Bitcoin Fundamental Report #232

Bitcoin news cycle was slow, but there are several developments that flew under the radar this week. Price, mining and lightning network.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Holding on |

| Media sentiment | Very Negative |

| Network traffic | Elevated |

| Mining industry | Surging |

| Price Section | |

| Weekly price* | $23,221 (-$1,694, -6.8%) |

| Market cap | $0.449 trillion |

| Satoshis/$1 USD | 4,308 |

| 1 finney (1/10,000 btc) | $2.32 |

| Mining Sector | |

| Previous difficulty adjustment | +9.9535% |

| Next estimated adjustment | +3% in ~4 days |

| Mempool | 38 MB |

| Fees for next block (sats/byte) | $0.57 (18 s/vb) |

| Median fee | $0.54 |

| Lightning Network** | |

| Capacity | 5,445.47 btc (+0.02%) |

| Channels | 74,590 (+0.01%) |

In Case You Missed It...

Market Pro

Community streams

- China Coming to Their Senses on Bitcoin?? - Daily Live 2.21.23 | E322

- A Better Bitcoin? plus, Human Rights in the Future - Daily Live 2.22.23 | E323

- More of the Same Won't Work, plus Policy or Panic - Daily Live 2.24.34 | E324

- What's Happening This Week in Bitcoin - Daily Live 2.27.23 | E325

Fed Watch

⬇️ Check out the video below ⬇️

Listen to podcast here

Headlines

Bitcoin

- The Biggest News of the Week is the Silvergate Collapse

Silvergate was a bank that stepped up and offered banking services to the bitcoin industry when other large banks shunned it. In yet another example of people not listening to bitcoiners and trying to leverage fraudulent "crypto", Silvergate could be the next shoe to drop in the industry.

They have delayed their 10-K filing with the SEC on Wednesday last week, causing a massive selloff in their stock of 57% on Thursday. By Friday, the industry was severing ties with the bank where they could, including Coinbase and Tether.

Of course, this doesn't effect the fundamentals or monetary arguments that have made Bitcoin unique, dominant and massively successful. Silvergate picked "crypto" over Bitcoin, and has failed because of it. This news does, however, effect the viability of 90% of "crypto" scams. A welcome development.

The poll was carried out in January of this year by the Tokyo-based media company Zero Accel, who contacted 330 cryptocurrency owners across 47 different Japanese prefectures. In a press release, Zero Accel noted that 82.7% of all cryptocurrency owners indicated they “plan to continue holding” their tokens in the future.

Nearly seven out of ten respondents named bitcoin (BTC) as their preferred coin, with the majority of the remaining respondents naming ethereum (ETH) as their preferred token.

The company stated that “those who invest in cryptocurrencies not only want to generate money, but also empathise with crypto projects’ ideas and beliefs” is “one of the reasons” Japanese crypto holders look inclined to HODL.

According to the media outlet Informer, Elizaveta Danilova, the bank’s Director of Financial Stability, said that allowing crypto into the Russian financial system would bring about “fundamental risks.”

The Ministry of Finance wants to legalize crypto – and regulate the use of tokens in the country. Crypto currently has no legal status in the nation, and trading tokens is neither illegal nor regulated.

But Danilova warned that “legalization” could “harm the well-being of citizens.” She said that it could also compromise the stability of the financial system and “pave the way” for an influx of illegal activities.

However, Danilova suggested that Central Bank was not opposed to allowing the use of crypto in international settlements. The bank could yet approve the legalization of crypto mining.

One lady, Elizaveta Danilova, says so. But also the Ministry of Finance as a whole wants to legalize bitcoin.

The sum that will be shared with beneficiaries includes a total of 142,000 bitcoin ($3.3 billion today), 143,000 bitcoin cash ($19 million), and 69 billion Yen ($510 million). These figures are in consonance with an earlier released balance sheet back in 2021.

Many are expecting this to mean large selling pressure, as these investors can finally get some of the coins back. I'm not so sure. These people were very early to bitcoin and likely hardcore bitcoiners by now. Most of this will end up in cold storage.

What doesn't end up in hoards might go toward healing some of the bankrupcty problems in the space. If we are very conservative on the number going into cold storage at 50%, that means $1.5 to 2 billion entering the space. That remainder doesn't have to be market sold on the exchanges though. Once again, these are very early adopters, many could have bitcoin related businesses now. They could use those coins to reinvest in their companies. That bitcoin could circulate and/or be used as collateral for rescue loans.

It is far from certain that any significant portion of the coming payouts, spread over the next 6 months, will make its way to a constant selling pressure IMO.

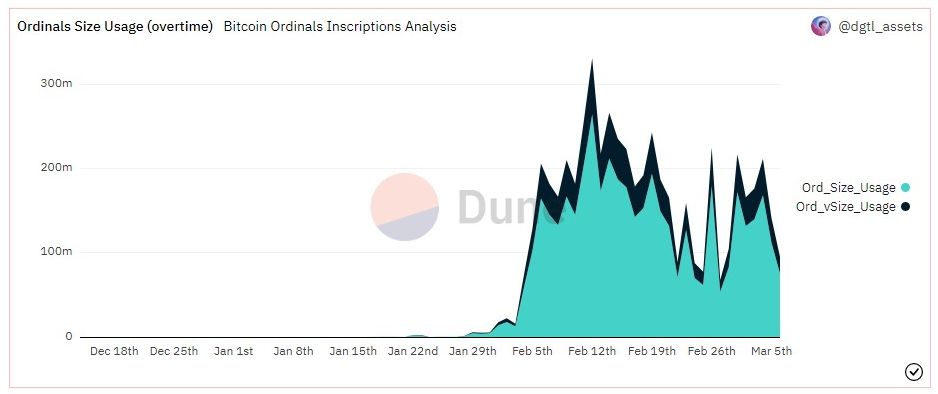

- Ordinals update

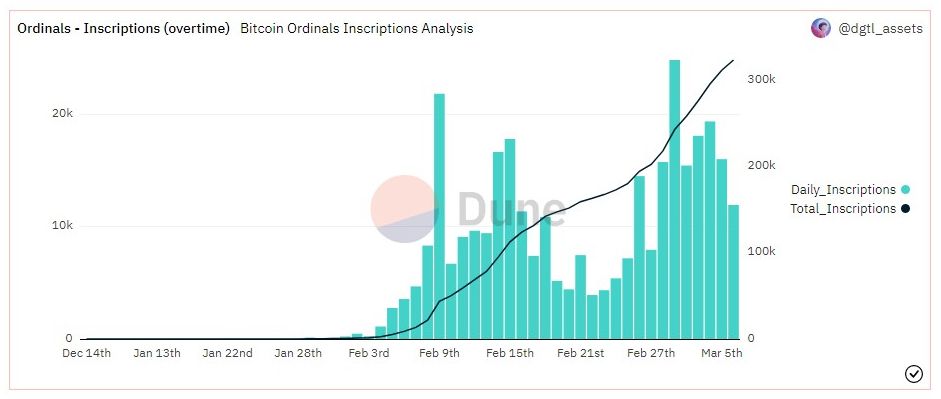

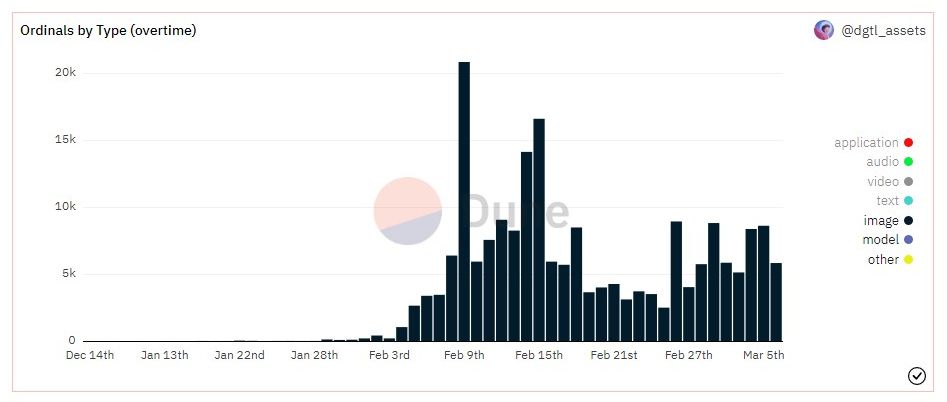

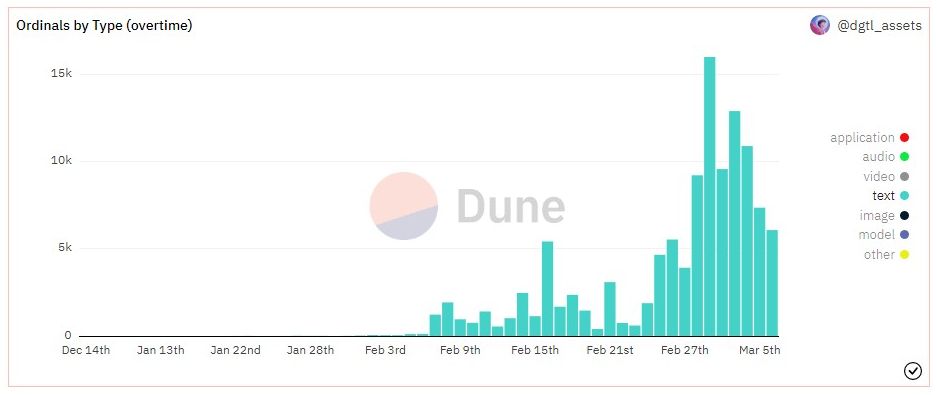

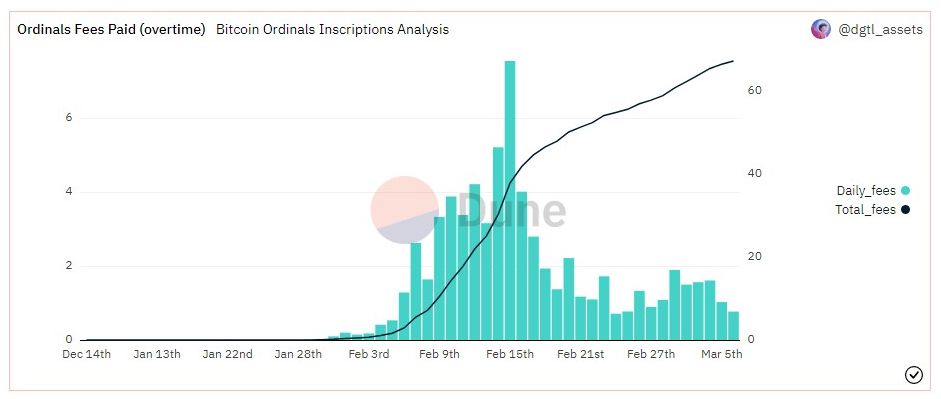

This is a good dashboard for ordinals. Below, I've included some interesting charts. In order they are, Total per day and Total, Image inscriptions per day, text inscriptions per day, Fees paid per day and Total in btc, and lastly, Size of inscription in bytes and vbytes.

As you can see, the number in images has tailed off, but the number of text inscriptions has jumped. This has translated into lower fees and lower sizes.

Macro

There is so much going on in macro and geopolitics. On the Telegram, we've talked a lot about China recently. There is too much to list here, honestly, but I'll post a couple things.

- Russian diplomat Lavrov talks China vs India relationship with Russia

I found this video this week, where Lavrov is asked a question on stage about the relationship Russia has with China vs India, considering India and China have a border dispute of their own.

His response was amazing, and confirmed what I've been saying about the falsely assumed warm relationship between Russia and China. They are fundamentally rivals as land powers in Asia.

Russia and India have on paper, "especially privileged strategy partnership. I don't know whether any other country has the same status on paper, officially."

Russia and China relations, on the other hand, "have never been that good since the beginning of China as a country." (I'm guessing he means CCP)

This is yet another example of why the Yuan can never be a serious currency. It also puts the Hong Kong opening up to bitcoin in a new context.

This was an interesting article from an influential person in the Bitcoin space, CEO of Bitmex Arthur Hayes. In it he uses oil as proxy, exactly as I have done for 2 years, to walk through a mental model for the coming geopolitical realignment.

I talked about it on Friday's live stream (not out yet in podcast form).

In the article, he claims that the coming turmoil over the basic necessity of energy, will force the Fed, the ECB and the BOJ to loosen monetary policy, while it will cause China to tighten theirs. This will lead to a major sell off in "risk assets" including bitcoin. However, after this singularity event where everything sells off, bitcoin will rocket higher as "inflation" wrecks the world.

I agree with many of his premises, but see a different path. A breakdown in the current financial system will lead to credit collapse. This is a deflationary event, not an inflationary one. Typical monetary policy, eg QE is not money printing, it only allays panic. We are unlikely to see inflationary monetary policy out of the Fed, which would mean actual unencumbered money printing, like cash bills or dollars without an associated debt.

We are, therefore, entering a period of monetary SHORTAGE not inflation. Bitcoin will benefit from being a monetary alternative in the US and an inflation hedge in places like Europe that might adopt a CBDC and actually print money.

- Zelenskyy says US and NATO blood must be shed

I've been told, this was taken out of context. He said it in reference to, "what if the US sent troops?" But, it still shows the bankrupt moral position of the unwinnable war in Ukraine.

Our research indicates that ESG investing does not have any advantage over broad-based investing,” Mr. Buckley said in a recent interview with the Financial Times.

“We don’t believe that we should dictate company strategy,” he said, in his first public comments about the decision.

“It would be hubris to presume that we know the right strategy for the thousands of companies that Vanguard invests with. We just want to make sure that risks are being appropriately disclosed and that every company is playing by the rules.”

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Daily chart

If bitcoin falls further, it will do damage to the chart and force us back into a defensive position. However, it has been very strong in light of the Silvergate scandal, and not making lower lows.

As of now, nothing fundamentally changed for bitcoin from a week ago. However, the highly correlated asset class of stocks has flown higher. The S&P 500 has set a new higher low and is surging.

I'm excited to see the cope from the perma-bears and recession-istas. We will have a recession again, just might not be in 2023 or 2024.

If February CPI slows, everything changes. So far, the Cleveland Fed's CPI Nowcast has overestimated CPI each of the last 4 months, by an average of 0.2% m/m. Right now, they are predicting 0.53% m/m for February. If it comes in around 0.2-0.3%, it will be a massive deal.

As of now, the market doesn't seem to be worried or care much about the upcoming CPI or even the Fed's dilemma.

Mining

Headlines

A Russian company has unveiled a new fund intended to finance crypto mining operations in the country.

The new mutual investment fund will be available to qualified investors who can invest a minimum of 300,000 rubles (approx. $4,000), and the money will be used to acquire crypto mining equipment and pay for electricity and other operating costs, Russian business outlet Kommersant has reported.

They hope to raise a total of 500 million rubles or approximately $6.6 million.

According to Kommersant, the launch of the fund is still subject to regulatory approval in Russia. However, industry observers believe there is a good chance the fund can be approved and that the central bank has “eased its attitude” towards crypto mining, the report said.

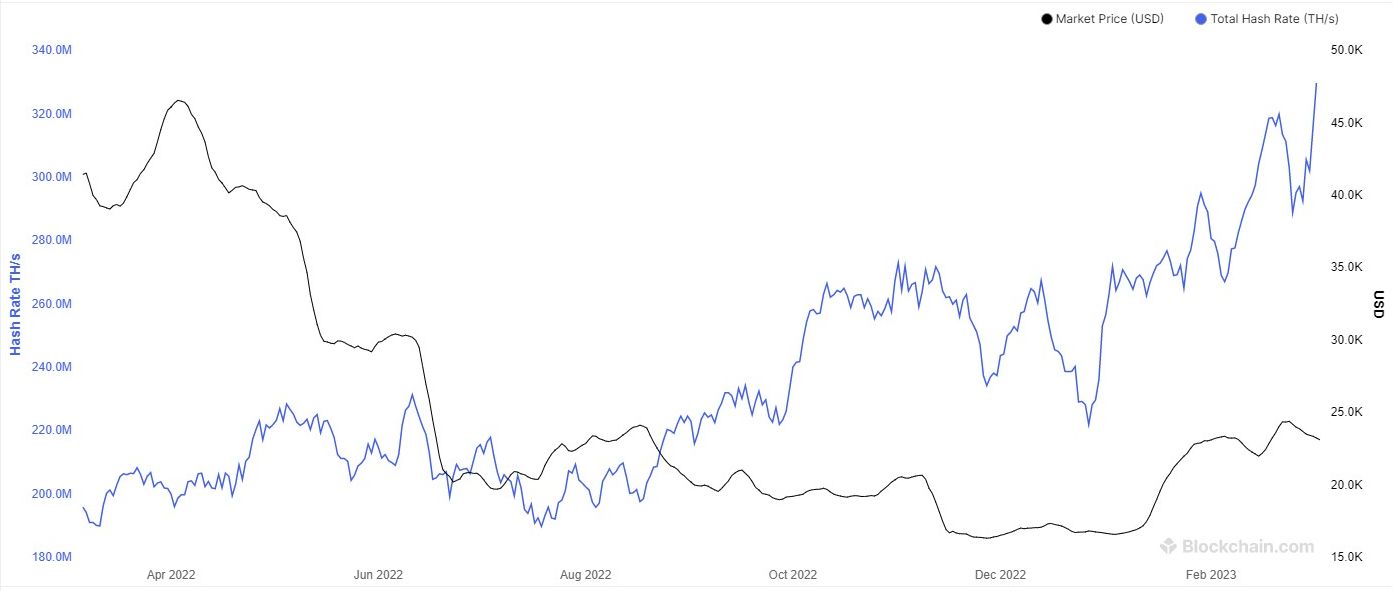

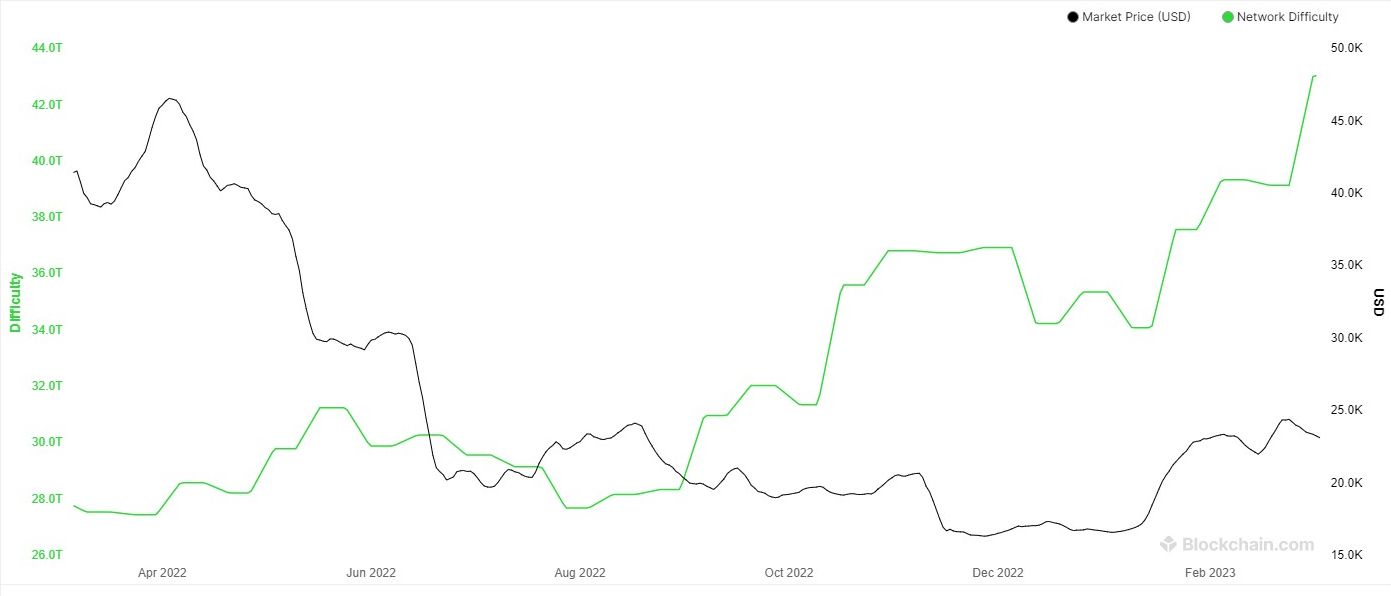

Difficulty and Hash Rate

Hash rate exploded again this week, rising far beyond an All-time High. Difficulty is now on pace to rise by almost 3% in a few days, as well.

Whatever is happening with price, the mining power on the network is telling us that we are likely very underpriced at the moment.

I want to spend a few lines on how to interpret the hash rate and difficult relative to price. I do this every so often on the newsletter, because I think it is important.

First, miners are exposed to an opaque side of the market, that of Over-the-counter (OTC) buyers of bitcoin, energy markets, investor appetite via both public and private bitcoin-related companies, a complex regulatory environment, and energy producer sentiments. A healthy increase in hash rate tells us something about this mix of inputs for miners.

Second, if the current price of bitcoin was seen as overpriced, hash rate being a result of this complex mix of inputs, would like remain stagnant or fall. If the current price is seen as underpriced, it will attract investment and hash rate onto the network, as we are seeing now.

Hash rate and difficulty confirm price. They are where the rubber meets the road, where bitcoin is the source of income, in a real business with real resource and economic concerns. Therefore, when we see the hash ribbons flashing buy, it should not be ignored.

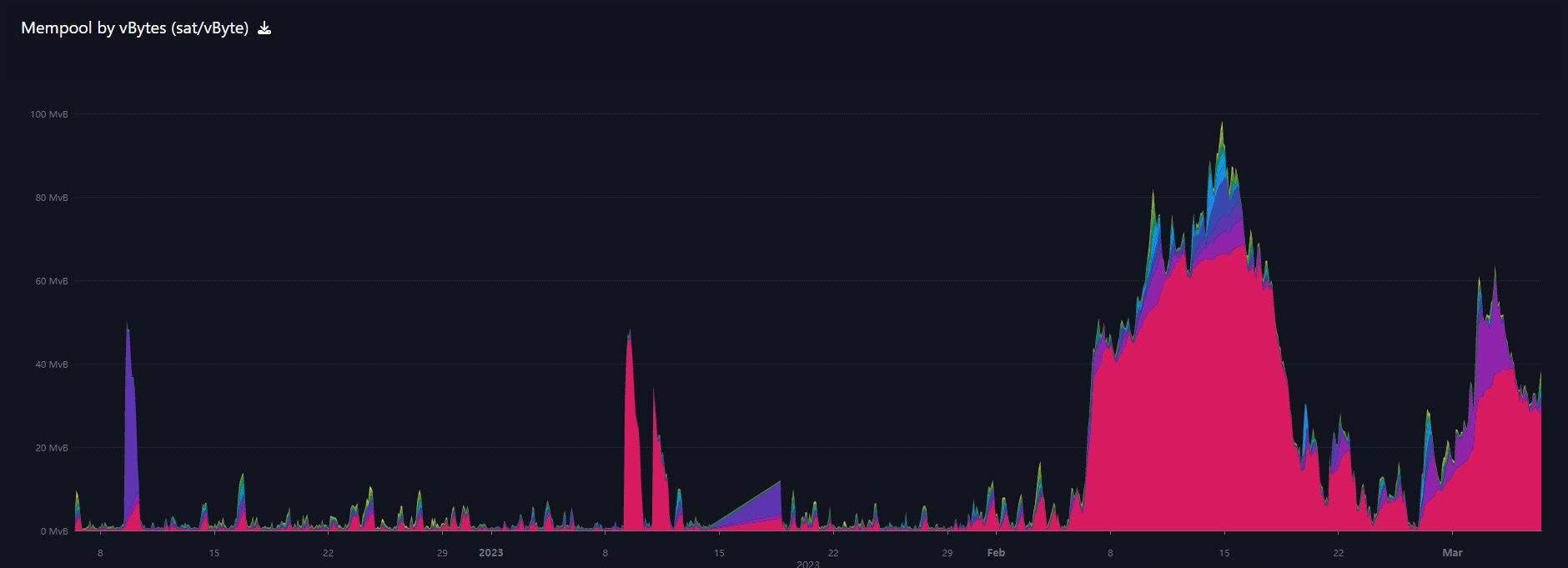

Mempool

The mempool (transactions waiting to be ordered and confirmed by miners) did reaccelerate a little this week, as the Ordinal Update above would lead one to expect. It did not hit a higher high, and so far, has only affected fees minimally.

Lightning Network

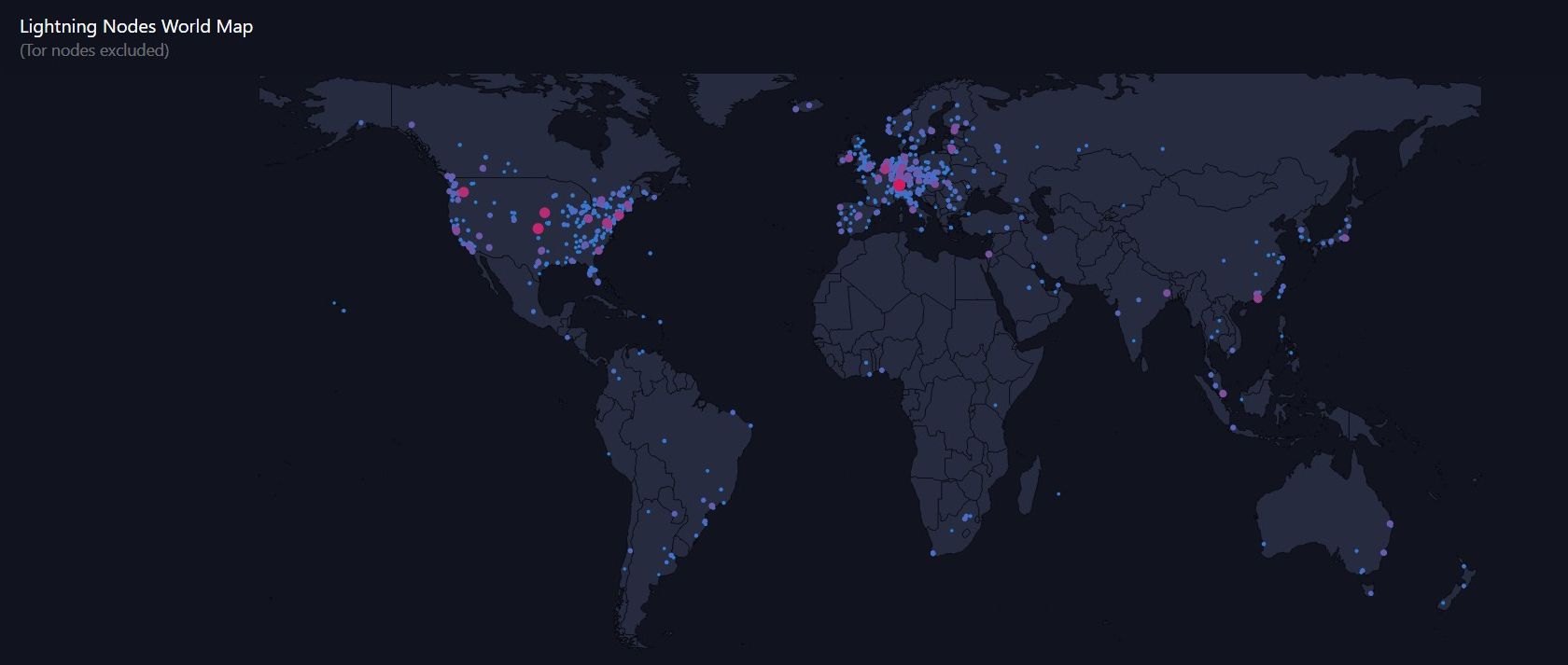

This map does not include Tor nodes, but as you can see, the Lightning Network is primarily a US and Europe phenomenon.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

March 6, 2023 | Issue #232 | Block 779,615 | Disclaimer

* Price change since last week's report

** According to mempool.space