Bitcoin Fundamentals Report #161

This week we discuss the evolving battle between agencies in the US government over bitcoin regulation and do a deep dive into on-chain volume and mining.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

In Case You Missed It...

- (Podcast) Evergrande: The Deteriorating Situation in China - FED64

- (member) Bitcoin Pulse #119 - Technical and fundamental analysis

- (blog) Greenspan Era: Fed Funds vs 3-month T-bill

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Held support, then rallied |

| Media sentiment | Very negative |

| Network traffic | Rising, still low |

| Mining | Growing |

| Market cycle timing | Second half of bull market |

Internal Jockeying in US Government Continues

Last week, I wrote about the 3-way battle that seems to be brewing within the US government about Bitcoin regulation:

The US government is not a monolithic thing. For years we've been confronted with the Federal Reserve and the Securities and Exchange Commission (SEC) making proclamations about bitcoin, but now a new entrant has arrived - Congress. [...]

This new bill also exposes what I'm interpreting as a internal jockeying for position. The SEC under Chairman Gensler has a clear vision and clear definitions. He wants all altcoins to be securities and to go after founders who've launched these unregistered securities. [...]

As for the Fed, they don't much care about bitcoin and two Chairmen, Yellen and Powell, have said as much. They aren't concerned about stablecoins either, to the annoyance of other central banks and Congress. There is likely no regulations for bitcoin, altcoins or stablecoins coming anytime soon from the Fed. If it does, it will be in the form of stablecoin reserve requirements. [...]

That leaves Congress, a swamp of socialists and authoritarians, dependent on control of the currency to fund their political objectives. [...]

This week we have some new comments by Chairman Powell:

Fed Chair Powell says he has no intention to ban #Bitcoin and cryptocurrencies 🚀🚀🚀pic.twitter.com/i2zfRPk1je

— LilMoonLambo (@LilMoonLambo) September 30, 2021

Question: "You said, quote, you wouldn't need stablecoins, you wouldn't need cryptocurrencies, if you had a digital US currency. Mister Chairman, as a matter of policy, is it your intention to ban or limit the use of cryptocurrencies like we're seeing in China?"

Powell: "No. And I immediately notice that I was misspoken there. Take the word 'cryptocurrency' out of that sentence."

As I've said, Powell and the Fed are not trying to ban bitcoin. As for stablecoins (tokens pegged to a $1 value), they would prefer to let them continue to grow and simply regulate some of the providers.

The Gensler and the SEC are not trying to ban bitcoin. He is trying to sent precedent in the courts, just like the Howey Test originally was.

The one of the three we have to watch is the Congress. They want to ban any threat to their budget, and bitcoin threatens to make them live within their means.

In the end, regulation will get passed but exempt bitcoin.

Unrealized Capital Gains Tax

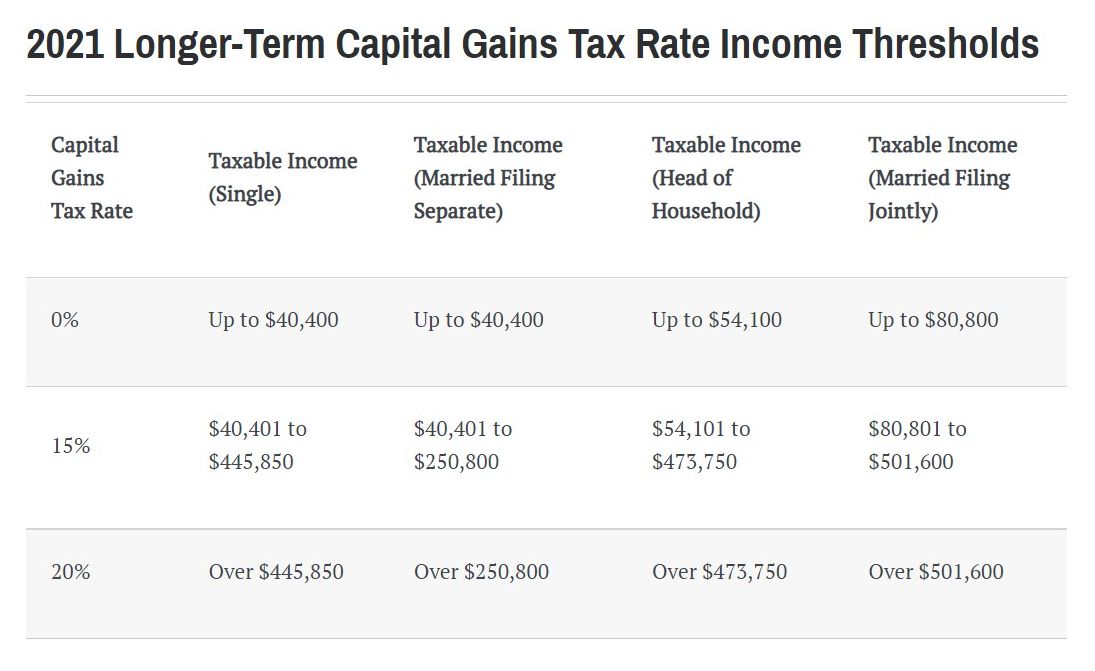

Senator Ron Wyden has proposed a new bill to tax unrealized capital gains of billionaires. Unrealized gains are paper gains made when an asset goes up in value. Those gains become "realized" when the asset is sold. Currently, realized gains are taxed at the capital gains rate, which differs from the income tax rate if held over 1 year's time. Here is a table of the current long-term capital gains taxes.

The proposed tax would affect billionaires' capital gains only, but we all know it just gets the government's foot in the door. If this is made law, it would soon expand to include gains on any investment including retirement and your house. The income tax started as a 1% tax on 1% of the population in 1913, and we know how that has turned out.

This tax would also be rapidly expanded to cover gains from politically unapproved assets like bitcoin. It is a very broad weapon that can be used as a political tool to tax wealth and the wealthy know this. It is highly unlikely to be passed.

Never addressed in these "tax the rich" bills is capital loss. What if billionaires report capital losses? Will the government start cutting checks to these people?

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $42,200 (-$5,535, -11.6%) |

| Market cap | $796 billion |

| Satoshis/$1 USD | 2,363 |

| 1 finney (1/10,000 btc) | $4.23 |

Become a paid member to access our much more in depth technical analysis and member newsletter.

Bitcoin Chart

Big move in the bitcoin price over the last few hours. Price was flat for 10 days as bears tried to take it down through the important support between $40-$42,000. The amount of volume support was simply too great. You can see that volume on the chart as the volume by price bars on the right. The more bitcoins traded at a certain level, the more support or resistance the price will experience there.

This could be bears taking a breather only to return a few days later, but new lows are unlikely. Sellers are exhausted and the believers keep chipping away at these price levels with a never-ending buy pressure. 5-10 million people buying $100/month or whatever it is goes a very long way. I don't think it's a coincidence that this spike happened on the 1st of the month.

Mining and Development

| Previous difficulty adjustment | +3.16% |

| Next estimated adjustment | 2% in ~3 days |

| Mempool | 15 MB |

| Fees for next block (sats/byte) | $0.53 (8 s/b) |

| Median fee (finneys) | $0.57 (0.13) |

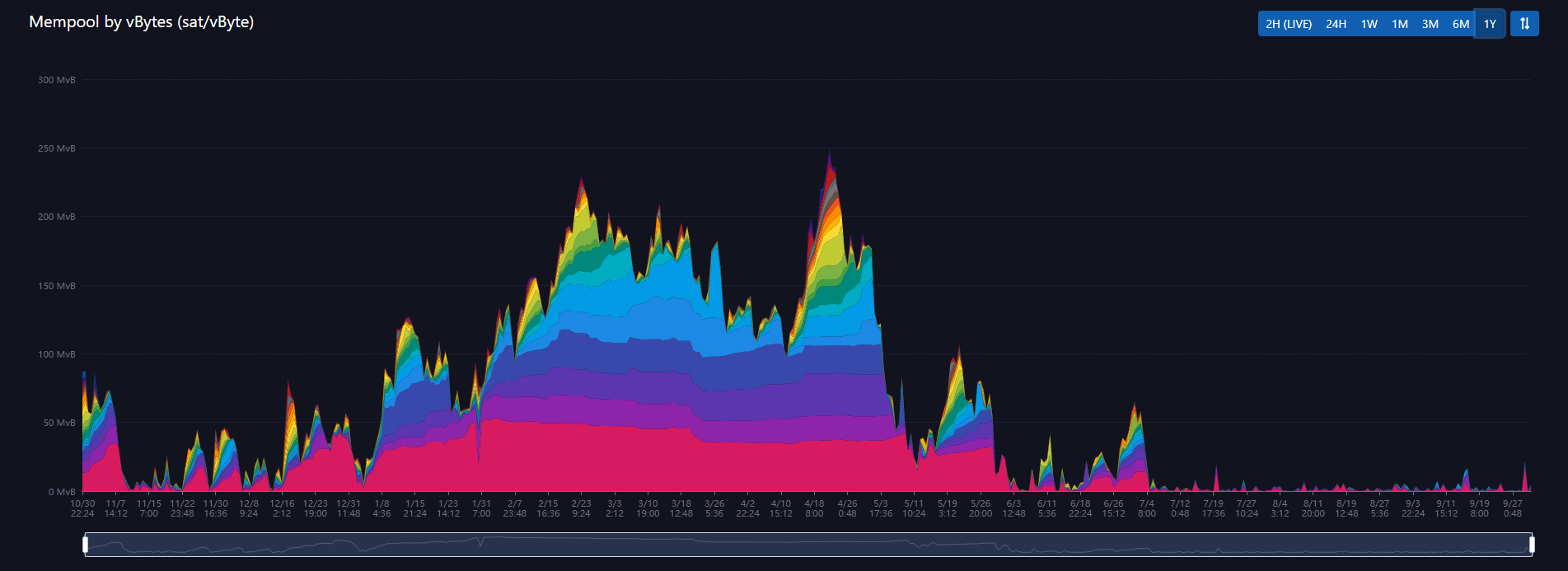

Fees and Mempool

For months, traffic on the bitcoin network has been sluggish. In prior years fees would reach $10-$20 on a regular basis, but over the past 6 months fees have been rock bottom at around $0.25. Transaction numbers are picking up and fees are rising slightly. Block space is still not being utilized 100%, so there is a bit of slack to handle a rising number of transactions. That being said, no one should be surprised with fees well over $1 in the near future.

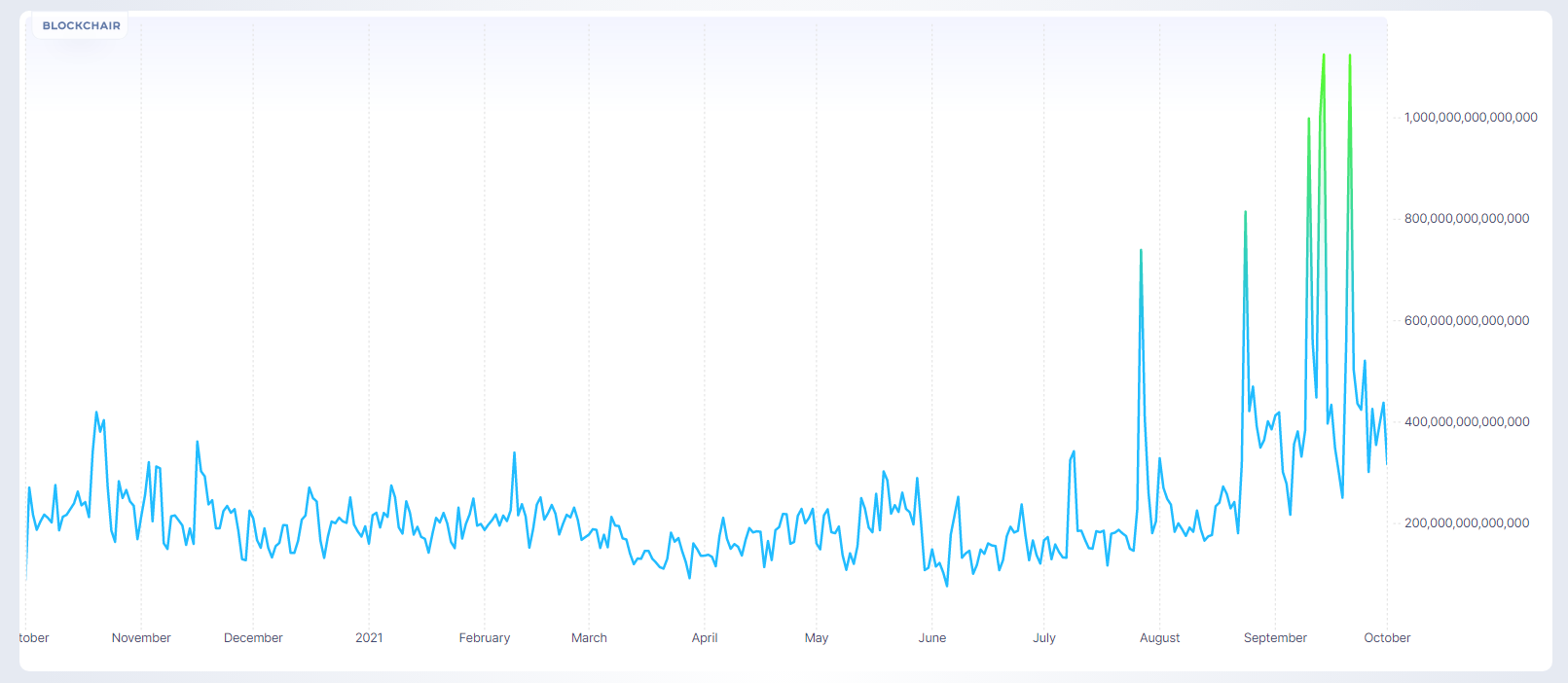

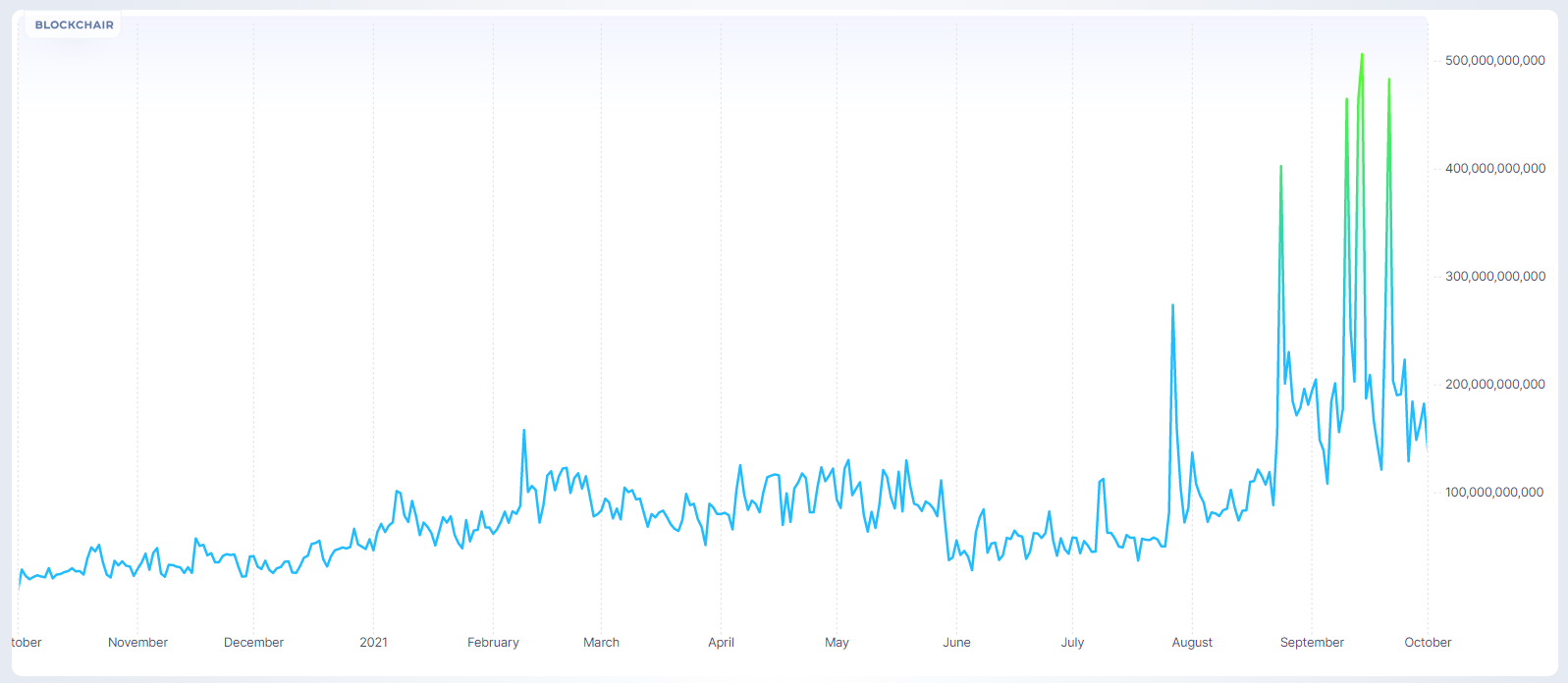

Massive Increase in Value Transacted

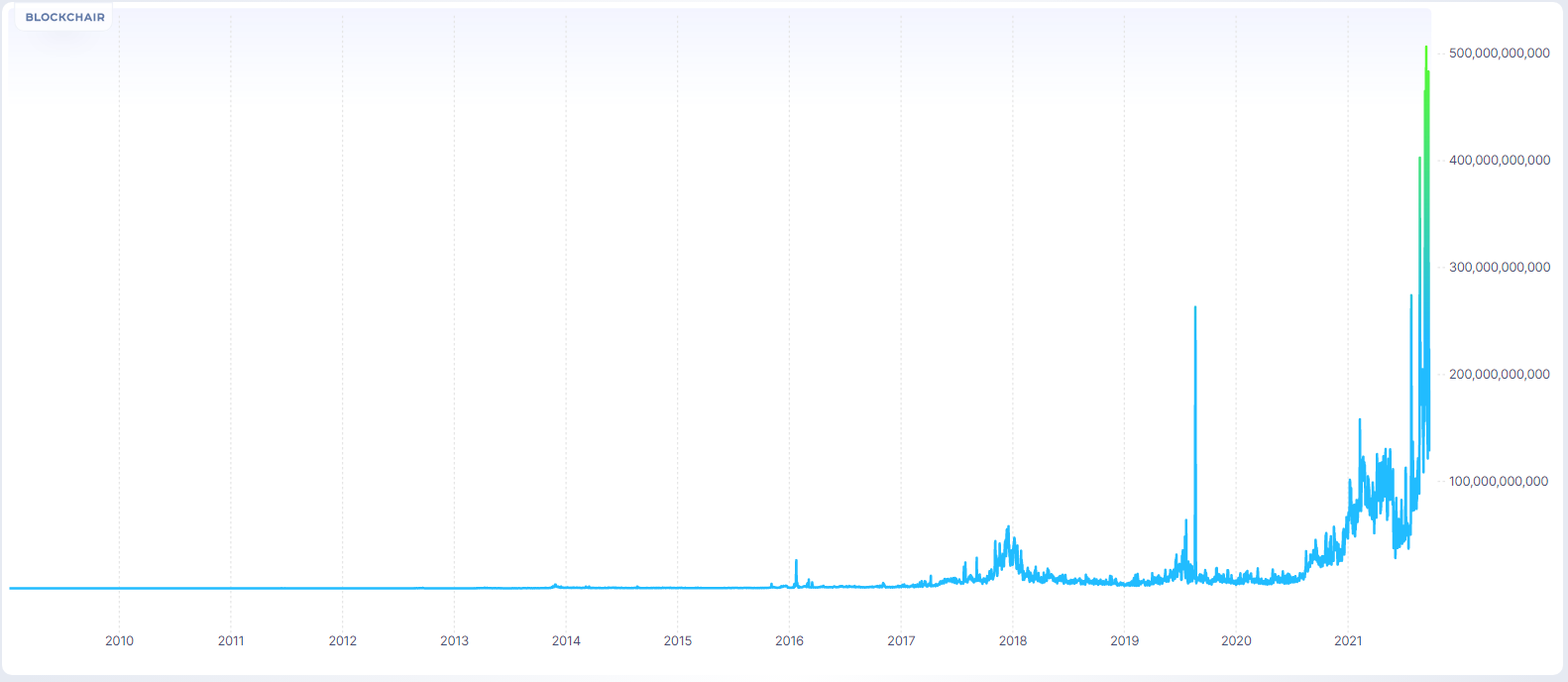

The biggest story about the network right now is the huge spike in value throughput. The bitcoin network is limited in how many transactions it can process in each block (a protocol limit imposed to keep nodes light and nimble and therefore the network decentralized), but the value that can be transacted in a block is only limited by the market cap of bitcoin.

Below, the first chart shows the number of bitcoins transacted per day (in satoshis), currently ~4 million btc/day. This is not an all-time-high for a single day, but it is the highest sustained volume in bitcoin's history.

The second chart shows the US Dollar equivalent of those bitcoins, ~$160 billion/day. Now, this is an all-time-high by a wide margin. The third chart shows just that, the entire history for USD equivalent on-chain volume.

This is a glaring sign that a major change in the market has taken place. Something changed in September.

El Salvador Volcano Mining

First steps...

— Nayib Bukele 🇸🇻 (@nayibbukele) September 28, 2021

🌋#Bitcoin🇸🇻 pic.twitter.com/duhHvmEnym

El Salvador has taken its first steps toward using their geothermal potential to mine bitcoin. This will send shockwaves around the world of mining. A government, sustainably mining bitcoin.

Via Bitcoin Magazine:

In just four months, the president has managed to make El Salvador the first nation to adopt Bitcoin as legal tender, distribute $30 worth of Bitcoin to all of the country’s citizens via the state-sponsored Chivo app, install 200 Bitcoin ATMs within the country, purchase 700 Bitcoin for the national reserve, and begin to mine the hardest money known to man in a way that is 100% renewable.

Miscellaneous

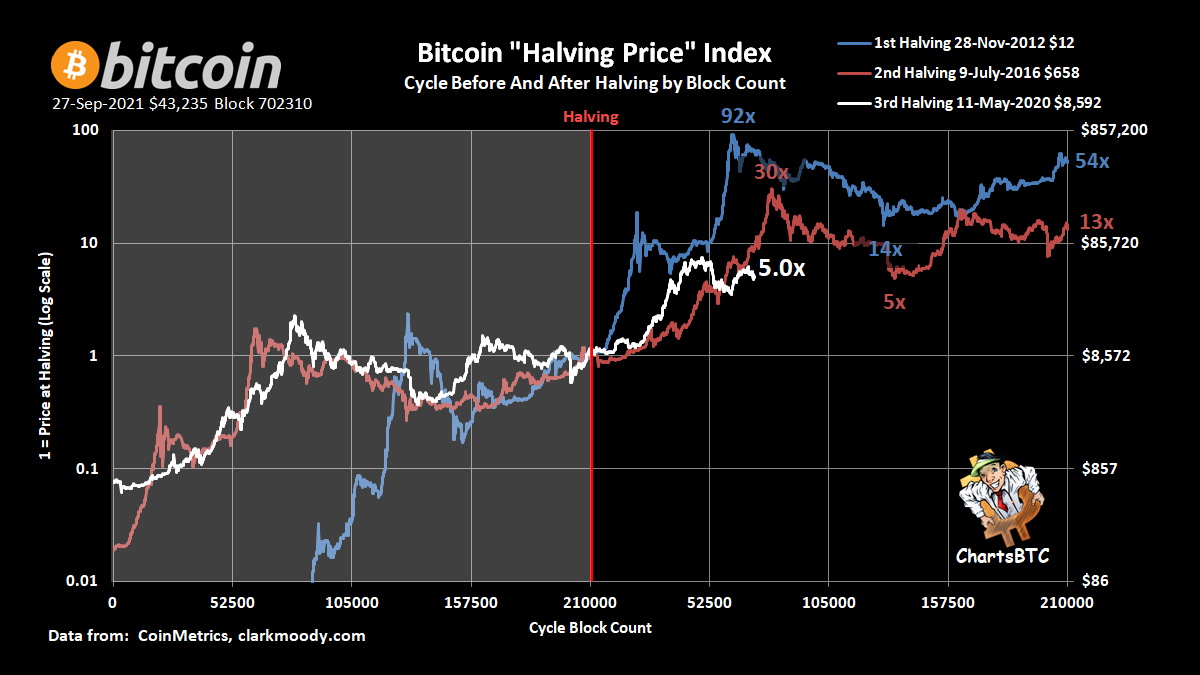

For those new to bitcoin and don't understand what I mean by "Market Cycle Timing" in the first table above, this chart produced by ChartsBTC is an excellent visual.

Bitcoin's issuance is programmatic. The number of new coins released every block gets cut in half every 210,000 blocks (~4 years). That causes a supply shock to the market and kicks off a price discovery cycle. There is an argument that as the number of new coins gets smaller and smaller, the halving will have less effect on the price. I agree it will lessen with time as bitcoin becomes less volatile at high prices, but you still will see some cyclical pattern to prices. It won't disappear completely.

As of right now, price is 5x where it was at the latest halving in May 2020. Compared to the previous cycles it is lagging slightly, but can catch up very quickly. My target for this cycle remains north of $200,000, so roughly a 25x on this chart.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 1, 2021 | Issue #161 | Block 703,065 | Disclaimer

Meme by: @swanbitcoin

* Price change since last week's issue