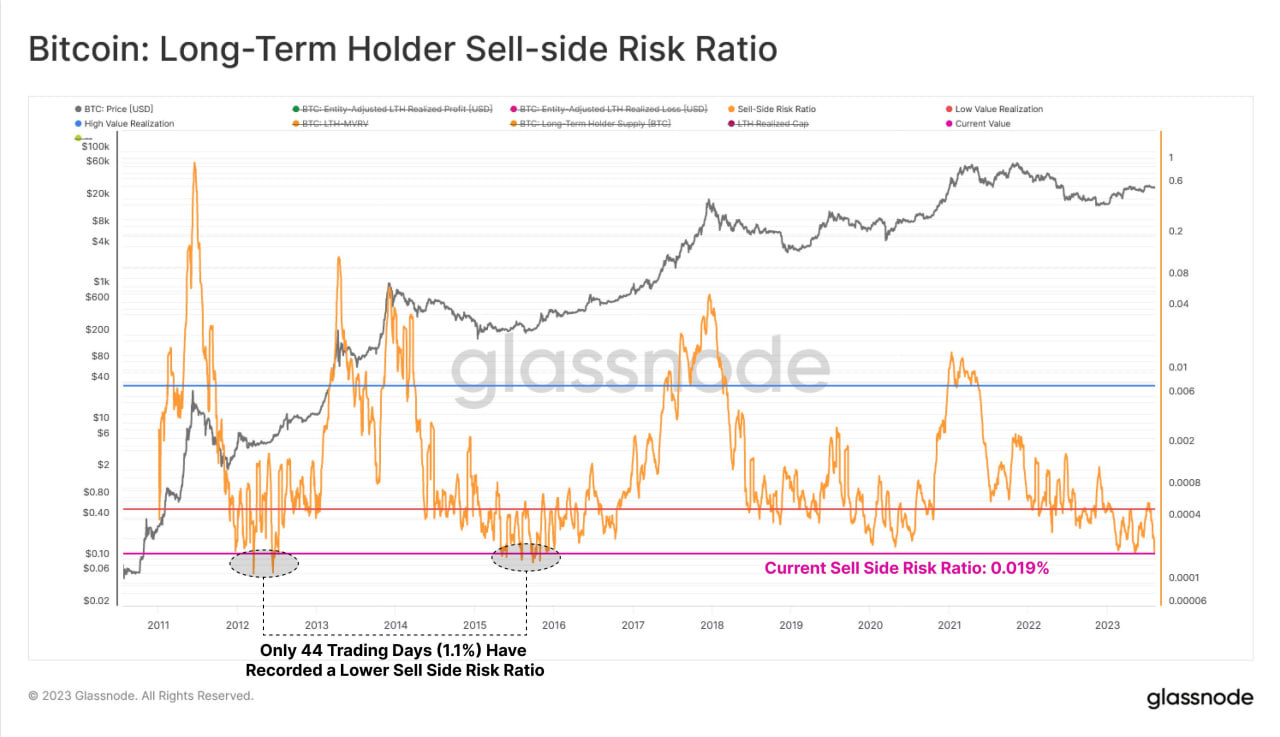

Sell-side risk is also very low.

Nothing has changed on the weekly.

I still think something BIG is going to happen soon. The ETF decision could be it. Only 18 days until the group comes up for approval.

If the price creeps up into the tip of this triangle pattern during those 18 days, or we see a major price spike, I will take that as a signal we are about to rocket even higher on ETF approval. If we fall out of this pattern, ETF approval becomes very questionable IMO.

Get my short, medium and long term forecasts on Market Pro!

Mining

Headlines

The positive research and headlines about Bitcoin mining continue. And this paper is getting MASSIVE attention.

In it’s first 48 hours the Bitcoin mining research paper is now #1 in views (6 months) and has an altmetric score of 344. This paper is now in the top 5% of all papers ever tracked (24+ million) by altmetric

The paper states what is starting to become common knowledge, that Bitcoin mining is a huge net positive. The lies used to attack Bitcoin for so long are completely destroyed.

The analysis states that a series of “unique characteristics” set miners apart from other energy buyers, helping provide “additional income and ancillary services” to renewable energy grids. Some of these characteristics include flexibility of load, interruptibility, portability, and waste heat utilization.

For example, miners can help absorb excess power generated by wind and solar facilities, helping those firms become more profitable. They also could be used to monetize stranded natural gas and landfill gas that would otherwise be flared into the atmosphere as highly pollutive methane, using containerized mining and generator solutions.

Just a few weeks ago, I was reporting on the record amount of Bitcoin leaving miners' wallets and going to exchanges. The public companies never were a big part of that group, but now they are starting to stack aggressively.

Not only has RIOT’s revenue from bitcoin mining increased, but their actual bitcoin holdings have also grown substantially. As of June 30, Riot held 7,264 BTC with the price of each BTC at $30,477.

Difficulty and Hash Rate

Bitcoin's difficulty adjusted a tiny amount last week by 0.12%.

Mempool

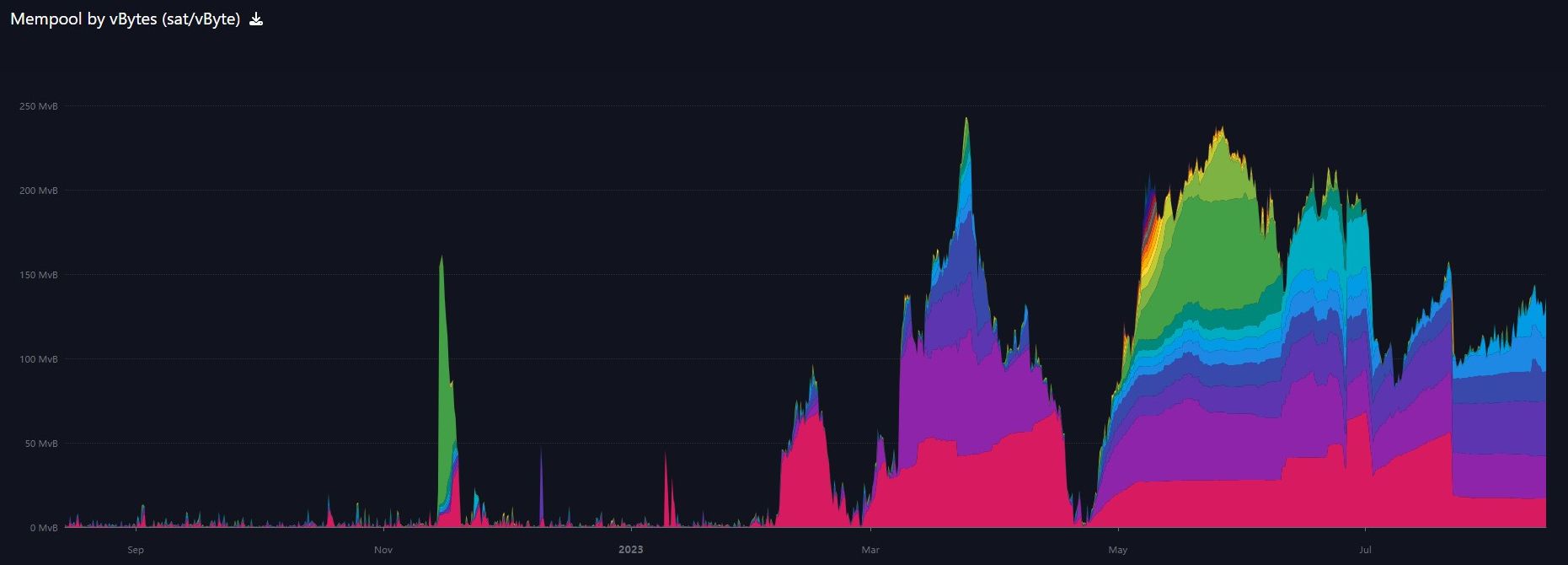

As you can see in this week's mempool chart, transaction traffic has remained very steady as the mempool increased marginally. Despite this, fees have actually dropped slightly since last issue. From $0.89 to $0.58 at the time of writing.

Ordinals

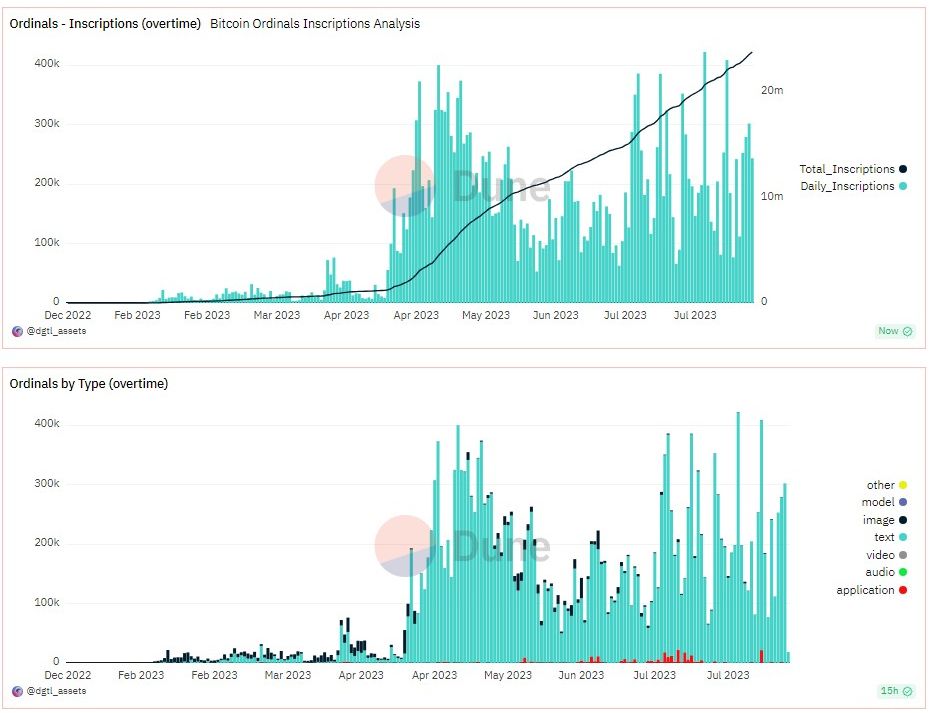

A quick update on Ordinal traffic. It seems to be remaining somewhat steady over the last couple of months. There is a weekly pattern with those spikes all occurring on Sundays. Yesterday, the 6th, July 30th, 23rd and so on. Notice they are almost exclusively "text" based ordinals, which are much better from a blockchain bloat perspective.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

August 14, 2023 | Issue #252 | Block 803,150 | Disclaimer

* Price change since last report

** According to mempool.space