Fundamentals Report #78 - 2/28/2020

Block 619,423 - Est. Days Until Halving: 73

Vital Stats

Block 619,423

Est. Days Until Halving: 73

Mayer Multiple: 0.988

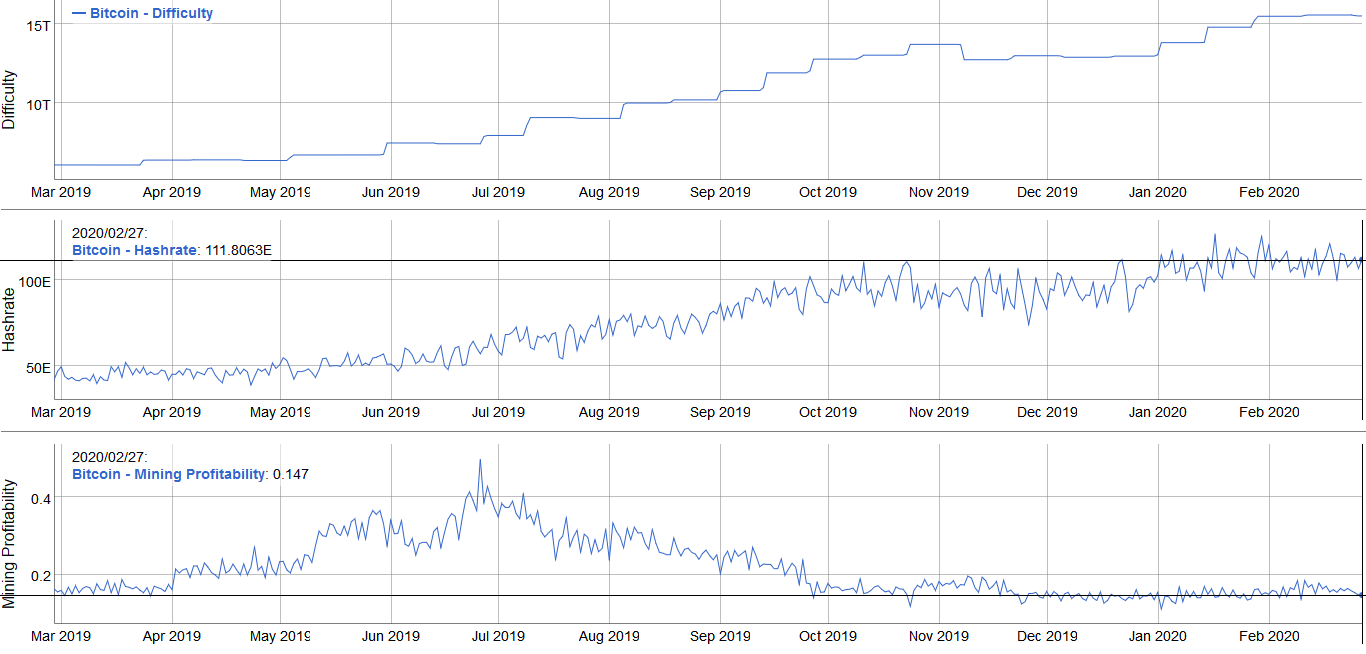

Est. Difficulty Adjustment: +1.0% in 13 days

Prev Adj: -0.4%

Weekly price H/L: $10,045/$8,436

Sats/$1 USD: 11,578

Disclaimer

MARKET COMMENTARY

We are living through historic times. As bitcoiners, we’ve realized this for years, but it’s surreal to watch it unfold. Bitcoin is the first great advance in money in 2000 years, and it’s caught on so quickly because the current financial system is fragile and threatens the fabric of our society.

The world’s economy is built on a decomposing capital structure, a witch’s brew of fiat debt and credit expansion, just in time inventory management, regulatory control, and corruption. The SARS 2 coronavirus, which is also a product of this mutant global order, has not only infected humans, it’s now infected our financial system. Like pre-existing conditions make death from this virus much more likely (co-morbidity), our financial system was already sick and dying slowly and it gets hit with this. Sell everything in rallies except bitcoin, gold, and dollars.

This coronavirus, which I spoke about first in episode 197 on 24 Jan, is the spark of a financial crisis. It cannot be stopped. Last week, despite 10% of the world’s population being in lock down, the virus exploded to all inhabited continents, blowing up in South Korea, Japan, Iran, countries across Europe and likely in the US. Government sycophants suffering from status quo delusion have had a hard time assimilating the scope of this disaster. Their calling card is, “no worse than the flu.” They have put you in danger.

Now is the time to have a clear head. Look at the physical evidence, don’t believe government propaganda. Get some basic necessities like food and hygiene items today, be prepared to stay inside for a couple of weeks. It’s almost too late. Images from Northern Italy, and today from New Zealand, show what will happen in the US. Empty shelves and a mad scramble to get supplies. Assume anything made in China won’t be restocked for 6 months.

Since you are reading this, you’ve smartly invested in Bitcoin. But your bitcoin investment won’t help you over the next few months (it might actually go down, more below). Be prepared, avoid crowds, do not believe the government, get plenty of rest.

TOP BITCOIN STORIES

Ethereum Community Comes Out Against ProgPow

Yet another controversial hard fork the Ethereum Foundation and Consensys are ramming down the throats of innocent Ethereans. The only way this could go through is with an iron fist.

ProgPow: Is DeFi in danger if controversial Ethereum upgrade passes?

Ethereans worry that ProgPow could jepardize the DeFi dreams. There is a feeling of false dilemma in this upgrade, almost as if they are setting up a scenario where the “community” can stand up against the Foundation to prove decentralization where none exists. What will Infura do?

Coronavirus stalls crucial South Korean crypto legislation

As predicted, the virus is pushing regulation to the back burner and we will very likely see talk around CBDC’s get delayed. CBDC’s might be included in discussions of a new financial order. Bullish for Bitcoin!

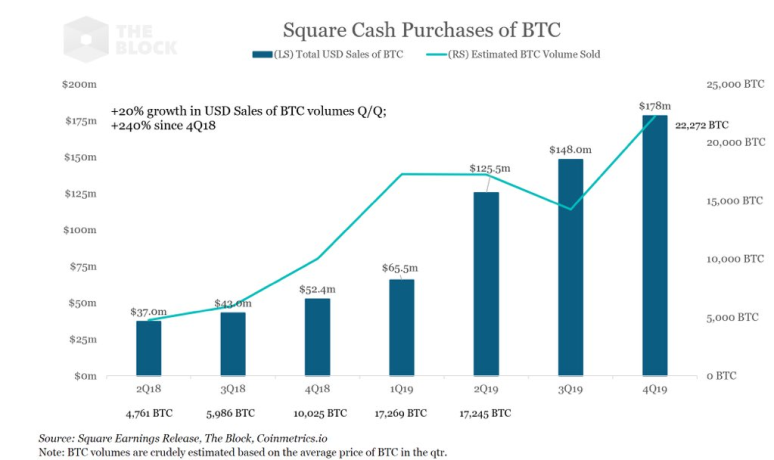

Cash App purchases continue to climb! Great time to stack sats.

PRICE

Weekly BMI | 0 : Neutral

What a wild few days. As predicted, bitcoin sold off with stocks, and is taking a beating in the initial states of the financial crisis. Nothing drops in a straight line, including the garbage stock market bubble. This is a dangerous place to trade, because there will be a bounce at some point, that could retrace 50% of the drop so far in stocks.

Bitcoin will bounce, too, but unlike stocks, Bitcoin won’t fall nearly as hard. There is no fundamental reason to be selling bitcoin, other than to get access to cash. If there is a banking holiday in the US to halt the collapse of the markets, it will add negative price pressure to bitcoin, because people will sell for cash.

Despite that negative selling pressure, the reason bitcoin will remain much more resilient than other assets at this time, is because money will be trying to get into bitcoin as a safe haven. There will be a significant tug-of-war developing as some investors sell for cash, while other buys for safe haven. As the next couple of months proceed toward the halving, the buyers will win, and the price will moon.

For more price analysis along with tons of charts, subscribe to the Member Newsletter on Patreon.

LIGHTNING / MINING

Esher joins Zap’s Strike in offering dollar to lightning payments. These apps allow you to link your bank account but scan and pay a lightning invoice. In the background, the company is paying the invoice and you are paying them. It’s very convenient. Some worries I have about this are the obvious centralization pressure this puts on the network. These companies will effectively be large hubs. This is counterbalanced somewhat by the businesses themselves becoming part of the network, but they might use a similar service. It’s likely dozens of apps like this come out over the next couple of years also providing a competitive pressure toward decentralization.

Mining in China is still chugging along. The most recent difficulty adjustment was only -0.38%, making the difficulty flat over the last month during the CCP Flu lock down.

MACRO

There’s so much going on economically in the world right now. Join our discord for up-to-date conversation and you can also follow my epic thread on the #EconomicContagion due to the coronavirus.

It’s no surprise that the mainstream media and the ruling class are going to try to scapegoat this collapse completely on the virus and as a failure of Trump. We cannot let them do that. The system is built on a fragile foundation on the unholy alliance of money and State. We must separate the power over the money from the State for any hope to build a more stable world. This is only the final straw, the fat-tail, the black swan that has exposed this all as a house of cards. Don’t forget, this virus was almost certainly created by a big government as a vaccine.

Here’s some macro headlines:

60% of U.S. Manufacturers Say Business Has Been Impacted by Coronavirus

China Banks’ Measures Insufficient to Save Millions of Failing Firms

No Financing And No Demand: Chinese Refiners Run Into Trouble

“at least three private refiners have had credit lines to the tune of $600 million suspended by banks including French Natixis, Dutch ING, and Singapore DBS Group Holdings.”

MISCELLANEOUS

Here is an updated stock-to-flow chart courtesy of digitalik.net, a site with a lot of cool charts displaying some of bitcoin’s data. We are approximately 73 days away from the halving where the block reward is reduced from 12.5 to 6.25 per block, and price remains near where the model projects.

A