Bitcoin Fundamentals Report #192

This week, El Salvador bitcoin assembly versus Davos, massive price analysis section, a new bitcoin mining research piece by Cambridge, and altcoin clown world.

This week... El Salvador bitcoin assembly versus Davos, massive price analysis section, a new bitcoin mining research piece by Cambridge, and altcoin clown world.

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

- (Fed Watch) Maximum Pain for Globalists ft. Tom Luongo - FED 93

- (Bitcoin & Markets) Biggest mistake Boomers make about Bitcoin, Confuse it with Crypto - E242

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to put in bottom |

| Media sentiment | Very negative |

| Network traffic | Back to normal |

| Mining industry | Equity struggles, mining stable |

| Market cycle timing | Capitulation |

San Salvador Assembly

My title for what is taking place in El Salvador this week is the San Salvador Assembly. In my opinion, this meeting is the most consequential event since the legal tender announcement in El Salvador. It will not result in immediate adoption of bitcoin as legal tender in multiple countries, but it will begin that process. All data is pointing in just that direction. Perhaps, within a year from now, we see the massive fruit of that labor.

Late Sunday night, El Salvador President Nayib Bukele announced on Twitter that 32 central banks and 12 financial authorities from 44 countries are to meet on Monday, May 16, to discuss financial inclusion, digital economy, banking the unbanked, El Salvador’s Bitcoin rollout and its benefits in the country.

The timing is also extremely interesting. Next week, the annual meeting of the WEF happens in Davos. It would be awesome if the San Salvador Assembly turned into a rival meeting every year at this time, marking a true bottom up shift away from globalist cabal.

Davos Next Week

If you're reading this newsletter, you probably know that Davos is the yearly meeting of the WEF, bringing together all the financial leaders of the world to a small city in Switzerland. While many central banks met in El Salvador this week, the enemies of the El Salvador policy are meeting in Davos.

"Davos" is what I like to call the globalist Marxists that have taken over Western countries, from the US democrats/neocons false divide, to pro-EU/anti-democratic leaders in Europe, and most ruling councils of international bodies. This is the modern elite class of royalty if you will, and we are in a revolutionary time.

Anyway, Davos is happening next week and I'm sure that El Salvador and bitcoin will be a topic. The Davos crowd is smitten with Central Bank Digital Currencies (CBDCs), so I'm sure we'll hear something about that. Davos see them as a way to offer what bitcoin can, as far as digital tokens and payments go, yet still give the elites total control.

Also, Europe is rapidly pursuing a CBDC because they do not want to lose market share for the Euro to US dollar stablecoins. As of April 7th, according to The Block, US dollar stablecoins amounted to $180 billion, while Euro-based stablecoins were less than 1% of that. USD stablecoins accounted for 99.37% of the market.

Coming out of Davos, I expect some commentary bashing dollar stablecoins (thanks to Terra) and news on a "digital Euro"/ CBDC plan. Many things are aligning against the Euro and the EU right now, and they desperately need a narrative to counter the strong dollar, USD stablecoins, and Bitcoin's San Salvador Assembly.

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $29,250 (-$825, -2.7%) |

| Market cap | $0.558 trillion |

| Satoshis/$1 USD | 3,412 |

| 1 finney (1/10,000 btc) | $2.93 |

Bitcoin Daily Chart

This week I have dueling charts, bearish and bullish. Of course, readers of this newsletter will know that I'm a perpetual bitcoin bull, however, there have been periods in the past where I was bearish. For example, August 2019 I turned bearish due to a weekly bearish divergence, resulting in a mini-bear market into the end of that year, and in January 2021 I turned bearish because of the exponential move and subsequent pull back. In the latter period, price did not get to my $24k target, but it is surprising that we are at almost the same levels today, that we were back then.

Bearish chart

As you can see above on the weekly chart with volume profile, price slashed through the massive bulge in volume thanks to the Terra dump. This means that area should now act as heavy resistance. Also, on that chart, you can see the record 8 red weekly candles in a row.

There were several bear runs in 2014 that approached this red candle record, but had minor green weeks embedded in them. The 8-week run of red candles is a record but not a huge deal IMO.

Bullish chart

This is a busy chart, I know. What you are seeing on the top panel with the price candles are vertical lines showing divergences on the daily chart. The red vertical lines are bearish, and the green are bullish. There have been 3 bullish divergences in relatively quick succession recently.

Also above, I have TD sequential turned on. That is the small numbers above and below the candles. This indicator is time based. The count continues in the trend as long as the closing price is in the trend 5 candles later, in this case 5 days later. When there is a sting of 9 candles in a trend, you print a reversal 9. That signals, at least, a consolidation period, but often a reversal.

Still on the above chart, the Red 9 lands on the candle after the low, and since then the red 9 has acted as support. So, we have a Red 9 corresponding to a bullish divergence, on oversold RSI, and it has acted as support. We also have a daily MACD crossing bullish.

Chart pattern

Here, I am simply showing the consolidation pattern at the bottom. Technically, this is a bear flag, but it can also be a reversal pattern. If price can push through $31.3k this pattern should be considered broken to the upside.

I do not expect any fireworks on the weekend, but it is possible. Therefore, I predict price to continue in this pattern until futures markets open on Sunday, or even stock market open on Monday.

CME gaps

I'll offer one more chart for your consideration. It is a common concept in the world of trading called filling the gaps. In other words, the price returns to those previous levels where price jumped, and fills in the missing structure. These gaps appear because of the off hours of exchanges. The next trading day, a price can open differently than it closed. If it is a big move, the gaps can be quite large.

On the bitcoin futures chart, we see that all gaps in the last 18 months or so have been filled. Even on the recent dip to $25,350, the bottom happened to land within a gap on the CME futures. Now, that whole gap did not get filled, but it might be good enough. During the recent sell off, a gap opened up between ~$34,400 and $35,400.

Additional note: that gap is also the area on the chart with the most structural resistance. So, it would make sense for the price to return to there in the near future to test resistance and fill the gap.

Market Bottom Sentiment is Shared

I'm still standing by my call that this is not a prolonged bear market for bitcoin or US stocks.

I have to point out that during the Terra/Luna implosion, they dumped $3 billion in bitcoin on the market in a very short period. It is very likely the reason for almost all the bearish pressure below $40k.

If you go back several years, that amount dumped on the market would have crashed the price much worse than it did last week. Bitcoin has grown much more resilient and liquid in those few years.

It is unlikely that another source of $3 billion in bitcoin could be dumped in the coming weeks, so if the price is to drop hard, where is all that bitcoin going to come from?

Bullish Reversal Idea Catching On

The sentiment that we are at least ready for a significant bear market rally is starting to creep into several famous analysts' outlooks. The above article points out:

The fundamental implications, if he’s correct, would be that the inflationary drivers of energy and commodities are peaking, which would put less pressure on inflation.

This is exactly what I've been saying for months.

Price Conclusion

I expect a steady recovery for the next 4-8 weeks. [...] In a major update to my prediction for the bitcoin price, I now do not see us challenging $46k until late-July. And the soonest we will bump up on the ATH is October. We could be shaping up for a replay of 2020.

Issue #191

I cannot rule out lower lows, but bitcoin is already historically oversold, on a historic bearish run of 8 weeks, bearish sentiment is overwhelming, stocks are oversold, and recession is taming CPI. We are bottoming. The market will not allow bears pick up cheap coins, I predict most people waiting at $29k to buy lower will miss this opportunity and FOMO in at $40k.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +4.8892% |

| Next estimated adjustment | -2.75% in ~4 days |

| Mempool | 2 MB |

| Fees for next block (sats/byte) | $0.64 (16 s/b) |

| Median fee (finneys) | $0.30 (0.102) |

Mining News

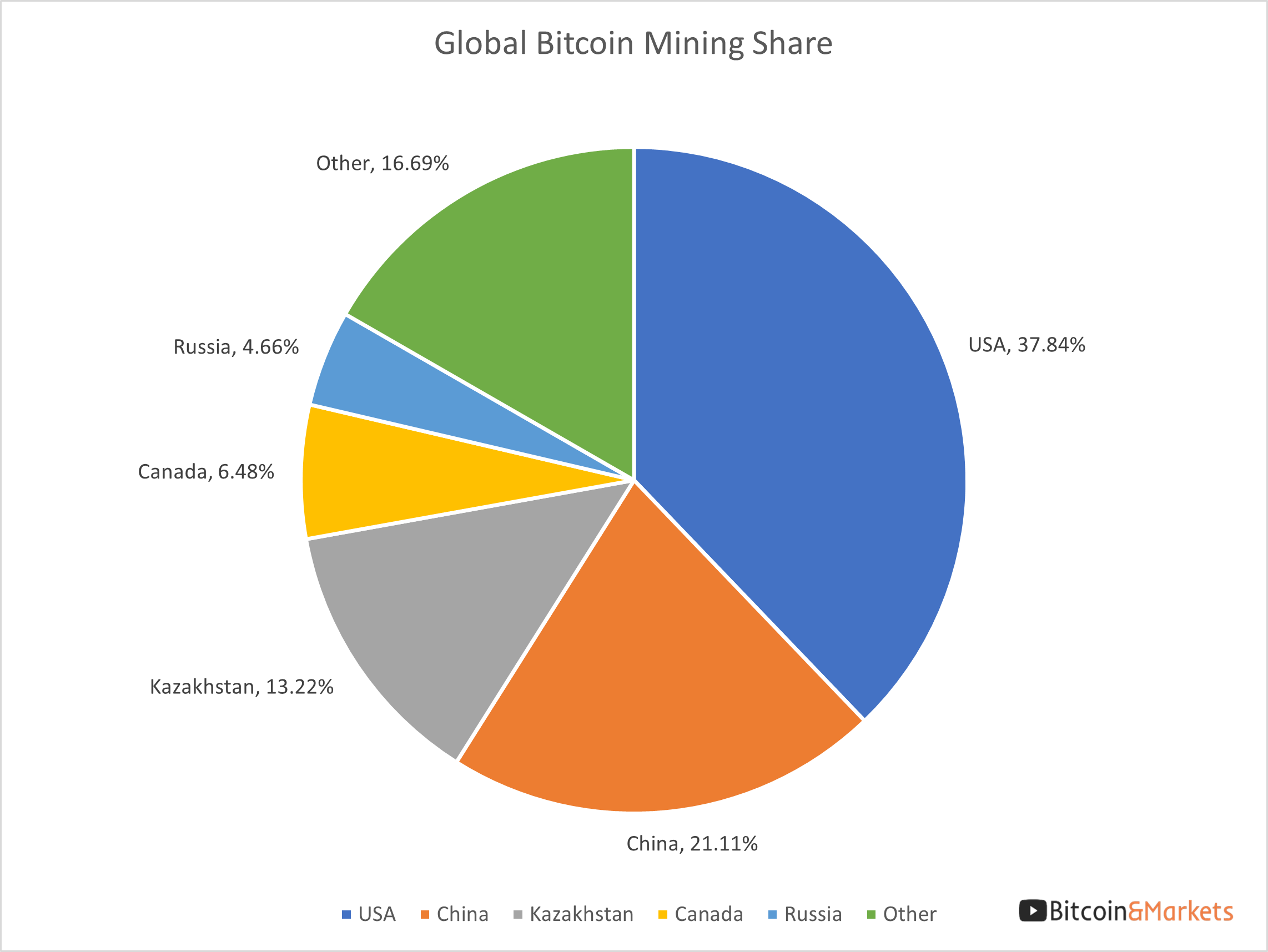

This was the big story this week. It appears that bitcoin mining in China is once again increasing according to a new Cambridge Research piece.

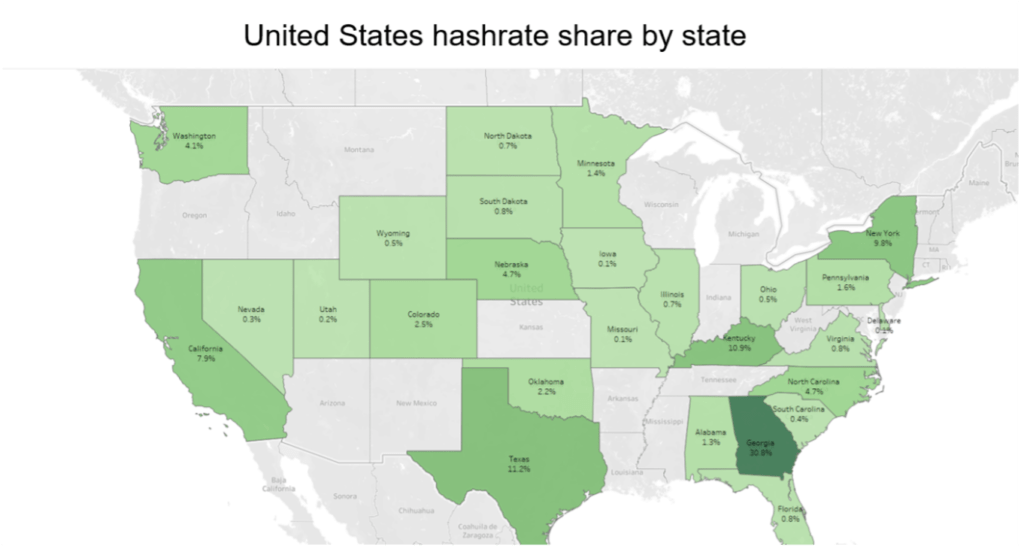

An interesting graphic they included was a map of US bitcoin mining by State. There are some surprises for me personally, like California, Kentucky, and Virginia.

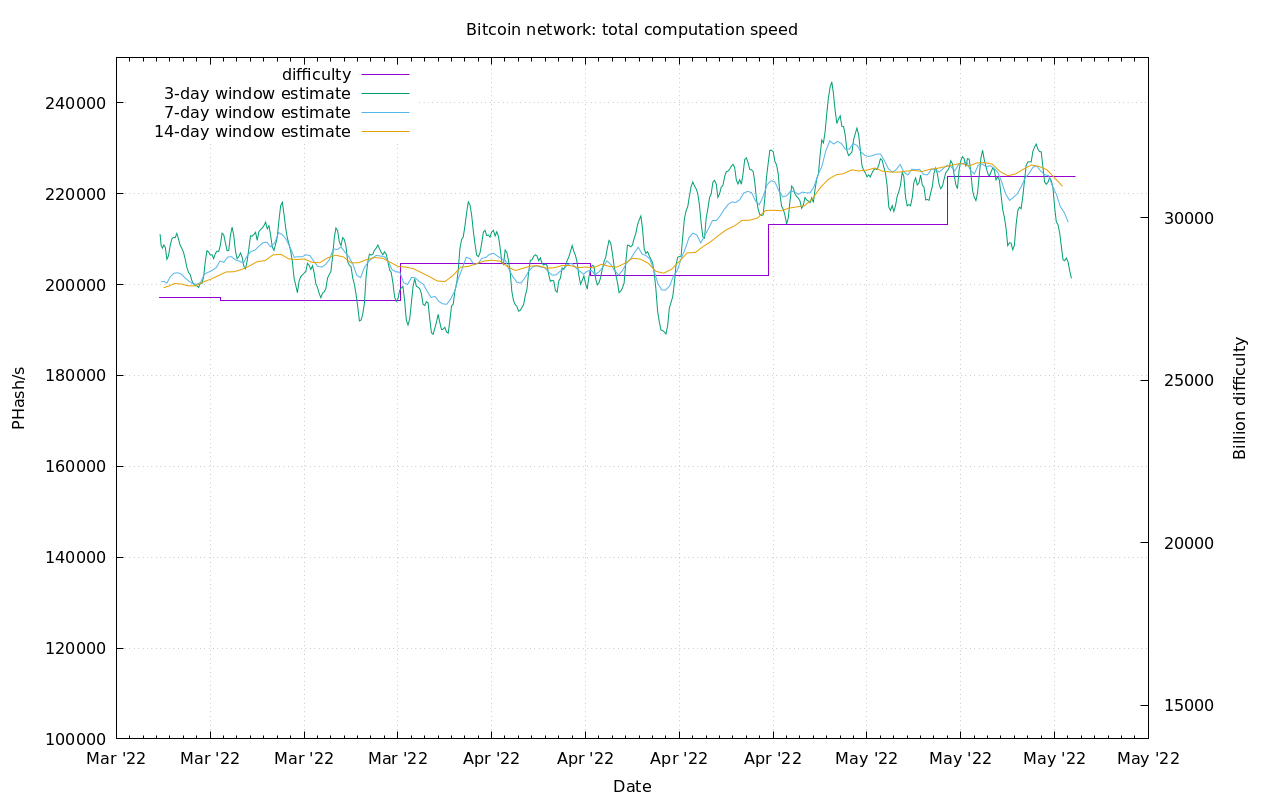

Difficulty and Hash Rate

Hash rate has pulled back a bit in reflexive response to the price decline probably. This will becoming a bearish sign after a few negative difficulty adjustments. But, right now, that would be unexpected.

Mempool

Huge recovery on the mempool. The last week has shown the bitcoin network to be very resilient. It handled the huge dump of transactions within a few days, no problem. And fees didn't move up that far either.

Macro

I will be publishing a Macro Update post later today or early tomorrow. Stay tuned and make sure you are subscribed. I'll cover the dollar, US Treasury yields, oil and gas prices, and commodities prices.

Altcoins / CBDCs

Ethereum insiders publicly praying for success

This flashed across my twitter feed this week, it is Vitalik seemingly making some sort of confession or prayer about his internal conflicts he feels about Ethereum.

Thread: some still open contradictions in my thoughts and my values, that I have been thinking about but still don't feel like I've fully resolved.

— vitalik.eth (@VitalikButerin) May 17, 2022

But it wasn't only Vitalik, Peter, the top Ethereum dev for the Geth protocol, also has somewhat of a confessional tweet thread this week. I'm unable to find it now, perhaps it was deleted, but I took a screenshot of some of it below.

Sounds like they are praying for some kind of miracle. #ETH pic.twitter.com/Ll19eawF6M

— Ansel Lindner (@AnselLindner) May 18, 2022

I think Ethereum folks are scared and starting to doubt their own creation. We won't be that lucky to see it collapse immediately, but it might run into massive trouble soon. It's important to be aware of this because a collapse of Eth could mean more temporary downside for bitcoin.

🤦♂️ Terra Luna to Relaunch??

In yet another example of the infinite stupidity of people, Terra Luna is trying to relaunch. To accomplish this they will fork the network and start over.

1/ Terra governance prop #1623 to rename the existing network Terra Classic, LUNA Classic ($LUNC), and rebirth a new Terra blockchain & LUNA ($LUNA) is now live.

— Do Kwon 🌕 (@stablekwon) May 18, 2022

Vote here: https://t.co/ZlGxNCUTMa https://t.co/plj0guJwao

Archived because The Block is a ponzi-dealer

Ripple lawsuit update

The SEC, which sued Ripple in 2020 for failing to register $1.4 billion worth of XRP as securities, has refused to release emails related to a 2018 speech by former director William Hinman in which he argued the ether cryptocurrency was not a security.

I remember clearly when this speech happened. It was interpreted by eth boys as an official statement when it clearly was Hinman speaking in a personal capacity. I do not personally see why this is important to Ripple's case.

Ripple is being sued by the SEC as an unregistered security, which it definitely is. If there is one altcoin that is a security it is Ripple. However, they are very well capitalized and have been fighting tooth and nail with the SEC.

A couple years ago, I remember thinking that this was the case with which the SEC is trying to make an update to the Howey Test for altcoins. It still seems to be that way.

Many altcoiners who do not understand money or bitcoin, cling to the hope that this case will end in Ripple's favor and give a big boost to altcoins. Keep dreaming guys. Ripple is a security along with all other altcoins, because they were issued by a central party with the expectations of gains. Pretty clear cut.

The SEC also recently claimed it was underfunded to take on the huge criminal space of altcoins. I think it is a definite possibility that this Ripple case as precedent, along with stablecoin regulation, could be a way for the SEC to reduce their burden by 90%.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

May 20, 2022 | Issue #192 | Block 737,215 | Disclaimer

Cover image: @bradmillscan

* Price change since last week's report