Bitcoin Fundamentals Report #224

Bitcoin news on DCG and Grayscale, Mexican CBDC, Russian bitcoin adoption news, price analysis, mining sector news.

Jump to: Bitcoin headlines / Price analysis + Price Conclusion / Mining sector

In Case You Missed It...

Daily Live streams

- Bitcoin Core Developer Hacked, Loses BTC - Daily Live 1.2.23 | E293

- Global Economic Slowdown Everywhere - Daily Live 1.4.23 | E294

- Malthus vs Free Market vs Credit Money - Daily Live 1/6/23 | E295

Article

Fed Watch

⬇️ Check out the video below ⬇️

Listen to podcast here

Headlines

| Weekly trend | Slight bullish twist |

| Media sentiment | Very Negative |

| Network traffic | High |

| Mining industry | Surging again |

Bitcoin

Slow news week in Bitcoin this week. I've dug up a few important developments. Overall, the ecosystem is very very slow, with everyone waiting for the next market move. The calm before the storm?

Rumors and analysis around DCG's financial situation continue to swirl. The most recent official update is the closing a subsidiary's HQ this week. Also, the deadline publicly set by Cameron Winklevoss of January for Barry Silbert to payback $900M loan passed yesterday with no update. Silbert has responded saying they will make all their payments on time, and January 8th was some arbitrary deadline.

It remains to be seen if DCG will go bust. I believe they are on the tightest of ropes trying to keep their head above water. Grayscale, however, their subsidiary that manages the Bitcoin Trust (GBTC) is untouched as far as I can tell. It is in no danger of being insolvent, AKA not having all the bitcoin they are legally required to have to back all their shares.

Central Bank Digital Currencies are all the rage with elites trying to keep their monopoly on currency. The ECB is the world's largest promoter of CBDCs, but many countries have pilot programs.

Mexico is one of them researching CBDCs, but in this article we see they are having the predictable problems I've pointed out for years.

[The Mexican central bank is] still determining the requirements for its issuance.

The Mexican CBDC is designed to be interconnected with the traditional financial system, allowing banks to facilitate the transaction of these tokens through the already-existent payment system.

Igor Belskikh, a Doctor of Economics, and Professor at the Department of Economics and Finance at the Plekhanov Russian University of Economics, stated that crypto is already “gaining more and more popularity” in Russia. He noted that crypto had become a tool that allowed Russians to – for instance – “transfer” funds abroad without having to make declarations to the government.

Meanwhile, sanctions that were intended to freeze Russia out of the dollar-powered global economy have reportedly led ordinary Russians – and the Moscow-based government – to seek out digital and analog alternatives to the greenback.

According to Elvira Nabiullina, the governor of Russian Central Bank, Russia is prepared to consider permitting #cryptocurrency use domestically, but only as part of a legal experiment.#RussianBankPanic #Russia #CryptoNews #crypto

— Whale Coin Talk (@WhaleCoinTalk) January 2, 2023

Macro headlines

Macro headlines too were slightly slower this week. Lots of economic data came out of the US, most of it conflicting. The guessing game around, what will the Federal Reserve do, continues.

Remember, if you want to predict what's going to happen in macro in the next 6-12 months, ignore the Fed. They will follow only too late.

It is my opinion that the US economy is slowing down rapidly, but from a very elevated height. The coming recession is the most anticipated recession in history. That is why I don't think it will be all that severe. Perhaps in 2024 or 2025 we get more of a downturn, but I'm predicting 2023 to be positive for stocks, bonds and bitcoin!

Price Analysis

| Weekly price* | $17,227 (+$506, +3.0%) |

| Market cap | $0.332 trillion |

| Satoshis/$1 USD | 5,802 |

| 1 finney (1/10,000 btc) | $1.72 |

Finally, we get some action in the price. My predictions for this year have been spot on recently.

Last week

I'm expecting the bitcoin price to make its way back into the resistance zone, up to possibly as high as $18,500 in the next couple of weeks.

Two issues ago

I'm expecting the bitcoin price to move slowly and cautiously higher, with some momentum beginning in the new year.

Daily chart

The last few days have noticeably turn upward. Price has marched 4% higher this week, in a fairly nice and steady cross of the 50-day moving average.

The resistance zone of $18-19,000 lays dead ahead.

TD Sequential

This indicator is a time-based trend indicator. The count goes up to 9 which typically signals the end of the momentum in that direction and a consolidation is warranted. However, when a 9 occurs after a long period of consolidation, it signals the beginning of a new trend.

As you can see below, we have hit a green 9 on the daily chart. This is the first green 9 since March 2022, and before that Oct 2021. The fact that it is happening now, after a long period of consolidation, tells me that a new bullish trend is being established right now.

Cloud

I'm updating the cloud chart from last week. As you can see on the daily with standard settings, the price has entered the cloud. Other things to note on this chart is the TK cross about ready to happen (blue/red cross), the lagging span (black line) is about to cross above price history, and lastly, the far side of the cloud is flat, which tends to act as a magnet. The flat cloud also is smack dab in the middle of our resistance zone that must be tested.

Below is the the cloud with extended settings, commonly used in bitcoin due to the 24/7 unique nature of the market.

On this version, the cloud is slightly higher, it has not twisted green as above. However, the other factors are even more bullish on this extended chart than the standard settings above. The TK cross (red/blue cross) has already occurred, and the lagging price (black line, I added a red star where you can see the lagging span over the price history). These are two factors that have turned bullish on this chart but not yet on the above chart.

Also, there is a flat side to the cloud up at $19,100 that correspond to the massive volume resistance (green horizontal line) at $19k.

Weekly Charts

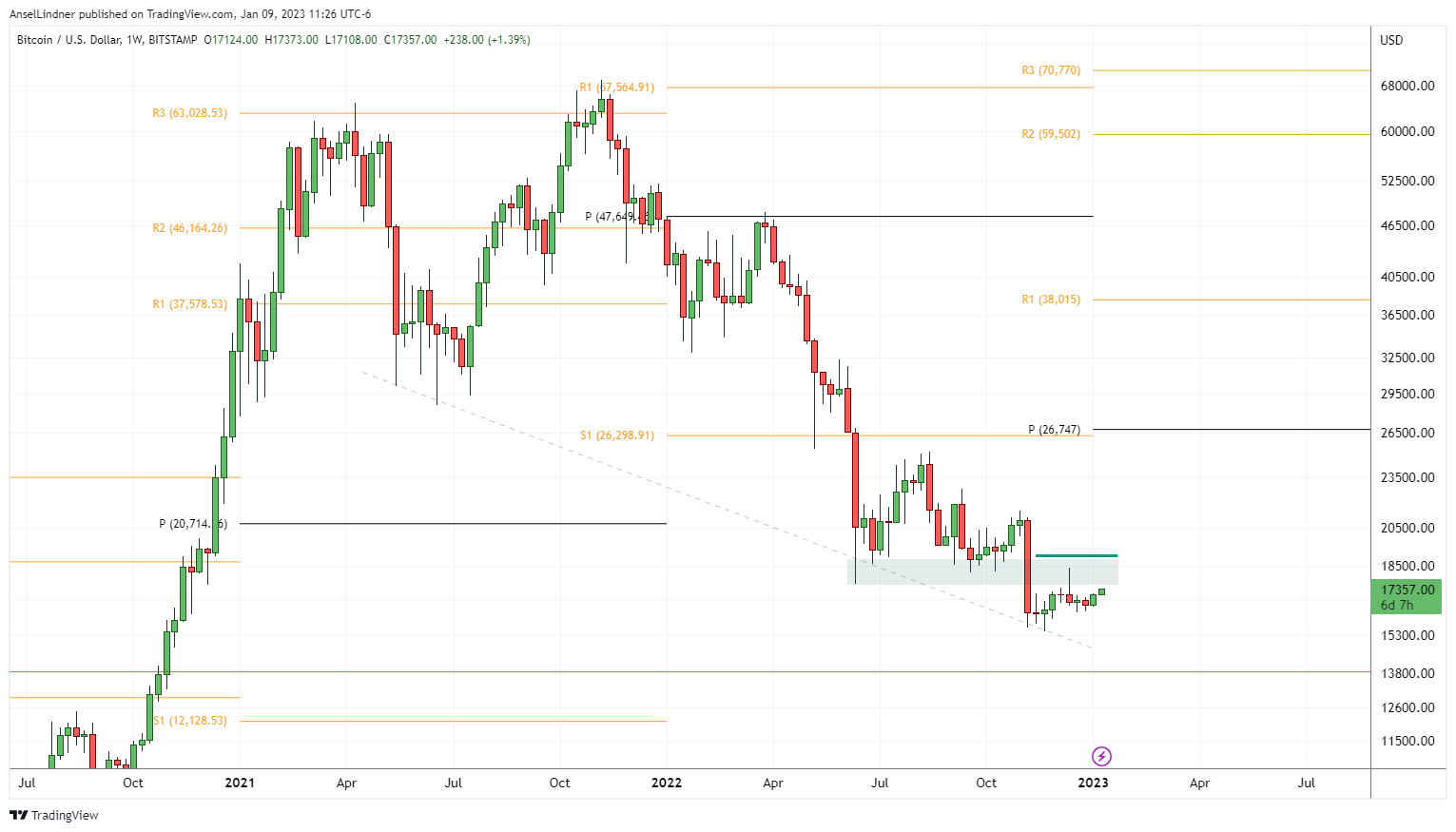

Yearly Pivot

A new year pivot has printed in the new year, and it sits very accessible up at $26,747.

Pivots are the median price of the last period. In this case, last year. This tends to be a highly relevant level and is most often hit early in the new period.

Here is a history of all the yearly pivots in bitcoin. Out of all the yearly pivots from 2014, only 2021 and 2015 were not hit, although 2015 was very close, and 2021 did go in the direction but didn't quite make it. Notice 2019, when the price was far under the pivot, and price screamed higher.

Price Conclusion

Summarizing...

Short term charts are turning decidedly bullish, despite the tension around regulation and Digital Currency Group. One of the hallmarks of a bull market is that uncertainty and bearish news doesn't have the much of an effect on the price. We could be seeing the early stages of that here.

Weekly charts look strong. We looked at the yearly pivot up at $26,700, but we also see plainly the heavy resistance at $19,000. I do not think price can immediately slice through this resistance. However, it is likely to test it, giving us a higher high, and a much more bullish technical picture.

Calls for recession remain deafening. US economic numbers are getting worse in many cases, BUT NOT ALL. There is still a chance to avoid recession outright, and a large chase of a mild recession at worst.

Most people think it is a choice between a good or a bad economy, but in fact, the most likely outcome is a so-so economy, with recessions in different parts of the world. That would be a direct replay of the post-Great Financial Crisis.

The beginning of the year tends to be free of major crunch points and significant calendar events. Therefore, we should expect a several weeks of calm for markets to consolidate and/or work their way higher.

Overall, risk of more bad news with devastating effects has been mitigated significantly. This week I expect more upside, and for price to test that resistance zone. A higher high is what we are aiming for, after which a consolidation within the resistance area would be ideal.

Mining

| Previous difficulty adjustment | -3.5926% |

| Next estimated adjustment | 8% in ~6 days |

| Mempool | 50 MB |

| Fees for next block (sats/byte) | $0.22 (9 s/vb) |

| Median fee (finneys) | $0.14 (0.081) |

Mining News

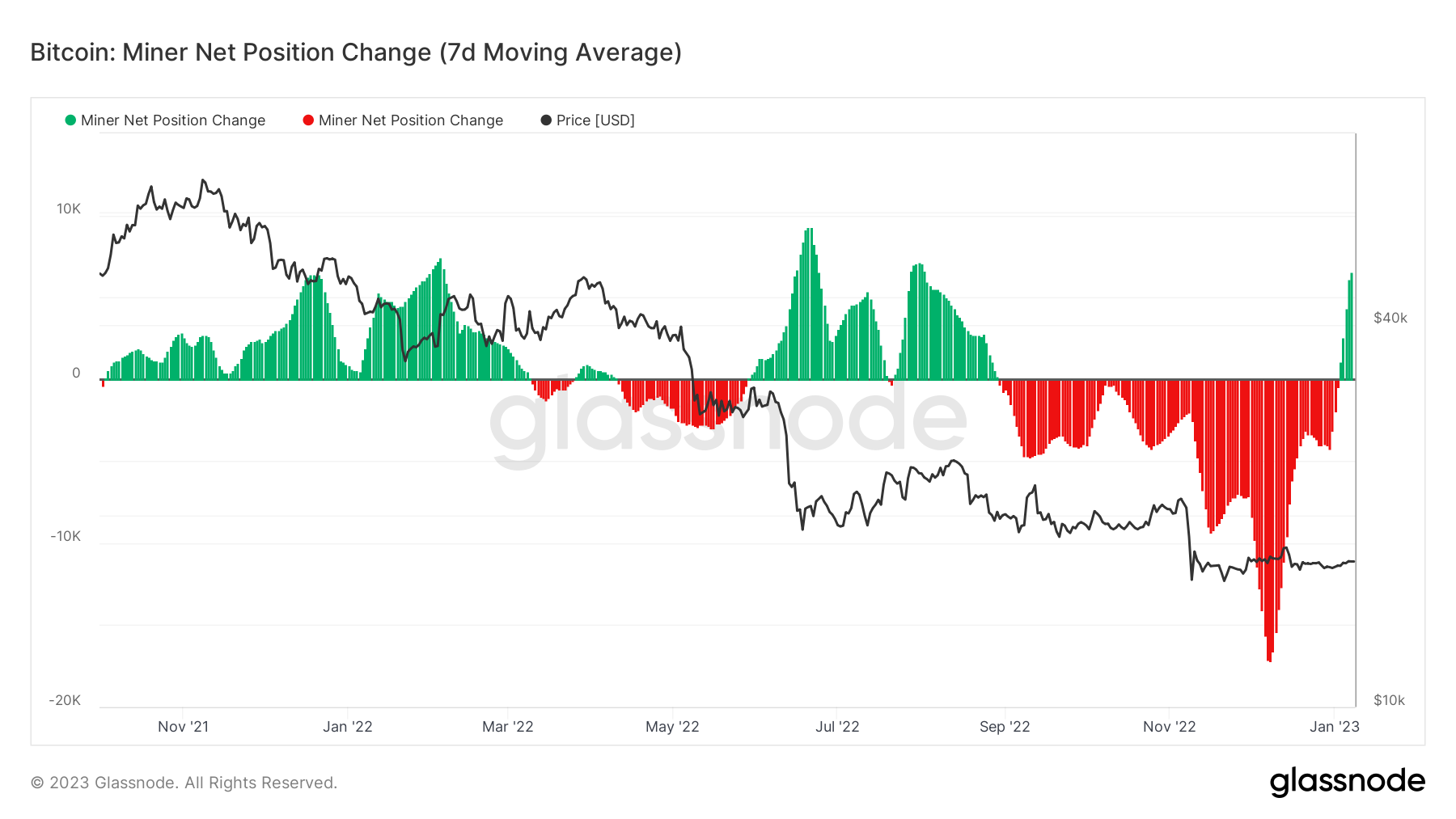

I've reported on this recently in the past, that the bitcoin miners have stopped net selling. The period of selling driven by the miners' financial situation as price crashed has ended at least for the time being. This could have big consequences for price. Exchange balances are thin, people continue to DCA, and now miners are able to hold their supply off the market as well. All these things add up to price increases in the near future.

More baseless and idiotic attacks on bitcoin's footprint.

“We need to better understand what is happening and to enforce the environmental laws that we have against coal and gas plants that are being operated primarily for the benefit of cryptocurrency operations,” Sierra Club staff attorney Megan Wachspress said in an interview.

Megan has one thing right, they need to better understand what the hell they are talking about. They sound moronic.

The NY moratorium on bitcoin mining was a disaster for clean energy in the State. Bitcoin miners were the most renewable industry they had, pushing that technology forward. Miners were powered by approximately 60% renewable if my memory serves, by far the most renewable industry in the State. The moratorium mandated 90% renewables, which NO industry in the State can reach btw.

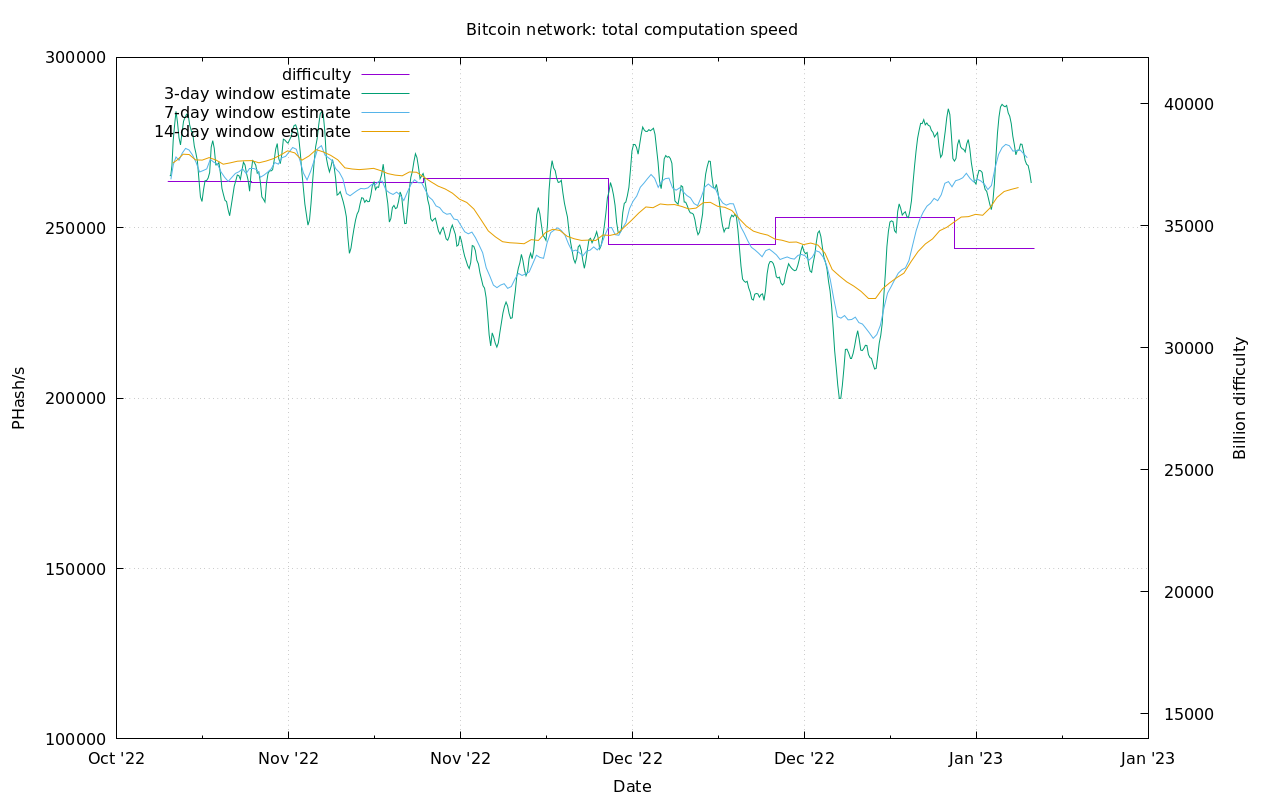

Difficulty and Hash Rate

Bitcoin hash rate has roared back with a vengeance! Nearly tying the previous ATH hash rate from early November 2022. Difficulty is estimated to rise by 8% after the previous -3% reduction.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 9, 2023 | Issue #224 | Block 771,171 | Disclaimer

* Price change since last week's report