Bitcoin Fundamentals Report #240

Bitcoin under attack. Is there anything to worry about from high fees and inscriptions? Find out this week.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Breaks support |

| Media sentiment | Negative |

| Network traffic | Extremely High |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $27,861 (-$387, -1.4%) |

| Market cap | $0.540 trillion |

| Satoshis/$1 USD | 3,588 |

| 1 finney (1/10,000 btc) | $2.79 |

| Mining Sector | |

| Previous difficulty adjustment | -1.4511% |

| Next estimated adjustment | -3% in ~10 days |

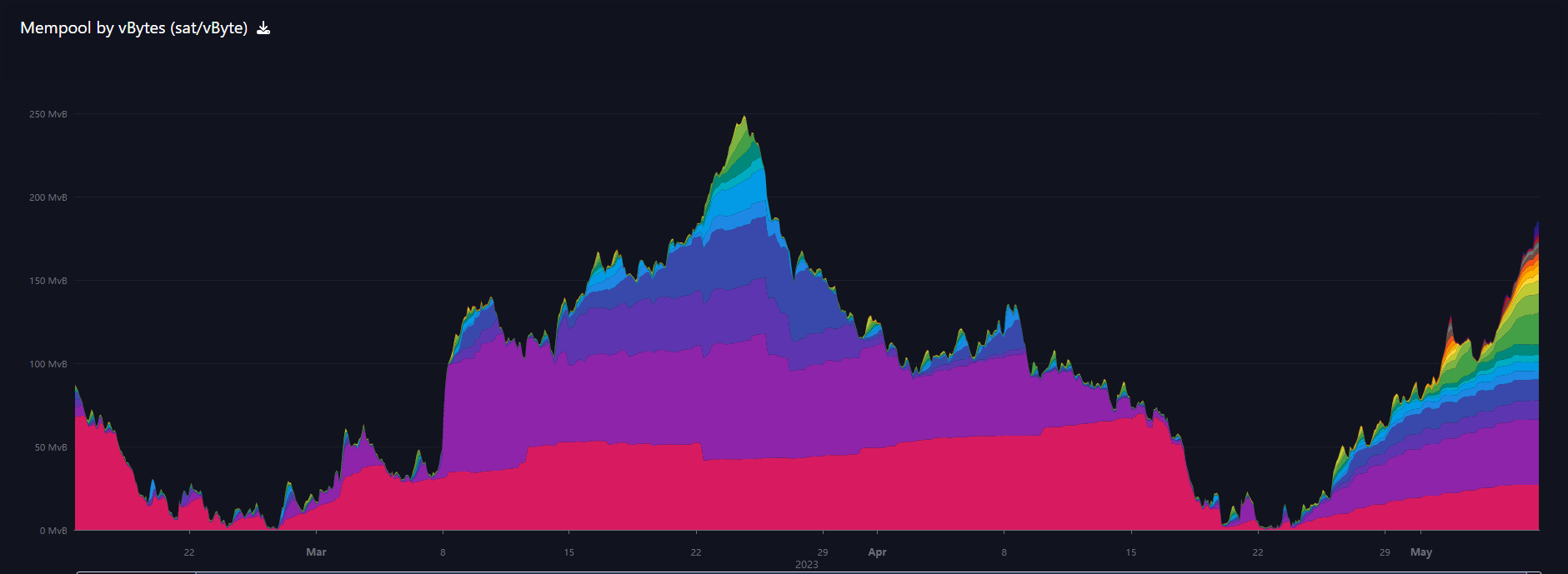

| Mempool | 190 MB |

| Fees for next block (sats/byte) | $14.77 (378 s/vb) |

| Median fee | $13.87 |

| Lightning Network** | |

| Capacity | 5,451.09 btc (-0.2%, -12) |

| Channels | 72,760 (+0.3%, +253) |

In Case You Missed It...

Market Pro

Community streams

- I'm Losing Faith in Bitcoin - Daily Live from 4/17/23 | E343

- Correcting Gold Bugs, plus Important Bitcoin Updates - Daily Live from 4/10/23 | E342

- Plus live streams that haven't made it to podcast yet!

Fed Watch

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

Bitcoin

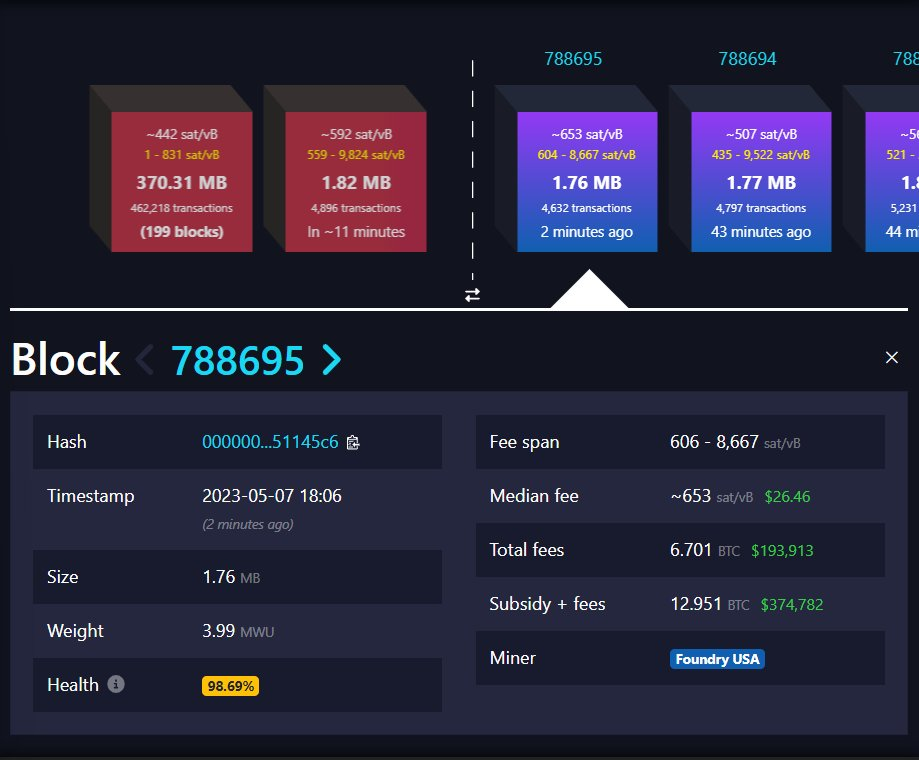

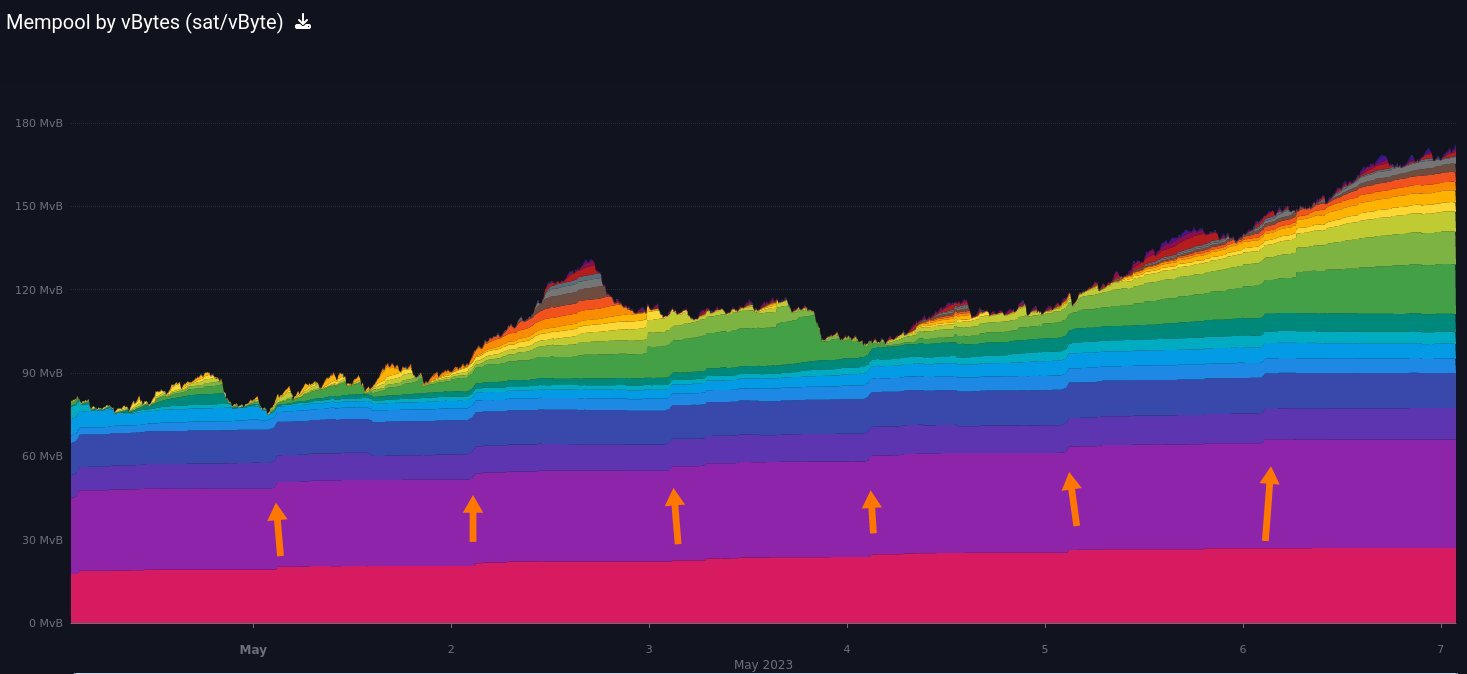

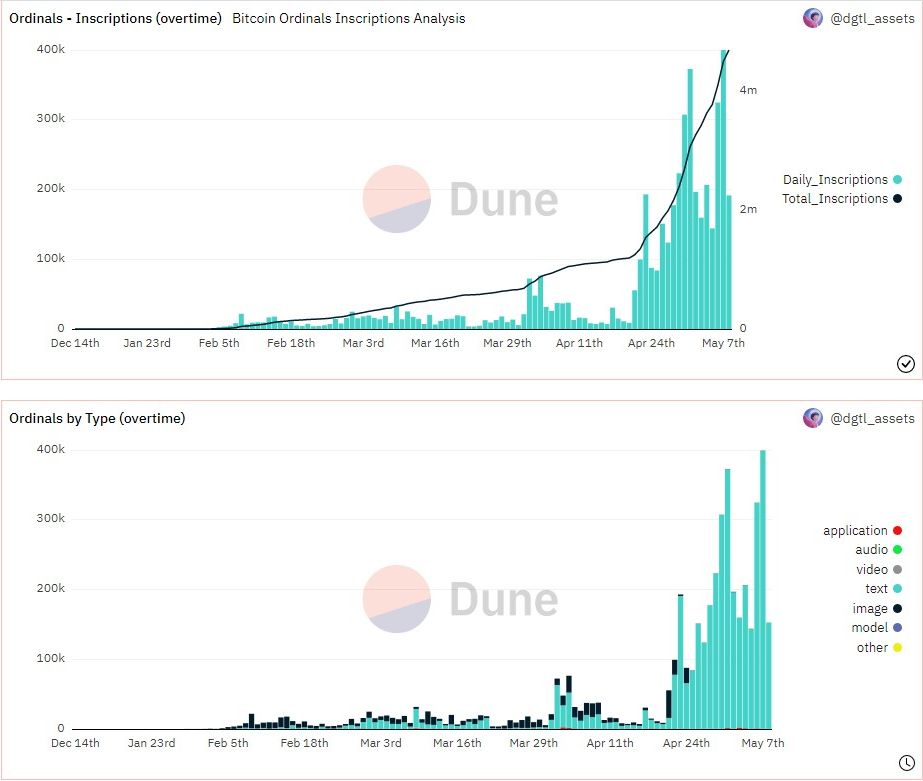

The MASSIVE headline this week is developing as I write, extremely high fees on bitcoin due to inscription traffic.

Supposedly, there was a large Twitter Spaces in which all the pump-and-dump scammers from Defi and NFTs in crypto were talking about moving to bitcoin and pumping inscriptions. The reactions I've seen from bitcoiners is universally negative on the motivations, but fairly positive on the outcome.

These scammers are explicitly trying to harm bitcoin by spamming their garbage NFTs onto bitcoin. They stated that they are intentionally rekindling the scaling debate to take bitcoin to "8MB blocks". This is just a marketing operation. Altcoin scammers business model is struggling badly and they will do anything to draw attention and pivot to new talking points.

LOL. Their plan is ridiculous on several levels:

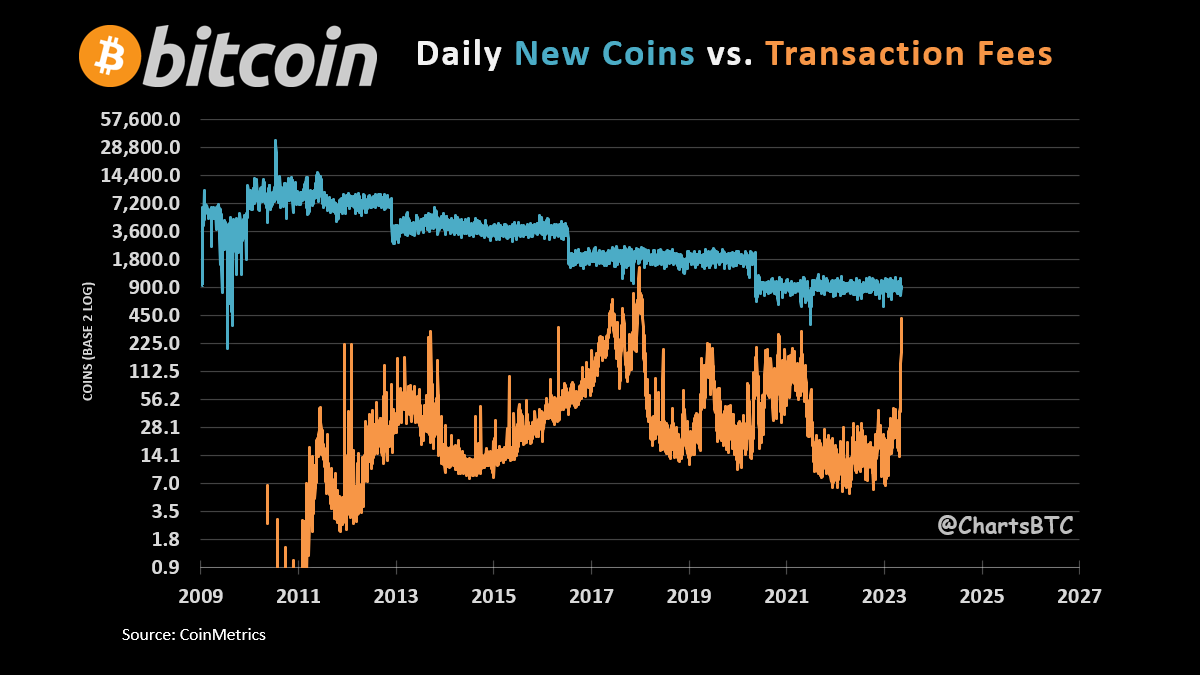

1) High fees are not "bad for bitcoin". They prove bitcoin's long-term security model.

2) Being "on bitcoin" doesn't make their garbage any more viable, or any less fraudulent.

3) Notice the absolute annialation of their fungible alternative to bitcoin arguments. IOW it is all about NFTs now, and not about alternative "monies" or "cryptocurrency".

4) They are spending a lot of money on fees for this marketing ploy. They will either go broke or be forced to buy bitcoin to restock.

5) Regarding scaling: The scaling conflict was a social conflict, never a technical one. Bitcoin cannot hard fork like this period. I've covered this many many times in my content in the past.

6) Attack -> attention -> sell scams. Their main goal is plain and simple fraud, not innovation. Same ol', same ol'. If they were honestly about the innovation, they could easily use the much more efficient RGB protocol or Liquid sidechain. No, the attention is the goal to drive to NON-INNOVATIVE crypto scams.

- @BitPaine has a good tweet thread summary

There are positives and negatives to this spam. It is testing bitcoin's incentives and they are proving perfectly adequate. There are very few negatives to high fees on the base layer, one being pricing out low value transactions.

Taproot made it easier to spam the #bitcoin blockchain.

— Bit Paine ⚡️ ⛓ 648 (@BitPaine) May 8, 2023

There is now an influx of spam transactions.

The mempool is processing them as designed, and fees are adjusting upward as appropriate.

This is resulting in extremely high transaction fees - the highest ever seen on #btc. https://t.co/1MlVNiK3hO

- A block had more in fees than in subsidy

- 421 bitcoins paid in fees yesterday

421 x $28,000 = $11,788,000 in fees in 1 day. This spam is EXPENSIVE and going to bitcoin miners.

- Binance halts withdrawals, mismanaged coins

The recent price dip might be related to Binance pausing withdrawals. They came out and said it was due to network congestion, but they have been doing a very bad job at coin management.

Every night they send out transactions to rebalance their wallets. Well, those have been getting caught in the bitcoin network and not clearing. It is possible they don't have the infrastructure to pay withdrawals. Guess they don't know how to use Replace by Fee (RBF).

Macro

- Hugh Hendry is my spirit animal, crushes inflationistas

I haven't been following Hugh for very long. He just recently burst onto the macro commentator scene. He sounds an awful lot like Jeff Snider and myself, but more colorful. In this clip, he spins the Federal Reserve and inflation narrative on its head.

"The Fed is in the business of camoflaged deceit, the aura that they are all powerful."

"CPI is transitory. I would anticipate, in 90 days, we are going to see CPI running under 3.5%. By the end of year we're going to be close to zero again."

Can't see video? Original here

- BIG week for economic numbers

This week we have April CPI, PPI, and the SLOOS survey of banks from the Fed.

This article breaks down these events. Follow my content for coverage of all of this!

Current forecasts for M/M CPI is around 0.6%. I will be surprised by a number that high.

The SLOOS data is a survey of banks, where the Fed asks them if they are tightening lending standards and what is happening to loan demand. Last release saw a massive swing toward deflationary conditions, where standards were tightening and demand was falling off a cliff. This is the most important inflation indicator.

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Last week's Market Pro letter was delayed. Not much price action. I'll be getting a VERY important issue out tomorrow, so subscribe to be ready for that drop!

Last week

Testing the this MA again so soon after failing to break higher is a sign of weakness. I would not be surprised if it failed to hold it this time.

It looked as though we could break higher out of this consolidation pattern on Saturday, but it was a fake out. Now we are squarely falling below the 50-day and pattern.

The stock market is holding up better than bitcoin right now. The dynamic between these two is interesting. Bitcoin has been a leading indicator for the stock market, and the stock market has been a BS detector for bitcoin dips.

I do not expect this to be a major dip. $27,000 has been a very strong area for the price in the last couple of months (green shaded area below). The red box is where several important support levels come together and the most likely place for a bounce if there is a further sell off.

The 200-week (red line) and 100-day (blue line), as well as several other indicators. No bearish divergences on the daily or weekly either, no bearish indicators for the most part at all.

Last, but not least, the high fees and inscription scandal is initially bearish, that's why we see the tiny dip right now, but soon they will run out of bitcoin to pay fees. At that time they will have to buy that bitcoin back.

Much more on the upcoming issue of Market Pro!

Mining

Headlines

According to Blockridge’s data, all mining companies sold 100% of their holdings, in the latter half of 2022.

However, for the first time in over six months, the liquidation ratio decreased to below 100% in March, subsequently dropping further to 95% in April. Indicating that these companies had slowed down on selling off their BTC holdings.

Important to note, the above is about "public bitcoin miners". Miners hodling more coins is happen as scammers are paying outrageous fees. So, those fees are likely to stay in reserves of the miners and lead to a supply squeeze.

CryptoQuant, however, is showing overall that miner reserves continue to contract. This is one metric I'll be watching, and will report on it again next week.

The back-and-forth over the new DAME tax (Digital Asset Mining Energy) is just heating up. Personally, I do not think it will get anywhere and is a great reason to get bitcoin's energy narrative out to the public more.

It is also funny that it is estimating to net $3.5 billion for the government over 10 years. Pennies.

Cryptocurrency miners based in the United States could soon face a tax equal to 30% of the cost of electricity they use if President Joe Biden’s proposed budget for the fiscal year 2024 is approved by Congress, but the proposal has sparked debate about whether it would actually decrease global emissions and energy prices.

Great response from Marathon Digital Holdings’s CEO Fred Thiel:

Either the administration is utterly misguided, or this proposed tax is nothing more than a move to hamper this industry for political reasons, because it is not in the interest of the people, the energy grid, or the environment.

Difficulty and Hash Rate

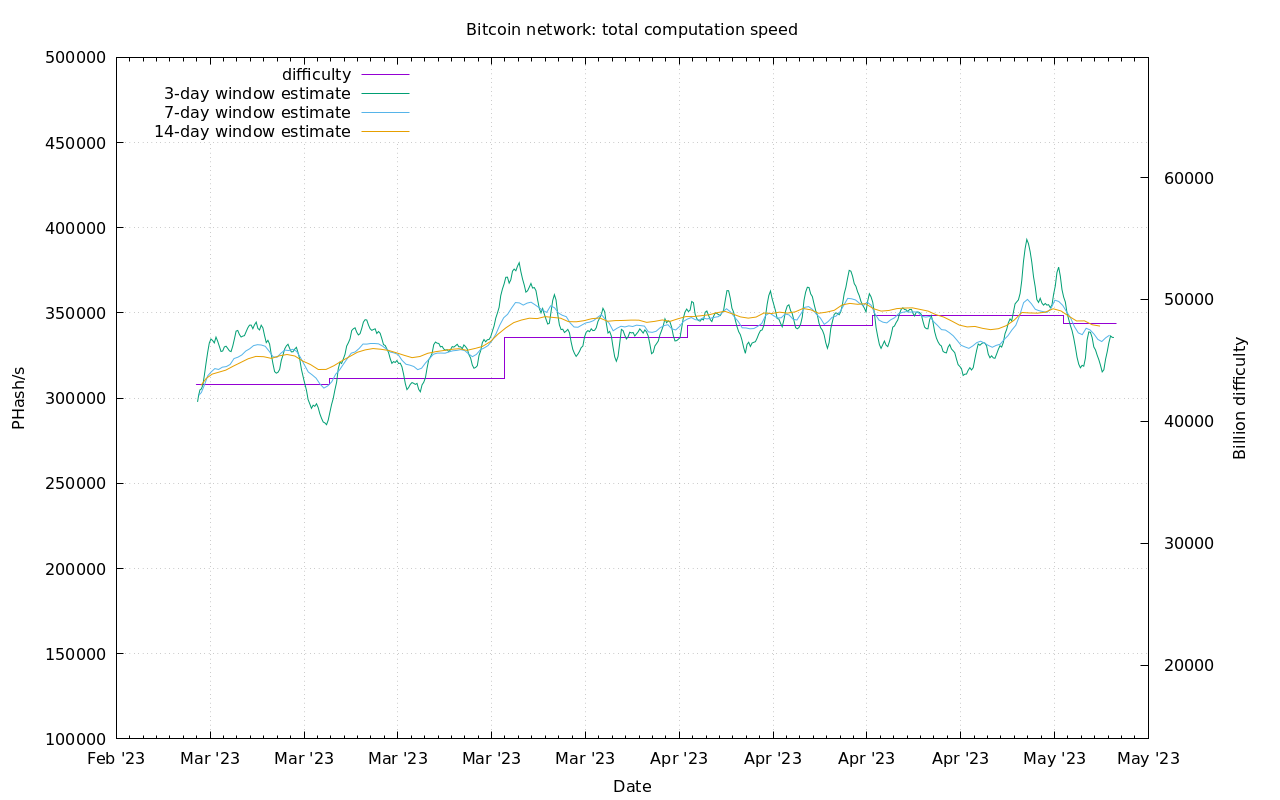

Once again this week, Bitcoin mining is stable, with hash rate only marginally more volatile than the week prior.

The network had the first bitcoin difficulty reduction in 6 adjustments this week. It was small but still negative, -1.45%. With 10 days to go until the next adjustment the current estimate is for another negative move, this time -3%.

Mempool

The mempool is at the center of the recent scandal over fees. The more backlog there is, the more it costs to get your transaction confirmed in a timely manner.

I have been pointing out the jump in inscriptions fore a couple weeks now. Here's a current look.

Many of the new inscriptions are still waiting to be confirmed, so the number SENT is a lot higher than what this chart shows of the number already confirmed.

Lightning Network

Lots of news this week in Lightning Network!

- Microstrategy announces massive integration with Lightning

Microstrategy integrating Lightning Rewards internally with Salesforce, Zoom, Adobe, and MoveSpring to incentivize employees to educate themselves, share their knowledge, hit their fitness goals, and more. pic.twitter.com/ZPvqmiAc8V

— Sam Callahan (@samcallah) May 4, 2023

- Binance adds Lightning Network support due to high fees

To prevent a similar recurrence in the future, our fees have been adjusted. We will continue to monitor on-chain activity and adjust accordingly if needed.

— Binance (@binance) May 8, 2023

Our team has also been working on enabling BTC Lightning Network withdrawals, which will help in such situations.

Bitcoin companies were forced to make changes when transaction fees were roughly this high in January 2018. Batching and SegWit were the main improvements added then. Layer-2 options like Lightning Network and federated sidechains needed this time around.

My take on this is like Kyle says above, this era in bitcoin will force improvements. It also exposes the weakness in courting low value transactions as the killer use case for bitcoin at this time. Those things will come, but it is much easier to do and much harder to attack high value settlement. A $20 fee is nothing to a $1 million transaction.

Lightning completely ceases to work if in a high fee env.

— Hampus (@hampus_s) May 2, 2023

Because HTLCs below the dust limit won't be possible settle onchain. So if the txfee is $100, it means every payment under $100 will be trusted & insecure.

We need to talk about scaling. Not playing around with ordinals. pic.twitter.com/b8BwWMZ8sK

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

May 8, 2023 | Issue #240 | Block 788,807 | Disclaimer

* Price change since last week's report

** According to mempool.space