Bitcoin Fundamentals Report #152

This week we get you up to speed on Senator Elizabeth Warren's recent crusade against bitcoin, update you on price analysis, mining, and CBDCnews and Tether.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (post) Macro Chart Rundown for 27.7.2021

- (article) What Caused this Mid-Cycle Bitcoin Price Correction, published with Bitcoin Magazine! Please SHARE!!

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $39,033 (+$6,763, +20.9%) |

| Market cap | $732 billion |

| Satoshis/$1 USD | 2,561 |

| 1 finney (1/10,000 btc) | $3.90 |

| Median fee confirmed (finneys) | $0.22 (0.06) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Bullish |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Recovery |

Market Commentary

The spike in bitcoin price is the major story of the week, which we cover below in the Price section. Here we'd like to discuss Senator Elizabeth Warren's recent comments on "crypto".

Elizabeth Warren is quickly becoming the most outspoken Congress person on bitcoin and "crypto", taking the place of the entertaining Rep. Brad Sherman. We use "crypto" in quotes because bitcoin is unique and should not be placed in the same category as altcoins/cryptocurrencies. They are imitations or spin-offs, without the essential characteristics of decentralization and technical robustness. Think of altcoins as fool's gold to bitcoin's gold. It doesn't make sense to regulate gold like you regulate fool's gold or fool's gold salesmen.

If you read between the lines of their public comments, regulators are starting to understand this distinction, but still lump all imitations in with bitcoin, no matter how obviously scammy, to push their slimy regulatory agenda.

Back to Warren - She sits on the Senate Banking Committee and took testimony from Treasury Sec Janet Yellen this week. We couldn't immediately find video or a transcript of the hearing, but we do have a letter from Warren to Yellen that outlines her comments, and Warren appeared on CNBC afterwards to summarize the conversation.

The term "bitcoin" did not appear in the body of the letter. Instead, Warren's comments centered around "cryptocurrencies", a blanket term to push blanket regulation.

I have become increasingly concerned about the dangers cryptocurrencies pose to investors, consumers, and the environment in the absence of sufficient regulation in the United States.

She's right, there are big dangers in "cryptocurrencies", but not specifically bitcoin. This requires a nuance that regulation-hungry politicians lack. Altcoins are dangerous, centralized, experimental, and dishonest. Bitcoin is not.

Here are another couple of highlights from the letter:

However, as the demand for cryptocurrencies continues to grow and these assets become more embedded in our financial system...

If bitcoin "continues to grow", how is it a threat to investors? Hint: it's not, imitation altcoin scams are. She also admits that she knows that bitcoin becoming embedded in the global financial system is inevitable.

There are a number of ways that our financial system has become exposed to these assets to such an extent that material distress in the cryptocurrency market could spread throughout the financial sector.

Again, we must have the nuance. Only bitcoin has become embedded, but altcoins are the threat to investors. She's concerned about a theoretical systemic threat, if altcoins become embedded. See the difference? She's worried about fool's gold getting embedded in the financial system and spreading systemic risk. Why lump gold into the discussion?

In Sen. Warren's interview with CNBC, she touched on a few other things. First, she made the analogy to snake oil salesmen in medication prior to the FDA, and once regulated, drugs became safer. Meaning, they must regulate "crypto" to make it safe. But Ms. Warren, there are snake oil salesmen in big pharma still today! <cough> Pfizer </cough>. There are already rules in place that could be applied to altcoins. What's the SEC's job again?

She also said that "crypto" is not an inflation hedge, which we have to partially agree with. Altcoins are universally scams and will not outperform the market long-term. Bitcoin, however, will. Bitcoin has gone up in dollar terms 10 of its 12 years. 12 years and roughtly 70,000,000%. In comparison, the #1 altcoin Ethereum, has gone up only 4 of its 7 years. Bitcoin has been a great inflation hedge, and more importantly, it also serves as a deflation hedge, for those times when the economy is slowing and investment opportunities are non-existent.

Lastly, Warren also spoke with a panel on "cryptocurrencies" this week, trying to learn about the tech and find room to regulate. The panel included Angela Walch, a professor who has studied "crypto", and Jerry Brito, of Coin Center fame, an organization that claims to educate regulators on bitcoin. It's worth the watch, better than most monotonous crypto podcasts today.

We could go on, but that it's for now. We'll probably be hearing a lot more from Senator Warren in the months ahead.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

Very nice breakout in price. Apparently, there was some pent up demand! Ansel writes about the relieving of uncertainty in the market in his latest piece for Bitcoin Magazine.

Bitcoin slashed through all the resistance and is on its way to the target we've mentioned for a month now of $47k. There is plenty of room for more bullish action in the oscillators as the MACD is strongly turning upward on the daily chart.

The one trouble spot we see is the volume. It has yet to confirm the breakout. It increased a little which is a good sign, but we want to see a doubling in the daily volume to be sure the trend has changed. Perhaps that will come as we approach the next critical level of $47k. The bearish price level to watch is $36.5k.

Mining

| Previous difficulty adjustment | -4.81% |

| Next estimated adjustment | +5.5% in 12 hours |

| Mempool | 0 MB |

| Fees | 1 sat/byte |

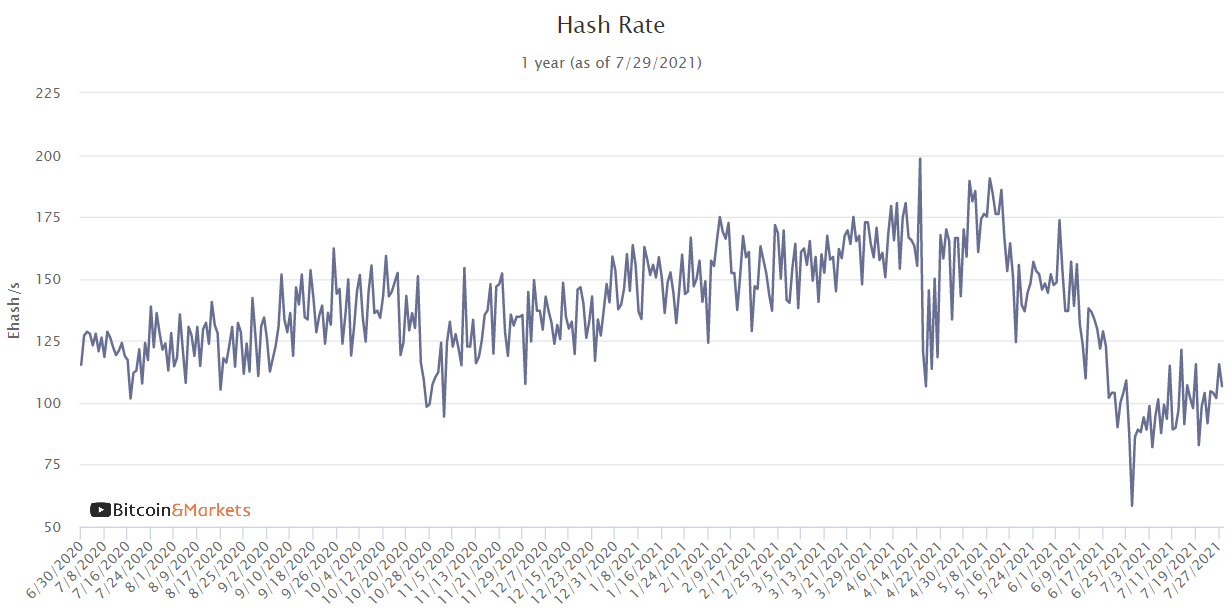

In our opinion, the hash rate chart looks beautiful, considering the events of the last few months surrounding the China mining regulations. The total drop was from a top of ~190 Eh/s to a low of ~60 Eh/s four weeks ago. Since then, mining power has steadily risen to over 100 Eh/s.

The hash rate coming back online this month is probably from hardware being relocated to facilities in central Asia near China, like Kazakhstan, or to places with infrastructure already built with excess capacity. Existing miners in the space outside of China speculate it will take up to 6 months for all of the equipment to find new homes because of the time needed to build infrastructure once existing vacancy runs out. We try not to underestimate bitcoiners, so, we would not be surprised if mining fully recovered sooner than expected.

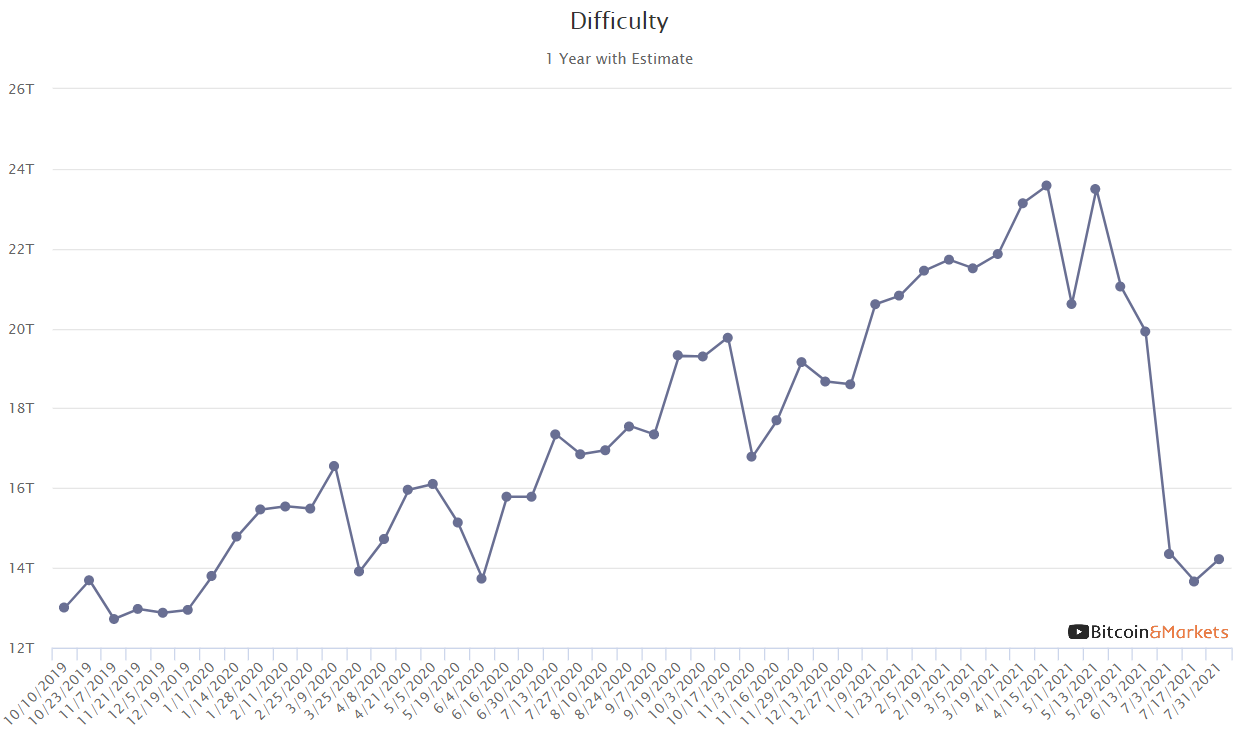

Difficulty has turned the corner. We expect several positive adjustments in a row as the recovery proceeds.

CBDC / Stablecoin / Altcoin

Tether

Tether is back under attack from the US government. Only a couple of months after Tether was exonerated in its NY State investigation, they are back in the spotlight of a US Department of Justice probe. Specifically, the DoJ is looking into allegations that years ago, in Tether's early days, they hid from banks the fact their business was related to bitcoin.

To us this is a minor matter. If it is true, ... well, of course Tether would hide that to avoid discrimination by banks. Until the last year, it was very difficult for bitcoin related businesses to find a single bank in the US that would service them, despite being completely on the up-and-up and compliant with all regulations. The blackout from banks was so complete, it had to be a coordinated unwritten policy. If the allegations are not true, this is bordering on harassment by US government agencies against Tether.

You have to ask yourself, why do they hate Tether so much? Why aren't they going after other USD stablecoins, especially the scammy defi ones?

US Congress on CBDCs

In a hearing of the House Subcommittee on National Security, International Development and Monetary Policy this week, lawmakers discussed Central Bank Digital Currencies (CBDCs). Specifically, they are trying to ascertain if, and by how much, the US is behind countries like China. They interviewed a panel of "experts" (who we haven't heard of!).

The general tenor of the discussion was the inevitability of the US government offering a digital dollar. This is very far from the truth. As we've pointed out many times in the past, the Federal Reserve and Chairman Powell are taking the most sober approach to CBDCs from any major central bank. Namely, they are investigating and observing. The Fed has also eluded to being happy with private alternatives like USDC and Tether that resemble banks issuing digital dollars with full reserves. The US is going toward bank-offered digital dollars, a very wise choice.

A CBDC is extremely dangerous for a currency issuer like a government, because it is a completely new form of money with unique properties. These new features of a CBDC make it impossible for authorities to resist meddling with, meaning they will print money and tweak interest rates incessantly. Holders of the currency, business, industry and investors, know the reason to adopt a CBDC is for the ability to mess with the currency, so they will flee.

CBDCs will lead very quickly to dumping of the affected currency in favor of others, including the US dollar and of course bitcoin. The launch of CBDCs will be a huge mistake for these central banks and a huge win for bitcoin.

Miscellaneous

To contrast Sen Warren from the Market Commentary above, we have Senator Cynthia Lummis, a staunch Bitcoin supporter from Wyoming, speaking to the same panel with Walch and Brito. Jump to mark: 46:27 in this video.

Interestingly, she asked about definitions of terms, and we have her covered with the Bitcoin Dictionary!

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 30, 2021 | Issue #152 | Block 693,433 | Disclaimer

Meme by @RandyMcMillan