Bitcoin Fundamentals Report #273

Bitcoin ETF launch exposes incompetent Tradfi, debrief, Macro new including CPI and Taiwan election, price analysis, mining news and more.

January 15, 2024 | Block 825,924

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Approval shock |

| Media sentiment | Very Positive |

| Network traffic | High |

| Mining industry | Spending on new equip |

| Days until Halving | 93 |

| Price Section | |

| Weekly price* | $42,886 (-$4,066, -8.7%) |

| Market cap | $0.840 trillion |

| Satoshis/$1 USD | 2,331 |

| 1 finney (1/10,000 btc) | $4.29 |

| Mining Sector | |

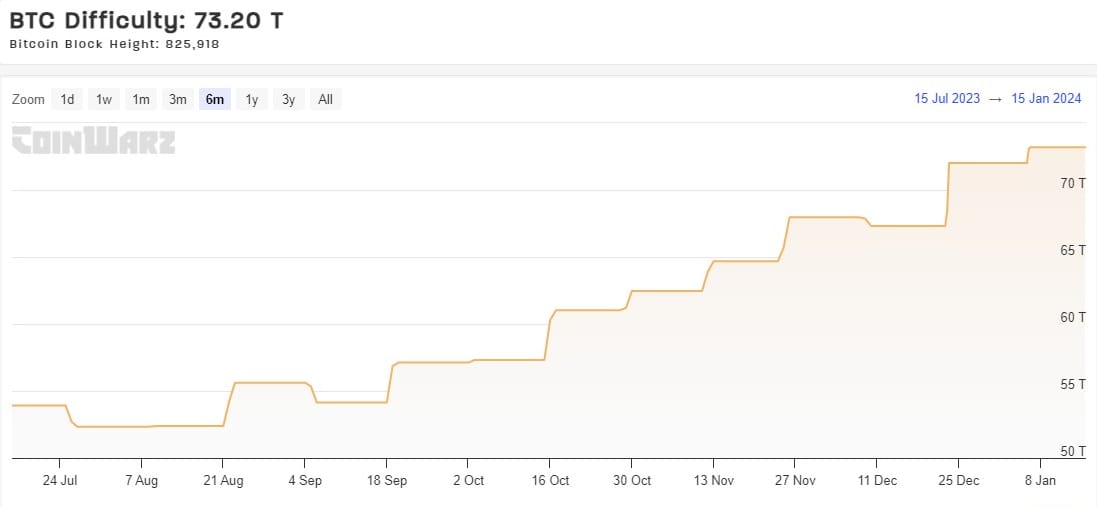

| Previous difficulty adjustment | +1.6547% |

| Next estimated adjustment | -2% in ~4 days |

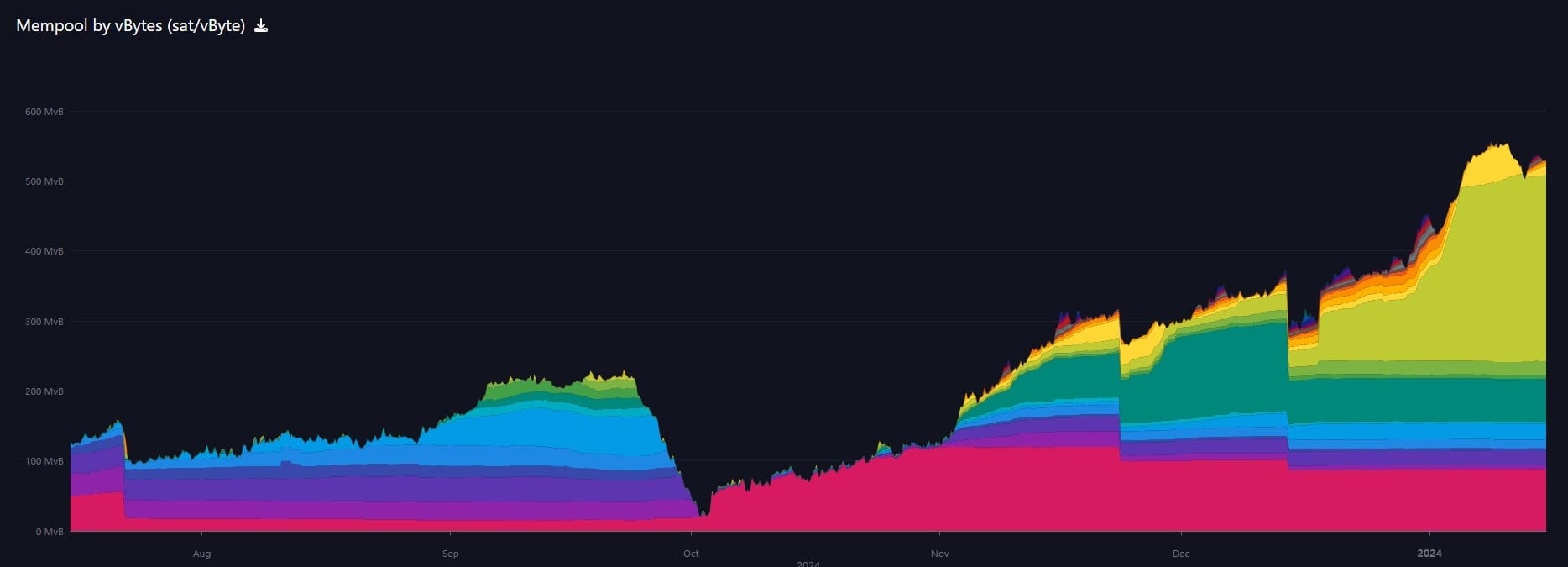

| Mempool | 527 MB |

| Fees for next block (sats/byte) | $3.06 (51 s/vb) |

| Low Priority fee | $2.94 |

| Lightning Network** | |

| Capacity | 4870.92 btc (-3.6%, -183) |

| Channels | 58,271 (-0.9%, -558) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

- $1.4 billion of inflows into ETF in two days

It was a record launch with $4 billion in volume on day one! Inflows steadied on day two. All-in-all it was a great launch, but it was still disappointing. More on that below.

LATEST: With two days in the books, the Nine Newborns have taken in +$1.4b in new cash, overwhelming $GBTC's -$579m of outflows for net total of +$819m. $IBIT now leading pack w/ half a bil, Fidelity close second tho. The newborns' $3.6b in trading volume on 500k indiv trades… pic.twitter.com/b7U5DjENaw

— Eric Balchunas (@EricBalchunas) January 13, 2024

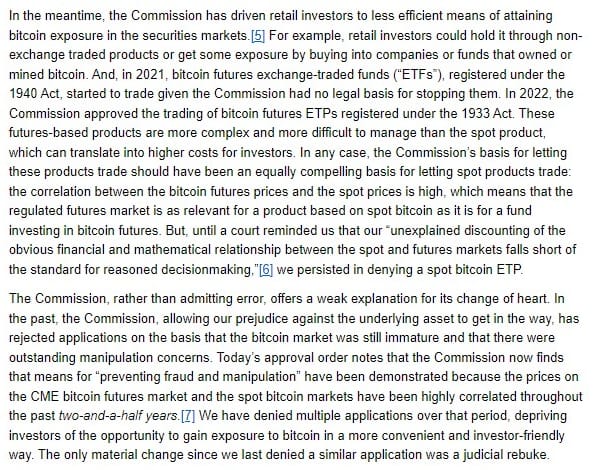

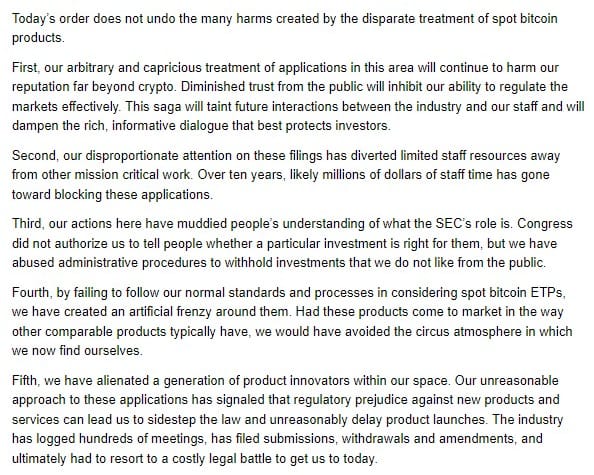

- SEC Commissioner, Hester Peirce, pens scathing statement on Bitcoin ETF approval process

Hester Peirce is a long time friend of bitcoin (and friend of crypto scams, but that's another story). After the approval of the Bitcoin spot ETFs she ripped into the SEC and the approval process.

- Gary Gensler is misunderstood

Gary Gensler is very very unpopular with crypto bro scammers, because he straight up says they are scams and unregistered securities. However, that does not mean bitcoiners should hate him. He has a positive view on bitcoin and Satoshi.

Bitcoin has been positioned against the regulatory State, but it shouldn't be. Yes, bitcoin makes it more expensive and less efficient to run an overweight bureaucracy, but it is an inanimate tool. It is a category error to place bitcoin opposed to something made up of many individuals. Those individuals will adapt to a new reality, one with Bitcoin in it.

That being said, Gary Gensler achieved a herculean task. He got the Bitcoin spot ETFs approved against the wishes of the globalist class in the administration he works for. It turns out he was the deciding vote in a 3-2 approval.

Macro

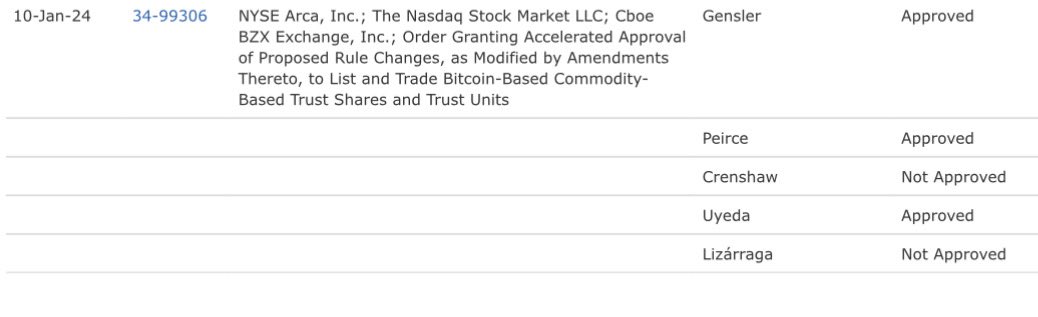

- US CPI a little hotter than expected, but still headed lower

CPI came out last week and it was slightly higher. Of course, this was met by terrible calls for a reacceleration of inflation, and higher for longer. Importantly, Shelter accounted for more than half the increase. If we take Shelter out (which is counted differently all over the world), month-over-month CPI is negative.

"Ansel, you are crazy. Shelter is a very important cost to consumers, you just want to take everything out that doesn't agree with your lower inflation calls."

I'm not concerned not with pointing fingers of blame for past price increases. I am concerned with figuring out where CPI will go in the future. Shelter is not an independent variable here. It does not have a mind of its own. If the rest of the CPI is in contraction, shelter will follow eventually. Also, every jurisdiction counts it differently (even the PCE and CPI measure it differently within the US), some measures are more dynamic and faster to respond.

The CPI Shelter component is dominated by Owner's Equivalent Rent (OER), which might be the slowest way to measure it. Homeowners estimate what it would cost to rent their home relative to last month. That, in turn, is influenced by rents affordability of a new mortgage. So, first rents have to fall - which they are - and mortgage rates have to fall, then owners have to notice that and adjust their OER estimates. It's a slow moving beast.

- Great video that is in line with how I see the financial system and the Federal Reserve

This video was forwarded to me by someone who thought it matched my outlook on markets. Ritik Goyal makes a compelling argument against the centrality of the Fed from a whole different angle, but he ends up in the same place as me.

IDK the policy prescriptions he has for the Fed, he might be an MMT'er, because he leaves the door open to changing the Fed's policy to actually work. That does not fit my interpretation. He also does not connect the dots to the FORM OF THE MONEY being credit-based (maybe because he's an MMT'er again). The form of the money allowed this system to evolve the way it has and now it will inevitably go back the other way to commodity money.

William Lai Ching-te from the governing Democratic Progressive Party (DPP) has emerged victorious in Saturday's historic Taiwan presidential election, and Beijing is not happy, having immediately issued a rebuke after having urged the populace not the vote for him, saying the outcome "will not impede the inevitable trend of China’s reunification."

Beijing further claimed that DPP doesn't represent the mainstream public opinion on the island, despite that Lai, who serves as the current vice president, has just taken over 40% of votes cast - according to partial early results - in the three-way race with Hou Yu-ih from the conservative Kuomintang (KMT) and former Taipei Mayor Ko Wen-je from the Taiwan People’s Party (TPP). It was comfortable victory and resounding message to China.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

We are two trading days into the bitcoin spot ETFs and we don't have transparent data. That is the big takeaway for me of the last week. Stark difference between modern bitcoin and modern bitcoin exchanges and Tradfi. I wrote about this situation extensively on today's Proton. Professional tier members can check that out.

It will likely take another week or two to get the internal processes of the ETFs smoothed out and the buying pressure to be represented in price.

As for being priced in, I have a few words about that. There is confusion over exactly what is priced in. A 95% chance of approval and 5% chance of rejection can be priced in. Estimates of flows can be priced in along with the 95% confidence level. Estimates of GBTC selling vs other ETF buying can be priced. Notice these are all estimates based on a confidence level.

What can't be priced in is the short or long term effects on market dynamics, portfolio construction, supply/demand dynamics etc. Those are just the known unknowns. There are also the unknown unknowns. Those cannot be priced in. All that said, I'll concede that a 95% for approval was priced in, but the after effects are still not.

To the chart... price performance was disappointing after the ETF launch, but we are hodlers, this is a dip for ants. We've been forged in the fire of 20% dips. There was some damage done to the daily chart with MACD crossing bearish and RSI resetting to the mid-line. Price also crossed below the 50-day moving average which signals near-term bearishness. However, horizontal support at $40k did hold so far, and oscillators need to be bearish to cross back bullish.

Things to consider in over the next week, 1) GBTC outflows should not be considered NET selling. They are likely rolling over to lower fee ETFs. 2) The premium on CME futures has also closed completely. Some analysts were saying that people were playing the approval by going long futures, and now they have to unwind those positions. When we look back in bitcoin bull market history, when the CME futures dips below spot, it typically happens before the next leg of the rally. 3) The constant buying pressure from the ETFs over the next month will eventually tip the scales radically bullish. In the build up to the ETFs, gains happened in relatively short windows. We should be surprised with brief periods of rapid appreciation followed by periods of calm.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Miner outflow has hit a multi-year high as tens of thousands of bitcoin (BTC), worth over $1 billion, have been sent to exchanges.

CryptoQuant data shows that the majority of the bitcoin has moved from mining company F2Pool. Bradley Park, an analyst at the company, told CoinDesk in a Telegram message that the move is due to miners facing increased costs.

Park pointed to the increased costs of F2Pool moving to Kazakhstan and the need to upgrade miners to Bitmain’s latest Antminer T21 before the halving – which decreases the rewards for mining and thus the per-machine yield – as the reason for the outflow.

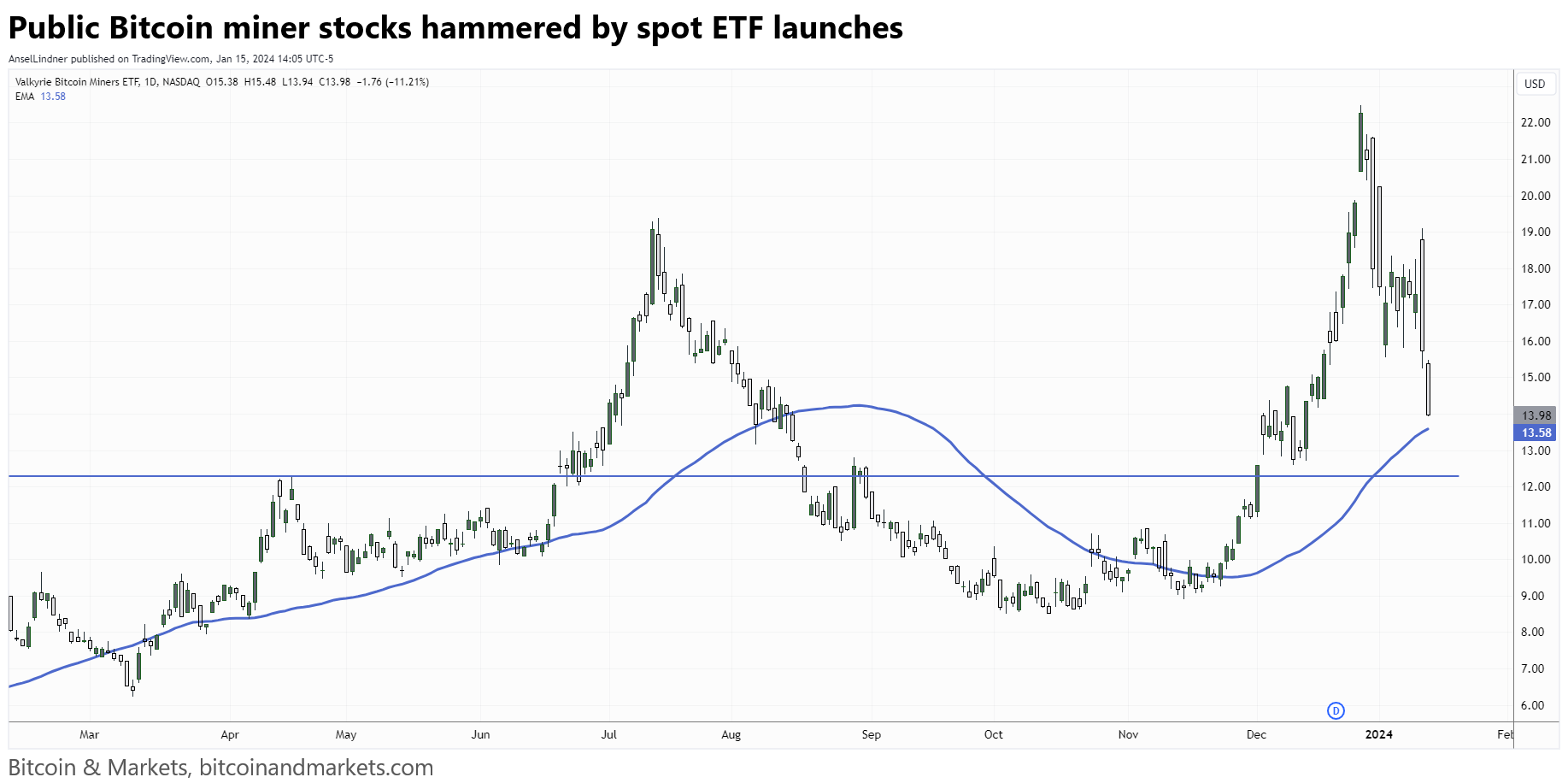

The stocks have risen significantly over the past year — gaining up to 300% — with investors potentially using the products as a proxy for bitcoin pre-spot ETF approval. Now that the bitcoin ETF products have launched, profit-taking appears to occur as the narrative draws to a close. However, some are speculating the proxy stocks are now draining into the new spot bitcoin funds.

Bitcoin mining company Riot was the most brutal hit, dropping 15.8% yesterday to $13.09 and is down a further 2.6% in pre-market trading, according to TradingView. The stock has gained 137% over the past year.

Difficulty

Difficulty is estimated to adjust downward in 4 days by -2%.

Hash Rate

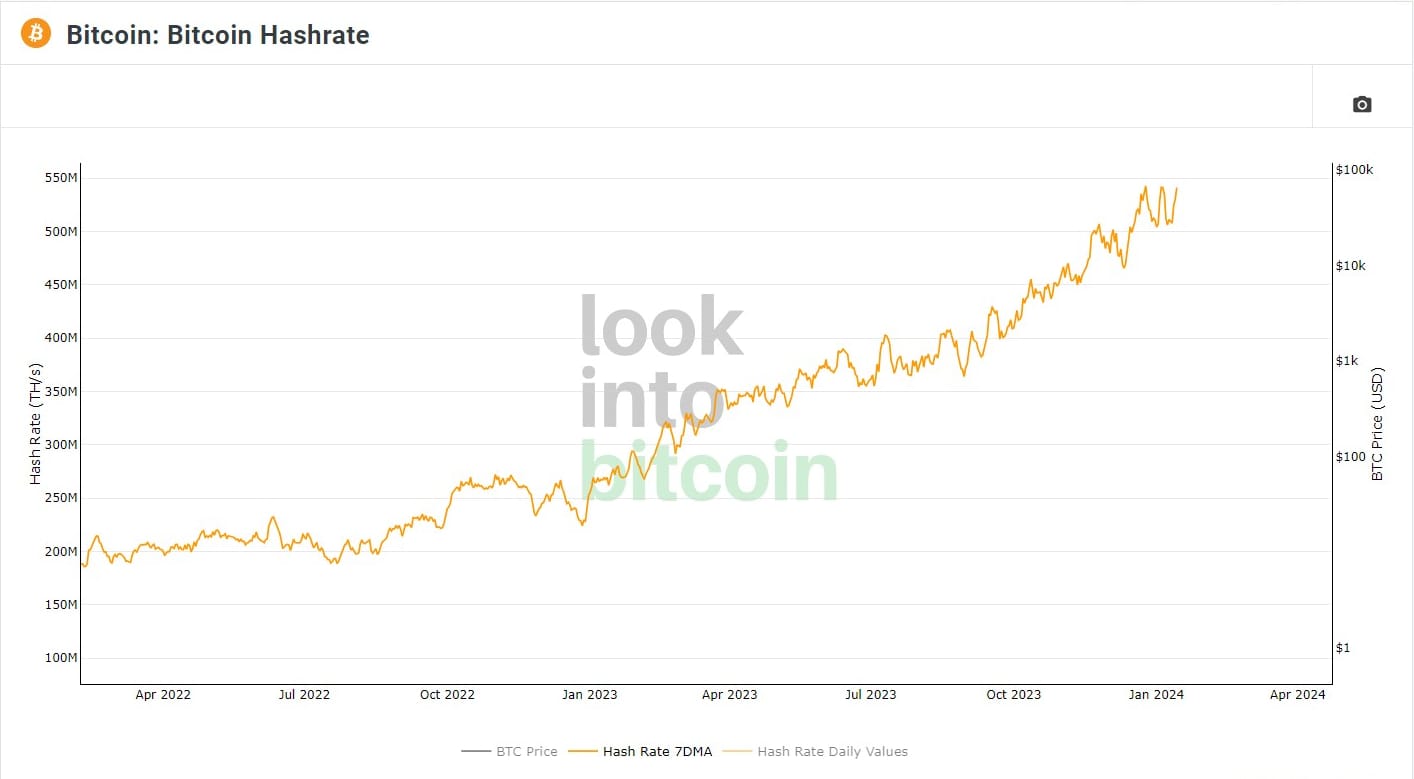

Hash rate is back up to ATHs.

Mempool

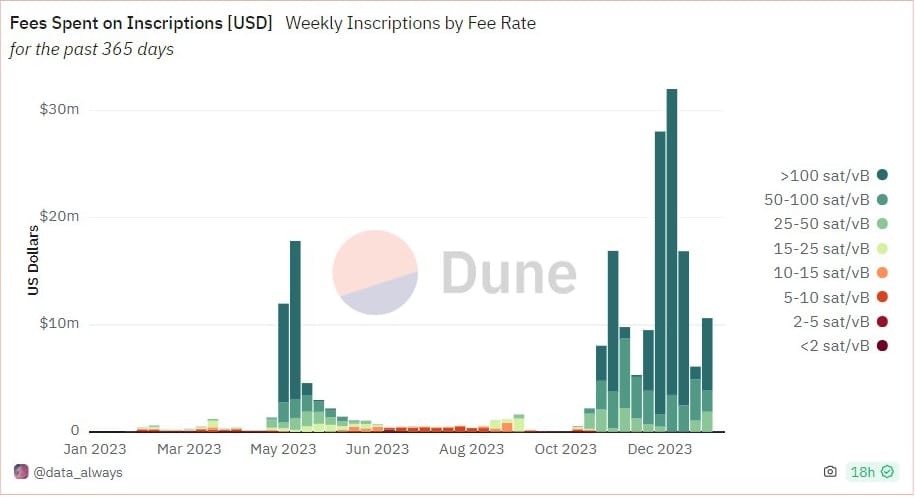

Mempool stabilized this week, but fees continue to be relatively LOW. This could be due to people done preparing and moving coins around prior to the ETF approval and/or inscriber becoming more patient and lowering their fees.

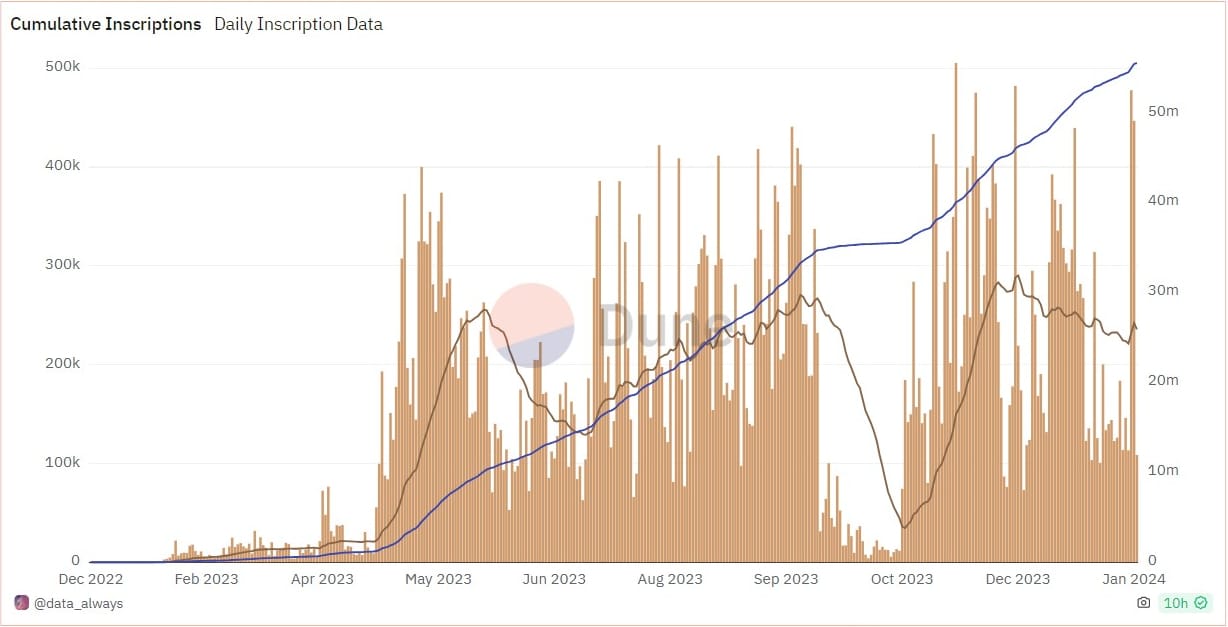

Inscriptions

After two weeks of lower numbers of inscriptions, the last 2 days have both been over 400,000/day. A balance might be emerging, inscriptions go up causing fees to rise, in turn causing inscriptions to fall leading to fees falling.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space