Bitcoin Fundamentals Report #212

Celsius client list, PayPal's woke mistake, Bitcoin relative performance, Price analysis including CPI and GDP effects, Mining sector and LN.

Jump to: Market Roundup / Price analysis / Mining sector / Lightning Network

In Case You Missed It...

- (Fed Watch) Federal Reserve vs UN and OPEC - FedWatch 115

- (Fed Watch Clips) New home of full Fed Watch videos. Multiple new this week!

- (Members) Five live streams this week uploaded to the Member Drive!

Join my Telegram Channel for all-day updates on bitcoin and macro!

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Very stable |

| Media sentiment | Very negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Trying to start rally |

Bitcoin Headlines

As part of Celsius' bankruptcy proceedings, the names of clients and amounts lost were released in public court filings. Yep, someone made a searchable website for the names.

Several bitcoiners are among those names, like Simon Dixon, who I'm surprised was not an insider enough to get his money out. Mine was not, Celsius was an obvious Ponzi scheme like 99.99% of altcoins. "Bitcoin content you can count on."

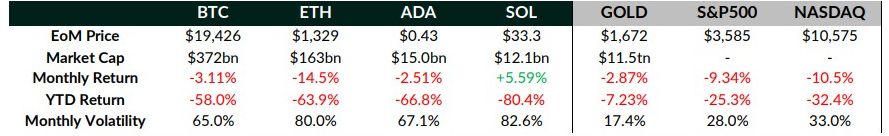

A report from Cryptocompare shows returns for several assets for September and the year. Bitcoin showed very good resilience over the month, posting a loss but a smaller loss than the S&P 500 or NASDAQ. Of course, it is still down much more over the entire year, but a stronger month could signal decoupling or a reversal is near.

Bitcoin also has become less volatile than the Dow Jones for the first time. This is a narrative/confidence win for bitcoin, as it slowly moves from a hyper-speculative asset to a Gold 2.0. However, it doesn't have a bullish correlation. The last time bitcoin's volatility was very close to the Dow Jones, in April of this year, it was right before the drop from $30k to $20k.

The Fed finally did it, they broke the market:

— zerohedge (@zerohedge) October 7, 2022

the dow jones (30 largest industrial stocks on planet earth) is officially more volatile than bitcoin pic.twitter.com/BfveiMYZy2

PayPal is not a competitor to Bitcoin. PayPal is a form of payment, while bitcoin is the medium of exchange used in payments.

They were going to try to steal up to $2,500 from clients for "misinformation" and "hate", basically wrong think. They were caught and viral outrage spread.

PayPal is a relatively woke company, obviously, but they are what they are. They've had a mixed past with Bitcoin, first getting involved through the subsidiary Braintree years ago, and most recently by allowing customers to buy bitcoin through their app.

I can't hate too badly on PayPal, they aren't that important. If anything, it shows how weak these effort really are, since they instantly rescinded the policy. This also gives us the perfect opportunity to speak about bitcoin to receptive ears.

Macro headlines

At a meeting of the Russian Security Council meeting on Monday, President Putin said that Moscow’s campaign of massed air and missile strikes against Ukraine were a response not only to the attack on the Crimean Bridge, but a long list of other terrorist actions by Kiev in recent months targeting Russian infrastructure and even Ukraine’s own cities and people.

This is a huge change in the way Russia is prosecuting this war. What was striking to me, after watching a video of a couple bombings this morning, is that there was zero anti-aircraft guns, zero surface to air missiles, zero air defense over KIEV!? I'm not sure exactly what is going on, but Russia has, for some reason, been holding back so far on this war. They could have bombed these cities unopposed for months.

I think winter is approaching and perhaps Russia is going to step their effort up, making the next couple of months key for negotiation.

Price Analysis

| Weekly price* | $19,241 (-$329, 1.7%) |

| Market cap | $0.369 trillion |

| Satoshis/$1 USD | 5,196 |

| 1 finney (1/10,000 btc) | $1.92 |

Daily chart

I spoke on my live stream this morning about bear market consolidations, specifically that they can be either in price or in time. In other words, the massive sell-off that people are expecting in bitcoin down to $12k or so, can be avoided by continuing sideways for a lot longer. That is, IF there is going to be more bear market to go.

This consolidation has taken a lot out of me and other holders. We did not experience the massive 20x gains of previous bull markets, which has made thids period feel much longer.

The market will not make it easy to time the largest returns, and won't make gains an obvious trade. This is the period where holders earn their generational wealth. Buying and selling, trying and most failing to time the tops and bottoms, is not the way to generational wealth, buying and holding when no one else does is the way to play that game.

Of course, if you feel uncomfortable with bitcoin's price action, whether it goes down from here or sideways for another year, it is likely you are over invested for your personal risk tolerance.

Weekly Chart

The last two weeks, I've shown the first ever weekly bullish divergence in bitcoin's history. This week, I'd like to bring in another indicator, the TD Sequential. This is a time-based indicator that measures the time in a trend. The count proceeds to a green or red 9 as long as candles continue in the trend (closing in trend according to the candle 4 before.

For example, you can see we are on a weekly red 9. It will stay a red 9 as long as it closes below the closing price of candle 5, AKA staying in the trend of the candle 4 prior.

A number 9 tends to signal the the momentum is running out simply based on timing the psychology of the market. We tend to see a correction or a reversal after a number 9.

This makes two strong weekly indicators signaling reversal, bullish divergence and TD Sequential.

Headwinds and Tailwinds

Stock Market

The stock market in the US is doing better than the headlines and FinTwit would have you believe. The bottom from September 30th has held today nicely and the market is only down ever-so-slightly since June.

The market sentiment, however, is still acting as a headwind for bitcoin. Everyone and their mother is talking about the upcoming crash. I'd be very careful being on the side of a trade that 95% of people agree with.

One still must be slightly bearish here, based on the chart and the sentiment, however,

CPI This Week

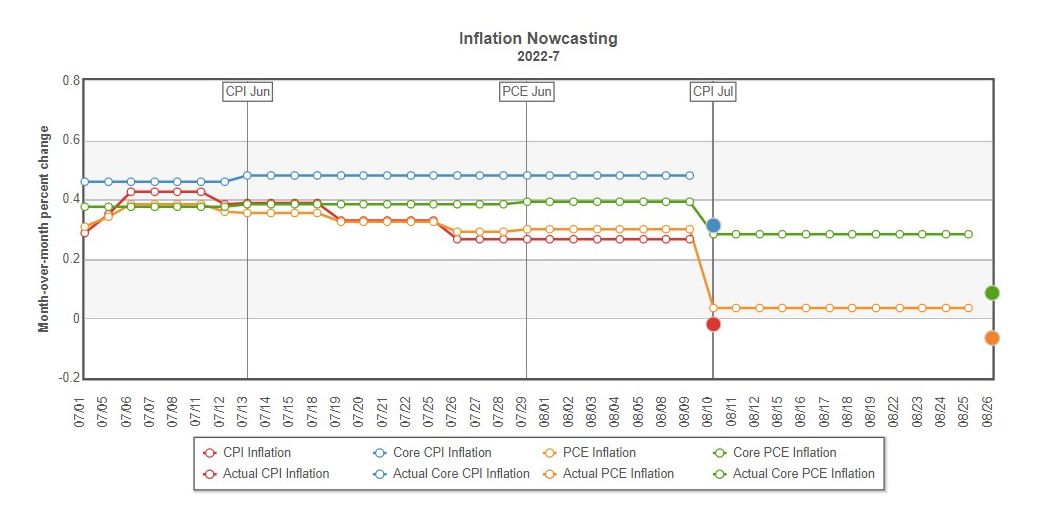

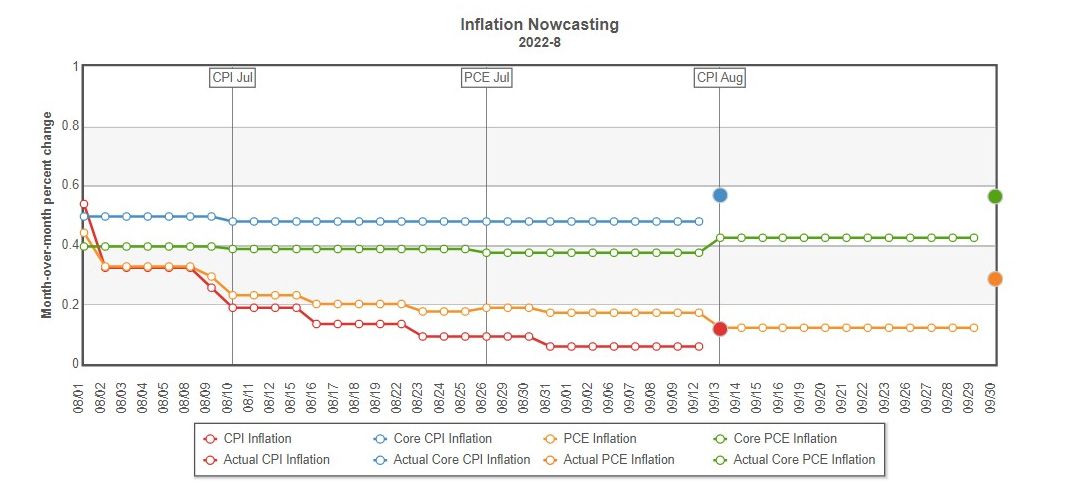

CPI will be released on Thursday this week, and then we are only 2 weeks away from the next FOMC rate hike.

Inflation Nowcast has the expected M/M CPI for September at 0.32%. The Fed's Inflation Nowcast was quite accurate in August, but missed in July by +0.27% on the M/M number. I don't have a strong feeling on this month, but I do think it will come in below the nowcast somewhat.

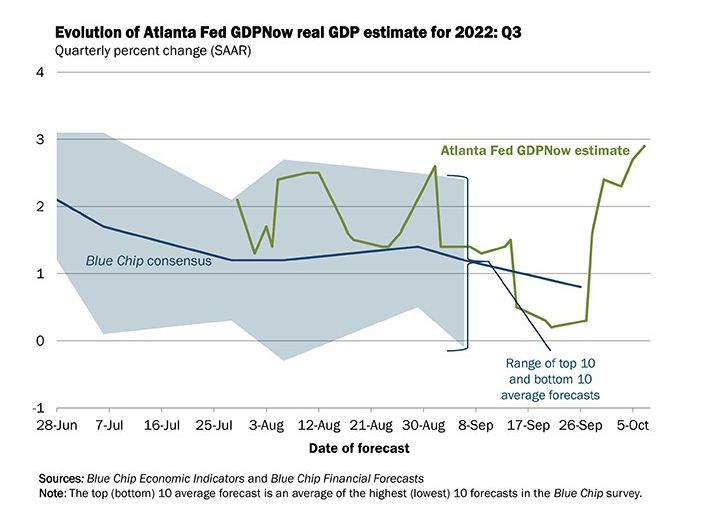

GDP Now

The Fed's GDPNow estimate rallied hard this week, up to nearly 3% (annualized) for Q3 2022. This is a big deal, because it is showing the US "inflation" is falling faster than nominal GDP, and that the coming recession may turn out to be shallower than many fear.

Price Conclusion

Summarizing...

The weekly chart has some strength, and bitcoin's relatively strong performance versus stocks in September, could be a sign the bottom will hold.

The stock market is bearish, but is only slightly lower than the June low and could be considered a double bottom it holds. I maintain that the bearish sentiment in the US market is overblown and a reversal is closer than most expect.

CPI and GDP estimates for Sept and Q3 respectively, are showing some signs of improvement, depending on your view. With these metrics looking okay, the Fed will likely not change course voluntarily.

While I do not believe the Fed matters mechanically to the market, it does massively effect market sentiment and behavior. But since these effects are not mechanical, the psychological effect of the Fed's policy eventually runs into extremes and must reverse. Things cannot go against other natural forces forever. I think we are close to that extreme.

Overall, the risk of a lower low this week increases, but I still expect support to maintain strong. There are few sellers left in this market and excessive leverage from altcoin Ponzis has been corrected. Therefore, any sell-off will likely not be able to turn into a cascading crash.

We have until late October for the squeeze of the chart pattern to force a choice, up or down. Perhaps we go sideways all the way until then.

Mining

| Previous difficulty adjustment | +13.5528% |

| Next estimated adjustment | +8% in ~13 days |

| Mempool | 2 MB |

| Fees for next block (sats/byte) | $0.05 (2 s/vb) |

| Median fee (finneys) | $0.03 (0.016) |

Mining News

The sluggish bitcoin price and increasing competition among miners is adding stress to another public bitcoin miner is having some trouble.

More pain for public bitcoin miners.

— Dylan LeClair 🟠 (@DylanLeClair_) October 7, 2022

Argo Blockchain $ARKB shares plummeted -23.26% today as the company announced plans to sell 3,400 ASICs and raise an additional £24 million via equity financing with a strategic investor. pic.twitter.com/w6TZSg3zuA

Difficulty and Hash Rate

Hash rate continues to climb, despite price remaining low. On this chart of hash rate vs price, the red arrow in 2020 shows a similar behavior of the hash rate during a period of volatility and price collapse. In 2020, the hash rate was very solid, signaling that the fundamentals had not changed and the price crash would be temporary.

The same dynamic is apparent recently. Price is extremely depressed yet hash rate is continuing higher.

This is also despite competition pushing down miner profitability. The chart below shows miner revenue is down to just $19 million/day. That is the size of the pie that all the mining firms are fighting over each day. You can see why this period is seeing the marginal miner, or the inefficient miner going out of business or selling some of its equipment to more well-run firms.

Lightning Network

The Bitcoin Lightning Network reached a milestone capacity of 5,000 BTC ($96 million). In effect, more and more Bitcoin is being introduced to Lightning Network payment channels worldwide, as Bitcoiners continue to support the growth of the network.

The growth of the lightning continues to surge, this week surpassing 5000 bitcoins in network capacity.

It is no doubt that use of the lightning network is steadily growing each month, but the new protocol called Taro could also be a big reason for the recent surge in capacity.

Taro is a new protocol that can be used with Lightning to mint stablecoins and send them over the lightning network. Pretty slick.

Taro alone is not a speculative token minter, but it probably does excite other businesses to experiment with the new protocol to start businesses or expand customer offerings. Overall, Taro provides some hype to LN that could be represented in the surge of capacity.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 3, 2022 | Issue #211 | Block 756,923 | Disclaimer

* Price change since last week's report