Bitcoin Fundamentals Report #173

A personal note, predictions for 2022, Kazakhstan commentary, quick price analysis, mining news, and update on NFT stats.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... A personal note, predictions for 2022, Kazakhstan commentary, quick price analysis, mining news, and update on NFT stats.

In Case You Missed It...

- (Podcast) Big Trends of 2021 and 2022 - FED 76

- (Podcast) What's happening in Europe - FED 75

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

- (Blog) Bitcoin Pulse #122 - from right before Xmas

- (Social) I'm now on GETTR. Find me @AnselLindner like on twitter

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Do-or-die support level |

| Media sentiment | Distracted |

| Network traffic | Stable but low |

| Mining industry | Tense due to political risk |

| Market cycle timing | Beginning new 18-month cycle? |

Hello dear reader,

We are back after a two week hiatus. In the history of this newsletter, I have never missed a week, in 172 weeks, until now, but for good reason. My father passed unexpectedly just before Christmas, so I needed to take some time to get through that on top of the holidays. He was a successful man, with 4 kids and 12 grandkids, a professional career, 50+ year marriage, and was a life-long saver. He introduced me to sound money, Austrian Economics, and libertarianism.

Thank you for all the support from my bitcoin family during this time.

On to more topical news. Let's dive in to this week's happenings.

El Salvador President Nayib Bukele 2022 Predictions

This week, Bukele tweeted his 2022 predictions. Let's walk through them quickly and I'll comment.

2022 predictions on #Bitcoin:

— Nayib Bukele 🇸🇻 (@nayibbukele) January 2, 2022

•Will reach $100k

•2 more countries will adopt it as legal tender

•Will become a major electoral issue in US elections this year

•Bitcoin City will commence construction

•Volcano bonds will be oversubscribed

•Huge surprise at @TheBitcoinConf

1) Will reach $100k - That is a given. I'm still expecting the first half of 2022 to be quite explosive. We have completely broken out of the 4-year cycles, that we have come to expect for bitcoin, and now wait for more data to see what will become the dominate repeating pattern.

Perhaps a shorter cycle, like I have posted about since September.

We could be looking at 18-month cycles, or something similar. The parallels are still uncanny.

2) 2 more countries will adopt as legal tender - We talked about this on the most recent episode of Fed Watch (linked above). Tonga seems to be very close to doing this, but doesn't matter in a market buying pressure sense, but does in a psychological sense.

Other likely candidates IMO are Panama, Ecuador, a Central Asian country (like Kazakhstan's ousted government in exile has made Tether its official currency), or a Western African nation (some have talked about it).

3) Will become a major electoral issue in US elections this year - I'm on the fence about this. There will definitely be talk about it, but it's not going to be a hot partisan issue IMO. Socialists like altcoins and attacking bitcoin's mining, and libertarians like bitcoin. There's not a major group in opposition to the space as a whole, minus a few Davos globalists elite puppets like the laughable Elizabeth "Pocahontas" Warren.

There is much more to fight about than bitcoin.

4) Bitcoin City will commence construction - I'm indifferent about this right now. It's cool but not yet a major jewel we can point to. It definitely won't be completed to any extent in 2022. I don't know the details to be honest, but I wouldn't expect anything built until 2024 or later.

5) Volcano bonds will be oversubscribed - This is very likely. Just like MicroStrategies corporate bond issuance was oversubscribed. It will be the common thing in bitcoin for a while.

Eventually, it will dawn on people that if bitcoin is being used, it means there is growth there. In a world of slow or no growth, where people have to gamble with Wall St Bets on Gamestop, bitcoin offers a great opportunity to get ahead through savings.

6) Huge surprise at Bitcoin 2022 - This is the Bitcoin Magazine conference in April in Miami. IDK if he has a surprise or he thinks someone else will.

Kazakhstan is on Fire

Another one of my predictions is coming true. I've said that with the US pulling out of Afghanistan, Central Asia will quickly devolve into chaos.

I told you central Asia was going to devolve quickly after the US left Afghanistan. Kazakhstan is in flames, and they're just the first. It's going to be very expensive for Russia and China to maintain order.https://t.co/vQqcgZ8vKzhttps://t.co/8KijzNNihz

— Ansel Lindner (@AnselLindner) January 6, 2022

Destabilized countries on your border is a huge expense. Russia now has two. They have their army on the border of Ukraine in a stare-down with NATO and the EU, and now Kazakhstan. Russia has Europe under control, but multiple fronts at once is not smart. They will probably look to get Kazakhstan wrapped up quickly by force.

It didn't take long to light the flame of chaos after the US left. What most people refuse to accept is that threats, destabilization, and war are the normal state of affairs in the world. It is only the leadership of the US, and the international institutions it built, that allowed 99% of the world to be at peace for the last 75 years. Who else is going to spend trillions of dollars to keep the peace? No one. Everyone will be left to deal with their neighbors on their own.

We are stepping into an era where North America and most of South America are the only places where economies will be able to function on a peaceful trade footing. Everywhere else will be under constant threat of the disruption of war.

Kazakhstan won't be the only Central Asian country to destabilize. This whole region is a tinderbox. The "Water Wars" are still a matter of life and death, Kyrgyzstan and Tajikistan had a battle in 2021 over a single water station with dozens killed. Now add to this, a well equipped Taliban on their doorstep in Afghanistan, plus regional power brokers from China and Russia trying to build "One Belt, One Road" (BRI). It is all a recipe for rising violence.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $41,578 (-$4,738, -10.2%) |

| Market cap | $0.788 trillion |

| Satoshis/$1 USD | 2,400 |

| 1 finney (1/10,000 btc) | $4.16 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Last issue's conclusion, so the basic expectation for all of December was:

The most likely scenario is sideways to down for the next week.

Price dropped a little more than I expected but I'd still call that spot on. Bitcoin has just been sluggish and boring. I'll note also, that $40k feels very oversold now. The market is used to $50k bitcoin, time to move to the next level higher.

Lot's of people have seen the Head and Shoulders pattern I overlined on the chart. It is a H&S with a height of 40% of price. If it plays out (almost impossible IMO), that would take price down to $24k.

Bitcoin Daily Chart

We are bouncing once again off the strong support area on daily oversold conditions. Several other indicators are also flashing at least a temporary bounce is incoming. So for this weekend, I expect a recovery up to previous support at $45.5k. For the next week, I expect this support area to hold and price to trickle upward now.

I'll be publishing another Bitcoin Pulse will all my indicators this weekend. So, subscribe to become a paid member to receive that.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +0.31% |

| Next estimated adjustment | +0.34% in ~12 hours |

| Mempool | 10 MB |

| Fees for next block (sats/byte) | $0.35 (6 s/b) |

| Median fee (finneys) | $0.29 (0.07) |

Mining News

Kazakhstan’s deadly protests hit bitcoin, as the world’s second-biggest mining hub shuts down

I wrote about the situation in Kazakhstan above, however, it also made the news because it is home to a significant portion of the bitcoin hash rate. As the government fought violent protests, they shut off the internet in the country. Since that is even possible should tell you all you need to know about the free market there, AKA it's non-existent.

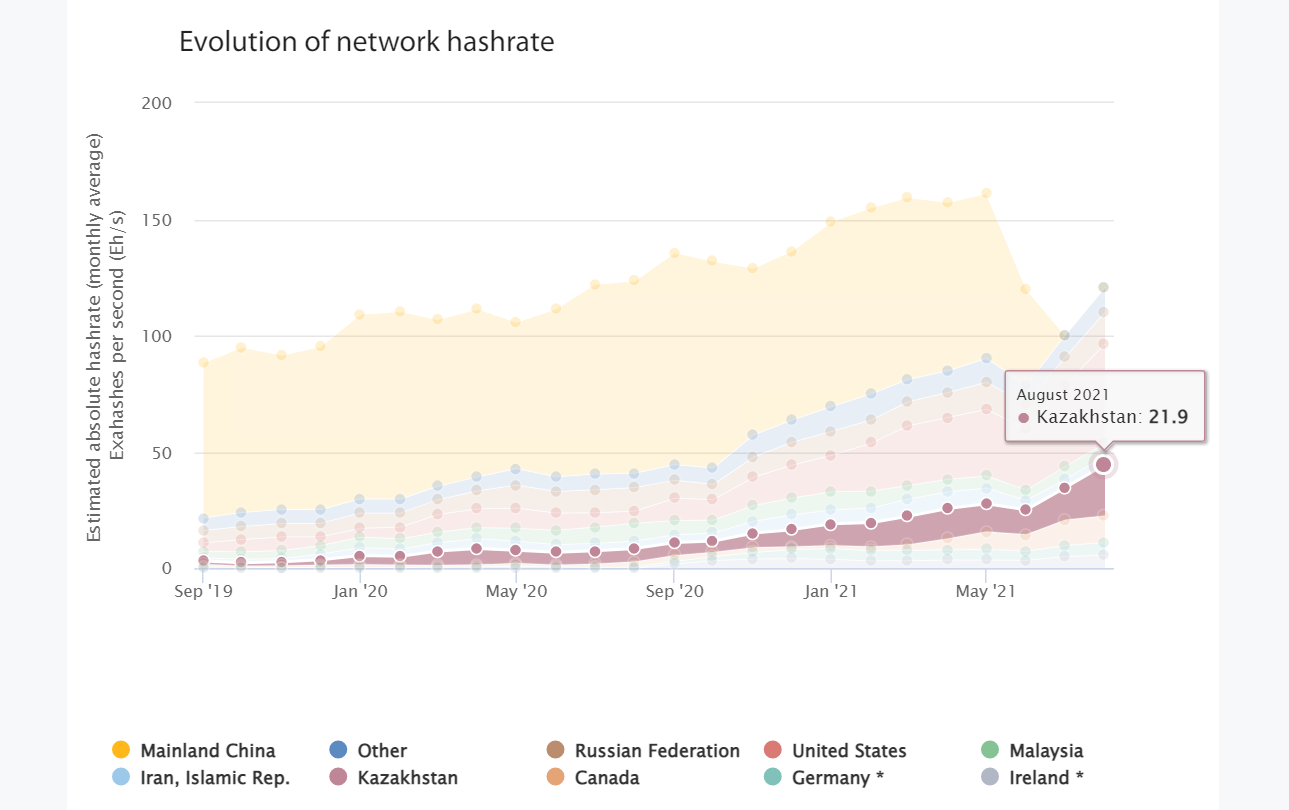

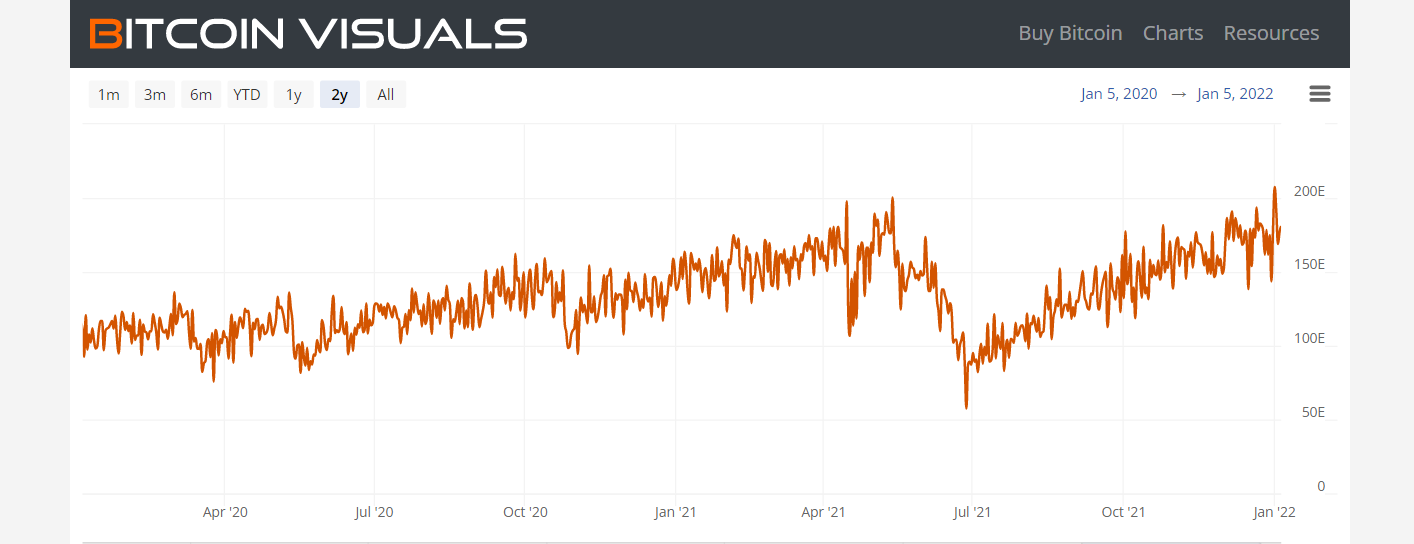

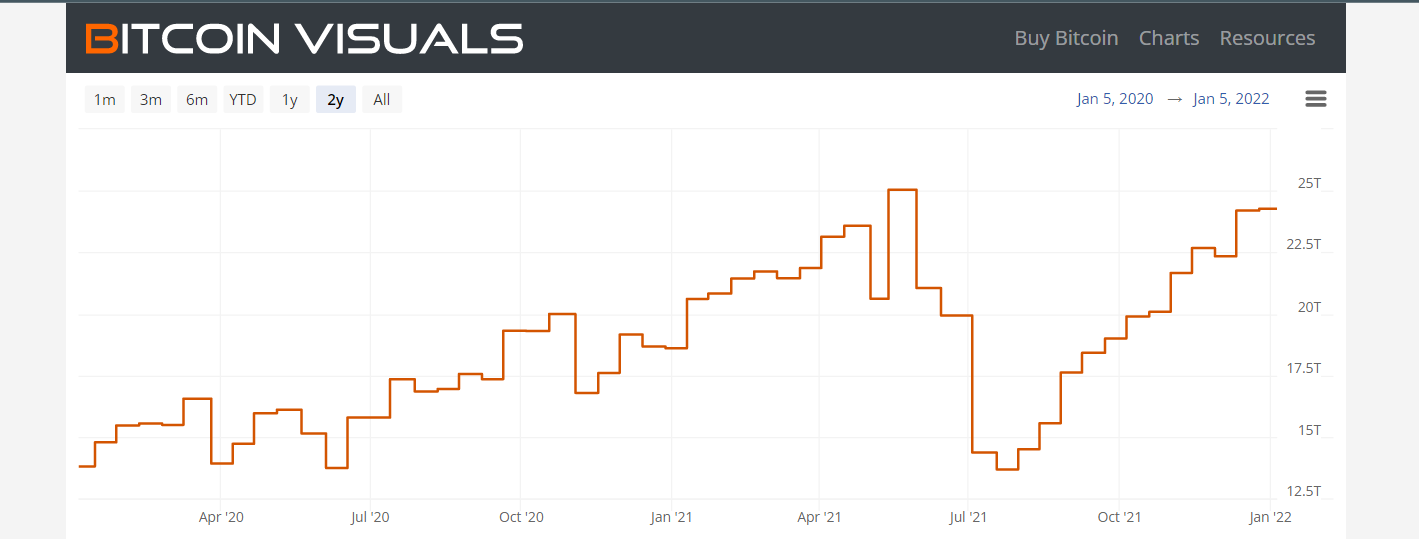

As you can see on the Cambridge bitcoin mining stats, Kazakhstan was estimated at 21% of global hash rate as of August. That has changed since then, with the most commonly cited number at 15%. But as you can see in the hash rate chart two below, the network has brushed it off. Perhaps, miners started moving in weeks prior when they were victim to rolling power cuts.

Some people like Matt Odell have claimed on twitter this is a "state-level attack". It is no such thing. This is general geopolitical and jurisdictional risk. It was not targeted at bitcoin specifically.

Bitcoin mining is being banned in countries across the globe—and threatening the future of crypto

The energy crisis sweeping the world is now being felt by bitcoin miners in many corners of the world. I've already covered Kazakhstan, but also Iran has suffered rolling black outs, Kosovo recently banned bitcoin mining, and Scandinavian countries are looking to ban it because they have bought into the climate change narrative.

All the better for North America IMO. On the latest episode of Fed Watch, I claimed the US will be involved with 50% of all bitcoin mining in coming decades. This all falls under general risk. The response to the energy crisis is to slightly concentrate on bitcoin mining, but the energy crisis itself is not only affecting bitcoin, it is a general event that we all must be ready for. And a predictable one I might add.

Hash Rate and Difficulty

Despite the Kazakhstan internet shutdown, it has only had a marginal effect on hash rate after hitting an ATH.

Difficulty is still on track for a 0.34% increase in 12 hours, following the 0.31% increase last time.

Altcoins / CBDCs

This is a follow up to last issue's discussion on the possibility that NFTs were peaking. It might be another spot on call you only heard here!

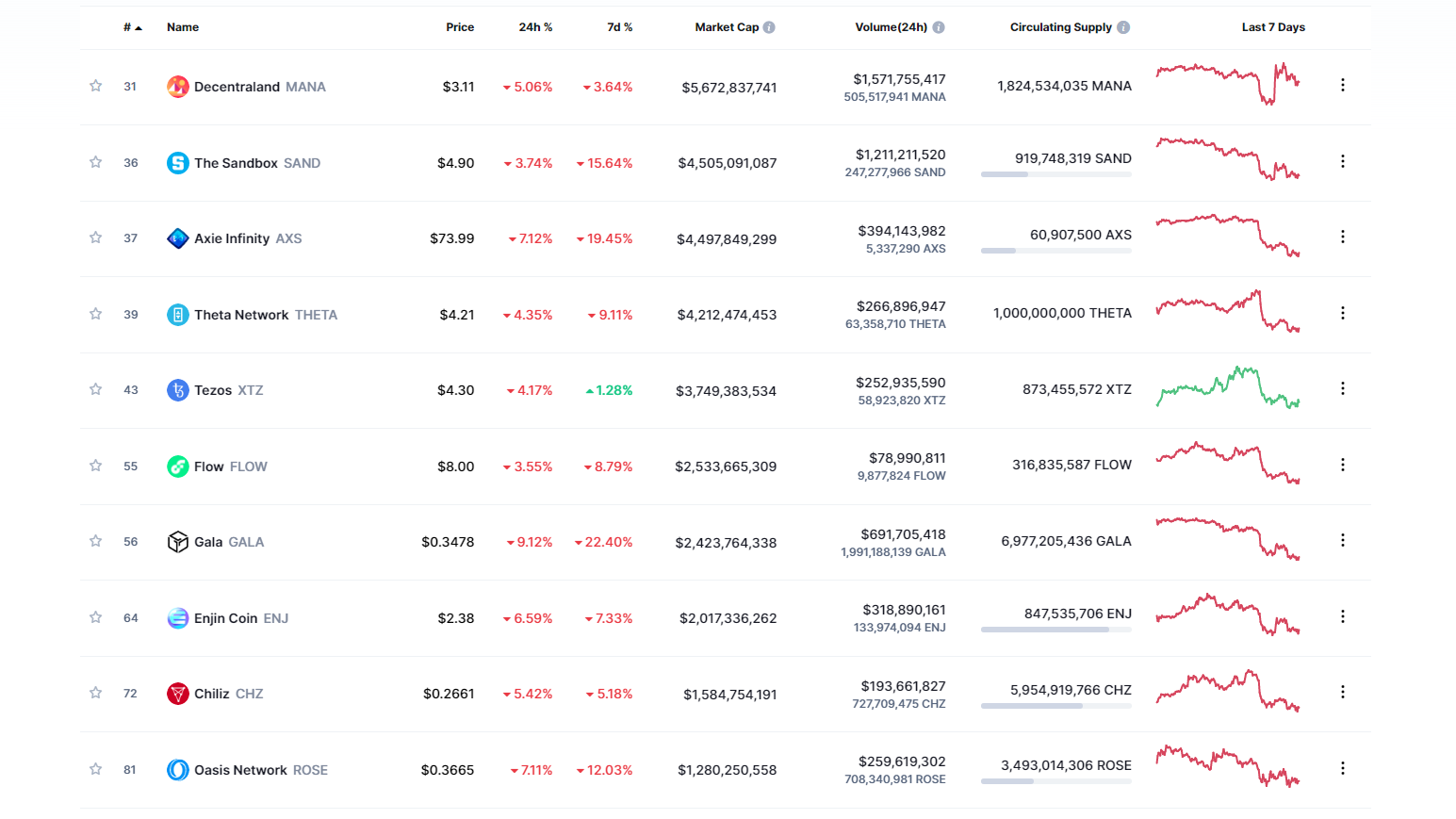

NFT related altcoins are still falling, these are altcoins primarily used on NFT networks. If their prices are crashing, the demand to trade NFTs is waning. To get a better look, go to the page from the image link, click on any of these coins and look at the 3-month chart. They are all bleeding out.

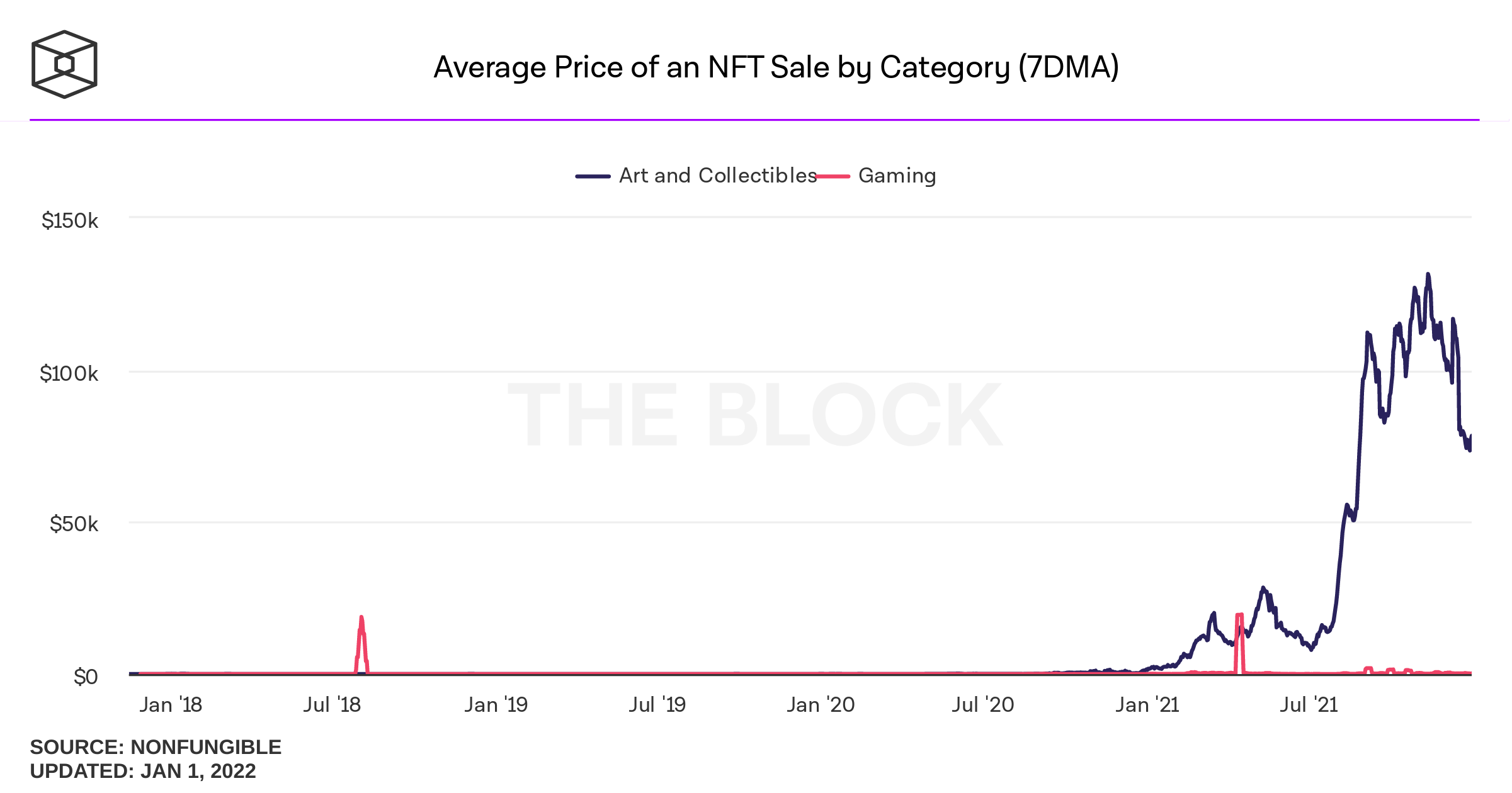

Average sale price has crashed to new lows. (Apologies for the chart scale, they didn't have a 12-month option)

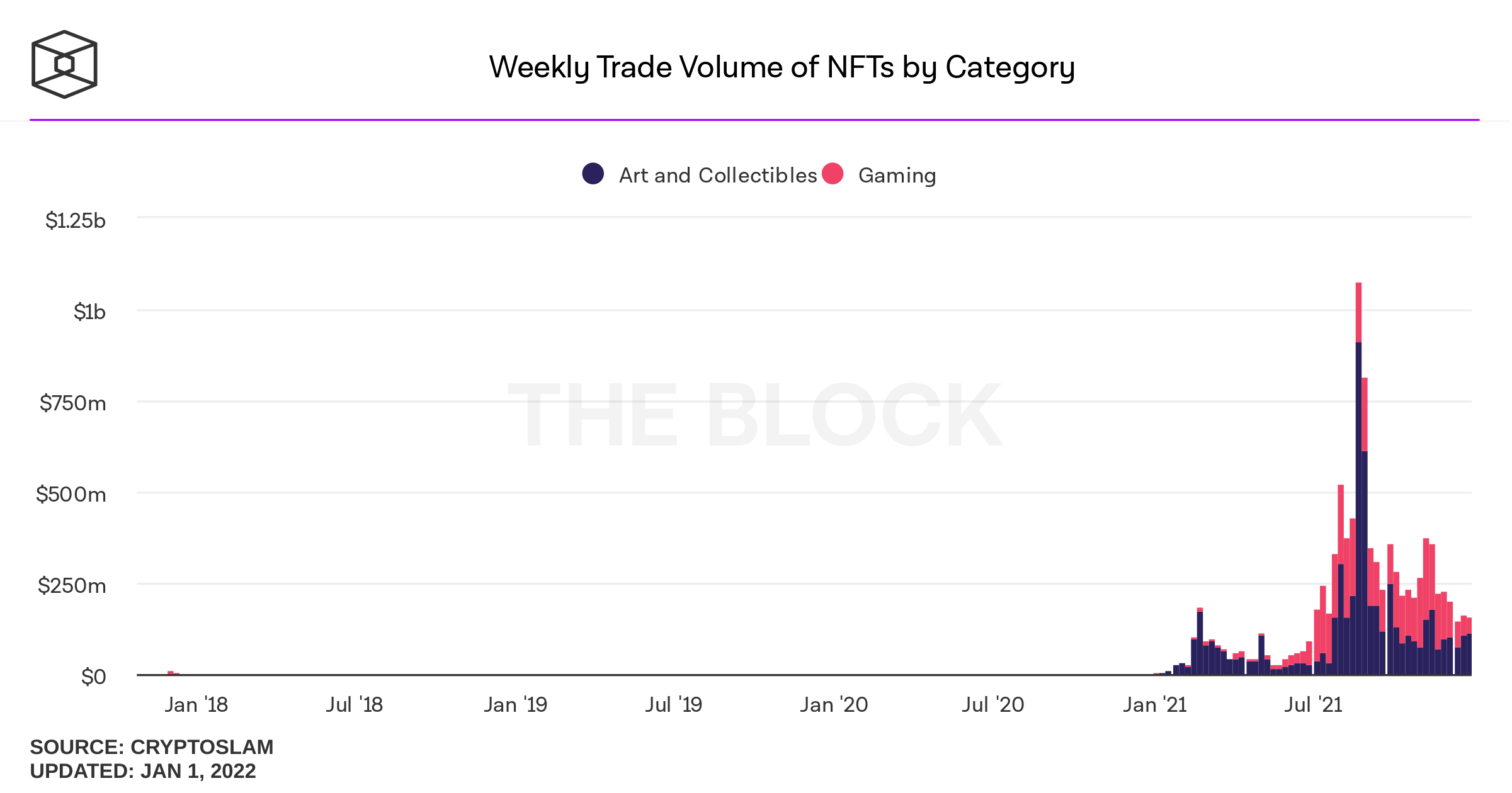

Weekly trade volume hit a new weekly low. From $160 mil the week of last issue to $136 mil currently.

The number of large corporations and famous people getting involved with NFTs is screaming top. In traditional markets, the saying goes, when your cab driver talks to you about an investment the top is near. Well, in the bitcoin industry, when normies and large corps start talking about a trend, the top is near.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 7, 2022 | Issue #173 | Block 717,630 | Disclaimer

Meme by: Unknown

* Price change since last week's issue