Bitcoin Fundamentals Report #176

Putin opposes bitcoin ban likes bitcoin mining, Biden to sign executive order on bitcoin rules, Powell hawkish presser, bitcoin price analysis, bitcoin mining news, and ETH 2.0 canceled.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Putin opposes bitcoin ban likes bitcoin mining, Biden to sign executive order on bitcoin rules, Powell hawkish presser, bitcoin price analysis, bitcoin mining news, and ETH 2.0 canceled.

In Case You Missed It...

- (Podcast) Jeff Snider: The Monetary System is Changing, Yield Curves, and Bitcoin - FED 78

- (Blog) Macro Chart Rundown - 25 Jan 2022

- (Twitter Spaces) Joined an Inflation vs Deflation debate

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Bottoming, look for breakout |

| Media sentiment | Negative |

| Network traffic | Off the floor |

| Mining industry | Booming |

| Market cycle timing | Middle of 4-year cycle |

Hello dear reader,

It has been an eventful week for bitcoin. Price bounced but remains closer to the bottom than a breakout. Today is the end-of-month for billions of dollars in futures and options, so I expect some action into close and immediately after. Biden and Putin both make comments about bitcoin.

Action was also happening in the legacy markets. Chairman Powell spoke after the FOMC meeting and reinforced his tight policy stance, bearish sentiment is spreading in stocks, Russia and Ukraine is still a threat, and many countries are coming to their senses about mandates.

Let's hit this week's top stories and fundamental developments...

Putin Opposes Russian Ban, Supports Bitcoin Mining

Last week I wrote about the proposed bitcoin ban from the Russian Central Bank. Well, that was followed this week by Putin opposing that ban, and instead flipping 180 degrees, supporting the promotion of bitcoin mining in Russia.

Via Bitcoin Magazine:

Putin on a Wednesday meeting with government officials acknowledged the central bank’s position but highlighted that Russia had some “competitive advantages” to mining bitcoin, given its “power surplus and well-trained manpower,” according to a translated version of a statement from the Kremlin.

Executive Order on Bitcoin is Coming

News of an upcoming executive order was reported on widely this week. The Biden administration is putting together some requirements of all government agencies that could be signed as early as February.

A keen person on twitter after hearing of this regulation, commented, "So they aren't going to ban it."

The anonymous sources of the report said, "the late-stage draft of the executive order details economic, regulatory and national security challenges posed by cryptocurrencies. It would call for reports from various agencies due in the second half of 2022."

That doesn't sound like regulation on citizens, more of an information gathering directive, or rules for executive agency outlining how bitcoin is to be treated. Overall, it might be seen initially as a negative, but it is going to be a huge positive in the long run. Remember, several months ago during the deliberations for new "cryptocurrency" language, the administration was the source of a bitcoin carve out. I don't think they are keen on losing out to other countries if they ban it.

Powell Speaks

After this week's FOMC meeting, Chairman Powell made his traditional press conference. As I watched it, I couldn't help but compare him to former Fed Chairs, like Yellen. Every time Yellen speaks it feels as if she is lying. Powell, on the other hand, strikes me as much more open.

The main takeaways of the press conference is that Powell thinks they could start raising the Fed Funds rate as early as the March meeting and that the labor market is very robust, and can, as of now, handle the tightening policy no problem. Markets have generally reacted negatively, though the stock market did not immediately sell off.

Labor Shortage vs Wage Shortage

Powell's cover for taper and raising rates is the tight labor market. There are currently more job openings than unemployed. His framework interprets this as the necessary condition for rising wages. Companies will be forced to bid higher for labor, driving wages up. The Fed has a long history of getting the employment picture wrong.

They mix up cause and affect. What is leading to the high number of job openings? It's not growth. How are companies supposed to pay higher wages? There is no such thing as a persistent labor shortage. When you hear that phrase, you should think: no, they aren't paying people enough. If a company has a job opening, but can't afford a high enough wage to attract a worker, it's not a labor shortage, it's a wage shortage.

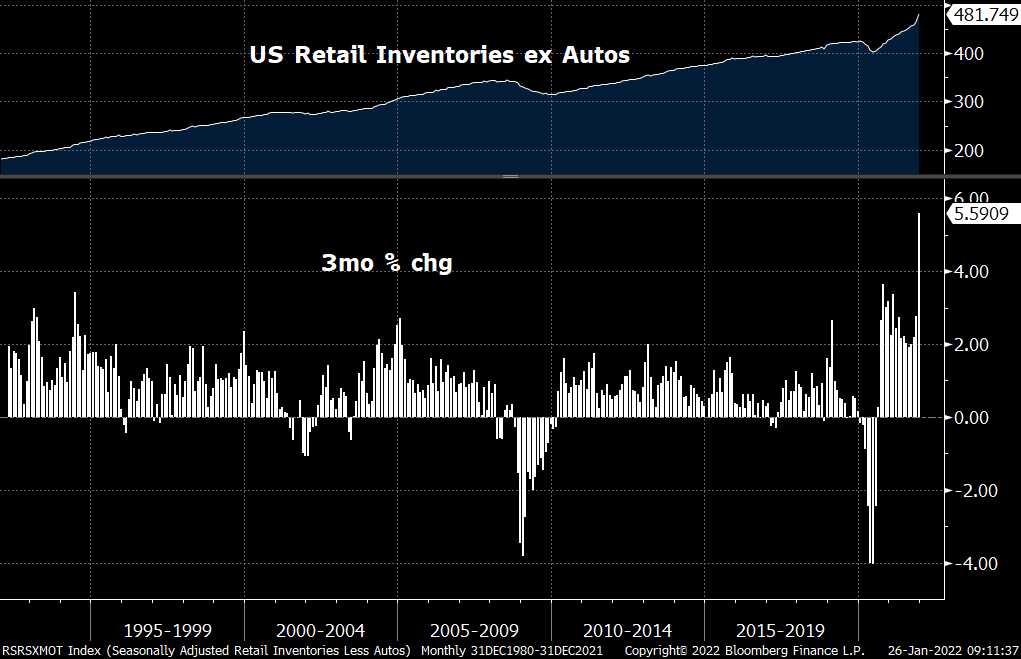

Powell views the labor shortage as inevitably leading to higher wages and price inflation. In fact, the wage shortage is going to lead to fewer jobs and falling consumer demand. This is also happening as inventories in the US are skyrocketing!

There are many implications to this inventory build. 1) Retailers will be forced to cut prices to get rid of inventories, 2) US wages will not be able to rise if prices are falling, 3) US orders to the rest of the world will fall off a cliff, right as the dollar is spiking. In summary, it's not looking good for the second half of 2022.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $37,078 (-$1,242, -3.2%) |

| Market cap | $0.699 trillion |

| Satoshis/$1 USD | 2,706 |

| 1 finney (1/10,000 btc) | $3.71 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Bitcoin will prove itself as uncorrelated very soon. The economy is running straight back into a slow patch, but bitcoin fundamentals continue to get better and better. For years, it was common knowledge, and it could be shown, that the bitcoin price was uncorrelated to every other asset class. All of a sudden, over the last year, the narrative has taken hold that bitcoin is correlated with stocks.

Perhaps, this has happened because legacy products, like CME futures and options and ETFs, have become a more important source of demand. It will bite these people in the butt if they treat bitcoin like any ol' speculative play.

Bitcoin will remain uncorrelated to other risk assets in the long term, because it is a fundamentally different value proposition. If anything, bitcoin should be correlated with the value of other monies. Demand for money goes up in a flight to safety, as leverage and credit collapses. Bitcoin, like gold before it, is the premier deleveraging investment. It cannot be diluted, and is no one else's liability.

Bitcoin Daily Chart

Above, I haven't moved my arrows this week, they remain where they were last time. We did dip down to $32.9k, with a bounce back of roughly 50% of the most recent leg down. That is not enough to be confident in this bounce. It all comes down to the next move.

As I mentioned above, there are $2 billion in futures and options contracts expiring today, so there is plenty of fuel for volatility. If price begins dropping here, the next dip is likely to take the price to $30k pretty quickly. However, at this time, price is leaning slightly toward breakout to the upside, with the 1hr chart showing higher lows and repeated pressure on the upper resistance. In that case, the next big resistance will be $40k even, and it will have to make it through the "strong support" area now turned resistance.

It's an up hill battle for the bitcoin price, but it's always darkest just before dawn.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +9.32% |

| Next estimated adjustment | -2% in ~6 days |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.68 (13 s/b) |

| Median fee (finneys) | $0.57 (0.15) |

Mining News

Top Bitcoin Miners Pressed by U.S. Lawmakers to Detail Climate Impact, Power Consumption

Globalist mouthpieces in the US Congress, like "Pocahontas" Warren, sent letters to bitcoin miners asking for information about there energy consumption and affect on local electricity prices.

This is a witch hunt promoted by the Davos globalists against bitcoin. The don't want bitcoin as competition, instead they want to clear the way for Central Bank Digital Currencies. They are losing.

I don't think Warren can even understand the nuanced arguments behind why bitcoin mining is good for the grid, economy and environment. She definitely doesn't want to.

Valkyrie Applies to List Bitcoin Miners ETF on Nasdaq

I've been expecting a bitcoin mining ETF for a couple months. Honestly, this is a fairly quick turn around, as most of these companies started trading not long ago.

A bitcoin mining ETF is a no-brainer and will rival the gold miner ETFs within a couple years. Bitcoin mining is so much more profitable than gold mining. These large miners can have 50% profit margins on their bitcoin when mined, and as the price rises over the years, that bitcoin becomes even more valuable.

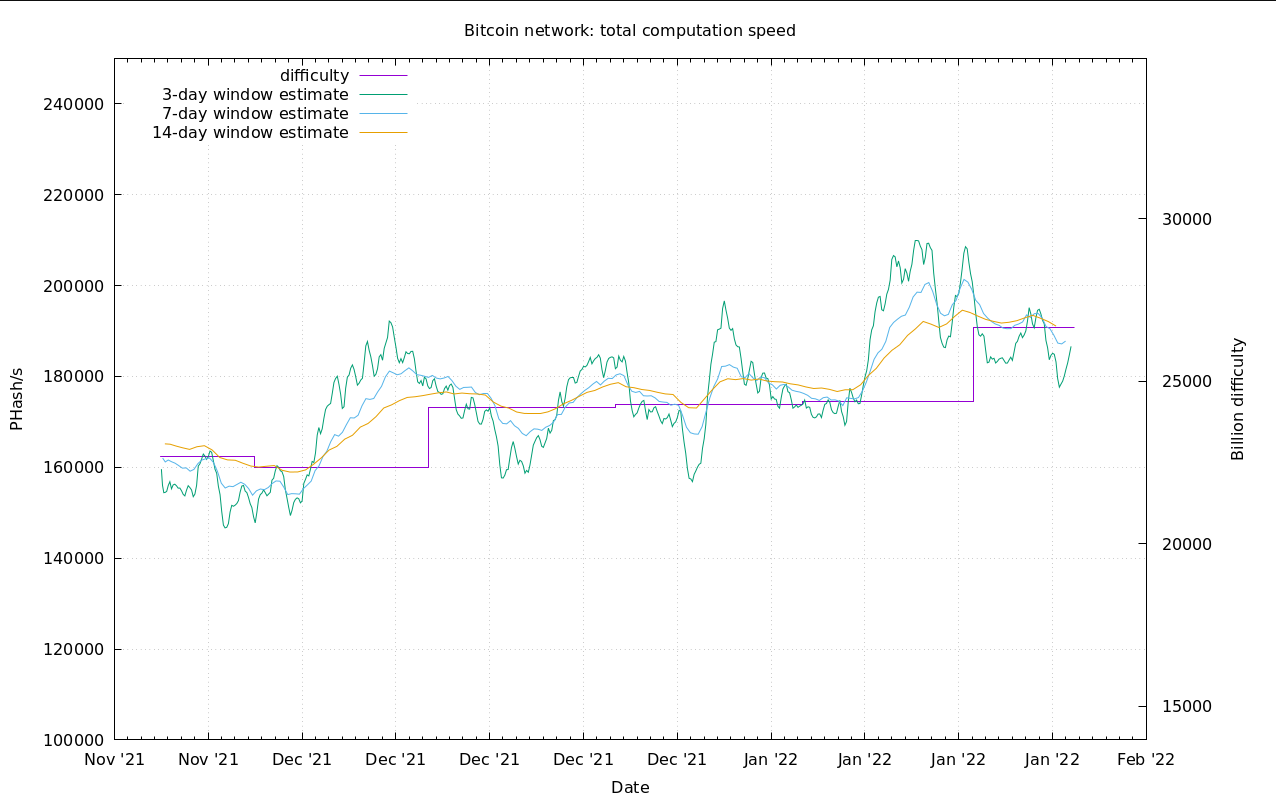

Hash Rate and Difficulty

Quickly to walk you through this chart, the straight lines are the difficulty and the other lines are different moving averages for the hash rate. Hash rate has fallen this week, but with the price bottoming that is to be expected.

At the time of writing hash rate is turning back upward and I expect this week to be a flat difficulty adjustment (+/- 1%). If price starts going up, we could see a larger jump in hash rate.

Altcoins / CBDCs

Ethereum was launched via an Initial Coin Offering (ICO) and promised returns on your initial investment. That is the definition of a security under the Howie Test and SEC rules. Since it was unregistered, it is an illegal security. Time will tell if the SEC will enforce their own rules.

At the launch they also included 70 million coins in the genesis block in a practice known as a "pre-mine", much of it gifted to insiders. Over the years, Vitalik and other insiders have sold coins, at or near cycle tops.

$ETH

— Edward Morra (@edwardmorra_btc) January 21, 2022

Friendly reminder that ETH foundation cashed out at the top (again). ETH down 40+% since then pic.twitter.com/Bp80hEDvK0

This week, the Ethereum Foundation, the centralized single point of failure for Ethereum (aka it's not decentralized), officially changed the plans for the new Ethereum network.

ETH 2.0 is never happening as predicted. Another shift in the narrative should be sufficient to keep everybody distracted and enthusiasts confused for another 4 years or so. https://t.co/q10pDEY6rM

— Plan Marcus ☣️⚡️ (@plan_marcus) January 25, 2022

The rebrand reflects the fact that what's been called Ethereum 2.0 is really more of a network upgrade rather than a whole new network. [...]

Henceforth, Eth1 will be known as the "execution layer" and Eth2 will be the "consensus layer."

But the beacon chain was ready well before other elements of Ethereum 2.0, all of which prompted what the foundation calls "a revival of research initiatives on the proof-of-work chain." Ultimately, developer Danny Ryan posited a way for current Ethereum client software to hasten the move to proof of stake without having to migrate away from the current network.

Nothing really changes in terms of the roadmap. Staking and sharding to ease network congestion are still on the way, the former projected for 2022 and the latter for this year or next.

Notice the goalpost moving. Bitcoiners, including myself, have said all along that Ethereum 2.0 is a pipe-dream. We were right, Ethereum experts were wrong (again), but they can try to claim they are still right because the "plans change guys come on". Well, that is exactly what we said they would have to do and Ethereum folks were too ignorant to realize it then.

I have a suspicion that legal concerns played a part with this as well. ETH2.0 coins are distinct, and swapping ETH1 for ETH2 coins would be a taxable event in the US. Notice the language, "network upgrade rather than a whole new network". Ethereum insiders look like they are attempting to obfuscate that distinction.

In the above quotes, you can see the fraudulent back and forth. One minute their plans didn't work and they make major changes, the next they sooth the market by saying "nothing really changes in terms of the roadmap."

Don't be fooled, this plan too, will have to change, because Proof-of-stake is unworkable on a decentralized network. PoS is a much older idea than Bitcoin's Proof-of-work. It didn't work back then necessitating the move to PoW. Now charlatans are trying to say they can do it this time.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 28, 2022 | Issue #176 | Block 720,795 | Disclaimer

Meme by: @BitcoinMagazine

* Price change since last week's issue