Bitcoin Fundamentals Report #180

European mismanagement of energy continues, bitcoin a safe haven?, Mexico legal tender proposal, holders' reward, price analysis, mining and lightning developments.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... European mismanagement of energy continues, bitcoin a safe haven?, Mexico legal tender proposal, holders' reward, price analysis, mining and lightning developments.

In Case You Missed It...

- (Fed Watch) Ft. Log Scale: Institutional Client Adoption - FED 83

- (Podcast) Bitcoin Report #1 and #2

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) With Sarah Bloom Raskin Up For Big Fed Role, Will Regulation Turn Against Bitcoin?

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying re-take support |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Stable |

| Market cycle timing | Beginning new 2-year cycle |

Hello Bitcoiners!

Huge week for international news, but another quiet week for bitcoin. We'll go over the large dip and bounce in the price section, but let's cover a few more articles up front. In the Mining & Development section I have a couple interesting new products and then we wrap it up for the week with some macro.

Let's hit this week's top stories...

Europeans are dumb when it comes to energy

I don't know about you, but the last people I'd take advice on energy management from is the Europeans. The current situation with Russia shows how horribly they've managed these resources that are the bedrock of modern civilization.

Without a hint of irony, and probably because they are worried about energy to heat their homes, the Europeans are attacking bitcoin mining once again. A draft proposal has been put forward called MiCA (Markets in Crypto Assets). It is a massive new European law that would, among other things, ban bitcoin mining in the EU.

A few gems from the above article:

“Sweden needs the renewable energy targeted by crypto asset producers for the climate transition of our essential services, and increased use by miners threatens our ability to meet the Paris Agreement,” - Finansinspektionen spokesman

Sweden has led the way in Europe, calling for a ban of bitcoin mining last November. The hilarity of the above statement is due to the complete lack of economic understanding. The socialists have placed "essential services" in a position where they will suffer from the tragedy of the commons. The things that are supposedly most important are put in the hands of the inept bureaucrats?! LOL If they want resources allocated best, they'd privatize essential services instead of fight nature and centrally plan them into the ground.

That's the main problem with central planning, it always leads to more central planning as the market undermines your efforts.

“We need to have a discussion about shifting the industry to a more efficient technology." - Vice-chair of the European Securities and Markets Authority, Erik Thedeen

This dude obviously did not get his position because of his competence. It's 2022 and he has no idea how ignorant that statement is. Bitcoin mining is 1) extremely efficient for what it does, and 2) cannot be changed or replaced by anything else, including an altcoin.

Some Bitcoin critics take the same view as Finansinspektionen, arguing that the use of renewable energy to mine cryptocurrency is a severe misallocation of valuable resources. - Decrypt, Scott Chipolina

Decrypt is a scam-coin pump outlet, so I'm not surprised they showed their bias here at the end. Again, it's only a misallocation of valuable resources due to government limits on market directed allocation. It cannot be "fixed" by more limitations, the bureaucrats must get out of the way.

What I predict is further intervention and further economic suppression. Europe is going to have to decide if they want to flourish or continue with socialism-lite. The worst outcome would be the return of authoritarianism and directed economies in Europe. Didn't end well last time.

Bitcoin a Safe Haven or not?

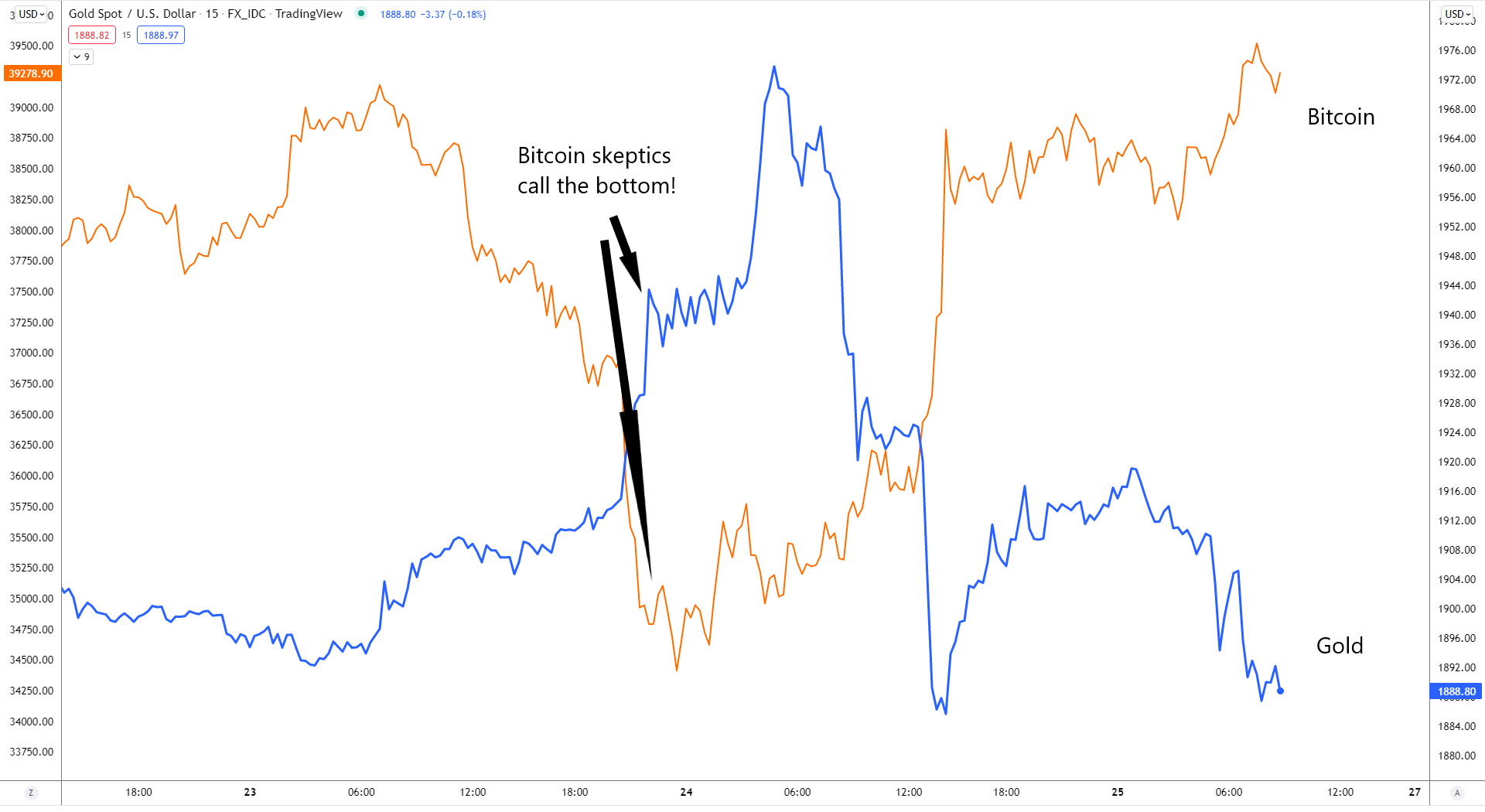

Even my Discord server (small online community I maintain) had a post about bitcoin vs gold's performance initially in the Ukrainian invasion. My friend Xan shared this tweet:

Safe haven: Gold or Bitcoin?

— David Ingles (@DavidInglesTV) February 24, 2022

We found out today. pic.twitter.com/Z9smsr8pu6

Of course, mainstream FUD news jumped on it fast too...

“The correlation between crypto and stocks has been high over the last few months on both inflation-related macro news and the Russia-Ukraine geopolitical situation. This correlation shows that Bitcoin is firmly behaving like a risk asset at the moment—not the safe haven it was touted to be a few years ago.” - Chris Dick, a quantitative trader at crypto market maker B2C2

But perhaps the most damning indictment of Bitcoin’s value as “digital gold” is that while most asset prices have plunged on news of war, real gold actually went up, hitting a 13-month high Thursday, approaching $2,000 an ounce. - Fortune, Eamon Barrett

Oops. Then this happened...

Mexico following El Salvador's lead

Indira Kempis, a senator representing Nuevo León state, is confident that Bitcoin should be legal tender in Mexico because its adoption can potentially drive global financial inclusion.

The senator is now developing a cryptocurrency bill based on El Salvador’s “Bitcoin Law.” She expects to introduce the bill to the Mexican Congress this year, Kempis said in an interview with El Salvador In English publication after visiting El Salvador a few weeks ago.

The ground swell for bitcoin among politicians is growing. While it is unlikely that Mexico will adopt bitcoin as a legal tender anytime soon, there is no better advertising.

A problem I noticed with Kempis' efforts here is her motivation:

“Making Bitcoin a legal tender means putting a level playing field for people who are excluded in almost all countries,” she said.

This is a misunderstanding of bitcoin and has collectivist undertones. It will not level the playing field, bitcoin makes the grass on the field grow better. Bitcoin might make inequality worse initially by limiting the ability for governments to tax the most able (to cut the tall grass to continue the analogy). Bitcoin rewards merit, restrains corruption, and makes socialist safety nets less viable.

In capitalism, inequality is addressed by the poor getting pulled up by the most able making the world better. It takes perhaps a generation to bear fruit. In socialism, inequality is alleviated by putting a bridle on the most able, and it is more immediate.

SHARE with those who need reliable bitcoin news !!

Quick Price Analysis

| Weekly price* | $38,809 (-$1,339, -3.33%) |

| Market cap | $0.737 trillion |

| Satoshis/$1 USD | 2,578 |

| 1 finney (1/10,000 btc) | $3.88 |

Did you hold? It really wasn't that bad this time.

Normies look at bitcoiners who have held for years and think we got lucky. As if we won the lottery or something. Other professional traders will make fun of bitcoiners who hold through the dips, thinking we are silly to sit on something that has crashed 50%. So wrong. We were the most stoic on the emotional roller coaster, we earned it by holding when others panicked.

What these critics don't understand is bitcoin is a monetizing asset. It creates an internal drive to hold it, and hold more of it. The instinctual drive to hold bitcoin is a characteristic of a monetizing asset. If it didn't create that drive in us, it could never become money. That's how we know the value will continue to appreciate, because the demand to hold it will spread far and wide, to all corners of the planet, and there is only 21 million.

It is a holistic cycle, we want to hold bitcoin because it's money, and it's money because we want to hold it.

Bitcoin Daily Chart

This is a critical price level for bitcoin. I identified $39,700 weeks ago as the critical level of support. Well, price dropped through it and is now struggling to get back above it. Support turned to resistance?

If price does get above, and stay above $39,700, we can comfortably say price has bottomed. Imagine, despite the Ukraine invasion and the Canadian crackdown, bitcoin did not sink to new lows!! That is mega bullish if you ask me.

I'm still sticking with my arrow projection on the chart for the next 6 months. Considering fundamentals like network growth, infrastructure growth, national adoption, and technicals, it is likely bitcoin sees explosive price increases soon.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +4.7831% |

| Next estimated adjustment | -2% in ~6 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.33 (6 s/b) |

| Median fee (finneys) | $0.33 (0.085) |

Development News

I'm always keeping my eye out for new point-of-sale systems for bitcoin. This one by RaPayGo looks very clean. It is a lightning enabled POS terminal, complete with receipt print out of the lightning invoice.

For the rookies reading this, Lightning is an open protocol on top of bitcoin offering instant payments for relatively small transactions. Like the early internet, the market is still advancing the user interface.

It took the internet 20 years to get to Netscape Navigator in 1994, before most people could intuitively use it. Lightning won't take that long, and it's already been 4 years. Give it another 4 years and it should be very easy and intuitive to use.

Cash App is ranked as the #1 finance/money app in both the Android play store and Apple app store. They are famous for integrating bitcoin buy/sell and withdraw options in the app, and now, they have integrated Lightning Network.

This recent upgrade uses their parent companies very own gift to the development community, the Lightning Development Kit (LDK). This is a software library that Block (formerly Square) and independent subsidiary Spiral, developed and released free to the world.

Brilliant work! Can't wait to use it.

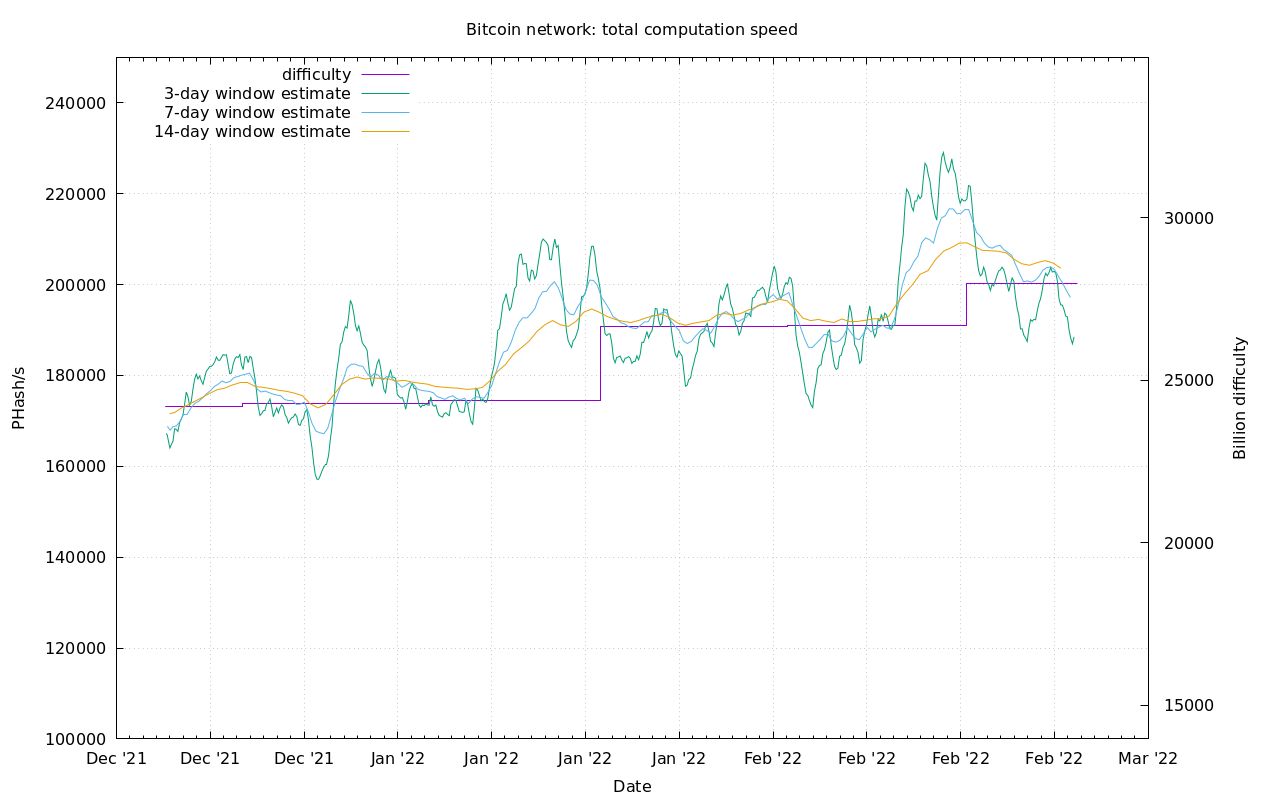

Hash Rate and Difficulty

Hash rate has followed price lower in the last week, but it is still within normal limits. The estimated adjustment of difficulty in 6 days is a -2%, which follows a +4% adjustment last week.

The relationship between price and hash rate is a complicated one. We need to take a few things into consideration when evaluating hash rate as a health indicator. First, hash rate is a lagging and confirming indicator only. It does not translate directly and immediately into price, price translates slowly into hash rate. Second, miners obey market forces within their domain and are forward looking. Third, the price of bitcoin is one of several prices that matter to miners, which also includes electricity, equipment, maintenance, labor, regulation and rent.

Macro/Geopolitics

Last week, I posted a link to a video by S2 Underground about the Ukraine situation that was an excellent summary and kept you, the reader, days ahead of this invasion.

This week, I have an insightful video by China Update to share on how China is addressing the Russia/Ukraine invasion. Bottom line, if you hear someone say current events with Russia provide a great opportunity for China to retake Taiwan, in some master plan against the West or something, you can be confident those people don't know what they are talking about.

China is intimately entwined with the US and Europe. Russia means next to nothing economically to China. What Russia does offer China is supporting vote in counterweight on the international stage. Therefore, China has remained relatively neutral over the last week on Ukraine, and also why they won't be retaking Taiwan anytime soon.

Have a great weekend. See you next week!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

February 25, 2022 | Issue #180 | Block 724,923 | Disclaimer

Meme via: @DWhitmanBTC

* Price change since last week's issue