Bitcoin Fundamentals Report #242

This week, a quick debrief on the Bitcoin 2023 conference in Miami, other news, macro, bitcoin price analysis, mining sector news and lighting news.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Sideways |

| Media sentiment | Neutral |

| Network traffic | High |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $26,854 (-$651, -2.4%) |

| Market cap | $0.521 trillion |

| Satoshis/$1 USD | 3,723 |

| 1 finney (1/10,000 btc) | $2.69 |

| Mining Sector | |

| Previous difficulty adjustment | +3.2166% |

| Next estimated adjustment | -0.1% in ~9 days |

| Mempool | 215 MB |

| Fees for next block (sats/byte) | $1.92 (51 s/vb) |

| Median fee | $1.66 |

| Lightning Network** | |

| Capacity | 5,394.47 btc (+0.0%, +2) |

| Channels | 70,992 (-1.3%, -944) |

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

Bitcoin

The major news event this week was, of course, the Miami conference Bitcoin 2023. I live chatted by thoughts for several panels and speakers. The Telegram was quite active during the event, so if you aren't subscribed on there, I recommend doing that to get the most out of your subscription.

- Miami Conference, Bitcoin 2023

I've been to 3 of the Miami conferences and each one is slightly different. 3 years ago it was Nayib Bukele, last year it was FTX and crypto confusion, this year had two main themes 1) clarity of mission, and 2) the politicians. Let me break those down a little bit more.

1) Clarity of mission

The altcoin scams were noticeably absent this year. Last year, FTX was a major sponsor of the Miami event and altcoin banners were everywhere. This year, there was none of that.

The event was definitely smaller in attendance and scope, eg the arena itself was not as cavernous. They used the space much more wisely. But it isn't clear if there were fewer bitcoiners, or fewer altcoiners and "crypto bros". I think the latter.

Last year, the bitcoin signal was lost among the scammy pump-and-dump altcoins and crypto casinos (exchanges). To an outsider, last year's message and mission of the space was extremely cluttered. DeFi, NFTs, blockchain, smart contracts, etc. What was the direction? What was the underlying force? Scams tend to obscure the truth from further investigation, else you will look under-the-hood so to speak, and notice it's just a scam. They obscure the meaning of words and the real uses of the technology. That's on purpose in order to sell you snake oil. None of that misdirection and hype-driven activity was present this year.

The messages this year were clear, "Bitcoin is the innovation, Bitcoin is not crypto, crypto is a scam, Bitcoin mining is not harmful it is beneficial, Bitcoin is a major force in the world for freedom and must be respected."

My hope for this conference, and frankly all of 2023, was to drive a wedge between "crypto" and bitcoin. I think they were very successful in doing that at Bitcoin 2023!

2) Politicians

We traded shitcoins for politics this year. Bitcoin is becoming a very important voting block in the US, and it started to get the respect it deserves.

Senator Cynthia Lummis spoke about all the efforts on Capital Hill and she reiterated the uniqueness of bitcoin when it comes to future regulation.

Of course, Robert F Kennedy Jr made a fantastic speech outlining bitcoin as unique and as a powerful force for freedom in the world.

Vivek Ramaswamy, polling 3rd in the Republican party for President, called bitcoin the key alternative needed to tame the Federal Reserve and out of control spending.

Tim Ryan and David McIntosh announced a bipartisan education initiative teaching why bitcoin not crypto. McIntosh runs the largest Republican Super PAC and Tim Ryan is a former Democrat Congressman with influence.

Tulsi Gabbard also spoke (I didn't get to see her comments yet, but she is an important voice in US politics).

Overall, the presence of the politicians shows bitcoin has arrived on the stage of power politics.

- Tether to invest 15% of profits toward Bitcoin on ongoing basis!

In massive news that flew under the radar for most people because of the conference this week was the announcement that Tether is going to be investing 15% of its operating profit into bitcoin on an ongoing basis. Absolutely massive! A constant buying pressure of 10's of millions of dollars a month.

Tether🧡#Bitcoin

— Tether (@Tether_to) May 17, 2023

Starting this month, Tether will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin. These Bitcoin shall be considered on top of the minimum reserves assets that 100% back tether tokens.

More 👉 https://t.co/7zC2swgwWH pic.twitter.com/BOcSDjjmDf

Cryptocurrency giant Tether on Wednesday said that it’s going to purchase hundreds of millions of dollars’ worth of bitcoin to back the world’s largest stablecoin.

The company said it would invest 15% of its net profit into bitcoin to “diversify” the reserves that back its USDT token, which aims to stick to a 1-to-1 peg to the U.S. dollar.

That would amount to roughly $222 million, based on the company’s last attestation report, which provides a breakdown of the assets that make up its USDT reserves as well as excess reserves and profits.

Macro

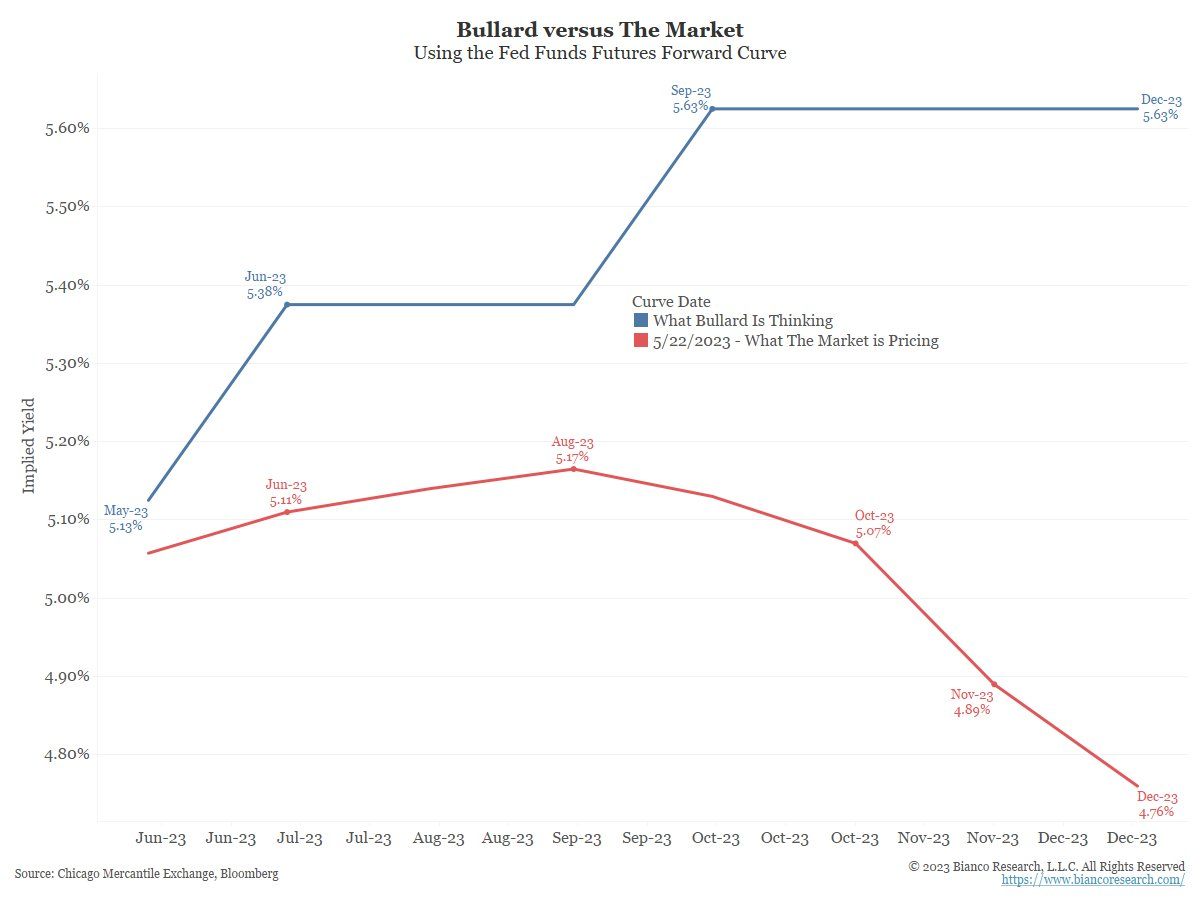

- Fed Officials Think More Rate Hikes are Necessary

Remember, the jawboning is the policy. Right now, the Fed is trying to talk the market out of pricing in rate cuts.

FED'S BULLARD: THE FED WILL HAVE TO GO HIGHER ON THE POLICY RATE, PERHAPS 50BPS MORE HIKING THIS YEAR.

— Breaking Market News (@financialjuice) May 22, 2023

- European Slide into Disaster Continues

- Demographic Collapse Starting to Get More Attention

I've been talking about the demographic collapse coming for a few years now. We cannot imagine the disastrous effects of the collapse in population.

Demographics also plays a massive role in my short China call. They have the fastest shrinking population today, and it will only take a few years to start seeing the unavoidable problems.

A new documentary called Birth Gap, does a deep dive into the reasons behind the population collapse. What they found was that it isn't that women have fewer kids on average. For example, the average mother isn't having only 1 child, where in the past they would have had 2 or 3. The average mother actually has more children today vs 40 years ago, 2.6 vs 2.5 in 1980.

The modern demographic problem is that fewer women are becoming mothers period. They wait too long to get married, get too captured by a career, and then it is too late. It's the same pattern everywhere modern culture spreads.

The US has the best demographics of the major economies, another reason to be relatively bullish the US. One thing is for sure, this demographic collapse will be talked about much more often in coming years. It is possibly the defining factor of the next 100 years.

Can't see video: Birthgap documentary

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Bitcoin

There was little price action during the Bitcoin conference week. You can see below on the daily chart, that the 100-day MA in blue is acting as support. And on the weekly chart, the 200-week MA is the support.

My red box still captured the low of this formation, but price does not look all that resilient right now. There is a strong bear contingent in the space, mainly consisting of altcoiners who don't know why bitcoin would catch a bid while altcoins whither.

Massive support is forming under the price at $25-26,000. It would take a big bearish turn in the market to break down through that. I could see a dip and bounce in that level though.

Most likely we see a move toward $28,500 soon. Last week, it was $29,000 to break out, but the resistances have come down slightly. See below, the red diagonal trend and the green 50-day MA. Closing a daily candle above those two, at $28,500 would signify a resumption of the price rise.

Stocks hit a new yearly high in one of the most hated rallies in decades.

The deflationary backside of "transitory" is starting to sink in. Economic numbers are bad, CPI is coming down, unemployment started to tick upward, deposit flight from the banks continues. This is a deflationary set up, but not necessarily a shock.

If there is a deflationary shock, like a major bank failure, we should expect bitcoin to take a hit. But short of that, say we just see continued recessionary pressure, bitcoin should continue higher along with stocks.

My 2023 call for higher stocks, bonds, gold and bitcoin has been spot on so far. The next rough patch that could see high levels of stress which could develop into a shock is EOQ Q3. We have 4 months.

Much more on the upcoming issue of Market Pro!

Mining

Headlines

- Mining was huge at Bitcoin 2023!

Bitcoin mining companies had close to 50% of the booths at Bitcoin 2023. It was an impressive mix of infrastructure and innovation.

While on the news desk at the conference, Michael Saylor said something to the effect that, "miners are the front line against regulators for bitcoin. They will fight the battle for all of us."

Also, RFK said in his speech that energy uses will not be discriminated against. The government should not have the power to tell you what you can and cannot do with the energy you buy.

As I said the first day the DAME tax was proposed, Cynthia Lummis at Bitcoin 2023 said, "That isn't going to happen."

She went on to say that mining can easily move anywhere with the energy and it is cleaning up the environment, not harming it. The education of the politicians is one of her biggest goals.

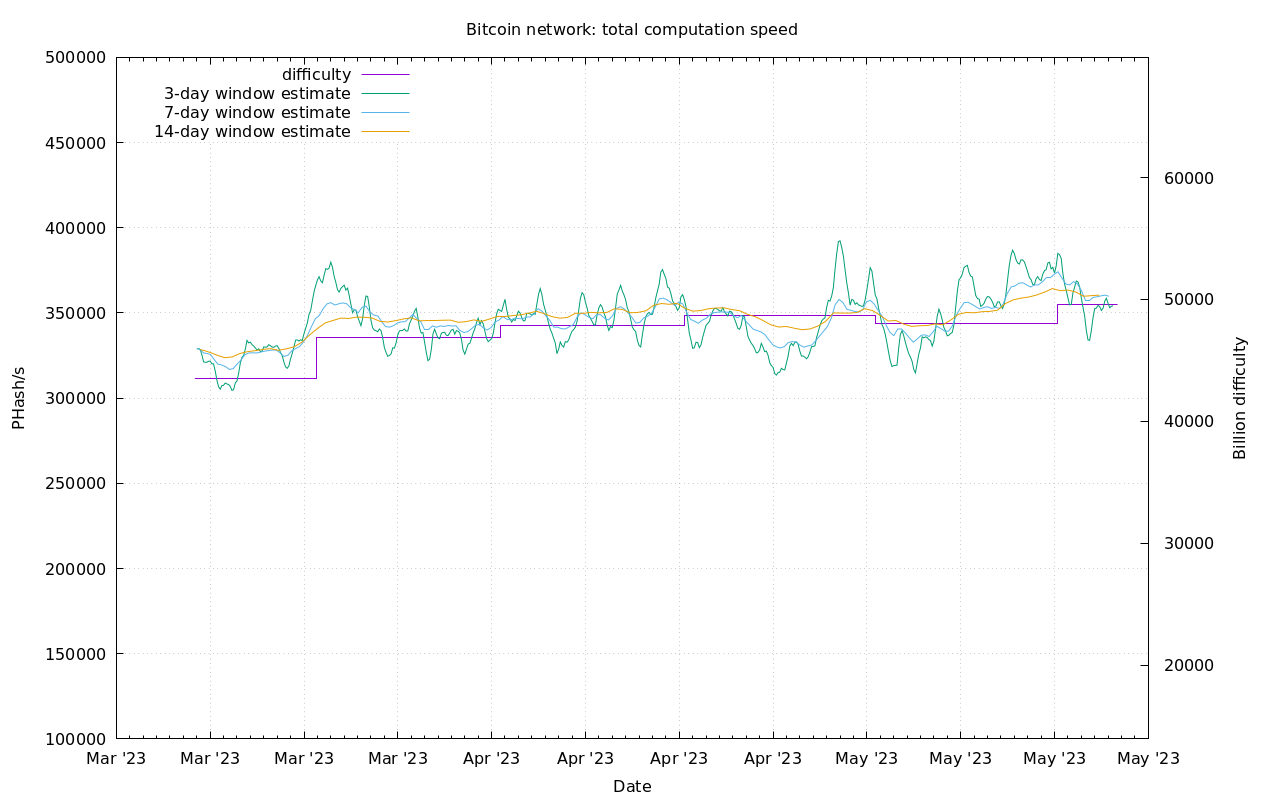

Difficulty and Hash Rate

Another week with bitcoin mining extremely stable. Difficulty adjusted up by 3.21%. From initially being estimated to be a decline by 2%, hash rate recovered over the 2-week period to adjust up.

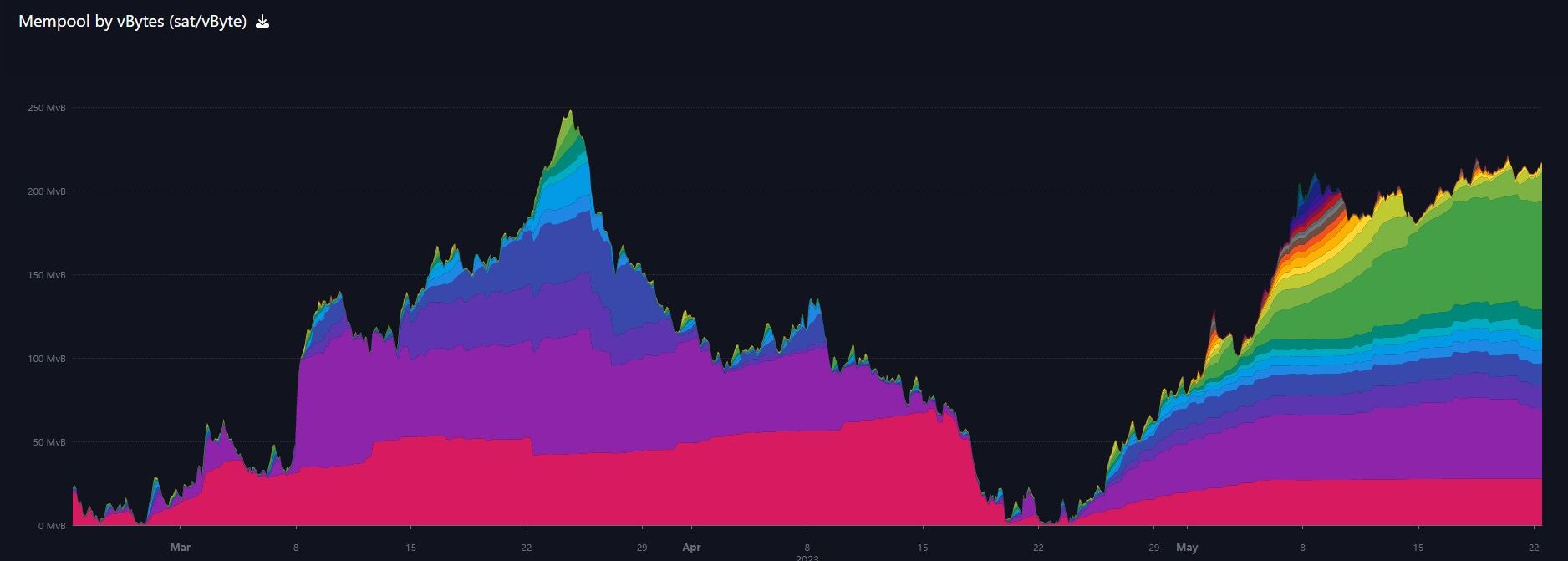

Mempool

The mempool evolution over the last couple of months is very interesting. You can see below, that the mempool is still quite full, but the fees are under control.

Those fees have settled back to around $1 at the time of writing, show massive resilience and adaptability of the bitcoin network.

Lightning Network

Slower week for Lightning Network news after last week's firestorm.

The Taproot Assets Protocol is designed to operate “maximally off-chain” in order to avoid the network congestion that has become an unfortunate characteristic of the Bitcoin network since the inception of the BRC-20 token standard by anonymous developer “Domo” on March 8.

Lightning Labs said Protocol users could soon integrate BRC-20 assets into the Lightning Network, with wallets, exchanges and merchants ported, over instead of needing to “bootstrap a new ecosystem” from scratch.

BRC-20 tokens on bitcoin are used specifically because they are inefficient, as a way to attack bitcoin. There is very little productive or lasting value to these NFTs, so they have to get their pump-amentals from marketing stunts. Causing a fight in the community over block space is a great way to get eyeballs that otherwise couldn't care less.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

May 22, 2023 | Issue #242 | Block 790,919 | Disclaimer

* Price change since last week's report

** According to mempool.space