Bitcoin Fundamentals Report #204

Commentary on Blackrock's Bitcoin Trust, the Antima meme, simple CPI math, plus Bitcoin price analysis including headwind and tailwinds, and mining sector news.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! 30 live streams in 30 days! Members can find the link to the recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) Accelerating China Issues | Bitcoin’s Place in Macro - FED 107

- (Fed Watch Clips) New clips coming soon - Subscribe!

- (Bitcoin & Markets) Bitcoin, Ukraine, Taiwan, Richard Werner | Telegram Live Stream - E246

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Battling higher |

| Media sentiment | Slightly negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Bull market starting |

Blackrock In Headlines again, with a spot bitcoin trust

BREAKING: $10 trillion BlackRock launches institutional trust for spot #Bitcoin exposure

— Bitcoin Magazine (@BitcoinMagazine) August 11, 2022

Yesterday, Blackrock announced they have launched a spot bitcoin trust.

BlackRock is committed to providing clients with access to their choice of investment opportunities and has launched a spot bitcoin private trust. The trust is available to U.S. institutional clients and seeks to track the performance of bitcoin, less expenses and liabilities of the trust.

We have few details at this time, but I assume it's model will be close to that of the Grayscale Bitcoin Trust (GBTC). Blackrock will buy bitcoin to back shares sold to clients. After a period of 6 - 12 months, owners can sell their shares on a secondary market. It is similar to an ETF on the secondary market, but new shares can only be bought by accredited investors through Blackrock.

This news comes right on the heels of last week's bombshell that Blackrock is going to allow bitcoin trading through its Aladdin platform, via a partnership with Coinbase.

It should not be overlooked that these two huge moves by Blackrock are bitcoin only. They do not include any altcoins, because of the growing uncertainty around altcoins and the SEC and, according to the release, interest from clients is focused on bitcoin only.

Bitcoin is the oldest, largest, and most liquid cryptoasset, and is currently the primary subject of interest from our clients within the cryptoasset space.

The drawback in these products is that they are not redeemable for the underlying asset. Clients will be able to trade bitcoin held in Coinbase custody, or in the Trust's custody, but cannot take delivery. Of course, nothing stops clients from buying bitcoin personally through other services for self-custody, while also investing through Blackrock. For instance, if I were an employee of Blackrock or one of their large institutional clients, and I knew that my Fund was diversifying into bitcoin, I'd personally buy some bitcoin for my own custody.

A benefit of a trust over an ETF is the long term holding of the Trust. Typically, once the Trust buys the asset, it is only sold off slowly for expenses. The secondary market must soak up all other selling demand. See Grayscale's treasury balance:

Estimating possible impact

Grayscale targeted accredited investors, where Blackrock has their own institutional investors. Grayscale's bitcoin balance maxed out at 655k bitcoins back in February 2021. During that time, September 2020 to March 2021, the bitcoin price rallied 530%.

Figuring Blackrock's institutional interest in their Trust will be comparable to Grayscale's, we can conservatively estimate a similar rise in price, of 500% up to $140,000 per bitcoin. However, the first-mover effect of Grayscale effectively takes 600k bitcoins off the market, meaning Blackrock will be chasing fewer coins and the effect could be much greater.

The Birth of a New Meme

The debate over Bitcoin Maximalism heated up again this week, as long time Bitcoin Core developer Matt Corallo attacked a straw man of bitcoin maximalism. Nic Carter road to the rescue, taking a break from his busy "raising star" schedule to dip his toe back into the fray.

It started here...

1/ Bitcoin maxis are a dying breed. While there was a time where ~everything except Bitcoin was basically a scam, that hasn't been true for a long time, and the smart money has moved on to figuring out which projects are going somewhere, and which are straight pump-and-dumps.

— Matt Corallo (@TheBlueMatt) August 8, 2022

Continued here...

3/ The "narrative wars" are coming, arguably are already here. With ETH (finally) moving to PoS, people who've only heard about how "PoS won't work" from Bitcoiners will have even less reason to care about what Bitcoiners have to say.

— Matt Corallo (@TheBlueMatt) August 8, 2022

Let me guess, he's raising money or attached to a project now that is raising money. LMAO, yep. He's gotten involved with the Venture Capital world. These guys are directly involved in every rug pull there is.

Follow the money. pic.twitter.com/Idg5W1KCAe

— Samson Mow (@Excellion) August 8, 2022

Anti-maximalists universally attack a straw man of bitcoiners. They say we accuse everything other than Bitcoin as being a scam just because we're toxic, or as a way to market bitcoin. They ignore that we make specific arguments about technological and economic trade-offs in design about these projects. We've studied this and can evaluate a project in under a minute in most cases.

Anti-maximalists are characterized by not engaging with the arguments, instead resorting to ad hominem and straw man attacks. They are also always invested in those very projects that bitcoiners have evaluated as scams.

Here bitcoiners are in a cult, still with zero actual arguments. What they are really saying, "stop calling our shitcoin investments scams!! Please, we need real devs from bitcoin projects to come a save our shitcoins."

I invite bitcoiners of all stripes to follow Matt's lead and publicly distance themselves from the maxi cult. At this point, there is only downside in being associated with this pathetic, delusional ideology.

— nic carter (@nic__carter) August 8, 2022

If #Antima made an actual argument, we'll talk. No problem. But they don't want that. Their audience is the newcomers to the space, shaming them to avoid looking into bitcoiners sound arguments. The scammers are trying to breath life back into their loser shitcoin scams.

It used to be that bitcoin itself had a barrier to entry, you had to read some books and do some work to understand it. Content creators (which I am one, but my contributions pale in comparison to some) have done such a great job making this stuff accessible to newcomers, that scammers now cannot count on this barrier to entry, so they create an artificial one, shaming and calling bitcoiners names to scare off newcomers from bitcoin.

They accuse bitcoiners of being toxic as a marketing ploy, when in fact they are projecting. They are being toxic toward bitcoiners as a marketing ploy for their scams.

Politics Clouds Understanding of CPI

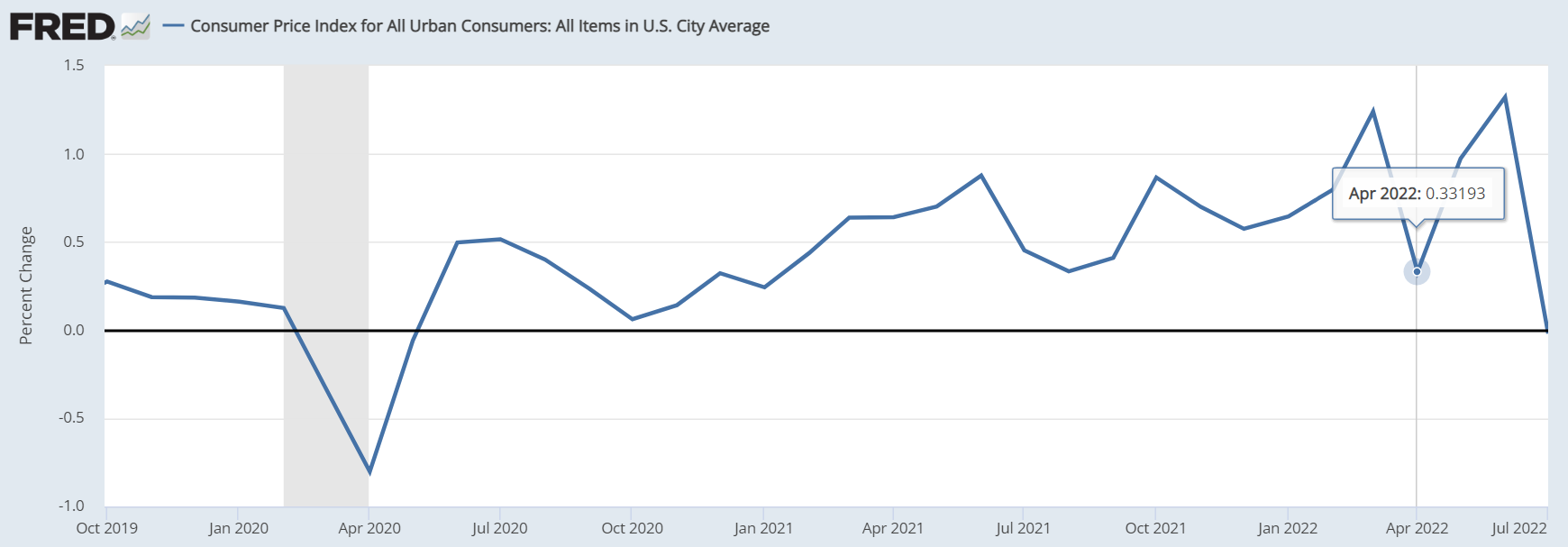

I was very disappointed in the Bitcoin space this week in the wake of the July CPI data release in the US. It was a shocking miss to the downside, with month-over-month (MoM) change of 0.0%, making the year-over-year (YoY) headline rate 8.5%.

First, I must note I'm unabashedly in the transitory camp. Peak CPI was bound to happen sooner or later, so a crash in CPI is no surprise to me. Inflationists, however, once again are confused and scream "manipulation and lies!"

Initially, it looked as though CPI would peak in March as I predicted. Back then, the MoM change in price-level dropped from 1.24% to 0.33% in April. However, I underestimated the effect of the Russia/Ukraine conflict on US prices and that dip was followed by another two month spike in CPI. That surge has proven to be temporary as well, with the July MoM price-level remaining "unchanged" or a 0% change.

What is so disappointing is that bitcoiners and macro people I thought knew better and were good at math, unanimously called this data bullshit. Most shocking of all was that they forced me into defending the idiotic and evil Marxist regime's claims that "inflation was zero in July."

what happens when our leaders lack so much numeracy that they can't even discriminate a 1st from a 2nd derivative @FossGregfoss ? https://t.co/Swl2G1MiGe

— ecofire (@ecofire2) August 10, 2022

ummm wrong

— FOSS - Lehman CDS at 9bps in '06, 🇨🇦 now at 33 (@FossGregfoss) August 11, 2022

Inflationists are allowing their bias to influence their understanding of CPI. Greg Foss is a great guy and good influence on the space, but what is this all about? He's dead wrong here.

Month-over-month CPI is extremely simple. It is the change in the absolute price-level, e.g. milk was $3 at the end of June and $3 at the end of July. Literally, 0% in July means there was no change in the price-level, the rate of change has nothing to do with it until you get into YoY.

Continued below...

Quick Price Analysis

| Weekly price* | $24,171 (+$1,160, +5.0%) |

| Market cap | $0.463 trillion |

| Satoshis/$1 USD | 4,137 |

| 1 finney (1/10,000 btc) | $2.42 |

TIME TO PAY ATTENTION!

For another week, the bitcoin price has remained quiet, but market sentiment has drastically shifted bullish. Price continued to struggle with the 50-day EMA (50-yard line), but in the last few days we successfully defended it and price is now pressing higher.

Daily chart

Bear Flag Update

Last week, I wrote about a textbook bear flag beginning to form.

Though we are seeing higher highs and higher lows, there is a growing likelihood that we are forming a bear flag.

What you can see above is the price still within this potential bear flag. However, the it turned before visiting the bottom of the channel, signaling to me that there is more likelihood to break the top of the channel than the bottom.

Weekly chart

The weekly chart with volume-by-price indicator is looking good here. Price is slowly getting ready to rally to the next level of resistance around $29,000.

Headwinds and Tailwinds

I'm changing up this section again, go figure. I've been including it as a Headwinds section while bitcoin was going down and bottoming, but now as we shift back into a bull market, I'm going to use this section for Headwinds and Tailwinds.

Stock Market

Last week, I wrote about stocks which have been highly correlated to bitcoin during the last year. This is a tailwind.

This market wants to go higher, and if stocks can brush off the jobs report, bitcoin should catch up quickly.

I've been a bull on the US stock market for months. Despite being in a "recession", and all the doom-and-gloom on FinTwit and Bitcoin Twitter saying stocks are going to crash, they have rallied, to bear's disbelief.

Stocks should go up from here for several reasons, which I've talked about many times on my Telegram live streams. 1) Cash on the sidelines is at a two decade high, in both stocks and bitcoin; 2) buyback season is upon us; and 3) the Fed will pivot to save face.

Altcoins

This week the Department of Justice and SEC in the United States, came out with a blacklist of many Ethereum addresses associated with money laundering through an app called Tornado Cash. There is much more to this situation, which I don't have time to cover here. Suffice it to say, many people got a wake up call on the security of centralized stablecoins.

In recent months then, altcoiners (unsophisticated and speculative investors) who believed the marketing of DeFi and altcoins, have learned that algorithmic stablecoins (so-called decentralized) and centralized stablecoins are both not the answer for altcoin success.

I do not promote centralized stablecoins, but do note they are much better than "decentralized" stablecoins. Tether as a company and team have been a bitcoin ally for many years. My warning is, unless you are a whale using Tether or USDC to arbitrage and trade, you are better off not holding them.

Anyway, USDC froze a bunch of people's stablecoin assets this week and caused a bit of drama within the Ethereum community.

For bitcoin, I'd count this as neutral. There is some negative effects like people being turned off to the space, but it will also convince people to hold bitcoin instead of stablecoins. In the long run, this is a tailwind, because those people who learned to hold bitcoin instead of leveraging stablecoins, will have a cumulative effect into the future.

Macro Headwinds

The Macro headwinds have eased a small amount this week. If we are looking only at the price of energy and the dire headlines about Europe and China at the moment, you might be asking, "how could macro headwinds have eased?"

Well, currencies are telling us a different story. Today, I'll use them as a proxy for developments in macro that we haven't seen yet, or that haven't bit the headlines yet. A strong dollar means people around the world are having a hard time servicing debt denominated in dollars; in other words a dollar shortage.

Pressure on the Hong Kong dollar peg is easing, as well as, the pressure on the Yen.

Even the Euro is back-testing resistance.

There is a possibility that the dollar weakens a little here over the next couple of weeks, down from 105 to 103-ish on the dollar index (DXY). Remember, nothing goes up in a straight line forever. This would give bitcoin and stocks some room to rally, as well. So, currencies/macro have eased from a headwind into a tailwind.

Price Conclusion

These bearish forces, however, are still outweighed by the bullish fundamentals. [...] I maintain my call for higher prices up to $29k, followed by consolidation.

- Last week

Price has, once again, been extremely stable this week, but battled important moving averages and volume zones. Stocks have raged, while bitcoin has held back. Macro pressures are easing slightly, as proxied by currency pressures, allowing bitcoin and stocks go up.

Again, I maintain my call for higher prices up to $29k or higher. The likelihood for a significant consolidation/pause at that level has lessened this week, due to the extended period it has taken to begin the upward push on the chart.

Mining

| Previous difficulty adjustment | +1.7409% |

| Next estimated adjustment | +2.5% in ~5 days |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.07 (2 s/vb) |

| Median fee (finneys) | $0.07 (0.029) |

Mining News

Mining companies Marathon Digital Holdings at 124.12%, Core Scientific at 110.39%, Hut 8 at 98.95% and Riot Blockchain at 96.69% have seen their stock prices rocketing upward over the last 30-days.

In the Price section, I wrote about currencies giving us a glimpse into macro pressures temporarily easing in the near term, the surge in the bitcoin mining industry is more confirming evidence of that.

Bitcoin miners have dealt with a falling bitcoin price, a heat wave causing some miners to voluntarily support the grid by pulling equipment offline, and sky high energy prices driven by sanctions and fears about the Russia/Ukraine conflict. Despite those factors, miners' shares are exploding in value.

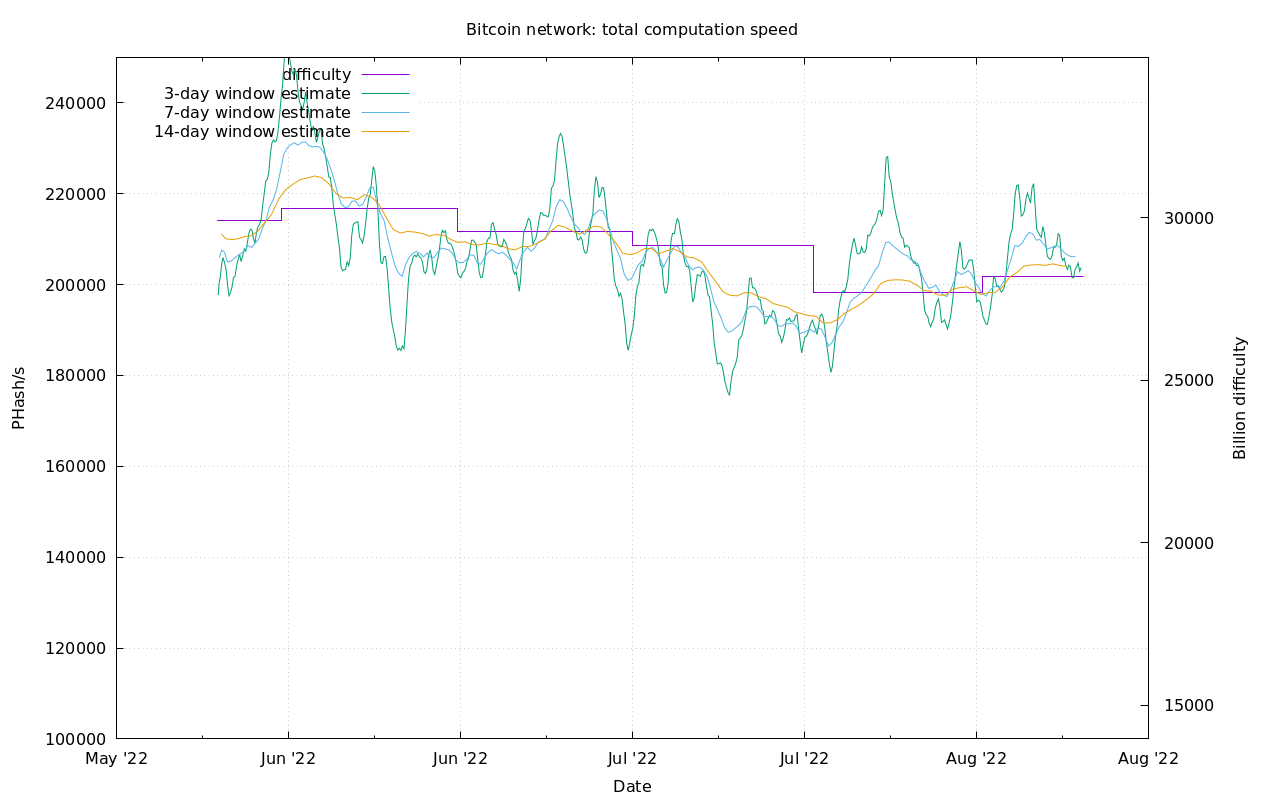

Difficulty and Hash Rate

This week saw steady improvement in the average hash rate on the network. Despite all those pressures mentioned above, plus the constant specter of government crackdowns, bitcoin mining is thriving.

The next estimated difficulty adjustment is in 5 days, and is on pace to be +2.5%.

CPI Rant Continued...

What is this 1st and 2nd derivative garbage? I excelled at math in school (granted that was a long time ago), completing Differential Equations by my first semester at college, plus with AP and transfer credits from high school, that qualified me for a Minor in Math, along with my Major in Economics. CPI has nothing to do with 2nd order derivatives.

The YoY rate is the cumulative MoM rate. It's very easy. Start with 1, then multiply (1+MoM) for the last 12 months and you get YoY. The base is the MoM rate. If the MoM is zero, that means velocity (or the change in price level) was zero.

These people are confusing themselves by worrying about the YoY rate to justify their inflationist bias.

CPI Going Forward

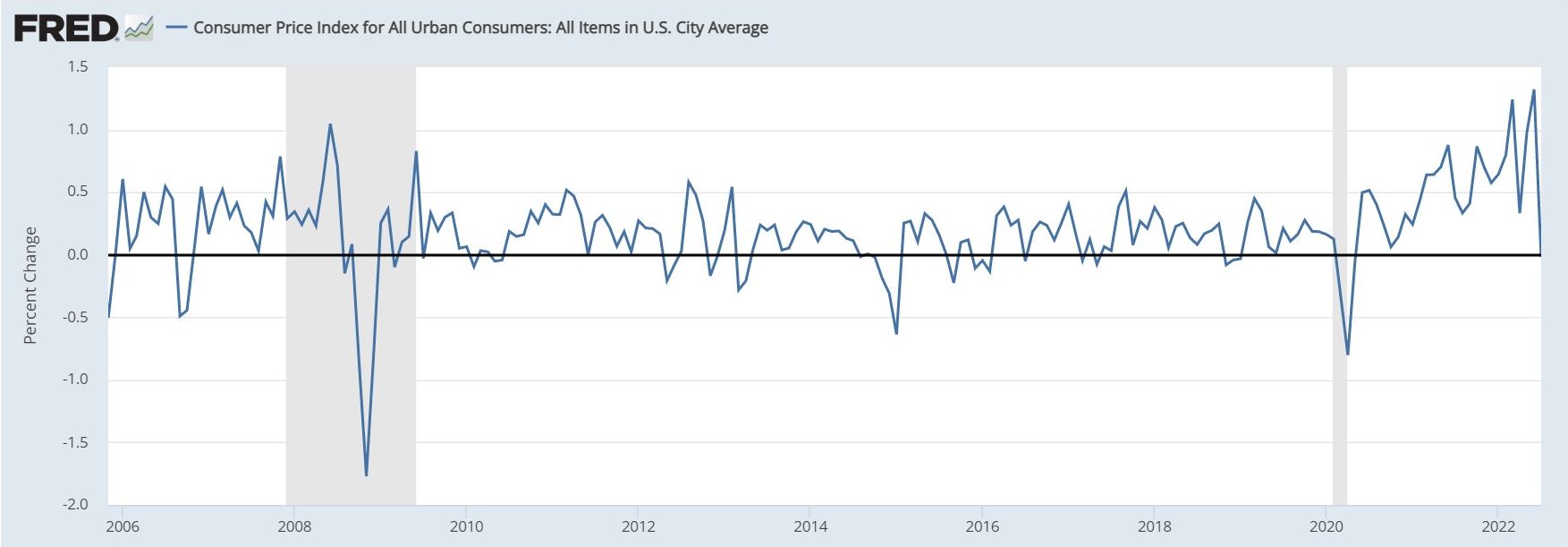

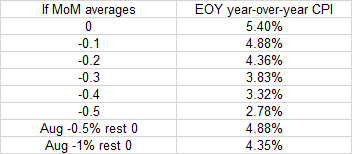

The YoY will continue to fall, probably faster than anyone expects. If we get a 0.0% for each month to the end of the year, YoY will end at 5.4%. However, I expect some negative months in there.

During the Great Financial Crisis, MoM CPI hit a low of -1.7%.

I don't expect something that dramatic, but I can see several negative prints in the coming months. This will pull YoY inflation down quickly. I put together a quick table. I'll try to get this into chart format and tweet it out.

You can see how the focus on headline (YoY) CPI causes confusion. If every month from now until the end of the year averages a 0% price-level change, not rate of change but literally the prices don't change, the ending yearly CPI will still by 5.4%, even after 6 months of 0%.

If we get a -1% MoM in August (possible) then 0% from there out, CPI will end the year at 4.35%, even with the last 6 months being negative!

Note on GDP: Quarterly price-level changes will effect real GDP (nominal GDP minus inflation). In Q2 2022, nominal GDP came it at a huge +7.8%, however, after adjusting for price increases, real GDP came in at negative -0.9%.

Regarding Q3: We already have one month of 0% price change, if the other two months come in similar, the inflation component of real GDP will be near 0%. Even if we see nominal GDP crash from +7.8% to, say, +3%, real GDP for Q3 will be around 3%. These numbers would match the GDPnow forecast's current estimate of +2.5% in Q3.

This creates the weird situation where nominal GDP is crashing, but switches from a negative to a positive result because CPI crashed faster.

Say bye bye to all that controversy about the definition of recession. Q3 GDP is looking like it will be positive IMO, and that will be bullish for stocks and bitcoin.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 12, 2022 | Issue #204 | Block 749,169 | Disclaimer

* Price change since last week's report

Cover image: @tecn9nesaurus