Bitcoin Fundamentals Report #220

This week was a slow news cycle for #Bitcoin. We cover a few headlines, price analysis including headwinds and tailwinds, mining sector and a lightning network story.

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Daily Live streams are going out on podcast apps, Rumble and Odysee. Find links to them here.

- (Article) Ghost money article I wrote for Bitcoin Magazine

- (Fed Watch) What does the Fed even do? - FED 121

⬇️ Check out the 30 min mark in the video below ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Avoidance |

| Media sentiment | Extremely Negative |

| Network traffic | Normal |

| Mining industry | Consolidating |

| Market cycle timing | Attempting to form bottom |

Bitcoin Headlines

Very slow week in the bitcoin news cycle. Here are the biggest stories I found other than FTX founder SBF not being charged yet.

Bold prediction.

I spent a couple live streams on this topic last week. Bottom line, they are recycling all old, debunked narratives. It is noteworthy because, where in the past they used proxies to attack bitcoin, this one was published directly on the ECB's blog.

- Bitcoin FUD articles pick up pace

On top of the ECB FUD, there are many posts recently about bitcoin being dead. Same thing, different cycle.

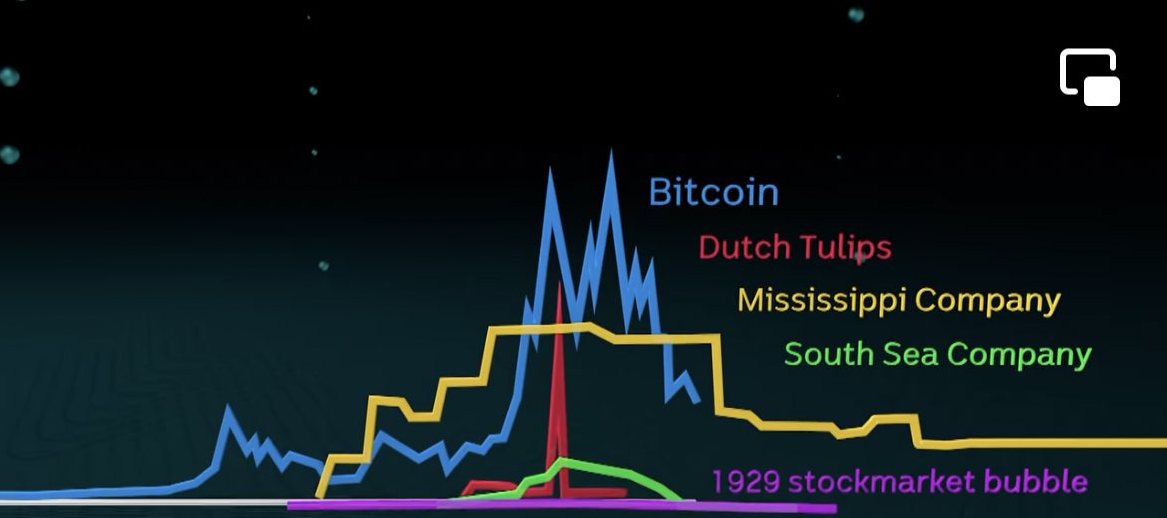

Of course, they only put one of bitcoin's bubbles on this chart. If they put all 4 on there, it would be obvious bitcoin isn't a one-off bubble.

Macro headlines

.jpg)

The Taiwan elections on November 26th are being touted by some as a rebuke of US involvement there, and a turn back toward China. This is not the case for several reasons. The winning party the KMT was the original "Republic of China" party. They just want a return to "One China, Two systems" narrative and peace. I think that is likely wishful thinking.

The absolute vote numbers would only slightly swung to the new party, all incumbents won, only the open seats flipped.

The OPEC+ alliance decided to maintain production at current levels, pausing to take stock of a global oil market that’s roiled by uncertainty over Chinese demand and Russian supply.

OPEC has cut their global demand forecast 5 times this year.

Per the price cap, Russia can export crude oil, ship it, and insure it using the services of Western companies only if it sells it at $60 per barrel or less.

Because all the biggest shipping and insurance companies are based in Western Europe and the U.S., the authors of the cap assumed it would be enough to bind Russia to its conditions.

I haven't seen the fine print of the sanction here, but I'm willing to bet there is a loophole big enough to drive an oil tanker through.

Price Analysis

| Weekly price* | $16,930 (+$692, 4.2%) |

| Market cap | $0.326 trillion |

| Satoshis/$1 USD | 5,903 |

| 1 finney (1/10,000 btc) | $1.69 |

Last week

We were bang on...

The risk of slightly lower prices remains elevated. I'm expecting more sideways to higher this week.

4-Hour chart

Bitcoin broke above the blue short-term trend line, and it approaching the resistance zone. The whole market will shift on a dime if bitcoin can break $19k heading to $20k.

Big investors will say, 'Wait a second. This industry just has a massive liquidity/leverage implosion and bitcoin is right back where it was at $20k? That's very strong performance. I need to take another look here.'

Daily chart

This isn't a strong chart, but it looks much better than last week. At least there is some positive movement and ability to break a little resistance. Of course, the big test is about to start.

The daily pivot is at $18,000, so it is highly likely we test there at some point soon. Pivots are simply the median of the last period. R's and S's are support and resistance levels based on formulas. As you can see on the last period, price stopped at S3, meaning it was a very statistically significant move.

Standard Ichimoku cloud is still bearish by much more bullish that the bitcoin specialized with extended settings. The standard settings are showing a path to a breakout.

Extended settings are showing possible move to Kijun and lagging price about to cross over. There are some positives here.

Weekly Charts

The price has been surprisingly stable, despite all the market turmoil. Just looking that the chart below, if you didn't know, where would you guess the FTX implosion occurred?

We also have a double bullish divergence on the weekly. Bitcoin has never had a single one until back in September, now it has two back to back.

While I'm at it, here is the Tether peg, too. 0.9995 to the dollar once again.

The FUD bred from the FTX the frustration spread to these products, which were never implicated in the rehypothication schemes. Interestingly, if these products were the next logical target for FUD, that makes be believe the serious damage is over for now.

Funny, Tether was hounded by the NYAG for years and still is, yet it was FTX that blew up. This supports the idea that the harassment of Tether was politically driven. It should also give us solace that Tether's role in the market is well-founded on demand.

Headwinds and Tailwinds

Dollar

The dollar continues to slide. This should be extremely bullish for bitcoin, not because it signals inflation or a dying dollar, but because it means global tightness has loosened up.

Recession talk

The calls of recession remain deafening, making most investors shy. Whether we get a recession is another story.

What most people fail to understand or especially do, is to call the recession while they are in it. Think about it, the lable of being a recession is a BACKWARD LOOKING label. If there is a recession the first half of next year, it won't be "official" until June or July.

What are the talking heads saying? They are calling for a recession next year. I'm saying right now, we are not in a textbook recession. I'm not sure about 2023, but I'll be the first to call it if we get there. I'll be way ahead of any official declaration.

We are in a depression, or a prolonged period of very low growth. That definitely will continue, which is why "inflation" won't. There's no economic activity to support elevated prices. Higher prices will only lead faster to recession.

Stock Market

The S&P 500 did break through the 200-day moving average. But is currently struggling to hold it. This pattern definitely has a fake-out look about it. The market peaked over the 200-day, hunting for stop-losses, only to turn back over.

I would not be surprised to see a testing of some lower support. Remember, if there is to be a recession in 2023, stocks will start pricing that in now. They are forward-looking while the recession label is backwards.

Treasury Yields

The 10Y US treasury is BELOW the Fed Funds target range! It is also hitting th 100-day moving average. It bounced here once in March as well. This time, however, it is happening below Fed Funds.

We can find the same thing with the 5Y and the 30Y. They are all hitting their 200-day MAs and are below Fed Funds. I think this could be a do or die time for the Fed. Either these rates start obeying what the Fed is saying and go higher, or the Fed will have to shift gears.

Oil

Oil is back below $80/bbl today. Showing a ton of weakness here. This tells us that global demand is in a much worse place than is being widely reported. If the US economy is doing okay, that means other places are being hit hard. First place to look is China.

Oil is below all major moving averages, shown are the 200 (orange), 50 (green) and 20-day (purple).

Price Conclusion

Summarizing...

This week is slightly more positive than we've seen in recent weeks, both for bitcoin and for associated markets.

Bitcoin's charts are still bearish, but are starting to turn around. There is a sign of life at least.

The dollar is weakening, which should be a good sign for bitcoin. Stocks are precarious, but have moved a lot more than bitcoin back to its 200-day MA. Oil is lower meaning price pressures (what normies call "inflation") are lower. Treasury rates are falling.

These things are signaling global slowdown with relative US strength, making me think the Fed has room to bailout the global economy where needed.

Same overall expectation from last week, watch for a test of $19k: Overall, the risk of further capitulation, minus a major company like Coinbase or Binance collapsing, is low. The risk of slightly lower prices remains elevated. I'm expecting more sideways to higher this week.

Mining

| Previous difficulty adjustment | +0.5122% |

| Next estimated adjustment | -7.5% in ~5 hours |

| Mempool | 2 MB |

| Fees for next block (sats/byte) | $0.64 (27 s/vb) |

| Median fee (finneys) | $0.21 (0.124) |

Mining News

A new report by Kommersant revealed that sales of Bitcoin mining machines in the country surged rapidly in the fourth quarter, a trend backed by a resurgence of demand, despite the chaotic price action of the crypto-asset.

Not directly related but... it looks as though Russia has some plans for Bitcoin. I don't know how Russia can stiff-arm bitcoin for much longer. They are a match made in Heaven.

JUST IN 🇷🇺 Russia's head of Congress finance committee: #Bitcoin and crypto products will "definitely" be legal next year

— Bitcoin Magazine (@BitcoinMagazine) December 5, 2022

Capitulation over?

Some new data shows miners are already reaccumulating after rapid streamlining.

Generating fear, uncertainty and doubt (FUD) around on-chain movements of bitcoin from miner addresses is a popular pastime for Twitter influencers. And observing miner balances can be helpful. Current data shows notably larger balances compared to just a month ago. In short, net selling activity by miners appears to have subsided and their stockpiles of bitcoin are on the rise again.

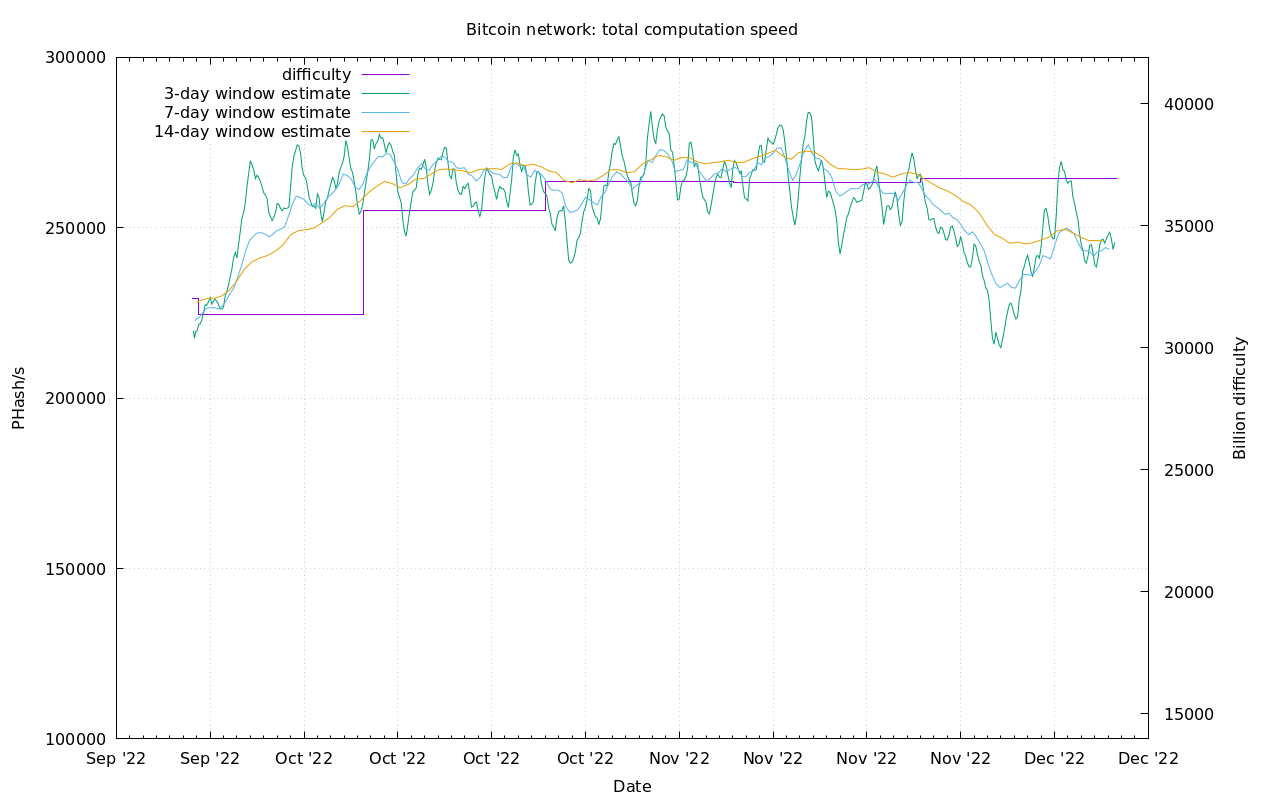

Difficulty and Hash Rate

The plunge in hash rate has leveled off for now, as mining rigs find news homes and operations have been streamlined. Hash rate is still estimated to drop by 7% today. That will make it more profitable for those miners that have so far survived.

Lightning Network

Slow week for lightning news, but here is fun article I found talking about the evolution of Lightning and human technology.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

December 5, 2022 | Issue #220 | Block 766,040 | Disclaimer

* Price change since last week's report