A World Without Inflation?

Understanding how fixed supply transforms economic incentives and re-routes the natural pressure to inflate.

I cannot provide this important Bitcoin and Macro analysis without you.

Please consider supporting independent content!

The Gold Standard and Inflation

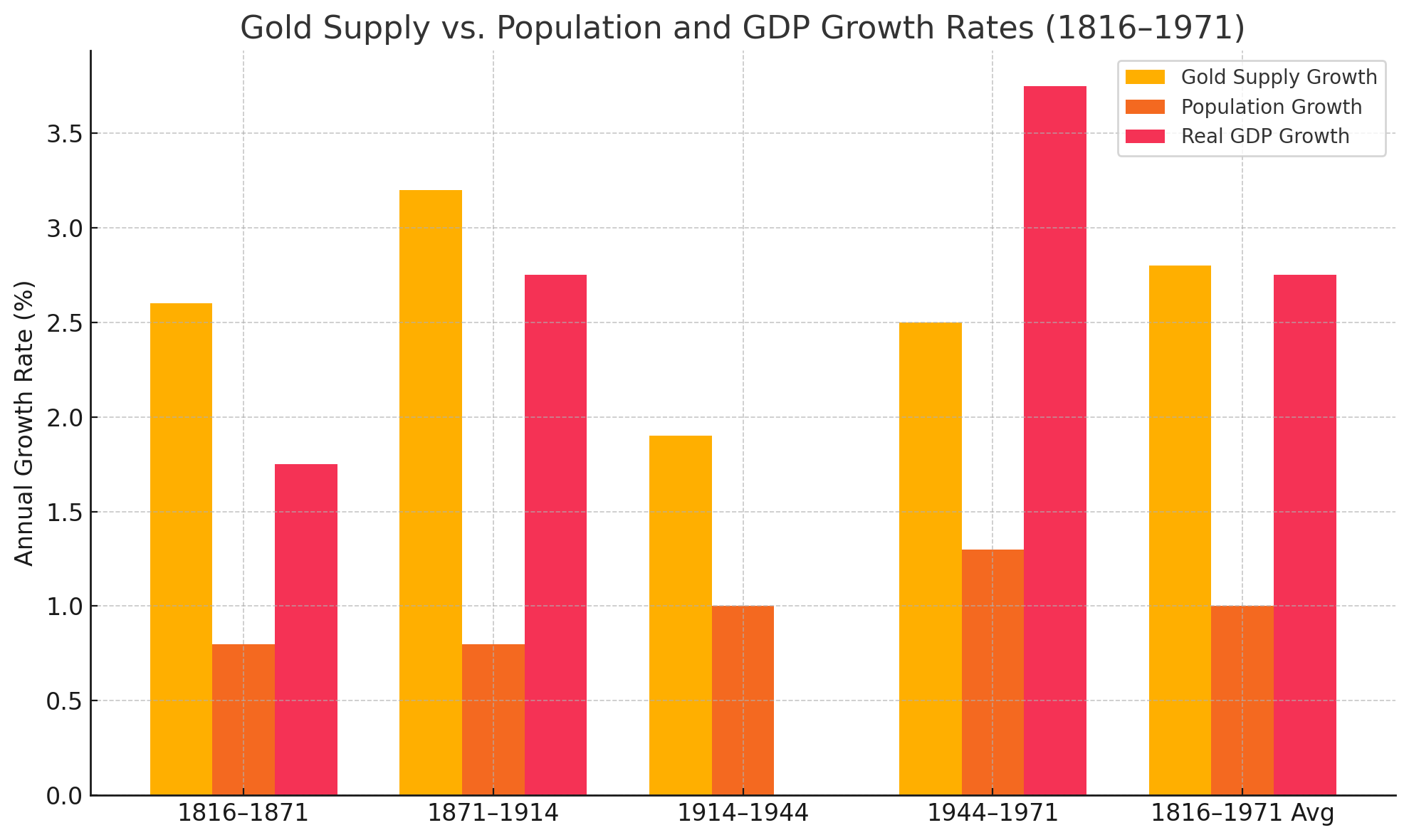

We are often told that inflation is a hidden tax. Macro pundits and bitcoiners point to the 2 percent central bank target and argue it deliberately erodes purchasing power. In their view, increasing the money supply is inherently destructive. The counter example they use is often the classical gold standard, describing it as a golden age of gently falling prices and hard money discipline, with no appreciation for the fact it had higher inflation than the 2% Federal Reserve target.

When we talk about inflation, it is essential to stay consistent. Most people will say the current system "prints money" and that's why prices keeps rising. But if told that periods with price declines also had an increase in the money supply, they'll switch to saying prices are inflation. The reality is, during the classical gold standard (1871-1914), money supply increased an average of 3.2%.

This post disputes the stereotype that inflation is always a bad thing, acknowledging the fact that every monetary system (until an eventual bitcoin standard) has been inflationary. That being the case, is it a bad thing that bitcoin doesn't have inflation? Where will the inflationary impulse be routed to, what will be the impact? We must honestly answer these questions, because the impulse to print money is one of the most basic of human characteristics.

Before we go further, I'd like to add the disclaimer that I am a bitcoiner. I do believe we are moving toward a bitcoin-based monetary system. But it's not because bitcoin is objectively "better money." There is only better money relative to the prevailing macro circumstances. For instance, as macro conditions change, the money best suited for those conditions also changes. New pressures and incentives arise as the economy, culture and market evolves. The legacy system is often tweaked, because the tools at our disposal didn't change. Gold and/or silver were the monetary tools for millennia. In that case, new derivatives and financial products can be built to suite new conditions. However, rarely do we face this type of transition with a whole new tool. Bitcoin is the best money for the present and foreseeable future circumstances.

Is Bitcoin's Fixed Supply Inherently Better?

Realizing that the supply of money rapidly increased under a gold standard is important because many people conflate “inflation” with artificiality and negative outcomes. It's commonly viewed as something imposed from above—always fiat-driven, always political, always bad. That view leads to the simplistic inverse assumption: that low inflation or even deflation is natural and good. From there, it’s a short leap to the extremely popular belief that bitcoin, with its fixed supply, must be the perfect form of money.

But that logic doesn't hold up under closer inspection.

Inflation has been a constant throughout human economic development. It has always occurred alongside expansion—more people, more trade, more output. From primitive forms of money like shells, to precious metals like gold and silver, to sophisticated credit systems, the monetary base has grown as a consequence of technological progress, resource discovery, increasing economic trust, and demand for money. Inflation is rarely the result of central planning. In most cases, it arises naturally, from the bottom up. Whether through gold mining or demand for commercial credit and willingness to lend.

In this broad history of monetary inflation, Bitcoin is extremely unique. It is the first monetary asset with a fixed supply, entirely indifferent to growth, productivity, or demand. If we are honest, no one knows how the economy will react to this new elemental discovery. It's akin to the adoption of gunpowder, bronze, iron or steel. Every prior civilization, even under gold, lived with inflation. In fact, monetary inflation has been so consistent and so intertwined with progress that many economists have come to see it not just as natural, but as necessary.

A Fixed Supply Isn’t Always the Ideal

This is where the real challenge for bitcoin begins. If inflation has always been a byproduct of growth, then what happens when a monetary system eliminates it by design? If inflation is not inherently bad—and has, in many historical cases, supported stability and expansion—why is bitcoin’s fixed supply held up as the perfect solution?

The "hardest money" narrative prevalent in bitcoin is partially a post-hoc rationalization. Bitcoin must have a fixed supply as a consequence of its nature. The path to adoption, without government force, is through the store-of-value function. A fixed-supply alternative would attract the capital away from the tail-emission clone because of the dilution. Therefore, a fixed supply is a necessary requirement of bitcoin adoption. But are we applying monetization logic to a money once monetized?

Imagine a scenario where a government decrees a bitcoin clone, with tail emission, as legal tender. It would offer greater monetary elasticity than fixed-supply bitcoin. If you can bypass the monetization phase, tail emission would likely be preferred in a high-growth-potential environment. However, it would also be vulnerable to political interference and corruption. The trade-off is censorship resistance and independent monetary policy in exchange for medium-term growth.

Some serious economists are skeptical of bitcoin not because they love fiat, but because they understand that an expanding money supply has been a core feature of every monetary system to date. Skeptics believe that without inflation, Bitcoin doesn't fit into the category of what they deem is a "monetary system." They wrongly assume that elasticity is the independent variable, and directly proportionate to growth. In reality, it is the macro environment which selects the money through the market with the best properties for the time.

As an economy grows, there is a natural incentive to increase the money supply. Bitcoin forces us to rethink where the incentive for monetary expansion will go.

How Bitcoin Achieves Balance Without Supply Expansion

The incentive to inflate sound money is natural and begins with a rise in its relative scarcity. As economic output rises, goods become more abundant relative to the money supply. The same amount of money chases more goods. This causes money to appreciate; IOW, prices of other goods fall relative to the monetary unit.

This shift increases the marginal revenue (MR) of money production. For commodity money like gold, that means mining becomes more profitable. As MR rises, it justifies greater investment and exploration. More labor, capital, and technological effort is directed toward increasing the money supply. Eventually, marginal cost (MC) rises and the value of money stabilizes as new supply enters circulation. Balance is restored through higher MC and increased supply.

In bitcoin, supply cannot increase. The same pressure to produce more money exists, but must be absorbed by other means—primarily through changes in marginal cost and velocity.

When bitcoin appreciates, more capital flows into mining. However, since the supply is fixed, there is no relieving effect from an increase in supply. Marginal cost will rise, reducing margins and absorbing excess profitability. At the same time, velocity will increase to mimic the effect of inflation. As mining costs rise, miners are forced to circulate more purchasing power.

This velocity effect can also arise from dormant coins reentering the market. If price appreciation entices long-held bitcoin out of hoards, circulating supply effectively increases. This pseudo-elastic response acts as a pressure valve.

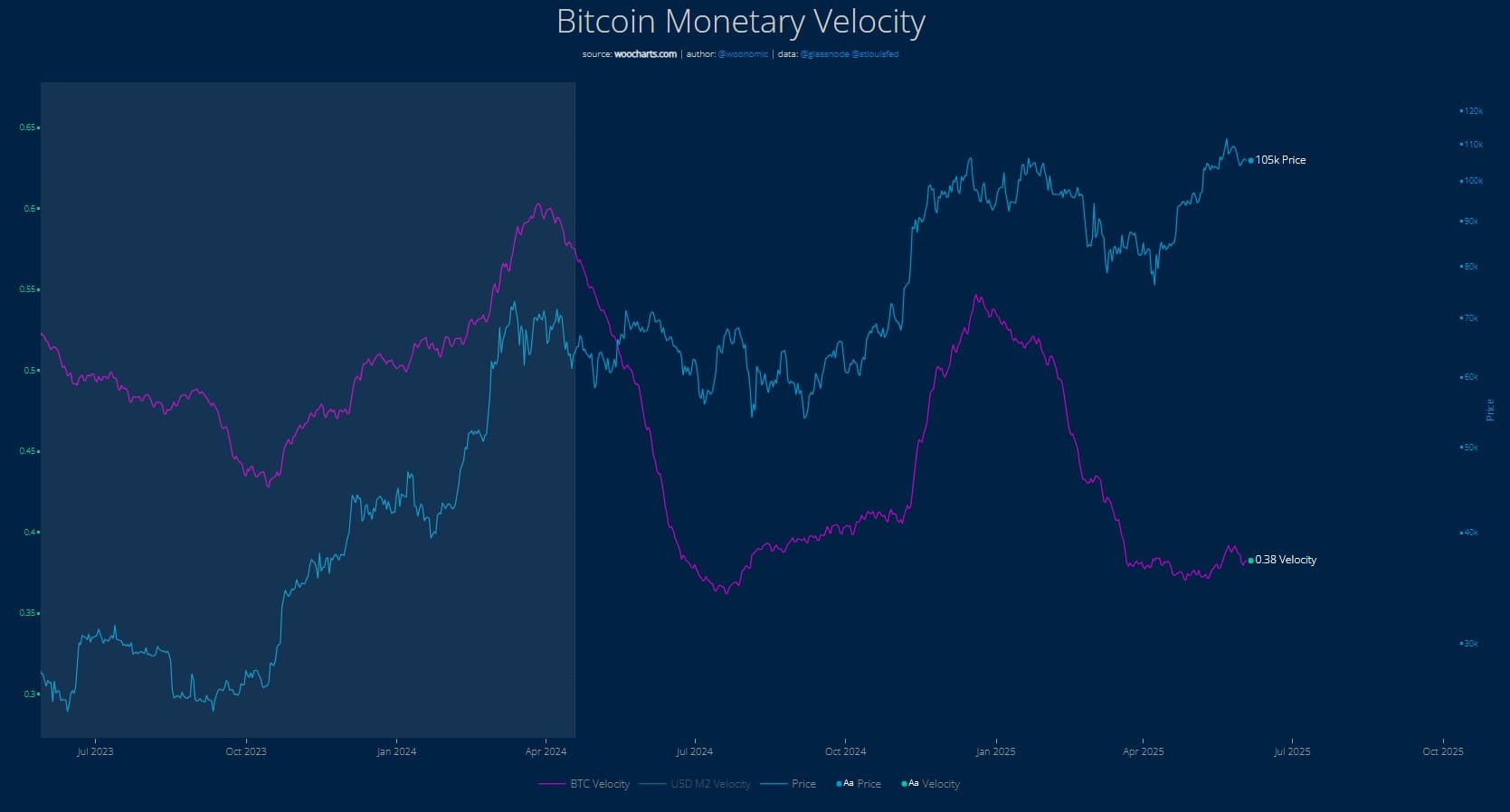

Several metrics help measure bitcoin velocity today:

- Realized Cap Velocity = Total Transaction Volume/Realized Cap

(I think this is what Willy Woo is doing below. You can plainly see this relationship in the past couple of years, as price rises realized velocity rises.)

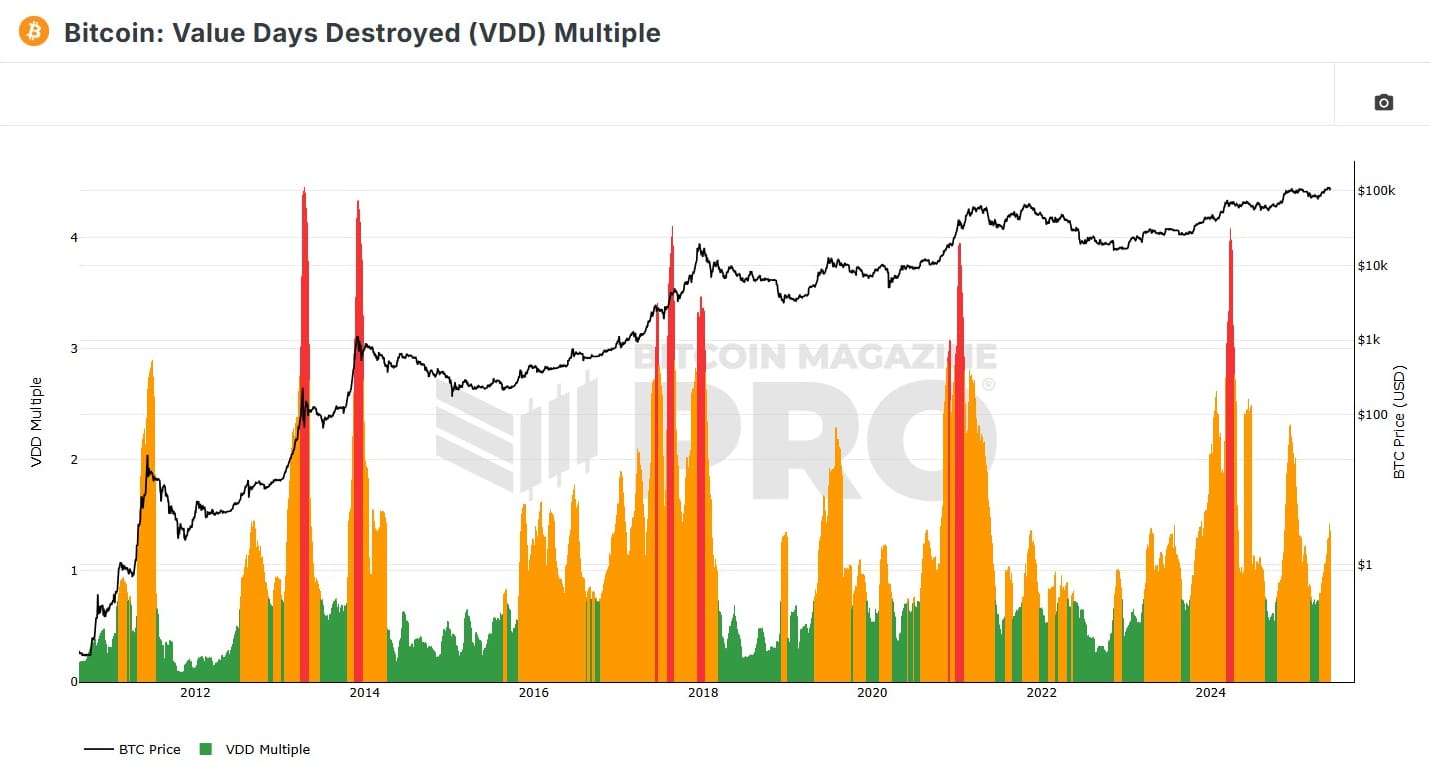

- Coin Days Destroyed (CDD) and Value Days Destroyed (VDD)

(Track movement of long-dormant coins and signal deeper market activity)

A viable way to introduce elasticity into a bitcoin-based system is through a bi-token model, where bitcoin acts as base money and a secondary token provides transactional flexibility. I'm not saying this is ideal, but it is an idea we should engage with. A bi-token standard mirrors historical bi-metallic gold-silver standards, with the secondary asset expanding in supply to relieve inflationary pressure as bitcoin appreciates. A secondary coin—pegged to bitcoin and governed by credit issuance or algorithmic rules—could absorb this pressure, offering a dynamic, rules-based outlet for monetary expansion without compromising bitcoin’s role as a stable, apolitical store of value.

Conclusion

The key insight from this exploration is that inflation is not inherently artificial or evil. It has always emerged as a natural response to growth, innovation, and rising productivity. For millennia, economies have adapted to inflationary pressures through commodity supply increases, credit expansion, or layered financial systems. Bitcoin, with its fixed supply, breaks this historical pattern and forces us to confront a fundamental question: where will the inflationary impulse go?

Bitcoin’s rigidity is not a flaw—it’s a revolutionary constraint. But constraints create pressure. If bitcoin becomes the monetary foundation of the future, that pressure will need release valves: through velocity, through innovation, and potentially through complementary monetary instruments. A bi-token model is one possible path, echoing past systems while remaining grounded in bitcoin’s core principles.

To build a sustainable future on bitcoin, we must not only defend its properties but also understand the economic forces that shaped the world it seeks to replace.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.