Fundamentals Report #126

Elon Musk, WallStreetBets, and Ansel's skeptical take. Of course, price analysis, and updates on mining and CBDC, and more.

January 29, 2021 | Issue #126 | Block 668,248 | Disclaimer

Written by Ansel Lindner and Jeff See

Bitcoin in Brief

| Weekly price | $34,600 (+$1340, +4.03%) |

| Satoshis/$1 USD | 2,890 |

| 1 finney (1/10,000 btc) | $3.46 |

| Stock to Flow (new supply to existing) 463/d | 1.16 |

| Mayer Multiple (ratio to 200 d MA) | 2.04 |

| Est. Difficulty Adjustment | +3.50% in 7 days |

| Previous Adjustment | +1.05% |

This week's Bitcoin & Markets content

- (Member) Is the Dip Over? - Bitcoin Pulse #99

- (Podcast) Deglobalization, Dedollarization, Depopulation w/ Max Keiser - FED 38

Go to our Info Page to join our discord community, find where to listen, and follow us. Become a member for exclusive content.

The Bitcoin Dictionary is LIVE on Amazon!

Market Commentary

Not much else to write about other than Elon Musk changing his bio to include #bitcoin and r/WallStreetBets (WSB) taking on hedge funds. I feel silly even having to write about Elon's bio to tell you the truth. Of course, Elon is a big deal, but he trolls, that's what he does.

Rumors are circulating that Elon will announce that Tesla is going to diversify some of its balance sheet into bitcoin at Michael Saylor's conference next week. ARK Investments' CEO, Cathie Wood, a large investor in Tesla, just two days ago was quoted saying she expects tech companies to add bitcoin to their balance sheets. If that is the case, it's crazy Elon would talk about it prior. Maybe it means they already bought?

Nothing has fundamentally changed and only slight damage has occurred to the charts. What did happen by this single word on Elon's Twitter bio is it sparked a massive short squeeze getting everyone back to the bull side of the boat. This Elon thing is very interesting and bullish, but it's not 20%-in-15-minutes bullish.

Be wary of lumping bitcoin in with other WSB type behavior. Bitcoin is much larger with much more balance to the market. It is generally uncorrelated, but if a legacy market crash is triggered, not even bitcoin will escape unscathed.

Cynical Ansel

As for the r/WallStreetBets war on hedge funds using Gamestop (GME), it is being framed as the little guy sticking it to the man, but that is not what happening. These retail traders are walking into major pain.

The framing of this is problematic IMO. People are going to get rekt. Let's play this out. What is going to happen if WSB wins and bankrupts major Wall Street players? The first thing is all the stocks they bought will crash back to fair market value. GME is not worth more than $5. These are the most shorted stocks for a reason. It doesn't matter if they are going to hodl them either. Price isn't set by holding, especially stocks. It is set by trading.

Second, exchanges will blow up. Robinhood is already scrambling to get a $1 billion bailout. Others will follow. The probability of a cascading failure if that happens is high, from stocks into the dollar and finally to the bond market. Is the rationale to burn it all down? This is not in the retail traders' best interest. The S&P 500 is already breaking its long held channel to the downside.

Third, nothing will change. The old bosses will be replaced by new bosses, likely worse with an axe to grind against allowing retail traders too much access. There are lots of corrupt wealthy people, but the people who know how to run large corporations are rich. What happens when workers get rid of those with the expertise? Shit falls apart.

Don't mistake this for Statism, it's not. Managers and hierarchy are natural and needed. I agree we need to get rid of regulation and corruption, but nuking the place is not good, especially when we are building the lifeboat (bitcoin).

This is not a "little guy" revolution, it's little guy scorched earth policy. The poor always get hurt the worst in economic crises. Concentrate on building the world you want to live in, instead of burning it down.

Quick Price Analysis

Weekly BMI | 0 : Neutral

Earlier this week, we saw many content producers turn bearish. Targets of $20k were common. We've been bearish since the top and this short squeeze, though strong, is within the scope of the downtrend.

Last week we wrote:

In the near term, we expect a sizeable bounce to a level where hope returns, followed by another drop to new fresh lows.

Viewed with an impartial eye, this appears to be exactly what happened. People woke up this morning and all bearishness was irradiated. At the time of writing, price has corrected back below the diagonal resistance line, and has resumed the previous pattern. It was a truly epic day in bitcoin history for sure. 16% up, 13% back down.

We are split on our sentiment. Ansel is still bearish, expecting big pain down to the mid-20s, while Jeff is bullish adding more weight in his analysis to fundamentals.

Be careful out there! Become a paid member to receive our exclusive technical and fundamental analysis in the Bitcoin Pulse.

Mining

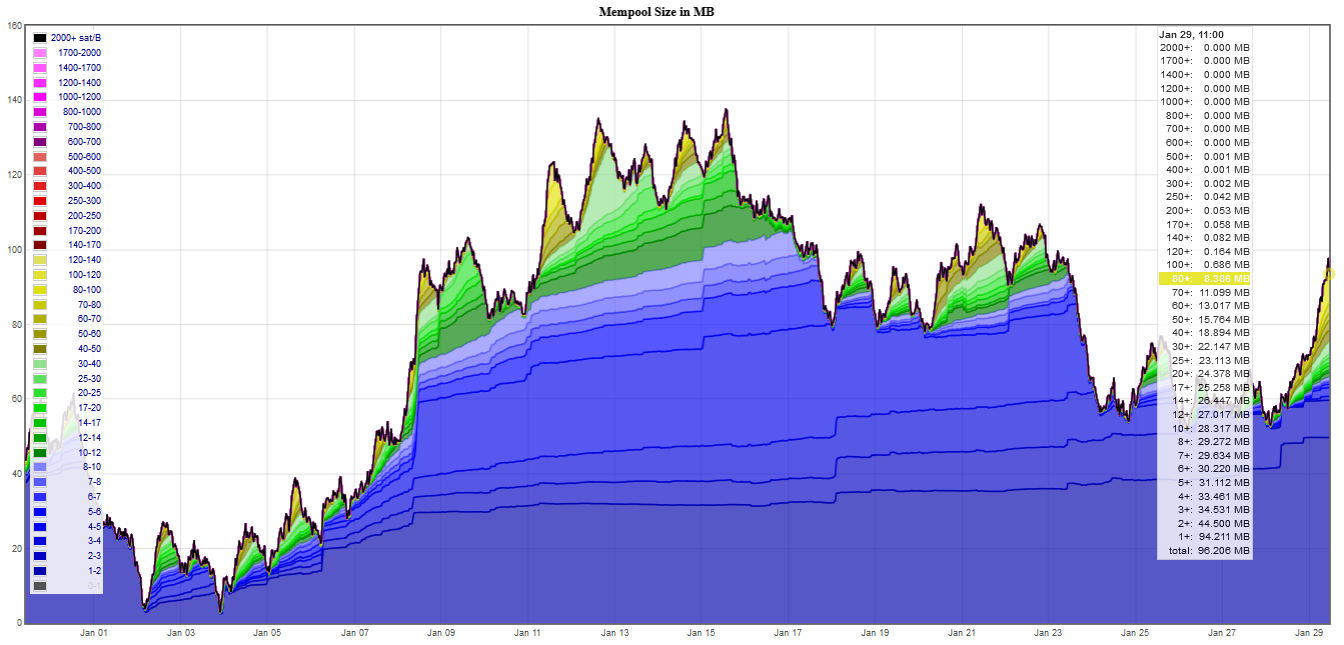

The difficulty increased 1.05% last Saturday and is currently estimated to rise another 3.5% in approximately 7 days. The mempool still remains busy and hasn't been close to clearing since the beginning of the month. At the time of writing, a 100+ sats/byte fee is required for the transaction to be picked up in the next block.

Marathon Patent Group, who is listed on NASDAQ and currently has 2,500 miners running, reports they placed an order for 100,500 S9 miners from Bitmain; which are scheduled to be delivered from July through December 2021. In addition, they purchased $150 million in bitcoin from money they raised in an equity round. We would love to hear why they spent ~$270m on mining hardware while spending $150m on bitcoin; was it a hedge against the hardware order, or FOMO? (Source: TheBlock)

Stablecoins / CBDC / Altcoins

Lagarde, President of the ECB, spoke about the digital Euro on 21 Jan 2021:

"But there are lots of questions that have not been resolved and that will, when they are resolved, determine the shape the technology support, the process by which the digital euro will be created, and I want to downplay any expectations that it is about to come. It will take a number of years, it is a complicated issue, it’s one that has to be resolved without disrupting the current financial scene, nor jeopardising the monetary policy transmission that we have currently. So, we have not yet either decided what the technology backbone would be ideally in order to support that digital euro."

As we've said many times, the digital Euro doesn't do much for central banks and has the potential to destroy the currency if it is anything but a glorified payment app. We are watching central bankers learn why CBDCs are stupid in real time.

Miscellaneous

Below is a chart from Glassnode showing the number of entities holding 1,000 or more bitcoin. Since March 2020, the number of entities has gone from ~1700 to ~2150 which is about an increase of ~25%. Glassnode has a method they use to group addresses or characterize an entity, so these numbers may have a big margin of error. However, paired with other data such as public filings, this is strong evidence new big players are moving in.

Lastly, we cannot forget to mention that bitcoin's censorship resistance and 24/7/365 trading stands in stark contrast to the WallStreetBets crowd being locked out of their accounts, having their forums censored or shutdown, and the utter farce traditional markets have become. Both big and little money are waking up to the benefits of bitcoin which is poised to make 2021 the year of the bull.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.