Bitcoin Fundamentals Report #200

Rant about fear based macro reporting, bitcoin price analysis, bitcoin headwinds, mining sector update, and a macro update on Dutch farmers and China.

This Week

Rant about fear based macro reporting, bitcoin price analysis, bitcoin headwinds, mining sector update, and a macro update on Dutch farmers and China.

Jump to: Market Commentary / Price analysis / Mining sector / Macro

In Case You Missed It...

Visit my content on other sites too. All clicks help! Subscribe and share! Thank you!

- (Fed Watch) The Focus on the Fed is Wrong, Here’s Why | Fed Watch 103

- (Fed Watch) New FED WATCH clips channel

- (Blog) Bitcoin Maximalism is Economic Stoicism

- (Bitcoin & Markets) Response to Jeff Snider's Criticism of Bitcoin - E244

- (Member) E244 Video

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Waiting game |

| Media sentiment | Very negative |

| Network traffic | Normal |

| Mining industry | Making statement |

| Market cycle timing | Despair, avoidance |

Dear readers,

I have some updates on my content. First, the website transition is complete. I believe everyone's subscription and membership transferred over correctly. If there are any problems please let me know.

Second, I've started a new Fed Watch clips YouTube channel. I'm going to be taking the best short clips from each week and publishing them on there. Please subscribe and share. We are getting new intro music for Fed Watch to make it more friendly to new listeners. The old music was not selected by me and I think could be causing new listeners to tune out before we even start talking. The next few weeks will be important to share the show as our new content will be more friendly to new listeners.

Lastly, I'll be appearing on Stephan Livera's podcast next week (or at least recording next week) to talk about deflation and credit-based money. It would be awesome if you guys showed support by listening to that and sharing it like crazy.

Thank you.

A

I'm Getting Tired of the Fear Porn

Usually, it is the mainstream media selling doom and gloom. "If it bleeds, it leads," as the old adage goes. But, we're in a weird time. The last few months, I've noticed it is the alternative media, the ones we have grown to trust throughout the pandemic and election fortification controversies, who are now selling fear of an impending collapse of the economy and our whole society. Even more, some claim it is "the end of western civilization".

Beware of fear hustlers. It's hard to put into words exactly what fear hustling is. As a short hand, anytime people are predicting something WAY out of the normal or historical trend is a good start. People calling for $200 oil comes to mind.

This is not to say that we aren't going through painful and scary times, but the market is resilient and there is a limit to how bad it can get. Right now, we are transitioning away from a credit-based global system, globalization, hegemonically imposed peace, and strong international institutions. Globalism and decadence is giving way to more localism and sounder values, both morally and economically.

It is not the end of western civilization anymore than the countless other times our world has been turned upside down. We must keep our wits about us, so we can see the truth and come out as good or better on the other side. For example, the Euro will likely break up in coming years, and readers in Europe will be told it is the end of life as you know it. The evil far-right wing fascists want to kill the Euro. In reality, the Euro was doomed from inception. It was a fantasy of Marxist globalists in the first place.

We will also be told (and I see this already everywhere) that Russia, China, and the BRICS will take over the world and be the next pluralist hegemony. Let me tell you, that is so unlikely it's laughable. Russia is winning the war in Ukraine for sure, but it is doing so because Ukraine and Western Europe are so weak. "Life as you know it" in Europe is as a weakling, elites using political tricks and bribery to get what they want. A change will be for the better, although hard while doing it.

I can't leave the US out of this. We are told that the progressive Marxists in the White House today, along with their crazy identity politics will lead to civil war. Again, very unlikely. First, the crazy Marxists don't have and guns; second, they don't have any kids and immigrants are turning on them; and third, their crazy ideas are based in being spoiled, they've never had to do an honest day's work and actually provide value to their fellow man. A civil war is expensive, and spoiled brats hate conflict.

I'm not sure where I'm going with this, other than to say I'm getting sick of the fear porn. I'm also not saying that the world will have some great flowering golden age after this difficult next year or two, likely most of the world will deindustrialize a little. But we'll be more happy and healthy.

Think of it like this: The world is like a 35 year old man living in his parent's basement. He has a super easy life of video games, trolling on Twitter, mommy doing his laundry, not paying bills, having meals cooked for him, etc. Right now, he is being forced to grow up, get a job and start a family. It's very painful and scary, but it's "good" for him. It's also good for the world to get back to sounder economics and values.

That is what the world is going through right now. After decades on the teat of easy credit and a secure and peaceful international order, the world has to grow up and make hard decisions. It is a return to a life as it was intended to be lived. I hope that makes sense.

Quick Price Analysis

| Weekly price* | $21,090 (-$654, 3.0%) |

| Market cap | $0.403 trillion |

| Satoshis/$1 USD | 4,737 |

| 1 finney (1/10,000 btc) | $2.11 |

Another week with price doing almost nothing, however, several factors are starting to show strength.

Weekly chart

It can be just as hard to hold through lack of action as it is during a crash. You don't know if you should DCA now, or wait for the next big dip. Given a couple weeks to think, maybe you decide it's all too risky. We are on our 5th week with price in this area of the chart.

Daily

Last week, I identified the above repeated pattern (red boxes). I warned that we could repeat that same thing because price was looking so weak. Fast forward to this week, and we did indeed see that same pattern play out.

There are some differences though. First, price did not touch the red line where I identified the resistance, that tells me there was no attempt to trap bulls. Second, in the pattern from May, the daily chart showed bullish divergences because of the lower lows (green line). Along with a stronger mid-pattern bounce, in hindsight we can see the bull trap clearly.

The next several days are pivotal for the bitcoin price. If it fails once again and rolls over, I think we see new lows down to $15,750. More likely though, in my opinion, is making it back up to the red resistance line, at which time it is likely to fill the volume gap in the weekly chart, up to $27,000. Of course, price could just go sideways for the next few weeks, but I think that is the least likely scenario right now.

Previous High

A lot has been made of the price breaking lower than the previous cycle high for the first time in bitcoin history. However, I'll remind you that we did have a semi-cycle in between now and the 2017 high, back in June 2019. This chart is just to show that there are alternative ways to look at the cycle high criticism.

Price Headwinds

Headwinds for bitcoin have eased greatly this week.

Altcoins

Another high profile leveraged Ponzi scheme has filed for bankruptcy, but this time did not have a noticeable effect on the price. To my casual bitcoin readers, these scams were completely contained in the non-bitcoin, "crypto" market. These are not "bitcoin Ponzis" they are altcoin Ponzis. They only affected bitcoin because they held bitcoin as reserves and had to liquidate it in an attempt to stay solvent.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XK34X5FIKRMPNDAKMO4XHU5CHI.jpg)

Last week, I said that bitcoin was showing surprising resilience even as multiple large altcoin scams closed their doors and filed for bankruptcy. This week, once again, the bitcoin price is holding up nicely despite the utter collapse of the altcoin den of lairs and thieves.

Any dip in price will almost surely not come from forced liquidations in the altcoin scams. That makes cascading liquidations in bitcoin very unlikely, meaning it will be hard to push the price much lower than it is.

Inflation and recession fears

I've been pounding the drum about recession fears for months, long before the mainstream financial press figured it out or the mainstream bitcoin press saw anything coming.

This week recession concerns intensified, but everyone is late to the party. They were late to call recession, and they will be late on calling the bottom, and try to sell it as being worse than it is (for the US).

Most people think recessions are bad for bitcoin, but I'm not one of them. Bitcoin has already finished its large liquidation cycle, so further recession should not affect price much. Recessions are characterized by money being in short supply, and that is exactly what bitcoin offers a money that can rapidly appreciate. The "dollar shortage" can be supplemented by a rising bitcoin value.

There is some lingering fear of inflation, but as gas prices come down in the US (for me $4.79 to $4.19 or 12.5% in two weeks), inventories hit critically full, and sales slash prices, inflation fearmongers will have to accept that it was "transitory".

Price Conclusion

Headwinds have dramatically eased this week. It is to the point where I don't think I'll have to include them starting next week.

Most liquidations are likely behind us (famous last words, lol). It is going to be harder to find sellers than buyers right now.

The chart is still quite weak, but we have a chance over the next several days to break the pattern of weakness that has dominated the chart for the last few months. Not sure if it will be this week, but once bitcoin shows just a little strength, I expect it to get into the $40k's or even $50k's within two months.

Mining and Development

| Previous difficulty adjustment | -1.4115% |

| Next estimated adjustment | -3% in ~5 days |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.70 (24 s/b) |

| Median fee (finneys) | $0.47 (0.223) |

Mining News

Texas miners save the power grid! This is the kind of news we need to bother our friends and family with about bitcoin. It's an incredible story!

1,000 megawatts of bitcoin mining load has been removed temporarily from the Texas electrical grid in what is a big test of the new bitcoin mining narrative of "grid stabilization". The total electrical consumption of Texas hit a new record last Friday of 78,206 MW. Bitcoin mining accounts for roughly 1.3% of that total. The beneficial effect would, of course, be greater with more bitcoin mining in the State.

The grid balancing argument goes as follows. There is a natural daily and seasonal cycle of energy demand. Power plants are designed to run efficiently within a narrow band of energy production, much narrower than these swings in demand. However, it is uneconomic to build excess power production if you only need it in extreme circumstances. Bitcoin mining can offer that marginal load, that can be ramped up or down instantly, while paying for itself. Therefore, bitcoin mining makes it economic to build the excess power production required to meet needs during the extremes.

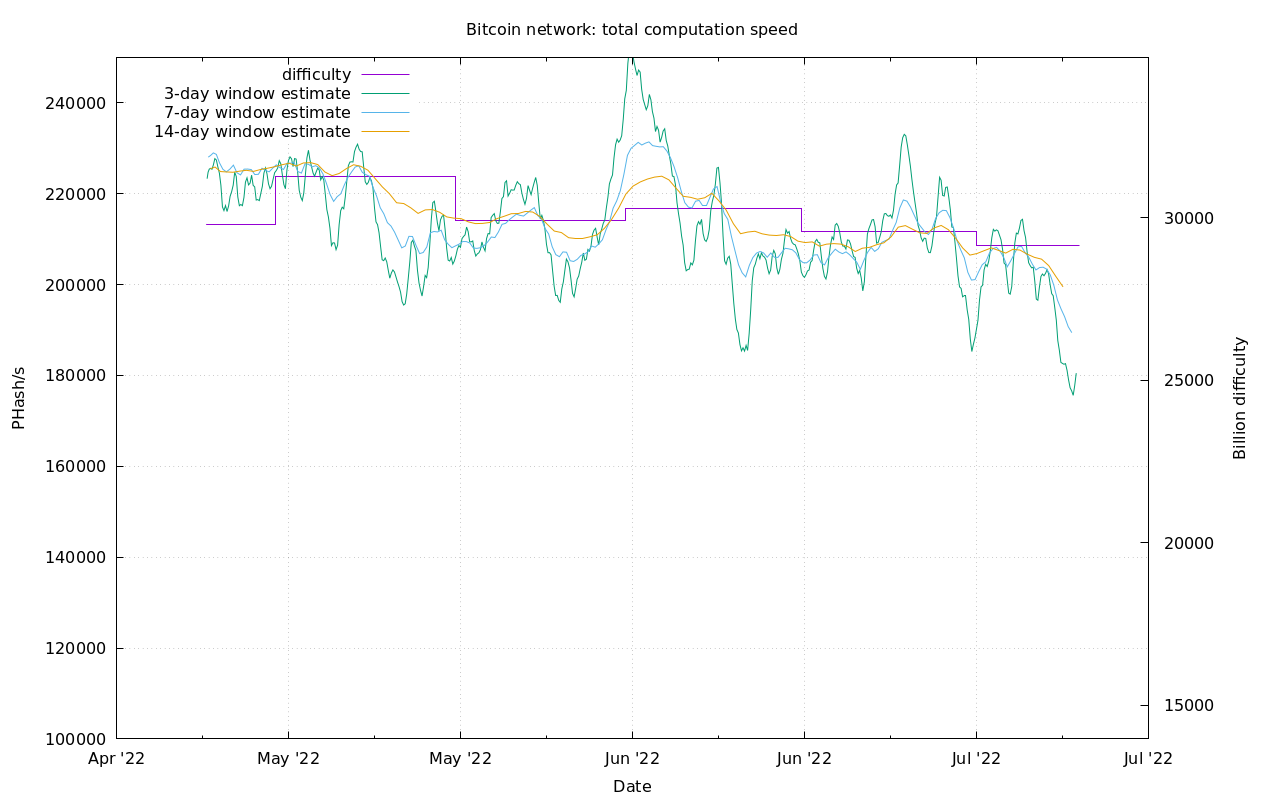

Difficulty and Hash Rate

We can plainly see the effect of the Texas miners coming off the network over the last week. Nothing much else to add to the below image. Mining is strong and making a statement right now in Texas that could massively bolster the case for bitcoin mining against the attacks by climate zealots and central governments.

Macro

Protests are spreading

This week we saw the expansion of the Dutch protests into Germany, Italy, Spain, Poland, and other European States. The list of countries now protesting is growing by the day. Below is a video with an update from this week, and words from a man on the ground in the Netherlands.

This is also a good one. Eva Vaardingerbroek is a very effective spokeswoman 👀. We don't have to look too far to find the globalist influence here as well. She puts it like this, to paraphrase, 'these new regulations will force farmers out of business the the land with go to the State. They already have plans to build housing developments for immigrants to the Netherlands.'

Energy supplies to Europe

The farmer protest comes right as the energy situation is getting worse in Europe. As written about last week, Russia is taking Nord Stream pipeline offline for scheduled maintenance on July 22nd, and Germans fear they won't turn it back on. They are mainly worried because Canada has a part the Russians need, but won't send it to them because of the sanctions.

Nothing has gotten better on this front. European natural gas futures are generally flat for the week, including that July 2023 (1 year out) contract that raced north last week.

China

China is falling apart at the seams. I've predicted for a very long time now that China is going to face a credit collapse like we've never seen before.

Real estate buyers across 22 different cities have decided to stop paying mortgages on unfinished apartments due to project delays and a drop in real estate prices. This type of property development is a gigantic portion of the Chinese economy and threatens to take down the Chinese banks.

Remember, China was built almost entirely on a credit bubble. The post-1990's era of peace and order allowed for the global economy to lever up. This era's crowning achievement of easy leverage is the modern Chinese economy.

Newest Q2 GDP number was 0.4% annualized and quarter-on-quarter of -2.6%. Of course, those are the official CCP government numbers, which even Chinese officials claim are overestimated. That being said, the Chinese economy GDP is likely negative on an annualized basis.

Why is this so bad for China? They are the most indebted country on the planet, with the fastest shrinking population due to demographics, that depends on exporting to a healthy world economy. I think it is impossible to avoid a collapse in China, the only question is how fast will it crash?

Good video from China Update.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 15, 2022 | Issue #200 | Block 745,129 | Disclaimer

* Price change since last week's report