Fundamentals Report #89

May 15, 2020 | Issue #89 | Block 630,495 | Disclaimer

May 15, 2020 | Issue #89 | Block 630,495 | Disclaimer

The Bitcoin Dictionary is LIVE on Amazon!

Vital Stats

Price: $9479

Market Cap: $174 billion

Mayer Multiple: 1.176

Est. Difficulty Adjustment: -1.3% in 3 Days

Prev Adj: +0.9%

Weekly price H/L: $9970 / $8160

Sats/$1 USD: 10,550

Market Commentary

A Short Story

Bitcoin hodling ain't easy. After studying a little, you overcome your initial skepticism and buy your first bitcoin. You're super excited, it's going to moon! However, very soon after you discover bitcoin has a mind of its own. 20% up days are euphoric, but the 20% down days make you pull your hair out. It will attempt to buck you off this ride any way it can.

Let's face it, you probably bought in a hype cycle of some sort, because that's the most likely time for it to come across people's radar. But that hype cycle quickly ends. It will go down in dollar terms from your initial purchase. You'll check the chart everyday hoping you didn't just make a big mistake.

Bitcoin will take its time, remaining stubbornly slow to moon. You read the industry rags, like Coindesk, tell you how altcoins, blockchain, defi, ICO, governance, and so forth (basically all their advertisers), are picking up speed, while bitcoin is "just a store-of-value". The sweet siren song of the altcoins is too hard to resist. Their marketing is fine-tuned to give you FOMO and second guess your bitcoin-only investment. We've all been there.

Eventually, you give in and buy a few ETH, Chainlink and shitcoin X; then some more. Before you know it, you are 80% in shitcoins.

You're feeling smart and diversified. You might even try to teach some bitcoin-only OG's on Twitter about these altcoins that are going to revolutionize supply chains and finance. Just when you thought you had it figured out, though, bitcoin starts to rally, and your shitcoin bags miss a milestone in their development.

You go to Reddit and Twitter asking why? Why hasn't the project launched phase 2? Why haven't users arrived? Can't everyone see the revolution that shitcoin X or platform Y is starting here?

Before you know it, your altcoin bags are down 80% against bitcoin, you wasted a year of your life and most of your initial investment. Nothing comes to fruition. You sell all your coins.

This could have been all avoided, if you would have stuck to the plan, but Bitcoin hodling ain't easy.

Top Stories

Binance Launches Options

This is older news from April, but Binance has launched their options platform to compete with Houbi and Deribit. The choices available and total liquidity in the bitcoin market is increasing dramatically.

FTX Launches Bitcoin Hashrate Futures

An interesting product that will give a longer term glimpse into sentiment and longer outlook of the market. Very cool.

Single-collateral DAI Shutdown Using Emergency Measures

This was a planned shutdown of Single-collateral DAI (SAI) as people have migrated to Multi-collateral DAI. I'll repeat, planned shutdown. It's a blatant example of the centralization of this supposedly decentralized DAO. This recent shutdown vote involved 18 (!) participants and 43,000 MKR tokens (out of 1,000,000 ! ).

Statistics for previous executive votes are seemingly impossible to find. We spent 1 hour this morning looking for them, finding no official records, only mentions and broken links in articles from the time. The original multi-collateral DAI (MCD) required only 41,000 MKR to approve it. From articles at the time, barely over 500 active MKR addresses during the MCD vote and one whale provided 34% of the necessary votes.

4% of MKR tokens control the whole system and can vote to shutdown the the app.

Price

Weekly BMI | -1 : Slightly bearish

This is a precarious point on the chart. Price is pressing into resistance without taking time for a significant consolidation. IF $9000 holds over the next week, chances are the rally continues. Several indicators are bullish, with some of our favorite like the Ichimoku Cloud and moving average crosses are very bullish.

However, we giving the edge to a slightly bearish outlook over the next 7 days. If price breaks below $9000, we could test the recent lows at $8000, and take our time breaking above the diagonal trend line from the ATH.

Don't buy at resistance, buy breakouts.

Become a paid member to access our full technical analysis and member newsletter.

Mining / Trends

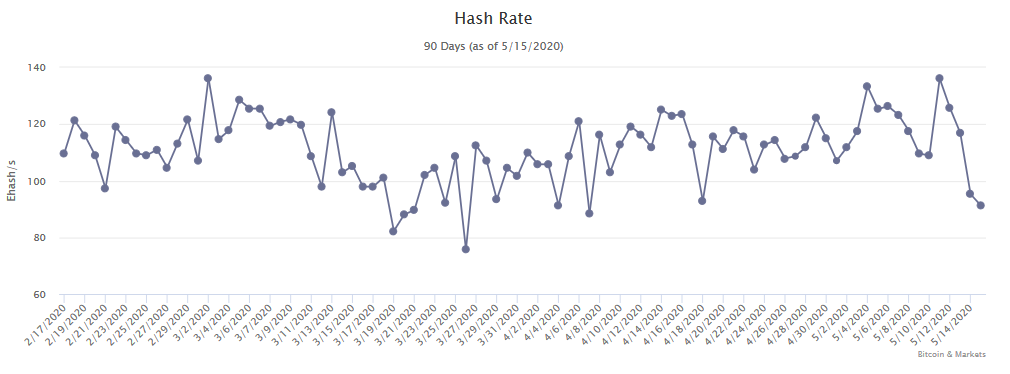

Let's take a look at what the hash rate has done since the halving. We would expect that with the reward cut in half, we would see the hash rate go down, and that's exactly what we see. It peaked on the day of the halving at 136 Eh/s and has since dropped by 33%.

The next difficulty adjustment is coming up in 3 days and currently estimated to be only a -1% adjustment, but we expect that to get more negative to roughly -2% to -4%.

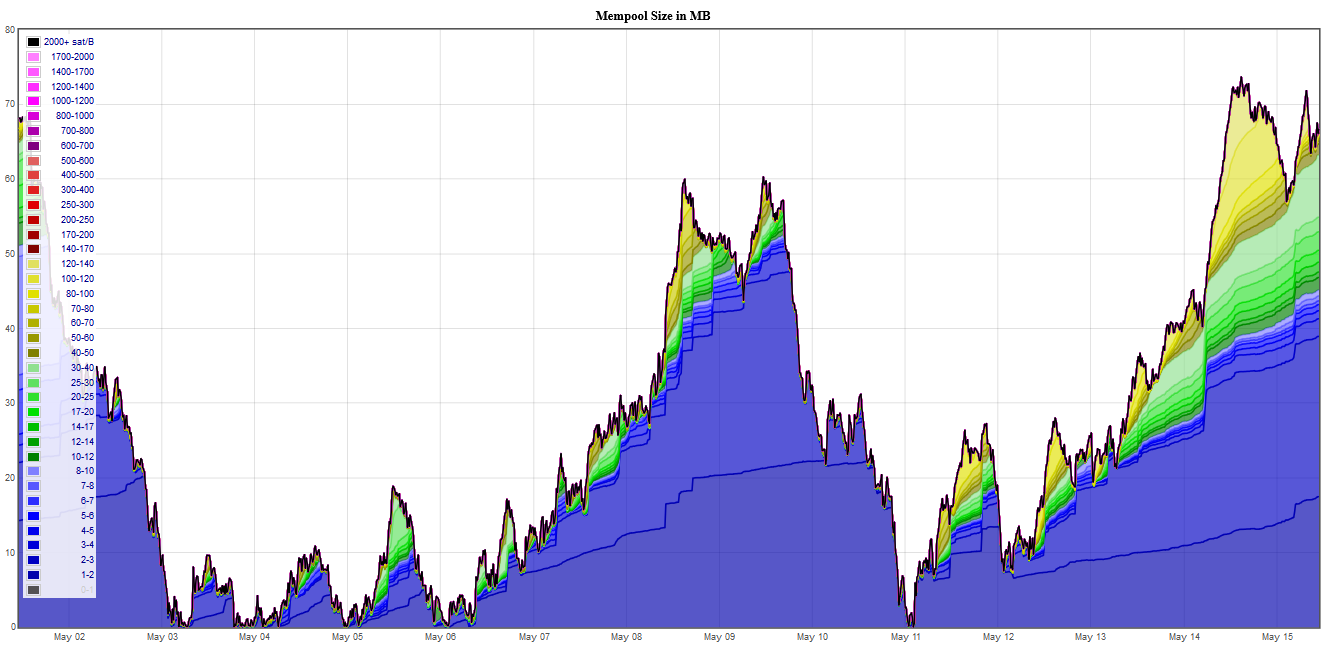

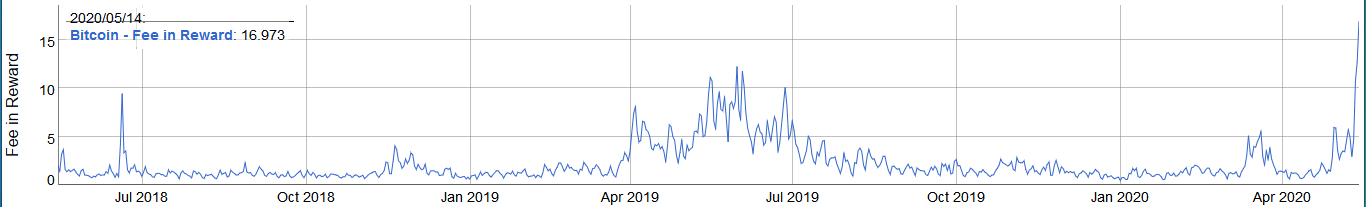

The slowing of hash rate also has an effect on the mempool. As blocks slow down, transactions build up. The counterbalance to this is increasing fees (second chart below). Over the last 24 hours, fees have averaged 1.31 btc/blk, or 20% of the subsidy. That's a great development and is proving out in real-time that fees can and do replace revenue from a decrease in the subsidy.

Stablecoins & Altcoins

The so-called Bitcoin Dominance Index is looking ready to breakout. That can happen as the bitcoin price goes up or down. If bitcoin falls 10% back to $8000, ETH and others will likely drop 15%+. We tend to lean toward that scenario versus bitcoin pulling away as it goes up, which won't happen until mid-way through the bull market.

Interestingly, the last time the Bitcoin Dominance broke out of its consolidation was last May. Will we see a replay?

Miscellaneous

Wow! This is the latest from Google Trends. As you can see, we compared "halving" to "buy bitcoin", and the recent attention the halving received is set to surpass even the height of the the mania around the ATH in Dec 2017.

GET THE BITCOIN DICTIONARY

Demystify Bitcoin Jargon

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

LIVE on Amazon!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See

Read next

Bitcoin Fundamentals Report #297

Bitcoin Fundamentals Report #295