Bitcoin Fundamentals Report #207

This week, community announcements, bitcoin getting more integrated, price analysis, and mining sector news.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! Members can find the link to all past live stream recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) Zoltan’s Three Pillars Versus Reality - FED 110

- (Bitcoin & Markets) The Geopolitics of Power - E249

- (Blog) Dollar Index DXY versus Broad Dollar: Death of the Euro

- (Fed Watch Clips) New clips coming soon!

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to hold on |

| Media sentiment | Negative |

| Network traffic | Medium |

| Mining industry | Surging |

| Market cycle timing | Bottoming |

Dear Reader,

I'm switching the Bitcoin Fundamentals Report (BFR) to Mondays after this week, due to scheduling conflicts. I originally chose Friday for the newsletter, because it was meant to be a summary of that week. It has evolved away from a news summary, into a focus on my unique commentary on the space and macro in general. Being a summary at the end of the week no longer makes sense in that regard.

Also, Fridays can be busy for everyone, the last thing some people want to do after work on Friday is read a newsletter. I hope this move also tackles that timing issue for readers as well.

I'm crunching out a lot of content recently, with the podcast, this newsletter, Fed Watch and associated 1000 word posts, live streams on telegram, etc. Over the next month or two, I'd like to streamline the content flow and perhaps drop something that people find adds the least value. This will allow me to focus my energy more on the highest value add content.

On a fun note, I'm expanding on the Monthly Prophet competition to include a prize each month. For readers who are unaware, each month for the last couple of years, our community on Discord has had a monthly competition to predict the price of bitcoin at the end of the month. I've expanded that to Telegram now. If you'd like to participate, you have to join Discord or Telegram and direct message me your prediction by the end of the day on the 4th of each month. This month will be a hat with a bitcoin B (see at the end of this newsletter for an image).

Feedback is always welcome. Please contact me via Telegram or Twitter (both @ansellindner). I'm constantly trying to elevate my content and add value to my readers, listeners and community members.

We soldier on. Hold fast.

Ansel

News Items

The bitcoin news cycle was slow again this week, but I dove in a pulled out a few storylines for you.

Archived (so you don't have to give the scam pumping website clicks)

According to data from the trading analysis platform TipRanks, while on-chain signals remain bearish for BTC, 62% of wallets have held BTC for one year and above. On the other hand, 32% of wallets are shown to have held for a month up to a year. Lastly, those who have been holding for less than a month are only 6%.

This is a metric like the Hodl Wave. More bitcoin being held longer is a sign that liquidation events are less likely AND that bitcoin has entered stronger hands.

- Iran has passed legislation establishing a legal framework for bitcoin and other cryptocurrencies.

- Under the new law, cryptocurrency can be used as payment for imports to the country by government and local businesses.

- The law also addresses fuel supply and electrical consumption for bitcoin mining.

This article goes on to say Iran's history with bitcoin policy has been very mixed, perhaps this is a sign that they have given it some deeper thought and came out with actual legislation.

Harkening back to May of last year, Iran previously banned the mining of bitcoin citing power grid concerns. Additionally, the Iranian central bank also banned the trading of cryptocurrencies mined outside of the country in the same month. The mining ban was later lifted in October just to be reimposed by December of the same year, once again citing power grid concerns.

The biggest technology firm in Indonesia, GoTo Gojek Tokopedia Tbk (GoTo), entered the Bitcoin and cryptocurrency space by acquiring local exchange PT Kripto Maksima Koin, per a report from Reuters.

GoTo acquired ownership of the exchange by purchasing 100% of available shares for 124.84 billion rupiah ($8.38 million). The tech firm reportedly stated the acquisition was part of a larger objective to become "a diverse money management hub."

Expanding Economic Integration Boosts Demand

As we can see in the last two headlines, Iran and Indonesia, many economies around the world are integrating with bitcoin. It is a slow process, but one that adds liquidity and stability to the asset. This stability then attracts new investors and prices go up.

It is a delicate balance that must be struck between supply and demand in a monetizing asset that is appreciating so quickly. In other words, supply and demand can get unbalanced when price rises or falls rapidly. There is a self-stabilizing effect as well, which unevenly advantages the price rises.

For instance, perhaps the a specific import export business in Iran needs $10 million in bitcoin value a month in order to run their business. At $20,000 that is 50 btc. However, as the price of bitcoin increases to $50,000, now they only need 20 btc.

As the value of bitcoin goes up, the absolute demand from business goes down. Of course, this process happens in reverse when price goes down, businesses will need more bitcoin.

The two non-business sources of demand are hoarding and speculating. Assuming constant business demand, hoarding disproportionately leads to price increases, because supply is reduced in the long term. Speculation, on the other hand, disproportionately will lead to price declines, because supply can rapidly flood the market.

That is why this average length of holding in wallets (article above) is an interesting metric, because it can give us information on the amount of short term speculation versus long term hoarding is. Right now, the hoarders are at ATHs, meaning price should tend to go up.

More hoarding and more business integration are bullish signs. All we need now is an ignition source. 🔥

Quick Price Analysis

| Weekly price* | $19,975 (-$732, -3.5%) |

| Market cap | $0.382 trillion |

| Satoshis/$1 USD | 5,007 |

| 1 finney (1/10,000 btc) | $2.00 |

On last week's report, price was at $20,707. Last week I concluded:

The risk of a large sell off is low, but there has been such a void in energy that price is finding it hard to get its feet under itself.

Overall, I expect the bitcoin price to continue a slow drop over the next week but for it to surprisingly hold its own relative to stocks.

That was right on. So far this week, price has traded sideways to down.

Daily chart

Interesting Friday pattern emerging. The last two Fridays have seen sell offs which could have something to do with traditional market products becoming more of the bitcoin trade volume. Things like ETFs, bitcoin trading in your brokerage accounts, CME futures, etc., could have an increasing effect on the bitcoin market.

I don't think this is anything to be worried about. These traders too get panicked and feel FOMO. They also are sitting on much more money on average than earlier bitcoin traders, so when momentum changes, price could really takeoff.

The dashed line in the chart above is simply showing that we are technically higher than prior bottoms.

I'm not an Elliot Wave technician, I don't even like it, but bitcoin and other markets tend to move in three impulses, which is an Elliot Wave of a 5 count.

As you can see below, after breaking bullish in mid-July (above the red line), we had three impulses higher. So far, we've had 2 impulses lower. Therefore, we could be in store for a third. But, since I do not expect much organized selling pressure, it could end up being quite timid, and not to new lows.

We can see these 3 impulses on longer time frames as well. Of course, there is quite a bit of artistic license here, which is one reason I do not rely on Elliot wave.

TD Sequential

This indicator is a time-based indicator, measuring how long the trend has been in a certain direction. The counts go up to 9 in a bullish or bearish direction. As you can see, last month was a Red 9, meaning this bearish move has reached a point of at least consolidation, with an increased chance of reversal.

The daily TD Sequential has been quite good on this whole down trend, with Red 9's calling points of consolidation. However, we are not close to a Red 9 today, only starting a new Red count on day 1.

My analysis of this indicator is as follows. If the monthly count is respected, we could see up to 8 days right here, of negative price pressure, at which time we reverse and head higher.

Headwinds and Tailwinds

Ethereum is a major headwind.

The Ethereum Crisis is coming to a head. The estimated merge date is the 14th, less than 2 weeks away. I haven't seen any new craziness about it, but there is a growing consensus that it is a "sell the news" event. Even some Eth folks have been starting to say that, because of where we are in the market cycle.

I'm a contrarian, and my opinions here are nuanced. I think the Eth 2.0 update will effectively castrate any hope Ethereum has to be a world changing network. It will be completely captured, censorable, and boring. But I also do not think it will see an immediate crash in price after the merge.

My intuition is saying that the upgrade will initially work, with a few minor fires put out on the first day of the merge. Then a week later or so, big problems will appear. Price won't crash, but it will be a controlled exit of Ethereum.

In addition, there has been limited pre-fork pumpage. A "sell the news" event comes after a large build up and market rally. Remember, it is "buy the rumor" then "sell the news". There hasn't been much buying of the rumor.

All in all, this is a headwind for bitcoin because it adds a lot of uncertainty into the market. Longer term, the slow deterioration of Ethereum will be a tailwind.

Stock Market

The correlation between stocks and bitcoin could turn from headwind into tailwind this week.

As you can see on the chart above, stocks dipped a toe into the golden pocket. I've been talking about this level for a week and a half as a possible target to buy the dip.

Earlier today, it looked as though stocks were set to rocket back up, and resume their climb. However, as negative economic data filled the headlines, stocks began to sink again.

I maintain my bullish outlook on stocks for the rest of the year. So, after this bounce, stocks could have a supporting effect on the bitcoin price.

Price Conclusion

The bitcoin market's energy remains low, there are signs that trading interest has dropped significantly with Friday dips, some momentum timing indicators are due for another impulse lower, while longer timing indicators are showing this month is time for a reversal.

Ethereum is still adding uncertainty, but shouldn't be the imminent implosion we all thought. Stocks could have found a bottom for now in the golden pocket and will continue their climb.

Overall, the risk of a dramatic sell off remains low. I expect the bitcoin price to continue sideways to slightly lower this week, but to find some footing very soon. By the end of the month, I think bitcoin has it's reversal.

Mining

| Previous difficulty adjustment | +9.2603% |

| Next estimated adjustment | -2.0% in ~11 days |

| Mempool | 12 MB |

| Fees for next block (sats/byte) | $0.39 (14 s/vb) |

| Median fee (finneys) | $0.36 (0.180) |

Mining News

Research pieces like this are very important to push back on the false fear-mongering done by climate alarmists.

If the BTC price hits $2 million in 17 years, Bitcoin may consume 894 Terawatt-hours (TWh) per year, surging 10 times from today’s level, the report suggests. Despite huge growth, such energy consumption would only account for 0.36% of the estimated global energy consumption in 2040, increasing from Bitcoin’s 0.05% share today, the analyst estimated.

The President of Paraguay, Mario Abdo has issued an executive veto on a recently approved cryptocurrency bill. Abdo’s veto decree states cryptocurrency mining is an “energy-intensive” and a low-value-added activity. The bill will now be returned to Congress to be approved again or to be rejected entirely.

Following on from the first headline, where Arcane showed bitcoin mining is minimal in energy terms, some countries are so blinded by their allegiance to the globalists, they will miss this huge opportunity.

Small countries have a small window to push quickly with bitcoin mining. They don't have to adopt bitcoin as currency yet, but at least position themselves as leaders in the industry. Paraguay missed a huge opportunity here.

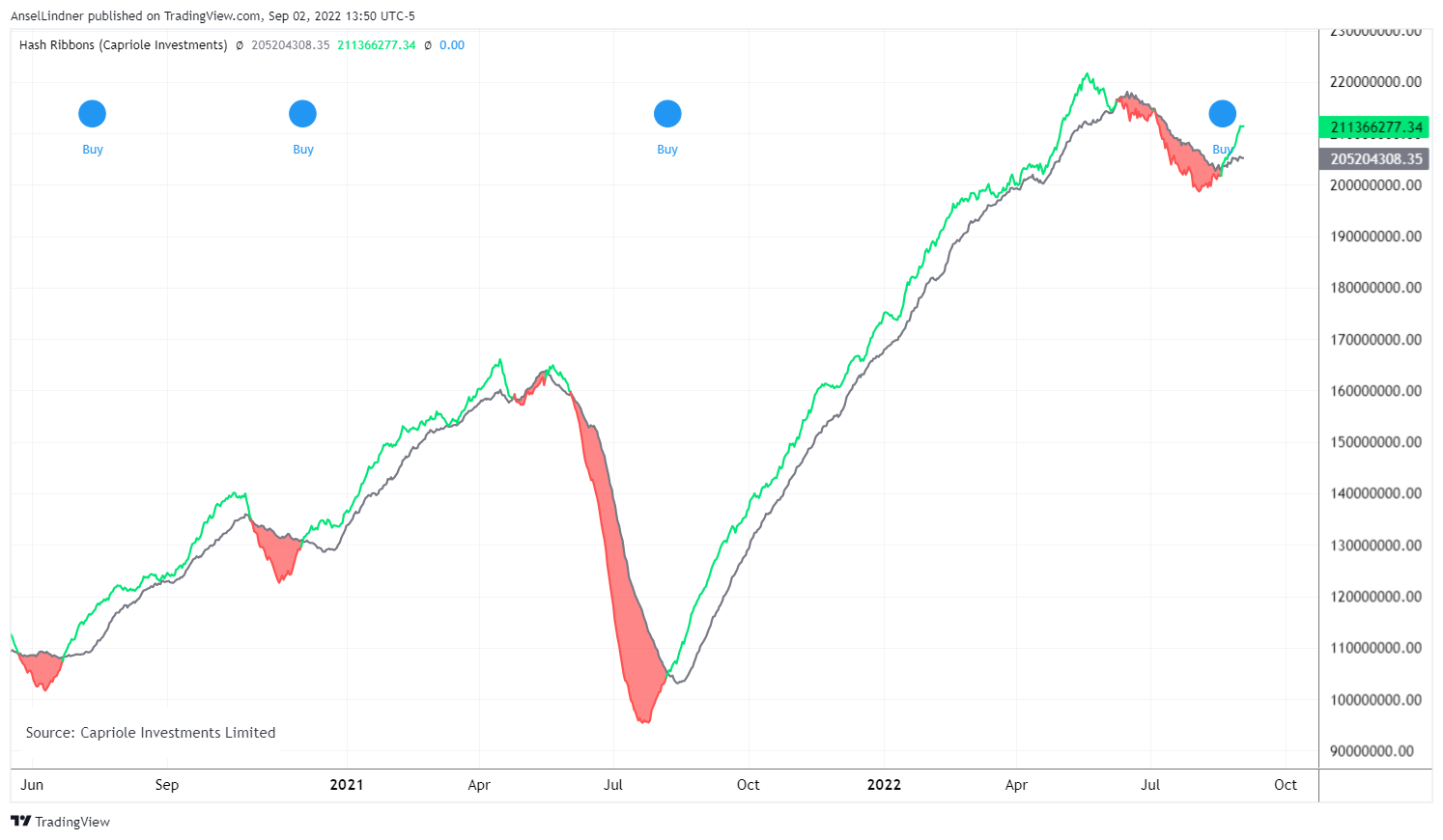

Hash Ribbons

The hash ribbons have really widened this week after the buy signal was confirmed. To recap, this is the 30-day and 60-day moving average of hash rate on the bitcoin network. These buy signals have been extremely accurate in the past.

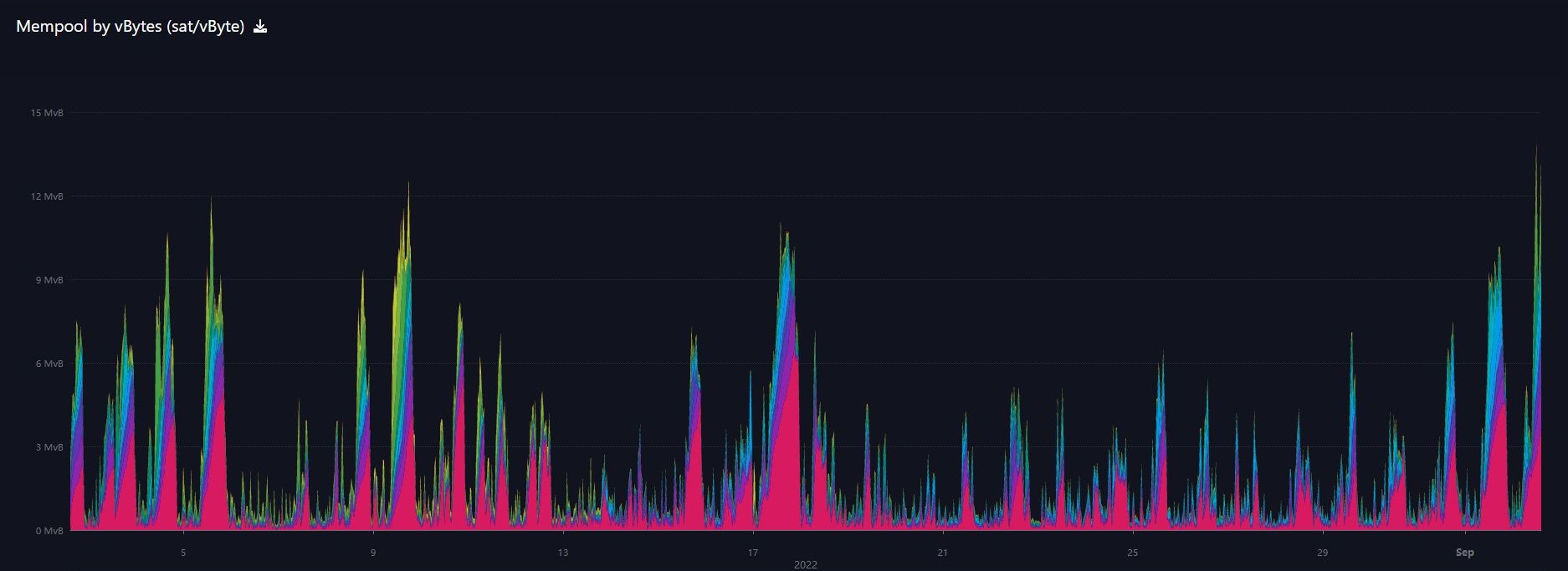

Mempool

The mempool represents the number of transactions that have been sent but not included into a block by the miners. It's hard to see but at the very far right on this graph, we see that this number is the highest in the last month.

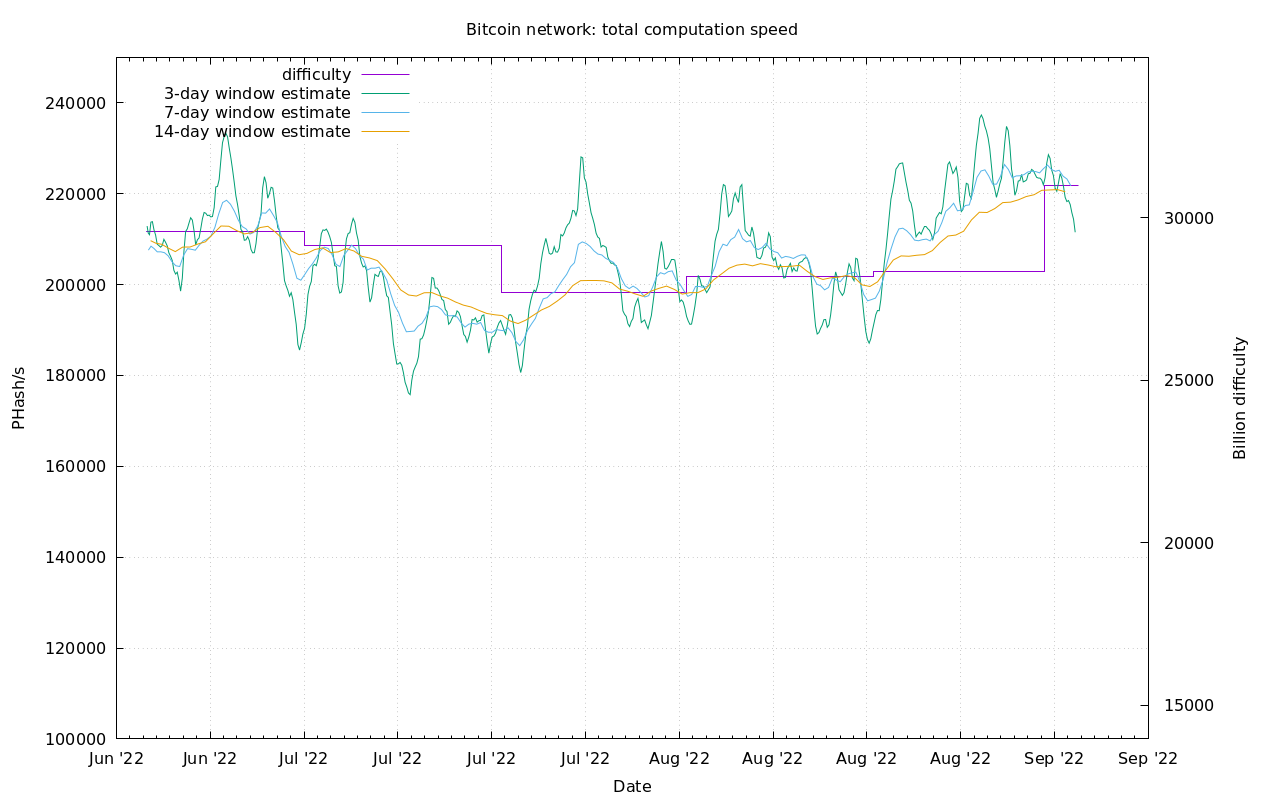

Difficulty and Hash Rate

Bitcoin mining had a huge surge in the last week, and saw the largest single difficulty increase of 9.26% since January, hitting an new ATH.

Bitcoin got close to a new ATH hash rate, despite the bitcoin price dips.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

September 2, 2022 | Issue #207 | Block 752,320 | Disclaimer

* Price change since last week's report