Bitcoin Fundamentals Report #170

This week... Dorsey goes all in bitcoin, Saylor wows on Tucker, Fidelity spot ETF, bitcoin price woes, mining attacks by climate zealots, more Defi hacks, #FreeRoss NFTs, and Google Trends.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Dorsey goes all in bitcoin, Saylor wows on Tucker, Fidelity spot ETF, bitcoin price woes, mining attacks by climate zealots, more Defi hacks, #FreeRoss NFTs, and Google Trends.

In Case You Missed It...

- (Podcast) Davos Conspiracy EXPLAINED, Downfall of Euro, Rise of Bitcoin

- (Op-Ed) Understanding the Interest Rate Fallacy: The Risk of Holding Fiat

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Scary consolidation |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Hash rate pause, investment surge |

| Market cycle timing | Second half of bull market |

Hello dear reader,

I will hopefully have some big news to share about my working relationship with Bitcoin Magazine in the next couple of weeks. In the mean time, I'll be continuing with this letter as usual.

This week I'll be posting a Macro Rundown and a Bitcoin Vital Signs. Stay tuned.

Let's dive in to this week's issue.

Slower Week in Bitcoin News

It's about time we had a slower week in bitcoin news. While we are experiencing a little respite here, some big chess pieces are moving around the board. Large whales continue to accumulate, infrastructure is building rapidly,

Bitcoin Supporter Dorsey Quits Twitter, Rebrands Square

Jack Dorsey is a polarizing figure. He is blamed by many for censoring on his platform, Twitter. I wonder if these people realize what Jack brought the world with Twitter, perhaps the most powerful communication tool in human history. He did that, then left. He was subsequently called back to captain the ship again, and now, left for a second time. He built this and stepped away from that ring of power twice.

Dorsey has been an unwavering supporter of free open-source software (FOSS) from the beginning. He is a cypherpunk at heart, but he was unable to make Twitter perfect from within such a highly political machine. Don't let perfect be the enemy of good. We have the most freedom of speech ever in humanity by multiples, thanks in part to Jack.

He's left Twitter and is giving Square his full attention. Immediately, he rebranded it to Block and is hitting the ground running to make a great bitcoin-first company.

MicroStrategy Buys $414 million more in Bitcoin

From Fortune:

The purchase brings MicroStrategy’s total Bitcoin holdings to 121,044 on expenditures of $3.57 billion. Based on the average purchase price of its portfolio, approximately $29,534 per Bitcoin, the company has unrealized gains of nearly $3.4 billion on its cryptocurrency holdings.

LOL, notice the use of "cryptocurrency" at the end. Michael Saylor buys $414 million in bitcoin while saying everything else is garbage, and scammers say "cryptocurrency". It should say "bitcoin holdings" people. Scammers desperately want to ride bitcoin's success by promoting confusion. Altcoins are nothing like bitcoin.

Anyway, back to Michael Saylor. He also went onto Tucker's program on Fox News and blew people's minds with a captivating discussion on money. His message was clear, simple and powerful. Check it out. I queued the video to start at the best part IMO.

Fidelity Launches Spot Bitcoin ETF in Canada

Didn't want to let this tidbit go unreported. Fidelity, one of the largest asset managers, launched a spot bitcoin ETF in Canada because they've been shot down in the US. Fidelity has been a friend of bitcoin for many years now. They are extremely bullish and this is yet another confirmation of that.

This ETF should provide a fair bit of spot buying pressure, and also put pressure on the SEC to pull their heads out of you-know-where and approve a spot bitcoin ETF in the US. This isn't the first bitcoin ETF in Canada, but it the most well-known and largest company to do so.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $52,800 (-$1,239, -2.3%) |

| Market cap | $1.002 trillion |

| Satoshis/$1 USD | 1,895 |

| 1 finney (1/10,000 btc) | $5.28 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Last week's chart:

Today:

I haven't moved the box. The arrow was tracking the price dead on, until the last couple of hours as I write.

Price was rejected several times from the declining read trendline this week. The more price bumps a specific level or trend line, the more likely it is to break. The current dip could be the last fake out before jumping back into the channel. I'm liking this as a BTD opportunity.

The level to watch is $59.4k. If price can get above that green line, it should be in the clear for the next leg higher, perhaps in a big way.

Bonus chart: Bringing back the bonus chart with the 100-day MA and 20-week MA, again. The comparison to September 2020 is still solid. Last week, I said price might continue toward the 20-week but should remain stable in the low-$50k's. I see no reason to change that prediction.

I'll wrap my discussion of the price by saying something I said a year or two ago. During this rally, most price gains will occur in a fairly short window. Unlike 2017, where price kept rising until the blow-off top, this time we'll see most gains restricted to only a couple months a year. I think those couple months are coming soon.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | -1.49% |

| Next estimated adjustment | +2% in ~8 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.54 (7 s/b) |

| Median fee (finneys) | $0.08 (0.015) |

Mining News

Bitcoin miner Griid is going public via a $3.3 billion SPAC deal

Elizabeth Warren Grills New York Bitcoin Miner on Climate

Progressive socialist Senator Elizabeth Warren is going after bitcoin miners. This marks the first time she gone after a specific bitcoin company. Warren represents the global socialists (I've started calling the Davos crowd) who hate bitcoin because it routes around their control. They also attack bitcoin with their favorite control tool, climate change.

Also, notice above the press uses the term "cryptocurrency" in regards to the aggressively bitcoin-only MicroStrategy, but here the negative headline waste time with the same equivocation. It's negative and pointed directly at bitcoin, so they can call it a "bitcoin" miner instead of "cryptocurrency" miner.

I don't deny it is bitcoin mining, we wear it proudly, because all other mining networks are pitiful. It's the framing that exposes the dishonesty. Sen. Warren's letter read in part:

“Given the extraordinarily high energy usage and carbon emissions associated with Bitcoin mining, mining operations at Greenidge and other plants raise concerns about their impacts on the global environment, on local ecosystems, and on consumer electricity costs,"

My response is simple.

1) Bitcoin is the most efficient use of that energy; in other words, we get the most bang for the MW as it were with bitcoin mining. If that power can be used more profitably elsewhere, it would be.

2) Bitcoin mining doesn't have carbon emissions at the mine (warehouse with the machines). Additionally, generators are being put on oil field flares and turning that 100% waste and dirty emissions into bitcoin.

3) Bitcoin mining cuts overall emissions due to slashing banking and finance usage (heat, AC, lighting, employee gasoline, etc etc) making them unnecessary to a large degree.

4) Bitcoin mining stimulates renewables too expensive for other uses.

5) Bitcoin mining stimulates local economies.

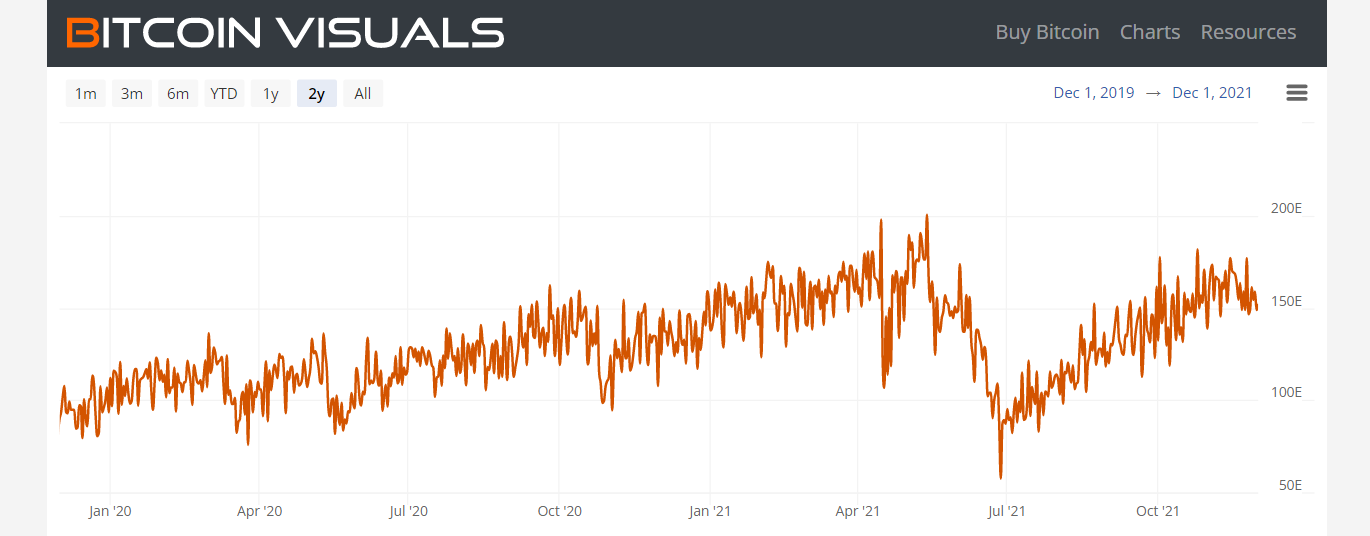

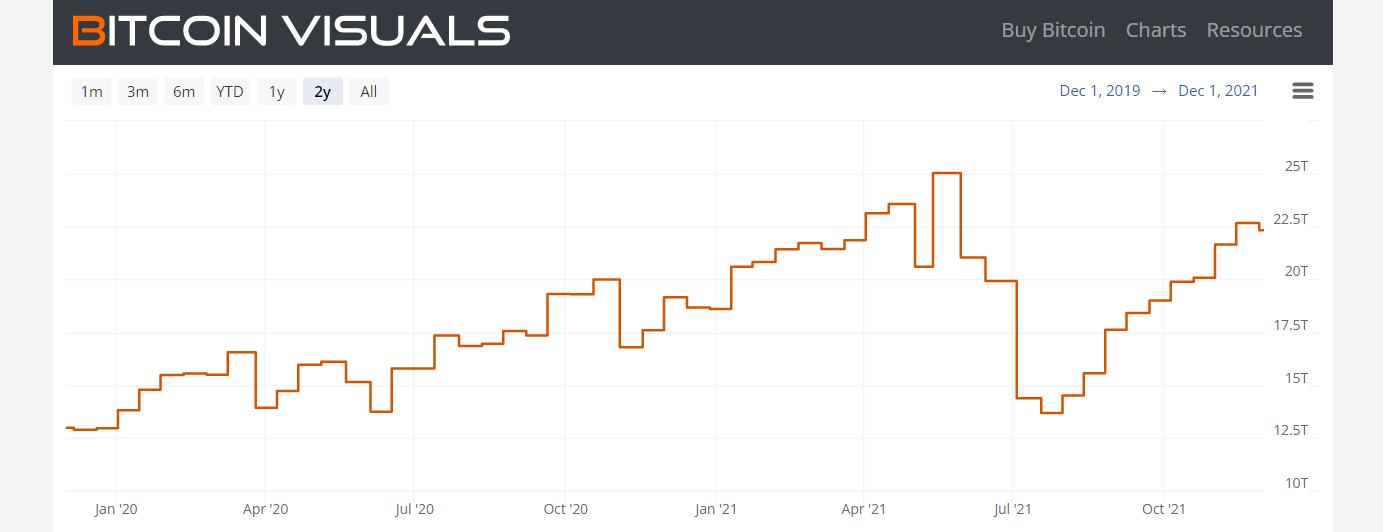

Hash Rate and Difficulty

Hash rate continues to cool off. Nothing worrisome, just the ebbs and flows of the industry.

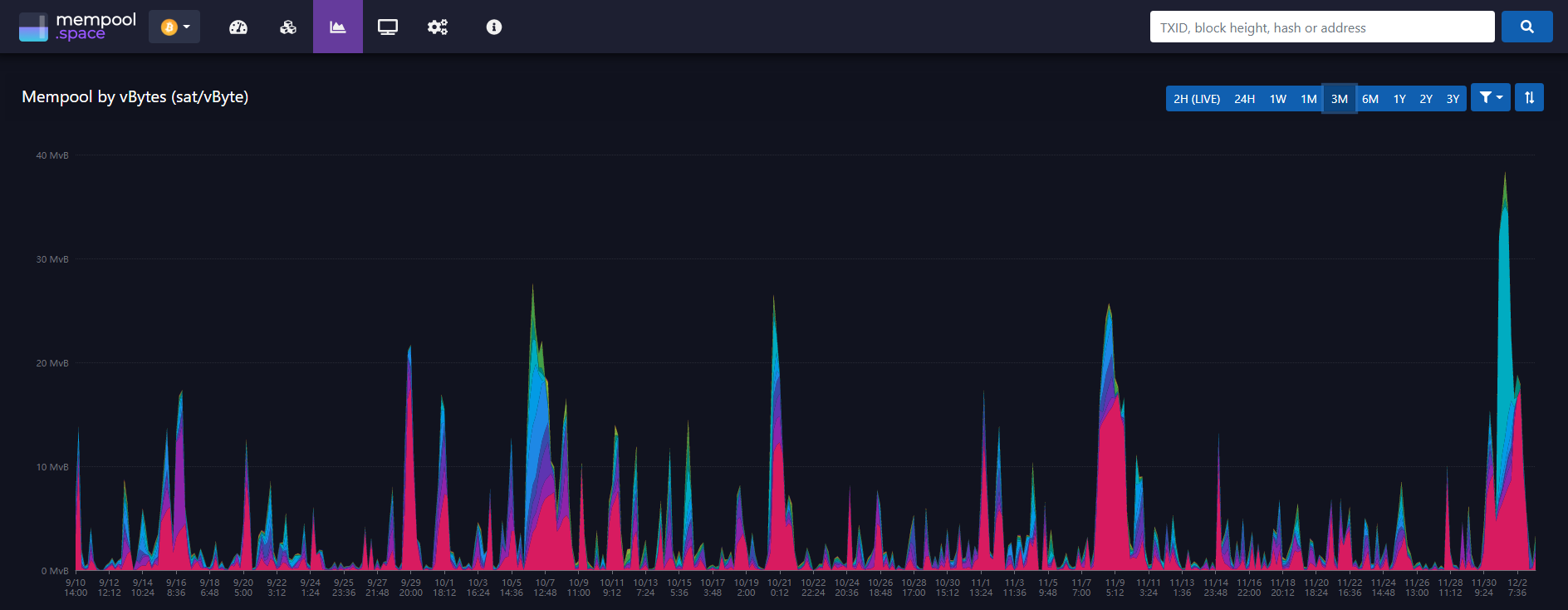

Mempool

The mempool hit its highest level in the last 3 months. The mempool is the size in bytes of all transactions waiting to be confirmed in a block. The mempool is still very empty when compared to other eras in bitcoin history, but there is signs of life.

If you want a break down of the throughput on the network, in both dollar and bitcoin terms, check out last week's issue. Bottom line, value throughput continues to rise, so the mempool is empty because people are using block space more efficiently.

Altcoins / CBDCs

Another DEFI Project Hacked

Badger DAO (Decentralized Autonomous Organization) was hacked this week losing approximately $120 million. A DAO is basically a program that will respond autonomously based on specific inputs. Of course, it doesn't work in practice. It is yet another example of deceitful altcoin marketing.

Badger has received reports of unauthorized withdrawals of user funds.

— ₿adgerDAO 🦡 (@BadgerDAO) December 2, 2021

As Badger engineers investigate this, all smart contracts have been paused to prevent further withdrawals.

Our investigation is ongoing and we will release further information as soon as possible.

What did this autonomous program do when the hack was discovered? That's right, a centralized team paused it and are investigating. Doesn't sound decentralized or autonomous. In fact, it sounds like any other organization and centralized software.

These altcoins will try to blow smoke up your butt and get you to believe, that IF the program runs properly, it will be decentralized and autonomous. Being a DAO is the goal or best case scenario, so they are lying when they call themselves a DAO today.

All software has bugs, and all this "financial" software has developers with skewed incentives to hack the programs themselves and claim ignorance. There is always a chance of an issue, so these DAOs and DeFi projects will always be centralized.

Ross Ulbricht is selling an NFT, #FreeRoss

You know me, I don't think NFTs are particularly interesting in their stated use cases. However, they are highly interesting as a means to launder money or scam people who are not so up-to-speed on the tech. Even the famous Beeple, who sold the world's most expensive art as NFT said, "I have no idea why these things are valuable."

Anyway, this is the only NFT project I have run across that I support 100%. Ross Ulbricht is going to sell a line of NFT art to raise money for his defense. These are an excuse to make a very nice donation to Ross.

Some background so readers are aware, Ross Ulbricht is the convicted owner the Silk Road, a marketplace website where you could find people selling drugs for bitcoin many years ago. He was put behind bars for running a website. He never sold drugs himself. He's a political prisoner, serving 2 consecutive life sentences, and never hurt a single person.

Please check out the fundraiser and donate if you feel so inclined. Thank you.

Miscellaneous

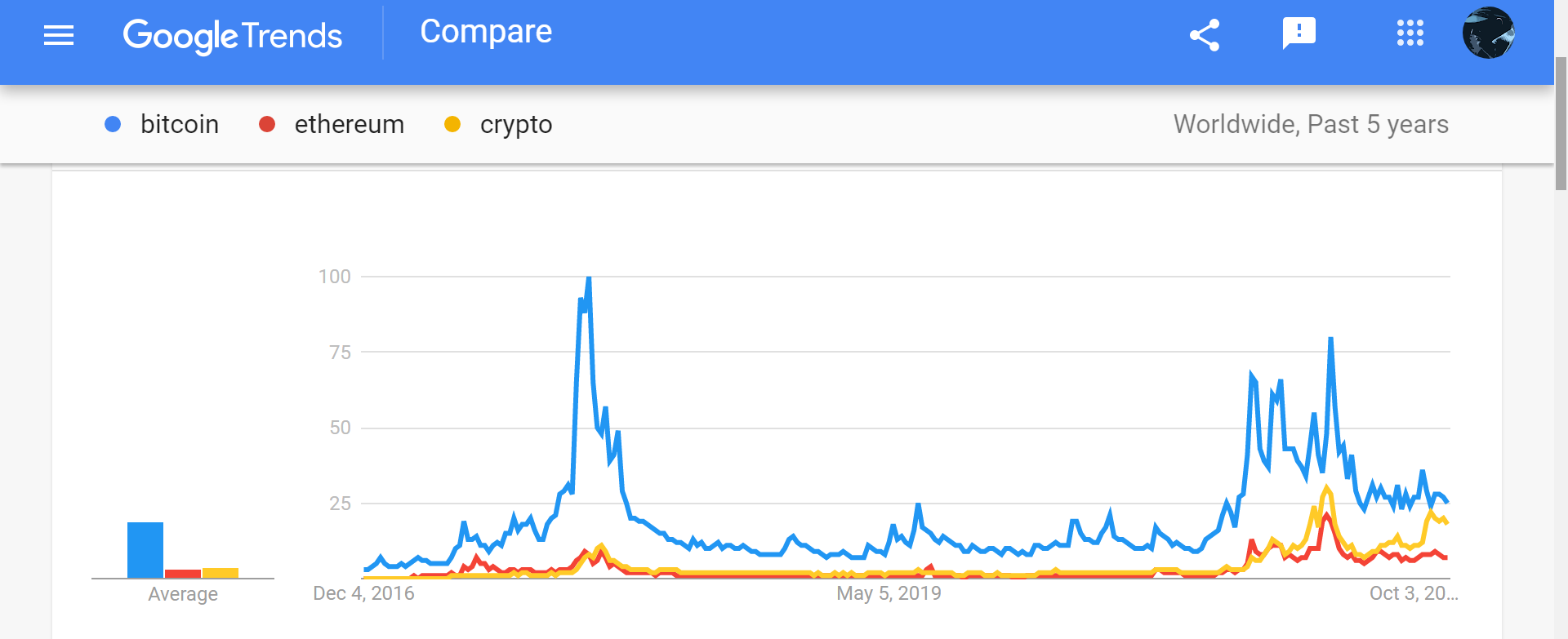

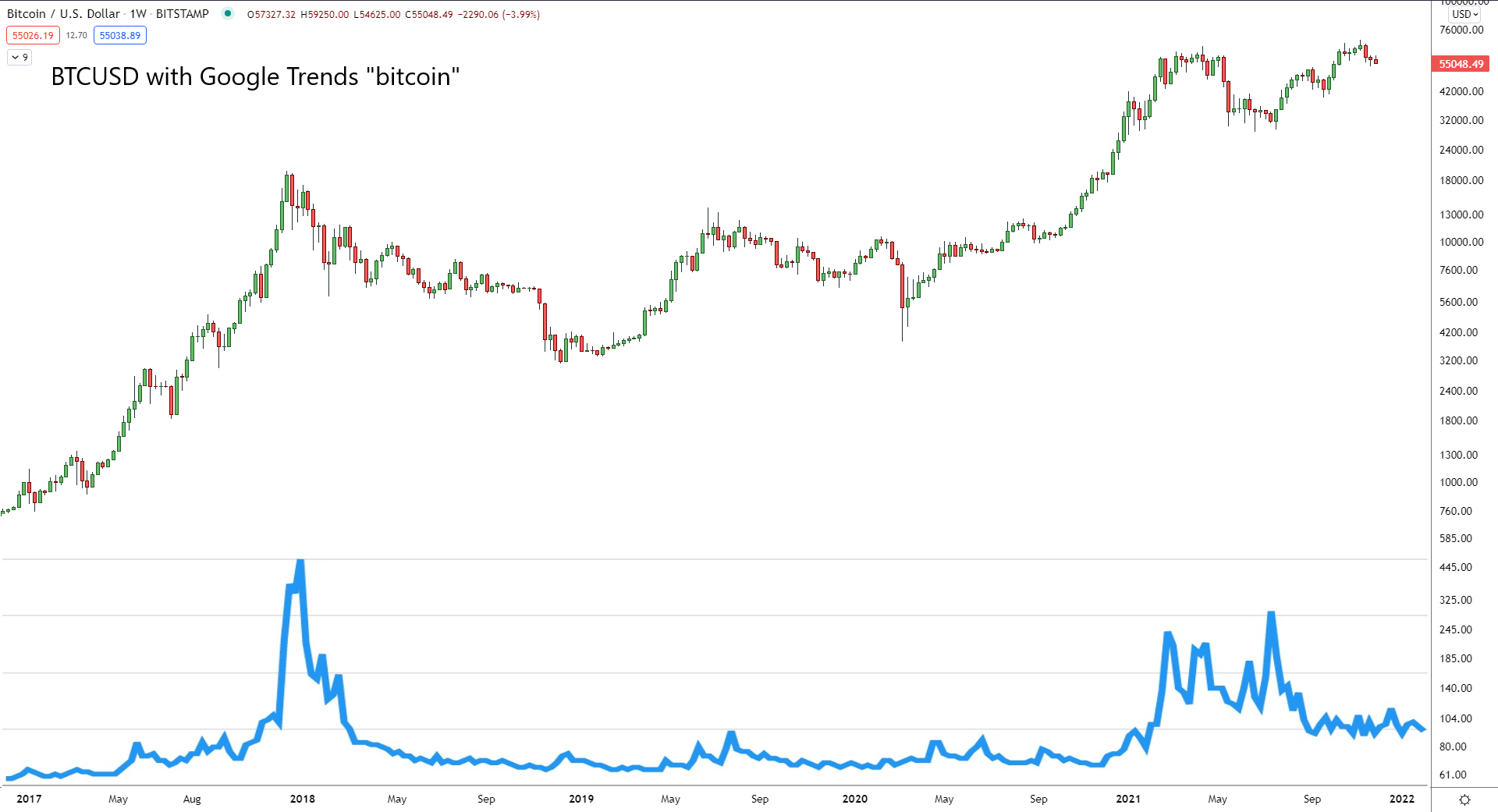

It's been a little while since we've taken a look at Google search volumes for bitcoin and related terms. Search volume is still above the long-term average, but not signaling the same mania as the end of 2017's blow-off top.

My base case for the coming rally is the following. The initial breakout and push to over $100k will be driven by large money/smart money. This will not show up in search volumes. When bitcoin breaks some big psychological levels like $100k, the retail FOMO will start, search volume will spike and take price to $200k+.

The other terms on this chart are ethereum and crypto. "Crypto" search volume is starting to become more important than ethereum. Despite ether putting in an impressive move versus the price the bitcoin, it has much lower interest than bitcoin according to Google Trends, and that is while bitcoin is in somewhat of a slow time.

All I did with the following chart was layer onto a 5-year bitcoin chart the Google search volume. There is plenty of room for the search volume to increase, but the bitcoin price is sitting basically at ATHs.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

December 3, 2021 | Issue #170 | Block 712,451 | Disclaimer

Meme by: Tom Luongo

* Price change since last week's issue