Bitcoin Fundamentals Report #196

Bitcoin has no substitutes (commentary), Bitcoin 2.0?, price analysis, mining news, hash ribbons, and Vitalik weird comments.

This Week

Bitcoin has no substitutes (commentary), Bitcoin 2.0?, price analysis, mining news, hash ribbons, and Vitalik weird comments.

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

- (Fed Watch) Bitcoin Price Analysis and Macro ft. Tone Vays - FED 98

- (Blog) Yield Curve Comparison in Recessions

- (Fed Watch) Supply Chains by the Numbers - FED 97

- See associated post for charts to FED 97

- (Bitcoin & Markets) Energy Crisis and Recession | A Reaction to Peak Prosperity - E243

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Nasty sell-off |

| Media sentiment | Very negative |

| Network traffic | High normal |

| Mining industry | Selling bitcoin |

| Market cycle timing | Capitulation |

Bitcoin, at the heart of Altcoin evolution

Let's talk about why bitcoin has been so affected by the altcoin market, and why it is imperative that this change.

I really dislike giving ink to altcoins. I do my best to only write minimally about them because they are categorically illegitimate. However, in this case, the bitcoin news cycle has been slow and I believe it is important to highlight why altcoins and bitcoin are highly correlated.

In economics, we often describe categories of goods in monolithic way. We might say "cars" or "candy bars" and examine the supply and demand for all items in that class of good. Of course, we could break it down further and talk about supply and demand for Fords, or even more specifically to Ford F-150s. That brings up the complication of substitutes. How does the availability of Dodge Rams change the supply and demand for the F-150?

Now, when we look at bitcoin, unfortunately we are faced with the same thing. Altcoins are seen by the lay public as substitutes for bitcoin, even though they are not. This is embodied in the terms "cryptocurrencies" and "crypto". These terms are dangerous because they trick people who don't know any better into thinking the underlying technology in these coins are all the same, and the actual competition (reason to bet on an altcoin or bitcoin) comes down to features. Hence, most people wrongly think bitcoin is old and slow, when in fact bitcoin's precisely balanced recipe is the only way to make this kind of technology work long-term and as advertised. Altcoins are, without exception, a fraudulent sales pitch.

In the short term, altcoins have an asymmetric advantage in narratives, because the most important feature of bitcoin, its fixed supply of 21 million, is undermined by substitutes. You might have heard well-meaning skeptics say things like, "how can bitcoin's supply be fixed when there is an unlimited number of altcoins?"

In the long term, however, altcoins are at a disadvantage, because they build their value proposition on features that will be obsolete in a couple years. They might be able to upgrade to keep pace with new projects for a short time, but eventually their technological debt (the complexity and loose ends in their codebase), corruption (being centralized, and founders/Venture Capitalists getting out) and history of failed promises, will drag them down. However, bitcoin is perfectly happy doing something no other false substitute can do, be incorruptible and have a fixed supply.

For bitcoin to take the next step in its monetization, people must understand that altcoins are not a substitute for bitcoin. Convincing them is an uphill battle, one that will happen slowly over many cycles, or fast via government regulation.

Current cycle

Other than altcoins being falsely perceived as substitutes, a large reason there's been such tight correlation in this downtrend is because bitcoin is owned by all these altcoin projects. The evolution of altcoins has passed through certain stages, from near clones of bitcoin, to independent unique use cases, to now being intertwined financial schemes on the margin of bitcoin. These leveraged financial schemes, holding bitcoin increases the liquidity of their reserves backing their assets. But like a run on an overleveraged bank, just having reserves to cover a small percent of your liabilities, leads quickly to insolvency.

Terra Luna, Celsius, 3AC and even ethereum are either insolvent and defuncted, or under threat of becoming so. Together, they hold billions of dollar worth of bitcoin.

I have to say, this is a step in the right direction though. The evolutionary pressure on altcoins will continue to push them closer to Bitcoin. Prior to this cycle, there were no reserves in altcoins when they imploded. Hopefully, the next cycle we will start seeing more responsible levels of reserves held in bitcoin, and these projects built on layers like Liquid or Lightning.

Bitcoin must break free of being considered "crypto" and being just another substitute. It must start being seen as it truly is, the only underlying asset in this ecosystem.

Bitcoin 2.0

There is not much news in bitcoin right now, outside of the price, altcoin collapse, and recession. That is why an old controversial figure easily stoked a little drama on Twitter this week over a theoretical Bitcoin 2.0.

Ari Paul has been around for at least 6 years in bitcoin. During the bitcoin scaling conflict, he was exposed as a mere pumper that didn't understand bitcoin basics. You would think in the subsequent years, by managing a fund called BlockTower Capital, he would have learned a few things. Well, he hasn't.

Yes we do. Current rough plan by core devs is to deliver it 2024-2025 as I understand it, as a soft fork. No other plausible way for BTC to be used by a non-trivial % of world. LN can’t scale in decentralized form without some change or major innovation as I understand it.

— Ari Paul ⛓️ (@AriDavidPaul) June 15, 2022

He claims "core devs" (the people who work directly on bitcoin's source code) have told him there is going to be some huge change to bitcoin coming in a few years that will revolutionize the network. He called it Bitcoin 2.0. Many core devs immediately and directly refuted this claim on Twitter.

I think he knows he's talking BS. I mean, he played the same character back in 2017. He still tries to promote the stupid idea that core devs and miners are in charge of bitcoin and can make any change they want. I think he does this to facetiously compare bitcoin to ethereum. "Ethereum is centralized to a powerful clique, but so is Bitcoin. This 'inner cabal' is who is really in charge of both projects." LOL

Readers, just be aware that no group controls Bitcoin. Bitcoin can not change for political reasons, and Bitcoin cannot hard fork (make a major incompatible change). It is set.

Bitcoin has what are called "consensus rules". These are rules that cannot be broken, else your nodes falls out of consensus with the network. If the entire network of nodes changes their set of valid rules, it is called a hard fork. In Bitcoin though, there is no way to get the entire network to change, and many game theory and other incentives are aligned to avoid a change like this. Hence, no hard forks.

We have seen soft rule changes throughout the years. These are changes that narrow existing rules. For a simple example of this, the block size limit is 1 MB (or 4 'virtual bytes'), but you could try to include a new rule that lowered that to 0.5 MB, because 0.5 MB would be a valid block under the old rules. This narrowing of rules is called a soft fork.

I have written and talked about this topic extensively over the years. Bottom line, there is no cabal to force a change to Bitcoin. Ari is being idiotic, probably for malicious reasons to help his Ethereum bags look less scammy. The environmental debate over Bitcoin mining will heat up in the next year, but will end by people accepting that bitcoin benefits energy grids and pushes sustainable energy innovation forward rapidly.

Quick Price Analysis

| Weekly price* | $20,458 (-$8,672, -29.8%) |

| Market cap | $0.391 trillion |

| Satoshis/$1 USD | 4,881 |

| 1 finney (1/10,000 btc) | $2.05 |

"Price is the only thing that matters." - Ansel Lindner :)

my permabull case for BTCUSD $100k this year. https://t.co/gsgdKFjzPP plus a US physical #bitcoin ETF chaser (GBTC upgrade + other) would create a nice whipsaw and probably trigger a big uncoupling and positive reflexivity into a blow off top next year. no leverage bois.

— Adam Back (@adam3us) June 16, 2022

For those beginners out there, Adam Back was cited in Satoshi's whitepaper, but didn't come into the bitcoin community until several years after it was launched. He's an OG cypherpunk, fighting for freedom and privacy through technology for decades. Zero scams to his name.

Weekly chart

We have paused just above the next level on the Volume by Price, tapping this zone would take us to $19,400. We are oversold on the weekly RSI for the first time since Dec 2018, and the most oversold EVER! We are also the most oversold on the Monthly RSI ever.

Monthly Chart

I applied the TD sequential indicator to the monthly chart below. It is a time-in-trend based indicator. The max is a "9" in a trend, at which point the count can start over after a period of consolidation, but 9 is the highest number and denotes a trend that is long in the tooth.

You might have to squint, but the bear market in 2015-2016 stopped at a monthly Red 8 after 16 months. In 2018, the bear market stopped at a Red 7 after 13 months. Now, in 2022, depending how you measure it, we've been in a bear market for 13 months and are on a Red 7 again.

Price Headwinds

The headwinds bitcoin is facing have been unrelenting. I've mentioned the specific factors of altcoin drag on the market, inflation hysteria, and a broad economic slowdown for several weeks now.

Altcoins

Several large altcoin Ponzi schemes are under threat of imminent collapse. It has been reported that Celsius will be forced to liquidate their bitcoin at around $18,000. However, that number has been changing in recent days as the corporation posts more collateral to keep from being liquidated.

Everyday, it seems another defi leveraged product is shutting down or imploding. I fear this particular headwind will continue until a massive capitulation.

Inflation hysteria

The inflation hysteria was in overdrive this last week due to the recent US CPI print of 8.6% and worry out of the ECB's inability to quit QE. A cure for CPI spikes is recession, so inflation worries have been tempered a little in the latter half of the week, shifting to a mix between inflation fear and recession fear.

Some nifty math. When you strip out of the CPI all the items that are linked to energy (air fares, moving/freight, rental cars, delivery services, new and used vehicles), the core was +0.36% and the YoY steadied near 4%. The truth beneath the veneer.#RosenbergResearch

— David Rosenberg (@EconguyRosie) June 10, 2022

Oil has come down this week, from $121/bbl to $111. I've also noticed gasoline prices near me falling about $0.30 from $4.89/gal to $4.59. We do not see this yet in the data (released weekly), but demand will fall rapidly in the current recession.

Broad economic slowdown

Recession is much closer than people think. Disposable income is at historic lows, as surging credit card debt is being used to pay bills. The average Joe is not going to be able to buy bitcoin for the next 6-12 months. However, that buying deficit will be more than offset by the amount of high-net worth individuals looking for a safe haven as the recession gets more acute.

Price Conclusion

After all that, it is hard to be bullish in the short-term. We are seeing many firsts in bitcoin, as noted above, so we should not be surprised if price dips below the previous cycle high for the first time in any cycle.

I still expect a dovish surprise from the Federal Reserve as soon as the recession and liquidity crisis becomes acute - sooner rather than later. When that happens bitcoin should get a big shot in the arm.

Also, there is something in the air, perhaps its my permabull nature, but a bullish surprise for bitcoin feels possible here. We are so oversold on many metrics, and bitcoin fundamentals are still very strong, we have to be close to a bottom.

I started this section quoting Adam Back saying $100k this year is still possible. I agree, but it seems like an outside chance at this point.

Mining and Development

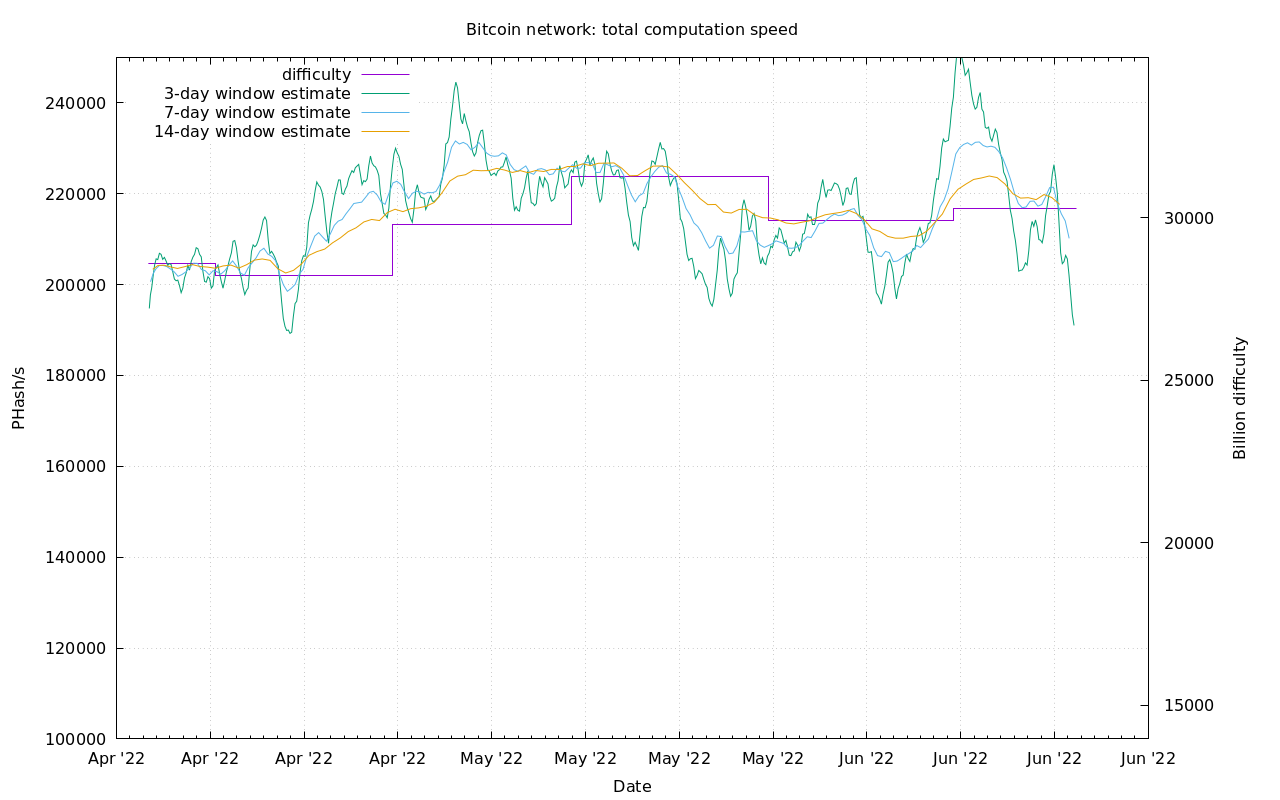

| Previous difficulty adjustment | +1.29% |

| Next estimated adjustment | -1.55% in ~4 days |

| Mempool | 7 MB |

| Fees for next block (sats/byte) | $0.60 (21 s/b) |

| Median fee (finneys) | $0.55 (0.268) |

Mining News

On-chain metrics have revealed that Bitcoin miners have been sending more of the asset to exchanges, with a new all-time high of 88,000 BTC sent on June 15, according to CoinMetrics.

The analytics platform also noted an all-time high in dollar terms with a net $1.94 billion worth of BTC sent to exchanges yesterday.

📈 #Bitcoin $BTC Miners to Exchange Flow (7d MA) just reached a 7-month high of 9.476 BTC

— glassnode alerts (@glassnodealerts) June 15, 2022

View metric:https://t.co/WwBf5cbd33 pic.twitter.com/LJkm728Zhp

If miners are selling now, they will be stacking later in the rally. I am generally unconcerned about the hash rate at this time, since we are so close to the ATH and have fallen so much in price. It makes sense. If miners were selling on a little 10% dip in price from the top, it would be concerning, because it would signify something going on in the market that the miners are seeing but everyone else hasn't yet.

Hash Ribbons

This is an indicator you can find on Tradingview. Just search for "hash ribbons" and you'll find it. It is based on the simple moving averages (MAs) of the hash rate. It turns red when the 30-day MA crosses below the 60-day, and vice versa for turning back to green. The buy signal uses MAs of price, when the 10-day MA crosses above the 20-day.

As you can see we have entered capitulation. Now, we are waiting for the 30-day MA to cross back above the 60-day, and the price MAs to cross back bullish. This signal should take several weeks to flash.

While the hash ribbon doesn't call bottoms, the buy signal does limit your downside risk from historical back-testing to only -11%. Anyway, it is interesting and being talked about in bitcoin right now, so I thought I'd include it here.

Difficulty and Hash Rate

Despite the miner capitulation, hash rate hit an All Time High last week. It has fallen pretty quickly, but so far only down the April 2022 lows.

Altcoins / CBDCs / Stablecoins

Lord Vitalik made another weird comment today.

ETHEREUM'S VITALIK BUTERIN: I DO NOT EXPECT CRYPTOCURRENCIES TO TAKE OVER THE WORLD, BUT WILL PLAY KEY ROLE AS ALTERNATIVE ASSET

— *Walter Bloomberg (@DeItaone) June 16, 2022

This follows the tweet thread a couple weeks ago, where he lists the many contradictions he sees in Ethereum, which I wrote about at the time in issue 192.

Thread: some still open contradictions in my thoughts and my values, that I have been thinking about but still don't feel like I've fully resolved.

— vitalik.eth (@VitalikButerin) May 17, 2022

This would worry me if I owned Ethereum. His recent comments are probably sending shock waves through the insider community. Vitalik is Ethereum.

Then again, maybe this is their attempt to have him step away to make Ethereum seem more "decentralized"? IDK, but I get the feeling that Ethereum insiders are growing very concerned, and Vitalik is losing confidence in the project.

Below is a weekly chart of Ether. I can easily see Ether dropping another 50% before the coming Ethereum upgrade.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

June 17, 2022 | Issue #196 | Block 741,191 | Disclaimer

Cover image: unknown

* Price change since last week's report