Fundamentals Report #96

July 03, 2020 | Issue #96 | Block 637,546 | Disclaimer

The Bitcoin Dictionary is LIVE on Amazon!

Vital Bitcoin Stats

Weekly price: $9073 (-$83, -1%)

Mayer Multiple: 1.083

Est. Difficulty Adjustment: +5% in 10d

Prev Adj: +0.00

Sats/$1 USD: 11.021

1 finney: $0.91

MARKET COMMENTARY

As expected, we had another uneventful week, even with all the craziness going on in the world. These are truly the times that test bulls as bears seem to win every small advance in the price. However, fundamentals have not changed, they’ve actually slightly improved.

Bitcoin has seen several new fundamental drivers, like US-based mining giants and supply restrictions from the halving causing dislocations in the market and forcing price up. These are not immediate pump-able things, they take 6-12 months to show up in the price, A long term stable price is a tell-tale sign of accumulation and eventual higher prices.

Don’t be distracted by a quick sell off. We could see the price fake out to lower prices. Buy the dips. If you’re a trader set trading bids around moving averages with stoplosses just below.

Other than that, take this slow time in bitcoin to become versed in other related topics. I’m learning about China, their economy, and why they are in more trouble than the US.

Inflation is a common troupe by bitcoiners, and we have put ourselves on the line calling for deflation. Bitcoin will gets it’s next bost from people seeking growth internationally. As the dollar system grinds down to zero growth and high debt, bitcoin will provide that escape for people seeking high growth and sound money.

OTHER TOP STORIES

Bitcoin data not protected by 4th Amendment, appeals court rules

The court’s opinion is data on the Bitcoin block chain is not private, treating on chain data differently than bank accounts. It’s not surprising and doesn’t rule on techniques of avoiding detection like passwords or mixing. This will be an interesting precedent when governments, central banks, or large corrupt multinationals are using bitcoin.

Bank of Japan Will Begin Experimenting With a Digital Yen

The CBDC parade continues. Japan is now aiming at their own digital Yen. This space is the future competition for bitcoin.

There Are More DAI on Compound Now Than There Are DAI in the World

More leverage while the price is flat on altcoins is a very dangerous place to be. Watch out as pseudo-finance apps leverage up with fractional reserve.

PRICE

Weekly BMI | 1 : Slightly bullish

In 2019, during the big run up, we were bearish, calling for a significant retest of breakout levels around $4k. It took a long time, but the retest finally came this year, touching $4200. By then, we were onto the next market move, ready to pivot to a bullish scenario. In March, we finally flipped expecting April and May to be a great months, which they were.

After the halving in May, the expectation in this letter was for a long-term consolidation prior to any deflationary spiral from the halving itself. The latter half of May and June became that period, and it seems to be stretching into July. However, July and August are all set to be bullish for bitcoin. Slow and steady accumulation will replace the slow selling in May and June.

Over the last week or two, several altcoins have outperformed bitcoin, but stay away. It’s impossible to call tops and bottoms in these illiquid coins unless you are babysitting your coins 24/7. If you miss the top, you may suffer more than 50% draw down. If you are trying to accumulate bitcoin for the coming rally, just buy and hold, or go long bitcoin on the dips.

Price is showing extreme resilience and low volatility. It is increasingly being seen as a viable asset class for diversification from big money. Demand will continue to grow. In the near term, we could still see a sell off to touch oversold, but it will be a great buy-the-dip opportunity.

MINING

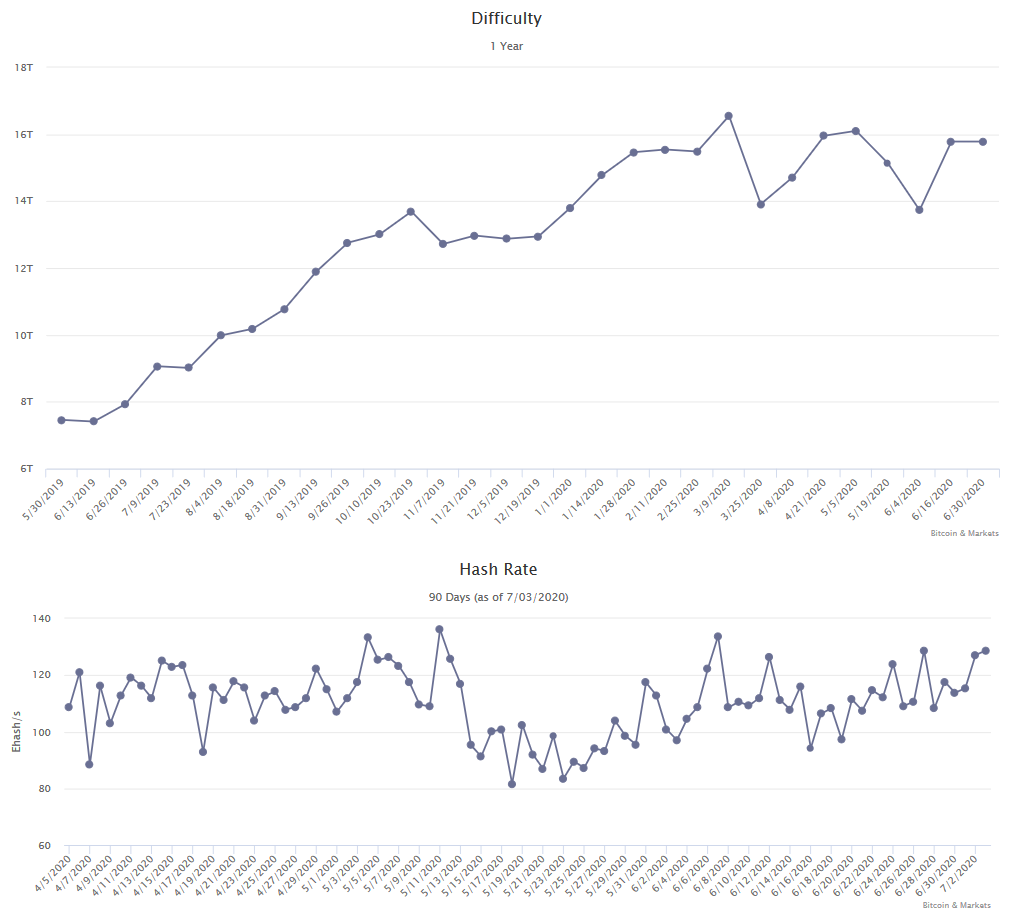

Difficulty is giving a great signal for equillibrium at this point. The most recent adjustment was 0.0% and currently hash rate is trending toward a 3% increase in difficulty 9 days from now. This is a typical increase. Since bitcoin mining is still very new to the large money investments, the typical month on month increase should be around 1-2%. A 3% increase is slightly higher and signals reserved bullishness from the capital expenditure side of the market.

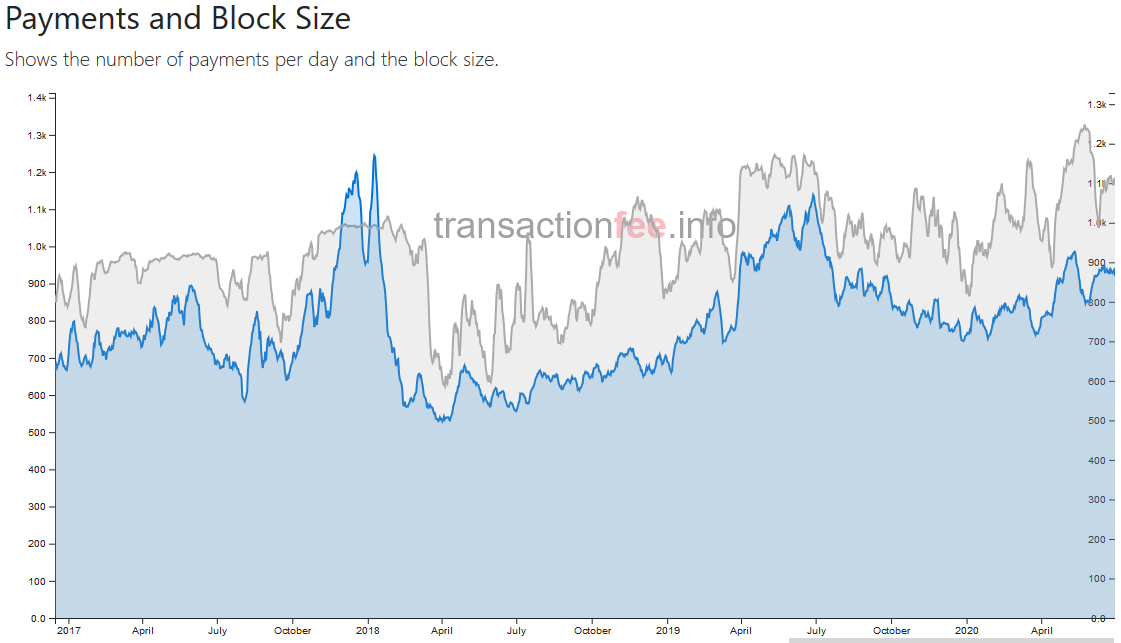

On the payments block size chart below, we can see the number of payments on chain. Remember, bitcoin is limited on the number of on chain decentralized payments it can make, because if you were to push the technical limits, the network requirements would grow too fast and keep many people from running a node. Low through put as to the number of transactions keeps bitcoin censorship resistant. Of course, there’s no limit when it comes to the value through put. In the last 24 hours, over 1 million bitcoins were sent over the network, which equates to $9 billion.

STABLECOINS

Tether Dominance : 10.47% (-0.1%) First weekly decline in 2 months.

There is a lot of drama happening in the psuedo-finance space (known as DeFi). We linked to the big story above in the OTHER TOP STORIES section and I’ll write about it in the next member newsletter, but suffice it to say here, the altcoin universe is using psuedo-finance to leverage up on their altcoins. Considering we think that altcoins will not have another day in the sun, this is an extremely dangerous developement.

As we mentioned in previous content, the huge premium on Gray Scale ethereum, the parasite Tether taking over their network, and the growing systemic risk in their finance apps, makes for a big ethereum fireworks waiting to be set off.

MISCELLANEOUS

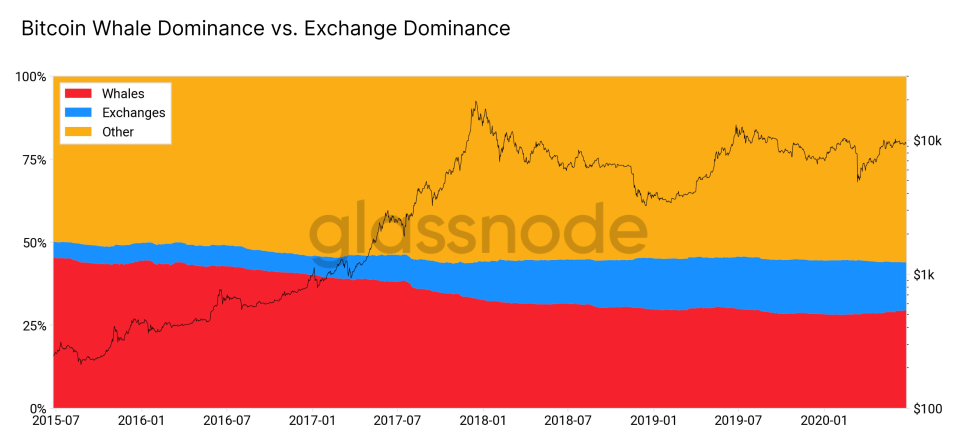

Here’s a fun chart from twitter user @liesleichholz showing the Whale vs Exchange “Dominance” since 2015. The Other category has held roughly 50% of the coins over that time while it appears whale’s coins have gone into the exchanges. Whale coins also get used toward capital expenditure of mining, a big difference between bitcoin and alternatives, where ownership is consolidated. Bitcoin ownership gets spread out due to Proof-of-work.

Demystify Bitcoin Jargon. Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages.

Over 180 Bitcoin related terms, concepts, and idioms.

This work exposes the reader to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Send feedback and/or take our quick survey!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See