Top 4 Stories of 2025 in Bitcoin

So many things happened in bitcoin in 2025. These are the top 4 narratives and categories of changes we saw this year.

1. Bull/Bear Dissonance: Old Models Die, New Ones Emerge, Confusion Reigns

- The halving cycle, sometimes simplified to a 4-year cycle, was completely and totally invalidated this year. This was the first time the year following the halving was negative. The old 🟢🟢🟢🔴 pattern is gone.

- Adoption fundamentals were amazing this year, with Wall Street embracing bitcoin treasury companies and ETFs, yet price did not reflect this massive adoption. Governments became more friendly, especially the US, but price has been stagnant leading to tough feelings of dissonance.

- Long dormant coins started to move and be sold. The largest single "Satoshi-era" transfer on record, occurred on July 4, 2025, sent to Galaxy Digital and sold off. Many other OG whales sold in the last half of the year. Distribution is a good thing.

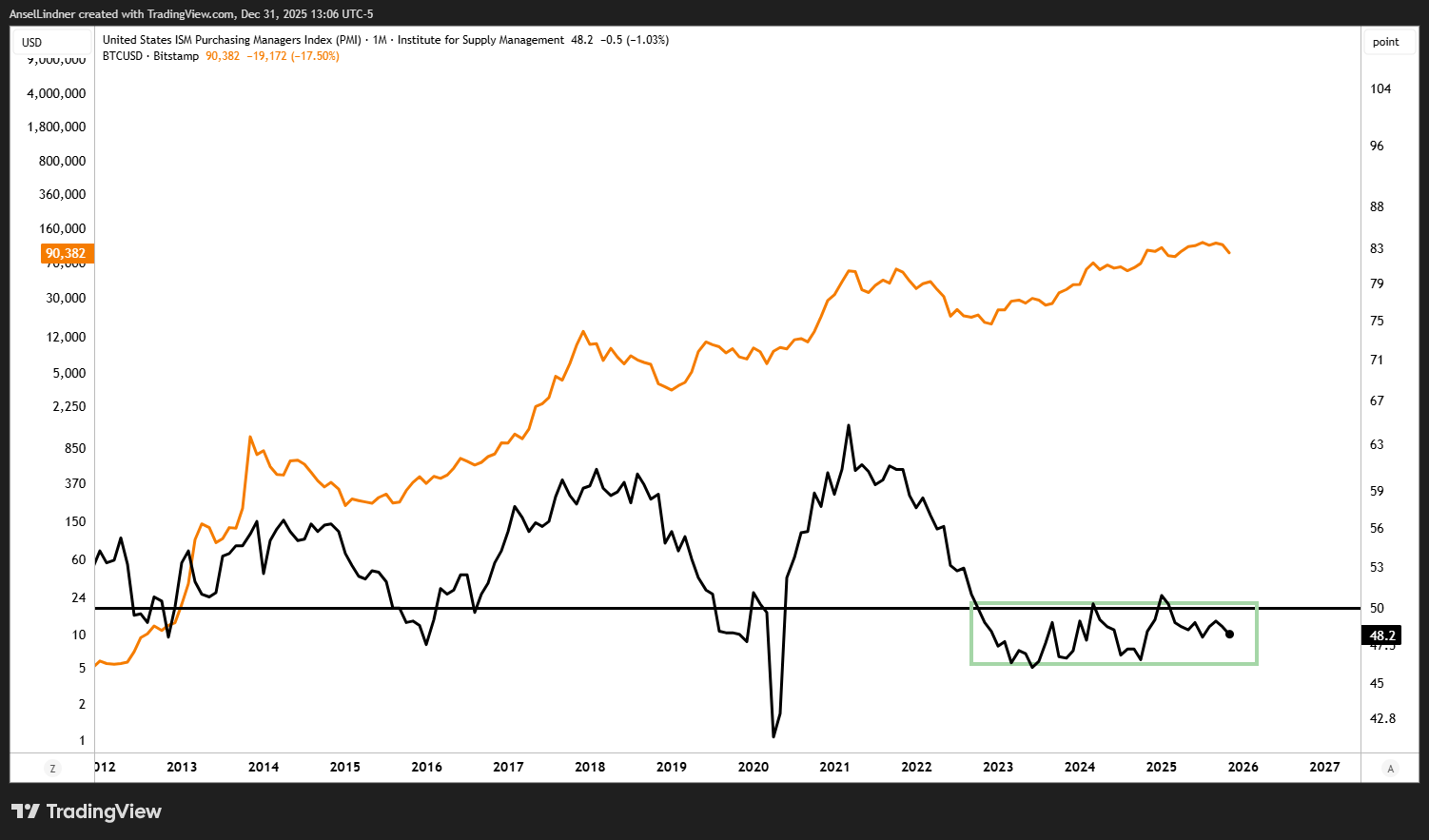

- New theories have sprung up to replace the halving cycle, most notable a simple business cycle theory. This theory claims that bitcoin's cycles have coincided with the ISM PMI cycles, which in turn track the business cycle. Bitcoin has underperformed, because the business cycle has been delayed.

2. Corporate & Treasury Adoption

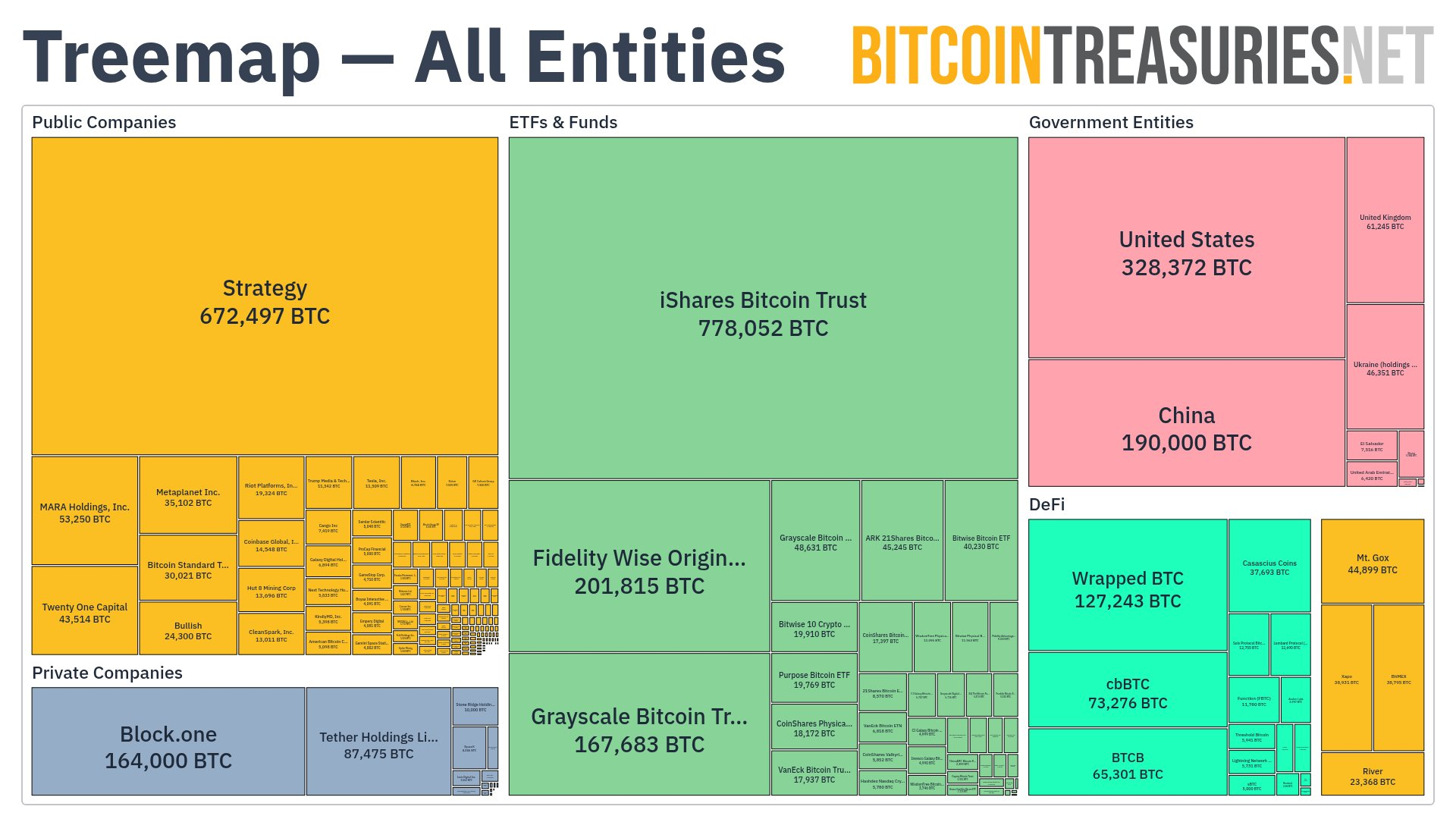

- Explosion of bitcoin treasury companies. BitcoinTreasuries.Net is now tracking 360 entities with bitcoin on their balance sheet, and there's likely many more holding MSTR or IBIT, and private companies they can't track.

We're currently tracking 360 entities, including:

— BitcoinTreasuries.NET (@BTCtreasuries) December 31, 2025

- 211 public companies

- 72 private companies

- 44 ETFs/funds

- 13 government entities

- Wrapped BTC on Ethereum

Note: data is community-sourced and may be inaccurate. Help us by contributing on https://t.co/7lHaYqHtbz! pic.twitter.com/stCTCc6SRH

- The Bitcoin Treasury Company (BTCTC) hype has thoroughly replaced altcoin hype. There was no altcoin season to speak of this year, it's an utter ghost town.

- Two distinct categories of bitcoin treasury companies (BTCTCs) have emerged: financial engineering firms pursuing scale through leverage and equity issuance, and operating businesses stacking bitcoin from profits. The former target returns on bitcoin and bitcoin per share, racing to scale and productize bitcoin exposure. The latter tend to be smaller, profitable companies quietly adding bitcoin to their balance sheet from operating cash flow.

- The first half of 2025 we saw Metaplanet and others break on the scene with high single digit or double digit mNAVs. They were able to aggressively raise money and stack bitcoin. As the year dragged on and price did not behave as expected, this bull market turned bear, and mNAVs dropped, many ended up below 1, meaning their market cap for their stock was below the value of the bitcoin they held.

- Jurisdictional arbitrage was a recurring theme throughout the year. Metaplanet became the first major bitcoin treasury company outside the United States, leveraging its location in Japan to uniquely access local capital markets. The idea spread with the launch of Nakamoto, a rebrand of the UTXO Fund, which aimed to replicate this model by spinning up multiple bitcoin treasury companies across different jurisdictions. While the approach saw early success with Metaplanet, the strategy faltered once Nakamoto went public, with the stock falling roughly 99% and the effort effectively collapsing.

- As the dust settled on the wave of bitcoin treasury company launches, two clear winners emerged: Strategy (MSTR) and the iShares Bitcoin Trust (IBIT). Their leads expanded in 2025 rather than narrowing. It is now clear that no treasury company can realistically catch MSTR absent some drastic internal event. Michael Saylor has built a monster. The estimated size of the broader MSTR ecosystem now reaches into the hundreds of billions of dollars.

- IBIT’s options market also matured significantly over the year, rivaling bitcoin-native options venues like Deribit in both size and volume. It is likely ending the year as the largest bitcoin options product in the world.

- MSTR innovated by launching preferred share offerings under new tickers, each with distinct properties. These instruments strip out portions of bitcoin’s volatility to offer investors differentiated exposure. This has become the gold standard in bitcoin financial engineering in 2025. Importantly, it reduces the need for companies to issue common stock via at-the-market offerings to acquire bitcoin. Instead, firms can issue preferred shares, purchase bitcoin, and offer investors perpetual interest payments.

- By the end of 2025, nearly all major wealth managers had moved from resistance to accommodation, allowing clients to gain exposure to bitcoin through approved products. What had once been a career-risk asset for advisors became a permissible, and in some cases expected, allocation. Vanguard was the last major holdout, and its eventual capitulation marked the end of institutional resistance.

- Banks bent the knee. Throughout 2025, major banks shifted from skepticism to participation, rolling out structured products and notes tied to bitcoin. JPMorgan had long been one of the most vocal institutional skeptics and the last major holdout, but even it crossed the line by offering a bitcoin-linked note to clients.

3. Governments

- The United States formally created a Strategic Bitcoin Reserve using bitcoin already in its possession. The President directed agencies to pursue budget-neutral methods for accumulating additional bitcoin, a mandate that has so far been met primarily through seizures rather than open-market purchases. A major bust of a Southeast Asian crime ring alone yielded roughly 100,000 BTC, which was added to the reserve. Other accumulation strategies have been discussed but not implemented, with further action largely waiting on additional legislation. One idea floated publicly was to revalue U.S. gold holdings from the official $42 per ounce to market prices, then sell a portion of that gold to acquire bitcoin.

- The passage of the GENIUS Act provided long-sought regulatory clarity around digital assets, custody, and market structure. The legislation focused on integrating both bitcoin and stablecoins into existing financial and legal frameworks, removing a major source of institutional uncertainty.

- After years of informal pressure on banks and financial intermediaries, Operation Chokepoint 2.0 quietly died in 2025. Access to banking services for bitcoin businesses normalized.

- Federal Reserve independence also weakened over the course of the year. Fiscal priorities increasingly dominated monetary policy, with Treasury influence becoming more explicit and reinforcing the perception that monetary policy is deeply political. Chair Powell drew the Federal Reserve directly into political controversy by citing tariff impacts in monetary policy decisions and by refusing a presidential order to remove Governor Lisa Cook from the Board. Cook was dismissed for cause under the statute, but contested the action on independence grounds. The dispute is now before the Supreme Court.

- Luxembourg’s central bank purchasing bitcoin was symbolically important, even if modest in scale. It demonstrated that bitcoin ownership has begun to extend into official reserve management.

4. Miscellaneous

- Stablecoins are increasingly viewed as a strategically important component of U.S. geopolitical strategy. There is very little global demand for stablecoins denominated in other currencies; roughly 99% of all stablecoin value is tied to the U.S. dollar. This aligns neatly with the rejuvenation of the Monroe Doctrine as outlined in the White House’s updated strategy document.

- Bitcoin miners diversified into AI data centers throughout the year. Given that their core competency is large-scale data center management, the move is logical. Several bitcoin miners, such as IREN, posted outsized gains on the year (around 300%) even as bitcoin’s price stagnated. Whether this diversification proves sustainable once the AI bubble eventually deflates remains an open question.

- Bitcoin and AI were discussed together far more frequently in 2025, often framed as parallel technologies reshaping capital allocation, energy markets, and infrastructure investment. If AI is truly going to be revolutionary, it will require a native, neutral value system. In that sense, bitcoin and AI are a natural fit.

- Several long-running FUD narratives faded entirely over the course of the year. Energy and environmental criticisms largely disappeared as mining became more closely associated with grid stabilization, stranded energy, and industrial optimization. Likewise, the persistent claim that governments would simply ban bitcoin lost credibility as states moved toward regulation, integration, and even ownership.

- As Tether and environmental FUD receded, MSTR-focused FUD moved to the forefront. The primary criticism centers on claims of a “Ponzi-like” structure. In reality, most critics simply misunderstand what MSTR is doing and usually don't know what a Ponzi scheme actually is. A Ponzi requires opacity, the absence of a real business or product, and the direct use of new investor capital to pay promised returns to earlier participants. MSTR fits none of those criteria.

Your support is crucial in helping us grow and spread my unique message. Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Hold strong and have a great day,

Ansel

- Were you forwarded this post? subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice.