Bitcoin Fundamentals Report #166

This week I discuss my upcoming presentation, drug mandates, bitcoin mayors unite, bitcoin price, mining, NFTs and the sneaky IRS is at it again.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week I discuss my upcoming presentation, drug mandates, bitcoin mayors unite, bitcoin price, mining, NFTs and the sneaky IRS is at it again.

In Case You Missed It...

- (Podcast) The Interest Rate Fallacy with Dylan Leclair - FED 69

- (Op-Ed) Understanding the Interest Rate Fallacy: The Risk of Holding Fiat

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Consolidation near highs |

| Media sentiment | Positive |

| Network traffic | Stable, low |

| Mining | Strong |

| Market cycle timing | Middle of bull market breakout |

Speaking in Kansas City at the Bitcoin Day Event

This week will be a slightly shorter report than normal. I'm enroute to Kansas City to speak about bitcoin. It's an event called Bitcoin Day, where this group sets up multiple single-day events around the country. The first one was Omaha, now Kansas City, next is Sacramento, etc.

I helped come up with the idea way back in 2014 during the first Bitcoin Day Omaha. It's a cool small atmosphere where you can go to hear bitcoiners speak about bitcoin and mingle. There are only about 100 tickets max for this event.

Anyway, I was scheduled to talk about Bitcoin Maximalism, but... I didn't know the topic until I checked it yesterday. I had already prepared a whole presentation titled, "The Terminal Decline of the Dollar System" instead. Below, I include a few images from that presentation, and I hope to provide audio and video within the next week for you guys.

Bitcoin Maximalism

I still might say a few words about bitcoin maximalism, i's an easy topic to cover in a few minutes. From the Bitcoin Dictionary:

Bitcoin maximalism 1) Originally, a pejorative intended to mean an unfounded belief in Bitcoin’s superiority, characterized by close-mindedness, aggressive debate style and public confrontation.

2) The general understanding of the technological, social and monetary properties of Bitcoin and how they explain the observable dominance of Bitcoin relative to altcoins.

Discussion: The term Bitcoin Maximalism was coined by the Founder of Ethereum, Vitalik Buterin, to poison the well against bitcoin arguments. 5 The label was quickly re-appropriated by bitcoiners to emphasize the economic and technical theory behind this technology.

Bitcoin maximalists typically have an appreciation for sound money and markets. They are passionate about free speech but have little patience for willful ignorance and con men intentionally misleading investors.

Related: convergence, monetary maximalism, toxic

Terminal Phase of the Dollar

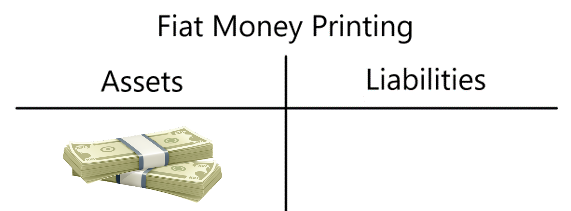

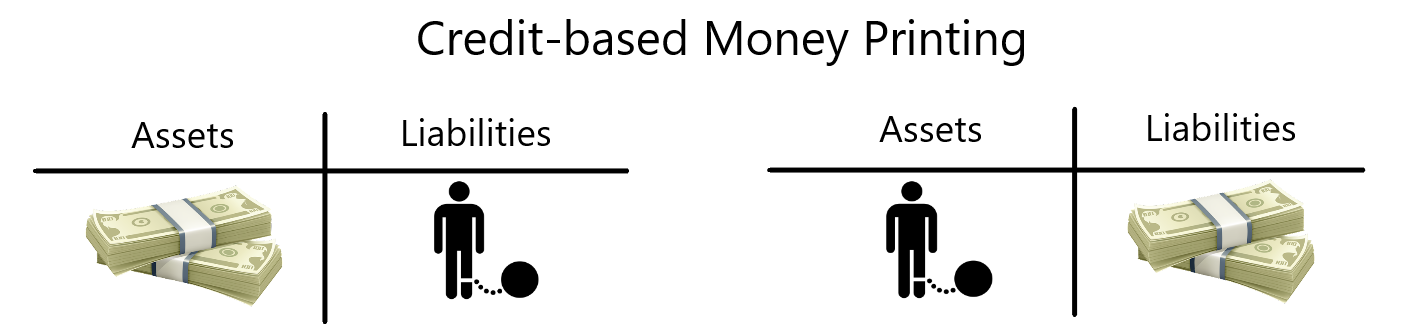

My presentation starts out establishing the US dollar as different from fiat money, instead it is credit-based money. That is a very important distinction that sets up the whole thesis for the decline of the dollar as we know it.

The difference can be seen easily by examining balance sheets after money printing of these two types of money. Fiat money printing produces only an asset with no associated liability. Credit-based money printing produces an asset and a liability for the recipient as well as an asset and liability for the bank.

Since the money is credit and depends on being debt to exist, credit expansion is required for growth. That is great in good economic times; people are spending, revenues are increasing, new businesses are being started, credit is expanding. The good time only end when debt runs into diminishing marginal return on debt, or when the economy gets saturated with debt.

Good times have ended with saturation of debt, and that turns into lower growth for longer. Lower growth manifests in tight money and low interest rates, as risk and fragility increase. You can't print your way out of debt saturation when the money is debt. The final stage is the rejection of counterparties and fleeing into a new money.

Good times -> Debt saturation -> lower growth -> tight money/deflation -> risk and rejection of counterparties

That's where bitcoin comes in. Bitcoin enables savings, and especially a savings mindset versus a debt mindset. It offers growth in a growth industry, and high rates of interest in its nascent debt market. Bitcoin is counterparty-free, sound money that restrains excessive debt back to the typical business cycle.

That's where I leave it for now. Stay tuned for the audio and video.

Bitcoin Mayors

This week saw the mayors of two major US cities, Miami and New York say they will be taking their paychecks in bitcoin!

First was Miami Mayor Francis Suarez, live on Fox News saying, "I will be taking 100% of my salary in bitcoin."

<embedded video on the website>

Not to be left out, new Mayor Elect of New York City, Eric Adams says he will be taking his first three checks in bitcoin.

Bitcoin is becoming a campaign issue for these mayors. Not an election campaign exactly, but a campaign to show the business friendly environment and forward thinking nature of their city. Suarez says it directly, he wants to "send a message to the world that we are going to be one of the most innovative governments and innovative cities on the planet." Sounds a lot like something El Salvador's President Bukele would say.

Vax Mandates

The rule from OSHA has finally been released and was instantly met by several lawsuits. That's the Occupational Safety and Health Administration in the US, an executive agency, what are they doing making medical decisions?? They are trying to sneak this in under false pretenses and the courts better get this right or there might be a real fight in this country.

There is a group of 24 States that have already sued the federal government over this and today, 11 States filed another lawsuit.

Missouri Attorney General Eric Schmitt led an 11-state coalition in filing a lawsuit in the U.S. Court of Appeals for the Eighth Circuit on Friday morning.

"The federal government lacks constitutional authority under its enumerated powers to issue this mandate, and its attempt to do so unconstitutionally infringes on the States’ powers expressly reserved by the Tenth Amendment," it reads. "OSHA also lacks statutory authority to issue this mandate, which it shoe-horned into statutes that govern workplace safety, and which were never intended to federalize public-health policy."

This whole thing is a farce. No one has provided any scientific evidence in defense of a mandate in court. Not one. They rely on their "experts" to say what is fact or not, it's not science.

I'm very bullish on the US in general over the next generation or two, and I think this could be a massive turning point right here. This OSHA mandate has to go, and I think the courts will kick it out. Federal employees will also be given access to a broad religious/ethical or moral exemption.

I know there are people who read this report from outside the US, but many other countries will follow the US's lead on this. Some countries in Europe have been excellent on both policy and scientific study of the illness and shots, hopefully the US can learn a thing or two.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $61,287 (+$357, +0.5%) |

| Market cap | $1.157 trillion |

| Satoshis/$1 USD | 1,632 |

| 1 finney (1/10,000 btc) | $6.14 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Bitcoin Daily Chart

This is one of the most bullish charts I've seen in the last 6 years. Price has held $60k like a champ despite multiple bearish developments in the broader macro environment. I called for one to two weeks of consolidation and that is exactly what we have here. I thought price could breakout this week, but that didn't happen. Weekends are still difficult because of the CME futures hours, but it's possible the market gaps higher and leaves traders stunned.

There are not a ton of shorts to squeeze for fuel to the upside. I was hoping that price could dip to the low $50s in order to get bears to come back in. That hasn't happened, demand is simply too strong. Every dip to $60k is being bought immediately and strongly.

Bitcoin Weekly Chart

The weekly looks even more bullish than the daily. Compared to the last time we were breaking the ATH at $20k, there's more time left in the TD sequential and more room to rally on the RSI.

Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +7.85% |

| Next estimated adjustment | +3% in ~8 days |

| Mempool | 6 MB |

| Fees for next block (sats/byte) | $1.11 (13 s/b) |

| Median fee (finneys) | $0.86 (0.14) |

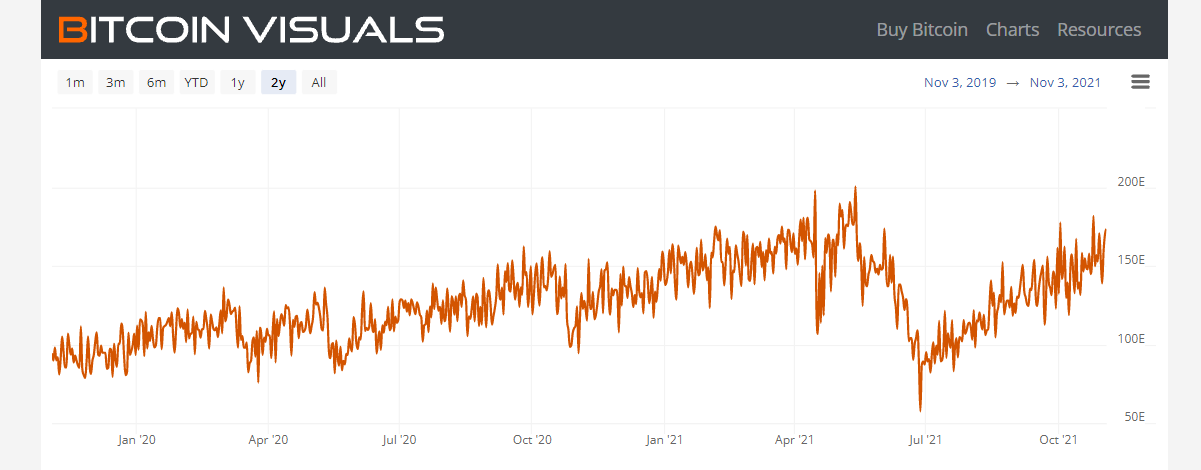

Mining and the network are strong. The hash rate continues to creep upward and fill in the hole from earlier this year. Miners are incredibly profitable right now, even with 5 year old mining equipment. The mempool is low and transactions are cheap.

Miners are still suffering from the chip shortage and supply chain bottlenecks, but they are using this time to build capacity and sign long-term contracts. They can set the groundwork now. Mining is becoming one of the most exciting aspects of the bitcoin industry.

I've been hearing that bitcoin companies are meeting with very big players in the US energy industry. Everyone is interested in using their flare gas (wasted and just burned into the atmosphere) to power a generator and mine bitcoin. This is a very big deal for bitcoin, because not only does it get many new people on board with a financial interest tied to bitcoin, it distributes mining to many different places in the middle of nowhere and enables a "green" narrative. Bitcoin really is saving the planet!

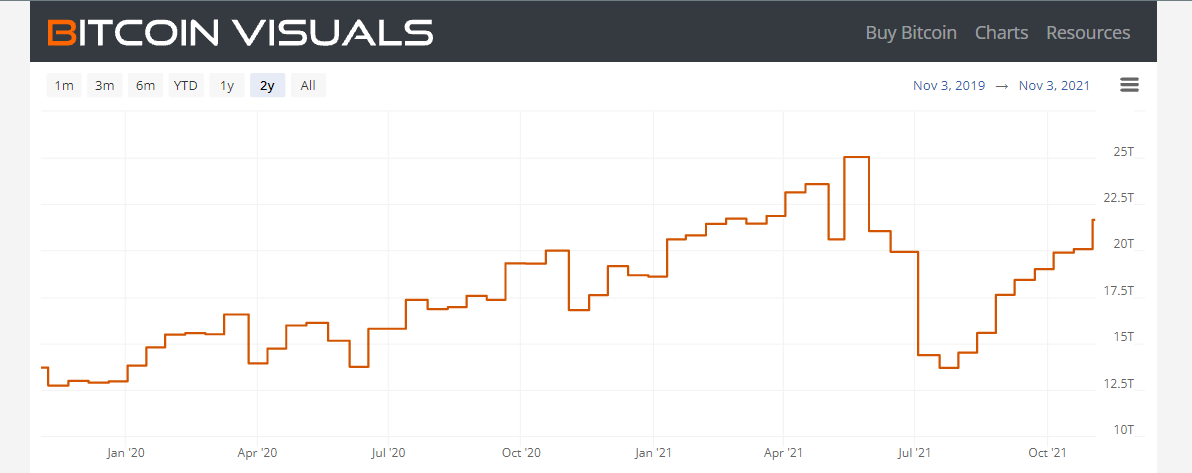

Hash Rate

Difficulty

Altcoins / CBDCs

@Bashco_ is on fire with NFTs

I just downloaded 10,000 NFTs worth "tens of millions of dollars" for free using wget. pic.twitter.com/LvXKwHyZFo

— BashCo (@BashCo_) November 4, 2021

For those who don't know, NFT stands for Non-Fungible Token, so a digital token that is not like any other digital token. They are not a money, which by definition has identical interchangeable (fungible) units.

NFTs are supposed to represent ownership of some item, usually a digital item like some silly artwork. But as Bashco points out, there is zero actually tying the NFT to the artwork. You can't own a digital image, it's just 0's and 1's.

In reality, the token is just a digital signature from the artist, on a transaction that has a link to some other server where the artwork is located. Move the artwork, crash the other server, hack the protocol, that link is gone. Not the artwork, that's still there, copied millions of times if you want. That artwork or ownership is not secured in anyway by the digital signature, it can be copied by anyone. In fact, someone could copy the JPG file for the art, and sell it as their own NFT. A complete and perfect fake. There is zero difference other than the artist. It's a total scam. You are literally buying a non-fungible ponzi token; you buy it because you think some greater fool will come and buy it from you later. What are you buying? You are buying a history of digital signatures. That is all.

From the Bitcoin Dictionary:

Non-fungible token (NFT) A class of digital tokens where every unit is distinct and not interchangeable.

Discussion: Non-fungible tokens have no use as money. They are used as either a digital representation of a physical item, like a piece of art, or a purely digital token. As of 2020, two applications for purely digital NFTs are prominent; (a) in game tokens, representing a scarce item like a sword; and (b) collectibles like trading cards. Non-fungible tokens technically do not require a block chain or a distributed network, they can be traded in a completely centralized fashion. If they are used on a distributed network via smart contracts, they require centralization. A trusted third-party must be involved to mint the token, maintain, and upgrade the smart contract, manage ownership records, and enable future trading. For example, scarce in-game items cannot be used if the game is upgraded to not recognize that token.

Related: fungible, altcoin, Dual consensus problem

These are facts about NFTs that I and others in the space have known forever, and have talked about at length on podcasts and in writing. It is a real test of sanity. I know NFTs are silly garbage and shouldn't be worth more than a buck or two depending on what it is, but people keep buying them. It's enough to make you crazy.

IRS rules

There is a hidden provision in the spending bill in Congress right now involving the IRS and bitcoin/crypto. It would apply an ancient regulation about cash transactions onto bitcoin, where you have to gather name and identity of people paying in cash. It is DOA but many people are worried.

This provision requires recipients of digital assets (incl. NFTs) to verify the sender’s personal info and record their Social Security number, nature of transaction, etc. Then, the recipient must sign under penalty of perjury and send a report to the government within 15 days.

— Abraham Sutherland (@abesutherland) September 17, 2021

Not only does this bill have to pass the Congress, which is looking more and more unlikely, it also has to pass any legal challenges brought by billionaire bitcoiners. The chance of something like this getting approved and having an effect on the space is very very low, less than 1%. You're more likely to be a healthy teenager dying of covid than this thing passing.

The fact of the matter is that bitcoin is simply too big now for something like this to ever pass. There are bitcoin billionaires, billion dollar companies, and billion dollar financial products that will fight this.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

November 5, 2021 | Issue #166 | Block 708,386 | Disclaimer

Meme by: @Bashco_

* Price change since last week's issue