Bitcoin Fundamentals Report #235

Attacks on bitcoin slow, FedNow update, dollar competition from BRICS and bitcoin, price analysis, mining and lightning news.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidation at recent high |

| Media sentiment | Very Negative |

| Network traffic | Moderate |

| Mining industry | Strong |

| Price Section | |

| Weekly price* | $28,041 (+$988, +3.7%) |

| Market cap | $0.542 trillion |

| Satoshis/$1 USD | 3,568 |

| 1 finney (1/10,000 btc) | $2.80 |

| Mining Sector | |

| Previous difficulty adjustment | +7.5581% |

| Next estimated adjustment | +1.5% in ~3 days |

| Mempool | 99 MB |

| Fees for next block (sats/byte) | $0.82 (21 s/vb) |

| Median fee | $0.71 |

| Lightning Network** | |

| Capacity | 5,448.62 btc (+0.0%, +5) |

| Channels | 73,079 (-0.7%, -486) |

In Case You Missed It...

Market Pro

Community streams

- Bitcoin 2.0 is Impossible - Daily Live 3/21/23 | E333

- Plus live streams that haven't made it to podcast yet!

Fed Watch

- Operation Chokepoint 2.0! Central Banks continue to Hike Rates! - FED 137

- Why Aren't Markets Crashing? - Fed 138

Headlines

Bitcoin

It was a quiet week for bitcoin news. Once again, we find ourselves in the quiet before the storm.

- Elizabeth "Pocahontas" Warren tries to build coalition against "crypto"

Thank God it is not against "bitcoin" ;). Bitcoiners will be the first to agree that "crypto" is a den of scammers and thieves. A popular meme within bitcoin for years has been that altcoins are money printing scams trying to take your bitcoin. Even if we were talking about a decent politician here, it shouldn't be a surprise they want to clean up the scams, which bitcoin is not a part of.

I think of it as globalist panic. Their plans are failing, they're losing to populists world wide. In their twisted world view, of artificial managerial incentives, they can manufacture incentives to keep people away from bitcoin. In reality, all they can do is chase people to bitcoin faster.

Bitcoin hasn't died (and my association these imitation scams haven't died either), bitcoin isn't going away, and it exposes the weak underbelly of globalist currencies, the worst being the Euro.

FedNow will begin trials in July this year. Most people wrongly think this is a step toward a CBDC. The Federal Reserve (and parent Wall Street banks) still has no intention of launching a digital dollar.

FedNow is simply a PayPal-type competitor to wire transfers. Banks will be able to transact with each other 24/7/365. That's all.

However, the recent lightning speed of bank runs on SVB and Signature, create some worry about letting bank transfers happen too fast. The traditional financial system finds itself stuck. They want to keep up with the private sector and offer competitive services, but don't realize the system has evolved the way it has for good reasons.

Five years ago, "blockchain" was all the rage. "The technology behind bitcoin" supposedly could solve everything, like equity settlement. Currently, it takes days to settle an equity trade on the back end. The way the system evolved was for a middle man (DTCC) to hold most publicly traded stocks and traders/investors only hold a promise from that company. Trades take place on a "layer 2" if you will. This system was created due to a complex legal atmosphere, not due to technical limitations. Therefore, a technological fix is not needed and the "blockchain" obsession disappeared. Apparently, it wasn't the technology behind bitcoin, it is bitcoin itself that is special.

It is similar with the bank transfer issue. A plus like fast transfers is a great in good times, but are trouble when disaster strikes. Slow transfers are a feature, not a bug. They are there for a reason. It is a fundamental limitation of a credit-based system.

How FedNow develops will be interesting to watch, but I can confidently say, nothing of significance will come from this avenue for years.

MicroStrategy has announced the repayment of a $205M bitcoin-collateralized loan in full at a 22% discount for $160M, along with the acquisition of an additional 6,455 BTC, bringing their total holdings to 138,955 BTC.

MicroStrategy continues to have the largest public corporation holdings of bitcoin, with second-in-line Marathon holding more than 100,000 bitcoin less than MicroStrategy.

Macro

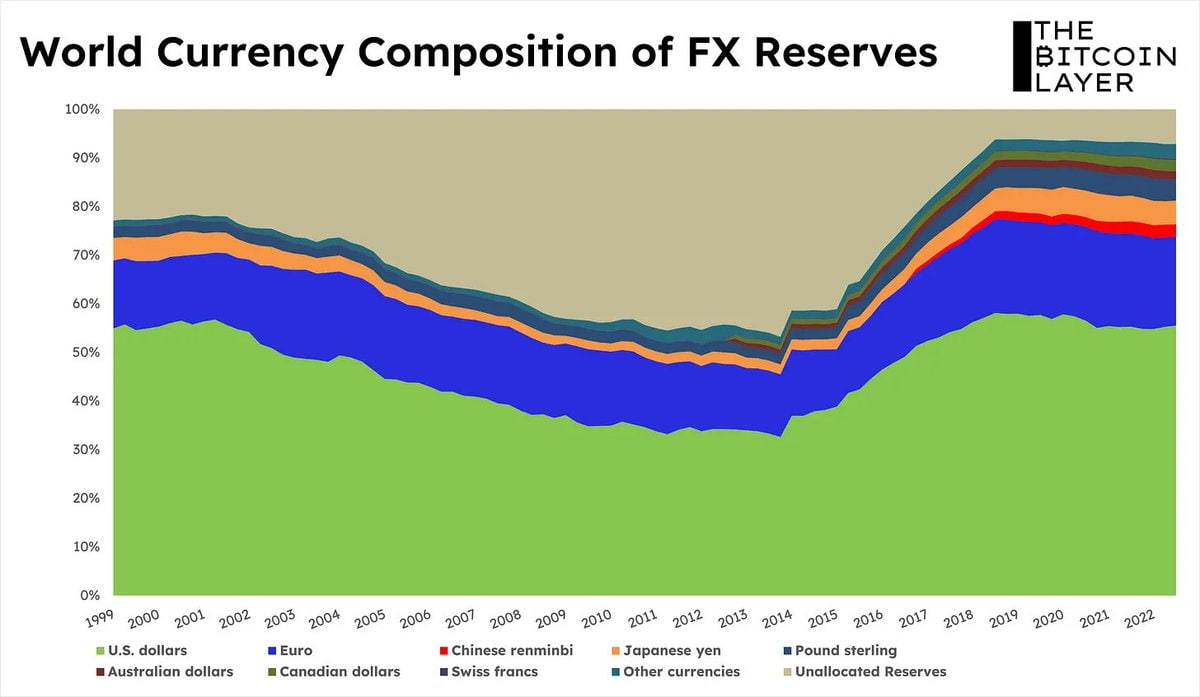

- De-dollarization rhetoric has hit a fever pitch this week

Despite the claims that corrupt and smaller economies' currencies are threatening the dollar, the dollar's share of global reserves show very little weakening. The dollar isn't going anywhere, it's what the dollar is that will change (i.e. being backed once again).

- China's BRICS agree to attempt a combined currency

The announcement of the BRICS intention to form a new currency to act as a global reserve currency sent shockwaves around the internet this week. Pundits and "experts" not worth their salt think it's the end of the dollar dominance. Nothing could be further from the truth.

If these countries were strong and thriving relative to the US they'd have no need to switch away from the dollar. This is a decision from weakness not strength. The fact is the BRICS and much of the world are struggling mightily right now, and it is politically expedient to blame the US and the dollar. Once again, being the global reserve currency is a huge burden. It makes the US the convenient scapegoat.

Below is a great thread about the difficulties of creating a new currency.

1) Agreeing on a unified set of economic policies

2) Creating a stable and liquid market for BRICS Bucks

3) Convincing the world that "BRICS Bucks" is safe & reliable

4) Imbalanced Contribution to the Group's GDP (China is 75% of BRICS GDP)

5) BRICs have diverse political systems, social issues, and economic challenges, that do not align.

This is, at minimum, a 20-year endeavor; unless they back it with bitcoin.

Russia, China, Brazil, India and South Africa are planning to develop a new currency to challenge the US dollar.

— Andrew Lokenauth (@FluentInFinance) March 31, 2023

This would be a big change to the global financial system but too many challenges exist for "BRICS Bucks" to become a currency.

Here are 5 reasons why it will FAIL: pic.twitter.com/QblFVOQzHu

- France makes LNG trade with China in yuan

What all this new currency fever symbolizes is the fact that the dollar system is not serving the world efficiently anymore and people are ready to try alternatives.

Another fiat is not the answer. Any other fiat option will have worse problems than the dollar. Trust is breaking down, credit creation is tanking, what is needed is a commodity money.

So, while we all search for monetary alternatives to bring back a functioning market, bitcoin is waiting for people to stop fighting their natural incentives to adopt it.

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Daily chart

Another flat week for the bitcoin price.

Below is a zoomed in look at the battle with price resistance. The black horizontal line in the red is $28,750 and if we can break that, we are set to move higher.

Beware of a fake out. If you are a trader, you are likely aware that bitcoin can fake a break out of patterns like these. I think a fake out higher is unlikely, but we can never be too careful. A stop loss at the break out level is mandatory.

More likely is a vanilla move higher here. Many of the on ramps and bitcoin exchanges are facing heightened oversight and much of the liquidity is drained. The coordination/liquidity to pull off a fake out is probably not there. The incentives are lacking for shorts or industry players to scalp a dip. This market is being driven by spot buying pressure IMO.

Mining

Headlines

Jason Lowery's new book "Softwar" has really taken off. In it he suggests that mining bitcoin is vital to the future national security of the US.

The thesis calls for the U.S. to stockpile Bitcoin, cultivate a domestic Bitcoin mining industry, and extend 2nd Amendment protections to the technology on the theory that it’s a weapon of self-defense.

The majority of power used in Bitcoin mining comes from renewable energy sources, according to research by ESG analyst and investor Daniel Batten.

Hydropower makes up 23.12% of all energy used in mining.

...wind is used to generate power for 13.98% of Bitcoin mining, while nuclear and solar account for 7.94% and 4.98%

Other renewable energy sources are used in about 2.40% of Bitcoin mining.

...roughly 52.4% of all Bitcoin mining relies on renewable energy

Meanwhile, roughly 43% of all energy used in Bitcoin mining is still generated via gas and coal. However, Batten noted that the electric vehicle industry still uses global gridmix, which generates 60% of its energy from fossil fuels.

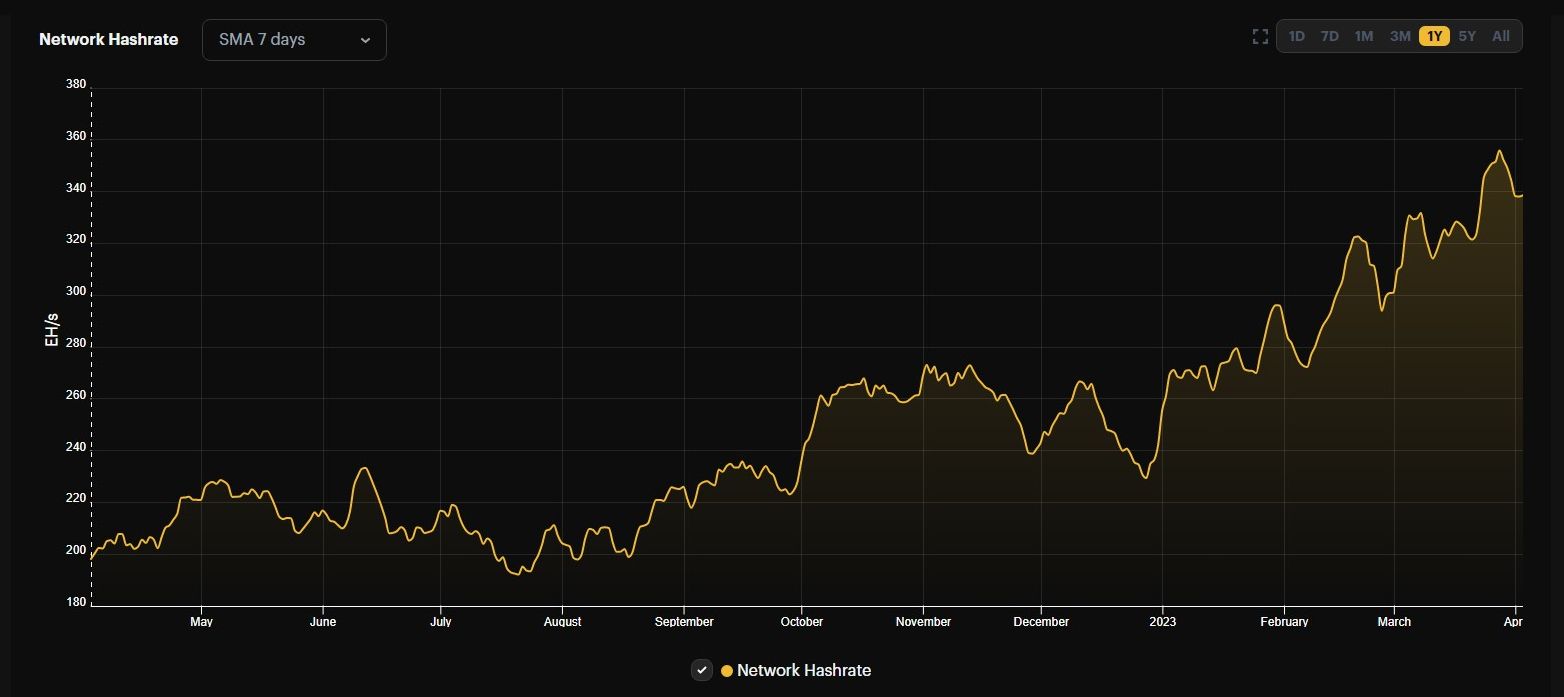

Difficulty and Hash Rate

I found a new hash rate chart. The computational speed of the network slowed slightly this week in its typical pattern, but we are still on track for a 1% difficulty increase in 3 days.

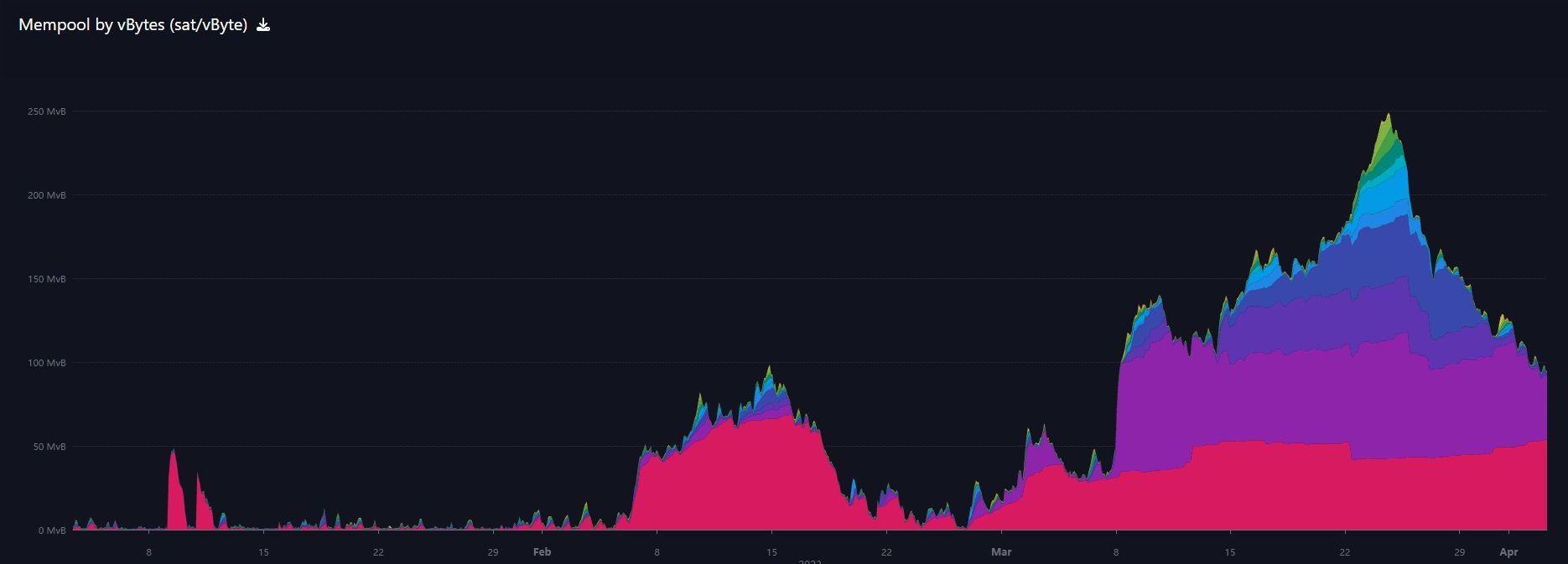

Mempool

The mempool (transactions waiting to be confirmed on the network) came down again this week. This signifies that the bitcoin network is able to deal with the stress of high traffic times.

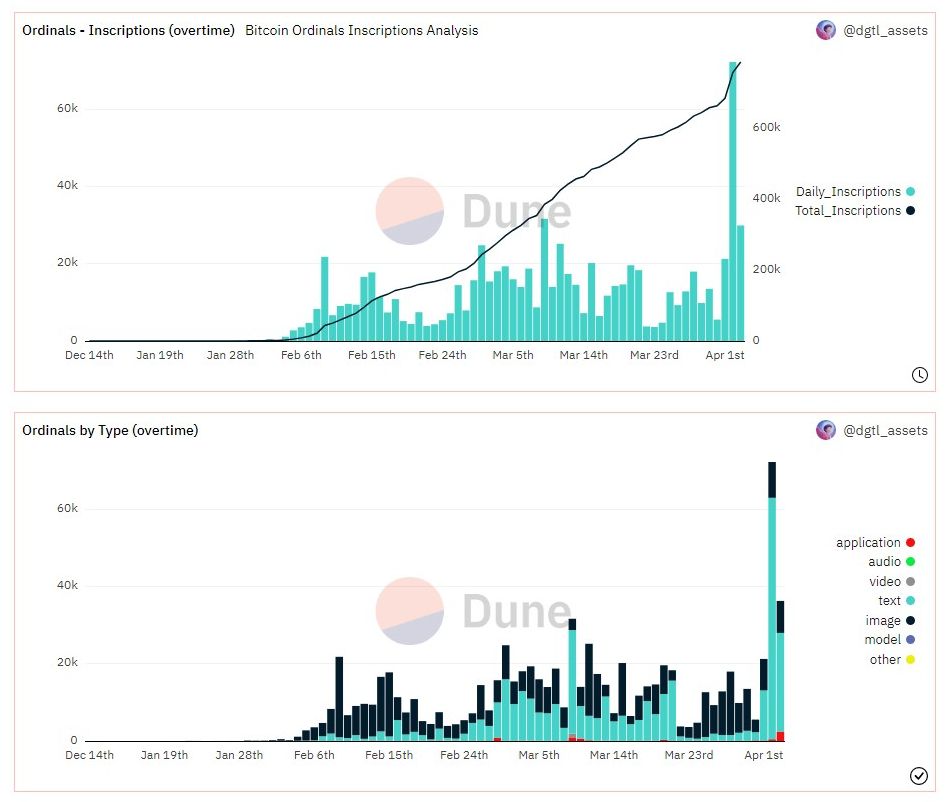

Once again, there doesn't seem to be any correlation with the mempool and inscriptions. April 2nd saw a massive spike in inscriptions, but no associated mempool spike.

Lightning Network

Lightning network capacity has plateaued in recent weeks. It has been stuck around 5400 btc and 73,000 channels.

It will be interesting to see how these numbers react in the bull market. As price goes up, LN capacity naturally goes up. There is lots of LN infrastructure being built as my weekly reports show, but how will a rising price and attention on bitcoin affect adoption rates of LN?

ZeroSync Association, a Swiss-based nonprofit, is developing tooling which allows users to validate the state of the Bitcoin network without having to download the blockchain or trust a third party for verification.

ZeroSync was formed to develop and maintain open-source software that enables succinct ZK-proofs on the Bitcoin blockchain. The group uses StarkWare’s proprietary Zero-Knowledge Scalable Transparent Argument of Knowledge (zk-STARK) validity proofs to generate ZK-proofs for the Bitcoin network.

Bitcoin gaming and payments company Zebedee has debuted a payment feature on its app that allows users to instantly send any amount of money to five jurisdictions, including the Philippines and Brazil, for little to no cost using Bitcoin’s Lightning Network.

The feature enables users to connect their Zebedee accounts directly to platforms run by bitcoin (BTC) payment firms including Philippines-based Pouch and Brazil-based Bipa, according to a release.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

April 3, 2023 | Issue #235 | Block 783,779 | Disclaimer

* Price change since last week's report

** According to mempool.space