Bitcoin Fundamentals Report #272

January 8, 2024 | Block 824,909

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Ready for approval |

| Media sentiment | Very Positive |

| Network traffic | Very High |

| Mining industry | Growing rapidly |

| Days until Halving | 99 |

| Price Section | |

| Weekly price* | $46,952 (+$3452, +7.9%) |

| Market cap | $0.919 trillion |

| Satoshis/$1 USD | 2,130 |

| 1 finney (1/10,000 btc) | $4.69 |

| Mining Sector | |

| Previous difficulty adjustment | +1.6547% |

| Next estimated adjustment | -4% in ~11 days |

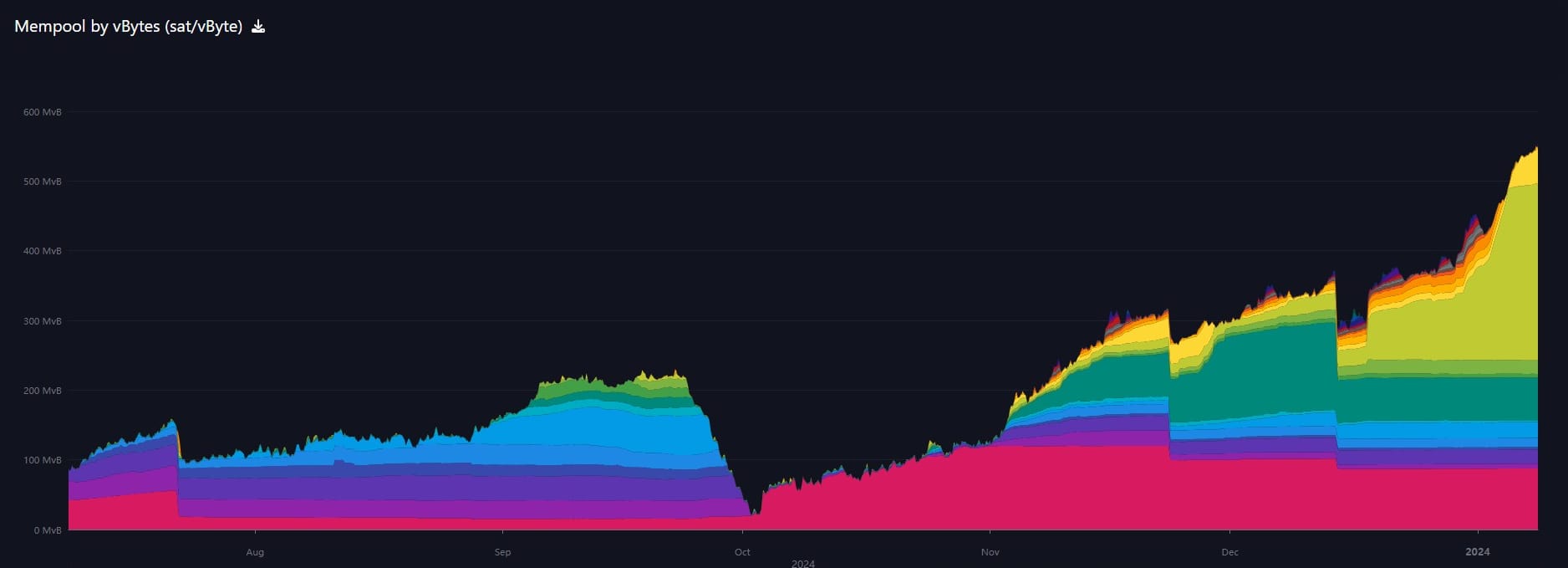

| Mempool | 549 MB |

| Fees for next block (sats/byte) | $4.93 (74 s/vb) |

| Low Priority fee | $4.93 |

| Lightning Network** | |

| Capacity | 5054.36 btc (+0.4%, +19) |

| Channels | 58,829 (-0.7%, -443) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- Communism Works Better than Markets With Today's Compute?

- Shale: An Earthquake in the Geopolitical Order

Bitcoin Magazine Pro

Headlines

The ETF approval window is officially here guys! Odds of approval by Wednesday are 95%+. It has not been priced in. Be prepared for some major volatility.

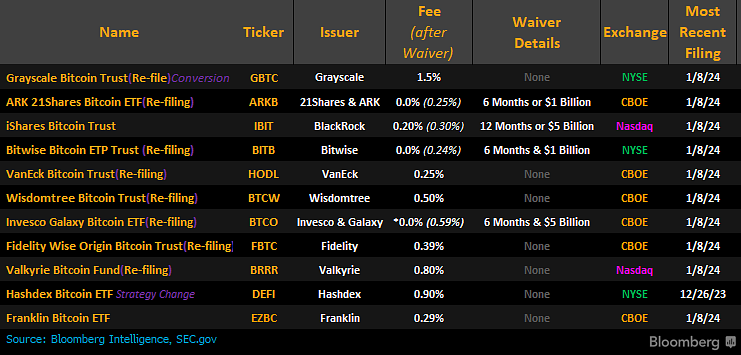

- Applicants are now fighting over fee structures

This morning we saw a flood of updated S-1 filings. This is the form that spells out the nuts and bolts of these products. They were shocking to say the least.

I quick note on ETFs for those who don't know, they have a fee to hold called an expense ratio. You can think of like a management fee. The average fee for a commodity ETF is 0.76%.

Before today, the lowest fee on a bitcoin ETF was from Fidelity at 0.39%. This morning VanEck lowered theirs to 0.25% along with ARK. However, ARK is going to 0.0% for 6 months or until they have $1 billion in bitcoin (could be a relatively short wait. Bitwise followed suit with 0.24% and 6 months or $1 billion. Finally, the heavyweight Blackrock came in strong with 0.30% and an introductory rate of 0.2% for 12 months or $5 billion. Invesco followed with 0.0% for 6 months or $5 billion but with a relative high fee after of 0.59%.

The issuers are in a race to get as many bitcoins in the initial launch as possible. 0.25% is the same as 0.5% if the price of bitcoin doubles.

The incentives for the ETF issuers are to get as much bitcoin as quickly as possible at launch. They've set their fee structure, now they are going to hit the advertising hard.

I've been calling this a Bitcoin singularity, because we can't see exactly what will happen. If we use some simple conservative assumptions, the price per bitcoin becomes ludicrous pretty quickly.

- Former SEC Chair Jay Clayton says bitcoin spot ETF approval is assured

BREAKING: Ex-SEC Chair Predicts Spot #Bitcoin ETF Approval Assured. ✅

— Simply Bitcoin (@SimplyBitcoinTV) January 8, 2024

States: “No more decisions left.” 📈 pic.twitter.com/LxJTP1mlvz

- The SEC isn't going to VOTE to approve the ETFs, they are approved by delegated authority

The SEC has never voted on bitcoin ETFs (spot denials or the futures approvals), they were denied or approved via "Delegated Authority"

If they did vote they'd have to have publicly scheduled a meeting. (none are scheduled)

If there were a vote, hard to imagine any poss Gary would vote no bc a) there's no basis to deny and b) he is literally the one who directed the Staff to put in thousands of man hours to work w 11 issuers on 5-10 rounds of comments, and most recently telling them they want these lined up for 1/11 launch.

Re the "but the SEC hasn't voted" and how that's some kind of poss rug pull. Few things, the SEC has never voted on bitcoin ETFs (spot denials or the futures approvals), they were denied or approved via "Delegated Authority" (see below from commish Peirce speech) which would make… pic.twitter.com/X8pzQchexj

— Eric Balchunas (@EricBalchunas) January 6, 2024

Macro

I've been talking about the inevitable collapse of the Chinese system for years. I said years ago, they have a choice to follow the path of Japan or North Korea. Now, it seems the mainstream press is finally starting to get it.

Japan’s descent into stagnation is an infamous economic tale known around the world. But at its start, in the early 1990s, it wasn’t abundantly clear what was happening to what was then the world’s No. 2 economy.

Much to the frustration of Japan’s Ministry of Finance, there was a coterie of keen financial analysts who warned that the country’s debt problem was a whole lot worse than advertised, and that economic growth wasn’t going to magically make it go away.

Fast forward to today, and something similar may be emerging with regard to China.

However, the timing of this historic debt bubble comes at a much worse time for China. China is already in a demographic collapse worse than Japan. They have a President that is an unapologetic Marxist/Leninist bent on completing the second communist revolution in China. Therefore, I see China likely to slip toward North Korea more in the next decade.

- German farmers protest globalists taxes

If you are into bitcoin and not following @EvaVlaar what are you doing?

The Canadian truckers won and changed everything. The globalists are scrambling to adjust to peaceful mass protests that cannot be ignored. They are trying to run fake narratives of violence, but the people are buying it. Germany is being de-industrialized rapidly and the populist wave is rising everywhere. The Globalists are on the back foot. What do you think is going to happen in November in the US? Is the US going to be the only place where populist nationalism does win? Very unlikely. Most of my content is not necessarily about what is happening right now, but what it means for the future. This will have dramatic consequences on trade flows and distribution of capital in the world.

🇩🇪 ALL EYES ON GERMANY

— Eva Vlaardingerbroek (@EvaVlaar) January 3, 2024

I’ll be traveling to Berlin next week as the German Farmers have announced that they will launch a protest “larger than the country has ever seen before” on Monday, January 8.

Multiple farmers' associations, the train drivers’ union and the trucking… pic.twitter.com/xDxttAbeqq

GOOSEBUMPS 🇩🇪🚜

— Eva Vlaardingerbroek (@EvaVlaar) January 8, 2024

Just witness countless German farmers on their tractors make their way onto the highway backed up by a HUGE convoy of German truckers.

This is the most amazing thing I have seen in a while.

This is how you show your government who’s boss. #Bauernproteste pic.twitter.com/HX8rQOmqDD

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Blackrock, Fidelity, JPMorgan, and Goldman Sachs are all soon going to be promoting Bitcoin to their clients and incorporating it in portfolio construction.

— Will (@WClementeIII) January 6, 2024

You had 15 years to front run the institutions; a new era for the asset class begins next week.

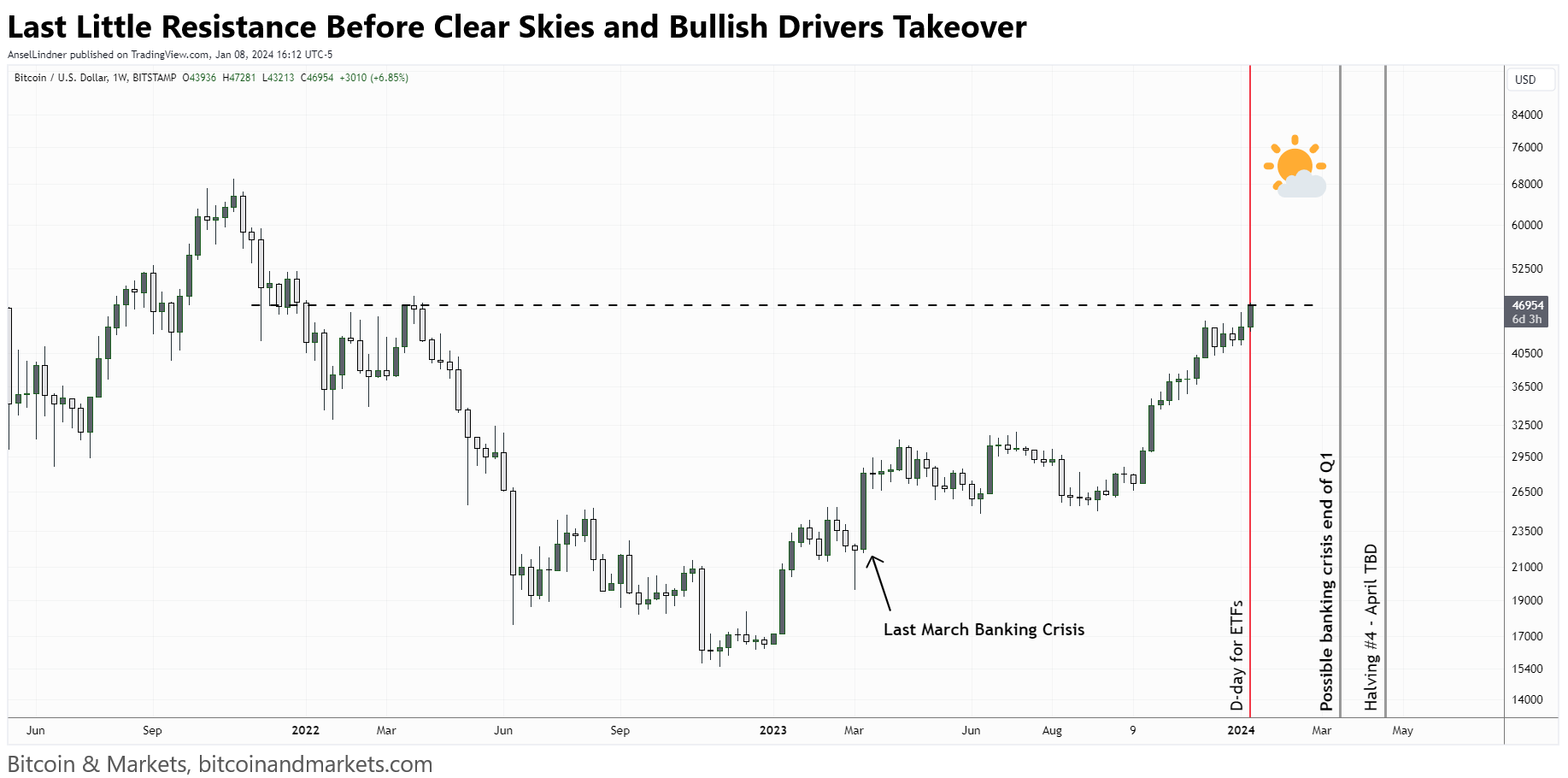

We aren't bullish enough. At the time of writing, price just passed $46,000. Are we to believe that $46,000 is pricing in all the Too Big To Fail banks pumping the bitcoin ETF to clients, and the epic flood of capital into bitcoin coming in the next few weeks? Not a chance.

Community member Point had a good insight on Twitter.

A lesson in incentives:

— 🕳️ (@point_btc) January 8, 2024

Plebs and people like Saylor want to accumulate as much bitcoin as possible. This incentivizes them to minimize their impact on the price.

ETF managers want to maximize AUM. They are incentivized to create bullish momentum in the price as a result.

Another one. StackHodler on twitter made the point that everyone is paying attention this. Large money in the Middle East, China, Japan, Europe, etc. They aren't going to be left behind.

Look I know my name is "Stack Hodler" and I'm basically a perma-bulltard.

— Stack Hodler (@stackhodler) January 8, 2024

But I think everyone is underestimating the mid-term price impact of these ETFs (besides @Excellion)

Fidelity, BlackRock, and Templeton aren't competing for second place. They want A LOT of coins ASAP.…

Where does this leave us? On this side of the singularity. The ETFs are definitely not priced in. The fact that people are making fun of the astronomically high price calls tells me they are possible. The charts are blue skies above $48k. Support is everywhere on the charts as well as in the fundamentals.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Last cycle we had outfits like BlockFi leveraging bitcoin, this time around could it be the miners themselves? This is definitely an area we have to think more about as an industry. It might introduce perverse incentives and increase systemic risk.

Cleanspark is moving to utilize its bitcoin to generate more revenue. The U.S.-based public mining company will launch an in-house cryptocurrency trading desk to take advantage of its bitcoin holdings later this year. According to Bloomberg, the company is seeking to put its more than 2,500 BTC to work amidst a surge in cryptocurrency prices due to the expectation of the upcoming approval of a Bitcoin ETF.

The company is not the first crypto miner to do this. Marathon, another public cryptocurrency miner, has sold call options to generate income from its holdings.

The Las Vegas-headquartered bitcoin mining firm Marathon Digital announced this month that its bitcoin production growth has skyrocketed, thanks to high transaction fees, allowing it to grow its average operational hash rate and more than triple its output from mining. Overall, the bitcoin mining company broke a company record and logged $81 million worth of bitcoin in December 2023.

In total, Marathon mined 12,852 bitcoins in the past 12 months, representing $563.4 million worth of bitcoin. This effectively more than tripled its production from 2022, which came in at 4,144 bitcoin. The same 12-month period also saw the miner gain an 18% increase in its average operational hash rate, reaching 22.4 EH/s.

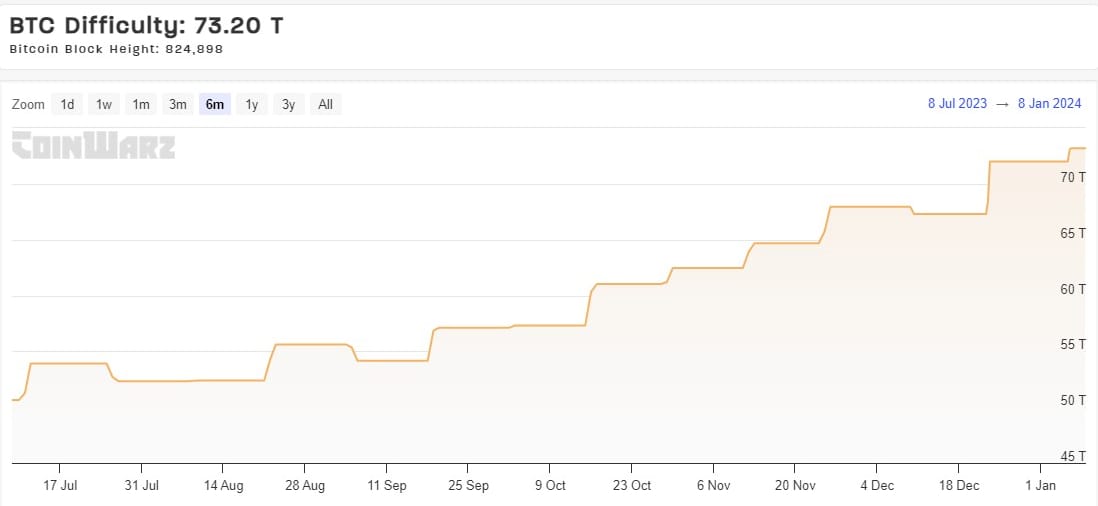

Difficulty

Difficulty edged higher yesterday by 1.6%. It is currently running behind, estimating -4% or so in 11 days. Overall, still very healthy and entering a bull market prior to the halving.

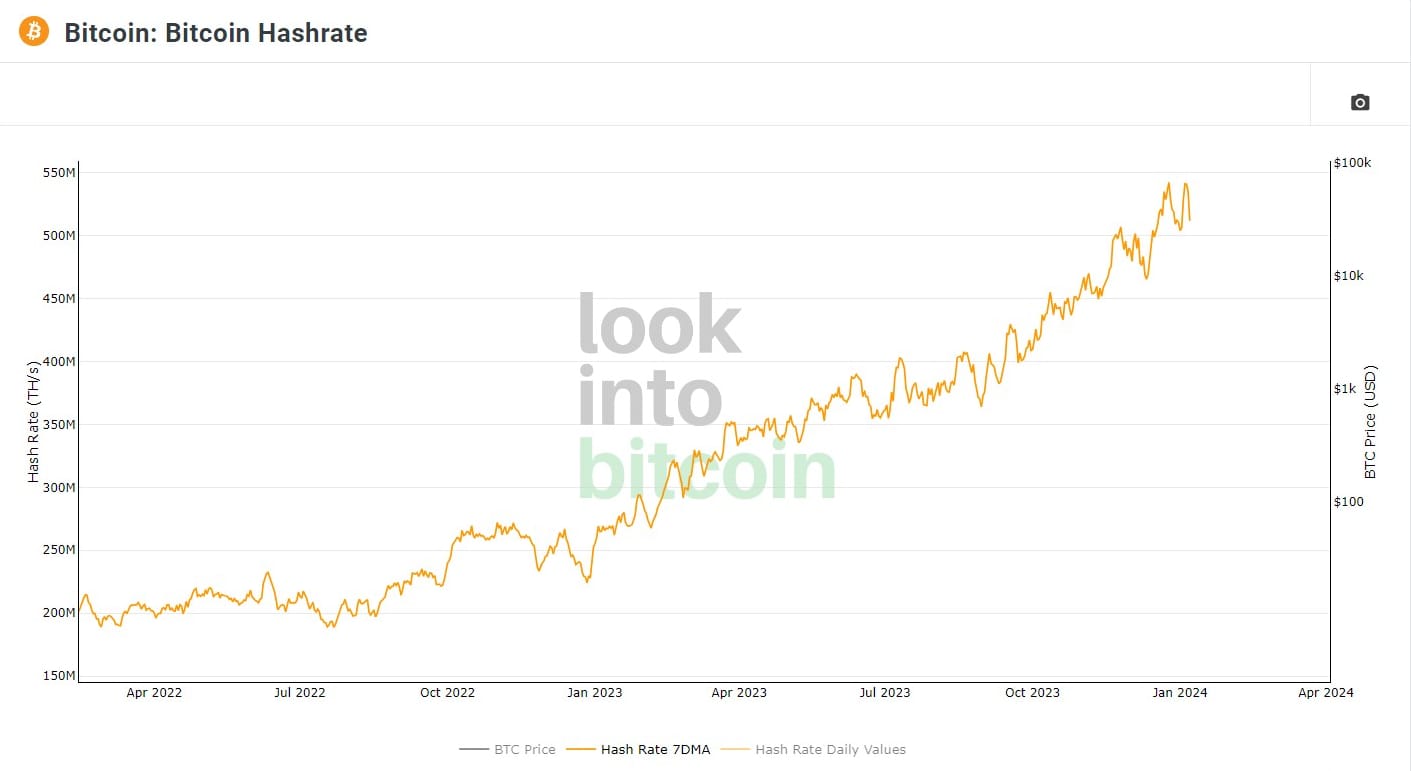

Hash Rate

Hash rate failed to make a new ATH but is still very strong.

Mempool

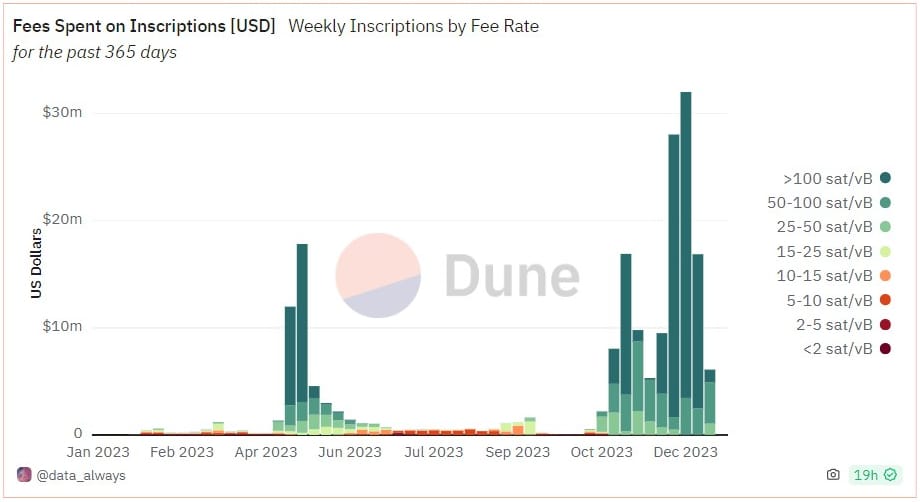

Mempool has screamed higher this week, but fees are dramatically LOWER. This could be due to people done preparing and moving coins around prior to the ETF approval and/or inscriber becoming more patient and lowering their fees.

Inscriptions

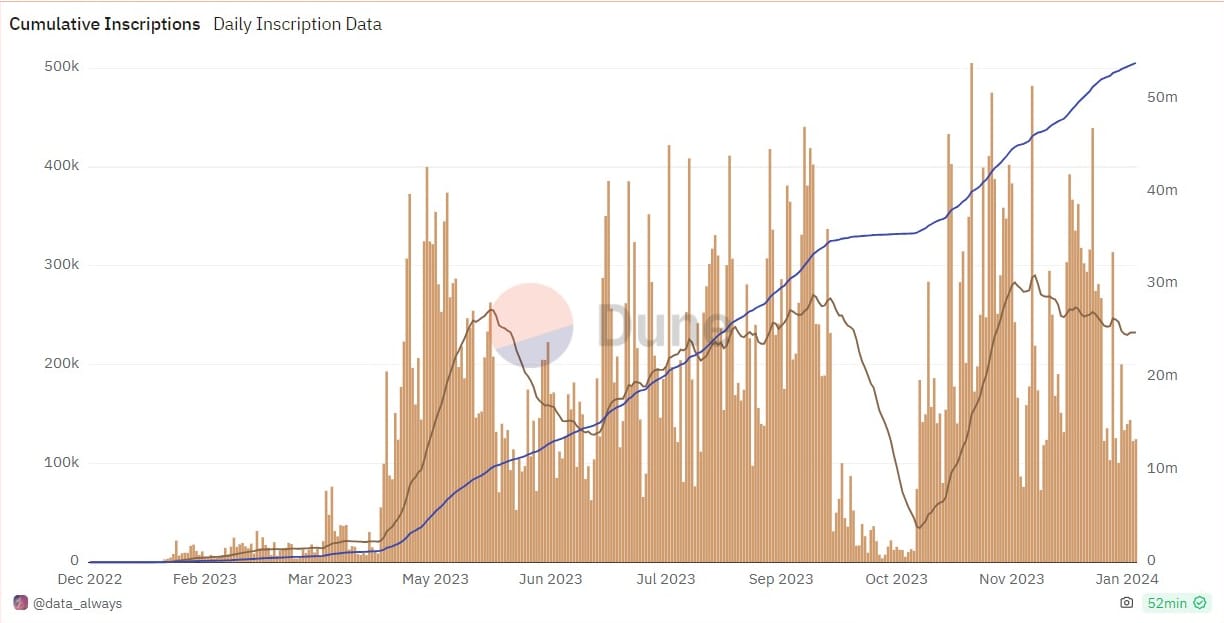

Inscriptions have definitely come down in number over the last couple of weeks. Averaging a little over 100,000/day. The hype could be dying down a little, again as all eyes are on the ETF.

Layer 2

You guys probably know by now that I'm more bullish Liquid-style sidechains than Lightning over the next decade. I'm not saying sidechains are better, just that I think sidechains have the proper trade-offs to scale in a quicker time.

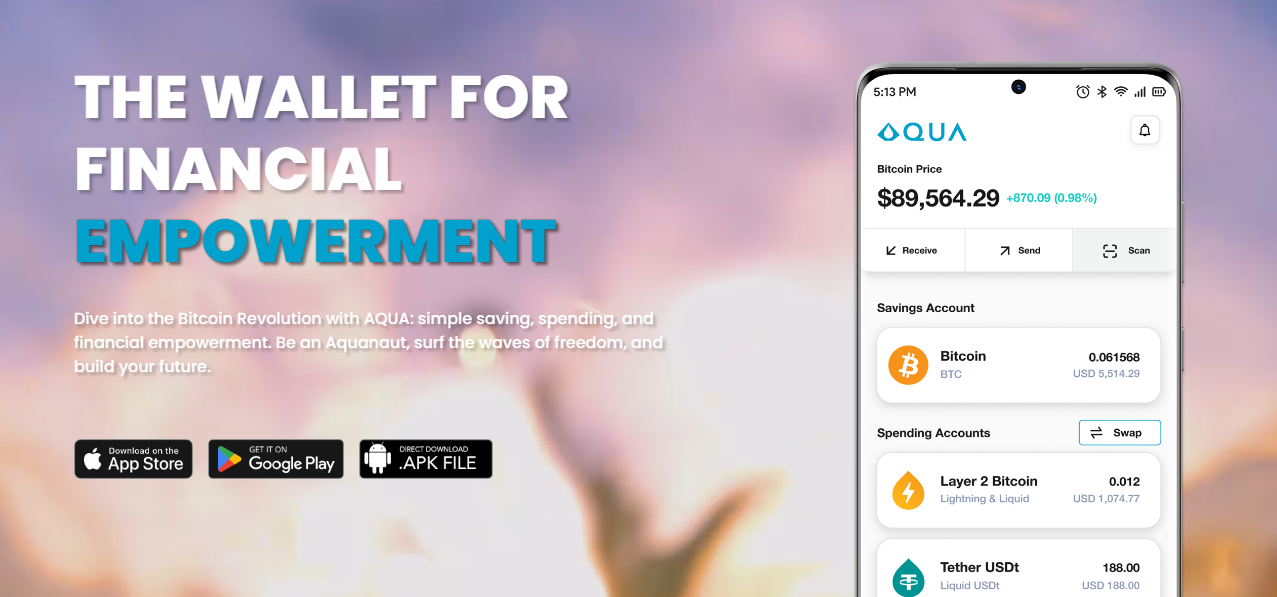

Aqua Wallet is a new wallet from Samson Mow's Jan3. They recently raised $21 million for it and other expansions of their product offerings. What I think is cool here is that Aqua interacts with Bitcoin on-chain, Liquid (LBTC), Lightning (via Liquid) and even Tether.

I'm not currently a user, but I will be trying this out next time I need a mobile wallet. For the time being, I'm simply an observer and like where this is headed. Liquid offers a great scaling solution for bitcoin.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space