Fundamentals Report #118

December 4, 2020 | Issue #118 | Block 659,940

December 4, 2020 | Issue #118 | Block 659,940 | Disclaimer

Written by Ansel Lindner and Jeff See

Bitcoin in Brief

Weekly price: $19,063 (+$873, +4.8%)

Mayer Multiple: 1.63

Est. Difficulty Adjustment: -3.5% in 9d

Prev Adj: +8.86%

Sats/$1 USD: 5,246

1 finney: $1.91

This week's Bitcoin & Markets content

Go to our Info Page to join our community, find where to listen, and follow us.

The Bitcoin Dictionary is LIVE on Amazon! Support our content!

Market Commentary

The bitcoin space feels like we are holding our breathe this week, as price hangs in the air after a fantastic rally to the ATH. Bitcoin is a hedge against the stagnation and the human response to stagnation in the form of violence around the world. Bitcoin's fundamentals are steady, but have a marked decrease across the board compared to a couple weeks ago.

Nothing has changed across legacy markets. Gold had a small bounce, the dollar index continues to slide, bond rates are relatively unchanged, stocks tick higher, and oil is flat. US markets too seem to be holding their breathe, likely because the Presidential selection is not over. In coming weeks, don't be surprised by a spike of uncertainty as legal battles get real and governments takes on Christmas over the coronavirus.

As the dollar index sinks, Europe is being crushed by a strong Euro. Germany is on the hook for part the €1.35 trillion PEPP loans that didn't even go Germany (which their courts already tried to block). They are an exporting nation hurt by a strong Euro. 2021 is going to be a very interesting year in Europe.

Quick Price Analysis

Weekly BMI | -1 : Slilghtly bearish

We wrote this week in our technical analysis letter the Bitcoin Pulse:

Overall, I'm very bullish on bitcoin! This cycle will go to 6 digits for sure, but several things coincide with the end of the year, that we can't overlook and expect price to simply shoot through ATH resistance like a hot knife through butter.

Bitcoin is volatile. I try to tempter my bullishness in a skeptical framework of reality. You could say there are three legs to my skepticism: 1) nothing goes up in a straight line, 2) central banks will fail and deflation will dominate, and 3) major geopolitical events are imminent (next 1-3 years) and will begin to be priced in soon.

Don't be surprised by a significant pull back here. The divergences are quite striking and are across the board. $20,000 (previous ATH) is not going to give up that easily. It will likely take at least two attempts to break and sustain above it.

Become a paid member to access our full technical analysis and member newsletter.

Mining

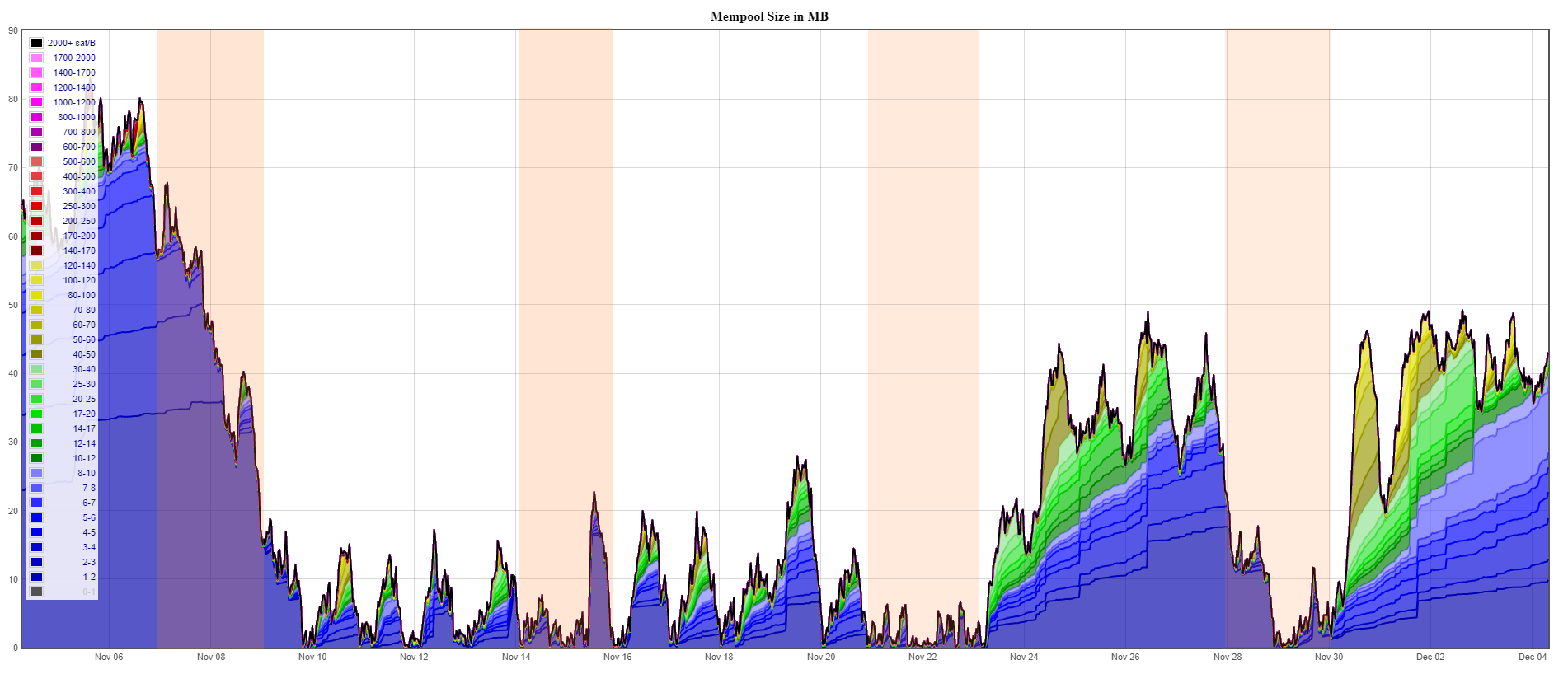

On a typical week the mempool starts to build on Monday and then clears over the weekend. This cycle is due to several factors, one being the natural flow of weekly business, a second being a remnant of the legacy banking system still the other side of many transactions. Once again, this week reached 40 MB worth of transactions in the mempool and we expect it to clear over the weekend.

The difficulty adjusted up +8.86% on Sunday November 28th and is currently estimated to adjust down -3.5% in 9 days.

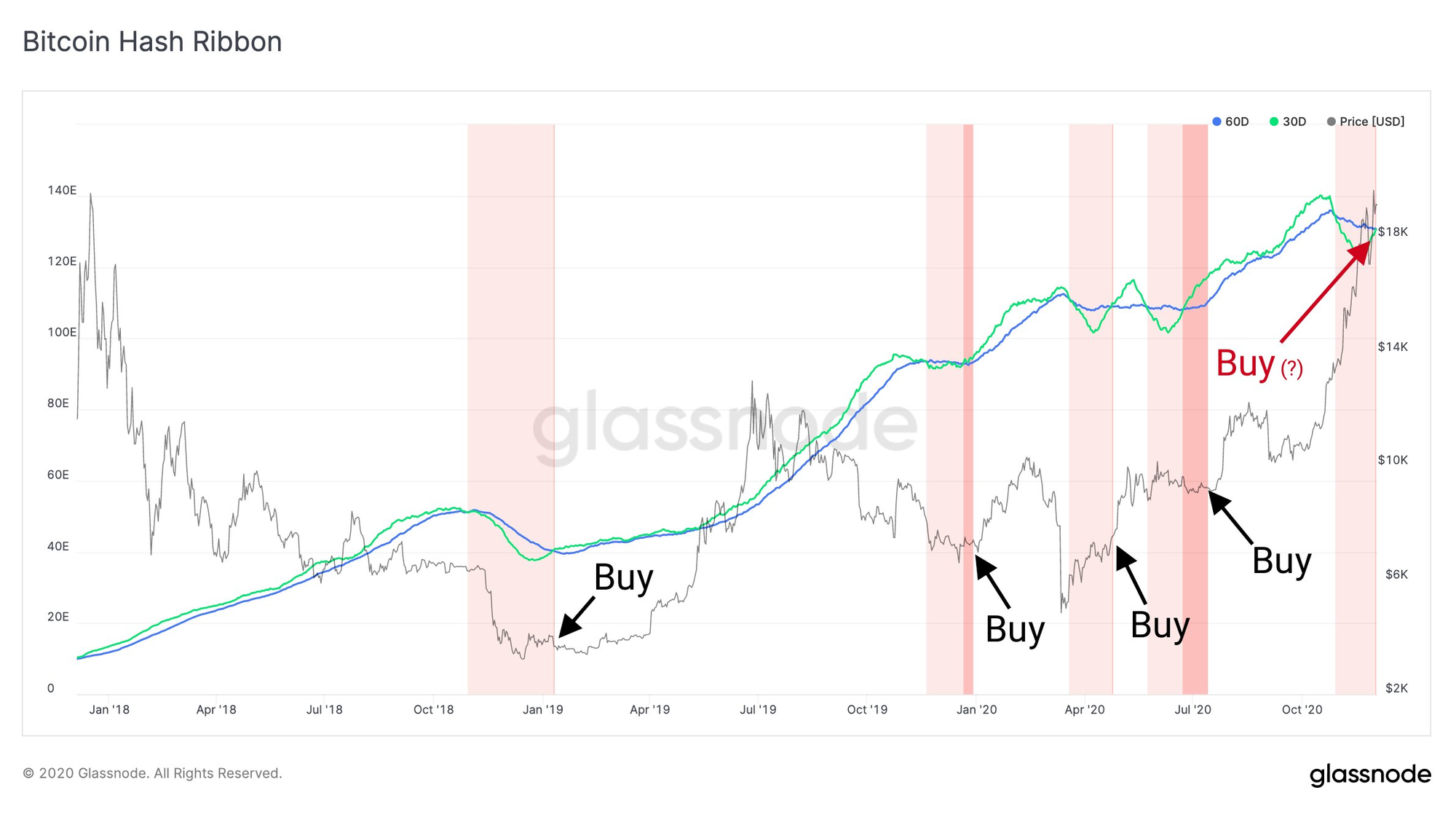

Below is a Hash Ribbon chart from @n3ocortex showing price going up when the hash rate momentum swings up. (You can find the Hash Ribbons indicator on Tradingview.) While this relationship makes logical sense, it doesn't have to hold precisely. See July 2020 and December 2019. In these cases price either didn't react immediately, or went the other way within a couple months.

Stablecoins / CBDC / Altcoins

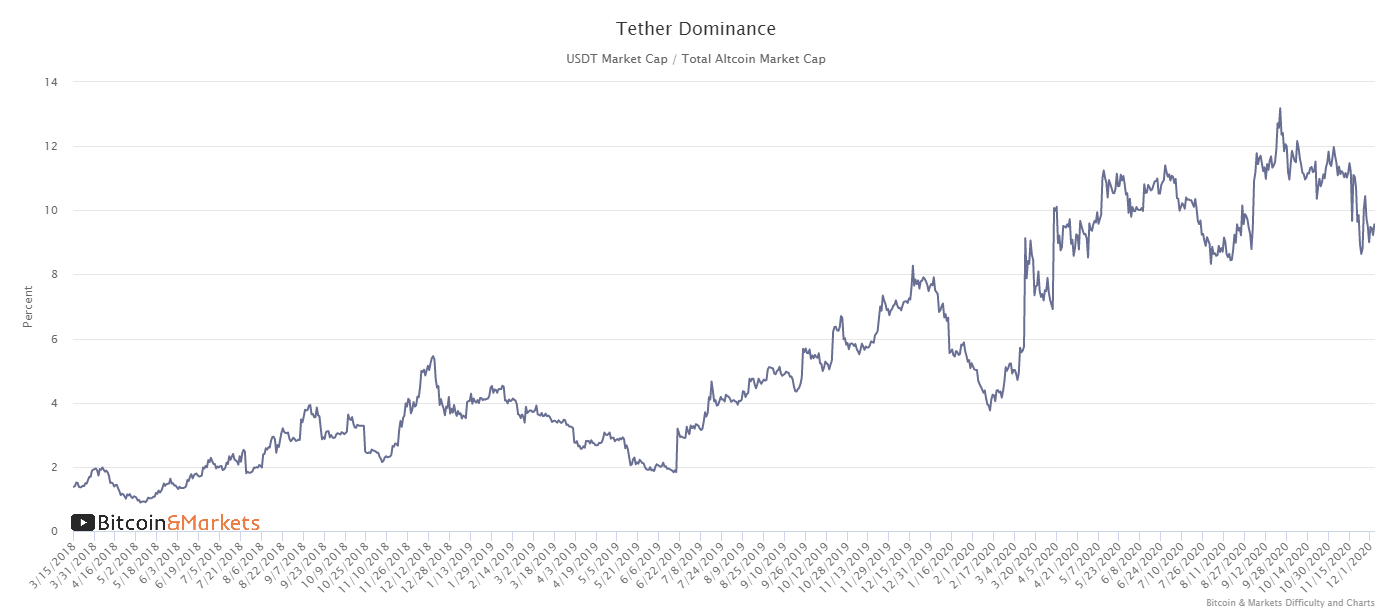

Tether Dominance: 9.6% (-0.8%)

Tether dominance is still low relative to the last 6 months. This means slightly illiquid conditions persist in the altcoins, and they are very overbought here. Consider Ripple, this completely useless coin currently has a $27 billion market cap. And the top 27 altcoins are all over a $1 billion market cap!? Continuation of the rally could still happen, but nothing has fundamentally changed, they are all still useless beyond ponzi-nomics. Retail hype has yet to materialize for this cycle, and might not due to poor economic conditions globally.

Ethereum 2.0

The first milestone along the long path to Eth2.0 launched this week. This milestone, called phase zero, introduces a separate network with a new blockchain called a "beacon chain" and a new token called Eth2. These new Eth2 tokens are "one-way pegged" to, but distinct from, Eth1, meaning Eth1 can be swapped for Eth2 at a 1-to-1 ratio, but not the other way around. Eth2 also has different properties, namely it can be staked and imply income.

Where these specifics matter is tax implications. Swaps between assets are a taxable event. This is starting to dawn on people. We first mentioned this back in 2019!

Should we have a serious discussion about the tax implications of ETH2.0?#ethereum #IRShttps://t.co/ZfWaHYceI4

— Ansel Lindner (@AnselLindner) October 14, 2019

We hope these people don't have to pay taxes, but investors should not be scammed into the unreasonable expectation that this will be treated by government as a tax-free transaction. We'll see how this develops.

Miscellaneous

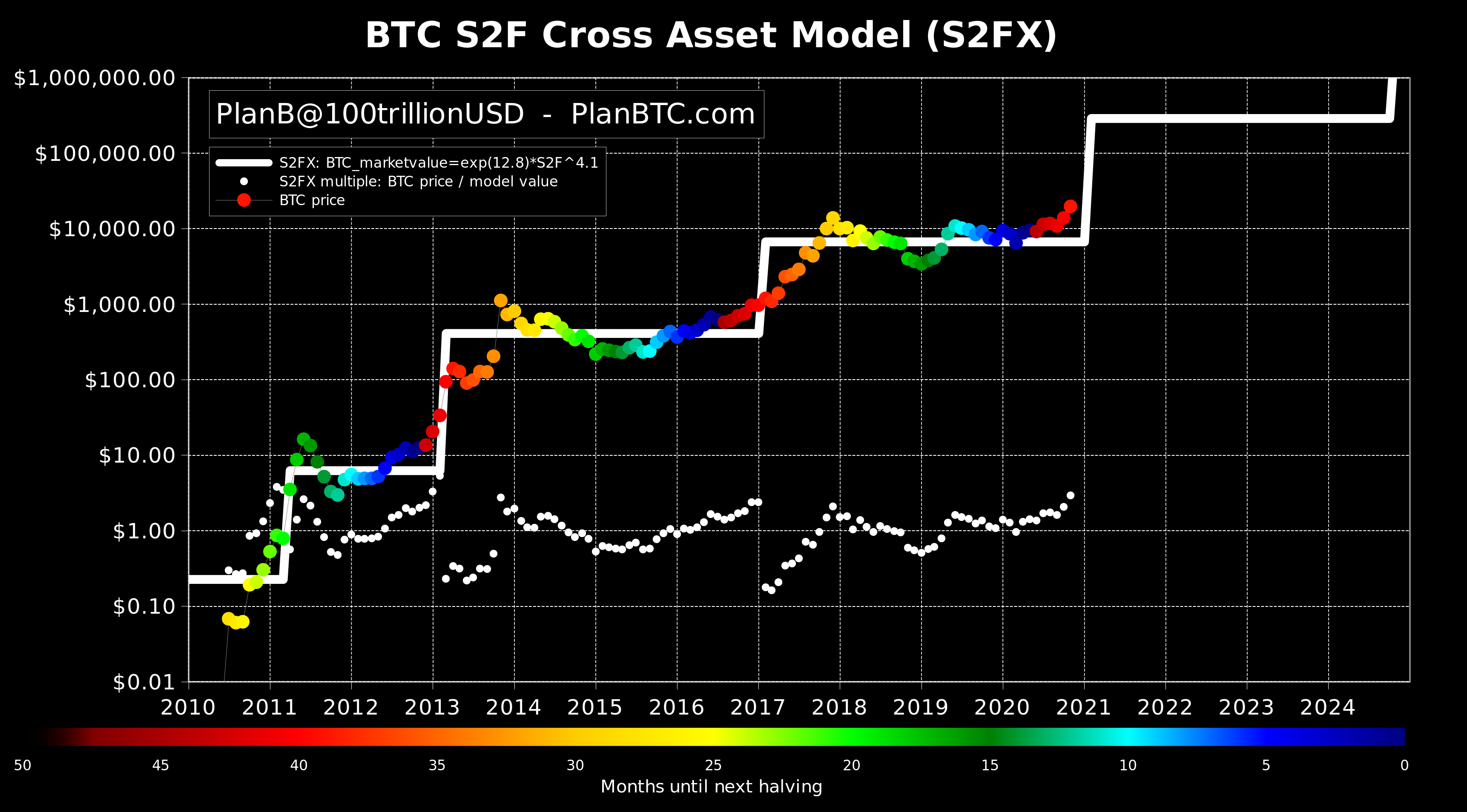

Trigger warning! We are excited to see the recent rally obeying S2F predictions. S2F deniers might short circuit as things play out once again as the model predicts. There is even a possibility that the S2F model is too conservative regarding the vertical portion of the S-curve of technology adoption. Cheers everyone!

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.