Bitcoin Fundamentals Report #218

This week I cover the contagion fears from FTX to Genesis to Grayscale to Coinbase, next is a price analysis, then miners selling bitcoin, and lastly BLIP and Lightning Network.

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Daily Live streams are going out on podcast apps, Rumble and Odysee. Find links to them here.

- (Article) Ghost money article I wrote for Bitcoin Magazine

- (Fed Watch) The Market is Pivoting, Forget the Fed - FED 119

- (Fed Watch Clips) Full, Fed Watch only video this week

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Fear not panic |

| Media sentiment | Very Negative |

| Network traffic | Still high |

| Mining industry | Financial trouble |

| Market cycle timing | Attempting to form bottom |

Bitcoin Headlines

The FTX contagion continues to spread this week. The main route this week is through the banking and settlement layer in the industry, namely Silvergate bank.

- Silvergate bank in trouble?

This thread by Dylan LeClair lays it out nicely. Silvergate banks a huge chunk of the space, including FTX, Coinbase, Gemini, Bitstamp, and USDC (Circle). Silvergate has also very recently been found guilty of laundering money for drug cartels.

This is what worries me,

— Dylan LeClair 🟠 (@DylanLeClair_) November 18, 2022

U.S. crypto firms really only have two banking relationships: SIlvergate & Signature.

SEN Network allows firms to transfer balances between each other.

Banking access and these dollar rails are key for these firms shown below

contd. 👇 pic.twitter.com/MdTnPLETNM

- The next shoe to drop might be Genesis?

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XZIQVKXGOZOHRBGAXUCCK7EP54.jpg)

Genesis, which brokers digital assets for financial institutions like hedge funds and asset managers, had almost $3 billion in total active loans at the end of the third quarter. On Wednesday, its crypto lending arm stopped making new loans and blocked customers from taking out money because of what it called "unprecedented market turmoil" that rippled through the market after FTX filed for bankruptcy last week.

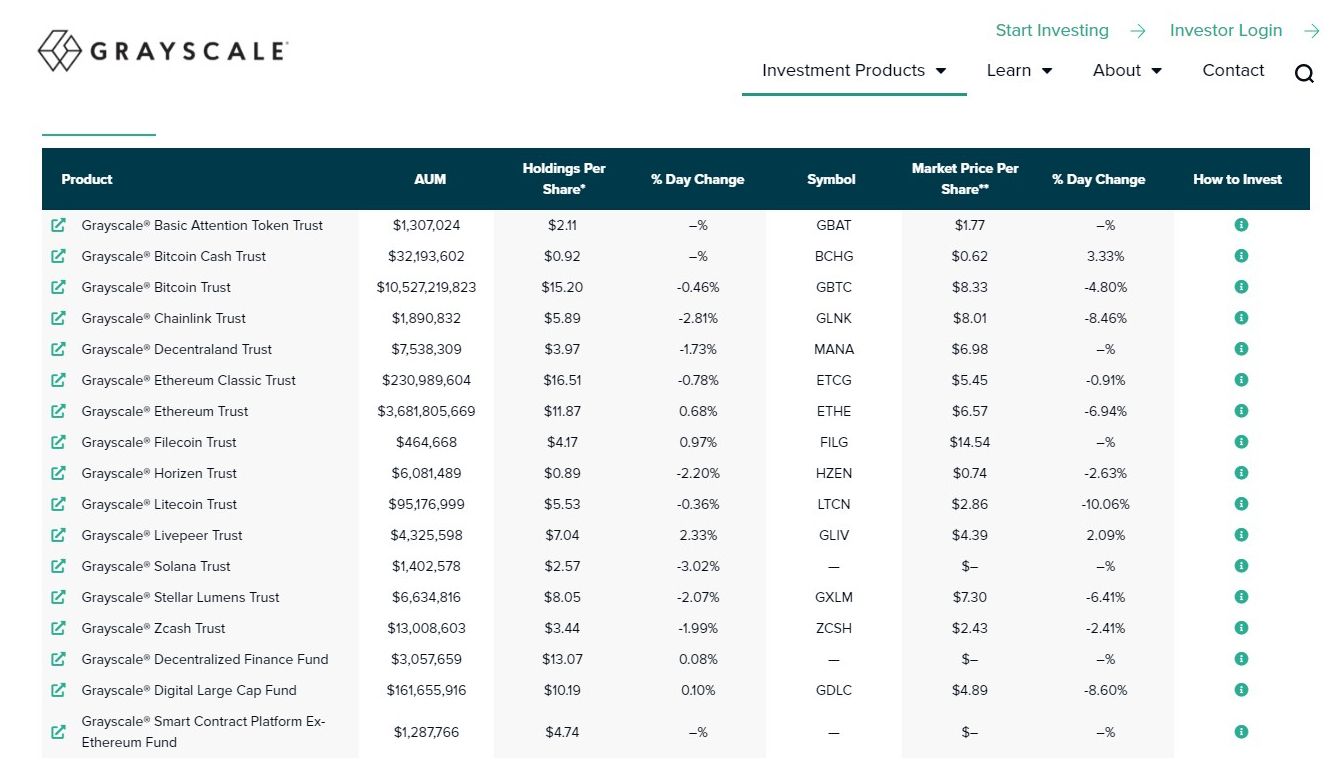

Genesis is owned by Digital Currency Group, which also owns Grayscale and Coindesk (why I don't like linking directly to Coindesk, because they are shittoken pumpers). Supposedly, Grayscale is in trouble for a loan to Genesis for $1.7 billion.

- From Genesis to Grayscale to Coinbase

Rumors have spread to Grayscale, home of the Bitcoin Trust (GBTC). It started with speculation about Grayscale simply not being fully backed with Bitcoin. They hold their bitcoin with Coinbase custody, so rumors of insolvency spread to Coinbase.

This forced Coinbase to attested that GBTC is fully backed.

BREAKING‼️ - Coinbase confirms that it holds ~635K #Bitcoin on behalf of Grayscale Bitcoin Trust and that they are secure.

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 21, 2022

Let's revisit what has happened here over the last two weeks. FTX, which held 1.1 bitcoins is all, was the center of a massive Ponzi ecosystem collapsed. Companies caught up in that Ponzi ecosystem - which does NOT include Bitcoin-only companies - are facing contagion, because 1) the value of their assets have crashed and 2) and they all owe money to each other. Why was GBTC implicated in the problems???

I think it is striking that only the Bitcoin product is getting this amount of FUD (fear uncertainty and doubt) thrown at it. Especially, when bitcoin is the bedrock asset of the industry and the shittoken products are much more risky. Not a peep of FUD about them. Hmmm

- My conclusion

Grayscale's Bitcoin Trust (GBTC) is fully backed and safe. When this blows over, the discount will disappear rapidly to the spot price (NAV). There is a potential that it is unwound, but IDK the implications of that that exactly. Other products by Grayscale are at more risk of insolvency due to centralized networks and possible hacks.

Coinbase is much more risky than GBTC. Their business model is dependent on a thriving ecosystem of scams. Since that is going away, their revenue is likely to suffer greatly while their expenses stay the same. They've tried to raise debt financing and it is trading at 50 cents on the dollar. They've also been selling new shares to raise money.

The implosion of FTX is not good news for #Coinbase: Bankruptcy of FTX removes a major competitor but it also evaporates confidence in the crypto economy. Bond market sounds the alarm bell. Coinbase 2028 bonds trading currently for 56 cents on the dollar. https://t.co/sWHhW49r9i pic.twitter.com/oz86xjkX7a

— Holger Zschaepitz (@Schuldensuehner) November 20, 2022

Coinbase could be in trouble financially, but that is not the same as what happened to FTX. If Coinbase's shittoken model fails, which it will eventually, their profitable lines of business (like custody) will be spun off and sold. Being insolvent because your revenue dries up, is not the same as being insolvent due to cooking the books. It will be sold and a huge enemy of bitcoin, in the heart of the industry, will get new ownership.

Macro headlines

Shipments of most major Chinese consumer products to the United States fell last month, hit by the triple whammy of dwindling demand, coronavirus disruptions to manufacturing and trade bans.

12.6% is up from the 11% pace of decline in September. In other words, the decline in exports accelerated their decline.

- Italian populist PM, Georgia Meloni fires at France

This video went absolutely viral this week. It shows Meloni claiming France is exploiting their former Africa colonies creating the immigration crisis in the first place. She's going hard, but...

Her position is extremely simple to understand, but it's not exactly correct. The living and working conditions of miners in some African countries like Burkina Faso are horrible, but it's not necessarily because the African Franc.

I covered this topic on today's live stream. Join the Telegram or listen on the podcast feed! Find it all here.

Price Analysis

| Weekly price* | $15,855 (-$220, 1.3%) |

| Market cap | $0.304 trillion |

| Satoshis/$1 USD | 6,332 |

| 1 finney (1/10,000 btc) | $1.59 |

Hourly chart

The price has been holding onto $16,000, but there is no vitality in this market whatsoever. It is concerning that bitcoin has been absent buy pressure for so long this year. It keeps trickling downward, causing more companies into financial tightness or selling, causing more weakness.

Daily chart

If you take the waterfall crashes off this chart, the price would be quite flat for most of the year. The damage has really just occurred during those crazy liquidations in Lune, Celsius, and now FTX, all having nothing to do with bitcoin itself!

I just threw some moving averages on this chart. As you can see back in July and August, after the last big sell off, price broke through the 50-day MA (blue) and touched the 100-day (red). I extended these averages into the future a couple weeks, and added arrows to approximate a path that would match July-Aug.

Weekly Charts

There is nothing to keep the price from dropping back to the 2019 high. The chart is not bitcoin's friend right now, nothing positive from a technical analysis perspective to be seen. However, there are some aspects outside bitcoin that are more bullish.

Headwinds and Tailwinds

ETH -> wrapped BTC -> BTC

The FTX "hacker" (likely insiders) are selling their ill-gotten ETH for wrapped BTC. This is bitcoin that is encumbered by a private key and spendable in an Ethereum transaction.

People are speculating that they will then convert it to regular bitcoin. Larry Cermak is far from a bitcoin maximalist, so this is the view of many middle of the road altcoiners. This makes people more bitcoin maximalist and adds buying pressure to bitcoin vs false substitutes.

The FTX blackhat just transferred 15k ETH to 12 different addresses, which amounts to ~$200M total. This means he will likely dump the ETH to renBTC and gradually exit to BTC mainnet. Selling didn't start yet but will take some time though as liquidity will need to be reloaded pic.twitter.com/h88BDNX9Hw

— Larry Cermak 🫡 (@lawmaster) November 21, 2022

Dollar

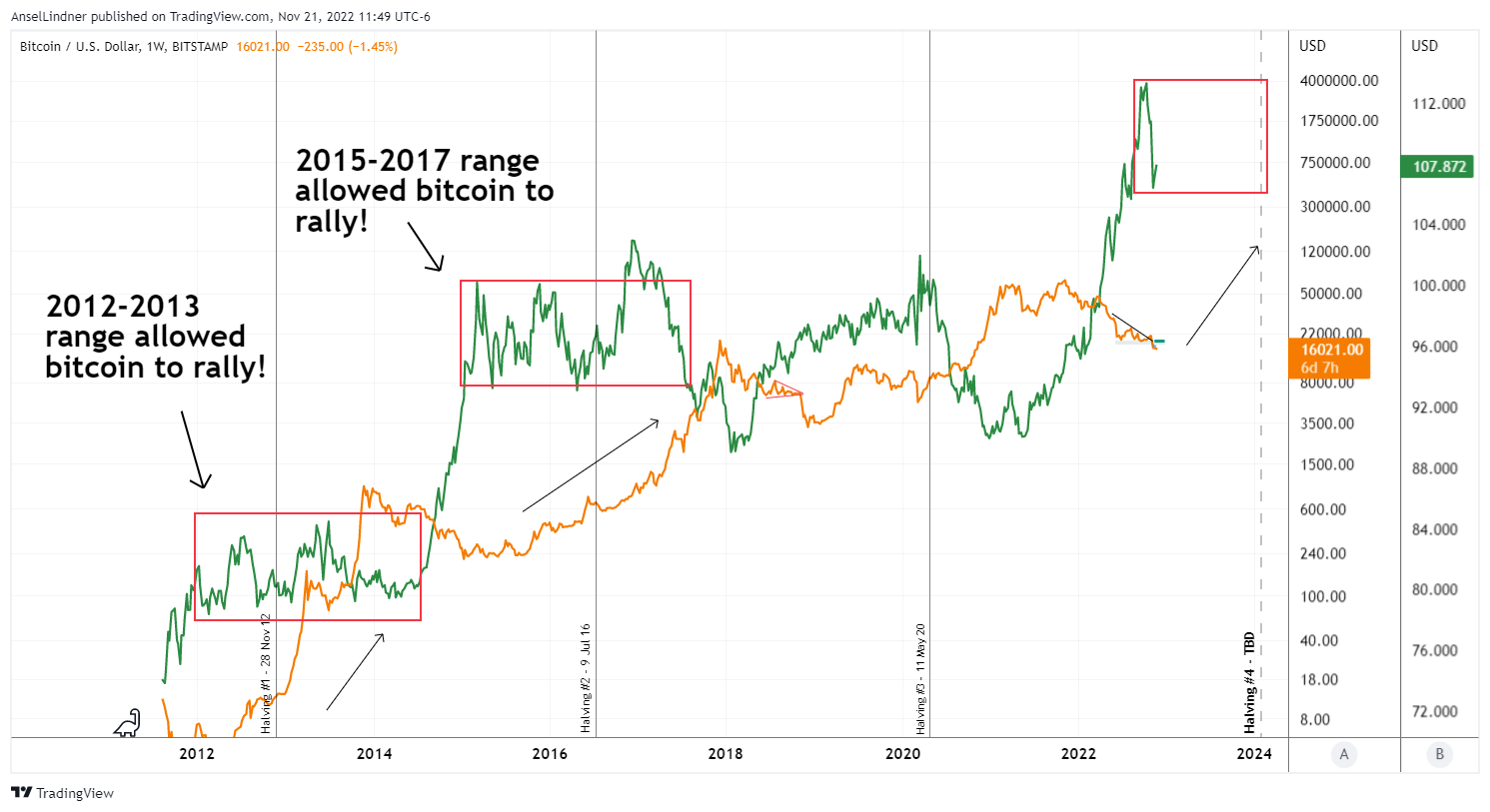

The dollar is proceeding as expected, entering a higher range like it did back in 2015 (the pink line pattern). If this plays out, it means we are returning to a post GFC normal that is very good for bitcoin.

Bitcoin's 2015-2017 massive bull market that ran 8000% from $200 to $18,000 while the DXY was range bound between 90 and 100. Even the huge 2012-2013 bull market occurred in a period where the DXY was range bound in the 80's.

Stock Market

The S&P 500 is holding above the 50-day moving average.

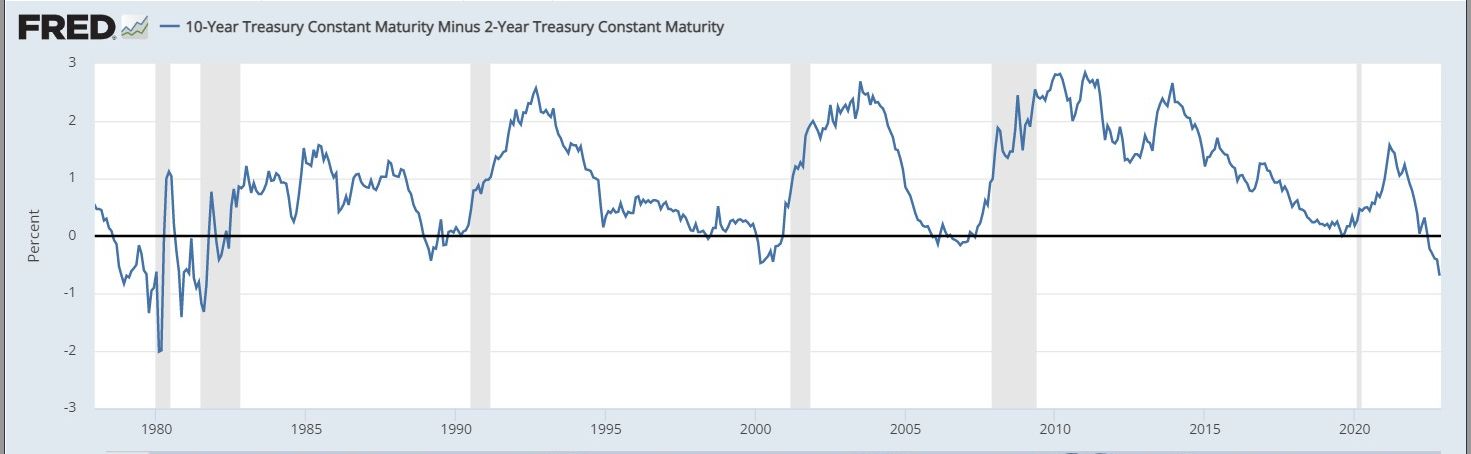

Yield curve inversions

The 10Y-2Y is at -72 bps!!! This is the most negative since the 1981 recession. That was a deep recession but was over by 1982.

The 10Y - 3M inversion is -0.39%!!! The low on the 16th was -0.55% which is lower than the 2020 inversion, but not the 2007 or the dotcom of 2001.

Even the 30Y dipped below the 4-WEEK yield briefly!

Price Conclusion

Summarizing...

Bitcoin's charts on all timeframes are very bearish. This is the most universally bearish the charts have been that I can ever remember in my nearly 10 years of watching.

If you zoom out enough, the long term trend of bitcoin market cycles going higher is obviously still intact.

Also, if you add in some macro context, like a newly range bound dollar, stocks over the 50-day MA, and the FTX ethereum being sold for BTC, bitcoin's fundamental value position remains strong.

The biggest level of resistance is at $19,000, and the largest support is down at the 2019 high at $14,000.

Yield curves are ugly and are signaling a hard recession. This is the one factor that doesn't quite match with my forecast, depending on your interpretation. I think a deeper fundamental point can be made about inflation vs CPI, in regards to nominal vs real GDP. So, not necessarily a deep recession.

Overall, the risk of further capitulation, minus a major company like Coinbase collapsing, is low. The risk of slightly lower prices remains elevated. If you take out only a hand full of days since May, price would be flat for the last 6 months.

I'm expecting more sideways until the market settles down, at which time we could recover really quickly.

Mining

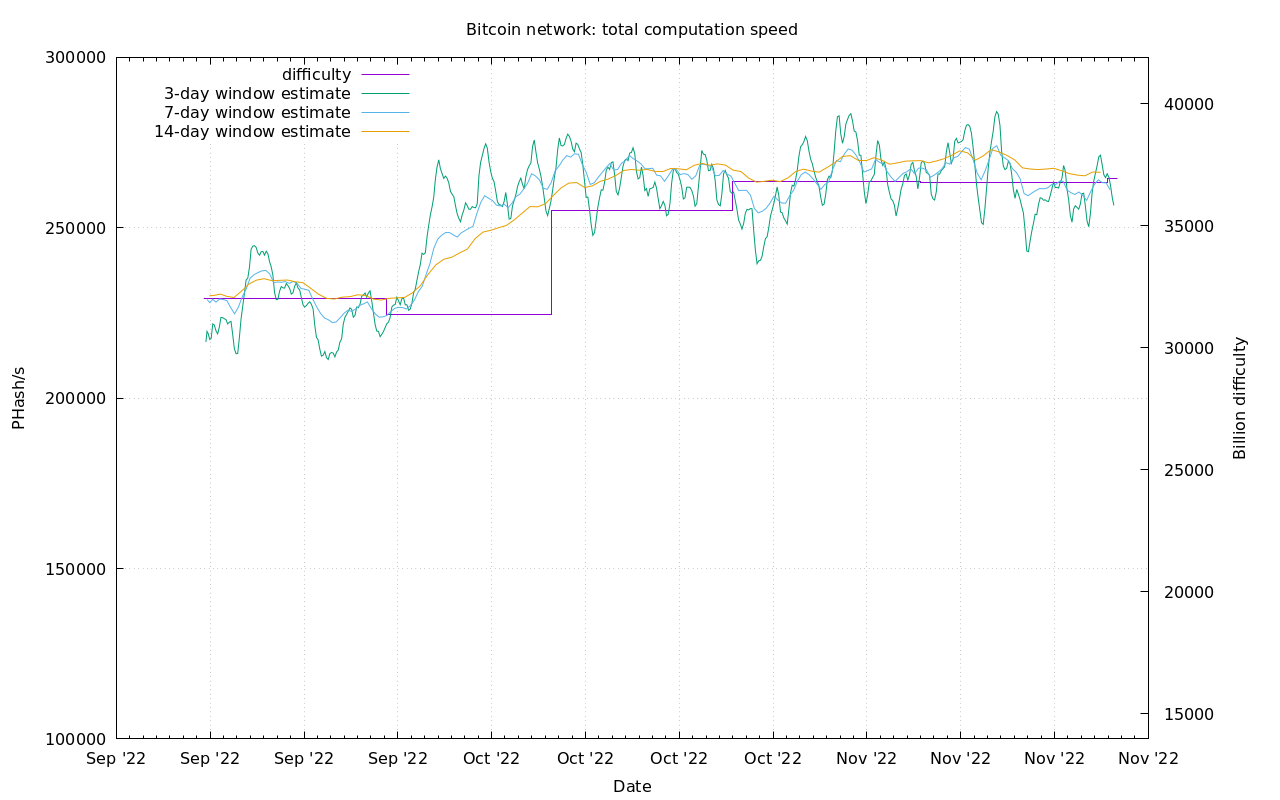

| Previous difficulty adjustment | +0.5122% |

| Next estimated adjustment | -4% in ~12 days |

| Mempool | 9 MB |

| Fees for next block (sats/byte) | $0.62 (28 s/vb) |

| Median fee (finneys) | $0.49 (0.310) |

Mining News

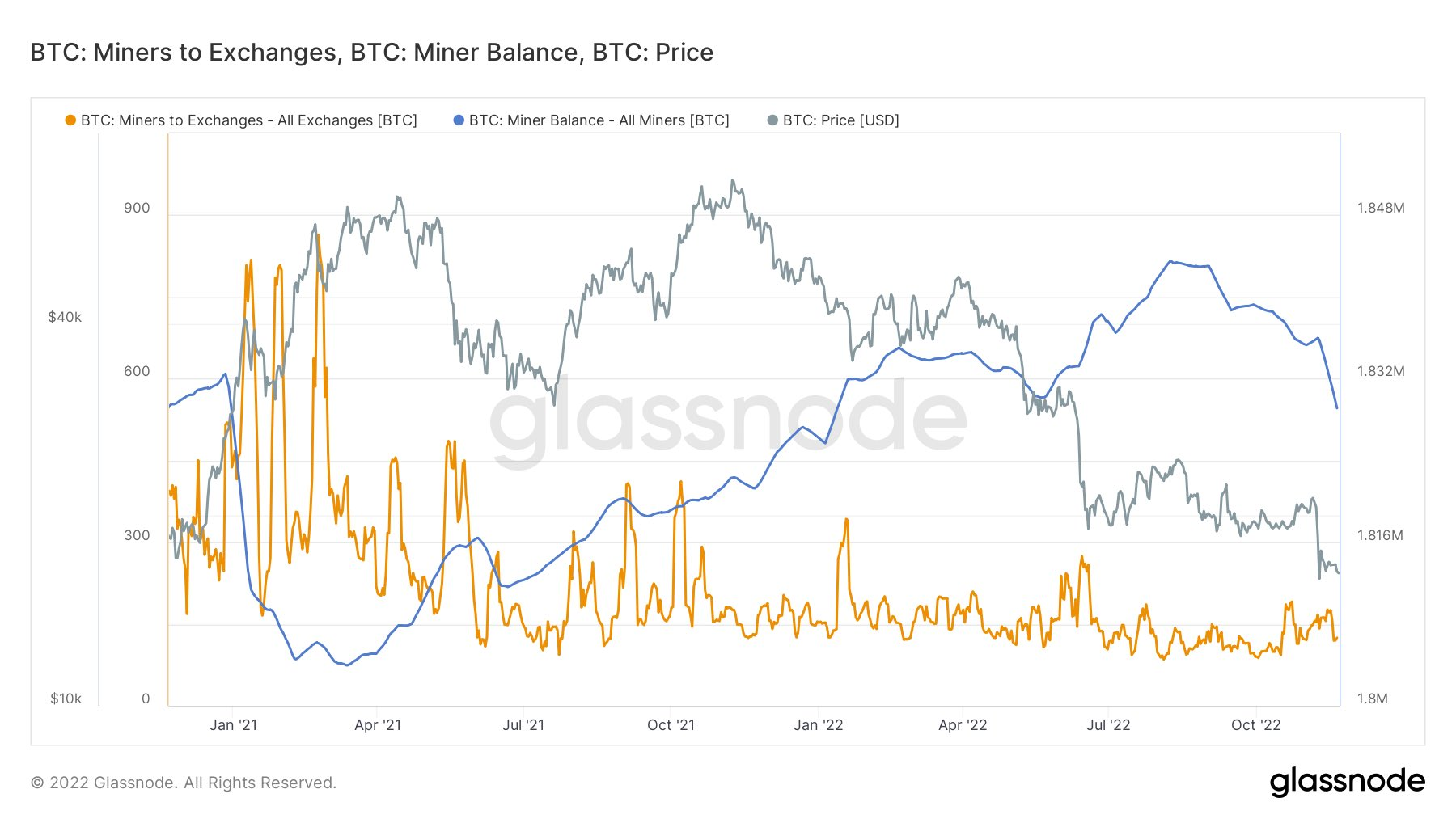

Rough times continue this week in the Bitcoin mining sector. Now they are selling their reserves of bitcoin at the fastest rate in 7 years!!

It's a Bitcoin miner bloodbath.

— Charles Edwards (@caprioleio) November 21, 2022

Most aggressive miner selling in almost 7 years now.

Up 400% in just 3 weeks!

If price doesn't go up soon, we are going to see a lot of Bitcoin miners out of business. pic.twitter.com/4ePh0TIPmZ

Here is that chart zoomed in... The blue at the bottom shows Miner Sell Pressure.

However, when we look at where the Bitcoin is going, we see it leaving miners but not going to exchanges. It must be being sold OTC to large buyers accumulating.

Don't forget, if miners are selling bitcoin now at the lows, they will likely restock on the run up too, adding extra fuel the coming bull market.

Conspiracy theory time... If FTX was a set up to cause a leverage unwind, the attackers could have easily planned to scoop up cheap OTC bitcoin from miners or the companies dumping to stay solvent. This means that large entities like governments or central banks might be secretly stacking bitcoin.

Difficulty and Hash Rate

Mining hash rate has remained constant despite the financial conditions of miners. There are rumors and theories still circulating about the possibility of a secret miner coming into to the space. I have seen no evidence of this at all really. The newest generation of miners that were purchased up to a year ago, are being delivered. They can replace older miners to run more cheaply. Therefore, miners could decrease their energy cost for the same hash rate.

Mempool

The mempool has returned back to normal after last week's massive spike in traffic, the highest since miners were kicked from China.

Zooming in (below) we notice the first spike back in May, peaked on May 13th, and was resolved by May 17th, corresponding to the breaking of support at $30k. This time, the huge spike corresponded to the breaking of support of $17k.

Lightning Network

New apps continue being enhanced by Bitcoin's Lightning Network. Unlike altcoins, the Lightning Network uses bitcoin as the money unit. Bitcoin's are exchanged in a secured, off-network protocol at lightning speed. This can be added to many different applications like BLIP.

The new app, yet to be publicly released, leverages Hexum, a proprietary multilayer encryption method, also created by the team behind BLIP, that promises a more secure communication than popular end-to-end (E2E) encrypted apps.

Muyshondt explained two other key differences between BLIP and the now-popular E2E apps setup: everything goes through Lightning and a phone number is not required.

This means it does not use the typical server model of other services. It leverages the Lightning Network infrastructure of nodes and addresses, as well as the PoW of bitcoin to send unstoppable messages. Send an uncensorable message for a sat ($0.00016).

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

November 21, 2022 | Issue #218 | Block 764,180 | Disclaimer

* Price change since last week's report