Fundamentals Report #76 - 2/14/2020

02/14/20 | Issue #76 | Block 617,401 | Disclaimer

Days Until Halving: ~87

Mayer Multiple: 1.168

Est. Difficulty Adjustment: -2% in 10 days

Prev. Difficulty Adjustment: +0.5%

TOP STORIES

Economic Contagion

China was on the brink of a financial crisis before the Wuhan coronavirus forced the lock down of 80% of the Chinese economy. They had a record number of bank failures in 2019, their GDP growth was slowing, and monetary stimulus had lost effectiveness.

China is only the worst off, but they definitely not alone in their financial troubles. The entire global economy has been living on the edge for years. The fiat-based financial order has resulted in the upside-down world of trillions of dollars in negative yielding bonds and unpayable debt. Just in the last week, some analysts are starting to ask if China will cause a global recession. Wake up, it's here.

Right now, the plan from the PBoC and other central banks is to continue to flood the world in liquidity. They will return to their old tricks, but this time is different.

This time the supply chains are severed, production halted, the economy is standing still. Sure, stimulus can fool the equity markets for a very short period of time in these conditions, but QE, REPOs and direct "loans" to businesses cannot magically create actual goods in the supply chain or actual demand for raw materials. The second and third order effects of this disruption are massive. The Chinese super tanker hasn't just slowed to a stop, it's run aground, damaging the hull and injuring all the crew. How do central bankers plan to refloat the economy? Print baby. What happens when you print money while the economy is stalled? Inflation.

High inflation will soon take hold in China. That might sound good to a central banker, they are all in a race to debase in a pseudo-mercantilism competition. They never expect runaway inflation. This dovetails with my strong dollar thesis. Money will flee emerging markets, China and Europe into US stocks, debt and USD.

(Here is a great place to follow the economic impact of the Wuhan coronavirus.)

Coin Mixing is Money Laundering?

The CEO of Coin Ninja (Dropbit) and operator of custodial Grams-Helix mixing service prior to 2017 has been arrested and bail denied on multiple charges including mixing as an illegal money service business. This case has broad and far reaching consequences for Bitcoin as precedent. I do have a positive spin though - this means that coin mixing works fairly well and the USG hates it.

Regulators

Over the past few days we've seen the financial criminals step up their rhetoric against bitcoin. The game is afoot. They are coming.

- Chairman Powell continues to talk about cryptocurrency

- Secretary Mnuchin said they are "spending a lot of time on this"

- The White House proposes legislation against cryptocurrencies on pg 86 of their budget.

It's not a coincidence that a Commissioner at the SEC is pushing a 3 year grace period for scammy ICOs while they continue to stall a bitcoin ETF, or that other agencies come down hard on bitcoin while shitcoin scams are fined only 0.1% of their raises. This is a coordinated effort to bolster shitcoins that are no threat to the existing system and crackdown on bitcoin itself.

The USG knows a crisis is coming soon and do not want bitcoin to benefit. It's desperate to enforce their sanctions unilaterally and talk tough to scare, what they probably view as, internet money nerds. In the end they will stimulate anti-censorship tech.

L-BTC on Bisq

Liquid Bitcoin (L-BTC), a two-way, 1-to-1 peg with bitcoin, support has been added to the current release of the decentralized exchange Bisq. This is a huge development. All the attention will be on mixing (which is vitally important) but that will give use of confidential transactions on Liquid room to grow. The government is incompetent and slow. They are cracking down on ancient centralized mixers today, when we've already moved on to non-custodial Chaumian coinjoin.

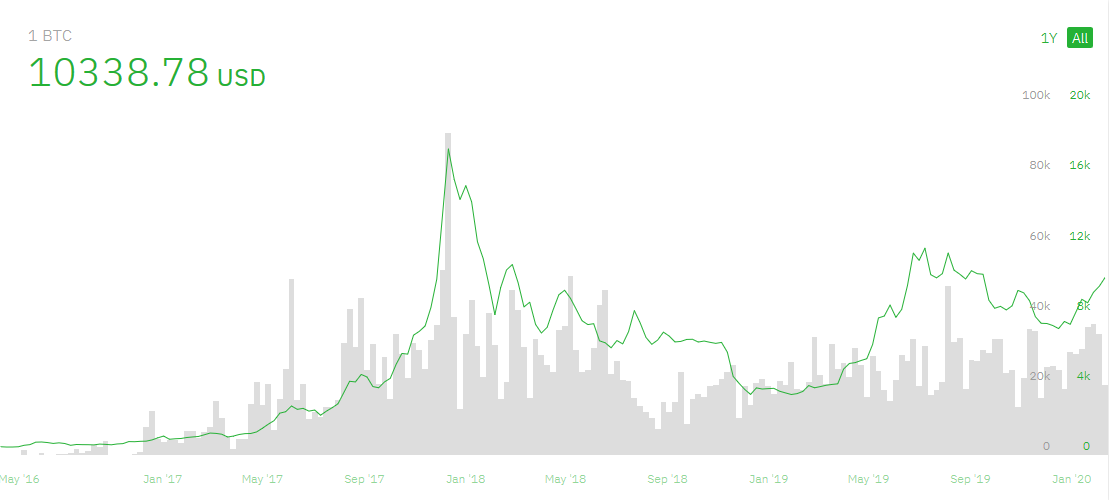

PRICE

Weekly BMI | 1 : Slightly bullish

Short term technical analysis (a few days) is bearish at the moment. The rising wedge might have topped with a bearish divergence on the daily, Stoch flat-ish top turning bearish, volume is only slightly elevated off the floor/declining weekly volume, we have a daily 9 on TD Sequential yesterday and longs are at an ATH. It should be noted that a rising wedge is not a great performing pattern, but this one has many additional factors that make it more likely in the short term. Any correction is not likely to be large and do damage to the chart.

The weekly time frame, is a different story. Price is lining up for a run all the way to $14,000 before a sizeable correction. This aligns with my fundamental analysis of the bitcoin mining situation in China during the virus outbreak, which is in a podcast released on Patreon already and will be coming out in a few days for everyone else.

For more analysis and charts subscribe to the Bitcoin Pulse, our member newsletter that comes out multiple times a week focused on technical and fundamental analysis of price.

TRENDS

Bisq is a decentralized trading client designed to facilitate peer-to-peer trading, kind of like localbitcoins but more censorship resistant. It launched late into the last bull market cycle so didn't benefit from most of the hype. In 2019, Bisq made a bunch of improvements and saw steady volume. Now, with the addition of L-BTC, it's ready to serve an important role in swapping L-BTC and BTC without the Liquid KYC requirements.

MISCELLANEOUS