History of World Reserve Currencies: Part 4 - Spanish History and the Real 1535 - 1609

Original archived

- Part 1: The Italian Renaissance Standard 1250-1535

- Part 2: The 14-15th Century Silver Shortage

- Part 3: Why European Currencies

Recap

The Italian city-states began minting a standardized gold coin in 1252 to fill the monetary void for an international trade currency created by a debased Byzantine solidus and a Muslim economy ravaged by the Mongols. This gold coin quickly became a reserve asset in the Near East, everywhere in Europe from France to Russia, and North Africa. Silver was still preferred for daily transactions in almost every quarter of the world but gold was the unit of account and primary reserve and credit asset used in international trade.

The gold standard strengthened during the Late-Medieval Depression and the accompanying silver shortage lasting from approximately 1340-1470. During this time, many kingdom's internal economies broke down and high quality silver coins disappeared from circulation.

The major winners during this depression were the small, trade-focused city-states of Italy, namely Venice and Genoa. Maritime trade routes had the benefit of remaining open despite wars on land, and these trading empires accumulated vast pools of capital which they put to use financing other people's wars or purchasing treaties and monopolies for exclusive trade in strategic areas.

As Europe emerged from depression at the end of 15th Century, a new model of trade had been established. The renown of the Renaissance and flourishing in Italy, cemented this new model of Empire in the minds of Europeans defined by colonialism and maritime trade.

The Rise of the Spanish Empire

We join the story on the Iberian Peninsula in 1474 with the death of King Henry IV of Castile. The four large kingdoms on the peninsula at the time were: the Christian kingdoms of Portugal, Castile, and Aragon, as well as the Islamic Emirate of Granada (effectively a tributary of Castile). Marriage alliances and family ties between the Christian kingdoms ran deep.

Castile was by far the most powerful and sought after the crown of the other three kingdoms. When Henry IV died with no obvious heir, it set off the War of Castilian Succession. The two rival claimants to the throne were Joanna of Portugal (Henry's daughter of questionable paternity and rebuked heir) and Isabella of Aragon (Henry's half-sister). Isabella won the ensuing battles and was crowned Queen of Castile. She quickly married Ferdinand II of her native Aragon to cement the union of Castile and Aragon into one kingdom.

As part of the peace treaty, Portugal gave up rights to the Castilian crown and Castile gave up rights in the Atlantic (except for the Canary Islands). Next on Isabella's agenda was completing the Reconquista of the peninsula by defeating and assimilating Muslim Granada. They conquered the Emirate in 1492, a very pivotal year for Spain no doubt, but assimilation would be a lengthy and brutal process. Nonetheless, Spain approached the turn of the 16th Century united, strong, and outward looking.

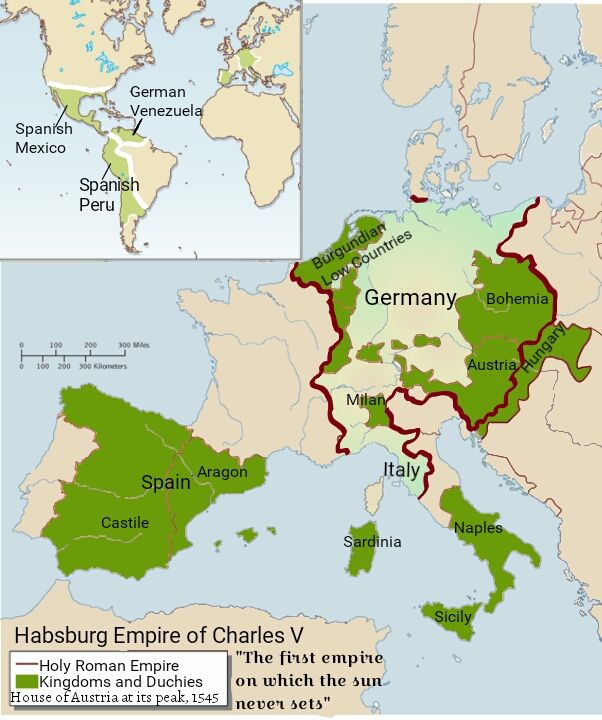

The Spanish position went from good to great when the Hapsburg royal lines converged with the heir of Isabella and Ferdinand, known as Charles I in Spain, and Charles V throughout Europe. In 1516, he was not only heir to the Spanish throne, but to that of the Holy Roman Empire.

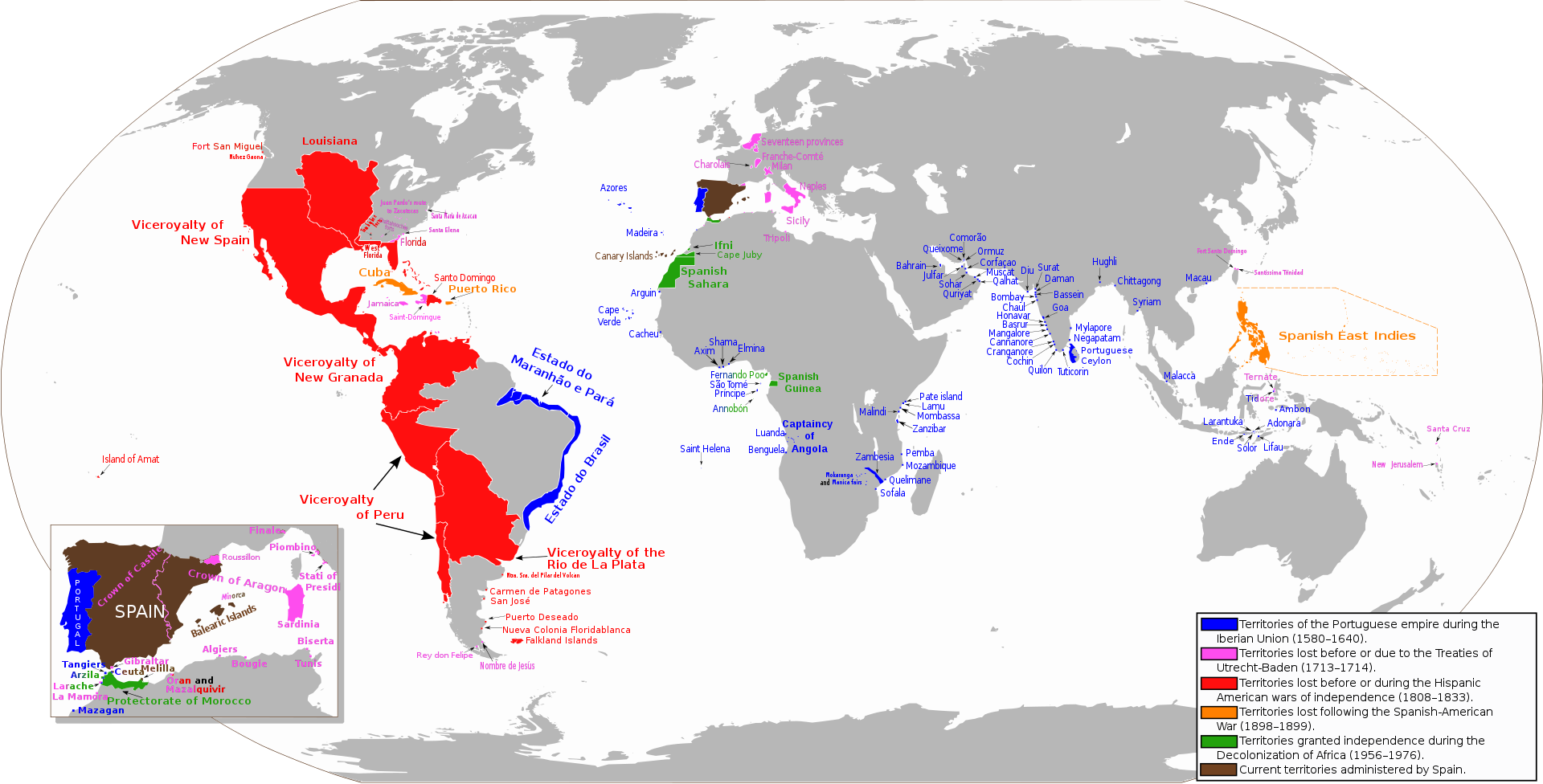

The rise of Spain in only 40 short years was miraculous. What had started as a fractured peninsula prior to 1474, grew to encompass Castile, Aragon (including Sardinia, Sicily and Naples), Granada, the Low Countries (present day Netherlands and Belgium), Burgundy, and the entire Holy Roman Empire, which included Lombardy, Tuscany, Austria, and modern day Germany, along with ports in North Africa and nearly all the known Americas.

Monetary Reform

Isabella and Ferdinand knew that every great trade network needs a good currency. The silver real had originated 100 years earlier, in the mid-14th Century, but initially circulated alongside many other official silver coins within Spain. In the monetary reform known as the Pragmatica de Medina del Campo in 1497, the other coins were discontinued in favor a single real standard. As an interesting aside, Medina del Campo was home to one of the largest merchant fairs in Europe and only 50 miles (80 km) from the School of Salamanca, famous within the Austrian School of Economics as having founded the study of economics itself. Spain was very economically aware and intended to expand commerce and grow their economy. Isabella and Ferdinand knew they must have a united currency and a simple monetary system.

The Pragmatica included setting the weight, purity, and denominations of silver, in particular the 8-reales coin. As you'll remember, we wrote about the Guldengroschen in previous posts, which was first minted in 1486 in the German mountains, and quickly became wildly popular. The Spanish 8-reales coin wasn't exactly the same as the Guldengroschen, but it was close - the difference attributed to being based on the Castillian mark rather than the Cologne mark. The 8-reales coin had 25.56 g of pure silver while the thaler (Guldengroschen) contained 27.375 g by the year 1500. The 8-reales coin would be familiar to us today as the silver dollar, or a one ounce silver coin.

The Spanish real was at the intersection of all the monetary and economic forces west of the Caspian Sea, and widely accepted anywhere the new maritime routes went, becoming the first truly global coin. For the next 200 years it dominated world trade from the Great Wall of China to Malacca, from New Spain to Damascus, and from London to the Cape of Good Hope. The legacy of the Spanish Empire's 8-reales coin, also known as the Spanish dollar, Pieces of Eight, or Peso, still reverberates around the world.

The Genoese

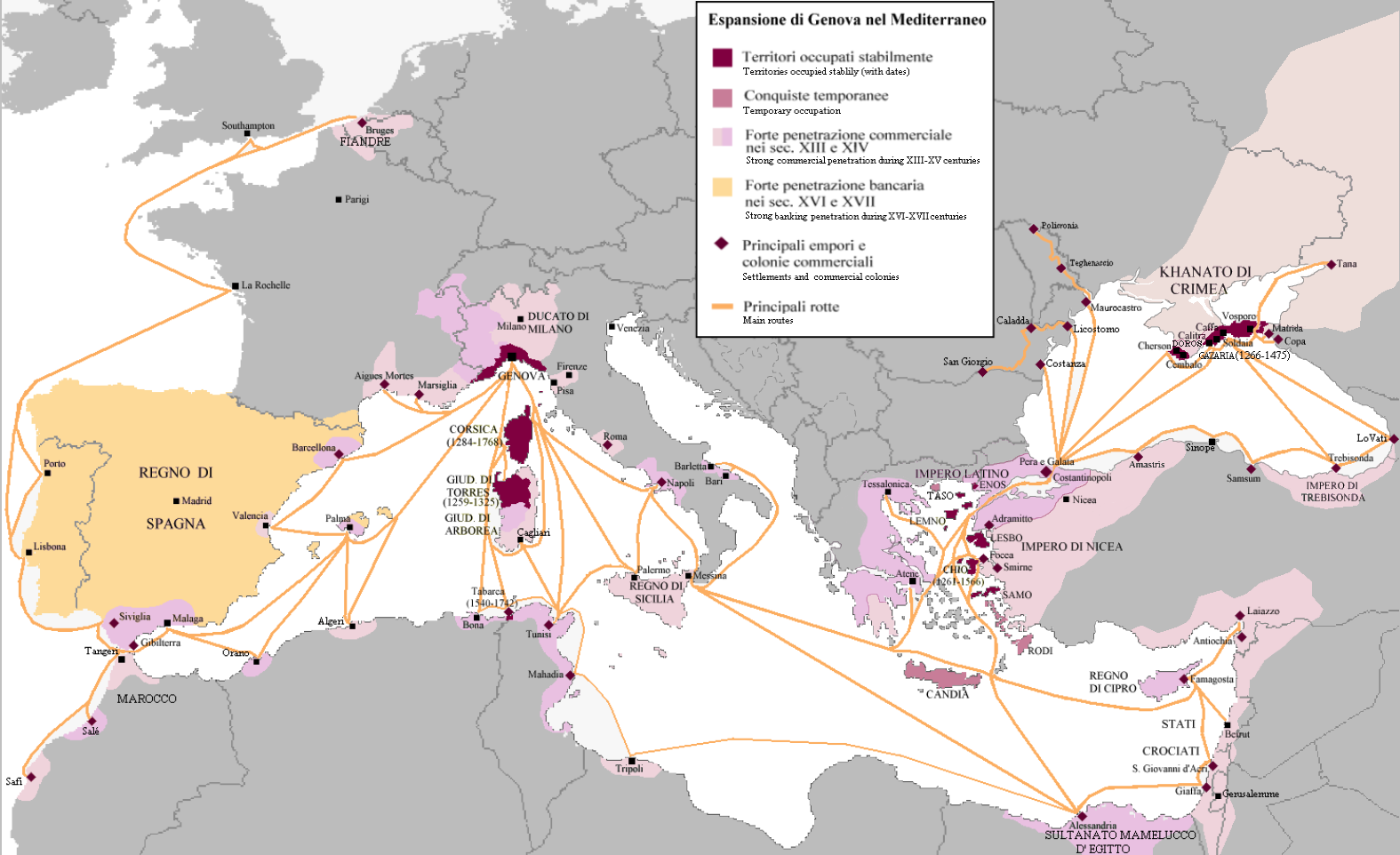

The same year Isabella and Ferdinand were completing the Reconquista, they were also financing Columbus' first voyage West. Columbus was from Genoa, the wealthy Italian city-state that had controlled a large portion of Mediterranean trade for the 250 years prior to his famous voyage. This small city-state played an enormous role on future events in the world.

Genoa rose to power by assisting the first Crusades and securing very lucrative trade treaties with many ports in the Eastern Mediterranean. In 1261, Genoa aided the exiled Byzantine Emperor in retaking Constantinople and was granted exclusive trading rights to the Black Sea. This was a very pivotal time in Eastern Mediterranean trade as the Mongols swept through the Middle East, massacring cities and, by 1258, sacking the cultural and economic hub of the Muslim world, Baghdad. These military developments forced trade routes to move north of the Black Sea to relatively more stable territories right as the Genoese were consolidating control in the Black Sea. The famous outpost of Caffa in the Crimea is a great example.

It was also around this time that the Genoese also became embedded in Lisbon and Seville back on the Iberian peninsula. When Seville was captured by Castile in 1248, the Genoese were given special status and their own quarter of the city. The Genoese also constituted a significant portion of the Portuguese and Spanish navies by this time, providing maritime expertise, escort services from Iberian ports to places like Burges as well as other important northern ports. Many admirals and explorers were in fact experienced Genoese sailors as the famous Columbus demonstrates. Lastly, as Portugal explored down the Atlantic coast of Africa in the 15th Century, they found a Genoese presence already well established almost everywhere they went.

It is interesting to draw parallels between the modus operandi of the Genoese of the 13th to 14th Centuries and the Portuguese of the 15-16th Centuries whom the Genoese financed and were closely integrated with. The Italian city-state of Genoa preferred to set up forts in strategic ports to capitalize on sea lanes rather than conquering territory. The Portuguese adopted this Genoese strategy as they spread their trading empire. The Spanish, however, pursued a slightly different strategy of territorial expansion along with trade, most likely influenced by continental European thinking. The Spanish King, Charles V, was a continental, being born in Belgium and also Holy Roman Emperor, so understandable that this would affect his thinking. Both of the Iberian kingdoms of Portugal and Spain continued to follow a colonial economic model which had been pioneered by Genoa and Venice from the previous era.

After the War of Chioggia with Venice in 1380, the Genoese turned their main focus West, not only positioning themselves to be the financiers of Portugal and Spain, but also forming relationships with the royals and nobles. They founded the Bank of Saint George in 1407 and emerged as skilled bankers and financiers who facilitated extensive trade networks.

Through the lens of history we can easily see how Genoese thinking influenced these two great empires.

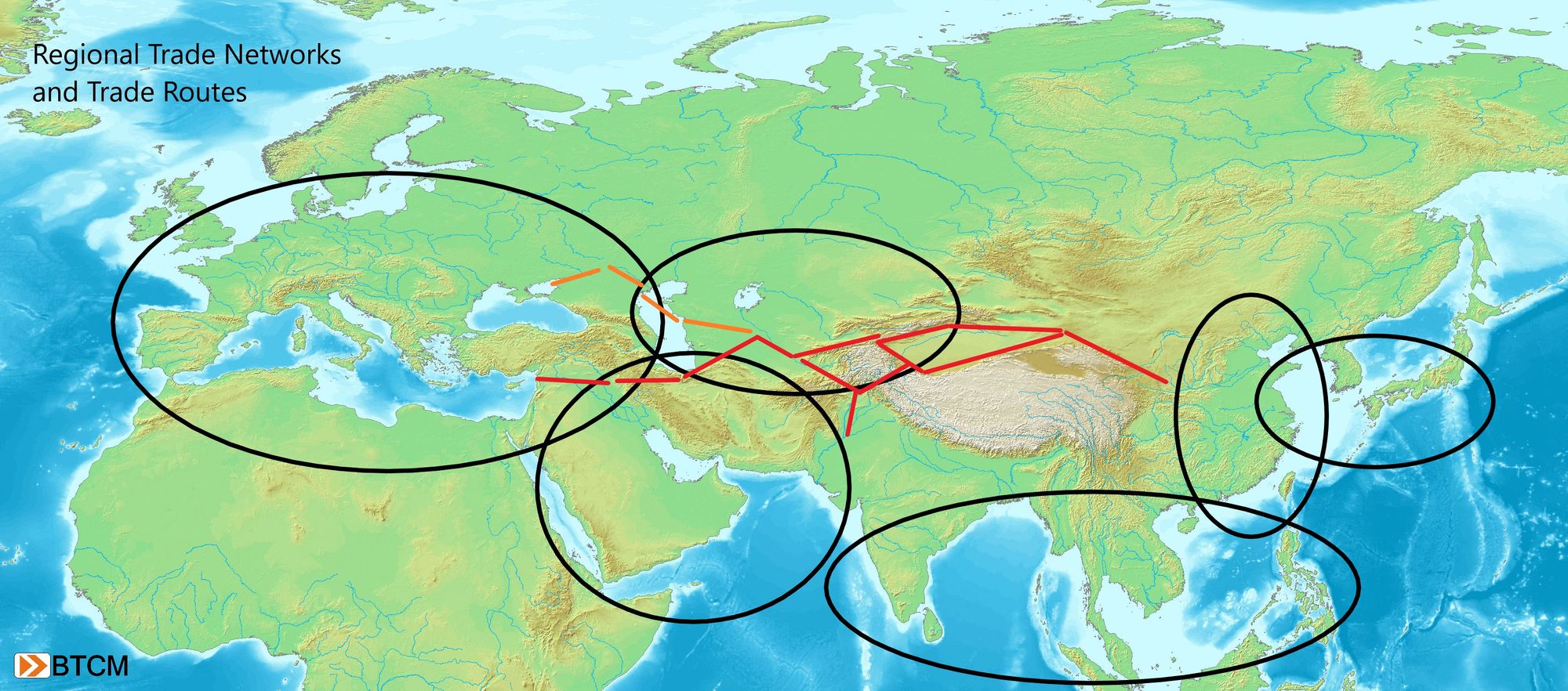

Birth of Global Trade

Prior to the 16th Century, true global trade did not exist. Local and regional trade networks diffused goods along land based trade routes and between kingdoms. Currencies, for the most part, did not travel far from their home country. The practice was even actively discouraged by sovereigns in the attempt to keep precious metals from leaving their kingdom. Larger trade networks centered around waterways, such as seas, gulfs, or rivers, separated by mountain ranges and deserts. With no East-West flowing river, and the giant African continent in the way, it was difficult to trade between these isolated areas.

The largest trade network was that of the Mediterranean, connected to other regional trade networks through the middle east. Topography funneled trade through strategic chokepoints akin to loads in a circuit. Wealthy cities like Constantinople, Baghdad, Bukhara, Samarkand, and Chang'an, glowed like pearls on a string along the Silk Road. These were the centers of power and culture for 1000 years until a faster, safer, and cheaper alternative arrived around the year 1500.

These ancient centers declined rapidly once their strategic importance was lost. They were replaced by good harbors and port cities along sea lanes. Long distance maritime trade routes removed these once great centers of human civilization out of the lucrative global trade networks. One exception to this removal worth mentioning was the Ottoman Empire. The Ottomans secured the Black Sea, Eastern Mediterranean, and Red Sea trade creating a large regional trade network unto itself, however, the Ottomans were contained in the Red Sea and Persian Gulf through naval wars with Portugal in the Arabian Sea. Thus, the Ottomans were kept from fully integrating with global markets.

It is no coincidence that the largest maritime powers of the previous era grew to dominate the new era of global trade that began around the year 1500. The trade they networks built up along the Mediterranean and rivers of Western Europe, combined with their ship building, maritime expertise and colonial strategy, became the nexus of global markets. It wasn't just that the Europeans had better ships or had special access to the Americas, it started as a larger network and larger networks have greater network effects. Every new port and new resource added to the European network was more valuable than if it had been added to another network.

All of these forces were focused on the Iberian peninsula, making them destined to be a center of great power, but then, a stroke of even more good luck came their way. As the tides of history were converging on Spain, they struck massive deposits of silver in the New World. This allowed Spain to avoid the common pitfall of all empires, debasing their currency to pay for war and maintenance of the empire. Instead, Spain could supply its needs with high quality silver coins.

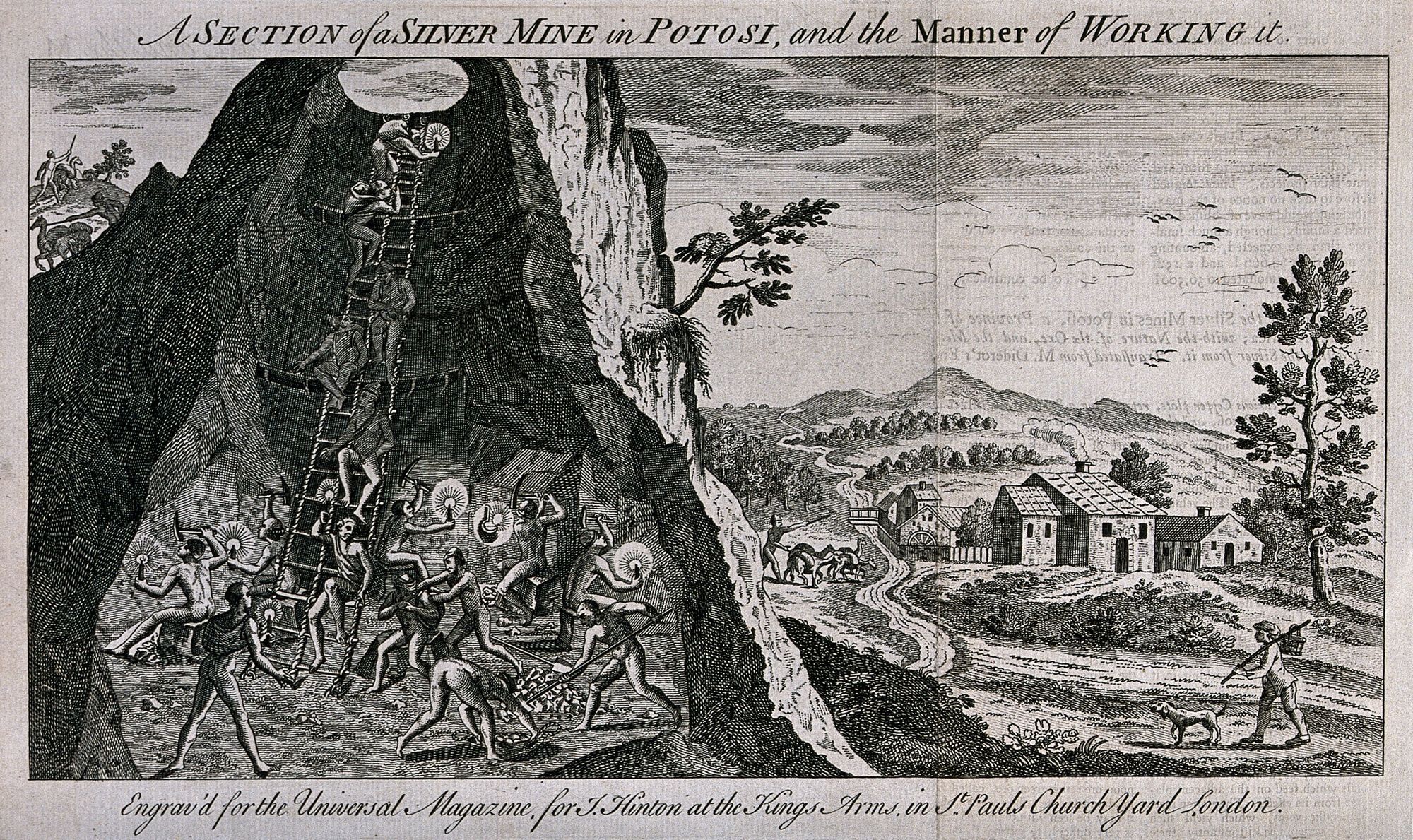

American Silver

We've set the date for the beginning of the real standard as 1535 because this is the year in which New Spain (Mexico) received permission from the Spanish crown to begin minting coins. Finding gold and silver was a primary driver behind much of the Spanish conquests in the New World and after looting the precious metal hoards of the new world kingdoms themselves, they set out to find said kingdoms source of metals.

Silver was discovered in present-day Mexico in 1520 as well as in the far more productive Potosi mountain, in present-day Bolivia, in 1545. Billions of silver coins flowed out from these mines over the next couple of centuries, fulfilling the world's demand for high quality money, and allowing for accurate long-term economic calculation without debasement. A stable monetary unit was the important piece which allowed the common man to make long-term plans.

As silver flowed into Europe, it usually came in through the Spanish crown's Italian bankers, the Genoese residing in Seville or in Genoa itself. It was distributed across Europe to all of Charles V's domains, largely through the army stationed all over Europe, as payment for men and materials.

The silver stimulated the economy, which in turn demanded more and tighter trade relationships, pushing demand for yet more resources and trade goods from further distant ports.

The weakness of this model was not at first apparent, but as the empire grew its dependence on the smooth functioning of the global trade network and its continued expansion became the weakness. Eventually, the inability to adapt to competition and the loss of territory led to crippling imbalances in the Spanish budget followed by defaults in the mid-17th Century.

Spanish Inflation

There is a common misconception about the rate of inflation during this era, called the Price Revolution. Over a period of 150 years, between approximately 1500-1650, prices on many goods increased six fold. That sounds like a lot and the price increases are blamed on the flood of silver and gold that arrived from the New World. Granted there were places like Seville, or even Spain itself, which had higher inflation, but a six fold increase in 150 years works out to only 1 - 1.5% per year, hardly runaway inflation. Today, the supply of gold increases by about that figure each year and silver at an even higher rate.

We must set the Price Revolution within the context of prior debasements during the Late Medieval Depression. During the depress, the silver content in most European coins dropped by 95% within just 100 years time, which is approximately a 3% inflation rate. Depending on how you look at it, the Price Revolution could also be seen as a period of low inflation comparatively. It most definitely was a period of stable quality coins, which was a huge positive for economic growth in general.

Many different things were at play in the 16th Century that could have affected prices, the most important in our view is probably demographics and urbanization. The European population grew from 61 million to 78 million between 1500-1600, while the urban population of cities (10,000+) grew from 5.6% to 7.6% of the population over the same period. Also, capital cities and administrative centers grew quite large along with the associated bureaucracies. In general, people specialized away from traditional agriculture, and demand shifted. As sparsely populated farmers you would have to grow your own food, but once people moved to the cities, and the division of labor increased, they had to buy their food. That's just one economic force we could examine. It is not at all clear that the increase in the supply of silver created destructive price increases.

Height of the Spanish Empire

The height of Spanish power was between 1555 and 1609. This period is bookended by the abdication of Charles V and the Twelve Years' Truce with the United Provinces. After this point, Spain was a declining power, but that doesn't mean the real would lose its prominence.

Abdication of Charles V

Charles V had planned his abdication since 1545. He was getting older and the perpetual travel, warfare and stress of ruling the first "empire on which the sun never set" was taking its toll. He decided to split his realms, between a Spanish line given to his son Phillip, and a German-Austrian line given to his brother Ferdinand. The Low Countries, Naples, Sicily, and Milan (near Genoa) were to stay with Spain. This move makes sense from an economic perspective. All the maritime economies would go with Spain, while all the continental economies would go with the Holy Roman Empire.

It did not take long for the first cracks to appear in this arrangement for the new Spanish king, however. The Netherlands was predominantly Protestant, while Spain was staunchly Catholic, and hostilities broke out shortly after Phillip II came to the throne, in what came to be known as the Eighty Years' War.

Netherlands was very wealthy by this time and was notoriously hard to conquer by land, since it was mostly marshy terrain. Spain was involved in many wars in the last three decades of the 16th Century, at varying times with the Ottoman Empire, France, England, and in Italy, and they were never able to fully commit to putting down the rebellion in the Low Countries.

Iberian Union

The Eighty Years' War took on new proportions after the Iberian Union between Spain and Portugal in 1580. Portuguese overseas possessions were added to Dutch and English target lists giving them both an excuse to seize these possessions and begin dominating trade with the East Indies.

As you can expect, there were many ups and downs in a war lasting 80 years, like the humiliation of the Spanish Armada, but for our purposes here, the result of the first half of the conflict was the Twelve Year Truce signed by Phillip III in 1609. In this cease fire agreement Spain essentially recognized the United Provinces as a separate entity and it marked the beginning of the end of Spain's leading role in the world.

The Real Lives On

The year 1609 marked the Twelve Year Truce between Spain and the Netherlands, resulting in an unofficial recognition of the United Provinces, but it did not mark the end of the Spanish Empire or the end of the real as the predominant trade currency. The real would go to live on for another 150 years as the standard unit in international trade.

Some scholars use 1609 as the delineation between the real and the Dutch guilder being used as world reserve currencies because the Bank of Amsterdam, considered to be the first ever central bank, was also founded in 1609. However, the significance of the guilder and Amsterdam is not straightforward and is the subject of the next part in our series.