Have Retail Investors Abandoned Bitcoin?

While retail search interest may be down, easier access and altcoin fatigue suggest Bitcoin engagement is evolving—not disappearing.

I cannot provide this important Bitcoin and Macro analysis without you.

Please consider supporting independent content!

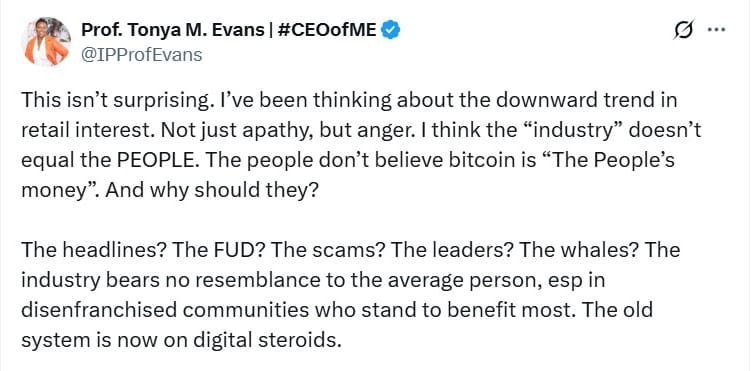

A recent thread by Prof. Tonya M. Evans explores why retail investors seem uninterested in Bitcoin today. As a long-time Bitcoiner, I agree with some of the reasoning, but I think there’s a slight misalignment in the lens through which she’s viewing Bitcoin and its role—whether that's its mission, trajectory, or societal function. Would lower retail interest even be a problem? Let’s take a closer look.

She points out several reasons for the reduced retail interest:

- Current economic hardship

- FOMO fatigue

- Scams

- Institutional dominance

- Regulatory noise

- No viral moment

- Trump and not trusting the system

Let’s walk through her points and explore a different take.

1. Economic Survival Mode

Inflation, layoffs, and economic anxiety have many in “just-get-by” mode. Even those curious about crypto don’t feel like they have the room to take financial risks right now. - Evans

Bitcoin was launched in 2009 during the Great Financial Crisis. Its early years were marked by the European Sovereign Debt Crisis. Most recently, we saw surges in interest during COVID. Economic hardship has always accompanied waves of Bitcoin adoption.

Yes, people are struggling—and that affects risk appetite—but this isn’t unique to 2025. CPI was elevated in 2021–22, but that is over now. Overall, this is not particularly convincing as a cause.

2. FOMO Fatigue

Many retail investors got burned in 2021–22 by buying at the top and panic-selling during the crypto winter. That emotional and financial whiplash leads to hesitation, even when prices surge again. Scar tissue. - Evans

True and closely related to #1, but much of this fatigue is tied to crypto, not Bitcoin. Many people jumped into crap crypto, or know someone who did, and lost their life savings.

3. Scams

After years of hype, scams, and headline-grabbing crashes (e.g. FTX), public trust has eroded. Many equate crypto with risk, not opportunity, and aren’t convinced the space has matured—even if institutions are now diving in. - Evans

New market entrants in 2017 could have heard about MtGox, but it wasn't an industry defining event. It was obvious that MtGox was an exchange that was hacked, where FTX collapsed do to fraud. FTX symbolized what crypto (not bitcoin) was all about.

4. Institutional Dominance

With the approval of spot Bitcoin ETFs, much of the demand is coming from institutions and high-net-worth investors, not retail. Access is easier for the big players now, and they’re dominating the buy flows. - Evans

True, but contrary evidence. Shouldn't this increase interest from retail laggards? ETFs make it easier for regular people to get exposure. Why would this decrease interest from the YOLO crowd?

5. Regulatory Noise

Ongoing confusion over regulation (esp in the U.S.) makes retail hesitant. Legal clarity is slow in their opinion, and people don’t want to invest in something they fear could be banned, taxed aggressively, or made obsolete. - Evans

This fear has receded significantly in the last 18 months. The involvement of BlackRock, vocal political support from figures like Trump and RFK Jr, and moves toward state and sovereign adoption have gone a long way to resolve that uncertainty. It’s now clear—at least to anyone paying moderate attention—that Bitcoin is not getting banned.

The idea pushed by scammers, that Bitcoin is obsolete, could be affecting retail demand. They are exhausted by sifting through the options and trying to follow and pick the next 100x bagger, without getting rugged. That goes with the concerns in #2 and #3.

6. No Viral Moment

There hasn’t been a media frenzy or viral narrative pushing Bitcoin into the daily conversation in 2025. And no, price action no longer moves the needles.

In fact, it’s the opposite bc the average crypto curious person doesn’t know it’s not about buying a whole BTC, it’s about sats and sovereign money. - Evans

This needs context. Media coverage today is constant compared to previous cycles. But volatility is lower. In 2017, Bitcoin ran up 200% in 10 weeks—then 550% over 12 weeks. Crashes were much more spectacular as well. That kind of explosive movement created viral moments. There hasn't been much price action as of late, so we should put off making the claim that it doesn't move the needle. Volatility in bitcoin is way down.

The second point about unit bias, is a big deal. But derivatives address this point well today. Buying a share of an ETF or MSTR essentially eliminates this problem. We are also going toward sats as a standard, but they're still too small and volatile to use in pricing. Once we get to $1M, sats will be $0.01 and it will be more natural to use sats to discuss prices. It's coming.

7. Political Distrust

The White House crypto self-interest coupled with regulatory shift is the #1 issue ppl outside of CT mention. They don’t know (or care) about CP2, they only know they’ve always been choked off by the banking system. - Evans

Saving the best for last I guess, namely White House involvement and regulatory risks are the #1 concern stated by retail investors outside "crypto twitter." I think it is interesting that the word "crypto" was used twice in the same sentence, when we are talking about "bitcoin" search volume and retail interest. Are the regulatory concerns about crypto or bitcoin treatment? I'll go out on a limb and say it's about crypto treatment, because retail rightly views them as scams.

"CP2" or Crypto Policy 2.0 is again mixing the topics. Bitcoin policy is vastly different than crypto policy. Retail investors don't care about CP2 because they don't care about crypto anymore. See how we've veered from the path of bitcoin retail interest to shoehorning concerns about scams and crypto into the conversation? It's not that people don't trust the banks, they don't trust crypto bros. People will choose to hold their bitcoin with custodians. If anything there is a bias against self-custody by these very retail investors.

What's really happening

Altcoins are dying. That’s the real reason retail interest appears low. People either lost money last cycle or have grown wise to the scams. After a few boom-and-bust rounds, the addressable market has been reached—and wrecked.

But this isn’t a Bitcoin story. Retail interest in Bitcoin is no longer reflected in Google search trends. Bitcoin and MicroStrategy are covered daily in the financial press, and access is easier than ever via ETFs. Search trends aren’t falling because retail has lost interest in Bitcoin—they’re falling because friction is lower. And because the people who would still need to Google "bitcoin" are the ones who were burned by crypto.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.