Fundamentals Report #137

This week's post includes a debrief of the Coinbase launch, Taproot developments, Turkey banning bitcoin, mining, Ethereum Berlin debrief, and a UTXO set visual.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Reactions to Jerome Powell on 60 Minutes - FED 49

- (members) Coinbase and the CIA - Bitcoin Pulse #106

- (blog) A Generation of Grifters: Our Aging Political Class, Their Peers, and the Connection to Wealth Inequality

- (blog) Macro Chart Rundown for 4/14/2021

Get our book the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $61,483 (+$3,299 +5.67%) |

| Market cap | $1.153 trillion |

| Satoshis/$1 USD | 1,626 |

| 1 finney (1/10,000 btc) | $6.15 |

| Median fee confirmed (finneys) | $12.14 (1.96) |

| Market cycle timing | Beginning 2nd half of bull market |

| Weekly trend | Continuing breakout |

| Media sentiment | VERY positive |

| Network traffic | Elevated |

| Mining | Stable and healthy |

Market Commentary

Other than Coinbase dominating this week's bitcoin news cycle, there were several other smaller items we link and comment on below.

Coinbase Direct Listing

Ansel did a big write up on the Coinbase direct listing launch on two consecutive issues of the Bitcoin Pulse, our member letter. For new people, Coinbase is an exchange not a cryptocurrency, they are just a bitcoin related company. Bottom line, the launch of their stock went well but bitcoiners don't really care beyond it being good for bitcoin.

There was a lot of hype in certain circles within bitcoin. Some people expressed worry about it being a "buy the rumor, sell the news" event, but others like this newsletter, said it was a general positive for the space. Price of the new stock did pump and then settle on the first day, currently it is holding $320's above the pre-valuation of $250.

Taproot - Bitcoin Upgrade

Taproot is the latest bitcoin upgrade that will add functionality and efficiency. It is a "soft fork" which means it introduces new software rules, but those rules fit within previous rules; in other words, the new rules are more specific. No previously invalid behavior is now valid.

Activating upgrades is always contentious in bitcoin even though it is not a hard breaking rule change. It is hard because no one is in charge to enforce updating nodes and keeping everyone in sync. Greg Maxwell, who proposed many of the ideas included in Taproot, offered his thoughts on some of the drama around its activation.

The discussion is currently focused on a new activation mechanism called "Speedy Trial" where they just put the upgrade out there and try to activate it quickly. It cuts through the drama and we think it has a good chance of success.

To replace the deadlocked proposal speedy trial was proposed which basically avoids any hard tradeoffs in activation by just trying a simple fast activation and learning from how it goes. It replaces subjectivity by doing something that will either work or fail fast. If it works, Great-- and if it doesn't work it doesn't harm anything, we all learn from how it goes and have objective data to inform next steps, and the delay isn't that substantial.

Turkey Bans Bitcoin

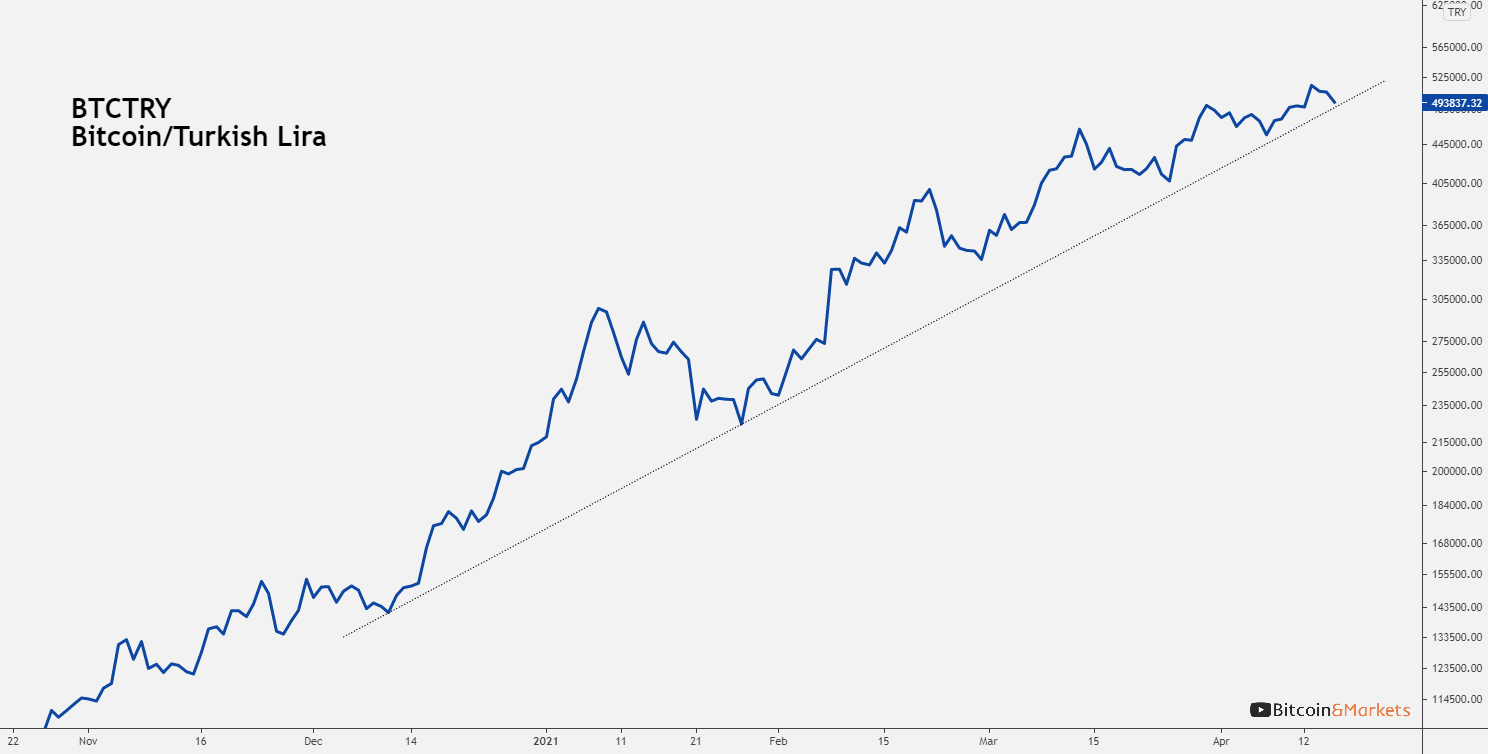

Turkey has banned bitcoin as the Lira devaluation continues. It is now down 8% on the year versus the USD, 15% since February, and 130% against bitcoin!

Via Reuters:

"Payment service providers will not be able to develop business models in a way that crypto assets are used directly or indirectly in the provision of payment services and electronic money issuance" and will not provide any services, it said.

"Their use in payments [...] include elements that may undermine the confidence in methods and instruments used currently in payments," the central bank added.

In February, we wrote about Nigeria's efforts to ban bitcoin and predicted other countries to follow suit. Currency crises will likely spread amongst emerging markets, who will either embrace bitcoin like Iran or ban it like Turkey and Nigeria. Either way, it will make demand for bitcoin increase.

This could be the first case of the natural use of bitcoin threatening a national currency, and is a sign of things to come over the next year or two. [...] What happened in Nigeria is very unlikely to happen in the US, but we can see most other jurisdiction cracking down as the weaknesses in their currencies become evident (even the EU).

Like our content? SHARE with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

The breakout started this week but has not picked up steam yet. This can be a little worrisome in the short term, so first a little caution. Price might try to test some support below current levels. In our opinion, $58k - $60k range is very strong with the next support below that approximately $53k - $55k.

However, we are still very bullish expecting this breakout to continue and pick up that steam it has lacked thus far. The two things we are watching closely right now are 1) the $62,500 handle, where the current weak overhead resistance is, along with the $60,000 strong support, and 2) the next pick up in volume will signal the direction over the next week or two.

Mining

Transaction fees over the last few days were "unfairly cheap" (insider bitcoin joke) costing only 4 sats/byte (~$0.35 fee) to be settled. Today, fees are back up to 100 sats/byte (~$9 fee) or more for confirmation in the next block. Approximately 20 blocks worth of transactions with fees of 30 sats/b or more waiting, meaning if you include a fee of less than the $9 median, your transaction could take more than a day to confirm.

The difficulty adjusted up 1.9% yesterday and it's too early to establish a reasonable trend for the next period in ~2 weeks. It is relatively quiet on the mining front despite hashrate and difficulty at ATHs and news that the microchip shortage could continue in the 2022.

Stablecoins / CBDC / Altcoins

In a surprisingly common occurrence, Ethereum had a planned hard fork yesterday April 15, 2021, codenamed Berlin, that resulted in a consensus failure. Ethereum uses a fundamentally different design philosophy than Bitcoin. Where Bitcoin provides an unbending rule of law on which to build an economic system, innovating at the edges, Ethereum completely rewrites its rules every 6-12 months and is planning a monumental overhaul of its entire rule structure known as ETH2.0.

When we speak of rule of law or rule structure, what we mean is the rules of the software. Bitcoin has concrete properties around which you must adjust, but you can be sure those rules won't change; the rug will not be pulled out from under you. That is very important for long term economic planning and the role of money itself.

Ethereum disregards rule of law in favor of rule by developer. They mask this by saying things like, "no, no, we are decentralized, we all upgrade, we all agree." This is disingenuous. Since the beginning, we've been told that Ethereum is a work in progress, which puts normal users at the mercy of developers, because who is going to be doing that work, and who are the normies to say no?

Anyway, that was some background on the situation. Yesterday, they had another rule change called Berlin......

Continue reading at our BTCM.co blog

Miscellaneous

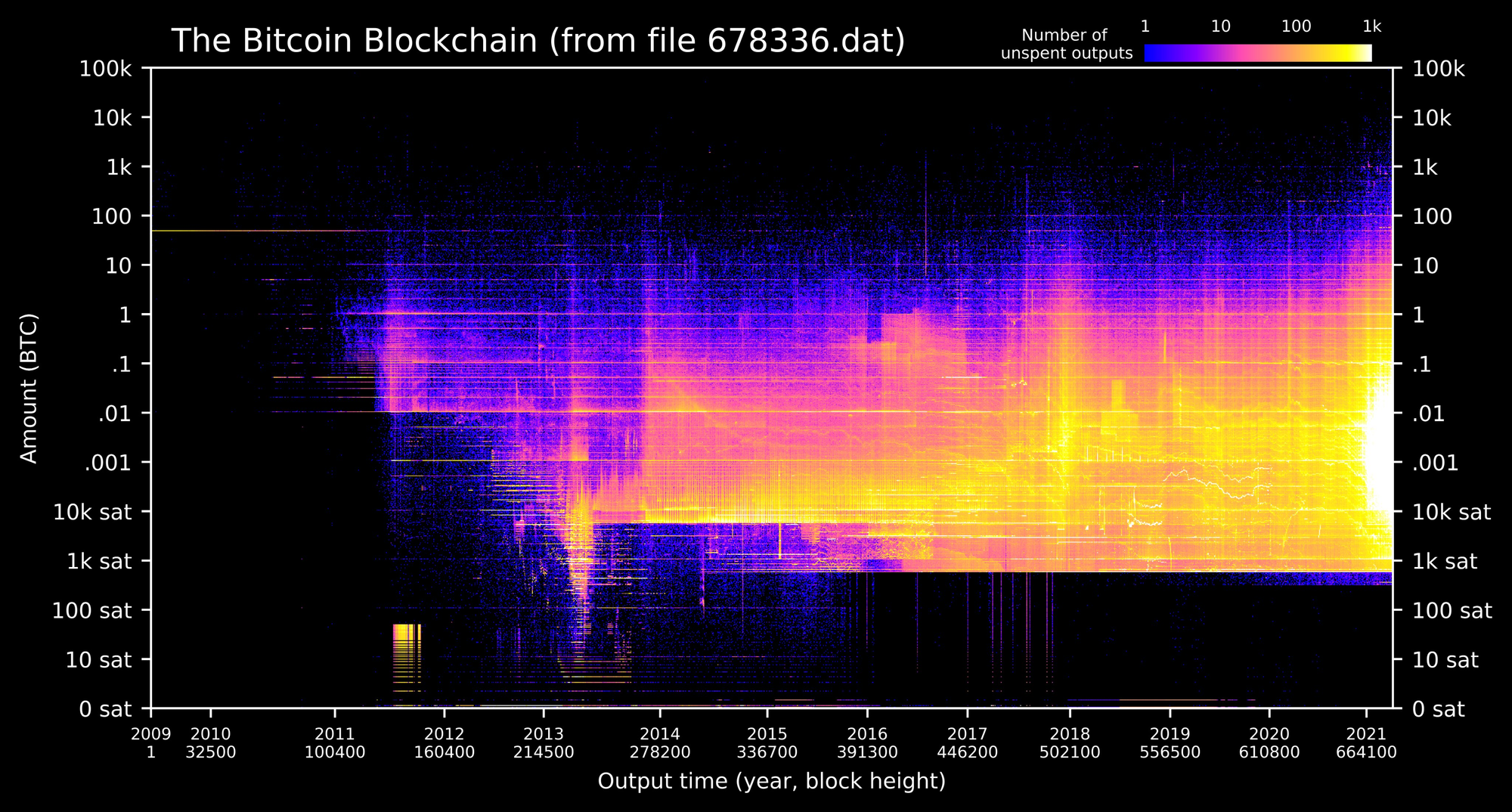

Below is a pretty chart visualizing the bitcoin UTXO (Unspent Transaction Output) set from Steve Jeffress on twitter.

From the Bitcoin Dictionary:

UTXO Set: A compact representation of all unspent transaction outputs kept separately from the block chain to increase the speed of real-time validation of incoming transactions and blocks.

More simply, the UTXO set is the current state of all balances in the block chain. This image is the time those balances were created plotted against their size. The amount of activity on the the right hand side in 2021 is amazing.

A lot of insight can be gleaned from the image, such as the dust limit line between 100 and 1000 sats (straight line on the bottom is a minimum transaction size constraint); or the line of UTXOs starting in 2009 and holding 50 btc from early mining rewards that have not been spent.

We'd love to see an animation of this image taken once a day over the course of a couple years if anyone has the skills. What do you see in this image?

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 16, 2021 | Issue #137 | Block 679,500 | Disclaimer

Meme by @michael_saylor