Bitcoin Fundamentals Report #239

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Holding support |

| Media sentiment | Negative |

| Network traffic | High |

| Mining industry | Very stable |

| Price Section | |

| Weekly price* | $28,248 (+$994, +3.6%) |

| Market cap | $0.546 trillion |

| Satoshis/$1 USD | 3,540 |

| 1 finney (1/10,000 btc) | $2.82 |

| Mining Sector | |

| Previous difficulty adjustment | +1.7220% |

| Next estimated adjustment | -2.3% in ~3 days |

| Mempool | 89 MB |

| Fees for next block (sats/byte) | $1.86 (47 s/vb) |

| Median fee | $1.74 |

| Lightning Network** | |

| Capacity | 5,462.67 btc (+0.6%, +33) |

| Channels | 72,507 (-0.6%, -436) |

In Case You Missed It...

Market Pro

Community streams

- Where We Are and Where We Are Going in Bitcoin & Markets - E341

- Plus live streams that haven't made it to podcast yet!

Fed Watch

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

Bitcoin

- Samson Mow of Jan3 made a speech in Mexico

In this video Samson lays out three main paths countries will take to Bitcoin adoption.

1- Add Bitcoin to the nation's treasury.

2- Bitcoin bonds and mining.

3- Enact laws allowing for Bitcoin to be used as currency

Can't see video? Original here

- Old video of Gary Gensler surfaces where he calls Bitcoin and many altcoins commodities not securities

The "crypto bro" crowd continues to latch onto anything they can find in an attempt to head-off the seeming inevitable crackdown by the SEC on their innovative Ponzi and pyramid schemes.

This video is of Gary Gensler in 2018 while teaching at MIT about blockchain. He was mistaken in this video. Plain and simple. He was speaking from an outside observer/professor/consultant position, but once he became the Chairman of the SEC, he learned more and believes differently today. This is not evidence that Coinbase or Ripple Labs can use in court.

Can't see video? Original here

- Coinbase starts a public manipulation campaign

First things first, this is hilarious and exactly inline with shitcoiners' modus operandi. According to them fraudulent shitcoins are legit progress and innovation, and the SEC is to blame because they don't believe that. They are pushing a layer two gaslighting operation in the attempt to manipulate public opinion.

They can trick the crypto bros into believing Ponzi and pyramid schemes are legit innovation and progress, and now they are trying to do the same to regulators and the general public. Sickening.

Cory ruthlessly points to the SEC's response to their IPO registration. I won't quote it all here, but these are the brief highlights:

We note your disclosure that "[t]he test for determining whether any given crypto a is a security is a highly complex, fact-driven analysis that evolves over time, and the outcome is difficult to predict." Please emphasize that this test is a legal test and is different than your scoring model, which is not a legal standard and only a risk-based assessment that does not preclude legal or regulatory action based on the presence of a security.

We note your disclosure that "[p]ublic statements by senior officials at the SEC indicate that the SEC does not intend to take the position that Bitcoin or Ether are securities (in their current form)." Please revise this risk factor to clarify that Bitcoin and Ether are the only digital assets as to which senior officials at the SEC have publicly expressed such a view, and further clarify that as to all other digital assets there is currently no certainty under the applicable legal test that such assets are not securities, notwithstanding the predictions of your scoring model.

Cory adds in his thread: "the above section does NOT contemplate Ethereum as an interest-bearing POS coin that centralizes even further over time by design."

Macro

- Stanley Druckenmiller takes aim at the dollar

Druckenmiller is an investment legend and he's a solid bitcoiner, but I disagree with both parts of this call. IDK if he is short the dollar credit-based "system" or the dollar's purchasing power? Two very different things.

Shorting the credit-based system is a deflationary call. This is my position. As credit markets fracture, dollars become scarce relative to debts. That will boost the value of the dollar relative to other currencies.

Shorting the dollar's purchasing power is the opposite of that, it is an inflationary call. For the the credit-dollar to expand you need expanding economic activity. That is VERY unlikely to happen.

Druckenmiller is a legend, and I feel hubristic to contradict him, but he is afflicted with a the inflationism disease, which stops him from seeing modern money correctly IMO.

"Stanley Druckenmiller is betting against the US dollar as his only high-conviction trade in what he believes is the most uncertain environment for markets and the global economy in his 45-year career."

— IV (@iv_technicals) April 25, 2023

- via the @FinancialTimes pic.twitter.com/kOvkk2NM0d

- Oil closes the OPEC+ production cut gap

Put quite simple, there is so little global demand, even with the OPEC cuts, the oil price keeps falling. I'll add that the cuts effect on raising prices hurts the recovery of demand back to pre-crisis levels. The global economy needs cheaper energy to stimulate recovery, but by trying to hold prices higher they are reinforcing the sour economic times that are causing the drop in demand.

- Piracy picks up pace

About a year ago, maybe more, I predicted that piracy would become an evergrowing problem in the coming decade. This is mainly because peaceful global trade is enforced by the US-led rules based order. Peter Zeihan states it something like this, "be allies of the US and we will protect your trade and shipping."

Now, as the US has lost the reason to enforce the rules (the Cold War is over and it is a net energy exporter), the natural order of things will come back, wars on land and piracy at sea.

This week we've seen the escalation of a tit-for-tat seizure of oil tankers, by Iran and then the US. This is just one such example out there.

- First Republic Bank fails and bought by JP Morgan

The interesting part of this is the interview comments by Jamie Diamond:

"The system is very, very sound."

"We need large, successful banks in the largest economy,"

"this is nothing like '08 or '09."

"this is getting near the end of it."

Most people will poo-poo these comments as extremely biased and self-serving. They are, but they also might be correct. Jamie Diamond doesn't want to crash the economy. In this case, his interests are aligned with the general public in avoiding a systemic collapse.

I, for one, tend to believe him, taken with a huge grain of salt.

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Last week

If we bounce on the 50-day MA right here, that is a very strong sign for bitcoin and stocks, meaning the stock market bears have been so very wrong this year.

Current chart...

As you can see above, the price held the 50-day MA, bounced into the resistance of the red zone, and is testing the 50-day MA again at a higher level. I added the 50-day EMA which is a faster moving average many traders watch, to show that it is generally in the same area.

I did not think a bounce on the 50-day would result in such a week move higher. Testing the this MA again so soon after failing to break higher is a sign of weakness. I would not be surprised if it failed to hold it this time.

One aspect I was watching today, and posted about it on Twitter and Telegram, is that 1st of the month paycheck effect. People tend to DCA at this time of the month, so I thought that could lead to the strength in this break out. That didn't happen.

However, like I stated above in the quote from last week, bitcoin's bounce led a general stock market rally as well. Catching up to bitcoin a bit here.

The NASDAQ closed at a fresh high for the year!

These things make me more confident that this dip today in bitcoin is not a shift in trend. Bitcoin is still bullish, just testing and retesting support. There is an increased chance that the 50-day does not hold this time, but at the same time, there is less of a chance that that will lead to uncontrolled downside.

Much more on the upcoming issue of Market Pro!

Mining

Headlines

Druk Holding and Investments (DHI), Bhutan's sole government-owned holding company, has confirmed that they have been mining Bitcoin for multiple years as a component of its diversified investment portfolio.

The company stated that it began devoting resources to Bitcoin mining when the price was around $5,000.

The all-time high was attributed to the expansion of production at its farm in Argentina, which was first fired up last year. ...

The most recent increase came as 2,100 new miners were energized earlier this week, while some existing miners who had been “underclocked” were brought to full capacity.

Block, a company owned by former Twitter CEO Jack Dorsey, has completed the prototype design of a 5-nanometer high-performance Bitcoin mining ASIC. The company announced this in an update post on April 28, 2023.

The US firm noted that developing bitcoin mining ASICs is a technically and financially challenging task. This led to a high level of centralization of the supply of Bitcoin mining ASIC, which it deems detrimental to miners and the Bitcoin network. ...

Intel had earlier in March said it had suspended production of ASIC chips for Bitcoin mining. The tech giant had launched its Blockscale line in April 2022 catering to increased demand for Bitcoin mining. However, it appears to be taking a new direction and will stop taking orders for Blockscale chips by October 20, 2023, and end production by April 2024. Block intends to take advantage of this to fast-track its development of proprietary mining kits using 3-nanometer chips, considered the most advanced chip technology to date.

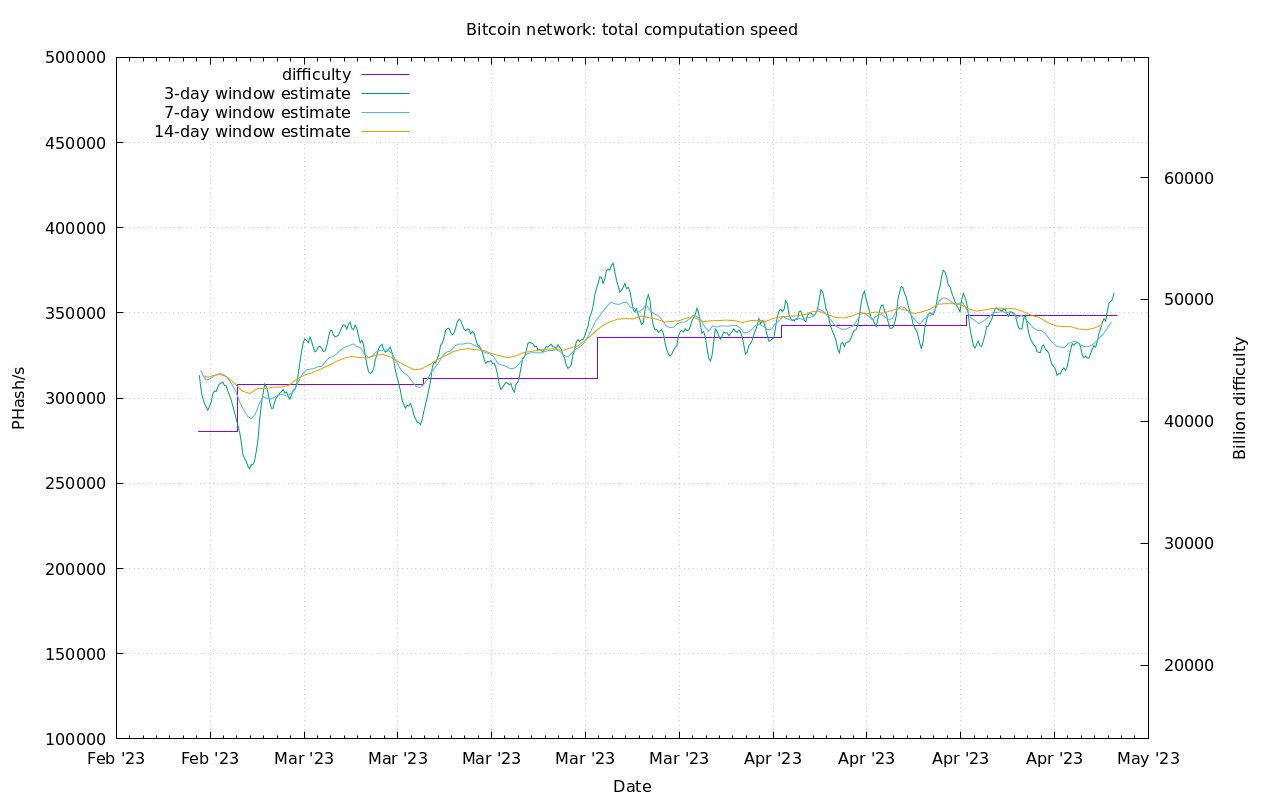

Difficulty and Hash Rate

Once again this week, Bitcoin mining is VERY stable. It is currently on track for a small decline of 2% in 3 days, the first decline in 6 adjustments.

The stable nature of hash rate can be interpreted as saying there are no systemic supply and demand imbalances in the market.

Mempool

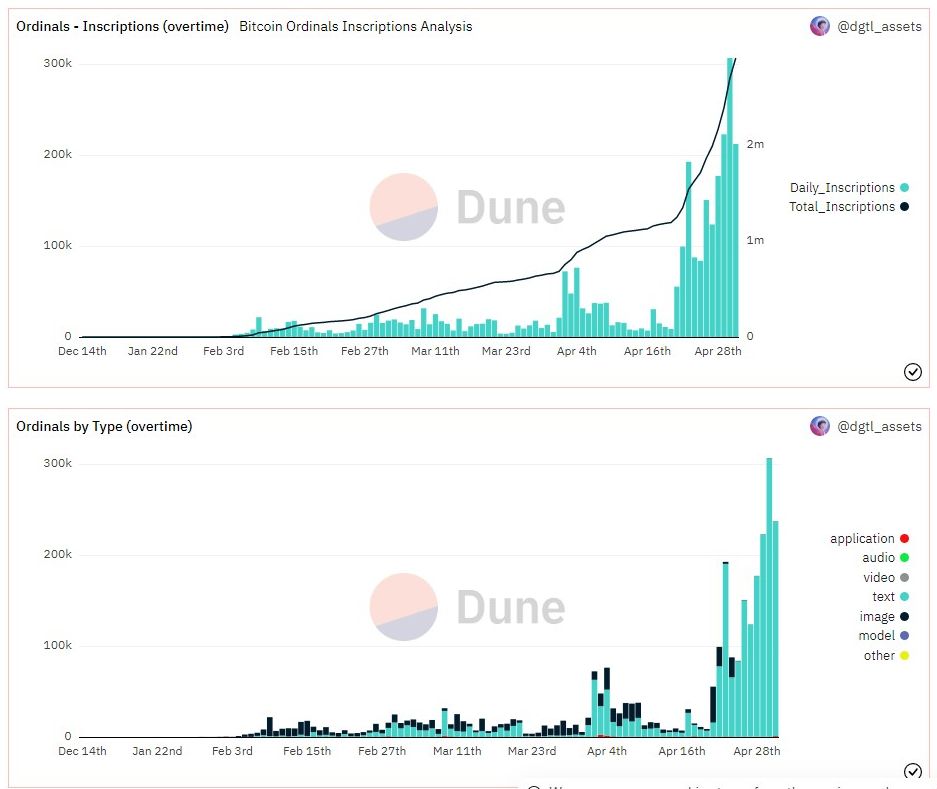

After the mempool cleared completely last week, it has ramped back up again. This means that there are more transactions sent than can be confirmed in blocks on the network. It is not substantial at this time, but a good sign of growing demand for bitcoin transactions.

This spike in the mempool does correspond to a massive increase in ordinal inscriptions over the last week. As you can see below, almost 100% of these inscriptions are text, so they will tend to be smaller in size I think. I'm not an expert on ordinals yet, but text inscriptions are probably smaller in size than say video!

Lightning Network

Lightning Labs manages a tool called Lightning Terminal to make managing Lightning nodes easier. Behind the scenes, Litd aims to abstract certain features of node management so users don't have to manage them directly, making it easier to use Lightning.

They've added: 1) auto-updating fees based on usage per week, and 2) "accounts" which allow multiple users to use one node.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

May 1, 2023 | Issue #239 | Block 787,826 | Disclaimer

* Price change since last week's report

** According to mempool.space